- Home

- »

- Advanced Interior Materials

- »

-

Blow Molding Tools Market Size Report, 2022-2030GVR Report cover

![Blow Molding Tools Market Size, Share & Trends Report]()

Blow Molding Tools Market (2022 - 2030) Size, Share & Trends Analysis Report By Method (Extrusion, Injection), By Application (Packaging, Automotive & Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-918-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global blow molding tools market size was valued at USD 12.71 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.5% from 2022 to 2030. The growing demand for blow molded plastics in the medical sector and increasing emphasis on plastic recycling is anticipated to positively influence the market growth during the forecast period.

Unlike most sectors, COVID-19 has affected the market positively as the demand for blow molding tools increased with the soaring need for plastic packages for hand sanitizers, cleaning products, and beverages like beer, juices, and water. For instance, according to a Spanish dealer of plastics machinery, in June 2020, the bottling and bottle industry produced 100% above their usual capacity.

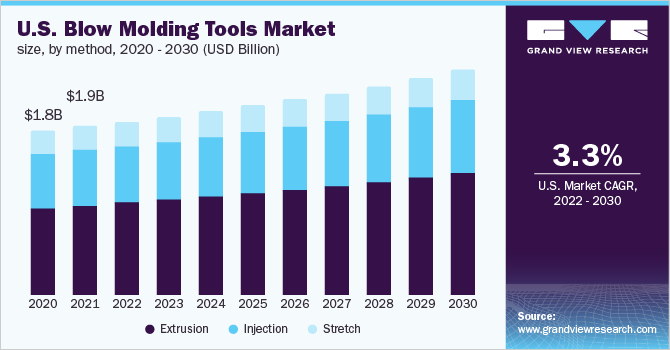

The growing demand for plastic containers is propelling the need for molds and eventually benefitting the market growth in the U.S. For instance, in August 2021, Meredith-Springfield Associates Inc. announced the expansion of its manufacturing space by 5,000 square feet. The company will install two extrusion blow molding machines and one injection stretch blow molding machine.

Plastics is the eighth largest industry in the U.S., which generated USD 394.7 billion in shipments in 2020. Out of these shipments, USD 2,777.1 million were held by the NAICS 33351105 molds for plastics that have around 637 total establishments and 15.6 thousand employees in the U.S. The large-scale spread of the plastic molds industry is owing to the increasing demand from various industries.

Furthermore, COVID-19 has raised the demand for medical equipment and market players are constructing new plants to meet the surging demand from the medical sector. For instance, in June 2021, Amgen announced the construction of a new USD 365 million manufacturing plant for producing vials and syringes in Columbus, Ohio. The plant is scheduled to operate in 2024.

Emphasis on the reuse of plastics is expected to benefit the market growth and trade-off the negative impact of the ban on single-use plastic on the blow molding market. For instance, in November 2020, Austria implemented mandatory targets by making a beverage reuse quota of 25% by 2025 compulsory in their Waste Management Act. With this, it became the first European country to do so.

Method Insights

The extrusion segment accounted for the largest revenue share of over 50.0% in 2021. The extrusion method is used to produce medium to large complex geometric hollow parts. It caters to highly technical requirements such as HVAC ducts, DEF tanks, and lawn mower seats. The growing demand for containers and closures specifically from the packaging and automotive sectors is projected to propel the demand for the extrusion method over the forecast period.

For instance, in February 2020, North America-based Pretium Packaging invested a sum of USD 3 million for extrusion blow molding equipment and infrastructure in Ohio, U.S. The equipment is for producing HDPE industrial round gallon containers to meet the rising demand from the household and industrial chemical markets.

The injection segment held the second-largest revenue share in 2021. This method is suitable for the mass production of products with complicated shapes. It is used in applications such as automotive components, dashboard switches, and knobs, engine bay connectors, mechanical parts such as gears, surgical instruments, syringes, appliance components, and storage containers.

Stretch blow molding is a widely used technique, especially to produce PET bottles. These tools are widely adopted for the production of HDPE, LDPE, PET, and PETG products. The tools use a lower pressure level, which results in lower machinery costs. Moreover, it has a faster turnaround when compared to injection molding.

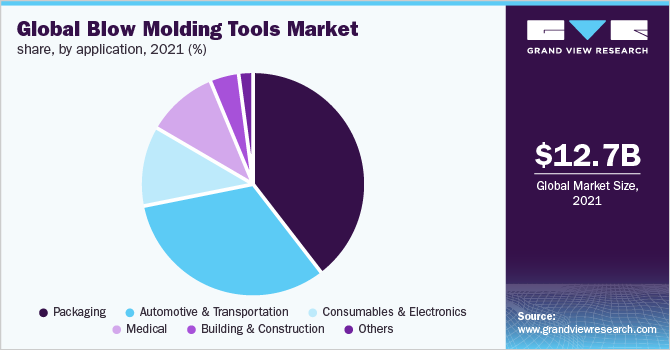

Application Insights

The packaging application segment accounted for the largest revenue share of over 35.0% in 2021 and this trend is expected to continue over the forecast period. The rising demand for packaged food and drinking water is projected to fuel the need for containers, which in turn, is expected to augment the growth of blow molding tools over the coming years.

Furthermore, rising demand for blow molded parts in the automotive industry is anticipated to propel the market growth. The growing demand is compelling manufacturers to expand their capabilities, for instance, in February 2022, Uniloy, Inc., a manufacturer of blow molds, acquired Century Die Co. LLC to expand its molding capabilities for automotive parts, health, cleaning, and household goods.

In addition, growing demand from the medical equipment industry is projected to expand the market further. For instance, in August 2021, Comar, a packaging and dispensing product supplier, inaugurated its 230,000 square feet facility in California, U.S. The facility will produce medical devices using injection and blow molding technologies.

Regional Insights

Asia Pacific held the largest revenue share of more than 35.0% in 2021. Rising demand from the packaging industry is propelling the market growth in the region. For instance, in December 2021, Mumbai-based Mahika Packaging announced to double its tube-making capacity in FY2022-23. The company supplies its products to cater to the packaging needs of the cosmetic and pharmaceutical industries.

Europe is anticipated to register a growth rate of 3.6%, in terms of revenue, over the forecast period. The expansion of plastic container manufacturing facilities is expected to boost the market growth in the region. For instance, in September 2021, Mauser Packaging Solution made a significant investment to expand its intermediate bulk container and plastic drums capacity. The company will install a blow molding machine for intermediate bulk container bottles production in 2022.

Furthermore, the pandemic augmented investments in disinfectants and sanitizers, which positively influenced the product demand in North America. For instance, in January 2021, the Ontario government provided CAD 1 million (~USD 0.79 million) to Merit Precision to boost the production of sanitizers and disinfectants. To complete the demand, Merit Precision invested in two blow-molding lines and tooling, necessary for the infrastructure.

Key Companies & Market Share Insights

The global market is competitive with the presence of numerous players worldwide. Key market players are constantly striving to stay competitive by manufacturing customized blow molds to cater to the needs of their customers. Moreover, they are involved in several strategic approaches such as acquisitions and capacity expansions to stay ahead of their competitors.

For instance, in August 2019, The Eastern Company acquired Big 3 Precision Mold Services, Inc., a leading company engaged in manufacturing blow mold tools. In August 2020, the company also acquired Hallink RSB, Inc., for strengthening its blow mold tooling business and increasing its geographical reach. Some prominent players in the global blow molding tools market include:

-

Abhijeet Dies and Tools Pvt. Ltd.

-

ADM Precision Tools

-

Creative Blow Mold Tooling

-

Gemini Group

-

HEISI INDUSTRIES, INC.

-

Kanton Engineering

-

Kaysun Corporation

-

Polymold AG

-

RPM International Tool and Die

-

The Rodon Group

Blow Molding Tools Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 13.08 billion

Revenue forecast in 2030

USD 17.33 billion

Growth rate

CAGR of 3.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Method, application, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; South Korea; Brazil

Key companies profiled

Abhijeet Dies and Tools Pvt. Ltd.; ADM Precision Tools; Creative Blow Mold Tooling; Gemini Group; HEISI INDUSTRIES, INC.; Kanton Engineering; Kaysun Corporation; Polymold AG; RPM International Tool and Die; The Rodon Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global blow molding tools market report on the basis of method, application, and region:

-

Method Outlook (Revenue, USD Million, 2017 - 2030)

-

Extrusion

-

Injection

-

Stretch

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Packaging

-

Consumables & Electronics

-

Automotive & Transportation

-

Building & Construction

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

- Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global blow molding tools market size was estimated at USD 12.71 billion in 2021 and is expected to reach USD 13.08 billion in 2022.

b. The global blow molding tools market is expected to grow at a compound annual growth rate of 3.5% from 2022 to 2030 to reach USD 17.33 Billion by 2030.

b. Based on the application segment, packaging held the largest revenue share of more than 39.0% in 2021, owing to rising demand in industries such as food & beverages, cosmetics, and medical.

b. Some of the key players operating in the blow molding tools market include ADM Precision Tools, Kanton Engineering, Gemini Group, HEISE INDUSTRIES, INC., and The Rodon Group.

b. Growing demand for blow molded plastics in the medical sector and increasing emphasis on recycling plastic are driving factors for the blow molding tools market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.