- Home

- »

- Renewable Energy

- »

-

Blue Hydrogen Market Size & Share, Industry Report, 2030GVR Report cover

![Blue Hydrogen Market Size, Share & Trends Report]()

Blue Hydrogen Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Chemical, Refinery, Power Generation), By Transportation Mode (Pipeline, Cryogenic Liquid Tankers), By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-091-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blue Hydrogen Market Summary

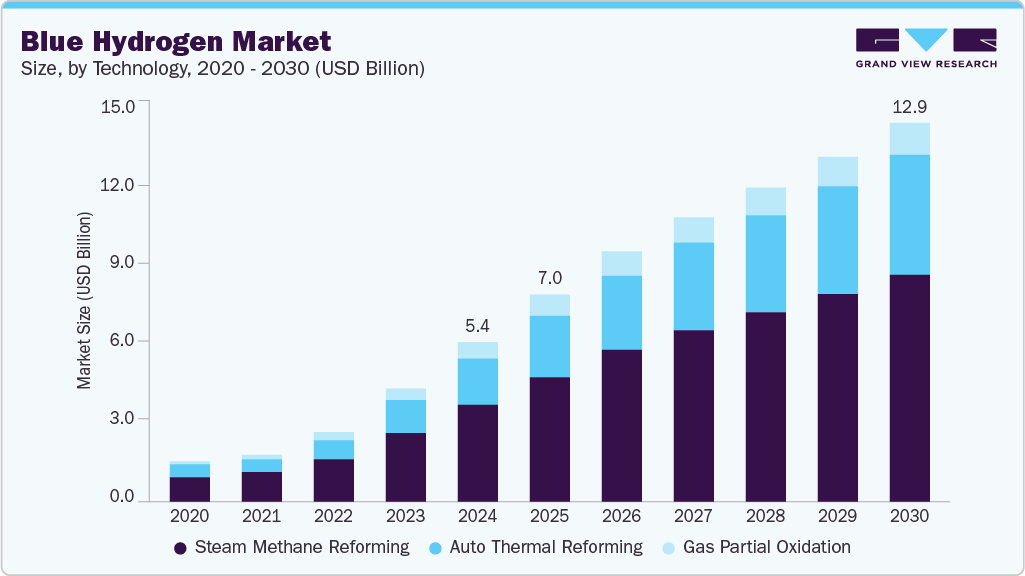

The global blue hydrogen market size was estimated at USD 5.43 billion in 2024 and is projected to reach USD 12.88 billion by 2030, growing at a CAGR of 13.0% from 2025 to 2030. A combination of environmental regulations, technological advancements, and the increasing demand for cleaner energy alternatives is propelling the market.

Key Market Trends & Insights

- The Middle East & Africa blue hydrogen market dominated the blue hydrogen industry with 32.2% of the revenue share in 2024.

- The U.S. blue hydrogen market dominated the North American market, with a revenue share of 58.8% in 2024.

- By technology, the steam methane reforming accounted for the largest revenue share of 60.9% in 2024.

- By application, the power generation accounted for the largest revenue share of 37.2% in 2024.

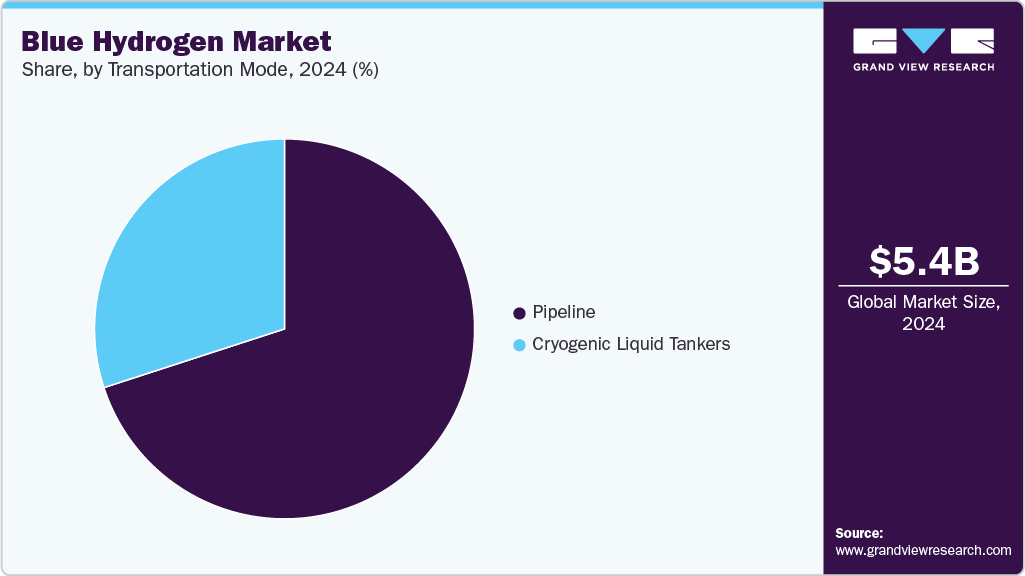

- By transportation mode, the pipeline accounted for the largest revenue share of 70.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.43 Billion

- 2030 Projected Market Size: USD 12.88 Billion

- CAGR (2025-2030): 13.0%

- Middle East & Africa: Largest market in 2024

- Central & South America: Fastest growing market

One of the primary drivers is the growing commitment to reducing carbon emissions worldwide. Governments and industries are setting ambitious net-zero targets, leading to investments in low-carbon hydrogen production. Blue hydrogen, derived from natural gas but with carbon capture and storage (CCS) technology, presents an attractive option for transitioning away from traditional fossil fuels while maintaining affordability and efficiency.

The expanding application of hydrogen across various industries. Sectors such as transportation, refining, and chemical manufacturing are increasingly looking to hydrogen as a sustainable fuel and feedstock. With hydrogen-powered fuel cells gaining traction in electric vehicles and heavy-duty transport, the demand for blue hydrogen is expected to rise sharply. Additionally, the steel and cement industries, notorious for their high carbon emissions, are exploring hydrogen as a cleaner alternative to conventional production methods.

Technology Insights

Steam methane reforming accounted for the largest revenue share of 60.9% in 2024, owing to SMR's established infrastructure and cost-effectiveness compared to other hydrogen production methods. This is attributed to the growing demand for blue hydrogen as a low-carbon fuel. Through this technology, the carbon dioxide generated is not released into the atmosphere; instead, it is captured and stored underground by the Carbon Capture, Utilization, and Storage (CCUS) process. As a result, this technology offers blue hydrogen that is free from greenhouse gas and carbon emissions, making it the preferred method for blue hydrogen generation. Auto thermal reforming technology is expected to grow at a CAGR of 20.4% during the forecast period. This growth is owing to its cost-effective process that offers increased energy efficiency in blue hydrogen.

The auto thermal reforming segment is expected to grow at the fastest CAGR of 14.3% from 2025 to 2030. This acceleration is largely attributed to ATR's ability to integrate seamlessly with carbon capture and storage (CCS) technology, making it a highly efficient and environmentally viable method for blue hydrogen production. Unlike steam methane reforming (SMR), which relies on external heat sources, ATR utilizes a combination of oxygen and steam within the reactor, leading to a more energy-efficient process with fewer emissions.

Application Insights

Power generation accounted for the largest revenue share of 37.2% in 2024, owing to the global push toward decarbonizing electricity production. As countries and industries transition from fossil fuels, blue hydrogen emerges as a viable alternative for providing reliable and cleaner energy. With carbon capture and storage (CCS) integrated into its production process, blue hydrogen significantly reduces greenhouse gas emissions, making it an attractive option for power plants seeking to meet stringent environmental regulations. Additionally, adopting blue hydrogen in power generation complements renewable energy sources. Hydrogen can be used in fuel cells or gas turbines to generate electricity, balancing wind and solar power intermittency.

The refinery segment is expected to grow at the fastest CAGR of 14.8% from 2025 to 2030. This is owing to several petrochemical companies, such as Exxon Mobil Corp., generating hydrogen for their oil and petroleum refineries using steam methane reforming technology. Utilizing this technology to produce hydrogen results in the generation of carbon dioxide as a byproduct. These companies are adopting sustainable production processes to achieve their sustainability goals by installing carbon capture storage systems to store carbon dioxide produced during the hydrogen generation process. This helps companies in turning their grey hydrogen into sustainable blue hydrogen with zero carbon emissions, propelling the demand for blue hydrogen generation in the refinery industries. The chemical application segment is driven by several projects by chemical industries to increase the production of blue ammonia derived from blue hydrogen and natural gas.

For instance, in January 2023, the Grannus Blue Ammonia and Hydrogen Project in Northern California, U.S. was launched by the U.S. government to produce 150,000 metric tons of blue ammonia and blue hydrogen every year. Such projects further drive the demand for blue hydrogen for use in the chemicals industry. The other segment comprises the transportation and steel industries. Blue hydrogen is also used for heating buildings and fueling buses and trains owing to its low-carbon fuel. Its usage in the transportation industry depends extensively on its prices. It is also based on the level of adoption of hydrogen fuel cells in this industry and the number of refueling stations established.

Transportation Mode Insights

Pipeline accounted for the largest revenue share of 70.0% in 2024. This growth is attributed to the large volumes of blue hydrogen in the gaseous form being transported through pipelines, which offer cost-effective and long-distance coverage. These pipelines are usually located in the regions where large consumers of blue hydrogen, including chemical manufacturing units, refineries, power generation plants, etc., are concentrated.

The cryogenic liquid tankers segment is expected to grow at the fastest CAGR of 14.6% from 2025 to 2030, owing to the increasing demand for efficient hydrogen transportation. As blue hydrogen adoption accelerates across industries, reliable long-distance transport solutions are becoming more critical. Cryogenic tankers, which store hydrogen in liquid form at extremely low temperatures, offer a practical alternative to pipelines by enabling flexible and scalable distribution.

Blue hydrogen in liquid form is transported and distributed using cryogenic liquid tankers. They are employed to distribute hydrogen by covering long distances in areas where installing blue hydrogen distribution pipelines is not feasible. The transportation and distribution costs of blue hydrogen through cryogenic liquid tankers to its end-use industries are lower than the transportation of blue hydrogen through pipelines. These factors further drive the demand for cryogenic liquid tankers as a blue hydrogen transportation mode.

Regional Insights

The Middle East & Africa blue hydrogen market dominated the blue hydrogen industry with 32.2% of the revenue share in 2024. This is owing to several investments in blue hydrogen projects taking place in countries, such as Qatar, UAE, and Saudi Arabia, to achieve the region’s target of reducing carbon emissions by 2030. For instance, in August 2022, Qatar announced its plan to construct the world’s largest plant to produce blue ammonia, using blue hydrogen as a feedstock.

North America Blue Hydrogen Market Trends

The blue hydrogen market in North America is expected to grow substantially over the forecast years. The region invests in hydrogen infrastructure, including carbon capture and storage (CCS) facilities, pipeline networks, and production hubs, which are crucial for scaling up blue hydrogen adoption. Moreover, there is a commitment to decarbonization across various industries. Sectors such as refining, transportation, and power generation are shifting toward hydrogen as a low-carbon alternative, supported by policy incentives and funding programs. The U.S. blue hydrogen market dominated the North American market, with a revenue share of 58.8% in 2024.

Europe Blue Hydrogen Market Trends

The market in Europe is expected to grow at the fastest CAGR of 16.1% during the forecast period. This is attributed to favorable initiatives undertaken by governments of countries of the region, along with the surged adoption of blue hydrogen.

Central & South America Blue Hydrogen Market Trends

The blue hydrogen market in central & south america is expected to grow at a CAGR of 73.1% over the forecast years. Increasing government support for clean energy initiatives and the region’s abundant natural gas resources serve as a crucial feedstock for blue hydrogen production. A

Key Blue Hydrogen Company Insights

Some of the key companies in the blue hydrogen market include Linde Plc, Shell Group of Companies, Air Liquide, Air Products and Chemicals, Inc., Engie, and others. Key companies resort to multiple mergers and acquisitions in a bid to gain market share in a particular region. In some cases, the companies build technological collaborations and agreements to produce an advanced product with superior performance characteristics to increase revenue. For instance, in February 2023, Linde Plc signed a long-term agreement to distribute and supply hydrogen to OCI's blue ammonia production plant in Texas, U.S. This agreement is expected to allow Linde Plc to strengthen its fuel and blue ammonia platform in supplying to the U.S. and international exports.

-

Linde plc covers every step of the hydrogen value chain, from production to industrial applications. Linde is actively involved in blue hydrogen projects, utilizing steam methane reforming (SMR) with carbon capture and storage (CCS) to reduce emissions.

-

Shell plc is heavily invested in blue hydrogen production, leveraging its proprietary Shell Blue Hydrogen Process (SBHP) to enhance efficiency and affordability. This process integrates carbon capture technologies to significantly reduce emissions, capturing up to 99% of CO₂ generated during hydrogen production.

Key Blue Hydrogen Companies:

The following are the leading companies in the blue hydrogen market. These companies collectively hold the largest market share and dictate industry trends.

- Linde plc

- Shell Group of Companies

- Air Liquide

- Air Products and Chemicals, Inc.

- Engie

- Equinor ASA

- SOL Group

- Iwatani Corp.

- INOX Air Products Ltd.

- Exxon Mobil Corp.

Blue Hydrogen Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.00 billion

Revenue forecast in 2030

USD 12.88 billion

Growth rate

CAGR of 13.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilo tons and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, Application, Transportation Mode, and Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; Japan; India; South Korea; Australia; Brazil; Columbia; Paraguay; UAE; Saudi Arabia; Egypt; South Africa

Key companies profiled

Linde plc; Shell Group of Companies; Air Liquide; Air Products and Chemicals, Inc.; Engie; Equinor ASA; SOL Group; Iwatani Corp.; INOX Air Products Ltd.; Exxon Mobil Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blue Hydrogen Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blue hydrogen market report based on technology, application, transportation mode, and region:

-

Technology Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Steam Methane Reforming

-

Gas Partial Oxidation

-

Auto Thermal Reforming

-

-

Transportation Mode Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Pipeline

-

Cryogenic Liquid Tankers

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Chemicals

-

Refinery

-

Power Generation

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Columbia

-

Paraguay

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

Egypt

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global blue hydrogen market was valued at USD 2.34 billion in the year 2022 and is expected to reach USD 3.82 billion in 2023.

b. The global blue hydrogen market is expected to grow at a compound annual growth rate of 19.0% from 2023 to 2030 to reach USD 12.88 billion by 2030.

b. The steam methane reforming technology recorded the largest market share of over 61.1% in 2022 owing to the growing demand for blue hydrogen as a low-carbon fuel.

b. Some of the key market players in the blue hydrogen market include Linde plc, Shell group of companies, Air Liquide, Air Products and Chemicals, Inc, Engie, Equinor ASA, SOL Group, Iwatani Corporation, INOX Air Products Ltd., and Exxon Mobil Corporation and others.

b. Several favorable government policies and strategies promoting the utilization of blue hydrogen are driving the blue hydrogen market.

b. The Middle East & Africa region recorded the largest market share of over 33.0% in 2022 owing to several investments and developments taking place in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.