- Home

- »

- Foods, Beverages & Food Ingredients

- »

-

Brewer’s Yeast Market Size & Share, Industry Report, 2033GVR Report cover

![Brewer’s Yeast Market Size, Share & Trends Report]()

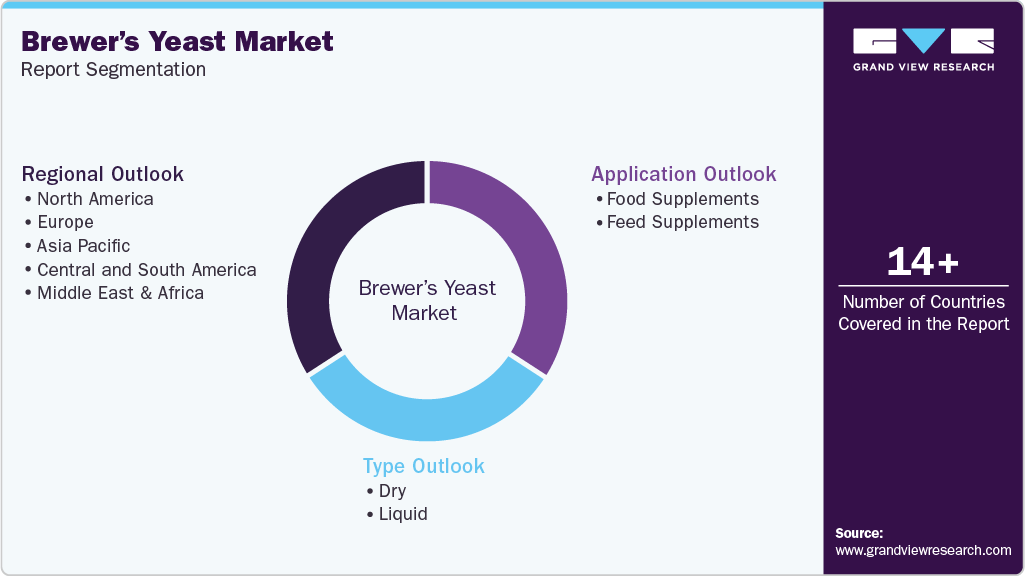

Brewer’s Yeast Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Dry, Liquid), By Application (Food Supplements, Feed Supplements), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-2-68038-632-5

- Number of Report Pages: 124

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Brewer’s Yeast Market Summary

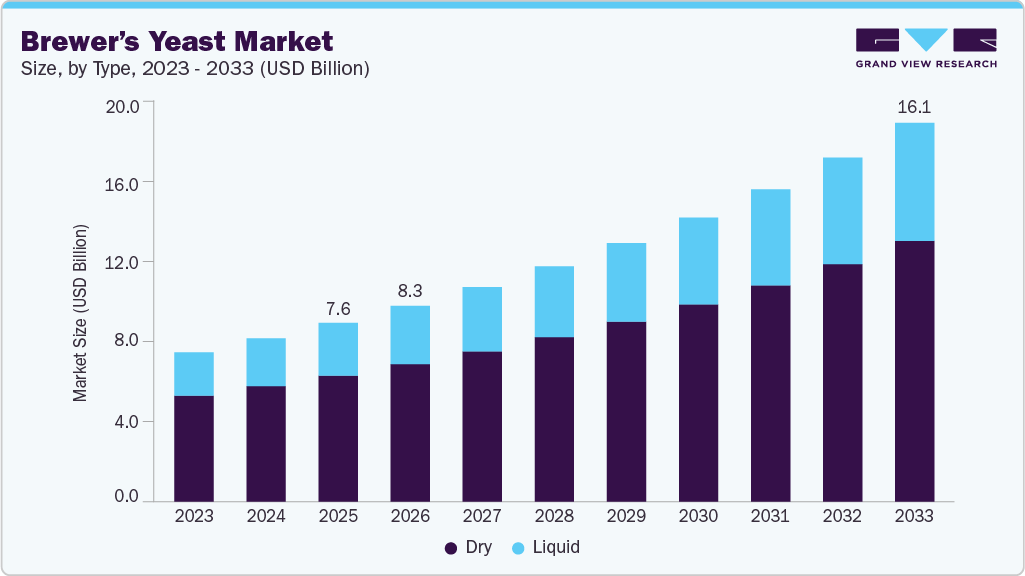

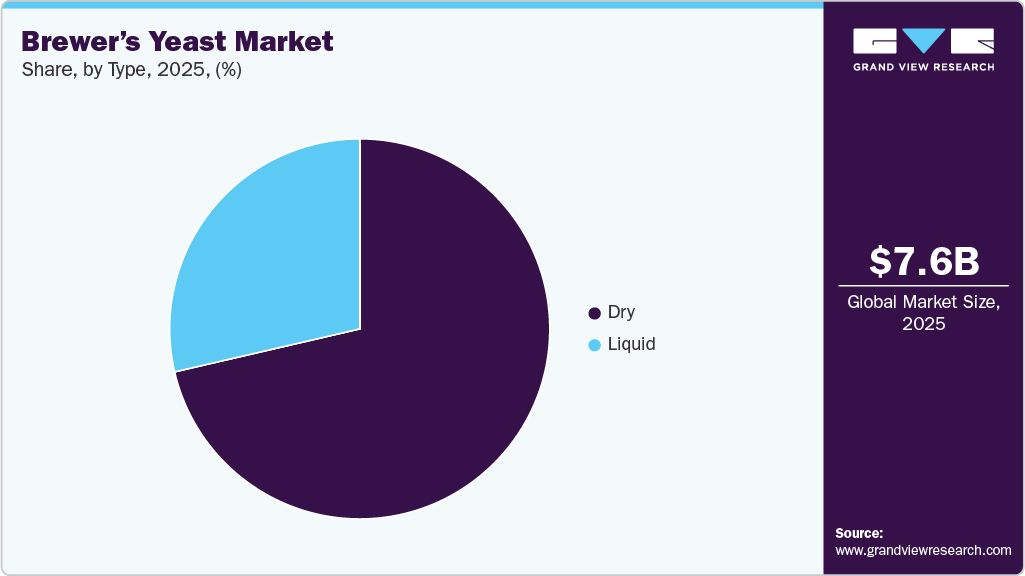

The global brewer’s yeast market size was estimated at USD 7.60 billion in 2025 and is expected to reach USD 16.12 billion by 2033, growing at a CAGR of 9.9% from 2026 to 2033. Brewer's yeast, rich in B vitamins, protein, and minerals, has become a key ingredient in a wide range of foods, from bread to dietary supplements and savory snacks.

Key Market Trends & Insights

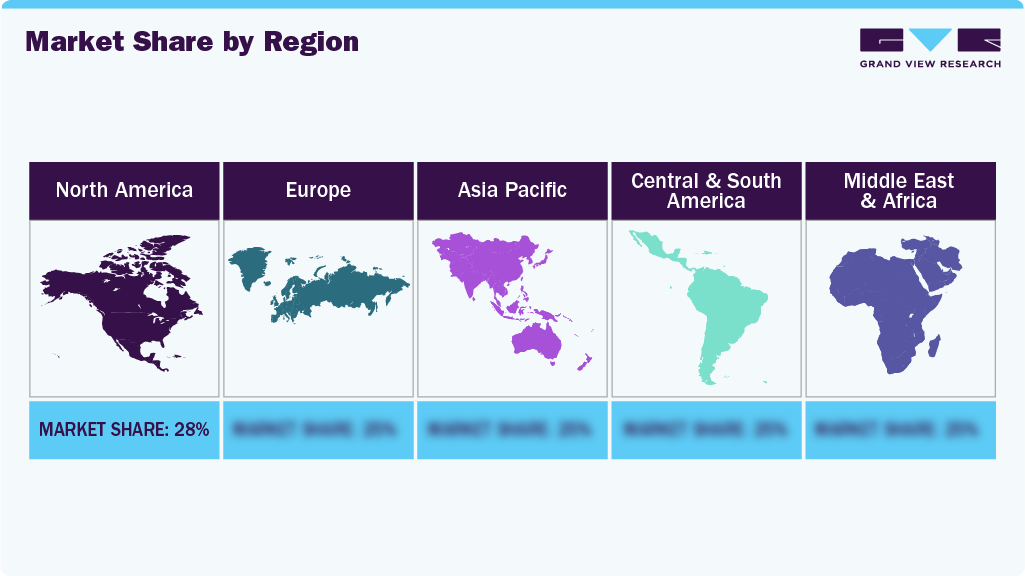

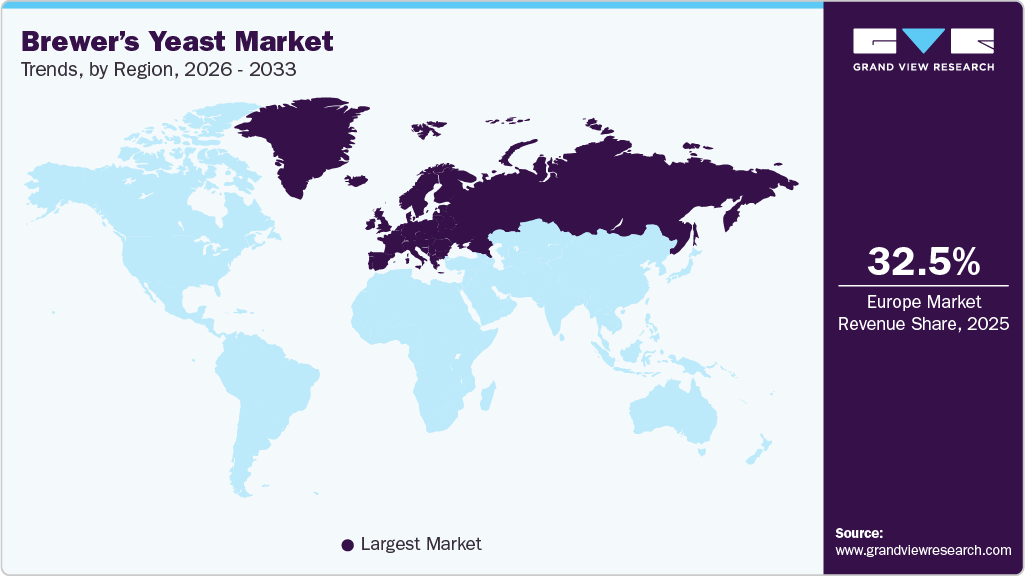

- By region, Europe led the market with a share of 32.5% in 2025.

- By type, skipjack led the market and accounted for a share of 70.5% in 2025.

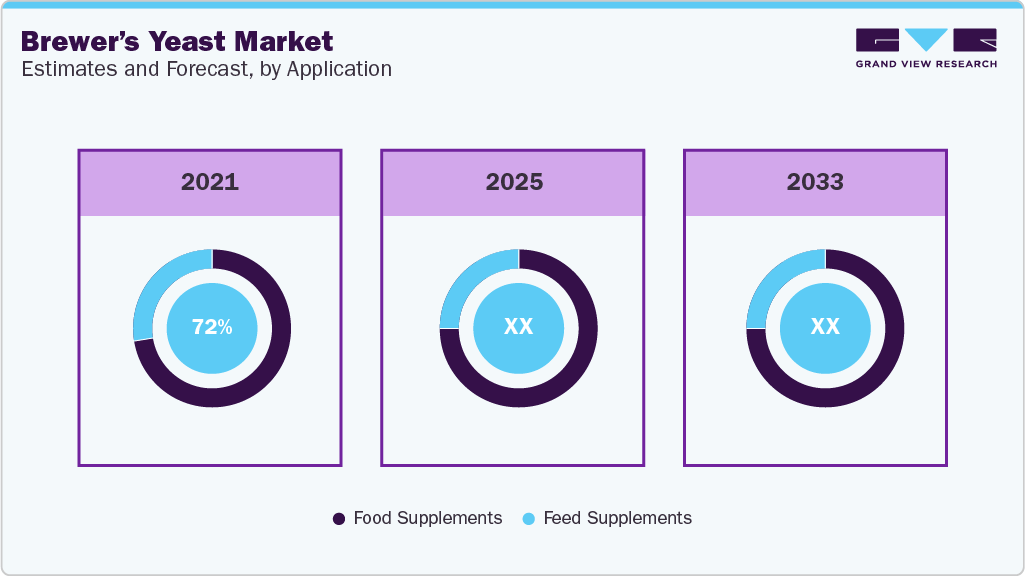

- By application, food supplements led the market, accounting for a share of 72.7% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7.60 Billion

- 2033 Projected Market Size: USD 16.12 Billion

- CAGR (2026-2033): 9.9%

- Europe: Largest market in 2025

With the rise in health awareness, consumers are actively looking for types enriched with nutritional benefits. This shift has led to a significant increase in the popularity of brewer's yeast as a natural nutrient source. The growth of the craft beer industry has significantly increased the demand for brewer's yeast. Craft brewers often experiment with unique yeast strains to create diverse beer styles and flavors, leading to increased consumption of brewer's yeast. Genetically modified brewer’s yeast is used to enhance the flavor profile of craft beer. Brewer’s yeast is genetically modified to support its usage in craft beer to enhance the flavor of the end product and reduce its bitterness. Therefore, the growing popularity of craft beers is expected to result in an increased demand for specific yeast strains.

The continuous demand for novel and sustainable alternative proteins is also driving the demand for brewer’s yeast. Technological innovations in the brewer’s yeast industry support the growing demand for yeast proteins. Yeast biomass contains 35%-60% of its dry weight as protein. Due to their ideal amino acid composition, yeast proteins offer significant potential as alternative proteins. Yeast proteins extracted from brewer’s yeast can be hydrolyzed to produce yeast peptides, which are used in protein supplements, meat extenders, and fining agents.

The ingredient’s versatility across industries is also fueling demand. Beyond human dietary supplements, brewer’s yeast is widely used in functional foods, bakery applications, pet nutrition, aquafeed, and even in cosmetic formulations due to its skin-conditioning and antioxidant properties. As manufacturers diversify formulations to include natural, nutrient-dense components, brewer’s yeast has become an attractive functional additive. Finally, improved distribution through e-commerce platforms, specialty health retailers, and pharma-led chains has made brewer’s yeast more accessible in Tier II/III geographies, contributing to overall market expansion. Together, these structural and behavioral shifts are driving sustained growth in the global brewer’s yeast market.

Consumer Insights

The demand for brewer’s yeast has been rising consistently as consumers increasingly prioritize natural, nutrient-rich ingredients over synthetic supplements. Brewer’s yeast is widely valued for its rich profile of B-complex vitamins (B1, B2, B3, B5, B6, B7, B9), as well as chromium, selenium, zinc, amino acids, and beta-glucans, which support immunity, energy metabolism, skin health, and gut function. As global consumers shift toward preventive wellness and clean-label nutrition, brewer’s yeast fits squarely into the “functional, natural, and plant-based” trend. Younger consumers, especially millennials and Gen Z, increasingly explore supplements to address fatigue, nutrient deficiencies, and lifestyle stress, and brewer’s yeast, perceived as both natural and affordable, gains traction as a daily nutritional support ingredient.

Brewer’s yeast has broad industrial applications due to its nutritional value, functional properties, and fermentation potential. In the dietary supplement and nutraceutical industry, it is used in tablets, capsules, gummies, and fortified food blends due to its naturally high vitamin and mineral content. The functional foods industry uses brewer’s yeast to enrich cereals, meal replacement powders, nutrition bars, soups, and even savory snacks, improving protein content and micronutrient density while maintaining a clean-label profile. In the bakery and food processing industry, yeast derivatives are added to doughs and baked goods to enhance flavor, provide natural leavening (in active forms), and increase nutritional value (in inactive forms).

The shift toward plant-based and vegan lifestyles is another key factor driving adoption. Brewer’s yeast serves as a non-animal source of protein and vitamins, making it attractive to vegetarians, vegans, and flexitarians. Its versatility, easy to incorporate into shakes, cereals, soups, and supplement capsules, also appeals to urban consumers seeking convenient nutritional solutions. Social media awareness, online wellness communities, and nutrition influencers further amplify demand, as more consumers learn about the benefits of yeast-derived nutrients for skin, hair, metabolism, and immunity. Improved availability through e-commerce and health retail chains has also accelerated penetration into Tier II/III cities, making brewer’s yeast an accessible and low-cost supplement option in many households.

Type Insights

Dry brewer’s yeast held a 70.5% share of the brewer’s yeast industry in 2025. Dry brewer's yeast is known for its reliability in delivering consistent fermentation and flavor profiles with a reduced risk of being affected by temperature variations. Its affordability is further enhanced by lower production and shipping expenses, making it a favorable choice for budget-conscious brewers. Moreover, the ease of exporting and distributing dry brewer's yeast globally, as opposed to its liquid form, enables manufacturers to expand their market presence and reach a broader customer base.

The liquid brewer’s yeast market segment is projected to grow at a CAGR of 10.7% from 2026 to 2033. Suppliers of liquid yeast provide a diverse selection of strains, encompassing the commonly used Saccharomyces cerevisiae for beer fermentation. Additionally, they offer wild yeast strains, such as Brettanomyces, known for imparting distinctive, intricate flavors to specific beer varieties. They also supply bacterial cultures, including Lactobacillus and Pediococcus, which are essential in crafting sour ales.

Application Insights

The food supplements segment led the brewer’s yeast market, accounting for a share of 72.7% in 2025. Brewer's yeast is widely used as a dietary supplement due to its rich source of B vitamins, minerals, and protein. It is available in several forms, including tablets, capsules, flakes, and powder. The B vitamins in brewer's yeast are essential for various metabolic processes, while minerals such as chromium and selenium offer a range of health benefits. Furthermore, its high protein content makes brewer's yeast appealing to those seeking to boost their protein intake for muscle development, repair, and overall health. An example is the B-complex vitamins supplement, which contains brewer's yeast and plays a vital role in energy pro.

The feed supplements segment is projected to grow at a CAGR of 9.5% from 2026 to 2033. As the global population rises, so does the demand for meat and animal-derived products, making livestock and poultry farming significant sectors in meeting this growing need. To address the escalating demand for animal feed in these industries, farmers and producers are exploring alternative, sustainable nutritional sources. Brewer's yeast, renowned for its dense nutritional content of protein, B vitamins, and minerals, emerges as a compelling choice for animal feed supplementation. Incorporating brewer's yeast into animal feed can enhance their overall well-being, growth, and productivity.

Regional Insights

North America Brewer’s Yeast Market Trends

The North America brewer’s yeast industry is expected to grow at a CAGR of 9.9% from 2026 to 2033. There is a high demand for brewer’s yeast in North America as the region is the largest producer of feed for cattle, turkey, pets, and horses. In addition, the U.S. has the lowest feed prices among all other economies, which is expected to develop new growth opportunities for the market players over the forecast period. Ruminant feed is the second-largest feed type produced in the U.S.

Europe Brewer’s Yeast Market Trends

Europe's brewer’s yeast industry accounted for a share of 32.5% in 2025. With over 70 million households in Europe owning pets, there's an increasing awareness of the need for well-balanced diets, which is likely to influence the demand for brewer's yeast positively. Additionally, there's a notable shift among European consumers towards greater health consciousness, with a preference for healthier, more sustainable food options.

The UK brewer’s yeast market is expected to witness a CAGR of 9.6% over the forecast period. Brewer’s yeast is rich in B vitamins, protein, amino acids, and trace minerals, making it increasingly popular in health foods, vegan formulations, gut-health supplements, and immune-support products. The shift toward clean-label, minimally processed ingredients, coupled with strong growth in the craft beer industry (leading to higher yeast availability and innovation), has further supported market expansion. Additionally, brewer’s yeast is now widely used in premium pet food, a segment growing faster than overall FMCG in the UK, further boosting its commercial demand.

Asia Pacific Brewer’s Yeast Market Trends

Asia Pacific is expected to witness a CAGR of 10.7% over the forecast period. Animal feed is one of the major end uses of brewer’s yeast, and the region is one of the largest animal feed producers in the world, led by China, India, and Japan. This is expected to play a key role in boosting the utilization of brewer’s yeast in animal feed. Rising swine feed production in Indonesia and Vietnam is also expected to positively impact market growth over the forecast period.

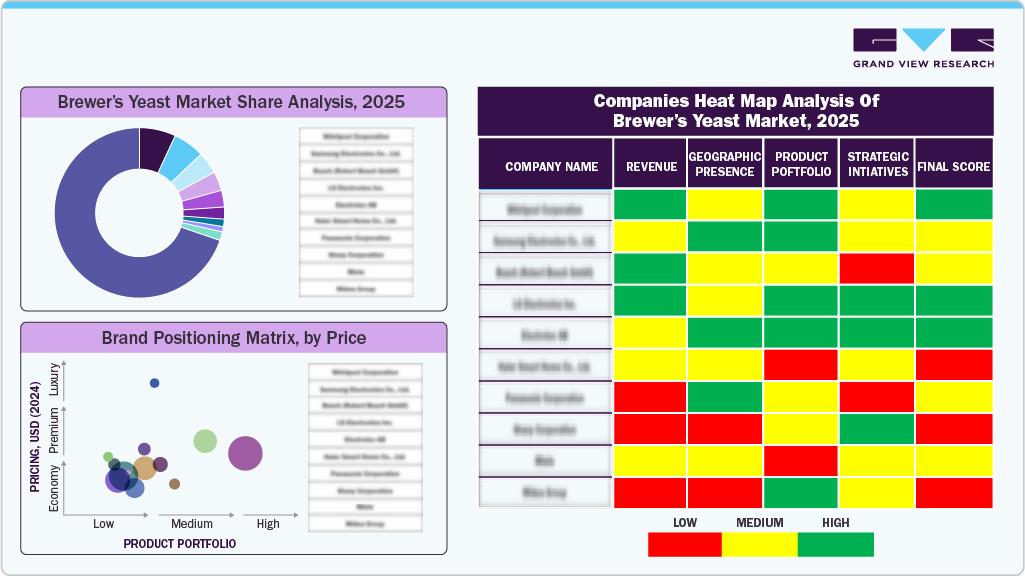

Key Brewer’s Yeast Company Insights

The global brewer’s yeast market remains highly competitive, with leading producers expanding their penetration across food & beverage, dietary supplements, animal nutrition, and cosmetics applications. Manufacturers are increasingly investing in advanced fermentation technologies, improved drying processes, and high-purity extraction methods to enhance product quality, nutrient density, and functional performance. Market growth is supported by the rising consumer focus on natural ingredients, gut health, and protein-rich supplements, as well as the growing demand for yeast-based probiotics and functional foods. Additionally, increasing adoption of brewer’s yeast in pet nutrition, feed formulations, craft brewing, and clean-label product development continues to accelerate its use across global markets.

Key Brewer’s Yeast Companies:

The following key companies have been profiled for this study on the brewer’s yeast market.

- Associated British Food plc

- Leiber

- Lallemand, Inc

- Archer Daniels Midland Company

- Chr. Hansen Holding A/S

- Shandong Bio Sunkeen Co., Ltd.

- Lesaffre Group

- White Labs

- Angel Yeast Co., Ltd.

- HEBEI TOMATO INDUSTRY CO LTD.

Recent Developments

-

In February 2023, White Labs launched a new dry yeast product, WLP001-California Ale Yeast, expanding its traditionally liquid yeast lineup. The dry format offers improved convenience, shelf-life, and global accessibility while maintaining high quality. It is available in professional 500g packs, with smaller packages for homebrewers coming soon, and more dry yeast strains are planned for future release.

-

In August 2024, AB Mauri North America, part of Associated British Foods, acquired Omega Yeast Labs, a notable craft yeast producer based in Chicago, to strengthen its specialty yeast business for craft beer within the AB Biotek division. Omega Yeast, known for its innovative liquid yeast strains since 2013, will expand AB Mauri’s offerings and global presence in the craft brewing market, aligning with recent AB Mauri investments in specialty yeast and beverage application centers worldwide.

Brewer’s Yeast Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8.32 billion

Revenue forecast in 2033

USD 16.12 billion

Growth rate

CAGR of 9.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilo tons, and CAGR from 2026 to 2033

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Associated British Food plc; Leiber; Lallemand, Inc.; Archer Daniels Midland Company; Chr. Hansen Holding A/S; Shandong Bio Sunkeen Co., Ltd.; Lesaffre Group; White Labs; Angel Yeast Co., Ltd.; HEBEI TOMATO INDUSTRY CO LTD.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Brewer’s Yeast Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the brewer’s yeast market report based on type, application, and region:

-

Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Dry

-

Liquid

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Food Supplements

-

Feed Supplements

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global brewer’s yeast size was estimated at USD 6.35 billion in 2023 and is expected to reach USD 6.94 billion in 2024.

b. The global brewer’s yeast is expected to grow at a compounded growth rate of 9.7% from 2024 to 2030, reaching USD 12.08 billion by 2030.

b. Some key players operating in white brewer’s yeast market are Associated British Food plc, Leiber, Lallemand, Inc, Archer Daniels Midland Company, Chr. Hansen Holding A/S, Shandong Bio Sunkeen Co., Ltd., Lesaffre Group, White Labs, Angel Yeast Co., Ltd., HEBEI TOMATO INDUSTRY CO LTD.

b. Some of the key market players in the brewer’s yeast market are Associated British Food plc., Lesaffre Group, Alltech, Leiber GmbH, Cargill, Incorporated, Angel Yeast Co., Ltd.

b. The increasing demand for alcoholic beverages, such as beer, wine, and spirits, is a significant driver. Brewer's yeast is a vital ingredient in the fermentation process, converting sugars into alcohol and carbon dioxide, thereby playing a crucial role in the production of these beverages.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.