- Home

- »

- Advanced Interior Materials

- »

-

Building Envelope Market Size, Share, Industry Report, 2033GVR Report cover

![Building Envelope Market Size, Share & Trends Report]()

Building Envelope Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Walls & Cladding Systems, Roofs, Windows & Doors), By End-use (Residential, Commercial, Industrial), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-713-4

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Building Envelope Market Summary

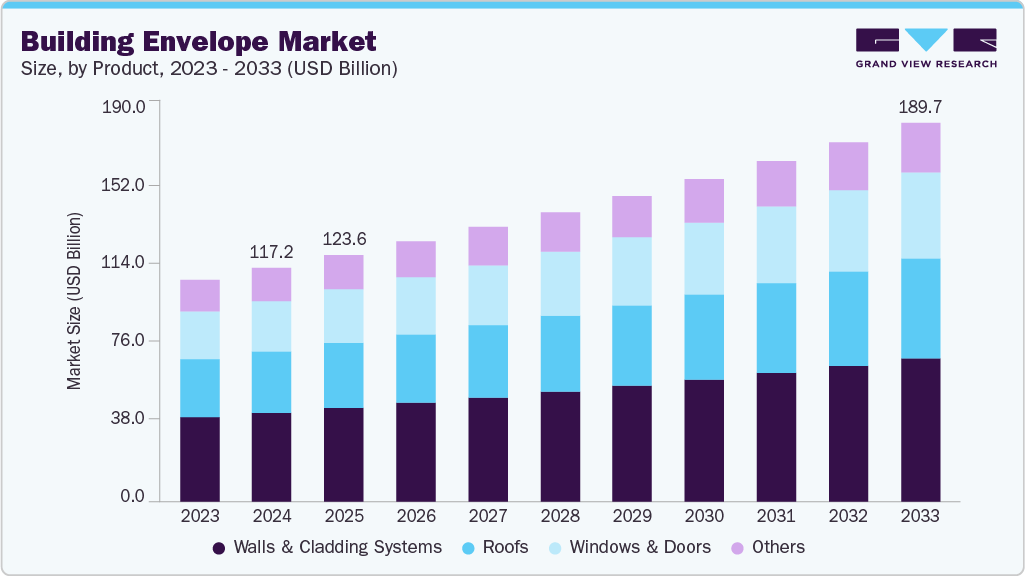

The global building envelope market size was estimated at USD 117.18 billion in 2024 and is projected to reach USD 189.73 billion in 2033, growing at a CAGR of 5.5% from 2025 to 2033. The demand for building envelope solutions is increasing as modern construction emphasizes energy efficiency, sustainability, and occupant comfort.

Key Market Trends & Insights

- North America dominated the global building envelope industry with the largest revenue share of 32.5% in 2024.

- The U.S. building envelope industry benefits from robust regulatory frameworks like ASHRAE standards and LEED certifications.

- By product, the walls & cladding systems segment held the largest revenue market share of 38.2% in 2024.

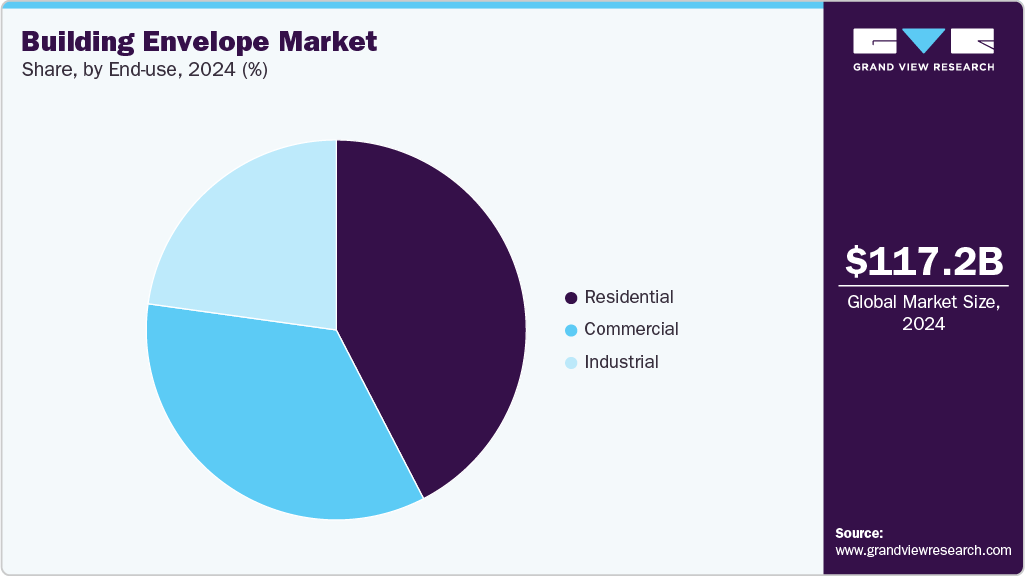

- By end use, the residential segment held the largest revenue share of 42.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 117.18 Billion

- 2033 Projected Market Size: USD 189.73 Billion

- CAGR (2025-2033): 5.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Rising awareness of climate change has driven governments, businesses, and homeowners to adopt advanced building envelopes that minimize energy loss and reduce greenhouse gas emissions. Urbanization and rapid infrastructure development in emerging economies are also expanding the construction of commercial and residential buildings, further fueling demand. The global trend of green buildings and certifications such as LEED and BREEAM has strengthened the use of high-performance envelopes.

Key drivers include the surge in green building certifications, the adoption of modern construction technologies, and the integration of advanced materials that enhance performance. Walls & cladding systems are increasingly demanded for thermal regulation and protection against environmental stressors. Roofs are influenced by demand for cool roofs, green roofs, and solar-ready installations, addressing both environmental concerns and cost savings. Windows & doors drive demand through their role in reducing heat loss, improving indoor comfort, and supporting architectural design flexibility. Other building envelope components, such as shading systems and ventilated facades, benefit from rapid urban development and growing interest in smart building solutions.

Innovations include the use of composite cladding materials, 3D-printed walls, and ventilated façade systems that improve thermal comfort and aesthetics. Roofing trends highlight green roofs, photovoltaic-integrated systems, and lightweight materials that reduce structural load. Windows and doors are evolving with smart glass, double/triple glazing, and automation technologies for improved efficiency. In the "Others" category, dynamic facades, modular construction components, and digital twins for envelope performance monitoring are gaining ground. Overall, technology integration, lightweight construction, and the rise of eco-friendly materials are reshaping the building envelope landscape, aligning with net-zero building objectives.

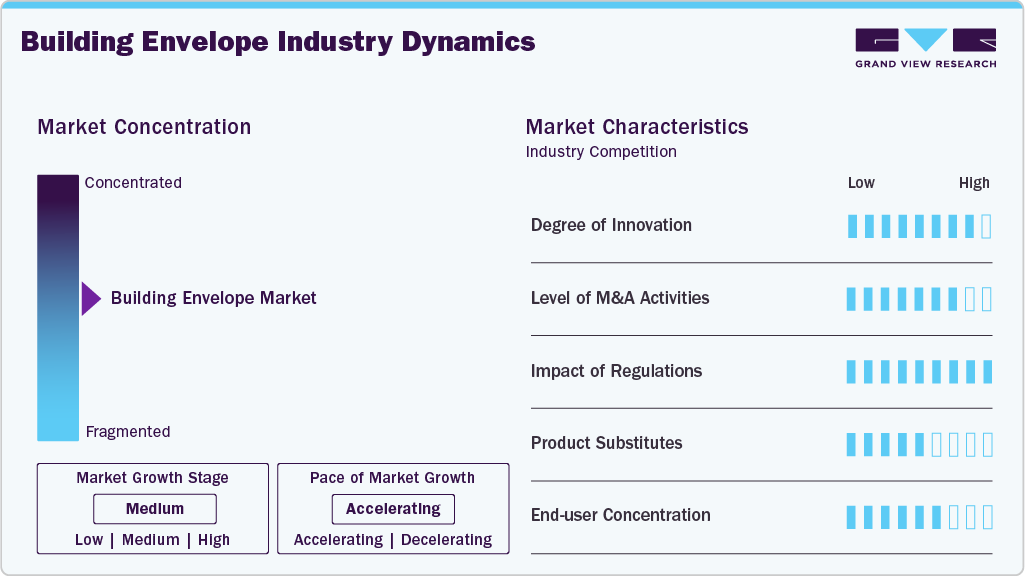

Market Concentration & Characteristics

The market for building envelope is moderately consolidated, with a mix of global players and regional specialists. Large companies such as Saint-Gobain, BASF, Owens Corning, Rockwool, and Kingspan dominate the supply of insulation materials and advanced facades. Meanwhile, glazing giants like Nippon Sheet Glass and AGC Inc. hold strong positions in window and glass solutions. Regional players focus on cost-effective and customized solutions for local markets, particularly in Asia and Latin America. Partnerships between construction firms and material suppliers are increasing as integrated solutions are preferred over standalone products. Mergers and acquisitions are also shaping market dynamics, enhancing portfolio diversity and global reach.

The threat of substitutes is moderate, as each segment provides unique functional and regulatory compliance features. Walls and cladding systems face limited substitution, although advanced coatings or prefabricated panels may replace traditional materials. Roofing systems may see competition from emerging membrane technologies and integrated solar structures. Windows and doors encounter substitutes in advanced shading devices or automated façade solutions, but direct replacement is unlikely due to their structural necessity. Other envelope components, like curtain walls, face minor substitution risks from prefabricated modular solutions. Overall, product necessity and regulatory compliance reduce substitution threats.

Product Insights

The walls & cladding systems segment held the largest revenue market share of 38.2% in 2024, driven by their crucial role in providing structural integrity, thermal insulation, and aesthetic appeal. The growing demand for energy-efficient and fire-resistant materials, such as aluminum composites, fiber cement, and high-performance panels, has strengthened their market dominance. Commercial and high-rise construction projects across Asia Pacific, North America, and Europe rely heavily on advanced cladding solutions for durability and compliance with green building standards. In addition, ventilated façades and rainscreen cladding systems are witnessing widespread adoption, further solidifying this segment’s leadership in the global building envelope industry.

The windows & doors segment is expected to grow at the fastest CAGR of 6.1% over the forecast period, fueled by rising demand for energy-efficient fenestration and smart building integration. Increasing adoption of double and triple-glazing, low-emissivity glass, and automated systems for natural light optimization is propelling growth. Stricter energy codes in developed economies, combined with rapid urban housing demand in emerging markets, are further boosting this segment. Moreover, smart windows with dynamic glazing and eco-friendly door materials are gaining traction, driven by the push toward net-zero energy buildings. This combination of regulatory pressure and technological innovation positions windows & doors as the most rapidly expanding segment of the building envelope industry.

End-use Insights

The residential segment held the largest revenue share of 42.4% in 2024, driven by rising urbanization, increasing housing demand, and government-backed affordable housing initiatives. Homeowners are increasingly investing in energy-efficient walls, cladding, roofing, and advanced window systems to reduce utility costs and enhance indoor comfort. The trend toward sustainable living has accelerated the adoption of insulated cladding panels, green roofing, and double-glazed windows in residential construction. In addition, renovation and retrofitting of old housing stock in developed regions are further boosting demand. With the growing popularity of smart homes, the residential segment continues to maintain its lead in the global building envelope industry.

The commercial segment is expected to grow at the fastest CAGR of 6.0% over the forecast period, supported by rapid urban infrastructure development and an increasing number of office complexes, shopping centers, and institutional buildings. Energy codes and sustainability certifications such as LEED, BREEAM, and WELL are compelling commercial builders to adopt advanced façades, high-performance glazing, and solar-integrated roofing systems. Corporate sustainability goals and the need for modern, aesthetic designs are also fueling demand for innovative cladding and curtain wall systems. Emerging markets, particularly in the Asia Pacific and the Middle East, are witnessing large-scale commercial construction, making this segment a key growth driver for the future of the market.

Regional Insights

North America building envelope industry dominated the global market and accounted for the largest revenue share of about 32.5% in 2024. The market in North America is driven by stringent energy efficiency regulations and demand for sustainable retrofitting. The U.S. and Canada are actively adopting advanced insulation and glazing systems to meet zero-energy building targets. The region has a mature construction industry with increasing investments in smart and green buildings. Rising awareness of climate resilience, especially in hurricane and wildfire-prone areas, is encouraging the use of durable envelopes. Technological advancements and innovation hubs in the U.S. are fostering new product development. Retrofitting older building stock with advanced systems remains a key growth area.

U.S. Building Envelope Market Trends

The U.S. building envelope industry benefits from robust regulatory frameworks like ASHRAE standards and LEED certifications. Federal and state-level incentives encourage residential and commercial projects to adopt advanced insulation, facades, and glazing solutions. Urban redevelopment and retrofitting projects are particularly strong drivers. The growing emphasis on net-zero buildings aligns with the adoption of innovative materials. Moreover, construction demand in metropolitan areas continues to rise, further boosting market growth. Partnerships between technology companies and construction firms are accelerating the adoption of smart facades.

Asia Pacific Building Envelope Market Trends

Asia Pacific building envelope industry is driven by rapid urbanization, strong infrastructure investments, and government regulations promoting energy-efficient construction. Countries such as China, India, and Japan are driving demand with high-rise residential and commercial developments. Rising population and growing disposable incomes also support new housing projects. The construction boom in smart cities and industrial zones is further boosting the adoption of advanced envelopes. Increasing foreign investments in real estate, coupled with affordable labor costs, make the region a hub for large-scale projects. Green building certifications are being rapidly adopted, further encouraging sustainable building practices.

China building envelope industry is the largest contributor within the Asia Pacific region, driven by its massive construction industry and government-led energy efficiency mandates. The Chinese government’s focus on green buildings under the 14th Five-Year Plan has accelerated demand for advanced facades and insulation systems. Large-scale urban housing projects and commercial towers are driving adoption of glazing and modern envelope technologies. Domestic manufacturers are investing heavily in cost-effective, energy-efficient materials to compete globally. In addition, rapid adoption of prefabrication in China is boosting market growth. Demand is expected to remain high as China continues to urbanize at scale.

Europe Building Envelope Market Trends

Europe building envelope industry remains a leader in sustainable construction practices, heavily influenced by the EU’s Energy Performance of Buildings Directive. Countries such as Germany, France, and the UK are enforcing strict efficiency standards that boost demand for advanced building envelope systems. Adoption of green certifications like BREEAM is widespread across commercial and residential projects. The region has a mature construction sector with an emphasis on retrofitting older buildings to meet modern standards. Innovation in glazing, insulation, and lightweight materials continues to expand. Europe also leads in the use of advanced façade technologies integrating renewable energy.

Germany building envelope industry is one of the most advanced markets for building envelopes, owing to its strict energy efficiency regulations and focus on sustainable building. The country has seen widespread adoption of Passivhaus standards, which prioritize airtight and highly insulated building envelopes. Germany’s advanced manufacturing base supports innovations in glazing and façade solutions. The retrofitting of older housing stock remains a significant driver of demand. In addition, government support for renewable energy integration in buildings is encouraging the adoption of solar facades. Germany’s emphasis on quality and sustainability ensures its leadership in the European market.

Central & South America Building Envelope Market Trends

The building envelope industry in Central & South America is growing steadily due to rising urbanization and increased investments in residential and commercial infrastructure. Countries such as Brazil and Mexico are leading the adoption of efficient construction practices. Although regulations are less stringent compared to North America and Europe, the growing influence of global green building certifications is shaping demand. Affordability remains a key factor, with many local players offering cost-effective insulation and façade solutions. The region also has potential for prefabricated and modular construction, further boosting the market.

Middle East & Africa Building Envelope Market Trends

The Middle East & Africa building envelope industry is expanding rapidly due to mega infrastructure and smart city projects, particularly in the Gulf region. High demand for energy-efficient solutions is driven by extreme climatic conditions that necessitate advanced insulation and glazing. Saudi Arabia, the UAE, and Qatar are investing heavily in green building initiatives. Africa is witnessing increasing urban development, though affordability challenges persist. International players are partnering with local developers to introduce advanced envelope solutions. The region’s strong focus on sustainability and iconic architectural projects is expected to fuel significant demand growth.

Key Building Envelope Company Insights

Some of the key players operating in the market include Saint-Gobain and Rockwool International.

-

Saint-Gobain is a global leader in sustainable building materials, offering advanced solutions in insulation, façades, glazing, and roofing. In the building envelope industry, the company is recognized for its energy-efficient wall and cladding systems, smart glass technologies, and sustainable construction materials that align with net-zero targets. Its strong presence in Europe, North America, and Asia Pacific makes it a dominant player in both residential and commercial applications.

-

Rockwool International specializes in stone wool insulation products, widely used in building envelope systems for thermal, acoustic, and fire-resistant performance. The company’s solutions are crucial for walls, roofs, and façades, enabling energy efficiency and compliance with green building regulations. With sustainability at its core, Rockwool has established a strong foothold in Europe and is rapidly expanding in North America and Asia.

Kingspan Group and GAF Materials Corporation are some of the emerging market participants in the building envelope industry.

-

Kingspan Group is a leading provider of high-performance insulated panels, cladding, façades, and roofing systems. Its innovations in energy-efficient and lightweight construction materials have positioned it as a key player in modern building envelope solutions. Kingspan’s focus on net-zero energy buildings and modular construction technologies has boosted its global presence, particularly in Europe, North America, and emerging Asia Pacific markets.

-

GAF Materials Corporation is one of North America’s largest roofing manufacturers, offering shingles, membranes, and ventilation systems that form a core part of building envelopes. The company has a strong presence in residential and commercial roofing markets, with growing emphasis on reflective, solar-ready, and energy-efficient systems.

Key Building Envelope Companies:

The following are the leading companies in the building envelope market. These companies collectively hold the largest market share and dictate industry trends.

- Saint-Gobain

- Owens Corning

- Kingspan Group

- Rockwool International

- BASF SE

- DuPont de Nemours

- GAF Materials Corporation

- Sika AG

- Etex Corp

- 3M Company

Recent Developments

-

In January 2025, Saint-Gobain completed the acquisition of OVNIVER Group in Mexico & Central America, further strengthening its worldwide presence in construction chemicals

-

In January 2024, Kingspan launched PowerPanel, an insulated panel with integrated solar PV.

-

In June 2025, Sika acquired Gulf Additive Factory LLC in the State of Qatar. The acquisition strengthens Sika’s foothold in the country and provides exciting opportunities for further expansion.

Building Envelope Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 123.63 billion

Revenue forecast in 2033

USD 189.73 billion

Growth rate

CAGR of 5.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Saint-Gobain; Owens Corning; Kingspan Group; Rockwool International; BASF SE; DuPont de Nemours; GAF Materials Corporation; Sika AG; Etex Corp; 3M Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Building Envelope Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global building envelope market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Walls & Cladding Systems

-

Roofs

-

Windows & Doors

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global building envelope market size was estimated at USD 117.18 billion in 2024 and is expected to reach USD 123.63 billion in 2025.

b. The global building envelope market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 189.73 billion by 2033.

b. The walls & cladding systems segment held the highest revenue market share of 38.2% in 2024, driven by their crucial role in providing structural integrity, thermal insulation, and aesthetic appeal.

b. Some of the key players operating in the building envelope market include Saint-Gobain, Owens Corning, Kingspan Group, Rockwool International, BASF SE, DuPont de Nemours, GAF Materials Corporation, Sika AG, Etex Corp, and 3M Company.

b. The building envelope market is driven by rising demand for energy-efficient, sustainable, and technologically advanced construction solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.