- Home

- »

- IT Services & Applications

- »

-

Business Software & Services Market, Industry Report, 2030GVR Report cover

![Business Software And Services Market Size, Share & Trends Report]()

Business Software And Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Software (Finance, Sales & Marketing), By Service (Consulting, Managed Services), By Deployment, By End-use, By Enterprise Size, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-149-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Business Software And Services Market Summary

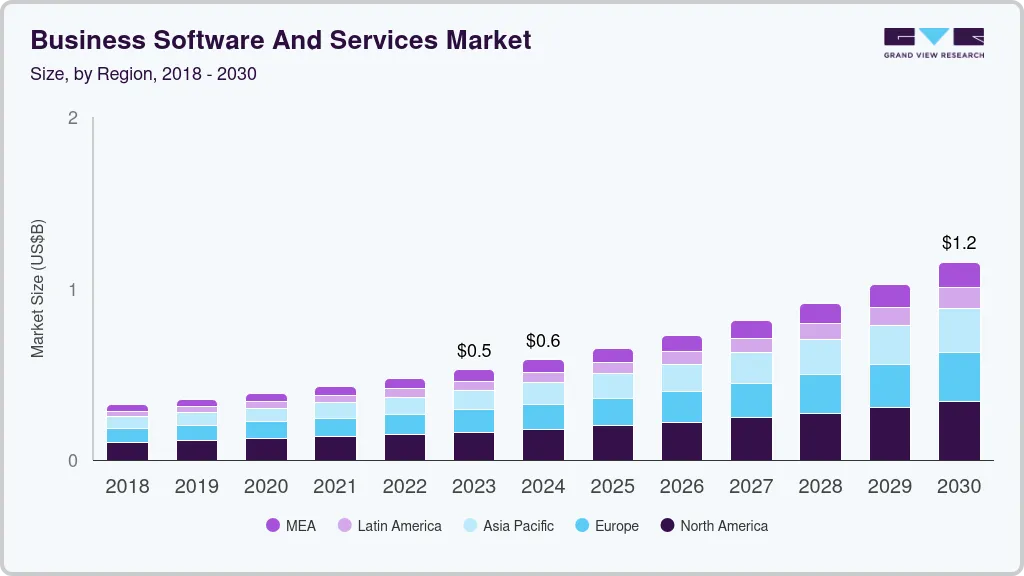

The global business software and services market size was estimated at USD 584.03 billion in 2024 and is projected to reach USD 1,153.75 billion by 2030, growing at a CAGR of 12.1% from 2025 to 2030. The market growth is driven by the increasing demand for automation in business processes. Organizations are leveraging software solutions to streamline operations, enhance productivity, and reduce operational costs.

Key Market Trends & Insights

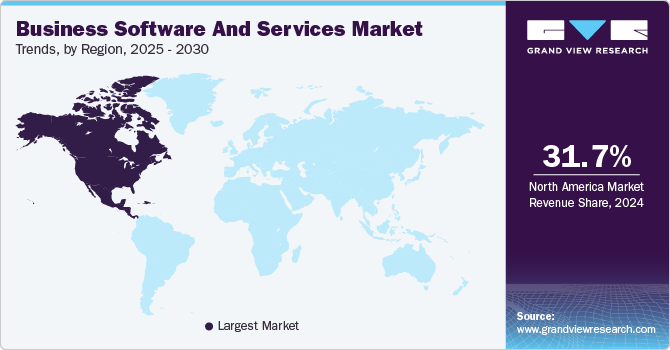

- North America business software and services market dominated the global market with the largest revenue share of 31.76% in 2024.

- The business software and services market in the U.S. is expected to grow at a significant CAGR of 10.9% from 2025 to 2030.

- The business software and services market in Asia Pacific is anticipated to grow at a significant CAGR of 13.1% from 2025 to 2030.

- Based on software, the finance segment led the market with the largest revenue share of 25.58% in 2024.

- Based on service, the support & maintenance segment led the market with the largest revenue share of 41.24% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 584.03 billion

- 2030 Projected Market Size: USD 1,153.75 billion

- CAGR (2025-2030): 12.1%

- North America: Largest market in 2024

- UK: Fastest growing market

With advancements in artificial intelligence (AI) and machine learning (ML), businesses can now integrate intelligent automation into tasks such as customer service, data analytics, and workflow management, further accelerating the adoption of business software. As companies shift to digital-first strategies, they are investing in business software and services industry to improve customer experience, optimize supply chains, and enable remote work. The rise of cloud computing has also played a pivotal role, allowing businesses to access scalable and cost-effective software solutions without the need for extensive infrastructure investments. Cloud-based Software-as-a-Service (SaaS) platforms have particularly gained traction, enabling real-time collaboration, secure data access, and flexibility in managing operations.

Moreover, the growing emphasis on data-driven decision-making is propelling the demand for advanced analytics and business intelligence tools. Businesses are increasingly relying on software to extract actionable insights from vast amounts of data, improving strategic planning and competitiveness. Coupled with the rise of cybersecurity concerns, organizations are also investing heavily in software solutions that ensure compliance, protect sensitive data, and mitigate risks in an evolving threat landscape. These factors collectively highlight the robust growth potential of the business software and services industry, catering to the dynamic needs of modern enterprises.

Enterprise software and services are widely utilized in end-use industries such as BFSI, government, healthcare, manufacturing, and retail as they facilitate the simplification of corporate operations. To accomplish data privacy and security goals, business software and services provide easy and quick access to unstructured data obtained through data analytics. Furthermore, the implementation of enterprise solutions leads to a significant reduction in raw material and inventory costs, allowing businesses to boost their profitability. Many businesses are implementing business solutions to improve their operational efficiency by combining administrative systems into a single software. Departmental data is linked with real-time updates in business solution modules, resulting in improved data transparency. Businesses select the software and solutions best suited to their requirements.

Software Insights

Based on software, the finance segment led the market with the largest revenue share of 25.58% in 2024. The segment is expected to benefit from the growing demand for financial management tools in businesses and enterprises for activities such as planning, budgeting, analysis, and reporting. Financial management software is widely used in the BFSI industry in North America for risk compliance and improvements in business operation efficiency and productivity. The increasing number of mobile applications facilitating financial data management and providing several other use cases related to financing is further anticipated to offer numerous growth opportunities to the market over the forecast period

The sales & marketing segment is expected to grow at a significant CAGR of 12.6% over the forecast period due to the increasing focus on customer-centric strategies. Businesses are leveraging sales and marketing software to gain deeper insights into customer behavior, preferences, and buying patterns. Customer Relationship Management (CRM) systems, in particular, have become indispensable tools, enabling organizations to build stronger relationships, enhance customer experiences, and improve retention rates.

Service Insights

Based on service, the support & maintenance segment led the market with the largest revenue share of 41.24% in 2024, due to the rising complexity of software ecosystems as businesses adopt advanced technologies such as cloud computing, artificial intelligence (AI), and the Internet of Things (IoT). These technologies demand specialized support and regular maintenance to ensure optimal performance, compatibility, and seamless integration with existing systems.

The managed services segment is expected to grow at a significant CAGR over the forecast period. The growing emphasis on cybersecurity is also driving demand in this segment. With the rising frequency and sophistication of cyberattacks, businesses are turning to MSPs to provide robust security solutions, including threat monitoring, incident response, and compliance management. Managed services ensure that organizations can stay ahead of potential vulnerabilities and meet industry-specific regulatory requirements without the need for significant internal investments.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 58.15% in 2024, owing to the increasing demand for scalability and flexibility. Cloud-based solutions allow organizations to scale their operations seamlessly, accommodating fluctuating workloads and business needs without significant infrastructure investments. This flexibility makes the cloud an attractive option for businesses of all sizes, from startups to large enterprises, enabling them to adapt quickly to market changes.

The on-premise segment is expected to grow at a significant CAGR over the forecast period. Many businesses, especially in highly regulated industries such as finance, healthcare, and government, prefer on-premise deployment to ensure compliance with stringent data protection and privacy regulations. Hosting software and services on local servers provides organizations with complete control over access, security protocols, and data storage.

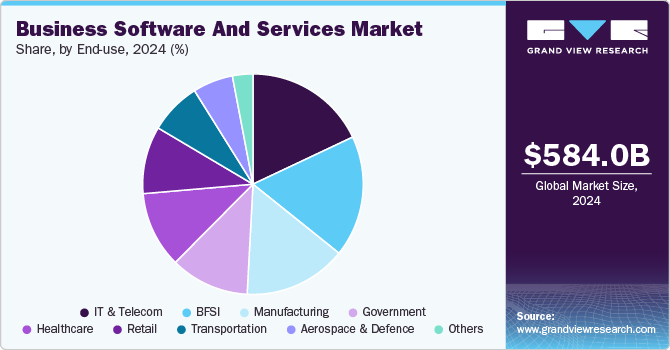

End-use Insights

Based on end use, the IT and telecom segment led the market with the largest revenue share of 18.0% in 2024, owing to the growing adoption of cloud computing and virtualization in the sector. Cloud-based solutions provide telecom operators and IT service providers the flexibility to scale resources, reduce infrastructure costs, and support next-generation technologies like 5G, edge computing, and the Internet of Things (IoT). These innovations demand sophisticated software to manage the increased complexity of networks, data flows, and service delivery.

The healthcare segment is expected to grow at a significant CAGR over the forecast period. The rise of data analytics and artificial intelligence (AI) is also fueling growth in the healthcare software market. Healthcare organizations are increasingly using AI-driven solutions to enhance diagnostics, predict patient outcomes, and optimize treatment plans. Data analytics platforms are enabling providers to extract actionable insights from large volumes of clinical data, which can improve decision-making, reduce costs, and enhance operational efficiency.

Enterprise Size Insights

Based on enterprise size, the large enterprises segment led the market with the largest revenue share of 61.0% in 2024, attributed to the growing emphasis on data-driven decision-making. Large enterprises generate massive volumes of data, and leveraging this data effectively is critical for maintaining a competitive edge. Advanced analytics, business intelligence tools, and artificial intelligence (AI) capabilities enable organizations to derive actionable insights, optimize strategies, and identify new growth opportunities. This need for sophisticated analytics solutions fuels investments in business software tailored for large-scale data processing and visualization.

The small & medium enterprises segment is expected to grow at a significant CAGR over the forecast period. The increasing focus on cost-effective solutions that enable SMEs to streamline operations and remain competitive. Business software, particularly cloud-based options, offers SMEs affordable access to advanced tools for managing finances, operations, customer relationships, and marketing, without the need for significant upfront investments in infrastructure.

Regional Insights

North America business software and services market dominated the global market with the largest revenue share of 31.76% in 2024. Cloud computing and Software-as-a-Service (SaaS) solutions are dominating the market. Organizations are increasingly shifting to cloud-based platforms due to their scalability, flexibility, and cost-effectiveness.

U.S. Business Software And Services Market Trends

The business software and services market in the U.S. is expected to grow at a significant CAGR of 10.9% from 2025 to 2030. AI and automation technologies are gaining traction as businesses in the U.S. look to enhance operational efficiency and reduce costs. The integration of AI-powered tools, such as chatbots for customer service, predictive analytics for marketing, and robotic process automation (RPA) for administrative tasks, is driving growth in the business software sector.

Europe Business Software And Services Market Trends

The business software and services market in Europe is anticipated to register at a considerable CAGR from 2025 to 2030. With the implementation of the General Data Protection Regulation (GDPR) and increasing concerns over data breaches, cybersecurity remains a top priority for European businesses. The demand for business software that helps organizations comply with data protection regulations is growing.

The UK business software and services market is expected to grow at a rapid CAGR during the forecast period. Business intelligence (BI) and data analytics are increasingly being used by UK organizations to make informed, data-driven decisions. Companies are adopting advanced analytics platforms to track key performance indicators (KPIs), monitor market trends, analyze customer behavior, and optimize their operations.

The business software and services market in Germany accounted for a substantial market share in Europe in 2024. German SMEs are adopting cloud-based business solutions, CRM software, accounting tools, and HR management systems to automate tasks and improve operational efficiency. SaaS platforms that provide a range of functionalities at an affordable price are particularly attractive to SMEs, allowing them to compete with larger enterprises in an increasingly digital economy.

Asia Pacific Business Software And Services Market Trends

The business software and services market in Asia Pacific is anticipated to grow at a significant CAGR of 13.1% from 2025 to 2030. Digital transformation is a key theme in the APAC region as organizations in sectors such as manufacturing, retail, banking, and healthcare are adopting new business software solutions to enhance productivity, streamline operations, and meet consumer expectations.

The Japan business software and services market is expected to grow at a rapid CAGR during the forecast period. Japan has a developed IT infrastructure, which supports the growth of business software and services. The country’s advanced telecom networks, high-speed internet, and data centers enable businesses to run sophisticated software solutions, including those requiring high-performance computing.

The business software and services market in China held a substantial market share in Asia Pacific in 2024. As the country continues to embrace digital finance, there is a growing demand for FinTech software solutions, including payment processing, lending platforms, and wealth management tools. The use of AI and big data in the financial services industry is enabling more efficient risk management, credit scoring, fraud detection, and customer service.

Key Business Software And Services Company Insights

Key players operating in the business software and services industry are Microsoft, Oracle, SAP SE, IBM Corporation, and Infor. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Business Software And Services Companies:

The following are the leading companies in the business software and services market. These companies collectively hold the largest market share and dictate industry trends.

- Acumatica, Inc.

- Deltek, Inc.

- Epicor Software Corporation

- IBM Corporation

- Infor

- Microsoft

- MicroStrategy Incorporated

- NetSuite Inc.

- Oracle

- SAP SE

- SYSPRO

- Unit4

Recent Developments

-

In January 2025, IBM revealed its plans to acquire Applications Software Technology LLC, an Oracle consultancy. The acquisition is expected to strengthen IBM's Oracle solutions, enabling the company to help clients in North America, the UK, and Ireland overcome common challenges in public sector cloud transformations, such as transitioning legacy systems, addressing skill shortages, and meeting high security and compliance demands. This move aims to deliver more effective digital transformation results with Oracle Cloud Applications.

-

In October 2024,Acumatica, Inc. introduced its new Professional Services Edition, designed to help small and midsized professional services firms improve efficiency and accelerate growth. This latest addition expands the company’s industry-specific product offerings, providing specialized features and capabilities to enhance collaboration and operational performance. Tailored for firms in architecture, engineering, IT, and more sectors, the solution is crafted to support the unique needs of these industries, enabling firms to optimize their workflows and drive business success.

Business Software And Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 650.49 billion

Revenue forecast in 2030

USD 1,153.75 billion

Growth rate

CAGR of 12.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Software, service, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; and South Africa

Key companies profiled

Acumatica, Inc.; Deltek, Inc.; Epicor Software Corporation; IBM Corporation; Infor; Microsoft; MicroStrategy Incorporated; NetSuite Inc.; Oracle; SAP SE; SYSPRO; Unit4

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Business Software And Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global business software and services market report based on software, service, deployment, enterprise size, end-use, and region.

-

Software Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finance

-

Sales & Marketing

-

Human Resource

-

Supply Chain

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consulting

-

Managed Services

-

Support & Maintenance

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global business software and services market size was estimated at USD 584.03 billion in 2024 and is expected to reach USD 650.49 billion in 2025.

b. The global business software and services market is expected to witness a compound annual growth rate of 12.1% from 2025 to 2030 to reach USD 1,153.75 billion by 2030.

b. The finance segment dominated the global business software and services market and accounted for the highest market share of over 25% in 2024.

b. The support & maintenance segment dominated the business software and services market with a share of 41% in 2024.

b. The cloud segment led the global business software and services market and accounted for the highest market share of over 58% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.