- Home

- »

- Medical Devices

- »

-

Calcium Hydroxylapatite Fillers Market Size Report, 2030GVR Report cover

![Calcium Hydroxylapatite Fillers Market Size, Share & Trends Report]()

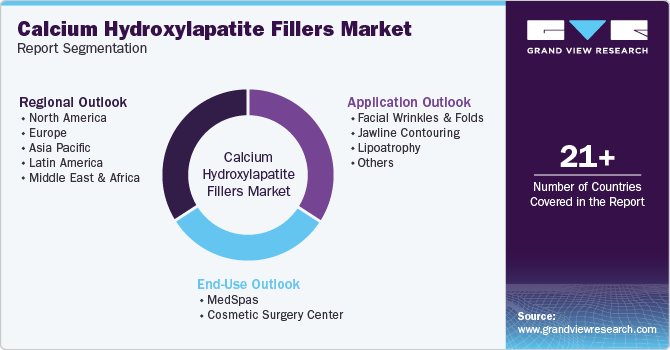

Calcium Hydroxylapatite Fillers Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Facial Wrinkles And Folds, Jawline Contouring, Lipoatrophy), By End Use (MedSpas, Cosmetic Surgery Center, Hospitals), And Segment Forecasts

- Report ID: GVR-4-68040-160-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Calcium Hydroxylapatite Fillers Market Summary

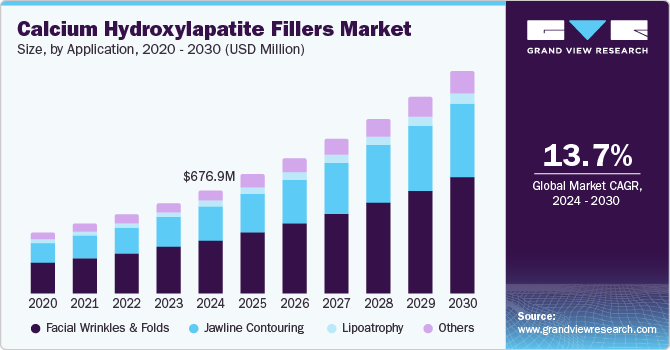

The global calcium hydroxylapatite fillers market size was estimated at USD 676.9 million in 2024 and is projected to reach USD 1.47 billion by 2030, growing at a CAGR of 13.7% from 2025 to 2030. Calcium hydroxylapatite (CaHA) is a dermal filler used in cosmetic procedures to restore facial volume, reduce wrinkles, and enhance natural contours.

Key Market Trends & Insights

- North America calcium hydroxylapatite fillers market held the largest revenue share in 2024.

- Asia Pacific calcium hydroxylapatite fillers industry is expected to grow at the fastest CAGR from 2025 to 2030.

- By application, the facial wrinkles and folds segment held the largest revenue share of 46.5% in 2024.

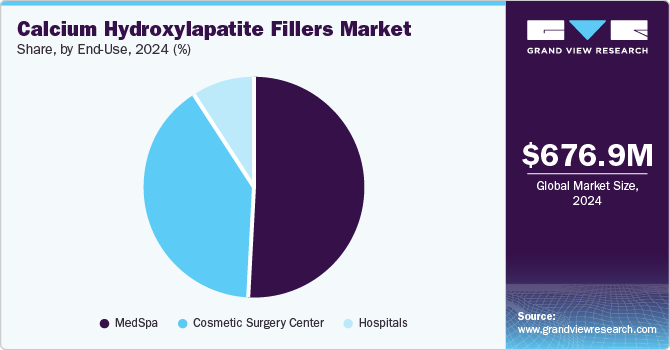

- By end use, the cosmetic surgery centers segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 676.9 Million

- 2030 Projected Market Size: USD 1.47 Billion

- CAGR (2025-2030): 13.7%

- North America: Largest market in 2024

The market is expected to grow due to factors such as changing beauty standards in developing countries, growing financial accessibility to aesthetic procedures, increasing regulatory approval for new-age dermal fillers, and growing cosmetic demand from the aging population. According to the report from the International Society of Aesthetic Plastic Surgery, nearly 350,716 CaHA filler procedures were performed globally in 2022.

The growing demand for cosmetic procedures from the aging population aids the market. According to the American Society of Plastic Surgeons report, nearly 50.2% of all CaHA filler procedures were performed on those aged between 55 and 69 in the U.S. The dominance of the age group is attributed to the loss of facial fat and volume in the geriatric population. CaHA fillers add volume to areas that have lost fat and collagen due to aging, restoring a youthful and lifted appearance. Moreover, these fillers have gained positive real-time safety results across age groups, driving market growth.

The COVID-19 pandemic, which is now endemic, had a negative impact on the market. According to the International Society of Aesthetic Plastic Surgery report, a marginal downfall in non-surgical aesthetic procedures was reported in 2020. Furthermore, the American Society of Plastic Surgeons reported a decline of 17% in the administration of CaHA fillers during 2020. Consequently, in December 2020, Merz Pharma, which manufactures Radiesse, reported a moderate 10.3% decline in its yearly revenues due to COVID-19.

The growing number of financing options to undergo surgical and non-surgical aesthetic procedures aid the market. Partnerships between healthcare providers, manufacturers, and credit-aiding companies make cosmetic procedures highly accessible to a broader patient pool, which drives growth. For example, CareCredit and PatientFi are key companies offering credit facilities to undergo non-surgical aesthetic procedures. These financing companies break down the treatment cost into monthly installments with minimal to no interest. Furthermore, in April 2022, AbbVie and PatientFi extended their partnership; as per the agreement, the latter firm agreed to provide financing options to AbbVie’s aesthetic product line. Such marketing agreements are expected to boost the demand for calcium hydroxylapatite (CaHA) fillers during the forecast period.

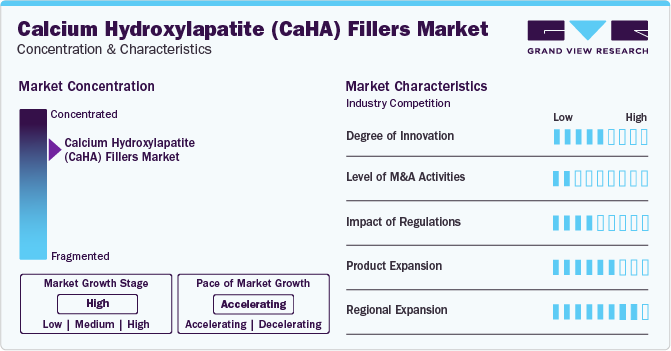

Market Concentration & Characteristics

The global calcium hydroxylapatite (CaHA) fillers market is characterized by a moderate degree of innovation, with new technologies and methods being developed and introduced at regular intervals. Merz launched Radiesse + Lidocaine for jawline contouring. Introducing Lidocaine, which is an anesthetic and antiarrhythmic medication, promises greater patient comfort during filler administration; thereby, market players are investing in innovative technologies and procedures to keep up with the demand.

Market players such as CGBio and AbbVie are involved in mergers and acquisitions. Through M&A activity, these companies can expand their geographic reach and enter new territories. For instance, in July 2023, CGBio acquired DNC AESTHETICS, which has a product pipeline consisting of dermal fillers, BOTOX, and other cosmetic products.

Companies actively invest substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. For instance, in April 2022, AbbVie reported that its acquired pipeline product, HArmonyCa with Lidocaine, received high user satisfaction in post-marketing clinical follow-up.

Companies are rapidly expanding their CaHA fillers product lines to garner the growing demand for non-invasive aesthetic procedures. For instance, Merz Pharma, a leading player in the market, received approval from the U.S. FDA for its Radiesse (+) product line. It is the first injectable approved for jawline contour improvement. Thereby, market players are actively expanding their products to treat a range of aesthetic concerns.

Companies are partnering with leading product distributors to grow their revenues through exports. For instance, in September 2023, CGBio launched its CaHA filler range, FACETEM, in Indonesia. After the launch, CGBio boosts the entire range of filler products in the country. Similarly, in October 2023, CGBio signed an export contract worth 100 million USD with HTDK to expand its offerings in Mainland China.

Application Insights

Facial wrinkles and folds segment accounted for the largest revenue share of 46.5% in 2024. The dominance can be attributed to its ability to effectively diminish lines and add volume in areas affected by age-related loss of skin fullness. Additionally, calcium hydroxylapatite (CaHA) fillers have become a preferred choice for individuals seeking to reduce wrinkles and enhance facial contours, providing a reliable solution in the aesthetics market. This is expected to boost the market growth.

This segment is anticipated to witness the fastest market growth over the forecast period. The growth is attributed to the integration of hyaluronic acid (HA) with calcium hydroxylapatite (CaHA) to aid in patients suffering from facial volume loss. For instance, HA contributes to immediate volumizing effects, addressing fine lines and wrinkles. In addition, CaHA's collagen-stimulating properties lead to sustaining results, extending the longevity of the treatment. Hence, the introduction of AbbVie's HArmonyCa in the marketplace is expected to create robust opportunities for the industry.

Jawline contouring is anticipated to witness significant market growth over the forecast period. Calcium Hydroxylapatite (CaHA) supports jawline contouring by providing structural support and enhancing volume in the targeted area. For instance, in February 2022, Radiesse (+) received an extended product application approval from the U.S. FDA to contour the jawline. The approval was granted after the product achieved a 75.6% improvement on the Merz Jawline Assessment Scale. Furthermore, the growing preference for minimally invasive procedures to uplift jawline is expected to drive the market growth.

End-Use Insights

Cosmetic surgery centers accounted for the largest revenue share in 2024. Cosmetic surgery centers have experienced and board-certified plastic surgeons who specialize in facial procedures and have access to a range of anesthesia options, including local anesthesia, twilight sedation, or general anesthesia. Furthermore, hospitals are preferred as aesthetic surgery locations in various developing countries. For instance, the ISAPS report stated that nearly 50% of all cosmetic procedures performed in Thailand occurred in a hospital. Similarly, Romania reported that nearly 45.6% of all cosmetic procedures were performed in a hospital.

The medspas segment is estimated to register the fastest CAGR over the forecast period. The growth is attributed to the inclusion of non-surgeons or non-medical professionals in this line of business. In addition, patient spending in medspas has grown by nearly 20% from 2020 to 2022 within the U.S., and the survey response from the American Med Spa Association in 2022 indicated that nearly 74% of the MedSpa owners expect an annual business growth of 10% or more.

Calcium Hydroxylapatite (CaHA) filler procedures are primarily performed by medspas owing to low patient downtime and non-invasive nature of cosmetic surgery. According to the American Med Spa Association, 8,841 medspas were operational in 2022. Moreover, medspas offer customer-friendly services such as subscription discounts, loyalty programs, and others, which augments their demand.

Regional Insights

North America dominated the overall market in 2024. The growth can be attributed to the population's high acceptance of cosmetic surgeries, technological advancements in surgical and nonsurgical techniques, and accessibility and availability of skilled professionals. However, a stringent regulatory approval process impedes the market growth in Canada. Moreover, the relatively high cost of products and treatments in Canada, in comparison with emerging economies in Asia, results in patients traveling to different regions for treatment. Furthermore, the country lags behind other developed and developing countries with regard to the number of aesthetic surgeons and professionals and accounts for only 0.8% (450) of the total number of plastic surgeons globally.

The U.S. accounted for the largest share of the market in North America in 2024. According to a report by the International Society of Aesthetic Plastic Surgery (ISAPS), in 2022, nearly 4,556,970 nonsurgical injectable procedures were performed in the U.S. Furthermore, the growing geriatric population in the U.S., which is susceptible to skin imperfections or diseases, is expected to increase the demand for filler procedures, thereby significantly contributing to the market growth over the forecast period.

Europe held a significant market share in 2023. The presence of a key player, Merz Pharma, in the region progresses growth for the overall market. The company is headquartered in Frankfurt, Germany, which advances its clinical and technological capability. Furthermore, the growing geriatric population in the region is expected to drive growth for the market. According to an article from Eurostat, nearly 21.1% of the European population was aged over 65.

Asia Pacific region is expected to grow at the fastest rate during the forecast period. With rapidly developing economies, the Asia Pacific market is expected to grow rapidly. This can be attributed to the growing medical tourism industry, especially in Southeast Asia. According to the ISAPS 2022 report, 29% of the patients undergoing aesthetic treatment in Thailand were foreign nationals.

China accounted for the largest share of the market in Asia-Pacific in 2024 and is estimated to be the fastest-growing region during the forecast period. For instance, CGBio, an emerging South Korean biologics and aesthetic company, announced a license-out agreement with HTDK Shanghai for its CaHA filler, FACETEM. The partnership is expected to generate revenues of over USD 100 million in five years in Mainland, China. Similarly, the company opened its medical aesthetic clinic in Bali, Indonesia, to supplement the growing demand for facial fillers and nonsurgical aesthetics.

Key Companies & Market Share Insights

-

Merz Pharma and AbbVie are some of the dominant players operating in the market.

-

Merz Pharma has a global presence and has been operating for more than 110 years. In 2019, the company split its business into three verticals, namely, Merz Aesthetics, Merz Consumer Care, and Merz Therapeutics.

-

AbbVie Inc. operates in five world regions across 70 countries. In 2019, AbbVie acquired Allergan to elongate its offering in the aesthetic market.

-

CGBio, Cytophil, Inc., and DR. Korman. are some of the emerging market players functioning in calcium hydroxylapatite (CaHA) fillers market.

-

CGBio is headquartered in South Korea and was founded in 2006. It offers products for bone and spinal, wound healing, aesthetics, interventional medicine, and 3D printing.

-

Cytophil, Inc. provides solutions for orthopedic, dental, aesthetic, and vocal markets. It was incorporated in 2005.

Key Calcium Hydroxylapatite Fillers Companies:

The following are the leading companies in the calcium hydroxylapatite fillers market. These companies collectively hold the largest market share and dictate industry trends.

- Merz Pharma

- AbbVie Inc.

- CGBio

- Cytophil, Inc.

- DR. Korman.

- Luminera

Recent Developments

-

In May 2023, CGBio concluded a supplier agreement worth KRW 12 billion (USD 10.2 million) with Argentina and KRW 45 billion (USD 38.2 million) with France over three years for its CaHA product, FACETEM.

-

In February 2022, Merz Pharma commercially launched Radiesse (+) Lidocaine injectable to improve jawline contouring in patients aged 21 and over.

-

In October 2020, AbbVie Inc. acquired Luminera, a company based in Israel with a portfolio and pipeline of dermal fillers.

Calcium Hydroxylapatite (CaHA) Fillers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 774.3 million

Revenue forecast in 2030

USD 1.47 billion

Growth Rate

CAGR of 13.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Merz Pharma; AbbVie Inc.; CGBio; Cytophil, Inc.; DR. Korman.; Luminera.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Calcium Hydroxylapatite (CaHA) Fillers Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global calcium hydroxylapatite (CaHA) fillers market report based on application, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Facial wrinkles and folds

-

Jawline contouring

-

Lipoatrophy

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

MedSpas

-

Cosmetic Surgery Center

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.