- Home

- »

- Pharmaceuticals

- »

-

Canada Pharmaceutical Market Size, Industry Report, 2030GVR Report cover

![Canada Pharmaceutical Market Size, Share & Trends Report]()

Canada Pharmaceutical Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Type, By Product (Branded), By Type (Prescription, OTC), By Disease (Cancer), By Route Of Administration, By Formulation, By Age Group, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-190-2

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canada Pharmaceutical Market Trends

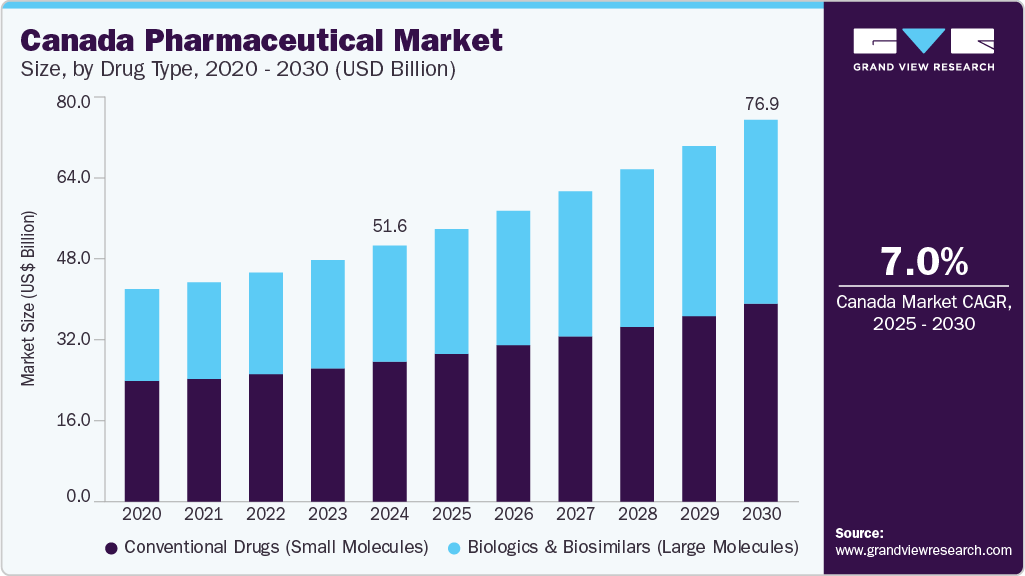

The Canada pharmaceutical market size was valued at USD 51.56 billion in 2024 and is projected to witness a CAGR of 7.0% from 2025 to 2030. The market is driven by several factors, including an aging population, increasing healthcare expenditures, growing demand for innovative drugs, and a strong focus on research and development. Additionally, government policies supporting healthcare access and investments in biotechnology contribute to the market's expansion. These factors collectively stimulate growth and advancements within the Canadian pharmaceutical industry.

The aging Canadian population serves as a significant factor influencing the pharmaceutical market. With the population of those 65 years and over expected to reach 5.1 million in the next decade, the demand for pharmaceutical products and healthcare services is expected to grow substantially. Seniors typically require medications to manage chronic health conditions and age-related illnesses. This demographic shift highlights the need for pharmaceutical companies to develop drugs and healthcare solutions tailored to the specific needs of older individuals. It also emphasizes the importance of geriatric medicine and healthcare services, making the aging population a key driver shaping the dynamics of the Canadian pharmaceutical market.

Increasing demand for early and accurate diagnosis of diseases, coupled with the growing need for enhanced therapies, is expected to fuel market growth. According to the Canadian Cancer Society, cancer is the leading cause of death in the country, accounting for more than 28% of annual deaths. Around 233,900 new cancer cases and 85,100 cancer deaths were reported in Canada in 2022. Of these, about 121,100 men and 112,800 women were diagnosed with some form of cancer in the same year. The most common types of cancer diagnosed in the country are lungs, breast, colorectal, and prostate.

Cancer and cardiovascular diseases are the most common causes of death in Canada. Cardiovascular diseases account for 18.5% of all annual deaths in the country. The increasing prevalence and mortality of cancer and cardiovascular diseases contribute to the growth of the nuclear medicine and radiopharmaceuticals market. According to data published by the Canadian Institute for Health Information (CIHI) in July 2022, approximately 2.4 million people in Canada have heart disease. Furthermore, according to the Heart and Stroke Foundation of Canada, 9 out of 10 Canadians have at least one risk factor for developing heart conditions, stroke, or vascular cognitive impairment. Cardiovascular disease costs around USD 21.2 billion, including direct and indirect costs, in Canada, while stroke costs approximately USD 3.6 billion annually. The CIHI has also collaborated with the Canadian Cardiovascular Society (CCS) to improve the quality of cardiac care nationwide. Supportive initiatives undertaken by government bodies and the increasing incidence of targeted diseases and high mortality rates are expected to drive the demand for novel and effective therapeutic products in the coming years.

In March 2023, the Canadian government allocated USD 59.0 million to the Canadian Critical Drug Initiative to enhance drug research, commercialization, and manufacturing in Alberta. This investment will support the construction of a 40,000-square-foot manufacturing facility and upgrading a 72,000-square-foot biotechnology business development center in Edmonton. Applied Pharmaceutical Innovation spearheads the initiative in collaboration with the Li Ka Shing Applied Virology Institute at the University of Alberta. Once completed, the manufacturing facility will produce small-molecule drugs and include a fill-finish line for packaging and labeling the drugs for distribution.

Drug Type Insights

The conventional drugs (small molecules) segment accounted for the largest market share of 54.7% in 2024. Small molecules play a pivotal role in propelling Canada pharmaceutical market. They are the foundation of drug development and continue to drive ongoing research and innovation in the sector. Their efficacy in treating a diverse range of medical conditions sustains high demand, fostering market growth and economic stability. Moreover, significant investments and strategic partnerships strengthen Canada's position within the global pharmaceutical industry, facilitating the development of novel medications and enhancing the country’s contribution to healthcare solutions on a worldwide scale.

In addition, strategic activities by key market players are expected to further drive segment growth. For instance, in April 2023, Takeda, a global pharmaceutical company, entered into an exclusive licensing agreement with Treventis for a group of small molecules designed to target tau, a protein associated with the misfolding and aggregation believed to contribute to Alzheimer's disease. Treventis developed these molecules, leveraging the expertise of Dr. Donald Weaver in Alzheimer's and neurodegenerative research. The significance of this partnership lies in the potential to create an effective drug targeting tau in the brain, which is currently lacking. Given the prevalence of brain-related conditions in Canada, such as Parkinson's, Alzheimer's, and epilepsy, this collaboration holds promise for advancing treatments and discovering cures through cutting-edge patient care and research efforts.

The biologics & biosimilars (large molecules) segment is projected to grow at the fastest CAGR of 8.1% from 2025 to 2030. Advances in biotechnology and the growing demand for personalized treatments drive the adoption of large molecules. Biologics offer targeted therapies for complex conditions such as cancer, autoimmune disorders, and rare diseases, while biosimilars present cost-effective alternatives, expanding access to these therapies. The Canadian healthcare system’s increasing focus on innovative treatments and the rising prevalence of chronic and complex diseases further fuel the growth of biologics and biosimilars in the market.

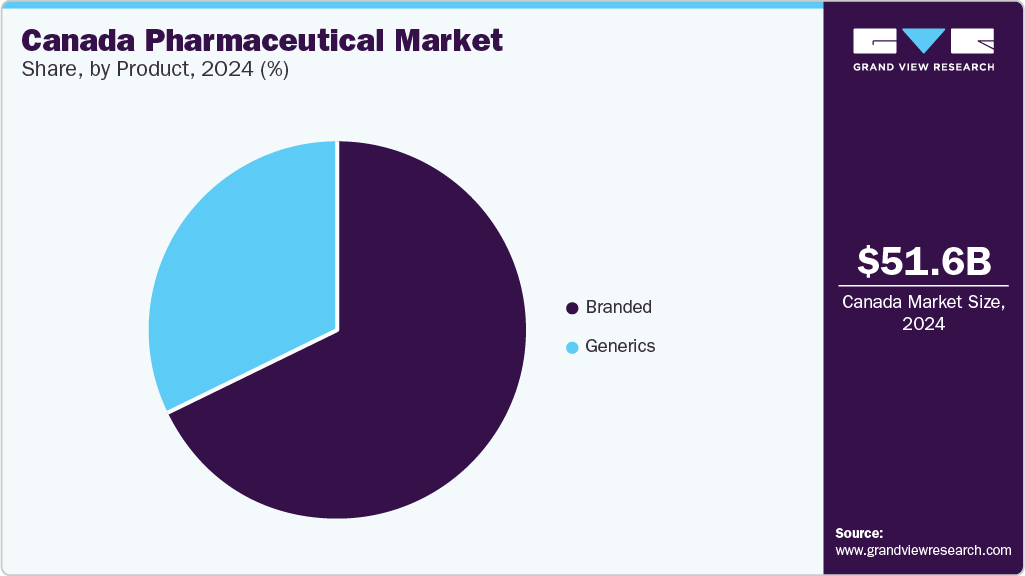

Product Insights

The branded segment dominated the Canadian pharmaceutical industry with the largest revenue share in 2024. The robust system of government price controls is the main factor driving the affordability of branded medications. The Canadian Patented Medicine Prices Review Board (PMPRB), established in 1987, plays a pivotal role in this endeavor. It regulates medication prices by limiting the maximum prices that can be charged for patented drugs. With a focus on controlling the ex-factory prices of patented medicines, the PMPRB effectively prevents excessive pricing, making pharmaceuticals more accessible to the Canadian population. This essential regulatory framework ensures Canadians have access to affordable, reasonably priced branded drugs, maintaining a delicate balance between innovation and accessibility in the pharmaceutical market.

In addition, new product launches will offer further lucrative opportunities in the forecast period. For instance, in December 2024, Eisai Co., Ltd. and Biogen Inc. received acceptance from Health Canada for a New Drug Submission (NDS) for lecanemab, branded as LEQEMBI in the U.S. Lecanemab is an experimental antibody designed to target Aβ protofibrils and is intended for treating early Alzheimer's disease, including mild cognitive impairment and mild dementia, in individuals with verified amyloid brain pathology. It marks a significant step toward addressing Alzheimer's disease in Canada.

The generics segment is anticipated to grow significantly from 2025 to 2030, fueled by increasing demand for cost-effective alternatives to branded drugs. The expiration of patents for several high-demand medications creates opportunities for generic drug manufacturers to offer affordable solutions. Healthcare cost containment efforts by the government and insurance companies further encourage the use of generics. Patients and healthcare providers are turning to generics to reduce treatment costs while maintaining efficacy. This growing preference is set to make the generics segment a key component in Canada’s pharmaceutical landscape.

Type Insights

The prescription segment held the largest market share in 2024, propelled bythe continuous demand for specialized treatments for chronic and complex conditions. Patients with diseases such as cancer, diabetes, and cardiovascular disorders rely heavily on prescription medications to manage their conditions. Advancements in drug development, particularly for targeted therapies and personalized medicine, have further fueled the growth of this segment. Furthermore, healthcare professionals play a crucial role in prescribing these medications, ensuring that prescription drugs remain a cornerstone of the Canadian pharmaceutical industry.

The OTC segment is expected to witness significant CAGR over the forecast period, driven by increasing consumer preference for self-medication and convenience. Rising healthcare costs and longer wait times for medical appointments encourage individuals to seek Over-The-Counter (OTC) solutions for common ailments. In addition, greater awareness about the safety and efficacy of OTC products has fueled their popularity. Retail expansion, easy access to online sales, and the growing demand for wellness and preventative care products further contribute to the anticipated boom in the OTC segment in Canada.

Disease Insights

The cancer segment led the Canadian pharmaceutical market in 2024, attributed to the rising prevalence of cancer and advancements in treatment options. Increasing cancer diagnosis, particularly in an aging population, drives the demand for targeted therapies, immunotherapies, and other innovative treatments. Ongoing research and development in oncology are leading to more effective and personalized medicines, further contributing to market growth. Moreover, government and healthcare initiatives aimed at improving cancer care support segment growth, making it a dominant force in Canada's pharmaceutical industry. According to the Canadian Cancer Statistics publication, cancer cases are expected to increase by 79% between 2028 and 2032. Recent reports indicate that the 5-year cancer survival rate in Canada is 64%. Hence, the projected rise in cancer cases is anticipated to drive market growth in the country.

In addition, product launches are another major factor driving market growth. In May 2023, BeiGene, Ltd. received a Notice of Compliance from Health Canada for BRUKINSA (zanubrutinib), a Bruton's Tyrosine Kinase (BTK) inhibitor, as a treatment for adult patients with Chronic Lymphocytic Leukemia (CLL). This marks the fourth approval for BRUKINSA in Canada, following previous authorizations for Waldenström's macroglobulinemia, mantle cell lymphoma, and marginal zone lymphoma. CLL, a type of blood cancer, affects over 2,200 individuals in Canada annually, with a higher incidence in men, typically occurring in those over 60, and the average age of diagnosis in the early 70s.

The neurological disorders segment is expected to experience significant growth during the forecast period, fueled by the rising prevalence of conditions such as Alzheimer's disease, Parkinson's disease, and multiple sclerosis. The aging population is particularly vulnerable to these disorders, creating a growing need for effective treatments. Advancements in neuroscience and drug development, including gene therapies and biologics, contribute to the emergence of innovative treatments. Increasing awareness, rising government initiatives, and growing investments in research and development are further fueling the segment’s expansion, making it a promising field in the market.

Route Of Administration Insights

The oral segment accounted for the largest market share in 2024, owing to its noninvasive and cost-effective nature and high patient compliance. Oral medications are the preferred delivery method, offering convenience and ease of use. Their versatility in treating various medical conditions further strengthens their market position, ensuring accessibility and effectiveness in drug delivery. This preference for oral treatments continues to drive growth, shaping the pharmaceutical landscape by making medications more user-friendly and accessible to a broad patient population.

The parenteral segment is anticipated to be the fastest-growing segment over the forecast period. This method involves injecting medications directly into the bloodstream, by passing the digestive system. It is vital for rapid drug delivery, precise dosing, and conditions that require immediate and consistent blood levels. Parenteral routes, including intravenous and intramuscular injections, are essential for critical care, emergency situations, and patients with difficulty swallowing or absorbing oral medications, making them indispensable in modern medicine.

Formulation Insights

The tablets segment dominated the Canadian pharmaceutical industry with the largest revenue share in 2024 due to its convenience, familiarity, and ease of use. Patients favor tablets for their precise dosing and extended shelf life, while manufacturers prefer them for their stability and compatibility with market demands. The ability to mask taste and control release rates further improves patient compliance, making tablets an ideal option for both consumers and healthcare providers. These advantages have led to the widespread adoption of tablet formulations, reinforcing their leading position in the pharmaceutical industry.

The sprays segment is projected to grow at the fastest CAGR from 2025 to 2030, driven by their ease of use and precise dosing, which make them increasingly popular among consumers. Their convenience aligns with the rising demand for innovative, user-friendly drug delivery methods. Pharmaceutical companies are increasingly launching products in spray formulations, capitalizing on their ability to provide efficient and targeted treatments. This shift towards sprays is reshaping the market, making them a preferred option for consumers seeking simplicity and companies looking to meet evolving healthcare needs.

Age Group Insights

The geriatric segment held the largest revenue share in 2024, attributed to the country's aging population. Seniors are the fastest-growing demographic, with projections indicating that by 2068, they could represent 21% to 29% of the population. Nearly 20% of Canadians are over 65, underscoring the increasing demand for healthcare and pharmaceutical solutions tailored to this age group. The growing prevalence of age-related conditions such as chronic diseases and cognitive disorders drives the need for specialized medications, solidifying the geriatric segment's dominant position in the market.

The children & adolescents segment is set to be the fastest-growing segment from 2025 to 2030. The rising incidence of pediatric chronic conditions such as asthma, diabetes, and neurological disorders is increasing the demand for specialized medications. Advancements in pediatric research, including gene therapies and personalized treatments, are leading to developing more effective and tailored therapies.

End-use Insights

The hospitals segment led the Canadian pharmaceutical market in 2024, owing to the increasing number of hospitals and high demand for pharmaceutical drugs for various medical treatments. These medications are crucial in treating various conditions, from acute illnesses to chronic diseases. The growth of healthcare infrastructure and the expansion of hospital facilities have further driven the utilization of pharmaceuticals in patient care. This rising demand highlights the vital role that pharmaceutical drugs play in enhancing healthcare standards and ensuring optimal treatment outcomes for Canadian patients in the expanding hospital network.

The clinics segment is expected to grow fastest over the forecast period, propelled by expanding healthcare services across Canada. Pharmaceuticals are crucial in managing chronic conditions, offering specialized treatments, and addressing various patient needs. Ongoing medical advancements contribute to the increasing reliance on pharmaceuticals within clinics, ensuring effective and accessible care for Canadians. These medications are integral to shaping the future of healthcare services in clinics, providing innovative solutions to an ever-growing array of medical challenges.

Key Canada Pharmaceutical Company Insights

Some of the key companies in the Canadian pharmaceutical industry include F. Hoffmann-La Roche Ltd, Novartis AG, GSK plc, Pfizer Inc., and Merck & Co., Inc.

-

F. Hoffmann-La Roche Ltd offers innovative pharmaceuticals and diagnostic solutions, focusing on oncology, immunology, neuroscience, and infectious diseases. The company develops cutting-edge biologics, small molecules, and diagnostic tests to improve patient outcomes globally.

-

Pfizer Inc. provides innovative medicines and vaccines across therapeutic areas such as oncology, cardiology, immunology, and infectious diseases. It focuses on research-driven solutions to prevent, treat, and cure complex health conditions worldwide.

Key Canada Pharmaceutical Companies:

- F. Hoffmann-La Roche Ltd

- Novartis AG

- GSK plc

- Pfizer Inc.

- Merck & Co., Inc.

- AstraZeneca

- Johnson & Johnson Services, Inc.

- Sanofi

- Eli Lilly and Company

- AbbVie Inc.

Recent Developments

-

In April 2025,Health Canada approved GSK’s Jemperli (dostarlimab) with chemotherapy for all adults with primary advanced or first recurrent endometrial cancer.

-

In March 2025, Shield Therapeutics plc, in collaboration with Kye Pharmaceuticals, launched ACCRUFeR (ferric maltol) in Canada following Health Canada’s August 2024 approval. The drug is now available as a prescription for adults with iron deficiency anemia (IDA).

-

In April 2025, Sunshine Biopharma Inc. announced the launch of Everolimus in Canada by its wholly owned subsidiary, Nora Pharma Inc. The oncology drug is expected to have a global market potential of USD 2.5 billion.

-

In May 2024, Lupin Limited, in partnership with Sandoz Canada, launched Rymti, its first biosimilar in Canada. Rymti is approved for treating various conditions, including moderate to severe rheumatoid arthritis, psoriatic arthritis, juvenile idiopathic arthritis, moderate to severe plaque psoriasis, severe axial spondyloarthritis, and chronic severe plaque psoriasis in adolescents and children.

-

In April 2024, Apotex announced its acquisition of Canadian pharmaceutical company Searchlight Pharma, a move expected to strengthen its presence in the specialty branded pharma market.

-

In May 2023,JAMP Pharma Group received Health Canada approval and launched Pr JAMP Dapagliflozin, a generic alternative to AstraZeneca’s Forxiga. It is indicated to improve glycemic control in adults with type 2 diabetes who cannot use metformin due to contraindications or intolerance.

Canada Pharmaceutical Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 54.9 billion

Revenue forecast in 2030

USD 76.9 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, product, type, disease, route of administration, formulation, age group, end-use

Key companies profiled

F. Hoffmann-La Roche Ltd;Novartis AG; GSK plc; Pfizer Inc.; Merck & Co., Inc.;AstraZeneca; Johnson & Johnson Services, Inc.; Sanofi; Eli Lilly and Company; and AbbVie Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Pharmaceutical Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Canada pharmaceutical market report on the basis of drug type, product, type, disease, route of administration, formulation, age group, and end-use:

-

Drug Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics & Biosimilars (Large Molecules)

-

Monoclonal Antibodies

-

Vaccines

-

Cell & Gene Therapy

-

Others

-

-

Conventional Drugs (Small Molecules)

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Branded

-

Generics

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription

-

OTC

-

-

Disease Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular diseases

-

Cancer

-

Diabetes

-

Infectious diseases

-

Neurological disorders

-

Respiratory diseases

-

Autoimmune diseases

-

Mental health disorders

-

Gastrointestinal disorders

-

Women’s Health Diseases

-

Genetic and Rare genetic diseases

-

Dermatological conditions

-

Obesity

-

Renal diseases

-

Liver conditions

-

Hematological disorders

-

Eye conditions

-

Infertility conditions

-

Endocrine disorders

-

Allergies

-

Others

-

-

Route Of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Topical

-

Parenteral

-

Intravenous

-

Intramuscular

-

-

Inhalations

-

Other Routes of Administration

-

-

Formulation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tablets

-

Capsules

-

Injectable

-

Sprays

-

Suspensions

-

Powders

-

Other Formulations

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Children & Adolescents

-

Adults

-

Geriatric

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

Frequently Asked Questions About This Report

b. The Canada pharmaceutical market size was estimated at USD 48.59 billion in 2023 and is expected to reach USD 51.56 billion in 2024.

b. The Canada pharmaceutical market is expected to grow at a compound annual growth rate of 6.88% from 2024 to 2030 to reach USD 76.86 billion by 2030.

b. Conventional drugs (small molecules) accounted for the largest market share of 44.79% in 2023. They are the foundation of drug development and continue to fuel ongoing research and innovation in the sector. Their efficacy in treating a diverse range of medical conditions sustains high demand, fostering market growth and economic stability.

b. Some key players operating in the Canada pharmaceutical market include F. Hoffmann-La Roche Ltd., Novartis AG, GlaxoSmithKline plc, Pfizer, Inc., Merck & Co., Inc., AstraZeneca, Johnson & Johnson, Sanofi SA, Eli Lilly and Company, AbbVie, Inc.

b. Key factors that are driving the market growth include an aging population, increasing healthcare expenditures, growing demand for innovative drugs, and a strong focus on research and development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.