- Home

- »

- Advanced Interior Materials

- »

-

Carbon Fiber Composites Market Size, Industry Report 2033GVR Report cover

![Carbon Fiber Composites Market Size, Share & Trends Report]()

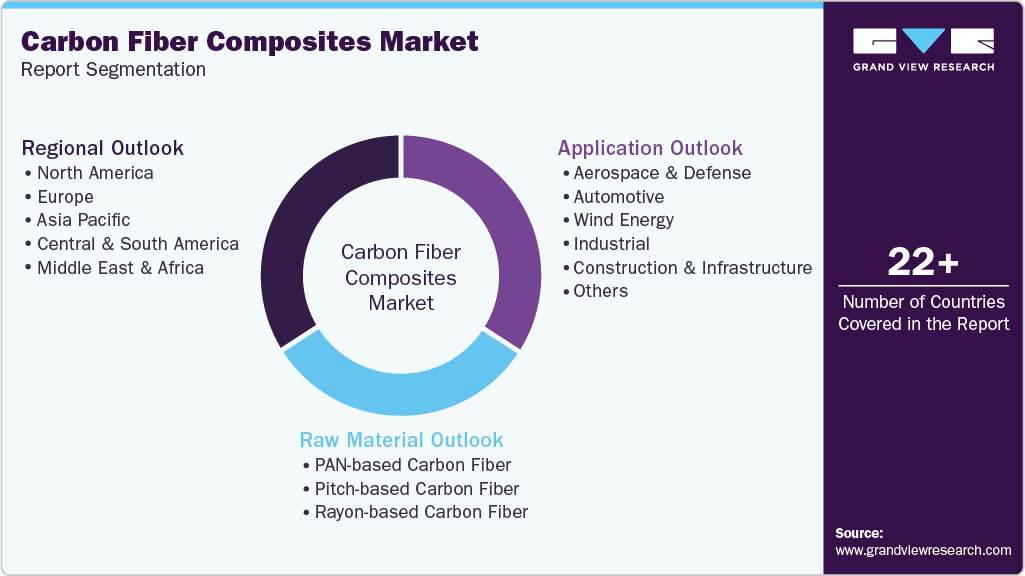

Carbon Fiber Composites Market (2025 - 2033) Size, Share & Trends Analysis Report By Raw Material (PAN-based Carbon Fiber, Pitch-based Carbon Fiber, Rayon-based Carbon Fiber), By Application (Aerospace & Defense, Wind Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-832-7

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Fiber Composites Market Summary

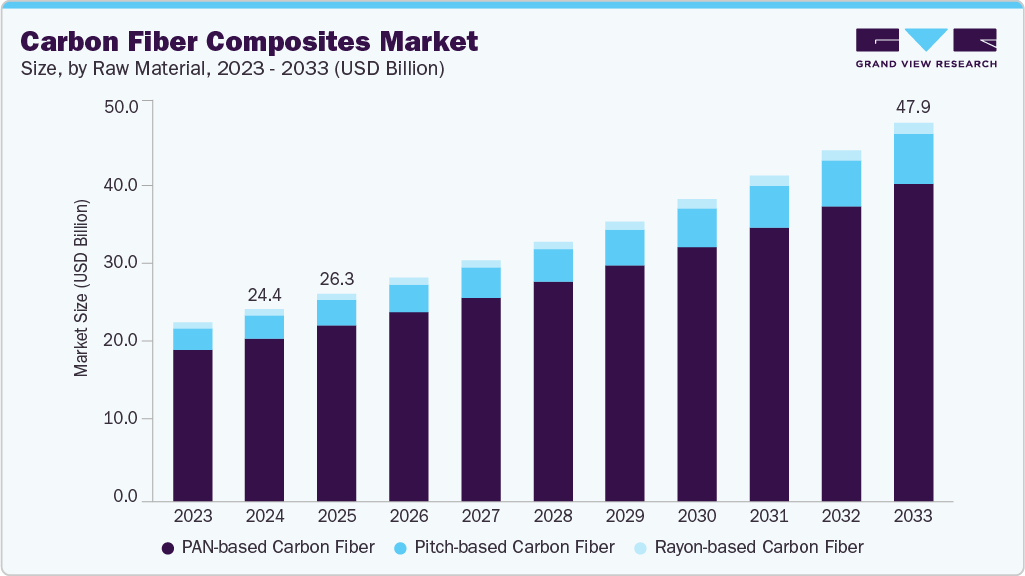

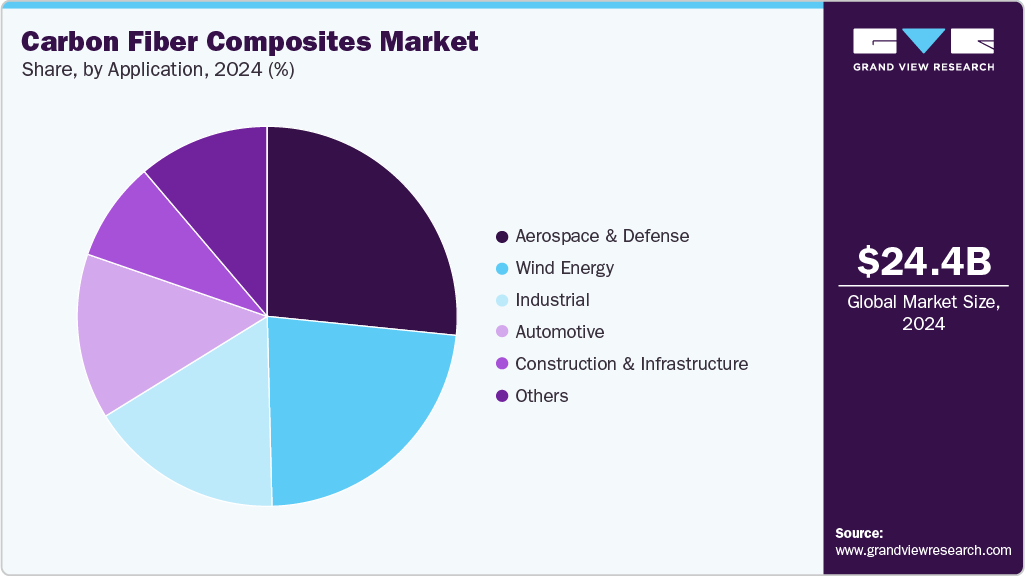

The global carbon fiber composites market size was estimated at USD 24.37 billion in 2024 and is projected to reach USD 47.91 billion by 2033, growing at a CAGR of 7.8% from 2025 to 2033. The demand for carbon fiber composites is increasing as industries transition toward lightweight, high-strength materials to meet fuel efficiency and emission reduction goals.

Key Market Trends & Insights

- Asia Pacific dominated the carbon fiber composites market with the largest revenue share of 34.6% in 2024.

- China carbon fiber composites market is expected to grow at a significant CAGR over the forecast period.

- By raw material, the pitch-based carbon fiber segment is expected to grow at the fastest CAGR of 8.7% over the forecast period.

- By application, the automotive segment is expected to grow at the fastest CAGR of 8.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 24.37 Billion

- 2033 Projected Market Size: USD 47.91 Billion

- CAGR (2025-2033): 7.8%

- Asia Pacific: Largest market in 2024

Aerospace OEMs are increasing the penetration of composites in next-generation aircraft structures, driving long-term demand. Automotive manufacturers are increasingly adopting carbon fiber for body panels, monocoques, and EV components to enhance performance and extend driving range. Wind energy is witnessing strong uptake, with larger turbine blades requiring high-stiffness materials. Industrial uses such as pressure vessels, robotics, and sporting goods are expanding rapidly. Rising investments in renewable energy and clean mobility are strengthening consumption.

A significant demand driver is the global shift toward lightweighting across aerospace, automotive, and energy markets. Growing EV production is boosting the demand for carbon fiber components that reduce vehicle weight while maintaining structural strength. The wind energy sector requires larger, more durable blades that depend heavily on carbon fiber composites for stiffness-to-weight advantages. The increasing adoption of automation and industrial robotics is driving the demand for high-performance mechanical structures. Expanding use in high-pressure hydrogen storage tanks is another strong driver, aligned with global clean fuel strategies. Technological improvements in precursor materials and automated fabrication processes are reducing costs, enabling wider adoption. The rise of premium sports equipment and performance applications also contributes to steady demand.

The market is witnessing a shift toward low-cost carbon fiber precursors like PAN alternatives, lignin-based fibers, and recycled carbon fiber. Advancements in automated fiber placement (AFP), additive manufacturing, and resin infusion are improving production efficiency and reducing manufacturing costs. OEMs are increasingly integrating hybrid composites that combine carbon fiber with thermoplastics for faster cycle times and improved recyclability. The aerospace sector is adopting higher-temperature resins and next-generation prepregs for improved performance. Growth in hydrogen tanks and battery enclosures is emerging as a key trend. Wind OEMs are moving toward ultra-long blades that require high-modulus carbon fiber. Sustainability innovations such as reclaimed fiber and circular composite solutions are gaining traction rapidly.

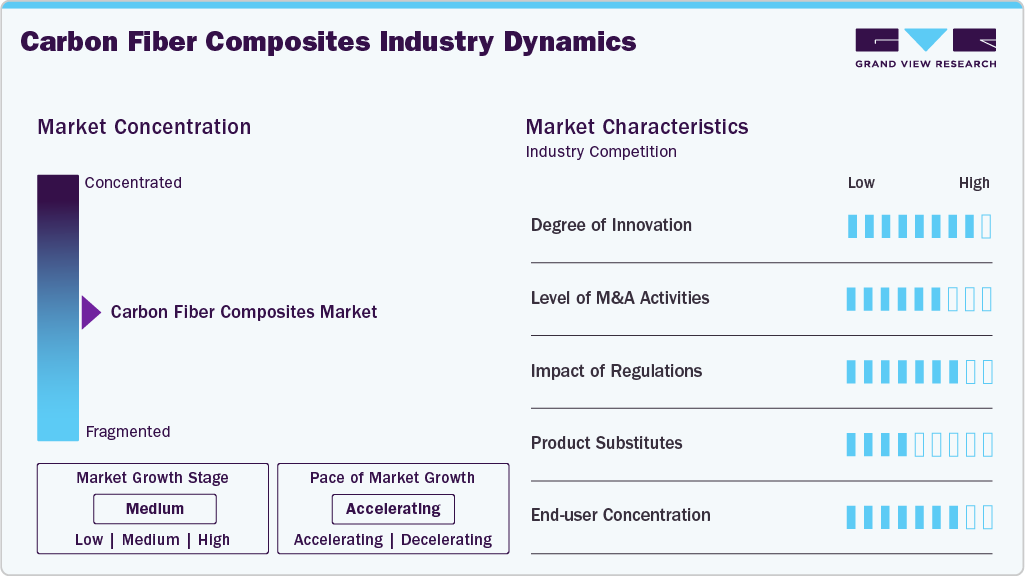

Market Concentration & Characteristics

The carbon fiber composites industry remains moderately concentrated, dominated by a limited number of integrated manufacturers producing both fiber and composite materials. Leading players, including Toray, Teijin, Mitsubishi Chemical, Hexcel, and SGL Carbon, control a significant share of the global capacity. High entry barriers, such as capital-intensive precursor production, stringent aerospace certifications, and advanced engineering requirements, limit new entrants. Tier-1 aerospace suppliers and automotive OEM partnerships further reinforce concentration. However, downstream composite fabricators are more fragmented, especially in industrial and sporting goods segments. M&A activities continue to shape competitive dynamics.

Substitutes for carbon fiber composites include glass fiber composites, aluminum, high-strength steel, and emerging thermoplastic composites. While glass fiber remains cheaper, it cannot match carbon fiber’s stiffness-to-weight ratio in premium applications, limiting its threat. Aluminum alloys compete in the production of automotive and aerospace parts, but face restrictions due to weight and forming limitations. Advanced thermoplastics and hybrid composites are gaining ground in mid-performance applications due to recyclability and lower production costs. In wind energy, alternatives are limited because ultra-long blades require the mechanical properties of carbon fiber. The substitution threat remains moderate, with cost-sensitive segments being more likely to shift to alternatives.

Raw Material Insights

The PAN-based carbon fiber segment held the largest revenue market share of 84.7% in 2024, due to its superior tensile strength, versatility, and wide applicability across aerospace, automotive, wind energy, and industrial sectors. Its established production ecosystem, stable precursor supply, and cost-efficient scaling make it the preferred choice for high-performance and structural applications. Manufacturers increasingly rely on PAN-based grades for consistent quality, lightweighting requirements, and stringent mechanical performance standards, reinforcing its position as the leading material type.

The pitch-based carbon fiber segment is expected to grow at a significant CAGR of 8.7% over the forecast period, driven by increasing demand for ultra-high modulus materials required in specialty applications such as aerospace components, robotics, medical devices, and advanced industrial systems. Its exceptional stiffness, thermal conductivity, and dimensional stability make it suitable for precision-critical structures. As industries expand into high-modulus composites and thermal management solutions, the use of pitch-based fibers is rising despite higher costs and limited production capacity.

Application Insights

The aerospace & defense segment held the largest revenue market share of 26.6% in 2024, due to its heavy reliance on lightweight, high-strength materials for aircraft structures, propulsion systems, UAVs, and defense-grade equipment. Increasing aircraft production rates, defense modernization programs, and requirements for fuel efficiency and structural durability drive sustained demand. Carbon fiber composites enable improved operational performance, reduced maintenance, and better energy efficiency, making them indispensable for next-generation aerospace systems.

The automotive segment is expected to grow at a significant CAGR of 8.9% over the forecast period, as a key consumer of carbon fiber composites, fueled by accelerating electrification, lightweighting targets, and stricter emission regulations. OEMs are integrating carbon fiber into battery enclosures, body panels, chassis components, and high-performance vehicle structures to enhance range, safety, and overall efficiency. Advancements in mass-production technologies, the adoption of recycled carbon fiber, and cost-optimized composite solutions are further supporting wider automotive penetration across both premium and mid-segment vehicles.

Regional Insights

The Asia Pacific carbon fiber composites market dominated the global industry, accounting for the largest revenue share of 34.6% in 2024, mainly due to the strong aerospace, automotive, electronics, and industrial manufacturing ecosystems across China, Japan, and South Korea. China’s rapid expansion in wind energy and EV production significantly boosts composite demand. Japan remains a global hub for high-quality carbon fiber production, with leading players such as Toray. Government policies that support clean energy and hydrogen infrastructure are accelerating their adoption. Growing industrial automation across APAC is increasing composite usage in robotics and high-performance machinery. Lower-cost manufacturing capabilities attract major OEM investments.

The carbon fiber composites industry in China is aggressively scaling carbon fiber manufacturing capacity to reduce reliance on imports and strengthen domestic supply chains. Rapid expansion in wind turbine installations and the world’s largest EV market drives significant composite consumption. Local players are entering high-end precursor production, narrowing the technology gap with global leaders. The aerospace sector is increasingly incorporating carbon composites in commercial and defense aircraft. Hydrogen storage tank development and fuel-cell commercial vehicles are emerging growth opportunities. Government incentives for new materials innovation continue to support R&D. China’s large-scale industrial applications further strengthen composite penetration.

North America Carbon Fiber Composites Market Trends

The carbon fiber composites industry in North America benefits from strong aerospace manufacturing, advanced defense programs, and a well-established wind energy sector. The U.S. leads in next-generation composite technologies, including high-temperature resins, automated layup systems, and hydrogen tank composites. EV manufacturing investments are increasing adoption in battery enclosures and structural components. The presence of major OEMs and composite fabricators supports market maturity. Regulatory pushes toward lightweighting and sustainability are accelerating the adoption of lightweight materials in the mobility and infrastructure markets. Growth in recreational sports and marine segments also contributes.

U.S. Carbon Fiber Composites Market Trends

The U.S. carbon fiber composites industry remains the core market for aerospace-grade carbon fiber composites, driven by Boeing, defense programs, and space exploration projects. Substantial federal funding for renewable energy supports the use of composites in wind turbines. The hydrogen economy initiatives are accelerating the adoption of pressure vessels and mobility solutions. The addition of EV production capacity and advancements in battery technology are driving demand for carbon fiber integration. Advanced manufacturing programs support R&D in lightweight materials and automated composite fabrication. The U.S. also leads in recycled carbon fiber technologies. Industrial robotics and performance sports equipment further complement market expansion.

Europe Carbon Fiber Composites Market Trends

The carbon fiber composites industry in Europe has a strong presence in aerospace, automotive engineering, and wind energy, which are key sectors driving demand for composites. Airbus remains a major consumer of carbon fiber for aircraft structures. Strict emission regulations and lightweighting mandates accelerate automotive adoption. Germany and the U.K. lead in composite R&D and high-performance engineering. Extensive offshore wind development boosts demand for high-modulus carbon fibers. EU initiatives promoting a circular economy support innovations in composite recycling. Hydrogen mobility and storage infrastructure rollouts are strengthening new application areas. Europe remains a technologically advanced and sustainability-focused composites market.

The Germany carbon fiber composites industry drives European demand due to its global leadership in automotive engineering, industrial machinery, and materials innovation. OEMs and Tier-1 suppliers increasingly use carbon fiber for structural and lightweighting applications. Strong R&D institutions and collaborative initiatives enhance composite manufacturing capabilities. Wind energy expansion and sustainability policies further support market penetration. Germany’s hydrogen programs are fostering demand for composite pressure vessels. The country maintains high standards for engineering performance, making carbon fiber a vital component in many precision applications. A mature industrial base and technology-driven adoption reinforce Germany’s market significance.

Central & South America Carbon Fiber Composites Market Trends

The carbon fiber composites industry in Central & South America presents growing opportunities driven by wind energy developments, industrial modernization, and expanding aerospace assembly operations. Brazil and Mexico are key markets, supported by rising investments in renewable energy infrastructure. Automotive production in Mexico contributes to the adoption of composites in lightweight component manufacturing. Sports equipment and consumer goods segments continue to expand. However, high material costs limit full-scale penetration compared to developed regions. Regional governments promoting clean energy and industrial upgrading create new avenues for composite usage.

Middle East & Africa Carbon Fiber Composites Market Trends

The carbon fiber composites industry in the Middle East & Africa is driven by emerging aerospace, automotive, and renewable energy initiatives. The UAE and Saudi Arabia are investing heavily in advanced manufacturing, composite materials, and hydrogen economy programs. Wind energy installations in North Africa support moderate composite usage. High-performance materials are increasingly used in oil & gas applications such as pipes, pressure vessels, and structural reinforcements. Growth in sports and luxury automotive markets also supports adoption. Limited local manufacturing capacity creates opportunities for developing the supply chain. MEA remains a niche but steadily developing market for carbon fiber composites.

Key Carbon Fiber Composites Company Insights

Some of the key players operating in the market include Toray Industries and TEIJIN LIMITED.

-

Toray Industries is a global leader in advanced materials, particularly carbon fiber, offering high-performance composites for aerospace, automotive, industrial, and energy applications, supported by large-scale production capacity and strong R&D capabilities.

-

Teijin Limited is a primary Japanese chemical and materials company known for its high-strength carbon fiber brand (Tenax), supplying aerospace, automotive, and industrial markets with cutting-edge composite solutions and sustainability-focused innovations.

Mitsubishi Chemical and DowAksa are among the emerging market participants in the carbon fiber composites industry.

-

Mitsubishi Chemical is a key global producer of PAN-based carbon fibers, advanced resins, and composite materials, serving aerospace, automotive, energy, and sporting goods industries with strong expertise in material science and high-performance engineering.

-

DowAksa, a joint venture between Dow and Aksa, is a leading producer of cost-effective carbon fiber and composite solutions, focused on large-volume applications such as wind energy, construction, and industrial sectors with a strong emphasis on scale and innovation.

Key Carbon Fiber Composites Companies:

The following are the leading companies in the carbon fiber composites market. These companies collectively hold the largest market share and dictate industry trends.

- Toray Industries

- TEIJIN LIMITED

- Mitsubishi Chemical

- Hexcel

- SGL Carbon

- Syensqo

- DowAksa

- ZOLTEK

- Hyosung Advanced Materials

- Carbon Composites, Inc.

Recent Developments

-

In October 2023, Toray Industries, Inc. announced that it has decided to expand the production facilities for regular tow medium- and high-modulus carbon fiber at its French subsidiary, Toray Carbon Fibers Europe SA.

-

In December 2023, Teijin Limited announced that it would begin producing and selling Tenax Carbon Fiber made with sustainable acrylonitrile (AN) using waste and residue from biomass-derived products or recycled raw materials that have received ISCC PLUS certification from the International Sustainability and Carbon Certification system.

Carbon Fiber Composites Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.27 billion

Revenue forecast in 2033

USD 47.91 billion

Growth rate

CAGR of 7.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Toray Industries; TEIJIN LIMITED; Mitsubishi Chemical; Hexcel; SGL Carbon; Syensqo; DowAksa; ZOLTEK; Hyosung Advanced Materials; Carbon Composites, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Fiber Composites Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global carbon fiber composites market report on the basis of raw material, application, and region:

-

Raw Material Outlook (Revenue, USD Million, 2021 - 2033)

-

PAN-based Carbon Fiber

-

Pitch-based Carbon Fiber

-

Rayon-based Carbon Fiber

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Aerospace & Defense

-

Automotive

-

Wind Energy

-

Industrial

-

Construction & Infrastructure

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global carbon fiber composites market size was estimated at USD 24.37 billion in 2024 and is expected to reach USD 26.27 billion in 2025.

b. The global carbon fiber composites market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2033 to reach USD 47.91 billion by 2033.

b. The PAN-based carbon fiber segment held the highest revenue market share of 84.7% in 2024, due to its superior tensile strength, versatility, and wide applicability across aerospace, automotive, wind energy, and industrial sectors.

b. Some of the key players operating in the carbon fiber composites market include Toray Industries, TEIJIN LIMITED, Mitsubishi Chemical, Hexcel, SGL Carbon, Syensqo, DowAksa, ZOLTEK, Carbon Composites, Inc., and Hyosung Advanced Materials.

b. Lightweighting requirements across aerospace, automotive, wind energy, and clean-energy applications are the key factors driving the carbon fiber composites market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.