- Home

- »

- Medical Devices

- »

-

Cardiac Cannula Market Size & Share, Industry Report, 2033GVR Report cover

![Cardiac Cannula Market Size, Share & Trends Report]()

Cardiac Cannula Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Arterial Cannulas, Venous Cannulas, Cardioplegia Cannulas), By Application, By Material (Silicone, Polyurethane, PVC), By Size, By Age Group, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-851-3

- Number of Report Pages: 185

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cardiac Cannula Market Summary

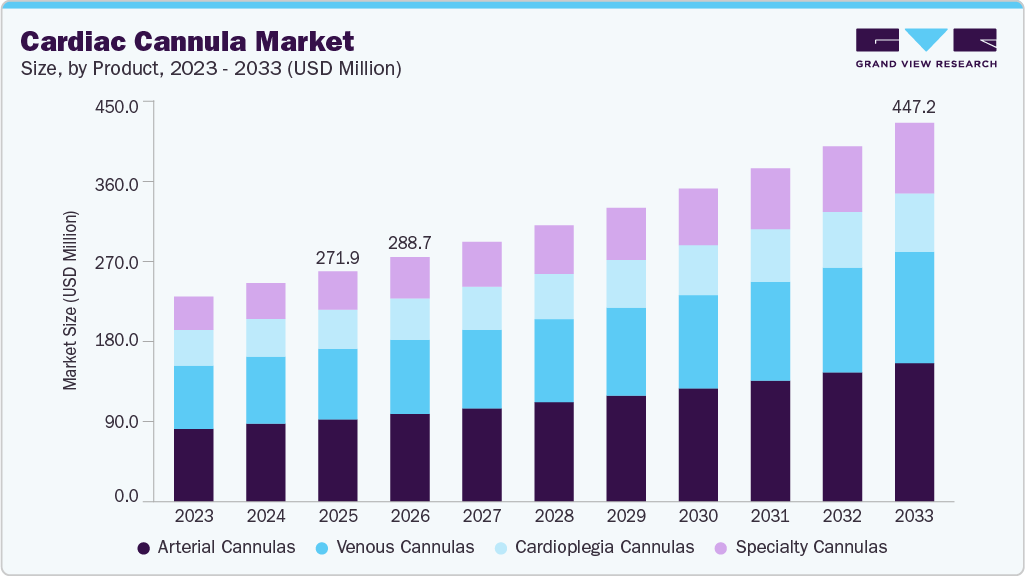

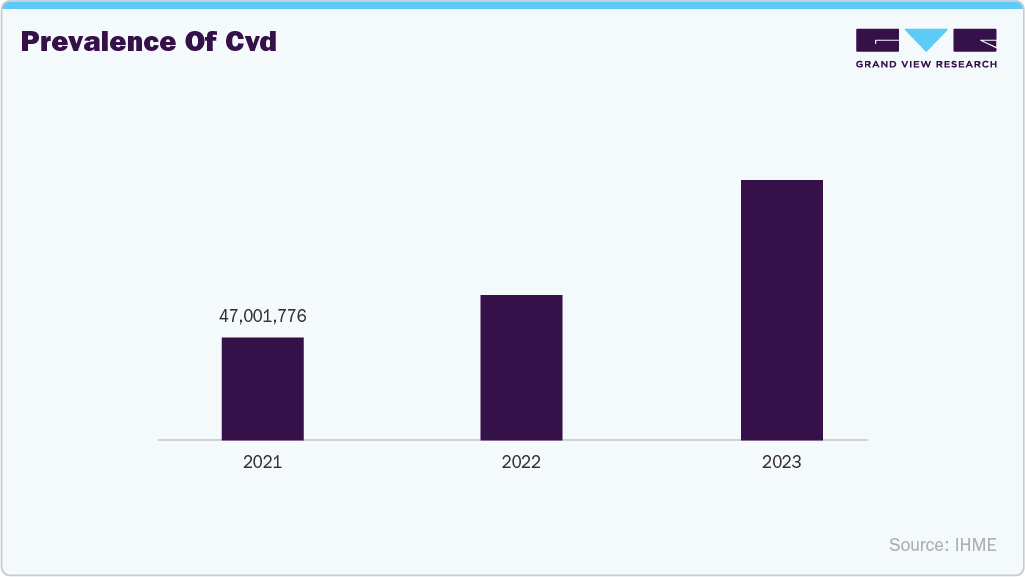

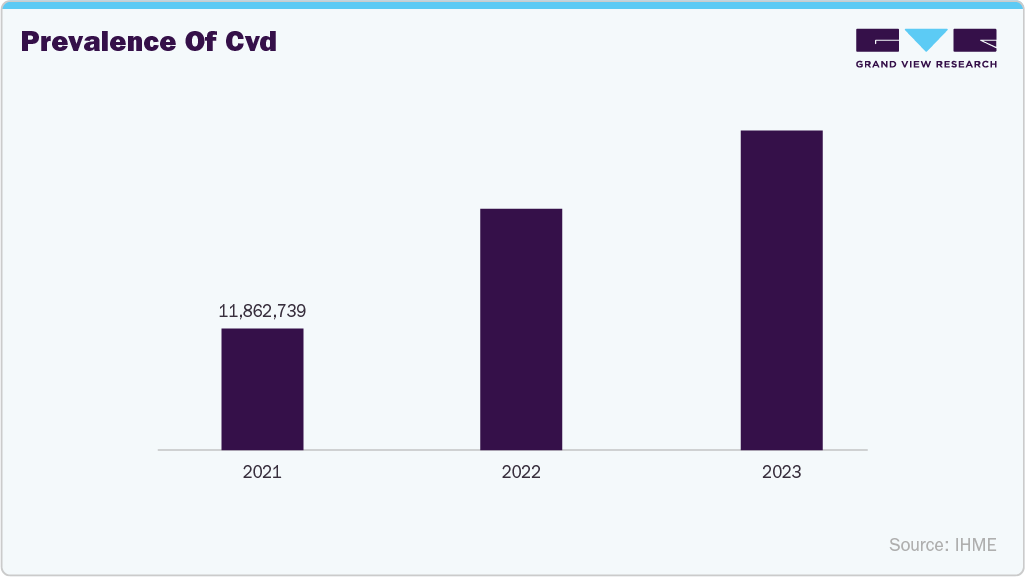

The global cardiac cannula market size was valued at USD 271.88 million in 2025 and is projected to reach USD 447.20 million by 2033, growing at a CAGR of 6.45% from 2026 to 2033. The market is driven by the rising prevalence of cardiovascular diseases and the increasing volume of cardiac surgeries worldwide.

Key Market Trends & Insights

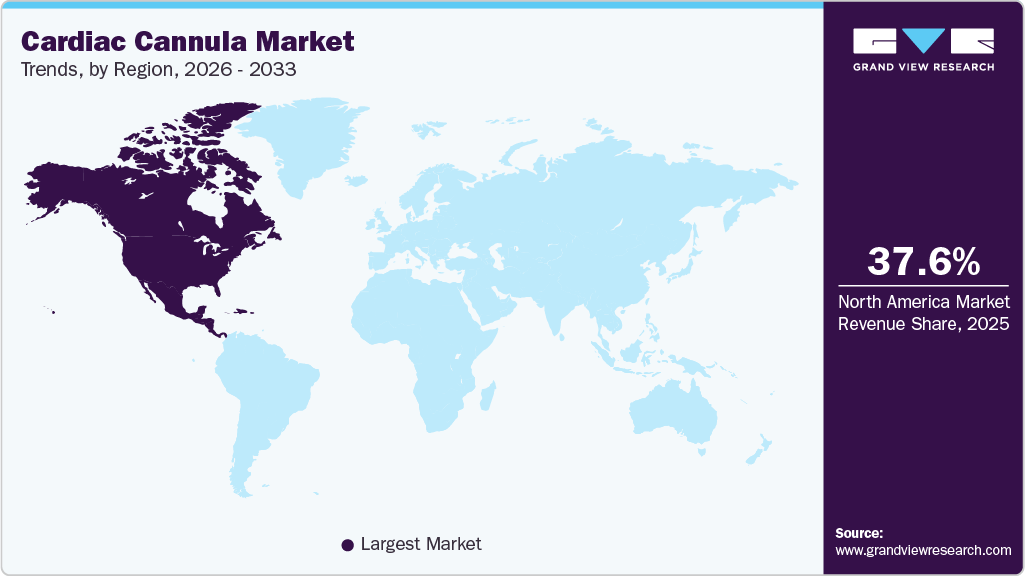

- North America dominated the cardiac cannula market with the largest revenue share of 37.97% in 2025.

- The cardiac cannula market in the U.S. accounted for the largest market revenue share in North America in 2025.

- By product, the arterial cannulas segment led the market with the largest revenue share in 2025.

- By application, the cardiopulmonary bypass (CPB) segment led the market with the largest revenue share in 2025.

- By material, the polyvinyl chloride (PVC) segment led the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 271.88 Million

- 2033 Projected Market Size: USD 447.20 Million

- CAGR (2026-2033): 6.45%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The growing adoption of minimally invasive and robotic-assisted procedures, along with the expansion of advanced cardiac care services, is driving demand for high-performance cannulas. Furthermore, the need for reliable extracorporeal circulation during complex interventions, along with advancements in cannula design and materials, is further fueling market growth.

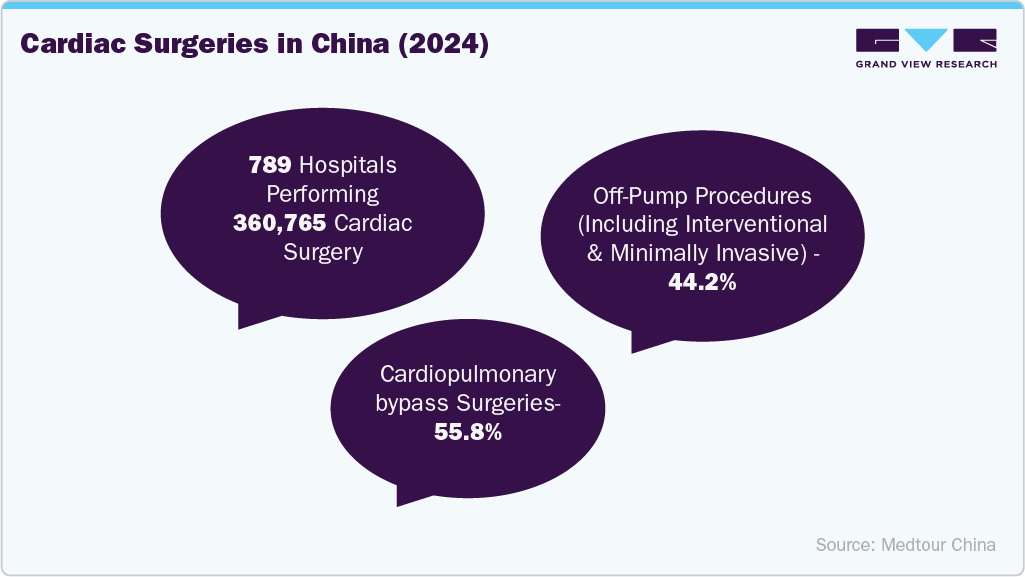

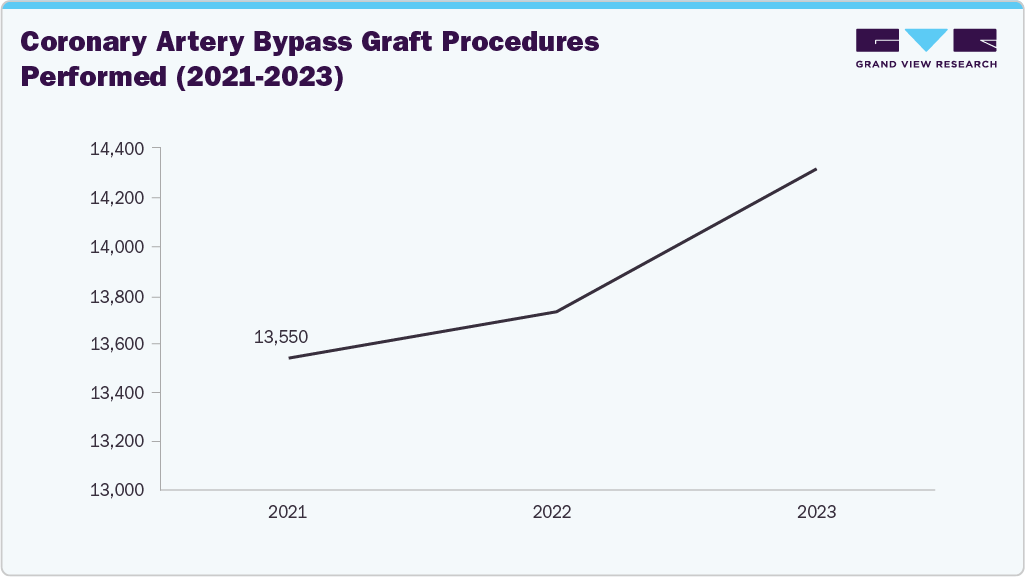

The increasing volume of cardiac surgeries is driving the global market by increasing demand for essential surgical tools used in these procedures. As more patients undergo interventions such as bypass surgeries, valve replacements, and heart transplants, hospitals and cardiac centers require reliable, efficient cannulas to ensure optimal blood flow and patient safety. This growing procedural demand directly fuels market expansion and innovation in cannula technologies. The table below presents the data on cardiac surgeries performed in China in 2024.

Furthermore, the rise in cardiopulmonary bypass (CPB) surgeries is boosting demand for cardiac cannulas, which are crucial for establishing and maintaining extracorporeal circulation during complex heart procedures. The increasing number of CABG, valve, and minimally invasive cardiac surgeries is driving the adoption of advanced arterial, venous, and femoral cannulas that enhance flow efficiency, safety, and overall clinical outcomes. The table below illustrates the distribution of patients undergoing cardiopulmonary bypass (CPB) before ECMO, along with the completeness of reported cardiac-related data across neonatal, pediatric, and adult populations.

Cardiopulmonary Bypass (CPB) Reporting and Duration by Age Group (2022)

Parameter

Pediatric

Neonatal

Adult

Patients with CPB prior to ECMO

7,689

6,067

7,125

Cardiac addendum completed (%)

58.2% (2,191/3,764)

63.4% (1,742/2,746)

19.3% (2,352/12,217)

CPB duration reported (%)

91% (3,830/4,217)

92% (3,050/3,299)

75% (3,044/4,035)

Cross clamp duration reported (%)

60% (3,478/5,797)

70% (2,878/4,128)

38% (2,710/7,133)

Source: Extracorporeal Life Support Organization Registry International Report

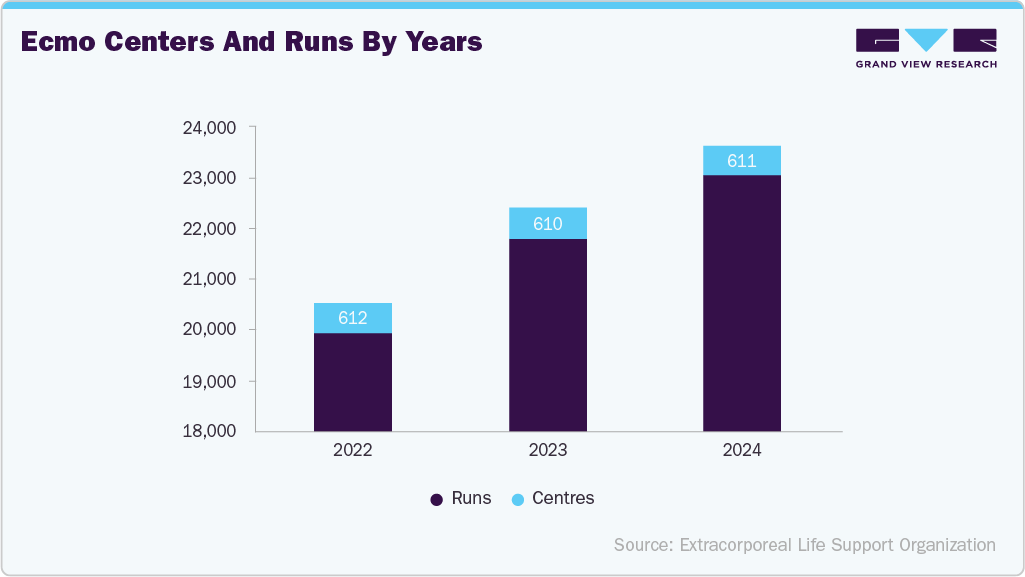

Similarly, the growing adoption of extracorporeal membrane oxygenation (ECMO) is significantly driving the cardiac cannula market, as these procedures require specialized cannulas to ensure efficient blood circulation and oxygenation in critical care patients. The growing use of ECMO for severe cardiac and respiratory conditions, including heart failure and post-surgical support, is driving demand for high-performance, biocompatible cannulas. Hospitals and specialized cardiac centers are investing in advanced ECMO cannulation systems to improve patient outcomes, fueling market growth and driving innovation in cannula design.

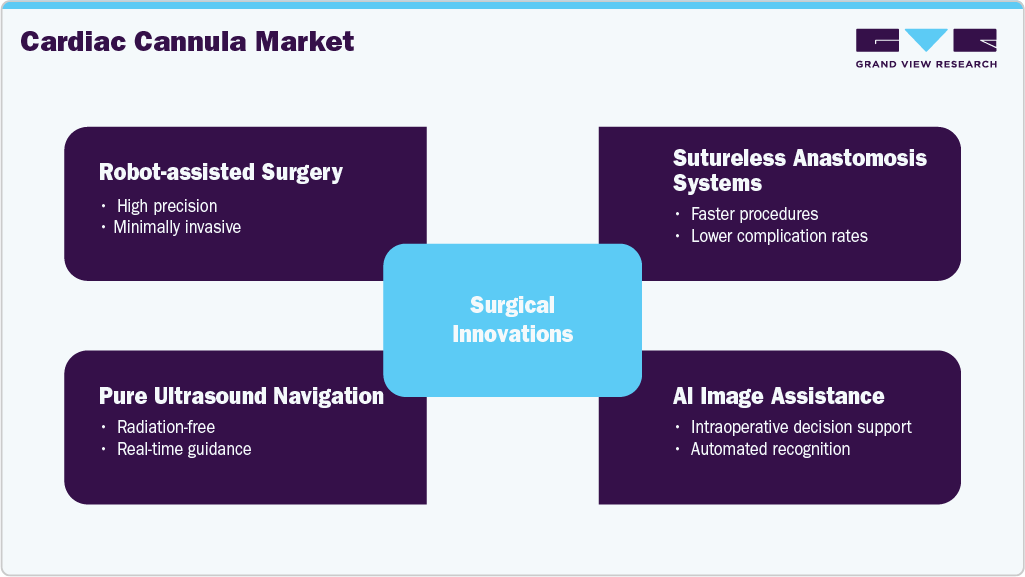

Furthermore, the rising shift toward minimally invasive and robotic-assisted cardiac procedures is driving the cardiac cannula market by increasing demand for smaller, more precise, and flexible cannulas. These advanced surgeries require high-performance devices that ensure efficient blood flow, minimize tissue damage, and improve patient recovery. As hospitals and cardiac centers adopt robotic-assisted and minimally invasive techniques, the need for innovative cannulas that are compatible with these procedures continues to grow, fueling market expansion and technological development.

National Minimally Invasive Surgeries Performed in 2024

Procedure Type

Number of Cases (2024)

Year-on-Year Growth (%)

MICS-CABG

5,063

35.50%

Minimally Invasive Valve Surgery

18,000

18.30%

Minimally Invasive Aortic Surgery

2,478

42.30%

Source: Medtour China

For instance, in October 2025, the American College of Surgeons reported that cardiac surgery is undergoing a significant transformation driven by advanced technologies, especially robotic-assisted systems. Innovations such as high-definition 3D visualization, enhanced instrument precision, and smaller incisions are reducing reliance on open-sternotomy and minimizing patient risk. These advancements give surgeons greater control and visibility, allowing them to perform complex procedures that were previously considered too invasive or high-risk.

“I think that for a long time, cardiac surgery was impervious to the adaption of minimally invasive operations, and that has to do with the inherent complexity of cardiac surgery, the need for good access, the rigid chest wall-all of which made it really hard to apply less-invasive approaches,” explained Dominic Emerson, MD, FACS, director of robotic cardiac surgery at Cedars-Sinai Medical Center in Los Angeles, California. “The robot has really changed that. The wristed instruments give you an amazing amount of dexterity. For the most common kinds of mitral pathology-which are degenerative mitral pathologies isolated to the posterior leaflet-our repair rates are greater than 99% in those patients with excellent durability. And it’s not just us-several other centers also have demonstrated those kinds of results.”

“The 3D visualization of robotics offers 10 to 12 times the magnification with very crisp images,” said Husam H. Balkhy, MD, FACS, FACC, professor of surgery and director of robotic and minimally invasive cardiac surgery at The University of Chicago (UChicago) Medicine in Illinois. “These kinds of images are also available in nonrobotic systems, but it is the integration of dexterity and visualization in the current robots that is very unique.”

“The history of surgical robotics began clinically in the late 1990s, and it was directed toward cardiac surgery,” said Dr. Balkhy. “It never matured or materialized because, at the time, I think the systems were a little bit primitive, relatively speaking, and the surgeons were not ready.”

“Where other specialties have kind of jumped in and started to use robotics in a very common way, cardiac surgeons have been a little bit late to the party, if you will,” said Dr. Balkhy. “And so now, with these more refined systems and more training, we’re able to realize that this approach is revolutionizing cardiac surgery and will continue to do so based on what I see after having been doing this now for almost 20 years.”

The expansion of advanced cardiac services is driving the cardiac cannula market by increasing the demand for high-quality cannulation devices in hospitals and specialized cardiac centers. As healthcare facilities invest in cardiac care units and surgical suites, the volume of complex procedures, such as bypass surgeries, valve replacements, and minimally invasive interventions, increases. This growth fuels the need for reliable arterial, venous, and specialty cannulas that enhance surgical efficiency, patient safety, and clinical outcomes, thereby supporting market expansion.

The increasing penetration of interventional and transcatheter cardiac procedures poses a challenge to the industry, as many of these procedures are performed without full cardiopulmonary bypass, reducing the need for traditional surgical cannulation. As lower and moderate-risk patients shift from open-heart surgery to catheter-based approaches, demand for standard central arterial and venous cannulas declines, particularly in elective cases. Even when cannulation is required in interventional or hybrid settings, it involves fewer access points, smaller cannula sizes, and shorter usage duration, resulting in lower cannula intensity per procedure.

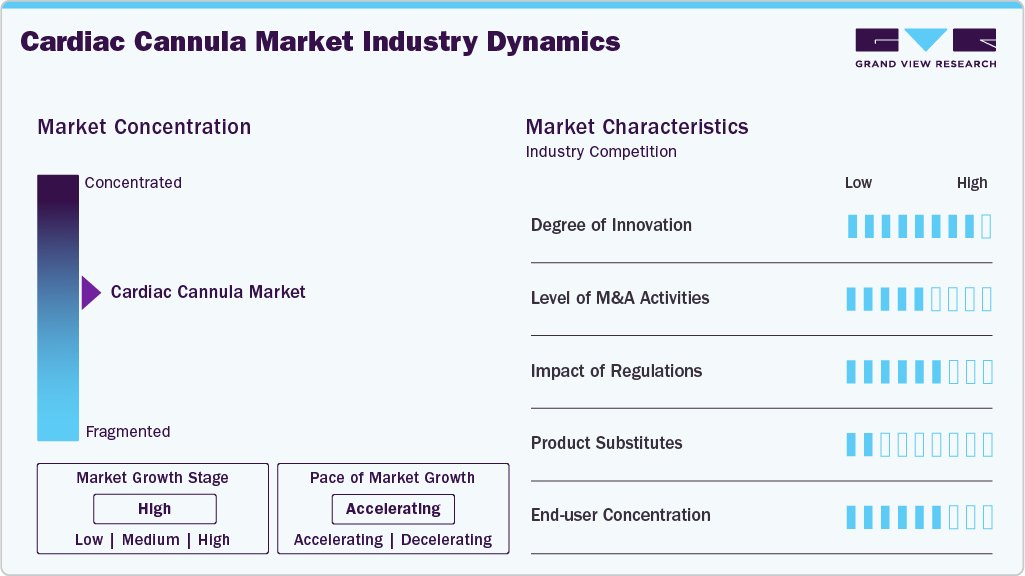

Market Concentration & Characteristics

The cardiac cannula industry is experiencing significant innovation, driven by advancements in materials, design, and performance that enhance surgical precision and patient safety. Emerging technologies, such as improved biocompatible coatings, ergonomic designs, and minimally invasive cannula systems, are reducing complications and improving outcomes. Continuous R&D by key manufacturers and rising demand for next‑generation cardiac devices are further accelerating innovation across the market. For instance, in January 2025, Oxford Academic published an article titled “Innovative Balloon-Inflatable Venous Cannula for Enhanced Cardiopulmonary Bypass in Minimally Invasive Cardiac Surgery.” This development in surgical devices, including the novel MICS venous cannula, is designed to minimize procedural trauma and simplify cardiac operations. By internally occluding venous blood flow with inflatable balloons, the cannula removes the need for external manipulations, dissections, or snares around the SVC and IVC, enhancing patient safety and expanding the use of minimally invasive techniques. Such innovations facilitate complex and less invasive surgeries, boosting demand for specialized cannulas and creating significant growth opportunities in the market.

The industry has seen moderate levels of mergers and acquisitions as larger medical device companies seek to strengthen their cardiovascular portfolios and expand their product offerings. Strategic acquisitions help firms access advanced technologies, expand their geographic reach, and enhance their competitive positioning. This consolidation trend is expected to continue as players aim to achieve economies of scale and respond to increasing demand for innovative cardiac care solutions.

Regulations play a significant role in the cardiac cannula market by ensuring product safety, quality, and clinical effectiveness through stringent approval standards and compliance requirements. Regulatory oversight from agencies like the FDA and European CE marking influences time‑to‑market and adds complexity to product development, increasing costs. However, strong regulatory frameworks also build clinician and patient confidence in advanced cannula technologies, ultimately supporting wider adoption.

The market is highly concentrated in hospitals, cardiac care centers, and specialty surgical clinics, which serve as the primary end users due to the need for advanced cardiovascular procedures. High adoption is observed in tertiary care hospitals equipped with cardiac surgery facilities. In addition, growing investments in minimally invasive cardiac interventions and expanding healthcare infrastructure are further driving the concentration of cannula usage in these clinical settings.

Product Insights

The arterial cannulas segment dominated the cardiac cannula market in 2025, driven by its essential role in maintaining blood flow during cardiopulmonary bypass and other cardiac surgeries. These cannulas are widely used in hospitals and specialized cardiac centers due to their reliability and compatibility with standard surgical procedures. High adoption is supported by the increasing number of cardiac surgeries and the need for precise, high-performance cannulation in critical care settings.

The specialty cannulas segment is expected to grow the fastest during the forecast period, driven by rising demand for customized solutions for complex and minimally invasive cardiac procedures. These cannulas are designed for specific clinical applications, offering enhanced precision, safety, and patient outcomes. Increasing adoption in advanced cardiac centers and growing focus on innovative surgical techniques are fueling rapid growth in this segment.

Application Insights

The cardiopulmonary bypass (CPB) segment dominated the market in 2025, driven by its critical role in open-heart surgeries and major cardiac procedures. CPB cannulas are widely used in hospitals and cardiac centers for efficient blood circulation and oxygenation during surgery. Their established clinical use, reliability, and compatibility with standard surgical equipment support the segment’s market-leading position.

The extracorporeal membrane oxygenation (ECMO) segment is expected to grow the fastest during the forecast period, fueled by rising demand for advanced life-support procedures in critical cardiac and respiratory cases. ECMO cannulas are essential for providing high-flow oxygenation and circulation support in severe cardiac conditions. Increasing adoption of ECMO therapy in hospitals and specialized cardiac centers is fueling rapid growth in this segment.

Material Insights

The polyvinyl chloride (PVC) segment dominated the industry in 2025 due to its cost-effectiveness, durability, and widespread availability. PVC cannulas are widely used in hospitals and cardiac centers for a variety of procedures, offering reliable performance and compatibility with standard surgical equipment. Their dominance is further supported by ease of manufacturing and strong clinician acceptance for routine cardiac surgeries.

The polyurethane segment is expected to grow at the fastest CAGR during the forecast period, due to its superior flexibility, biocompatibility, and resistance to kinking. These properties make polyurethane cannulas ideal for complex and minimally invasive cardiac procedures. Increasing demand for high-performance materials that improve patient safety and surgical outcomes is driving rapid adoption of this segment across hospitals and specialized cardiac centers.

Size Insights

The 11 Fr - 22 Fr segment dominated in 2025 and is also expected to grow the fastest over the forecast period. This is due to its versatility and suitability for a wide range of cardiac procedures, offering optimal flow rates and ease of use. Hospitals and cardiac centers prefer these sizes for both adult and pediatric surgeries, driving strong adoption. The increasing demand for high-performance reliable cannulas further supports the segment’s rapid growth.

The 23 Fr - 36 Fr segment is significantly growing in the market for cardiac cannula, driven by its use in complex and high-flow cardiac procedures. These larger-sized cannulas are preferred in adult open-heart surgeries and extracorporeal circulation, where higher flow rates are critical. The rising demand for advanced surgical interventions and improved patient outcomes is fueling the adoption of this segment across hospitals and specialized cardiac centers.

Age Group Insights

The adult segment dominated the industry in 2025 due to the higher prevalence of cardiovascular diseases and the large number of cardiac surgeries performed in adults. Advanced cannula technologies are widely adopted in adult cardiac procedures to improve surgical efficiency and patient outcomes. The segment’s dominance is further supported by established healthcare infrastructure and higher procedural volumes in hospitals and specialized cardiac centers.

The pediatric segment is expected to grow the fastest during the forecast period, driven by increasing awareness and treatment of congenital heart diseases in children. Specialized pediatric cannulas designed for smaller anatomy and safer surgical outcomes are seeing higher adoption in hospitals and cardiac centers. Advancements in minimally invasive pediatric cardiac procedures are also contributing to the rapid growth of this segment.

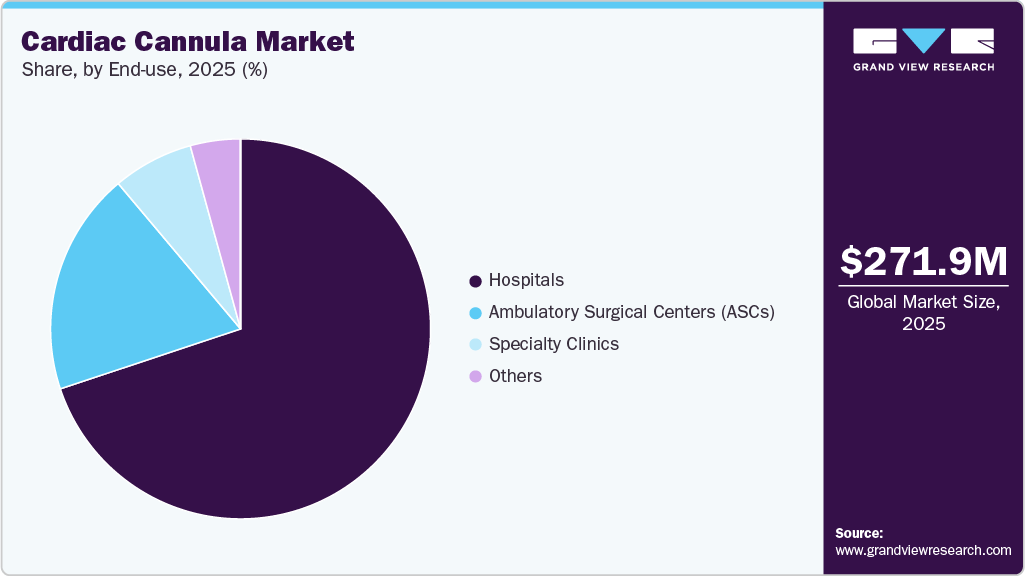

End-use Insights

The hospitals segment dominated the market in 2025, due to the high volume of cardiovascular surgeries and advanced cardiac care procedures performed in these settings. Hospitals have the infrastructure, skilled surgeons, and resources to adopt technologically advanced cannula products, driving strong demand. Their established procurement networks and focus on improving surgical outcomes further reinforce their leading position in the market.

Ambulatory surgical centers (ASCs) are expected to witness the fastest growth during the forecast period, driven by the increasing shift toward outpatient cardiac procedures. ASCs offer cost-effective, convenient, and efficient care, attracting more patients for minimally invasive surgeries. The adoption of advanced, compact, and easy-to-use cannula technologies in these centers is further accelerating market expansion in this segment.

Regional Insights

The North America cardiac cannula market held the largest share and accounted for 37.65% of global revenue in 2025. Driven by the increasing prevalence of cardiovascular diseases, rising surgical procedures, and technological advancements in cannula design and materials. Adoption of minimally invasive cardiac surgeries and enhanced clinician preference for high-performance, biocompatible cannula products further supporting market demand. In addition, supportive reimbursement policies and strong healthcare infrastructure in the United States and Canada continue to sustain market expansion.

U.S. Cardiac Cannula Market Trends

The cardiac cannula industry in the U.S. held the largest share of the North America market in 2025. The industry is growing due to rising cardiovascular surgeries, the increasing prevalence of heart disease, and ongoing innovations in cannula design and materials that improve patient outcomes. There is strong demand for minimally invasive and high-durability cannula products, supported by advanced healthcare infrastructure and favorable reimbursement policies. Furthermore, strategic collaborations and product launches by key medical device manufacturers are further driving market growth.

Europe Cardiac Cannula Market Trends

The cardiac cannula industry in Europe is driven by the increasing incidence of cardiovascular diseases and the growing focus on advanced surgical interventions across the region. Adoption of innovative cannula technologies that enhance surgical precision and biocompatibility is rising, particularly in key markets such as Germany, the UK, and France. In addition, supportive healthcare policies and investments in cardiac care infrastructure are strengthening market growth.

The UK cardiac cannula industry is growing due to the rising prevalence of cardiovascular conditions and the increasing number of cardiac surgical procedures. There is strong uptake of advanced cannula technologies that offer improved performance and patient safety, supported by the NHS’s focus on quality care and innovation. Ongoing investments in healthcare infrastructure and favorable reimbursement frameworks are further driving market expansion.

The cardiac cannula industry in France is experiencing growth driven by rising cardiovascular disease prevalence and expanding cardiac surgery volumes. There is increasing adoption of technologically advanced cannula products that enhance surgical efficiency and patient outcomes. In addition, strong healthcare infrastructure and government initiatives to improve cardiac care services are supporting market development.

Asia Pacific Cardiac Cannula Market Trends

The cardiac cannula industry in the Asia Pacific is expanding rapidly due to the growing burden of cardiovascular diseases, rising healthcare expenditure, and increasing access to advanced cardiac care. Demand for innovative and cost-effective cannula solutions is rising, particularly in emerging markets such as China and India. The improving healthcare infrastructure and greater adoption of minimally invasive cardiac procedures are further driving market growth.

The China cardiac cannula industry is witnessing strong growth driven by a rising prevalence of cardiovascular diseases and increasing volumes of cardiac surgeries. Growing investments in advanced healthcare infrastructure and the adoption of innovative cannula technologies are enhancing surgical outcomes. Furthermore, favorable government initiatives to expand access to cardiac care and rising patient awareness are further supporting market expansion. For instance, in June 2023, the National Health Commission (NHC) and the World Health Organization (WHO) reported that China faces a substantial cardiovascular burden, with approximately 330 million patients and heart disease accounting for over 40% of all deaths. To address this, the "Healthy China 2030" initiative has expanded health insurance coverage to nearly 100% of the population, reducing barriers for essential surgeries such as Coronary Artery Bypass Grafting (CABG) and valve repairs.

Latin America Cardiac Cannula Market Trends

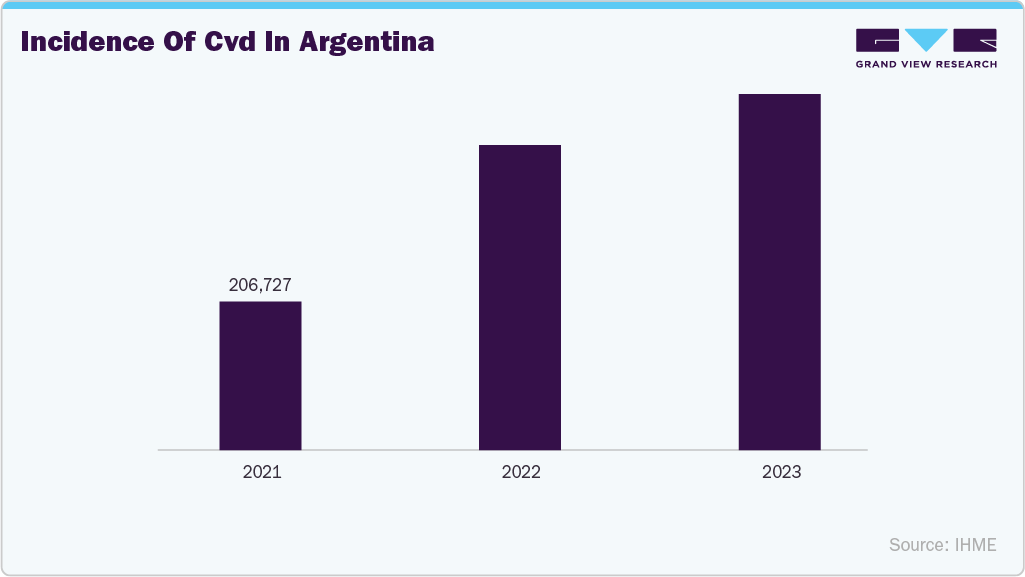

The cardiac cannula industry in Latin America is expanding due to the growing prevalence of cardiovascular diseases and an increasing number of cardiac surgeries across the region. Rising investments in modern healthcare infrastructure and the adoption of advanced cannula technologies are improving surgical outcomes. Furthermore, supportive government initiatives and greater awareness of cardiovascular care are driving demand for high-quality cardiac cannula products.

Middle East and Africa Cardiac Cannula Market Trends

The cardiac cannula industry in the Middle East and Africa is gradually growing as cardiovascular disease rates rise and more hospitals invest in advanced cardiac surgical equipment. Increased healthcare spending and expansion of specialized cardiac care centers are boosting the adoption of improved cannula technologies. The efforts to enhance clinical outcomes through training and technology upgrades are supporting demand for high‑quality cardiac cannula products across the region.

Key Cardiac Cannula Company Insights

The market is characterized by several established medical device manufacturers with strong global distribution networks and broad cardiovascular portfolios. Leading companies hold significant market share through continuous product innovation, regulatory approvals, and long-term partnerships with hospitals and cardiac centers, while smaller players compete by focusing on specialized designs and niche clinical applications.

Key Cardiac Cannula Companies:

The following key companies have been profiled for this study on the cardiac cannula market

- Medtronic

- Edwards Lifesciences Corporation

- Braile Biomédica

- BD (Becton, Dickinson & Corporation)

- Surge Cardiovascular

- LivaNova PLC

- Getinge

- EUROSETS

- INVAMED

- Cardinal Health

- Andocor

- Xenios AG (Fresenius Medical Care)

- MERA (Senko Medical Instrument Mfg. Co., Ltd.)

- Prymax Healthcare LLP

- Vitalcor, Inc.

- Cormed Medizintechnik GmbH & Co. KG

- Smartcanula LLC

- Changzhou KangXin Medical Instruments Co., Ltd.

- NIPRO

- Spectrum Medical

Recent Developments

-

In June 2025, EUROSETS announced the start of an expansion of its production facility in Modena, supported by a €24 million investment, with completion expected by 2026. The project will double the plant size to 23,000 square meters and includes new clean rooms, expanded manufacturing and warehouse space, and a dedicated research and development center to support technological innovation.

-

In September 2024, BD announced the completion of its acquisition of Edwards Lifesciences’ Critical Care product group, with the acquired business rebranded as BD Advanced Patient Monitoring.

-

In March 2021, Berlin Heart announced that it received CE approval and successfully completed the first implantation of an innovative bridging solution for patients with a single ventricle.

Cardiac Cannula Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 288.66 million

Revenue forecast in 2033

USD 447.20 million

Growth rate

CAGR of 6.45% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, material, size, age group, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Norway; Denmark; Sweden; Spain; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; KSA; UAE; South Africa; Kuwait

Key companies profiled

Medtronic; Edwards Lifesciences Corporation; Braile Biomédica; BD (Becton, Dickinson & Corporation); Surge Cardiovascular; LivaNova PLC; Getinge; EUROSETS; INVAMED; Cardinal Health; Andocor; Xenios AG (Fresenius Medical Care); MERA (Senko Medical Instrument Mfg. Co., Ltd.); Prymax Healthcare LLP; Vitalcor, Inc.; Cormed Medizintechnik GmbH & Co. KG; Smartcanula LLC; Changzhou KangXin Medical Instruments Co., Ltd.; NIPRO; Spectrum Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiac Cannula Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global cardiac cannula market report on the basis of product, application, material, size, age group, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Arterial Cannulas

-

Venous Cannulas

-

Cardioplegia Cannulas

-

Specialty Cannulas

-

-

Application Outlook (Revenue, USD Million; 2021 - 2033)

-

Cardiopulmonary Bypass (CPB)

-

Minimally Invasive & Robotic Surgery (MICS)

-

Extracorporeal Membrane Oxygenation (ECMO)

-

-

Material Outlook (Revenue, USD Million; 2021 - 2033)

-

Silicone

-

Polyurethane

-

Polyvinyl Chloride (PVC)

-

-

Size Outlook (Revenue, USD Million; 2021 - 2033)

-

4 Fr - 7 Fr

-

8 Fr - 10 Fr

-

11 Fr - 22 Fr

-

23 Fr - 36 Fr

-

36+ Fr

-

-

Age Group Outlook (Revenue, USD Million; 2021 - 2033)

-

Adults

-

Pediatric

-

-

End-use Outlook (Revenue, USD Million; 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiac cannula market size was estimated at USD 271.88 million in 2025 and is expected to reach USD 288.66 million in 2026.

b. The global cardiac cannula market is expected to grow at a compound annual growth rate of 6.45% from 2026 to 2033 to reach USD 447.20 million by 2033.

b. North America dominated the cardiac cannula market with the largest revenue share of 37.97% in 2025.

b. Some key players operating in the cardiac cannula market include Medtronic, Edwards Lifesciences Corporation, Braile Biomédica, BD (Becton, Dickinson and Company), Surge Cardiovascular, LivaNova PLC, Getinge, EUROSETS, INVAMED, Cardinal Health, Andocor, Xenios AG (Fresenius Medical Care), MERA (Senko Medical Instrument Mfg. Co., Ltd.), Prymax Healthcare LLP, Vitalcor, Inc., Cormed Medizintechnik GmbH & Co. KG, Smartcanula LLC, Changzhou KangXin Medical Instruments Co., Ltd., NIPRO, Spectrum Medical, and others.

b. The cardiac cannula market is primarily driven by the rising global burden of cardiovascular diseases, which increases the need for cardiac surgeries and extracorporeal procedures such as cardiopulmonary bypass, CABG, and ECMO.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.