- Home

- »

- Biotechnology

- »

-

Cell Dissociation Market Size, Share & Growth Report, 2030GVR Report cover

![Cell Dissociation Market Size, Share & Trends Report]()

Cell Dissociation Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Cell Detachment, Tissue Dissociation), By Product (Enzymatic Dissociation), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-037-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global cell dissociation market size was valued at USD 310.8 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.55% from 2023 to 2030. When working with cells of any kind (tumor cells, immune cells, etc.) the first step is to collect the preferred cell sample from the host tissue. Dissociation involves the breaking down of a cell culture to obtain a small group. Dissociation is an indispensable technique that allows researchers to mark and isolate the types of cells they are trying to study. The global industry is rapidly growing, with a wide range of products available to help researchers, pharmaceutical companies, and clinicians in their efforts to study, manipulate, and utilize cells.

COVID-19 has boosted the demand for cell culture products due to the substantial role played by cell culture technologies in discovering therapeutic and novel diagnostic options for the disease. For instance, culturing techniques offer important tools for manufacturing viral particles for vaccine development, thereby widening the growth prospects in this market. The rising focus on developing cell-based therapeutics is the major factor driving the industry's growth. Increasing clinical trials, FDA approvals, and strategic initiatives by key players are boosting market growth. For instance, in December 2022, Sanofi and Innate Pharma SA expanded their collaboration with Sanofi for natural killer cell therapeutics in oncology.

Moreover, in September 2022, Century Therapeutics and Bristol Myers Squibb announced a research collaboration and license agreement to commercialize and develop up to four iPSC-derived programs for solid tumors and hematologic malignancies. Moreover, launching innovative products further offers lucrative opportunities in the forecast period. For instance, in November 2021, LevitasBio launched Optimized Tissue Dissociation Reagents. The company’s tissue dissociation kits are specially designed for the LeviCell workflows, allowing for end-to-end handling across a wide range of human and model tissue types, including heart, tumor, brain, liver, lung, and kidney.

The kit will allow customers to achieve high viability suspended cell enrichment while reducing cell damage, stress, or population bias. In addition, increasing funding for stem cell research by government bodies and companies is likely to offer new growth opportunities for the industry. For instance, in March 2022, the City of Hope received a USD 4.9 million grant from California Institute for Regenerative Medicine. The funding will help the Research Centre to guide the next-gen of scientific leaders in stem cell research and its translation into innovative lifesaving treatments. The grants will fund laboratory research and aid scientists to implement cell-based therapies, engineering, and manufacturing cells, gaining regulatory authorization, and commercializing biomedical products.

Furthermore, researchers focus on developing sophisticated technologies to meet the rising demand. For instance, a team of researchers from Brown University is developing an inexpensive, simple, portable device to detach the tissues into viable single cells electrically and anticipate using the approach useful in both basic scientific research and clinical diagnostics. Moreover, the group has partnered with PerkinElmer to bring the technology into a commercialized product. The group of researchers is also exploring other innovative physical mechanisms for dissociation.

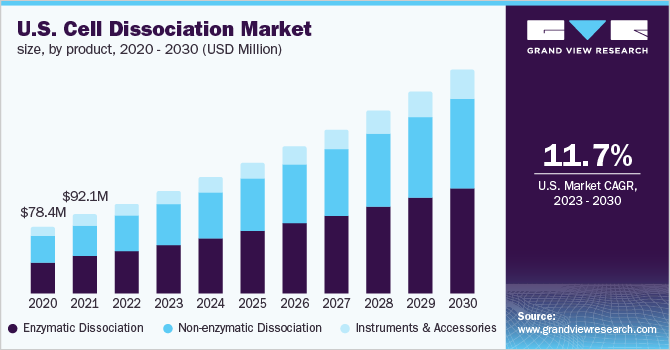

Product Insights

The enzymatic dissociation segment dominated the global industry in 2022 and accounted for the maximum share of more than 47.90% of the overall revenue. Based on product, the global industry is further categorized into non-enzymatic dissociation and instruments & accessories. Enzymatic dissociation uses enzymes to digest the cut-up tissue pieces, thereby releasing the cells from the tissue. Several different types of enzymes are used in the dissociation process and can also be used in combination. All enzymatic dissociations provide a more effective and efficient method for isolating mononuclear cells from the spinal cord and brain. The non-enzymatic segment is expected to grow at the fastest CAGR from 2023 to 2030.

The enzyme-free formulation helps preserve the cell surface proteins’ functional and structural integrity. It also benefits in evading the cytotoxic effects associated with the chelating agents. Moreover, the use of animal-derived components is experiencing ever-increasing regulatory examination in biopharmaceutical manufacturing. Therefore, there is a need to develop non-enzymatic products for cell culture, thereby driving segment growth. However, the solution is not suggested for cells with specific adhesive properties. For those cell lines, which are tough to remove, the biopharmaceutical industry has developed a Papain Dissociation Solution.

Type Insights

On the basis of type, the industry has been further categorized into tissue dissociation and cell detachment. The tissue dissociation type segment dominated the global industry in 2022 and accounted for the maximum share of 56.55% of the overall revenue. The segment is projected to expand further at a steady growth rate maintaining its dominant position in the global market. Factors, such as the increasing focus of biopharmaceutical and pharmaceutical companies on the development of monoclonal antibodies and customization of treatment, are anticipated to drive the growth of this segment.

On the other hand, the cell detachment type segment is anticipated to register the fastest growth rate during the forecast period. Cell detachment is important in culturing adherent cells. Trypsinization is the most common detachment technique. The increasing funding for the cell culture launch of innovative products and strategic activities by key industry players are among the major factors driving the growth of this segment.

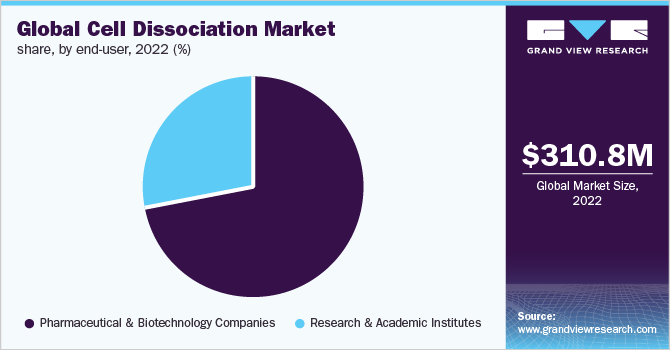

End-user Insights

On the basis of end-users, the industry has been further categorized into pharmaceutical and biotechnology companies and research & academic institutes. The pharmaceutical and biotechnology companies end-user segment dominated the industry in 2022 and accounted for the maximum share of more than 71.60% of the overall revenue. The segment is projected to expand further at the fastest growth rate maintaining its leading position in the global market during the forecast period.

The high share and rapid growth of this segment can be attributed to the widespread use of cell dissociation enzymes in pharmaceuticals. Enzymes like collagenase and trypsin are important for detaining solid tissues and adherent cells for subculture and experiments. In addition, cell tissue disaggregation and dissociation are the beginning of a wide range of research applications, including the research developing into cancer treatments, cell expansion, and the production of vaccines.

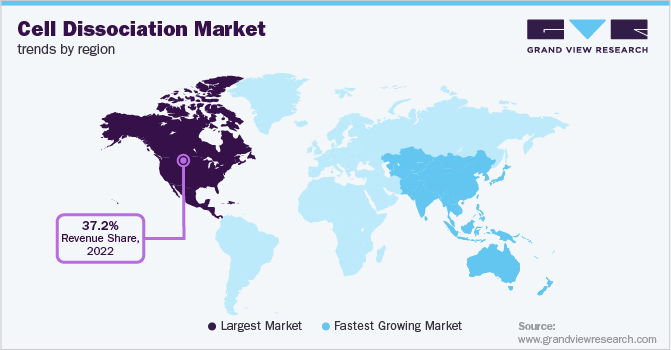

Regional Insights

North America dominated the global industry in 2022 and accounted for the maximum share of more than 37.20% of the overall revenue. The high share of the region can be attributed to the rise in investment initiatives by the government, increasing incidence of chronic diseases, such as cancer, and the presence of high-quality infrastructure for clinical & laboratory research in the region. For instance, according to the Globocan report in 2020, approximately 2,281,658 new cancer cases were recorded in the United States, with nearly 612,390 deaths. Thus, the rising prevalence of chronic and infectious diseases, coupled with the increasing focus on cell-based therapeutics, is expanding the growth prospects of the market.

The Asia Pacific region is estimated to register the fastest growth rate during the forecast period due to the rising demand for novel therapeutics. Furthermore, increasing R&D investments by governments and rapid infrastructural development are among the other key factors boosting the regional market growth. In addition, several regional companies are receiving funding to develop a treatment for various chronic diseases, such as cancer. For instance, in June 2022, Immuneel Therapeutics received a budget of USD 15 million for developing affordable cell and gene therapy for cancer patients in India.

Key Companies & Market Share Insights

Major players are executing various strategies including novel product launches, partnerships, collaborations, mergers & acquisitions, and geographical expansions to expand their industry presence. For instance, in February 2020, S2 Genomics launched Singulator 100 System. The System automates the processing of solid tissue samples into suspensions of nuclei or single cells with high yields and from small samples for an extensive range of genomic analyses and single-cell biology. The instrument standardizes the dissociation method of solid tissues, making it simple for the investigators to reproducibly prepare the suspensions of high-quality, highly viable nuclei or cells with minimal variability. Some of the key players in the global cell dissociation market include:

-

Merck KGaA

-

Thermo Fisher Scientific

-

Danaher Corp.

-

STEMCELL Technologies

-

Sartorius AG

-

BD

-

Miltenyi Biotec

-

PAN-Biotech

-

HiMedia Laboratories

-

F. Hoffmann-La Roche Ltd.

-

S2 Genomics, Inc.

Cell Dissociation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 354.7 million

Revenue forecast in 2030

USD 863.3 million

Growth rate

CAGR of 13.55% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Merck KGaA; Thermo Fisher Scientific; Danaher Corporation; STEMCELL Technologies; Sartorius AG; BD; Miltenyi Biotec; PAN-Biotech; HiMedia Laboratories; F. Hoffmann-La Roche Ltd; S2 Genomics, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

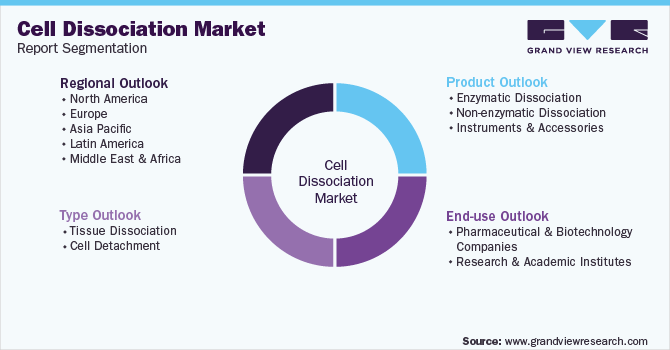

Global Cell Dissociation Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell dissociation market report based on product, type, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzymatic Dissociation

-

Trypsin

-

Collagenase

-

Elastase

-

Papain

-

Hyaluronidase

-

DNase

-

Others

-

-

Non-enzymatic dissociation

-

Instruments & Accessories

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tissue Dissociation

-

Cell Detachment

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical And Biotechnology Companies

-

Research & Academic Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell dissociation market size was estimated at USD 310.8 million in 2022 and is expected to reach USD 354.7 million in 2023.

b. The global cell dissociation market is expected to grow at a compound annual growth rate of 13.55% from 2023 to 2030 to reach USD 863.3 million by 2030.

b. The enzymatic dissociation segment dominated the global market in 2022 and captured the maximum overall revenue share. This is attributed to the increase in the requirement and importance of enzymatic dissociation products for pharmaceutical & biotechnology companies, which is likely to increase the adoption and anticipate market growth.

b. Some key players operating in the cell dissociation market include Merck KGaA, Thermo Fisher Scientific, Danaher Corporation, STEMCELL Technologies, Sartorius AG, BD, Miltenyi Biotec, PAN-Biotech, HiMedia Laboratories, F. Hoffmann-La Roche Ltd, S2 Genomics, Inc.

b. The rising prevalence of chronic and infectious diseases and the increasing focus on cell-based therapeutics are expanding the market's growth prospects. In addition, growing funding for cell-based research is the key factor driving the cell dissociation market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.