- Home

- »

- Biotechnology

- »

-

Cell Therapy Technologies Market Size, Industry Report 2030GVR Report cover

![Cell Therapy Technologies Market Size, Share & Trends Report]()

Cell Therapy Technologies Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Raw Materials, Instruments), By Workflow (Separation, Expansion), By Cell Type (T-cells, Stem Cells), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-516-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Therapy Technologies Market Summary

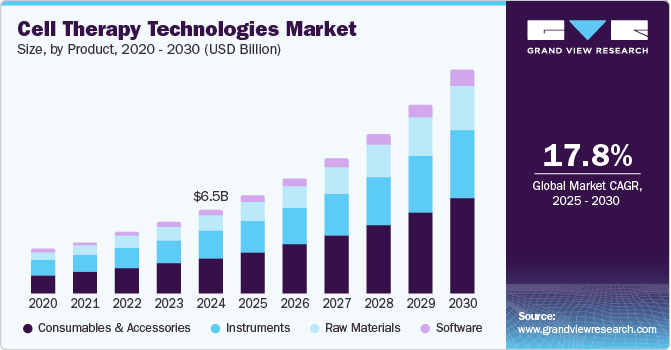

The global cell therapy technologies market size was estimated at USD 6.54 billion in 2024 and is projected to reach USD 17.46 billion by 2030, growing at a CAGR of 17.84% from 2025 to 2030. The industry is experiencing significant growth, driven by advancements in personalized medicine and substantial investments from pharmaceutical giants.

Key Market Trends & Insights

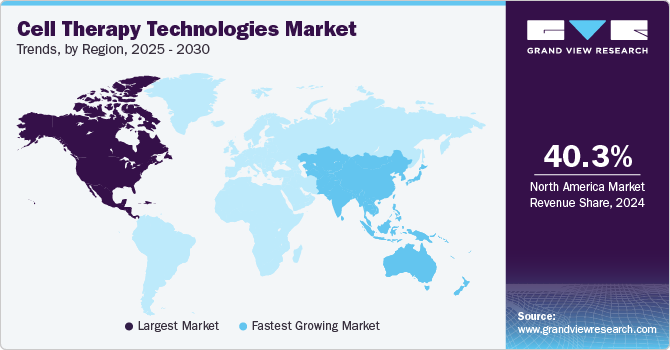

- The North America cell therapy technologies market led the global industry with a 40.32% share.

- Based on product, the consumables segment dominated the market with a 42.70% share in 2024.

- Based on workflow, the separation segment led the cell therapy technologies market, holding a 34.55% share in 2024.

- Based on cell type, the T-cells segment dominated the cell therapy technologies market with a 57.49% share in 2024.

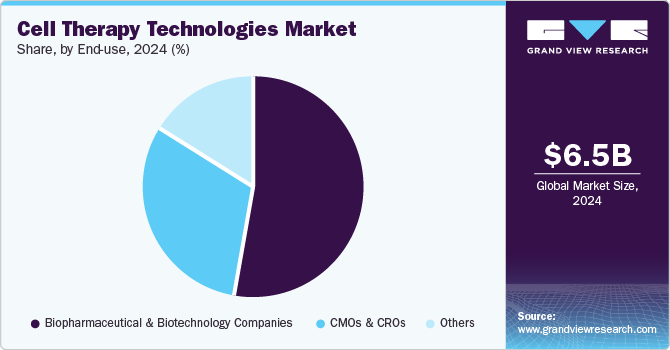

- Based on end-use, the biopharmaceutical & pharmaceutical companies held the largest market share of 53.23% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.54 Billion

- 2030 Projected Market USD 17.46 Billion

- CAGR (2025-2030): 17.84%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The increasing focus on tailoring treatments to individual patient needs has led to the development of innovative cell-based therapies, enhancing treatment efficacy and patient outcomes. This personalized approach is particularly evident in the rise of CAR-T cell therapies, which modify a patient's cells to combat diseases like cancer. Companies such as Autolus are at the forefront of developing new CAR-T cell therapies like Aucatzyl for acute lymphoblastic leukemia, which has recently received approval from the U.S. FDA.

The COVID-19 pandemic has further underscored the importance of rapid and adaptable therapeutic development. The success of mRNA vaccines during the pandemic has accelerated interest in applying similar technologies to cell therapies. Companies like BioNTech and Moderna, known for their COVID-19 vaccines, are now focusing on personalized mRNA cancer vaccines to bolster the immune system's ability to fight the disease. This shift highlights the versatility of mRNA technology and its potential to revolutionize cell-based treatments.

Recent company initiatives reflect a strategic emphasis on expanding cell therapy capabilities. For instance, in November 2024, Roche's acquisition of Poseida Therapeutics for up to USD 1.5 billion aims to enhance its pipeline in oncology, immunology, and neurology cell therapies. Poseida specializes in CAR-T cell therapies, and this acquisition is expected to facilitate the development of next-generation off-the-shelf CAR-T treatments that are scalable, potent, and safer.

Similarly, in February 2024, AstraZeneca's acquisition of Gracell Biotechnologies for up to USD 1.2 billion signifies a strategic move to advance cell therapies. Gracell, based in Shanghai, is critical for AstraZeneca's goal to launch 20 new medicines by 2030, focusing on innovative cell therapy solutions. This acquisition highlights the growing importance of cell therapy technologies in the pharmaceutical industry's future strategies.

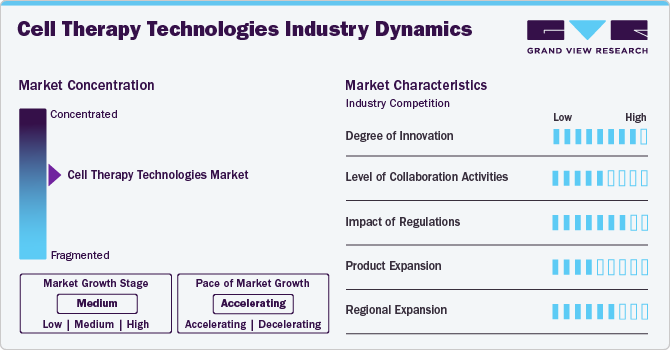

Market Concentration & Characteristics

The cell therapy technologies industry is set for strong growth, driven by advances in automation, bioprocessing, and genetic engineering. Growing demand for personalized medicine, regenerative treatments, and cancer therapies is boosting investment. Supportive regulations and improved manufacturing processes are also helping companies scale up production and bring new cell therapies to market faster.

The industry is growing steadily, with moderate collaboration activity among industry players. Key drivers include the rising demand for advanced therapies, automation in manufacturing, and increased R&D investments. Strategic partnerships between biopharma companies, CMOs, and tech firms are helping improve efficiency, scalability, and innovation in cell therapy development and production. In June 2023, StemCyte partnered with a leading U.S. immune cell therapy company to supply raw materials for the development of allogeneic modified cell therapies.

Regulations have positively influenced the cell therapy technologies market by ensuring manufacturing quality, safety, and standardization. Clear guidelines have accelerated product approvals, encouraged investments, and supported automated processing and scalable production innovation. This regulatory support is helping companies bring advanced cell therapies to market more efficiently.

The cell therapy technologies industry has seen moderate growth in product expansion, driven by advancements in automation, bioprocessing, and raw material development. Increasing demand for efficient manufacturing solutions and innovations in cell expansion, separation, and cryopreservation technologies are shaping the industry’s growth.

The cell therapy technologies market is expanding gradually across regions, driven by growing demand, supportive regulations, and new investments. Companies are setting up new facilities, forming partnerships, and improving production capabilities to enter new markets and meet the rising need for advanced cell therapies.

Product Insights

In 2024, the consumables segment dominated the market with a 42.70% share, driven by the high demand for culture media, reagents, and growth factors essential for cell therapy research and production. The increasing adoption of cell-based therapies, advancements in bioprocessing techniques, and the rising number of clinical trials have further fueled market growth. Additionally, the recurring nature of consumable usage in manufacturing and research makes this segment a key revenue driver in the industry.

The software segment in the cell therapy technologies market is expected to grow at the highest CAGR of 19.88% from 2025 to 2030. The increasing need for data management, automation, and regulatory compliance in cell therapy development and manufacturing drives this growth. Advanced software solutions help streamline workflow automation, real-time monitoring, and quality control, ensuring efficiency and scalability. As the industry moves toward digitalization and process standardization, the demand for specialized software to support clinical trials, manufacturing, and supply chain management continues to rise.

Workflow Insights

In 2024, the separation segment led the cell therapy technologies market, holding a 34.55% share, and is expected to grow at the fastest rate, 19.20% CAGR in the coming years. The need for greater efficiency, scalability, and cost reduction in cell therapy manufacturing drives this growth. Automating key processes like cell expansion and separation is a major factor behind this trend. For example, in February 2024, Multiply Labs and Thermo Fisher Scientific expanded their partnership to automate these steps, improving workflows, efficiency, and production speed while ensuring quality control. This automation is expected to help scale manufacturing, lower costs, and meet the rising demand for cell therapies.

The expansion segment is also set for strong growth, driven by the need for scalable and automated manufacturing to enhance the production and effectiveness of cell and gene therapies, particularly for solid tumor treatments. In September 2024, Xcell Biosciences strengthened its partnership with Labcorp by launching AVATAR Foundry, a platform designed to automate large-scale cell and gene therapy production. This initiative aims to make cell therapies more scalable and potent, addressing the increasing demand for efficient manufacturing in this rapidly growing market.

Cell Type Insights

In 2024, the T-cells segment dominated the cell therapy technologies market with a 57.49% share and is projected to grow at the fastest CAGR in the coming years. This growth is driven by the increasing adoption of T-cell therapies, such as CAR-T and TCR-T therapies, for treating cancer, autoimmune diseases, and infectious diseases. Advances in genetic engineering, cell expansion, and automation are further boosting demand. As research and clinical applications expand, the need for advanced technologies and raw materials to support T-cell therapy development and manufacturing continues to rise.

The stem cells segment is expected to grow strongly in the cell therapy technologies market, driven by their expanding use in regenerative medicine, tissue repair, and autoimmune disease treatments. Increasing clinical research, advancements in stem cell banking, and improved bioprocessing techniques further fuel demand. Additionally, the rising prevalence of degenerative diseases and supportive regulatory frameworks encourage investments in stem cell-based therapies, boosting market expansion.

End Use Insights

In 2024, biopharmaceutical & pharmaceutical companies held the largest market share of 53.23%, driven by their growing focus on cell therapies for diseases like cancer, autoimmune disorders, and degenerative conditions. These companies invest heavily in research, development, and commercialization, increasing demand for high-quality raw materials needed in cell therapy production. For example, in September 2023, Novo Nordisk invested USD 136 million to build a cell therapy manufacturing facility in Denmark at the Technical University of Denmark (DTU). This facility will focus on producing stem cell therapies for early-stage clinical trials.

Meanwhile, the CMOs & CROs segment is expected to grow the fastest in the coming years. The rising trend of outsourcing has fueled this growth, as biopharmaceutical companies seek specialized expertise and cost-effective solutions for cell therapy development and production. CMOs and CROs provide end-to-end services, from research to manufacturing, allowing companies to focus on innovation while reducing operational costs and risks. This shift has significantly increased demand for key raw materials like growth factors and culture media. As investments in cell therapy R&D continue to rise, CMOs and CROs will support the industry’s expansion.

Regional Insights

North America cell therapy technologies market led the global industry with a 40.32% share, driven by the rising cases of cancer, diabetes, and heart diseases. The growing demand for advanced cell-based treatments has increased the need for essential raw materials, software, and instruments. The region's strong healthcare system and clear regulations have made it easier for companies to develop and bring cell therapies to the market. This supportive environment has attracted significant investments from governments and private companies, boosting research and innovation in the field.

U.S. Cell Therapy Technologies Market Trends

The cell therapy technologies market in the U.S. is growing rapidly due to the rising demand for advanced treatments in cancer, autoimmune diseases, and regenerative medicine.

Europe Cell Therapy Technologies Market Trends

The cell therapy technologies market in Europe is driven by the growing demand for advanced therapies and increasing investment in cell biology research. The region has seen significant growth in recent years as the industry continues to develop.

The UK cell therapy technologies market is expanding quickly as more cell-based treatments are used for cancer, autoimmune disorders, and genetic diseases. Advances in regenerative medicine and personalized therapies drive demand for key raw materials like growth factors, cytokines, and cell culture media, essential for developing and producing cell therapies.

The cell therapy technologies market in Germany is growing rapidly due to the rising demand for advanced regenerative medicine and cancer care treatments.

Asia Pacific Cell Therapy Technologies Market Trends

The cell therapy technologies market in Asia Pacific is expected to grow at the fastest CAGR of 18.92% from 2025-2030, driven by rising chronic and degenerative diseases like cancer, heart diseases, and neurological disorders. This has increased the demand for cell therapies and the raw materials needed for their production. Additionally, supportive regulations in countries like China and India are helping to accelerate market growth.

China cell therapy technologies market is set for rapid growth, driven by the adoption of automated systems that improve production efficiency, data monitoring, and support for clinical trials and R&D. For example, in October 2024, Sino-Biocan (Shanghai) Biotech Ltd launched the WUKONG Automated Cell Processing System, which streamlines the entire process from blood collection to cell drug production. This closed-loop, real-time monitoring system enhances efficiency and supports the development of new cell therapies.

The cell therapy technologies market in Japan is driven by the use of robotics and pharmaceutical technologies to improve production efficiency, quality, and cost-effective scaling. For example, in May 2024, YASKAWA ELECTRIC CORPORATION and Astellas Pharma partnered to develop a cell therapy platform that integrates robotics with pharmaceutical processes, helping research institutions and startups transition from lab research to large-scale manufacturing while ensuring high quality and stability.

Key Cell Therapy Technologies Company Insights

Key players operating in the cell therapy technologies market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Cell Therapy Technologies Companies:

The following are the leading companies in the cell therapy technologies market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher Corporation

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Lonza Group

- Sartorius AG

- Promega

- BD

- Miltenyi Biotec

- CellPort Software

- Shimadzu

Recent Developments

-

In December 2024, BioCentriq invested USD 12 million in a new cell therapy manufacturing facility in Princeton, NJ, which will also be its headquarters. This expansion will strengthen its cell therapy development and production capabilities.

-

In September 2024, Vertex Pharmaceuticals partnered with Lonza in a long-term supply agreement to manufacture Casgevy, a gene-edited cell therapy for sickle cell disease and β-thalassemia.

-

In December 2023, Miltenyi Biotec and Replay signed a licensing and manufacturing deal to develop GMP-compliant TCR-NK cell therapies targeting PRAME, a tumor-associated neoantigen, advancing cancer immunotherapy.

Cell Therapy Technologies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.69 billion

Revenue forecast in 2030

USD 17.46 billion

Growth rate

CAGR of 17.84% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, workflow, cell type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

Danaher Corporation; Merck KGaA; Thermo Fisher Scientific Inc.; Lonza Group; Sartorius AG; Promega; BD; Miltenyi Biotec; CellPort Software; Shimadzu

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Therapy Technologies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell therapy technologies market report based on product, workflow, cell type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Raw Materials

-

Media

-

Sera

-

Cell Culture Supplements

-

Antibodies

-

Reagents & Buffers

-

Others

-

-

Instruments

-

Cell Therapy Processing Systems

-

Cell Culture Systems

-

Cell Sorting & Separation Systems

-

Other Instruments

-

-

Software

-

Consumables & Accessories

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Separation

-

Expansion

-

Apheresis

-

Fill- Finish

-

Cryopreservation

-

Others

-

-

Cell Type Outlook (Revenue, USD Million, 2018 - 2030)

-

T-cells

-

Stem Cells

-

Other Cells

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Biotechnology Companies

-

CMOs & CROs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell therapy technologies market size was estimated at USD 6.54 billion in 2024 and is expected to reach USD 7.68 billion in 2025.

b. The global cell therapy technologies market is expected to grow at a compound annual growth rate of 17.84% from 2025 to 2030 to reach USD 17.46 billion by 2030.

b. The consumables segment held the largest share of 42.7% in 2024. The growth of the consumables segment can be attributed to their high demand and recurring usage in the cell therapy development.

b. Some of the key players operating in the market include, Danaher Corporation; Merck KGaA; Thermo Fisher Scientific Inc.; Lonza Group; Sartorius AG; Promega; BD; Miltenyi Biotec; CellPort Software; Shimadzu

b. The market growth can be primarily attributed to advancements in cell-based therapy development and increased funding and investment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.