- Home

- »

- Advanced Interior Materials

- »

-

Mixed Flow Pump Market Size, Share Analysis Report, 2030GVR Report cover

![Mixed Flow Pump Market Size, Share & Trends Report]()

Mixed Flow Pump Market (2024 - 2030) Size, Share & Trends Analysis Report By Configuration (Single-stage, Multi-stage), By End-use (Agriculture, Power Generation, Construction & Building Services, Water & Wastewater), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-158-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mixed Flow Pump Market Size & Trends

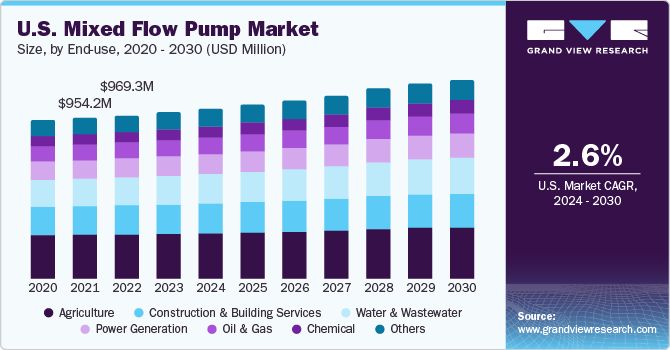

The global mixed flow pump market size was estimated at USD 9.48 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2030. Mixed flow pumps offer a balance between radial and axial flow pumps, resulting in efficient fluid movement with moderate to high flow rates and head capacities. This efficiency is a significant driver in applications where fluid transport is required across a range of flow rates and pressures.

Strict government laws on energy efficiency, safety, and standards are anticipated to have a significant impact on the market. While many established nations have already made investments in water treatment business, developing nations in Asia Pacific and North America are anticipated to encourage and boost investments in the sector in the coming years.

According to the International Energy Agency (IEA) the U.S. has the third-largest hydropower power generation capacity in the world. An ongoing project, to upgrade the Bad Creek hydro station in South Carolina, U.S., is adding to demand for mixed flow pumps. This upgrade reported by the National Hydropower Association (NHA) in March 2022 is planned to increase the hydropower generation by 280MW. Thereby, it generated growth opportunities for the mixed-flow pumps market, as mixed flow pumps are used in the power generation facilities.

According to the International Hydropower Association, in 2022 34 GW of hydroelectric power had been produced globally,crossing the 30GW limit firsttimesince2016. Mixed flow pumps are employed in hydropower generation, both for new projects and upgrades to existing facilities. The push for renewable energy sources and the need to modernize aging hydropower infrastructure contribute to the demand for mixed flow pumps.

The chemical manufacturing sector across the globe relies on mixed flow pumps for various processes, including cooling, circulation, and fluid transfer in chemical, and petrochemical industries. Thus, the increasing manufacturing and rising demand for chemicals across the globe will necessitate the adoption of mixed flow pump, thereby boosting the market growth in the coming years.

According to the United Nations World Water Development Report, water scarcity is expected to increase worldwide and the rise in urban population can be observed from 930 million in 2016 to between 1.7 and 2.4 billion people in 2050. Clean freshwater is essential for a healthy human life; however, approximately 1.1 billion people across the world lack access to clean water, with approximately 2.7 billion people facing water scarcity at least once a year. As water scarcity becomes a concern, water management and conservation efforts are on the rise. Mixed flow pumps are used for efficient water distribution, irrigation, and water recycling in agricultural, municipal, and industrial applications.

End-use Insights

The agriculture segment accounted for a maximum share of 25.9% in 2023. Efficient water distribution is essential for crop growth. Mixed flow pumps offer the necessary pressure to transport water from sources such as wells, rivers, or reservoirs to fields for irrigation. The ability to ensure consistent and adequate water supply to crops is a key market driving factor. In aquaculture, these pumps are used to supply, maintain, and circulate water in fish farms to maintain the water quality and oxygenation for aquatic organisms. As these pumps are designed to maintain high discharge rates, they are used to ensure uniform water distribution across the field.

The chemical segment is expected to witness significant growth with the highest CAGR of 6.0% over the forecast period. Mixed flow pups can easily handle various types of chemicals with different pH and viscosity. They are used to transfer chemicals from one point to another inside the chemical plant. Due to their high discharge maintenance capacity, they are used in high pressure application such as chemical industry.

These pumps ensure efficient transfer of chemicals and fluid in the chemical processing plants throughout the manufacturing process. These pumps help to improve the effectiveness of the manufacturing process, as flow rates can be maintained and altered through remote monitoring and control and adjustable speed drives. Further, the mixed flow pumps used in chemical industries come with modular and customizable designs which allows them to operate as per the facility requirements. Hence the mixed flow pumps can cater unique needs of the chemical industry.

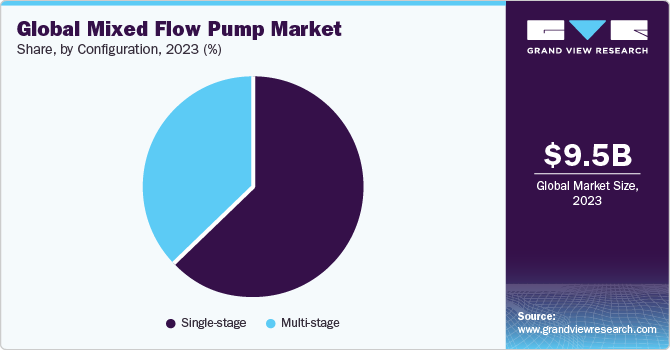

Configuration Insights

Single-stage mixed flow pumps accounted for a market share of 63.1%, in terms of revenue, in 2023. These pumps have a relatively simple design with fewer components compared to multi-stage pumps. Their cost-effectiveness and ease of maintenance make them attractive for applications where high-pressure differentials are not critical. Owing to the need for cost-effective fluid handling solutions, reliable performance, and ease of integration into existing systems, single-stage mixed flow pump’s adoption is significantly high.

Single-stage mixed flow pumps are commonly used in municipal water supply systems for distributing clean water to communities and ensuring reliable access to fresh water. These pumps play a crucial role in agricultural irrigation, to move water from water sources to fields and crops efficiently. The versatility, simplicity, and moderate pressure handling capabilities of single-stage mixed flow pumps make them suitable for a wide range of applications across different industries.

Multi-stage mixed flow pumps are likely to witness lucrative growth with a CAGR of 5.5% over the forecast period. The demand for these pumps is driven by their ability to efficiently handle high-pressure applications across a wide range of industries. As industrial processes become more demanding and energy-efficient solutions are sought, the multi-stage mixed flow pumps industry continues to grow. As these pumps have the ability to generate more pressure heads, they are used during the construction of high rise buildings to supply water and fluid at higher heights. In addition to that they are used in power generation facilities, these pumps are used to feed the water inside the boilers at high pressure and discharge rates.

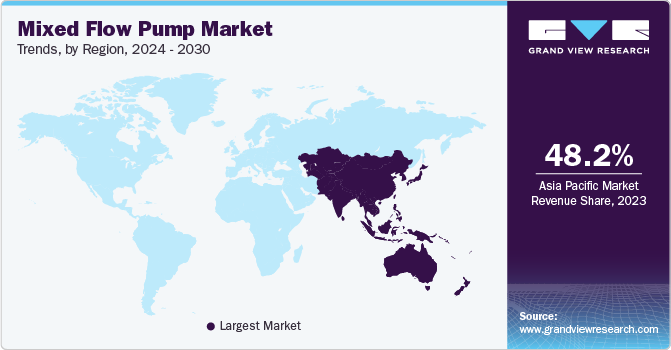

Regional Insights

Asia Pacific accounted for a 48.2% share of global revenue in 2023 and is expected to expand at the highest CAGR from 2024-2030. The economies in the region are likely to flourish over the forecast period because of the rising investments by governments in the agriculture, power generation, and construction sectors. Furthermore, the expansion of operations in the chemical & food processing industry as a result of increasing FDI is likely to propel the market growth over the forecast period.

These pumps are considered prime inputs in agriculture sector, as adequate water supply to irrigate crops is not possible without them. Agriculture & chemical, and food processing industry in Asia Pacific has been witnessing significant growth on account of rising urbanization, and per capita income. Middle East & Africa is expected to witness the second-highest CAGR of 5.5% over the forecast period due to the well-developed oil & gas and power generation industry. The region is the major hub for the production of oil & gas. Mixed flow pumps are used during the crude oil transferring, and refining process.

Moreover, Middle Eastern countries have been investing heavily in constructing facilities that can generate potable water from saline water. Mixed flow pumps are used to transfer high quantity of water in the water treatment plants. In arid regions of the Middle East and Africa, mixed flow pumps have been used to supply water for agriculture use, municipal use, and households to maintain a reliable water distribution system.

Key Companies & Market Share Insights

The industry is significantly competitive due to the presence of both international and local players in the market. Mixed flow pump manufacturers use a variety of strategies to increase market penetration and meet the dynamic technological demands of end-use industries, such as agriculture, construction & building services, water & wastewater, power generation, oil & gas, chemical, and others.

In August 2022, Grundfos Holding A/S expanded its production facility in Serbia. This expansion initiative is expected to strengthen the company’s supply chain in Denmark, France, and Serbia. This expansion is expected to add 17,000 square meters to its existing facilities in Serbia and help the company to penetrate the European market further.

Key Mixed Flow Pump Companies:

- Sulzer Ltd.

- Kubota Corporation

- Pentair plc

- Xylem Inc.

- Franklin Electric

- Grundfos Holding A/S

- Flowserve Corporation

- Ebara Corporation

- KIRLOSKAR BROTHERS LIMITED

- WARSON

Mixed Flow Pump Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.85 billion

Revenue Forecast in 2030

USD 13.15 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, trends

Segments covered

Configuration, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; France; Germany; Italy; UK; China; Japan; India; Australia; Argentina; Brazil; Saudi Arabia; UAE

Key companies profiled

Sulzer Ltd.; Kubota Corporation; Pentair plc; Xylem Inc.; Franklin Electric; GRUNDFOS; Flowserve Corporation; Ebara Corporation; KIRLOSKAR BROTHERS LIMITED; WARSON

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

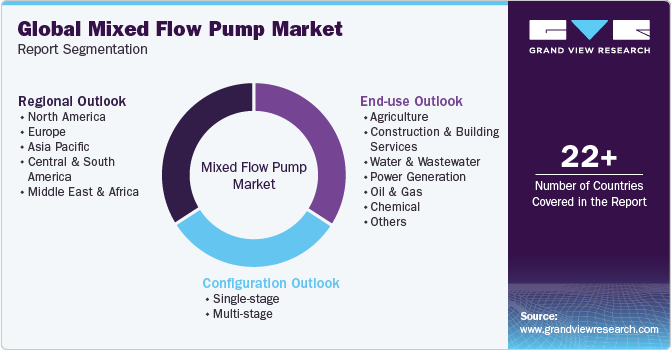

Global Mixed Flow Pump Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mixed flow pump market report based on end-use, configuration, and region:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Construction & Building Services

-

Water & Wastewater

-

Power Generation

-

Oil & Gas

-

Chemical

-

Others

-

-

Configuration Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-stage

-

Multi-stage

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global mixed flow pump market size was estimated at USD 9.48 billion in 2023 and is expected to reach USD 9.85 billion in 2024.

b. The global mixed flow pump market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030 and reach USD 13.15 billion by 2030.

b. Asia Pacific dominated the mixed flow pump market with a revenue share of 48.2% in 2023 owing to the growing demand for the growing demand for mixed flow pumps due to the tremendous growth of the end-use industries, including domestic water and wastewater and petroleum.

b. Some of the key players operating in the mixed flow pump market include Sulzer Ltd., Kubota Corporation, Pentair plc, Xylem Inc., Franklin Electric, Grundfos Holding A/S, Flowserve Corporation, Ebara Corporation, KIRLOSKAR BROTHERS LIMITED, and WARSON.

b. The key factors that are driving the mixed flow pumps market include the growth of the market can be primarily attributed to the pump's efficiency, versatility, and suitability for a wide range of applications. As agriculture, construction & building services, and chemical industries continue to grow and evolve, the demand for reliable and efficient fluid handling solutions, such as mixed flow pumps, remains strong.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.