- Home

- »

- Homecare & Decor

- »

-

Ceramic Sanitary Ware Market Size & Share Report, 2030GVR Report cover

![Ceramic Sanitary Ware Market Size, Share & Trends Report]()

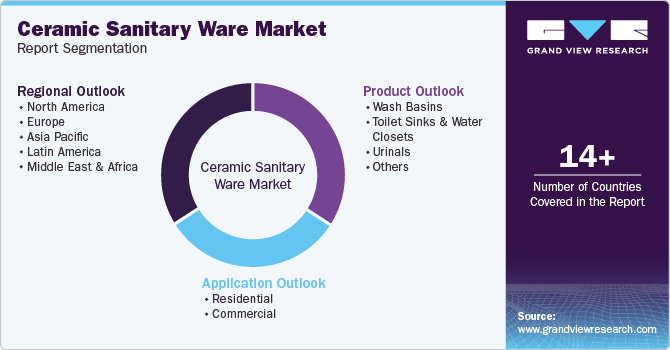

Ceramic Sanitary Ware Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Wash Basins, Toilet Sinks & Water Closets), By Application (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-3-68038-238-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ceramic Sanitary Ware Market Summary

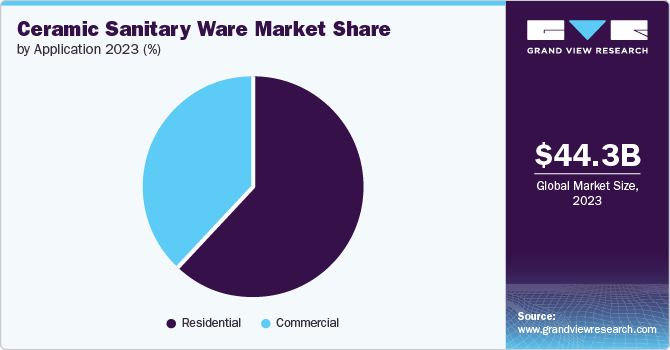

The global ceramic sanitary ware market size was estimated at USD 44.3 billion in 2023 and is projected to reach USD 80.99 billion by 2030, growing at a CAGR of 9.4% from 2024 to 2030. This growth is driven by increased urbanization and rising consumer demand for aesthetically appealing and durable bathroom fixtures.

Key Market Trends & Insights

- The Asia Pacific ceramic sanitary ware market accounted for a revenue share of 40.4% in 2023.

- North America is expected to witness the fastest CAGR of 11.0% over the forecast period.

- Based on product, the toilet sinks and water closets segment accounted for the largest market revenue share of 43.0% in 2023.

- Based on application, the residential segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 44.3 Billion

- 2030 Projected Market Size: USD 80.99 Billion

- CAGR (2024-2030): 9.4%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

The increase in population, growing housing and industrial construction infrastructure, and growing economies are driving the market.

Industry and government agencies are launching various initiatives to inform consumers about quality cleaning product requirements. For instance, In 2022, the Toilets 2.0 initiative under SBM (Swachh Bharat Mission) Urban was introduced to create a clean, safe, hygienic, and encouraging environment for people to use CT/PTs. The challenge was the need for more basic amenities, public infrastructure, and citizen awareness. Countries such as China, India, Bangladesh, and other emerging economies are promoting the use of sanitary ware products.

The increasing global infrastructure projects and the demand for high-quality, durable sanitary ware drive the worldwide market. Rapid urbanization in many developing countries has led to residential, commercial, and public buildings being constructed. This surge in construction activities directly leads to increased demand for ceramic sanitary ware products, essential components of modern bathrooms and kitchens.

Smart homes integrate advanced technologies to enhance convenience, efficiency, and comfort, extending to bathroom and kitchen fixtures. Smart ceramic sanitary ware includes intelligent toilets with automated flushing, heated seats, touchless faucets, and sensor-based urinals. These high-tech products offer enhanced user experiences, energy efficiency, and water conservation, aligning with the preferences of tech-savvy consumers and driving their demand in the market. For instance, in August 2023, SYNSOL launched its second-generation smart toilet lineup. These smart toilets have medical-grade health monitoring features, including 6-lead ECG monitoring and electrolyte detection. Regularly monitoring indicators such as potassium, sodium, and creatinine levels in urine drives the integration of health monitoring features in smart toilets. The toilets offer convenience for individuals to carry out tests in the comfort of their own homes.

Product Insights

The toilet sinks and water closets segment accounted for the largest market revenue share of 43.0% in 2023. The demand for new residential and commercial buildings has subsequently increased the need for high-quality bathroom fixtures, including ceramic toilet sinks and water closets. These products are favored for their durability, ease of maintenance, and aesthetic appeal, making them popular in modern construction projects. Additionally, with the rise of smart homes and technology, toilet sinks have also been incorporated with environmentally friendly features such as water-saving methods and energy-efficient lighting. In November 2022, Bagnodesign launched a new bathroom brassware range called Bristol. The collection is inspired by mid-20th-century design and brings classic elegance to the modern bathroom. The Bristol brassware range includes basins, bathtubs, and taps in five finishes such as soft bronze, PVD Santiago, chrome, brushed nickel, and matte black.

The urinals segment is expected to register the fastest CAGR during the forecast period. With growing environmental concerns, there is a rising demand for water-efficient sanitary ware. Modern ceramic urinals, such as low-flow and waterless models, are designed with features that reduce water usage. These innovations help conserve water and reduce operational costs, making them attractive to commercial and institutional buyers. Ceramic urinals are preferred in urban areas due to their durability, ease of maintenance, and cost-effectiveness, driving their demand in crowded cities. For instance, in March 2024, TOTO introduced a new wall-hung urinal with an integrated ECOPOWER flush valve. This urinal combines style, convenience, and environmental sustainability. The urinal features an incorporated hydroelectric flush valve that generates electricity when water spins a small internal turbine. The urinal has an ultra-high efficiency of 0.125 gallons per flush (GPF), which helps conserve water and reduce water consumption.

Application insights

The residential segment accounted for the largest market revenue share in 2023. Homeowners are increasingly prioritizing the design and functionality of their bathrooms. This shift has increased demand for innovative sanitary ware solutions that match modern home decor. With their wide range of designs, colors, and finishes, Ceramic products cater to this demand, allowing homeowners to create personalized and stylish bathroom environments. In December 2022, American Standard launched the Neo Modern collection, a functional and smart sanitary ware collection that combines convenience, smart functionality, and new design. The collection includes a selection of basins and faucets that match each other perfectly.

The commercial segment is expected to register the fastest CAGR during the forecast period. The ongoing expansion of commercial infrastructure, including office buildings, shopping malls, hotels, restaurants, and healthcare facilities, drives the demand for clean and modern ceramic products. As urbanization progresses and economies grow, the demand for commercial spaces increases, necessitating the installation of high-quality and durable sanitary ware. Ease of maintenance and ability to withstand high usage make commercial ceramic sanitary ware a practical and cost-effective choice for businesses and institutions.

Regional Insights

North America is expected to witness the fastest CAGR of 11.0% over the forecast period. The region benefits from a strong and stable construction sector driven by ongoing urbanization, population growth, and economic expansion. As cities expand and new residential, commercial, and institutional buildings are constructed or renovated, there is a consistent demand for high-quality sanitary ware products. Consumers and businesses increasingly focus on sustainability, reducing their environmental footprint and adopting eco-friendly sanitary ware solutions.

U.S. Ceramic Sanitary Ware Market Trends

The U.S. market is expected to witness significant growth over the forecast period. Consumers are increasingly interested in smart bathroom fixtures that offer convenience, energy efficiency, and enhanced hygiene. These technological advancements and the trend toward smart homes drive the ceramic sanitary ware market in the U.S. Smart toilets with features such as automated flushing, heated seats, and integrated bidet functions are gaining popularity, appealing to tech-savvy homeowners looking to upgrade their living spaces. In October 2022, American Standard launched the Spalet Collection, which includes beautifully crafted shower toilets such as the Acacia and Aerozen and electronic bidet seats with spa-like functions to deliver everyday comfort and enhanced personal hygiene. The collection also offers dual nozzles, Posterior Cleansing, Deodorizer, and antibacterial protection, including antibacterial resin on the seat, cover, nozzle, and remote control

Asia Pacific Ceramic Sanitary Ware Market Trends

Asia Pacific dominated the market and is expected to maintain its dominance throughout the forecast period. Rapid urbanization in countries such as China, India, and others has increased construction activities. As urban populations grow, there is an increasing demand for residential and commercial buildings, driving the need for high-quality sanitary ware products. Durability, affordability, and diverse consumer preferences drive the demand for the ceramic sanitary ware market.

The Chinese market is expected to witness significant growth over the forecast period. The rise of e-commerce and digital platforms has revolutionized the market by making a wide range of products accessible to a larger audience. Online shopping provides convenience and various choices, enabling consumers to compare products and prices easily. Manufacturers and retailers in China leverage digital marketing strategies to reach tech-savvy customers, further increasing sales. This digital transformation, combined with growing investments in research and development for innovative products, continues to drive the ceramic sanitary ware market in China.

The Indian market is expected to witness significant growth over the forecast period. Government initiatives in India have been driving the demand for ceramic sanitary ware, particularly in promoting hygiene and sanitation nationwide. Government initiatives such as 'Swachh Bharat Abhiyan' (Clean India Mission) and the National Urban Sanitation Policy promote hygiene and sanitation across the country. These initiatives have created awareness among consumers about the importance of using quality sanitary products, including ceramic sanitary ware, which are durable, easy to maintain, and hygienic.

Europe Ceramic Sanitary Ware Market Trends

Europe is expected to witness significant growth over the forecast period. The rising population, urbanization, and the need for residential and commercial buildings equipped with bathroom fixtures drive the demand for ceramic sanitary ware. Demand for ceramic sanitary ware and tiles has increased significantly in the European Union (EU). In 2021, these products accounted for more than 40% of total EU consumption.

France is expected to witness significant growth over the forecast period. The construction industry and infrastructure development projects contribute to France's demand for ceramic sanitary ware. Installing bathrooms and sanitary facilities is required in new buildings and renovation projects, driving the demand for products such as toilets, sinks, and showers. Moreover, rising tourism leads to the construction of new hotels and restaurants, driving the demand for ceramic sanitary ware.

Key Ceramic Sanitary Ware Company Insights

Key participating companies include TOTO Ltd.; Kohler Co.; Roca Sanitario, S.A.; Geberit AG; Villeroy & Boch; American Standard; Duravit AG; LIXIL Group Corporation; Hindware; Hansgrohe; Mergers and acquisitions and innovation are expected to continue to be important success factors over the next few years.

-

TOTO Ltd is a Japanese company known for its high-quality bath products and hygiene products, including advanced toilets, bidets and baths. Toto Ltd has greatly improved bathroom technology by developing new baths and accessories, contributing to hygiene standards varieties have improved.

-

The Kohler Company has made significant contributions to design and engineering for homes and commercial spaces, receiving numerous awards for its sustainable practices and innovation. The company offers a wide range of fixtures, faucets, cabinetry and tiles and is recognized for its innovative design and quality craftsmanship.

Key Ceramic Sanitary Ware Companies:

The following are the leading companies in the ceramic sanitary ware market. These companies collectively hold the largest market share and dictate industry trends.

- TOTO Ltd.

- Kohler Co.

- Roca Sanitario, S.A.

- Geberit AG

- Villeroy & Boch

- American Standard

- Duravit AG

- LIXIL Group Corporation

- Hindware

- Hansgrohe

Recent Developments

-

In April 2024, Roca Group, a leading producer of bathroom furnishings, acquired Nosag and IneoCare, which is dedicated to producing and commercializing bathroom and toilet assist devices. Both companies are involved in the production of bathroom and toilet assist devices.

-

In December 2022, Kohler launched a new smart toilet with speakers, mood lighting, and Alexa support. It is designed to enhance the bathroom experience with innovative functionalities. The built-in Alexa support allows users to control the smart lights, among other features.

-

In December 2023, Utopia Bathrooms launched a new space-saving collection called Corr. The Corr collection includes basins and water closets designed to save space in the bathroom. The collection features the Corr water closets, available in back-to-wall, close-coupled, or wall-hung options, and incorporates a rimless design that optimizes water usage and flushing efficiency.

Ceramic Sanitary Ware Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 47.27 billion

Revenue forecast in 2030

USD 80.99 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Historical data

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; South Africa

Key companies profiled

TOTO Ltd.; Kohler Co.; Roca Sanitario, S.A.; Geberit AG; Villeroy & Boch; American Standard; Duravit AG; LIXIL Group Corporation; Hindware; Hansgrohe

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Ceramic Sanitary Ware Market Report Segmentation

This report forecasts revenue growth on a global, regional and country level and analyzes the latest trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global ceramic sanitary ware market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wash Basins

-

Toilet Sinks & Water Closets

-

Urinals

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.