- Home

- »

- Electronic & Electrical

- »

-

China Commercial Vacuum Cleaner Market Size Report, 2030GVR Report cover

![China Commercial Vacuum Cleaner Market Size, Share & Trends Report]()

China Commercial Vacuum Cleaner Market (2025 - 2030) Size, Share & Trends Analysis Report By Power Source (Corded, Cordless), By Product (Upright, Canister, Robotic, Wet & Dry, Drum, Central, Backpack), By End-user, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-586-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

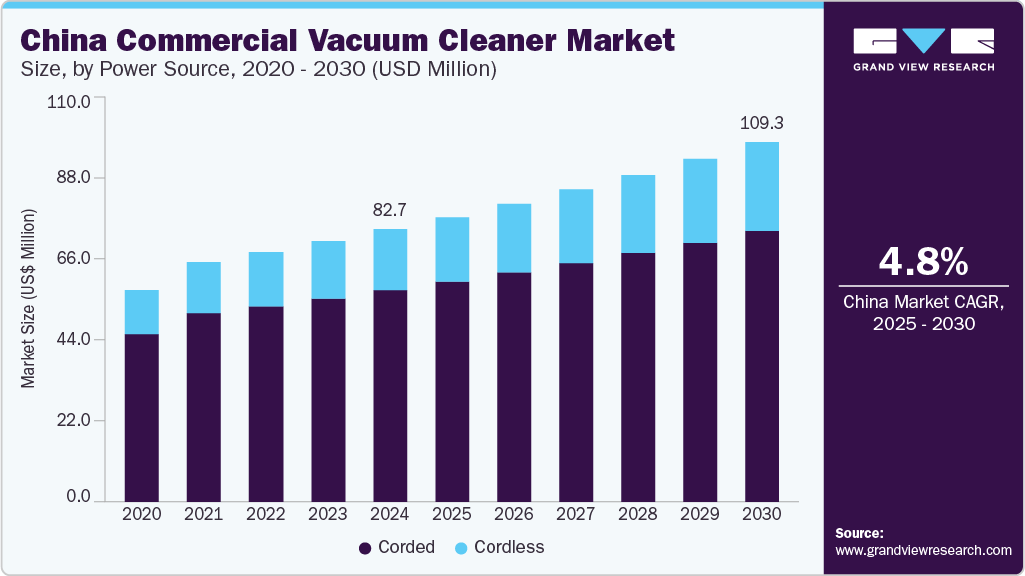

The China commercial vacuum cleaner market size was estimated at USD 82.7 million in 2024 and is projected to grow at a CAGR of 4.8% from 2025 to 2030. The growth is attributable to rapid urbanization and economic development in China that has led to increased construction of commercial spaces such as offices, hospitals, shopping malls, and entertainment venues, all of which require efficient cleaning solutions to maintain hygiene standards. This urban growth drives demand for commercial vacuum cleaners that are both effective and technologically advanced, catering to the needs of large-scale cleaning operations.

Another key driver is the rising awareness and regulatory emphasis on cleanliness and sanitation in commercial environments. Industries such as healthcare, hospitality, and retail are under growing pressure to comply with stringent hygiene regulations, boosting demand for vacuum cleaners equipped with features such as HEPA filtration and multi-surface cleaning capabilities. For instance, entertainment and leisure facilities in China prefer backpack-style wet and dry vacuum cleaners for their portability and efficiency, which helps staff maintain cleanliness in large spaces like cinema halls.

The competitive landscape in China also fuels market growth. Strong competition between international brands such as Dyson and domestic manufacturers such as Haier and Midea encourages continuous innovation and product diversification. This competition leads to the availability of a wide range of vacuum cleaner models tailored to Chinese commercial consumers’ preferences, including energy-efficient and technologically advanced products. Additionally, the rise of e-commerce platforms in China facilitates easier access to these products, further expanding market reach and sales.

Furthermore, China's position as a major global manufacturing hub for vacuum cleaners supports market expansion. This robust production and export capacity ensures a steady supply of commercial vacuum cleaners domestically and abroad, sustaining market growth and innovation.

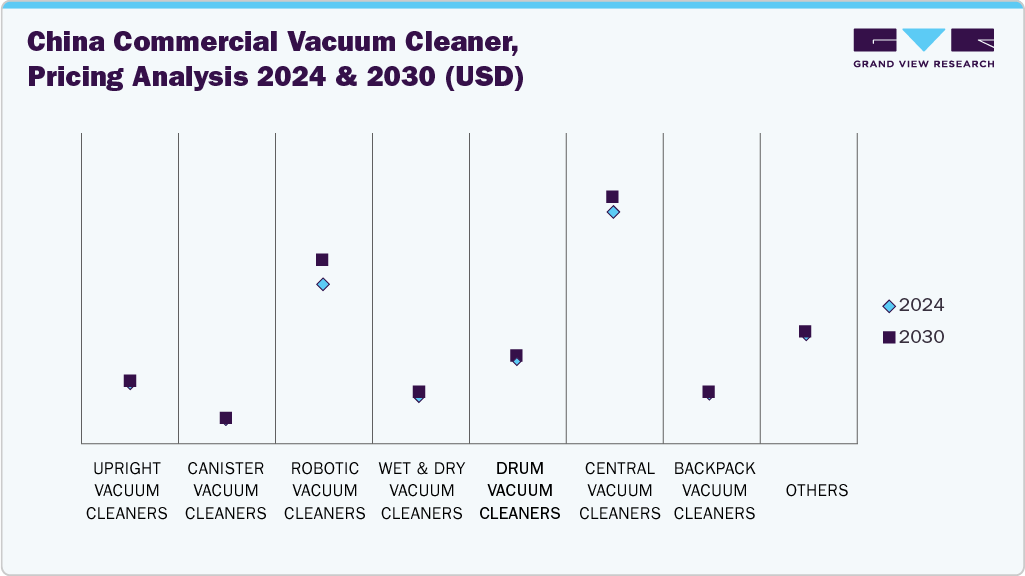

Pricing Analysis:

China commercial vacuum cleaner industry displays a wide pricing spectrum, driven by domestic manufacturing capabilities and diverse end-user needs. Locally produced upright, drum, and wet & dry models dominate the mid- to low-price segments, making them affordable for small businesses and institutions. Central and robotic vacuum cleaners are priced higher due to their advanced features and are increasingly adopted in large facilities and smart commercial settings. Foreign brands and imported high-tech models tend to occupy the premium range. Price sensitivity remains high, especially among small enterprises, but demand for cost-effective, feature-rich products continues to shape the market landscape.

Power Source Insights

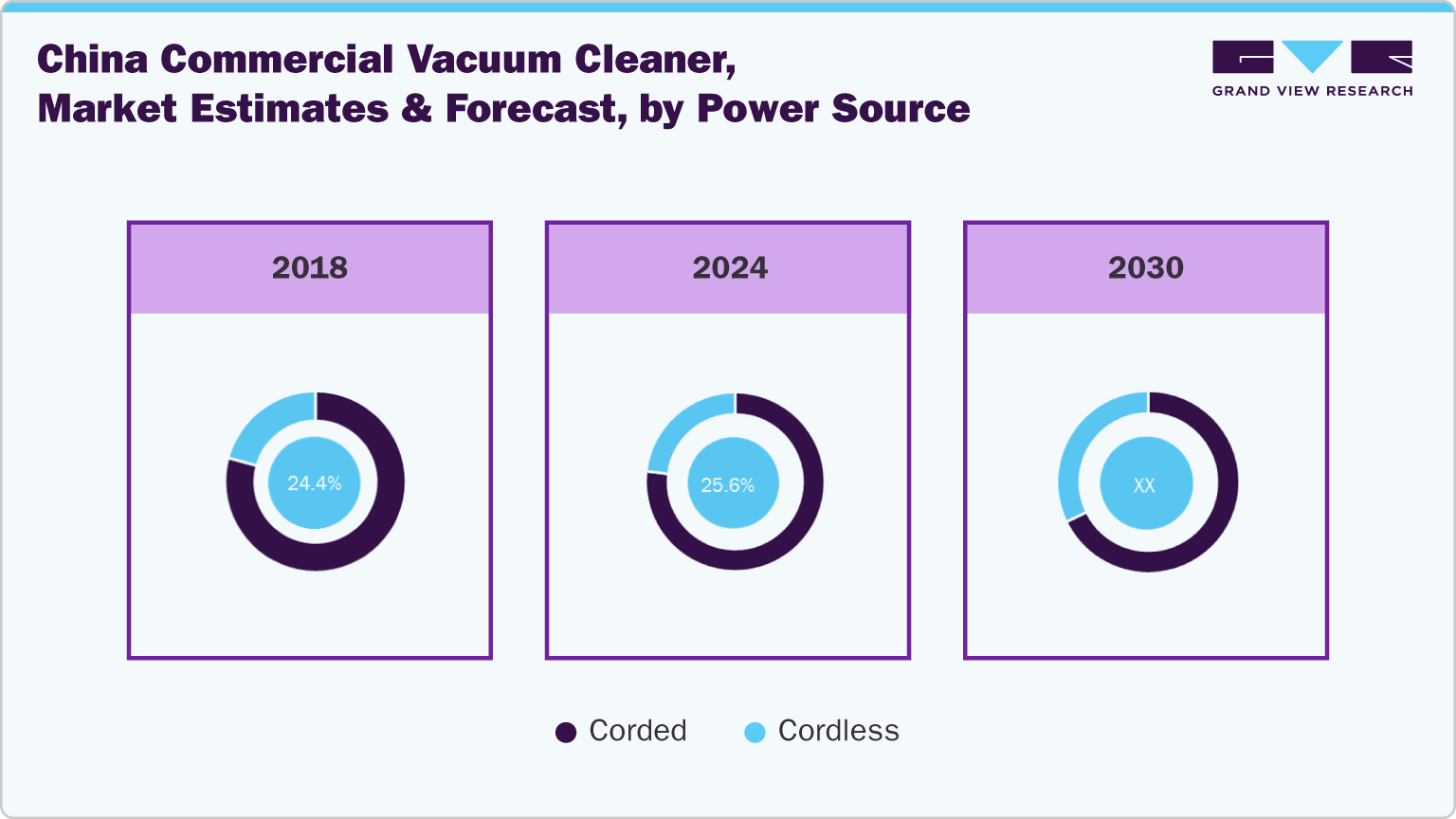

The corded commercial vacuum cleaner market accounted for a share of 77.6% of the China revenue in 2024, due to its reliability and suitability for large-scale, continuous cleaning tasks in commercial settings such as hotels, hospitals, schools, and airports. Corded vacuums provide an uninterrupted power supply, eliminating downtime associated with battery recharging, which is crucial for cleaning crews working under tight schedules. In addition, the extensive use of corded backpack vacuums, which combine mobility with powerful suction and ergonomic design, supports prolonged cleaning sessions efficiently without causing user fatigue. Technological advancements, including HEPA filtration and noise reduction, further enhance their appeal by ensuring high indoor air quality and user comfort. The rapid urbanization and rising disposable incomes in China have increased demand for effective and durable cleaning solutions in commercial spaces, reinforcing the preference for corded models over cordless ones despite the latter’s growing popularity.

The cordless commercial vacuum cleaner market is projected to grow at a CAGR of 6.6% from 2025 to 2030, due to advancements in lithium-ion battery technology that have significantly improved battery life, suction power, and charging speed, narrowing the performance gap with corded models. This growth is driven by an increased focus on workplace safety, as cordless vacuums eliminate tripping hazards from power cords, making them ideal for high-traffic commercial environments like hospitals, schools, and shopping centers. In addition, the convenience and portability of cordless models enable faster and more flexible cleaning, which reduces labor costs and enhances operational efficiency. Rising urbanization, higher disposable incomes, and growing demand for multi-surface and smart cleaning solutions also contribute to market expansion. For example, healthcare facilities prefer cordless vacuums to maintain hygiene without the risk of cord-related accidents, while benefiting from improved filtration and noise reduction technologies. These factors collectively make cordless commercial vacuums a practical and increasingly popular choice in professional cleaning.

Product Insights

The upright commercial vacuum cleaners market accounted for a share of 30.4% of the China revenue in 2024, due to their strong suction power, ease of use, and efficiency in cleaning large carpeted and commercial spaces such as hotels, offices, and retail outlets. Upright models are favored for their ability to handle high-traffic areas with durability and ergonomic design, which reduces operator fatigue during prolonged use. Technological advancements, including lightweight construction, enhanced maneuverability, and HEPA filtration systems, have made these vacuums more energy-efficient and effective in improving indoor air quality-an important factor in sectors like healthcare and hospitality. In addition, the introduction of wet and dry upright vacuum cleaners, often marketed as “floor washers,” has driven rapid growth by combining vacuuming and mopping functions, appealing to Chinese consumers seeking convenience and hygiene. For example, hotels prefer upright wet and dry vacuums for thorough cleaning and sanitization, supporting their popularity in the commercial sector.

The robotic commercialvacuum cleaners market is projected to grow at a CAGR of 12.7% from 2025 to 2030, due to rapid advancements in AI-powered navigation, sensor technology, and IoT integration, which enable efficient, autonomous cleaning with minimal human intervention. These robots improve operational efficiency in commercial spaces like malls, offices, and airports by performing cleaning tasks continuously and precisely, reducing labor costs and downtime. The growing demand for smart, time-saving cleaning solutions in China’s expanding urban and commercial sectors, coupled with rising disposable incomes and increasing adoption of smart technologies, further drives market growth. In addition, the development of versatile wet & dry robotic vacuums enhances their appeal by offering multi-surface cleaning capabilities. For example, airports increasingly deploy robotic vacuums to maintain large floor areas efficiently while minimizing disruption to passengers. These technological innovations and convenience factors make robotic commercial vacuum cleaners a preferred choice, fueling their strong market expansion.

End-user Insights

The commercial vacuum cleaners in cleaning service providers accounted for a share of 30.8% of the China revenue in 2024, due to the sector’s growing reliance on professional cleaning companies to maintain hygiene in large commercial and public spaces. Rapid urbanization and infrastructure development have expanded the demand for contract cleaning services, which require versatile, durable, and high-performance vacuum cleaners to efficiently clean diverse environments such as offices, hospitals, retail stores, and entertainment venues. Cleaning service providers prefer models like backpack and upright vacuums with HEPA filters and multi-surface compatibility, enabling them to meet strict sanitation standards and improve indoor air quality.

The commercial vacuum cleaners in offices and commercial buildings is projected to grow at a CAGR of 6.1% from 2025 to 2030, due to increasing emphasis on maintaining high hygiene and cleanliness standards in workplaces. Rapid urbanization and rising disposable incomes in China and other regions are driving demand for advanced, efficient vacuum cleaners that can handle large areas with diverse flooring types. Moreover, stricter sanitation regulations and growing awareness about indoor air quality push businesses to invest in vacuum cleaners equipped with HEPA filters and multi-surface cleaning capabilities. The expansion of outsourcing cleaning services encourages the adoption of specialized, durable vacuum cleaners that improve operational efficiency and reduce labor costs. For instance, office complexes increasingly use backpack and upright vacuums with ergonomic designs to ensure thorough cleaning while minimizing staff fatigue. In addition, the rise of e-commerce platforms facilitates easy access to a wide range of commercial vacuum models, supporting market growth. These factors collectively fuel steady demand and technological innovation in the commercial cleaning sector.

Distribution Channel Insights

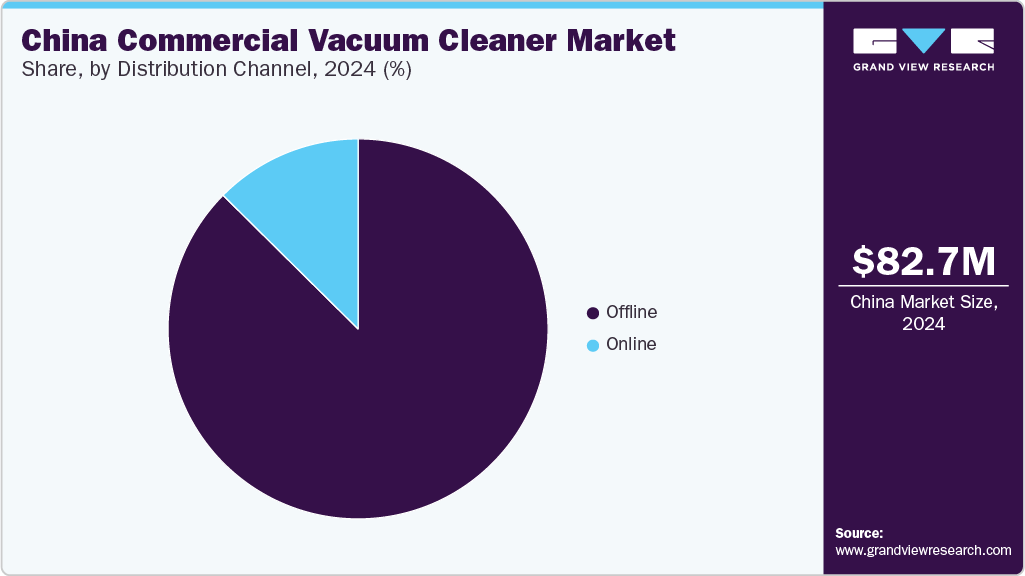

The sales of commercial vacuum cleaner through offline channels accounted for a share of 87.8% of the China revenue in 2024, primarily as many commercial buyers prefer the hands-on experience and personalized service that physical stores, distributors, and specialist suppliers offer. In sectors like hospitality, healthcare, and facilities management, buyers often need to physically inspect machines, test their functionality, and assess build quality before purchasing high-investment equipment. Offline channels also provide strong after-sales support, including product training, on-site demonstrations, installation assistance, and long-term service contracts, which are crucial for businesses seeking reliability and minimal downtime. For instance, hospitals and hotels rely on offline retailers for immediate support and servicing to maintain continuous operations. Although online sales are growing due to convenience and broader product access, the trust and comprehensive service provided by offline channels remain key drivers of their dominant market share in China’s commercial vacuum cleaner market.

Commercial vacuum cleaner sales through online channels are projected to grow at a CAGR of 6.7% from 2025 to 2030, mainly due to evolving buyer behavior favoring digital procurement for its convenience, wider product variety, and faster price and feature comparisons. Facilities managers, cleaning service providers, and business owners increasingly use online platforms to save time and reduce the need for physical visits to suppliers or showrooms. The rise of e-commerce infrastructure in China supports quick delivery and reliable after-sales services, making online purchases more attractive. In addition, many brands offer innovative commercial vacuum models with advanced features like HEPA filtration, long battery life, and smart controls through online channels, expanding customer choice.

Key China Commercial Vacuum Cleaner Company Insights

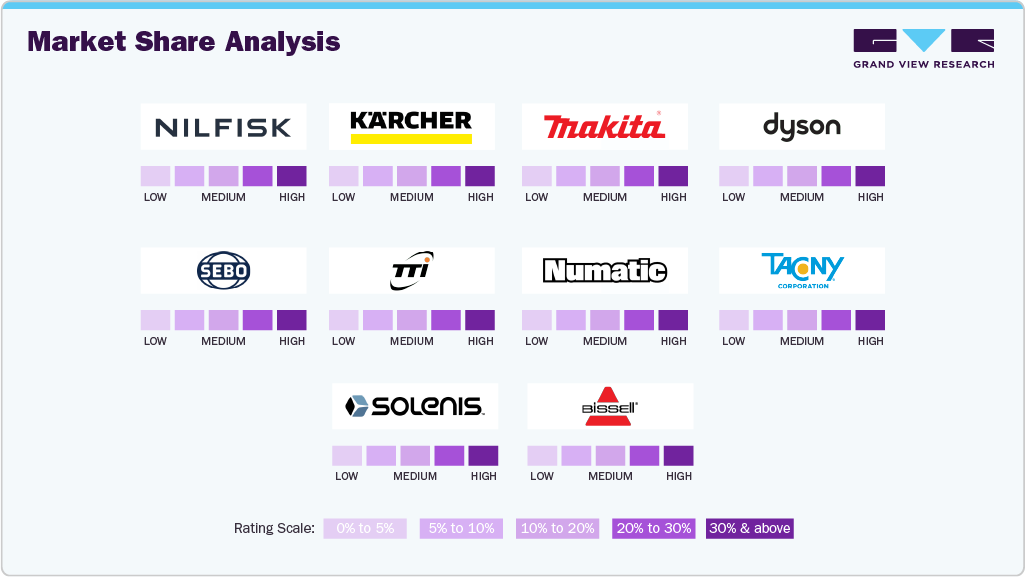

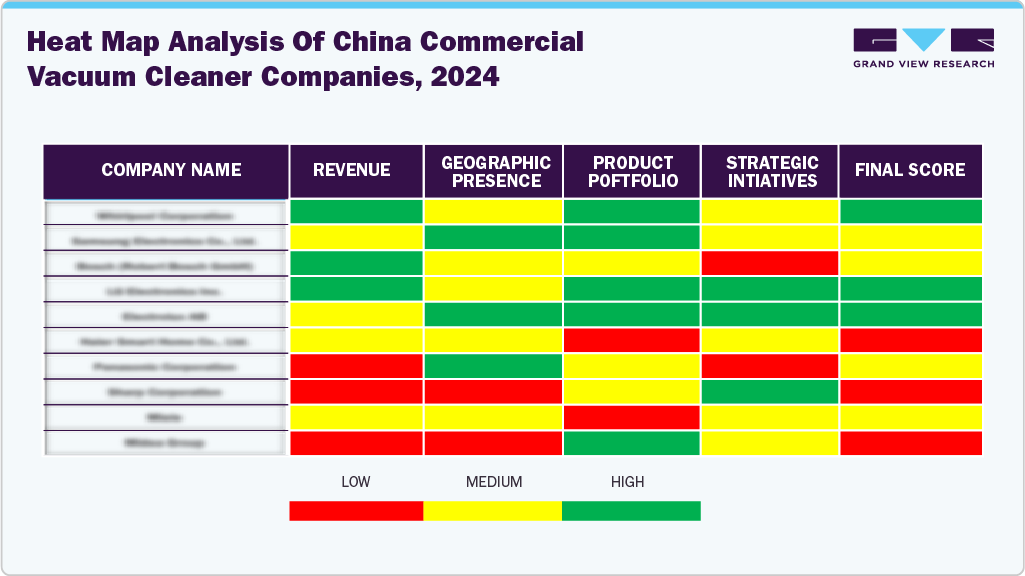

In the China commercial vacuum cleaner market, key companies utilize a range of strategies to strengthen their market positions, including continuous innovation in product design, improved energy efficiency, and enhanced filtration technologies to meet evolving industry standards. These companies also focus on expanding their distribution networks and establishing localized manufacturing or service centers to improve customer responsiveness. In addition, they invest in digital solutions, such as smart and automated cleaning systems, aligning with the growing demand for intelligent cleaning technologies in commercial sectors across China’s rapidly urbanizing landscape.

Key China Commercial Vacuum Cleaner Companies:

- Nilfisk Group

- Alfred Kärcher SE & Co. KG

- Makita Corporation

- Dyson Limited

- Hako Group

- Techtronic Industries Co. Ltd.

- Numatic International Ltd.

- Tacony Corporation

- BISSEL Group

- ProTeam, Inc.

- SEBO America, LLC

- Pacvac Pty. Ltd.

- SPRiNTUS GmbH

China Commercial Vacuum Cleaner Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 86.5 million

Revenue forecast in 2030

USD 109.3 million

Growth rate

CAGR of 4.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in thousand units, revenue in USD million CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Power source, product, end-user, distribution channel

Country scope

China

Key companies profiled

Nilfisk Group; Alfred Kärcher SE & Co. KG; Makita Corporation; Dyson Limited; Hako Group; Techtronic Industries Co. Ltd.; Numatic International Ltd.; Tacony Corporation; BISSEL Group; ProTeam, Inc.; SEBO America, LLC; Pacvac Pty. Ltd.; SPRiNTUS GmbH

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

China Commercial Vacuum Cleaner Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China commercial vacuum cleaner market report based on power source, product, end-user, and distribution channel:

-

Power Source Outlook (Revenue, USD Million; Volume, Thousand Units)

-

Corded

-

Cordless

-

-

Product Outlook (Revenue, USD Million; Volume, Thousand Units)

-

Upright Vacuum Cleaners

-

Canister Vacuum Cleaners

-

Robotic Vacuum Cleaners

-

Wet & Dry Vacuum Cleaners

-

Drum Vacuum Cleaners

-

Central Vacuum Cleaners

-

Backpack Vacuum Cleaners

-

Others

-

-

End-user Outlook (Revenue, USD Million; Volume, Thousand Units)

-

Healthcare Facilities

-

Hospitality and Lodging

-

Retail Stores

-

Shopping Malls

-

Educational Institutions

-

Offices and Commercial Buildings

-

Cleaning Service Providers

-

Car Detailing Services

-

Entertainment and Leisure Facilities

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Thousand Units)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The China commercial vacuum cleaner market size was estimated at USD 82.7 million in 2024 and is expected to reach USD 86.5 million in 2025.

b. The China commercial vacuum cleaner market is expected to grow at a compounded growth rate of 4.8% from 2025 to 2030 to reach USD 109.3 million by 2030.

b. The corded commercial vacuum cleaner market accounted for a share of 77.6% of the China revenue in 2024, due to its reliability and suitability for large-scale, continuous cleaning tasks in commercial settings such as hotels, hospitals, schools, and airports.

b. Some key players operating in the China commercial vacuum cleaner market include Nilfisk Group; Alfred Kärcher SE & Co. KG; Makita Corporation; Dyson Limited; Hako Group; Techtronic Industries Co. Ltd.; Numatic International Ltd.; and others

b. Key factors that are driving the market growth include rapid urbanization and economic development in China, which has led to increased construction of commercial spaces such as offices, hospitals, shopping malls, and entertainment venues, all of which require efficient cleaning solutions to maintain hygiene standards.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.