- Home

- »

- Advanced Materials

- »

-

Circular Economy In Mining Market, Industry Report, 2033GVR Report cover

![Circular Economy In Mining Market Size, Share & Trends Report]()

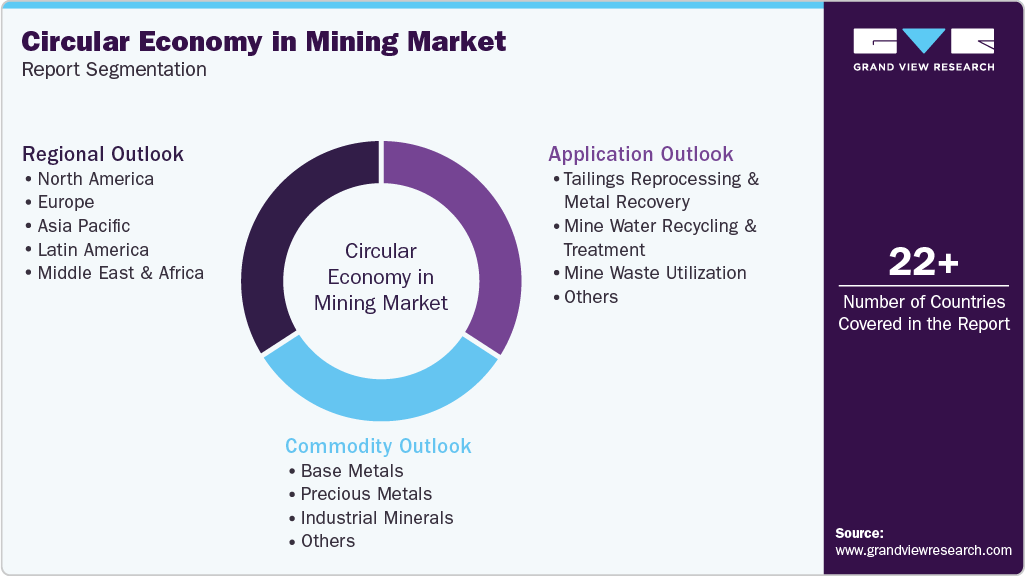

Circular Economy In Mining Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Tailings Reprocessing & Metal Recovery, Mine Water Recycling & Treatment), By Commodity (Base Metals, Precious Metals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-787-9

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Circular Economy In Mining Market Summary

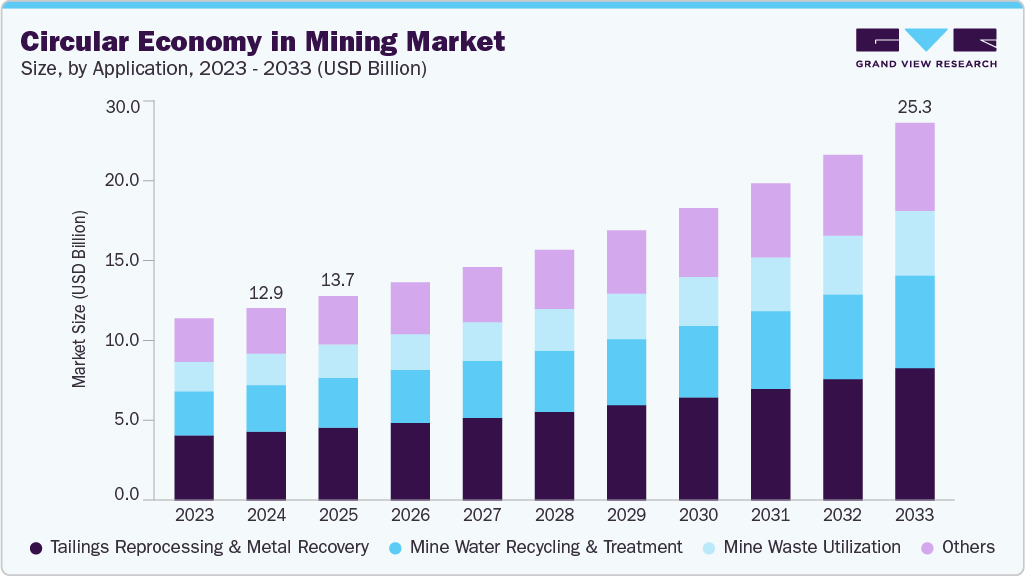

The global circular economy in mining market size was estimated at USD 12.90 billion in 2024 and is projected to reach USD 25.30 billion by 2033, growing at a CAGR of 8.0% from 2025 to 2033. The growth is driven by rising demand for critical minerals such as metals, cobalt, and others, alongside the increasing adoption of sustainable, low-emission extraction technologies.

Key Market Trends & Insights

- Asia Pacific dominated the circular economy in mining market with a revenue share of 37.9% in 2024.

- By application, tailings reprocessing & metal recovery dominated the market with a revenue share of over 35.0% in 2024.

- By commodity, the base metals segment held the largest share, over 46.0% of the circular economy in mining industry.

Market Size & Forecast

- 2024 Market Size: USD 12.90 Billion

- 2033 Projected Market Size: USD 25.30 Billion

- CAGR (2025-2033): 8.0%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Enhanced waste recycling, resource efficiency, and government initiatives aimed at strengthening mineral security and reducing import dependency are further fueling the adoption of circular economy practices in mining. Sustainability is central to market expansion, with companies and governments emphasizing energy-efficient operations, ethical sourcing, and traceable supply chains to minimize environmental impact. Integrating recycled and secondary materials through circular economy initiatives reduces reliance on virgin ores, promotes resource efficiency, and aligns mining operations with Environmental, Social, and Governance (ESG) standards. These practices position electrochemical processing as a key enabler of sustainable metal production while supporting global environmental targets.

Technological innovations enhance process efficiency, reduce operational costs, and enable recovery from complex ores and mining waste. Supportive government policies and strategic initiatives to secure critical minerals are accelerating adoption across major regions, including Asia Pacific, North America, and Latin America. As global energy transitions increase the demand for metals and critical minerals, circular economy solutions, particularly electrochemical processing, are emerging as environmentally responsible, commercially viable, and strategically essential for the modern mining industry.

Drivers, Opportunities & Restraints

The industry is propelled by escalating demand for critical minerals essential for clean energy, electric vehicles (EVs), and advanced electronics. Governments worldwide invest in domestic processing capabilities to reduce reliance on foreign suppliers and enhance supply chain resilience. For instance, the U.S. Department of Defense allocated USD 20 million to establish a cobalt refinery in Ontario, Canada, to secure a stable supply chain for cobalt, a crucial material for EV batteries, electronics, and military hardware.

The global push toward a circular economy and government policies encouraging e-waste recycling and sustainable practices present significant opportunities in the mining sector. Many countries offer incentives, subsidies, and regulatory frameworks to promote responsible recycling, creating business potential for companies specializing in material recovery. Additionally, the growing adoption of electric vehicles, renewable energy technologies, and high-tech electronics increases the demand for critical metals, providing urban mining companies with new avenues to expand their operations and develop innovative recovery solutions.

Despite the promising prospects, the industry faces several challenges. High capital and operational costs associated with recycling facilities and adopting new technologies can deter investment. Moreover, environmental regulations and ESG compliance pressures can increase operational complexities and costs. Volatility in commodity prices further exacerbates the financial risks for companies transitioning to circular economy models.

Application Insights

Tailings reprocessing & metal recovery dominated the market with a revenue share of over 35.0% in 2024 due to their large-scale efficiency in recovering valuable metals and reusing process water. Mine waste utilization is gaining traction, supported by converting overburden, slag, and waste rock into construction aggregates and backfill materials. These processes enhance resource efficiency, reduce waste generation, and minimize environmental footprint, forming the foundation of sustainable and low-impact mining operations.

The market is witnessing consistent growth driven by rising demand for critical minerals essential for renewable energy, electric mobility, and industrial manufacturing. Circular mining practices are increasingly prioritized for their ability to optimize material recovery, ensure long-term resource security, and reduce dependency on virgin ores. Advancements in reprocessing technologies, water recycling systems, and waste-to-value innovations improve operational efficiency and environmental compliance, positioning circular economy models as a strategic pathway toward sustainable and resilient mining operations.

Commodity Insights

In 2024, the base metals segment held the largest share, over 46.0% of the circular economy in mining industry. The industry is driven by strong demand for base metals, which remain the largest contributor due to their widespread use in industrial, construction, and infrastructure applications. Circular practices such as tailings reprocessing and mine waste utilization enable efficient copper, nickel, and zinc recovery from low-grade ores and secondary sources. Advancements in material recovery, waste reprocessing, and energy-efficient refining technologies are improving yield, reducing environmental footprint, and ensuring a consistent supply for downstream industries.

Precious metals represent another key segment witnessing steady expansion, supported by growing demand from jewelry, electronics, and automotive catalyst applications. Circular mining processes, including reprocessing mine tailings and e-waste recycling, are increasingly utilized to recover gold, silver, and platinum with minimal environmental impact. Innovations in extraction and purification technologies enhance recovery from complex waste streams, reflecting the industry’s focus on sustainability and resource optimization.

Due to their reuse in construction materials, fertilizers, and chemical manufacturing, industrial minerals such as limestone, silica, and phosphates are also gaining importance within circular mining frameworks. The “others” segment, encompassing critical and emerging minerals such as lithium, cobalt, and rare earth elements, is expected to experience rapid growth driven by the global shift toward clean energy, electric vehicles, and advanced manufacturing. Circular recovery solutions, including secondary sourcing and closed-loop recycling, are helping secure the supply of these high-value materials while aligning with environmental and energy transition goals.

Regional Insights

The circular economy in mining market in North America is experiencing significant growth, driven by the increasing demand for critical minerals essential for defense, clean energy, and high-tech industries. Governments invest in domestic processing capabilities to reduce reliance on foreign suppliers and enhance supply chain resilience. For instance, the U.S. Department of Defense has allocated USD 20 million to establish a cobalt refinery in Ontario, Canada, to secure a stable supply chain for cobalt, a crucial material for electric vehicle batteries, electronics, and military hardware.

U.S. Circular Economy in Mining Market Trends

In the United States, states like Oklahoma are positioning themselves as critical mineral processing hubs. The state hosts facilities for lithium refining, battery recycling, rare earth magnet production, and electronic waste recycling. These initiatives are part of a broader strategy to support battery and EV supply chains and reduce dependence on foreign sources. Additionally, BHP is considering reopening defunct copper mines in Arizona in response to major policy shifts under U.S. President Donald Trump. The company's CEO highlighted a "breathtaking" turnaround in the U.S. approach to critical mineral supply, citing enhanced support for mining, faster permitting, and trade protection measures as key motivators.

Asia Pacific Circular Economy in Mining Market Trends

Asia Pacific dominated the circular economy in mining market with a revenue share of 37.9% in 2024. The circular economy in mining market in Asia Pacific is fueled by rapid industrialization, increasing energy transition demands, and strong government support for strategic mineral reserves. Nations including China, India, and South Korea actively invest in electrochemical processing infrastructure to secure domestic supplies of lithium, cobalt, and rare earth elements.

These measures strengthen supply chain security and promote sustainable extraction and processing practices in line with growing regional and global environmental standards. However, Japan, Spain, and South Korea have expressed concerns over unsustainable copper processing fees, warning that current market conditions are making operations unsustainable.

Europe Circular Economy in Mining Market Trends

The circular economy in mining market in Europe is accelerating the development of electrochemical processing capabilities to support its green energy transition and reduce dependence on external sources for critical minerals. The European Union has launched 47 strategic projects across 13 countries focused on extracting, processing, and recycling essential metals like aluminium, lithium, and rare earth elements. These initiatives aim to enhance regional resource self-sufficiency, foster sustainable practices, and strengthen the competitiveness of Europe’s clean energy, defense, and high-tech industries. A recent report indicates that improved materials management, including reduction, reuse, and recovery measures, could help the EU industry reduce between 189 and 231 million tonnes of CO₂ equivalent per year.

Key Circular Economy In Mining Company Insights

Key players operating in the circular economy in mining market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Anglo American plc, Boliden Group, DRDGOLD Limited, and Others.

-

Anglo American plc, established in 1917 and headquartered in London, United Kingdom, is a leading diversified mining company integrating circular economy practices. Through its FutureSmart Mining initiative, the company emphasizes water recycling, tailings reprocessing, and renewable energy use to minimize waste and carbon emissions. Anglo American focuses on developing sustainable mining technologies, promoting material reuse, and achieving long-term resource efficiency across its global sites.

-

Boliden Group, founded in 1931 and headquartered in Stockholm, Sweden, is a significant mining and smelting company recognized for its strong commitment to circular economy principles. The company operates some of Europe’s most extensive metal recycling facilities, reprocessing copper, zinc, and precious metals from electronic waste and industrial by-products. Boliden’s strategy centers on reducing environmental impact through waste valorization, energy recovery, and closed-loop material cycles.

-

DRDGOLD Limited, established in 1895 and headquartered in Johannesburg, South Africa, is a pioneer in circular mining focused on re-mining and reprocessing historical gold tailings. The company transforms waste materials into usable resources through advanced recovery techniques that reduce environmental liabilities and restore mined land. DRDGOLD’s operations contribute to sustainable urban mining and resource circularity while generating economic value from legacy waste.

Key Circular Economy In Mining Companies:

The following are the leading companies in the circular economy in mining market. These companies collectively hold the largest market share and dictate industry trends.

- Anglo American plc

- Antofagasta plc

- BHP Group Plc

- Boliden Group

- DRDGOLD Limited

- Newmont Corporation

- Rio Tinto

- Sibanye-Stillwater

- Teck Resources Limited

- Umicore NV

Recent Developments

-

Boliden Group, in July 2025, received approval from Sweden’s Land and Environment Court for a new remediation method at its Maurliden site. Instead of depositing tailings in a storage facility, it will use paste made from tailings, binding agents, and water to backfill open pits and underground mines. This extends the life of the Boliden Area by around 10 years, reduces land use, enhances tailings recycling, and improves environmental performance.

-

In mid-2025, Boliden Group commissioned NCC to build a sand recycling plant in Skellefteå, Sweden. The plant will include a sand recycling building, silo, media bridge, and required technical installations. Construction will start in Q3 2025 and be completed in 2026. This initiative supports the circular reuse of by-products and reduces dependence on virgin raw materials.

-

In 2025, Sibanye-Stillwater and DRDGOLD entered a strategic partnership in which Sibanye-Stillwater will vend selected surface gold processing assets and tailings storage facilities to DRDGOLD in exchange for a 38% stake. The collaboration includes the West Rand Tailings Retreatment Project (WRTRP), which is focused on reprocessing historical waste to recover gold, minimize environmental impact, and promote circular resource use.

Circular Economy In Mining Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.69 billion

Revenue forecast in 2033

USD 25.30 billion

Growth rate

CAGR of 8.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, commodity, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK.; Italy; China; India; Japan; South Korea; Brazil; South Africa

Key companies profiled

Anglo American plc; Boliden Group; DRDGOLD Limited; BHP Group Plc; Antofagasta plc; Rio Tinto; Sibanye-Stillwater; Teck Resources Limited; Umicore NV; Newmont Corporation

Market definition

Circular Economy in Mining refers to the market for technologies, services, and processes that recover, recycle, and reuse materials from mining operations. Revenue represents the value generated from these circular economy activities rather than conventional mining sales.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Circular Economy In Mining Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global circular economy in the mining market report on basis of application, commodity, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Tailings Reprocessing & Metal Recovery

-

Mine Water Recycling & Treatment

-

Mine Waste Utilization

-

Others

-

-

Commodity Outlook (Revenue, USD Million, 2021 - 2033)

-

Base Metals

-

Precious Metals

-

Industrial Minerals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global circular economy in mining market size was estimated at USD 12.90 billion in 2024 and is expected to reach USD 13.69 billion in 2025.

b. The global circular economy in mining market is expected to grow at a compound annual growth rate of 8.0% from 2025 to 2033, reaching USD 25.30 billion by 2033.

b. By application, tailings reprocessing & metal recovery dominated the market with a revenue share of over 35.0% in 2024.

b. Some of the key vendors in the global circular economy mining market are Anglo American plc, Boliden Group, DRDGOLD Limited, BHP Group Plc, Antofagasta plc, Rio Tinto, Sibanye-Stillwater, Teck Resources Limited, Umicore NV, and Newmont Corporation.

b. The global circular economy in mining market is driven by rising demand for critical minerals, stricter environmental regulations and ESG pressures, and technological advancements in resource recovery that enable efficient recycling and waste reduction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.