- Home

- »

- Next Generation Technologies

- »

-

Cloud Managed Services Market Size, Industry Report, 2030GVR Report cover

![Cloud Managed Services Market Size, Share & Trends Report]()

Cloud Managed Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Business Services, Network Services), By Cloud Deployment (Public, Private), By End-user, By Verticals (BFSI, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-221-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Managed Services Market Summary

The global cloud managed services market size was valued at USD 134.44 billion in 2024 and is projected to reach USD 305.16 billion by 2030, growing at a CAGR of 14.7% from 2025 to 2030. Several key factors, including the increasing adoption of cloud computing, the need for cost optimization, and the rising complexity of IT environments, drive the growth of the cloud-managed services market.

Key Market Trends & Insights

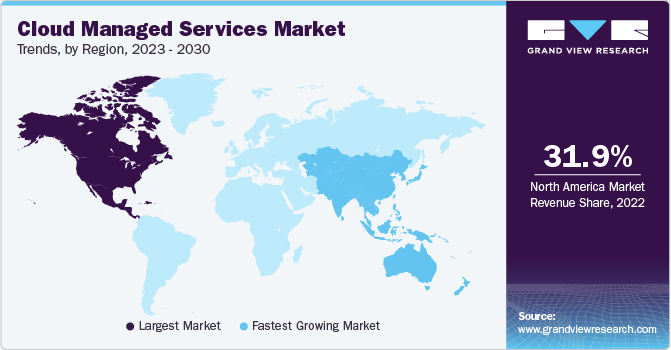

- North America cloud managed services industry held the major share of over 44% of the cloud managed services industry in 2024.

- The cloud managed services industry in Asia Pacific is expected to grow significantly at a CAGR of over 21% from 2025 to 2030.

- Based on service type, security services segment accounted for the largest market share at over 26% in 2024.

- Based on cloud deployment, the public cloud deployment segment accounted for the largest market share of over 61% in 2024.

- Based on verticals, the BFSI segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 134.44 Billion

- 2030 Projected Market Size: USD 305.16 Billion

- CAGR (2025-2030): 14.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Organizations across industries are shifting to cloud-based solutions to enhance scalability, flexibility, and operational efficiency while reducing capital expenditures on IT infrastructure. Additionally, the growing reliance on digital transformation initiatives and the surge in remote work and hybrid cloud deployments have heightened the demand for managed services that ensure seamless cloud operations, security, and compliance. The rapid advancements in artificial intelligence (AI), automation, and analytics further contribute to market expansion by enabling service providers to offer more intelligent, proactive, and cost-effective solutions.

Moreover, businesses are increasingly outsourcing cloud management to specialized providers to mitigate cybersecurity risks, address skill shortages, and focus on core competencies. As regulatory requirements and data privacy concerns become more stringent, managed service providers (MSPs) play a crucial role in ensuring compliance and risk management, further driving market growth.

The increasing adoption of cloud computing is a fundamental driver of the cloud-managed services market. Organizations across industries are transitioning from traditional on-premises infrastructure to cloud-based environments to enhance agility, scalability, and cost efficiency. Cloud computing enables businesses to access computing resources on demand, reducing the need for large capital expenditures and allowing for a more flexible operational model. As enterprises accelerate their digital transformation efforts, the reliance on managed services to optimize cloud performance and ensure seamless integration continues to grow.

The need for cost optimization is another key factor propelling the demand for cloud-managed services. Maintaining an in-house IT team to manage cloud infrastructure can be costly, requiring investments in skilled personnel, infrastructure, and ongoing maintenance. By outsourcing cloud management to specialized service providers, businesses can significantly reduce operational costs while benefiting from expert oversight. Managed services offer predictable pricing models, such as subscription-based or pay-as-you-go plans, helping organizations align IT expenses with business needs.

The rising complexity of IT environments has also expanded the cloud-managed services market. As enterprises adopt multi-cloud and hybrid cloud strategies, managing diverse cloud platforms, applications, and security protocols becomes increasingly challenging. Cloud-managed service providers (MSPs) help businesses navigate this complexity by offering end-to-end management, from cloud migration and optimization to security and compliance. This ensures seamless operations, reduced downtime, and enhanced overall performance.

Service Type Insights

Security services accounted for the largest market share at over 26% in 2024. Security services dominate the cloud-managed services market due to the increasing frequency and sophistication of cyber threats, data breaches, and regulatory compliance requirements. As businesses migrate their critical workloads and sensitive data to the cloud, they face heightened risks related to unauthorized access, ransomware attacks, and insider threats. Cloud security services, including threat detection, identity and access management, encryption, and firewall management, help organizations safeguard their cloud environments against evolving cyber risks.

Additionally, stringent data protection regulations such as GDPR, HIPAA, and industry-specific compliance mandates require businesses to implement robust security frameworks, further driving the demand for managed security services. Many enterprises lack the in-house expertise to manage complex security protocols effectively, prompting them to rely on specialized managed service providers (MSPs) for continuous monitoring, incident response, and regulatory compliance assurance. As security remains a top priority for cloud adoption, the demand for managed security services continues to outpace other service segments.

The mobility services segment is expected to grow at a significant rate during the forecast period. Mobility services are experiencing significant growth in the cloud-managed services market, driven by the widespread adoption of remote work, mobile-first business models, and the increasing use of enterprise mobility solutions. The proliferation of smartphones, tablets, and other connected devices has transformed workplace dynamics, necessitating seamless and secure access to cloud applications from any location. Cloud-managed mobility services, including mobile device management (MDM), enterprise mobility management (EMM), and mobile application security, enable businesses to enhance productivity while maintaining stringent security controls. As organizations embrace bring-your-own-device (BYOD) policies and hybrid work environments, the need for comprehensive mobility solutions to manage access, data security, and endpoint compliance has surged.

Cloud Deployment Insights

The public cloud deployment accounted for the largest market share of over 61% in 2024.The increasing adoption of cloud-native technologies, cost-efficiency, and the need for scalable, on-demand computing resources fuels the substantial growth in public cloud in the cloud-managed services market. Enterprises leverage public cloud services to drive digital transformation, support remote work, and enhance business agility. Public cloud deployments provide businesses access to advanced technologies such as artificial intelligence (AI), big data analytics, and serverless computing without large upfront investments in infrastructure. Furthermore, the rise of multi-cloud strategies, where organizations use multiple public cloud providers to optimize performance and avoid vendor lock-in, has accelerated the adoption of public cloud services. As public cloud security capabilities continue to improve and regulatory barriers decrease, its adoption is expected to grow further across industries.

The private segment is expected to grow at a significant rate during the forecast period. The growth of private cloud in the cloud managed services market is primarily driven by its ability to provide enhanced security, control, and compliance, making it the preferred choice for enterprises operating in highly regulated industries such as finance, healthcare, and government. Organizations handling sensitive data prioritize private cloud deployments to maintain stringent data protection standards, ensure regulatory compliance, and mitigate cybersecurity risks. Private cloud environments offer greater customization, enabling businesses to tailor infrastructure, security protocols, and resource allocation to their specific needs. The growing demand for hybrid cloud models, where private cloud serves as the foundation for mission-critical workloads while integrating with public cloud services, further reinforces its leading position in the market.

End-user Insights

The large enterprise segment accounted for the largest market share in 2024. The dominance of large enterprises in the cloud-managed services market is primarily driven by their complex IT infrastructure, higher cloud adoption rates, and the need for advanced security and compliance solutions. Large organizations operate across multiple locations and business units, requiring robust cloud management services to ensure seamless integration, scalability, and operational efficiency. Additionally, they often deal with vast amounts of sensitive data, making security, regulatory compliance, and risk management top priorities. Cloud-managed service providers (MSPs) offer tailored solutions, including automated monitoring, AI-driven analytics, and multi-cloud management, enabling large enterprises to optimize costs, improve performance, and focus on core business functions. Furthermore, given their substantial financial resources, large enterprises are more willing to invest in comprehensive cloud management solutions, reinforcing their dominance in this segment.

The small & medium enterprise (SME) segment is expected to grow at the fastest rate during the forecast period. The increasing accessibility of cloud technologies, cost-saving benefits, and the need for operational agility drive SMEs' significant growth in the cloud-managed services market. SMEs rapidly adopt cloud solutions to reduce capital expenditures on IT infrastructure while gaining access to enterprise-grade technologies. The scalability and flexibility of cloud-managed services enable SMEs to expand their digital capabilities without the burden of managing complex IT environments. Moreover, the rise of subscription-based and pay-as-you-go pricing models makes cloud services more affordable, allowing SMEs to leverage managed services without large upfront investments. As cybersecurity threats grow and regulatory requirements become more stringent, SMEs increasingly rely on MSPs to enhance data security, ensure compliance, and maintain business continuity, further accelerating their adoption of cloud-managed services.

Verticals Insights

The BFSI segment accounted for the largest market share in 2024. The BFSI sector dominates the cloud-managed services market due to its high dependence on secure, scalable, and resilient IT infrastructure. Financial institutions require advanced cloud solutions to handle vast amounts of transactional data, ensure seamless digital banking experiences, and maintain uninterrupted financial operations. The increasing adoption of cloud computing in BFSI is driven by the need for real-time data analytics, fraud detection, and enhanced cybersecurity measures. Managed cloud services enable banks and financial firms to comply with stringent regulatory requirements such as PCI-DSS, GDPR, and Basel III while ensuring data integrity and business continuity. Additionally, the rise of fintech innovations, mobile banking, and AI-driven financial services has further accelerated the adoption of cloud-managed services in this sector, solidifying its position as the leading vertical.

The government segment is expected to grow at a significant rate during the forecast period due to the increasing focus on digital transformation, e-governance, and data-driven decision-making. Governments worldwide are modernizing their IT infrastructure to enhance public service delivery, improve operational efficiency, and ensure data security. Cloud-managed services enable public sector organizations to scale IT resources efficiently, reduce operational costs, and enhance disaster recovery capabilities. Furthermore, the growing emphasis on cybersecurity and compliance with national data protection regulations drives government agencies to adopt managed cloud solutions for secure data storage and access. The expansion of smart city initiatives, digital identity programs, and AI-driven governance further propels the demand for cloud-managed services, making it one of the fastest-growing verticals in the market.

Regional Insights

North America cloud managed services industry held the major share of over 44% of the cloud managed services industry in 2024. In North America, the cloud managed services industry is characterized by rapid digital transformation across industries, with a strong focus on hybrid and multi-cloud environments. Companies increasingly adopt cloud solutions for enhanced scalability, security, and cost-efficiency. The rise of edge computing, AI-driven automation, and increased regulatory requirements, particularly data privacy and security, also drive regional growth.

U.S. Cloud Managed Services Market Trends

The cloud managed services industry in the U.S. is expected to grow significantly from 2025 to 2030. In the U.S., the cloud managed services market is witnessing significant growth due to widespread cloud adoption in the healthcare, finance, and telecom sectors. The need for enhanced cybersecurity, compliance with regulations like HIPAA, and the adoption of AI and machine learning are key trends fueling this market.

Europe Cloud Managed Services Market Trends

The cloud managed services industry in Europe is expected to grow significantly at a CAGR of over 17% from 2025 to 2030. In Europe, the cloud managed services industry is evolving due to a mix of regulatory pressures, particularly around GDPR and the increasing adoption of cloud-native technologies. European businesses focus on cloud solutions to improve efficiency, reduce costs, and meet compliance requirements while integrating artificial intelligence and machine learning into cloud services.

The U.K. cloud managed services industry is expected to grow rapidly in the coming years. In the U.K., there is a growing demand for cloud services in sectors like finance and public services. Companies are moving towards cloud-based solutions for enhanced security, improved business agility, and regulatory compliance, especially following Brexit, which has heightened data residency concerns.

The cloud managed services industry in Germany held a substantial market share in 2024. In Germany, cloud managed services industry is expanding rapidly, driven by the country's strong manufacturing sector and a growing focus on Industry 4.0. German companies are adopting cloud solutions to support digitalization, automation, and innovation in manufacturing, while compliance with GDPR remains a top priority.

Asia Pacific Cloud Managed Services Market Trends

The cloud managed services industry in Asia Pacific is expected to grow significantly at a CAGR of over 21% from 2025 to 2030. In the Asia Pacific region, the cloud managed services industry is growing rapidly as businesses in countries like China, Japan, and India embrace digital transformation. The demand for cloud solutions is driven by the rise of IoT, smart cities, and the need for scalable and flexible IT infrastructure to support fast-growing economies and industries.

China cloud managed services market held a substantial share in 2024. In China, the cloud managed services market is expanding rapidly due to the government's push for digital infrastructure development, the rise of e-commerce, and large-scale cloud adoption by both state-owned and private enterprises. The focus on cybersecurity and data localization regulations also plays a crucial role.

The cloud managed services market in Japan held a substantial share in 2024. In Japan, the cloud managed services industry is growing as manufacturing, automotive, and retail companies seek to modernize their IT infrastructure. Adopting cloud-based services, along with integrating AI and automation, enables businesses to enhance operational efficiency and innovation.

India cloud managed services market is expanding rapidly. In India, the cloud managed services industry is witnessing a significant growth driven by the increasing digitalization of enterprises, a large IT services outsourcing sector, and the rise of startups. The growing demand for cloud adoption among SMEs and government initiatives promoting digital infrastructure further accelerates the market's expansion.

Key Cloud Managed Services Company Insights

Key players operating in the cloud managed services market include IBM Corporation, Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson, Verizon, Accenture, NTT DATA Corporation, Huawei Technologies Co., Ltd., Fujitsu, CHINA HUAXIN, CenturyLink, and Trianz. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2024, IBM and HashiCorp Inc., a prominent company specializing in multi-cloud infrastructure automation, announced a definitive agreement under which IBM acquired HashiCorp for USD 35 per share in cash, reflecting an enterprise value of USD 6.4 billion. HashiCorp's portfolio of products offers comprehensive security lifecycle management and infrastructure lifecycle management solutions, empowering enterprises to automate their hybrid and multi-cloud environments. This acquisition is a further testament to IBM's ongoing commitment and investment in hybrid cloud and artificial intelligence (AI), the two most transformative technologies for its clients.

-

In April 2024, Fujitsu Limited and Oracle announced a collaboration to provide sovereign cloud and AI capabilities to meet the digital sovereignty needs of Japanese businesses and the public sector. Through Oracle Alloy, Fujitsu will enhance its hybrid IT offerings under Fujitsu Uvance, supporting customers in growing their businesses and addressing societal challenges. This partnership will enable Fujitsu to operate Oracle Alloy independently within its data centers in Japan, granting the company greater control over its operations.

Key Cloud Managed Services Companies:

The following are the leading companies in the cloud managed services market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- CenturyLink

- CHINA HUAXIN

- Cisco Systems, Inc.

- Fujitsu

- Huawei Technologies Co., Ltd.

- IBM Corporation

- NTT DATA Corporation

- Telefonaktiebolaget LM Ericsson

- Trianz

- Verizon

Cloud Managed Services Market Report Scope

Report Attribute

Details

Market size in 2025

USD 153.39 billion

Revenue forecast in 2030

USD 305.16 billion

Growth Rate

CAGR of 14.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service type, cloud deployment, end-use, verticals, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

IBM Corporation, Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson, Verizon, Accenture, NTT DATA Corporation, Huawei Technologies Co., Ltd., Fujitsu, CHINA HUAXIN, CenturyLink, and Trianz

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Managed Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud managed services market report based on service type, cloud deployment, end-user, verticals, and region.

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Business Services

-

Network Services

-

Security Services

-

Data Center Services

-

Mobility Services

-

-

Cloud Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

Private

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Verticals Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail & Consumer Goods

-

Telecom & ITES

-

Manufacturing & Automotive

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud managed services market size was estimated at USD 134.44 billion in 2024 and is expected to reach USD 153.39 billion in 2025.

b. The global cloud managed services market is expected to grow at a compound annual growth rate of 14.7% from 2025 to 2030 to reach USD 305.16 billion by 2030.

b. North America dominated the global cloud-managed services market with a share of over 44% in 2024 owing to the presence of technology giants such as International Business Machines Corporation, Google, Inc., Cisco Systems, Inc., and Verizon Communications. Initiatives by the federal government are increasing the adoption of cloud managed services.

b. Some of the key players in the global cloud managed services market include the International Business Machines Corporation, Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson, Verizon, Accenture, NTT DATA Corporation, Huawei Technologies Co., Ltd., Fujitsu, CHINA HUAXIN, CenturyLink, and Trianz.

b. Several key factors, including the increasing adoption of cloud computing, the need for cost optimization, and the rising complexity of IT environments, drive the growth of the cloud-managed services market. Organizations across industries are shifting to cloud-based solutions to enhance scalability, flexibility, and operational efficiency while reducing capital expenditures on IT infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.