- Home

- »

- Consumer F&B

- »

-

Coffee Substitute Market Size & Share, Industry Report 2033GVR Report cover

![Coffee Substitute Market Size, Share & Trends Report]()

Coffee Substitute Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Herbal, Grain Based, Plant Based), By Form (Powder, Liquid), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-631-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coffee Substitute Market Summary

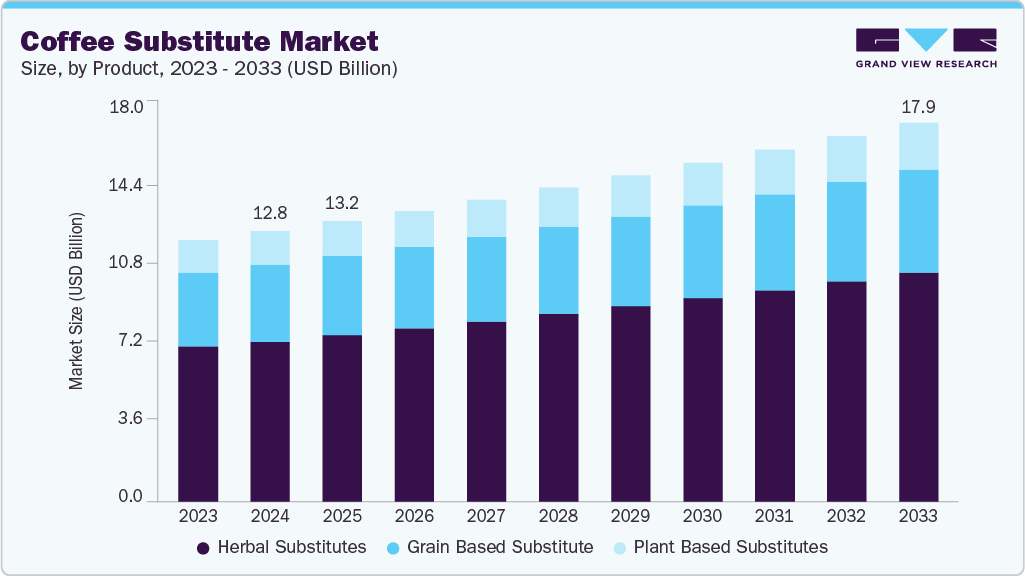

The global coffee substitute market size was estimated at USD 12.75 billion in 2024 and is projected to reach USD 17.88 billion by 2033, growing at a CAGR of 3.8% from 2025 to 2033. One of the primary reasons is the increasing consumer awareness about the health risks associated with caffeine consumption.

Key Market Trends & Insights

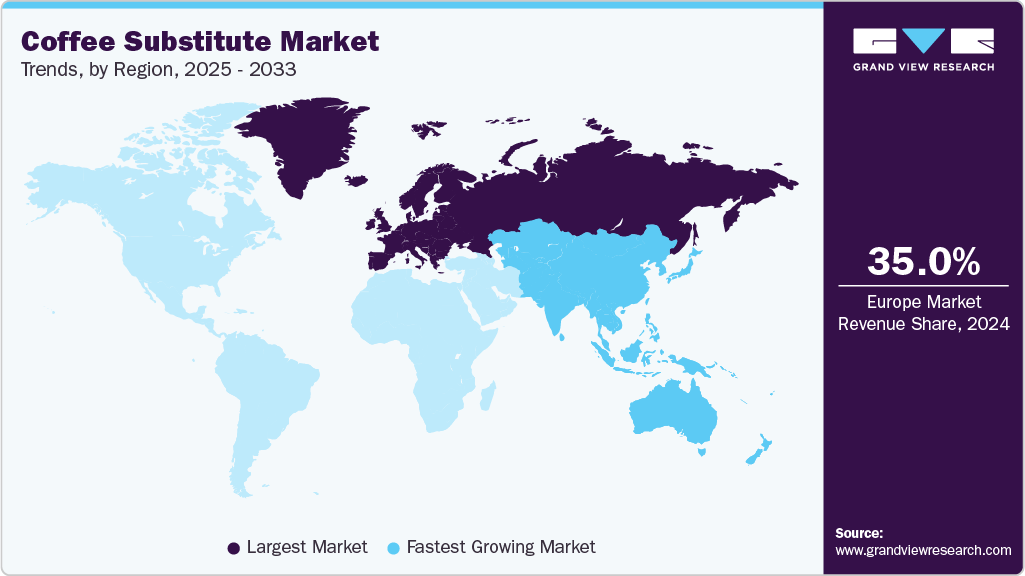

- Europe held the largest share in the coffee substitute market, accounting for over 35% of the global market in 2024.

- The coffee substitute market in Asia Pacific is expected to witness the fastest growth at a CAGR of 4.3% from 2025 to 2033.

- By product, the herbal coffee substitute held the highest market share of 60% in 2024.

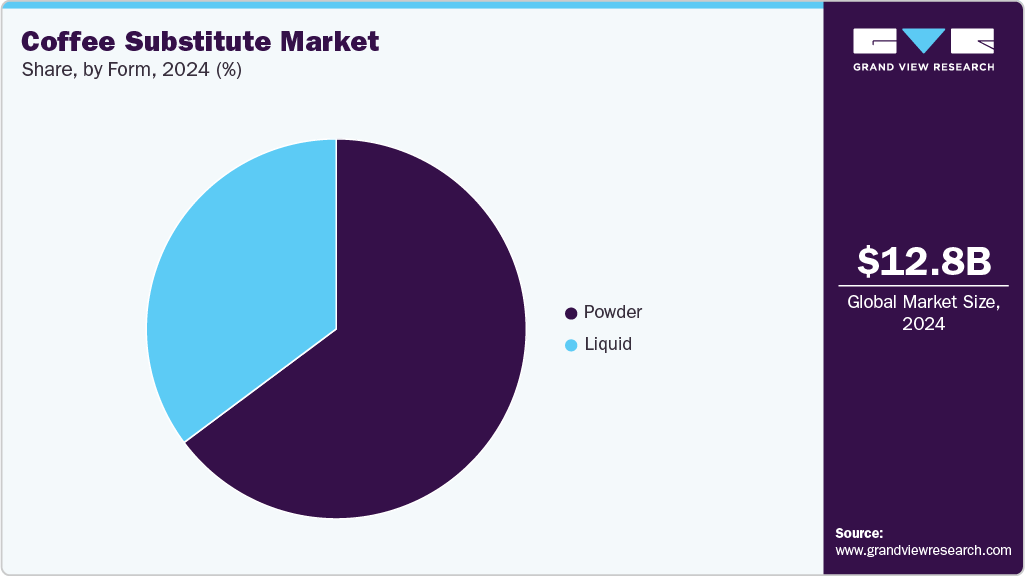

- Based on form, powder coffee substitutes were the largest category, accounting for over 60% of the market in 2024.

- By distribution channel, supermarkets and hypermarkets were the leading distribution channel for coffee substitutes, generating USD 4.75 billion in revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.75 Billion

- 2033 Projected Market Size: USD 17.88 Billion

- CAGR (2025-2033): 3.8%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Many individuals are seeking caffeine-free alternatives due to concerns over caffeine-related issues such as anxiety, sleep disorders, and other health complications. This shift is supported by reports indicating that a significant portion of adults are actively trying to reduce their caffeine intake, which directly boosts demand for coffee substitutes made from ingredients like chicory, barley, and various herbs. Another key driver is the rising interest in healthier lifestyles and wellness trends. Coffee substitutes often contain beneficial nutrients such as fiber, vitamins, and antioxidants, which appeal to health-conscious consumers. For example, ingredients like chicory root and dandelion root are known for their digestive and liver health benefits, while some substitutes offer antioxidant properties that may reduce the risk of chronic diseases. This nutritional advantage, combined with the caffeine-free nature of these products, makes them attractive to a wide demographic, including pregnant women, individuals with caffeine sensitivity, and those following vegetarian or vegan diets.

Sustainability and natural product trends also play a significant role in the market's expansion. Consumers are increasingly prioritizing organic, plant-based, and eco-friendly products, which aligns well with coffee substitutes that often use natural and sustainable ingredients. The demand for organic coffee substitutes is growing rapidly, supported by government initiatives and consumer preference for products that reduce exposure to synthetic chemicals and pesticides. This trend is especially strong in regions like Europe and Asia-Pacific, where ethical sourcing and environmental considerations are highly valued.

Innovation and product diversification further fuel market growth. Manufacturers are investing in developing new flavors, improving taste profiles, and creating blends that closely mimic the sensory experience of traditional coffee. Advances in flavor technology and the introduction of functional beverages with added health benefits are expanding the appeal of coffee substitutes. Additionally, convenient packaging options such as pouches enhance product shelf life and consumer convenience, contributing to broader market penetration.

The market is also benefiting from changes in distribution channels and consumer purchasing behavior. The rise of online retail and the growing presence of coffee substitutes in supermarkets and hypermarkets make these products more accessible to consumers. The convenience of purchasing from these outlets, combined with the increasing consumer tendency to scrutinize product ingredients, supports the steady growth of the coffee substitute market.

The demographic and social trends such as urbanization, rising living standards, and the growing trend of veganism contribute to the expanding market. Urban consumers with higher disposable incomes are more likely to experiment with alternative beverages that align with their health and ethical values. The increasing number of health-conscious and environmentally aware consumers worldwide provides a fertile ground for coffee substitutes to gain market share and sustain long-term growth.

A major obstacle for market growth is the strong competition from the conventional coffee sector, which dominates consumer preferences due to its established taste, aroma, and cultural significance. Many consumers remain skeptical about the flavor and sensory experience of coffee substitutes, finding it difficult to fully accept alternatives that do not precisely replicate traditional coffee’s richness and complexity. This skepticism is compounded by limited consumer awareness about coffee substitutes, as many potential buyers are either unfamiliar with these products or unsure about their benefits and taste profiles. As a result, market penetration remains constrained despite growing health-conscious trends.

Another significant challenge is the relatively high price of coffee substitutes compared to traditional coffee. The production of coffee substitutes often involves sourcing less widely cultivated raw materials such as chicory root, dandelion root, and other specialty grains or herbs, which increases production costs. This limited availability of raw materials drives up the final product price, making coffee substitutes less accessible for price-sensitive consumers, especially in emerging markets. The premium pricing reinforces the perception of coffee substitutes as niche or luxury items rather than everyday alternatives, thereby limiting mass-market appeal.

Product Insights

Herbal coffee substitute was the largest product segment and accounted for a revenue of USD 7.57 billion in 2024. The growth of herbal substitutes in the coffee substitute market is primarily driven by their health benefits and caffeine-free nature. Ingredients such as dandelion root, chicory, cinnamon, and carob are widely recognized for their digestive and liver health properties, as well as their antioxidant content, which may reduce oxidative stress and the risk of chronic diseases. These herbal alternatives offer a coffee-like experience through unique roasting processes without the adverse effects of caffeine, making them appealing to health-conscious consumers, those sensitive to caffeine, and individuals seeking diverse flavor profiles. The rising consumer emphasis on wellness trends, including adaptogens and nootropics, further boosts demand for herbal coffee substitutes that provide functional health benefits beyond just flavor.

The plant based coffee substitutes are expected to grow at a CAGR of 4.2% over the forecast period. Plant-based substitutes, which include ingredients derived from herbs, roots, grains, and mushrooms, are expanding rapidly due to the global rise in veganism and demand for natural, minimally processed products. These substitutes cater to consumers seeking clean-label beverages that provide functional benefits like prebiotic fiber for digestive health, essential nutrients such as vitamin B6 and manganese for brain health, and natural stimulants from adaptogens like ginseng and rhodiola. The shift toward plant-based and organic products is supported by consumer preferences for sustainability and ethical sourcing, making plant-based coffee substitutes attractive for environmentally conscious buyers. Manufacturers are investing in research and development to innovate with new plant-based ingredients, improving flavor profiles and health benefits, which drives market growth and diversification.

Grain-based substitutes, including roasted barley, rye, oats, and millet, are gaining traction due to their natural, plant-based origins and nutritional benefits. These substitutes are rich in fiber, vitamins, and minerals, supporting digestive health and overall wellness, which aligns with the increasing consumer preference for healthier and organic food products. The growing trend toward plant-based diets and sustainability also favors grain-based coffee substitutes, as they are often organic and environmentally friendly. Their ability to mimic the texture and flavor of coffee while being caffeine-free attracts consumers looking for alternatives that fit vegan and health-conscious lifestyles. Additionally, innovation in product development and packaging enhances their accessibility and appeal in markets such as Europe and North America, where health awareness and organic consumption are high.

Distribution Channel Insights

Supermarkets and hypermarkets were the most used distribution channel for coffee substitutes and accounted for over USD 4.75 billion in 2024. The growth of supermarkets and hypermarkets as key distribution channels for coffee substitutes is driven by their convenience, wide product variety, and increasing consumer preference for one-stop shopping experiences. These retail formats offer extensive shelf space that accommodates diverse coffee substitute brands and product types, including organic and plant-based options, allowing consumers to compare and choose according to their health and dietary preferences. The rising health consciousness among consumers encourages them to personally check product ingredients and certifications, which supermarkets and hypermarkets facilitate through clear labeling and product availability. Moreover, the expansion of these large retail chains into urban and semi-urban areas enhances accessibility, driving higher sales volumes of coffee substitutes through these channels.

The sale of coffee substitutes through the online channel is expected to grow at a CAGR of 4.3% over the forecast period. Online distribution channels are also experiencing rapid growth due to the increasing consumer demand for convenience, variety, and personalized shopping experiences. E-commerce platforms enable consumers to access a broader range of coffee substitute products, including niche and premium brands that may not be widely available in physical stores. The ability to read detailed product information, reviews, and health benefits online supports informed purchasing decisions, especially for health-conscious buyers. Additionally, online sales benefit from direct-to-consumer models, subscription services, and targeted marketing, which foster brand loyalty and repeat purchases. The growing penetration of smartphones and improved logistics infrastructure further bolsters online sales, making it a crucial channel for market expansion alongside traditional retail.

Form Insights

Powder coffee substitutes were the largest category, accounting for over 60% of the market in 2024. The growth of the powder form in the coffee substitute market is primarily attributed to its ease of use, affordability, and long shelf life. Powdered coffee substitutes are convenient for consumers as they can be quickly mixed into hot water or other beverages, making them suitable for home brewing and DIY consumption. Their longer shelf stability compared to liquids reduces spoilage and storage constraints for both retailers and consumers. Additionally, powders are easier and more cost-effective to package, ship, and store due to their compact size and lower weight, which appeals to manufacturers and distributors. Technological advancements have also improved the solubility and taste of powder forms, enhancing the overall consumer experience and driving their dominant market share.

On the other hand, the liquid segment is experiencing significant growth due to rising consumer demand for ready-to-drink (RTD) coffee substitutes that offer convenience for on-the-go lifestyles. Busy consumers increasingly prefer beverages that require no preparation, such as bottled herbal or grain-based coffee alternatives, which fit well with fast-paced routines. The liquid form also aligns with trends in functional beverages, as many RTD products are fortified with superfoods, adaptogens, and other health-promoting ingredients, appealing to wellness-focused consumers. While the powder segment remains dominant, the liquid segment’s higher growth rate reflects changing consumption patterns favoring convenience and immediate usability.

Regional Insights

North America coffee substitute market is propelled by rising health awareness and a growing preference for plant-based, organic, and functional beverages. Consumers increasingly seek caffeine-free or low-caffeine alternatives due to concerns about health and wellness, which boosts demand for coffee substitutes. The presence of innovative brands and expanding retail channels, including supermarkets and online platforms, enhances product accessibility and consumer choice. North America’s market is also influenced by trends such as veganism and sustainability, which align with the attributes of many coffee substitutes.

Europe Coffee Substitute Market Trends

The coffee substitute market in Europe accounted for over 35% share in 2024. The growth and dominance of the coffee substitutes market in Europe are largely driven by the region's strong health consciousness and cultural affinity for coffee alternatives. Europe has a long-standing tradition of consuming coffee substitutes like chicory, which aligns well with increasing consumer demand for organic, natural, and caffeine-free products. The region’s focus on sustainability, organic sourcing, and premium quality products further fuels market growth. Additionally, the well-established coffee culture in countries like Italy, France, and Germany supports the acceptance of specialty and alternative coffee beverages, making Europe the largest and fastest-growing market for coffee substitutes.

Asia Pacific Coffee Substitute Market Trends

The coffee substitute market in Asia Pacific is expected to witness the fastest growth at a CAGR of 4.3% from 2025 to 2033. The Asia-Pacific region is witnessing rapid growth due to increasing disposable incomes, urbanization, and rising health consciousness among consumers. Growing awareness about the adverse effects of caffeine and a shift toward healthier lifestyles drive demand for coffee substitutes. The region benefits from diverse local ingredients like dandelion and grains, which are incorporated into coffee substitutes, catering to traditional preferences and modern health trends. Expanding retail infrastructure, including supermarkets, hypermarkets, and e-commerce, further supports market penetration. Additionally, the adoption of Western dietary habits and increasing exposure to global wellness trends contribute to the region’s fast-paced market growth.

Key Coffee Substitute Company Insights

Key players operating in the coffee substitute market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Coffee Substitute Companies:

The following are the leading companies in the coffee substitute market. These companies collectively hold the largest market share and dictate industry trends.

- Hand Family Companies

- Anthonys Goods

- The Hain Celestial Group, Inc.

- Rishi Tea and Botanicals

- Teeccino Caffe, Inc.

- Mud Wtr Inc.

- Minus Coffee

- Postum

- Sip Herbals

- Urban Platter

- Micro Ingredients

- Four Sigma Foods, Inc.

- Kein Kaffee

- Dandy Blend

- Nestlé S.A.

Coffee Substitute Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.23 billion

Revenue forecast in 2033

USD 17.88 billion

Growth rate

CAGR of 3.8% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

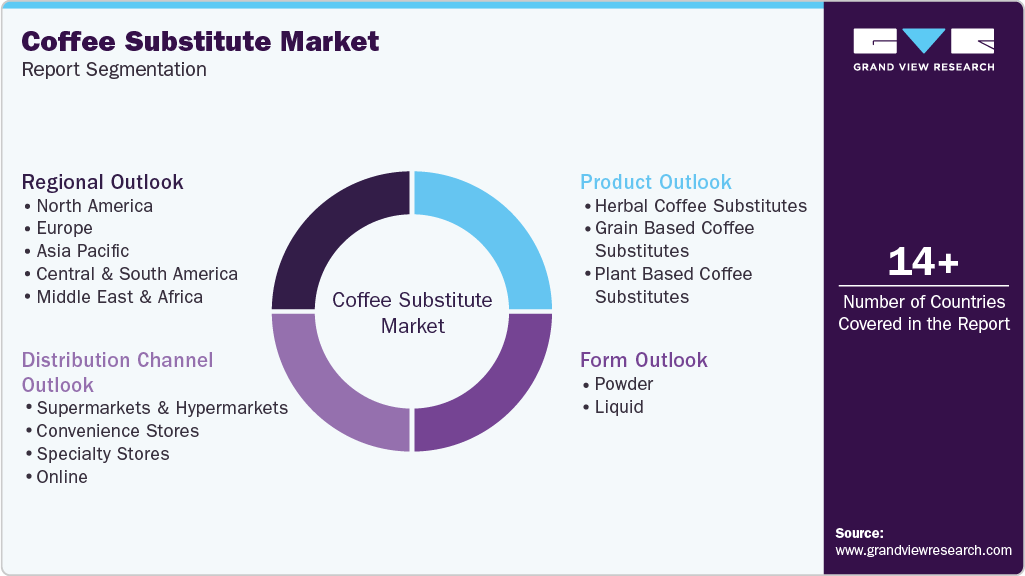

Segments covered

Product, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Hand Family Companies; Anthonys Goods; The Hain Celestial Group, Inc.; Rishi Tea and Botanicals; Teeccino Caffe, Inc.; Mud Wtr Inc.; Minus Coffee; Postum; Sip Herbals; Urban Platter; Micro Ingredients; Four Sigma Foods, Inc.; Kein Kaffee; Dandy Blend; Nestlé S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coffee Substitute Market Report Segmentation

This report forecasts revenue growth globally, regionally, and country-wide and analyzes the latest industry trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global coffee substitute market report by product, form, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Herbal Coffee Substitutes

-

Grain Based Coffee Substitutes

-

Plant Based Coffee Substitutes

-

-

Form Outlook (Revenue, USD Billion, 2021 - 2033)

-

Powder

-

Liquid

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global coffee substitutes market was valued at USD 12.75 billion in 2024.

b. The global coffee substitutes market is expected to reach USD 17.88 billion by 2033, growing at a CAGR of 3.8% from 2025 to 2033.

b. Herbal coffee substitute was the largest product form and accounted for a market of USD 7.57 billion in 2024. The growth of herbal substitutes in the coffee substitute market is primarily driven by their health benefits and caffeine-free nature. Ingredients such as dandelion root, chicory, cinnamon, and carob are widely recognized for their digestive and liver health properties, as well as their antioxidant content, which may reduce oxidative stress and the risk of chronic diseases. These herbal alternatives offer a coffee-like experience through unique roasting processes without the adverse effects of caffeine, making them appealing to health-conscious consumers, those sensitive to caffeine, and individuals seeking diverse flavor profiles. The rising consumer emphasis on wellness trends, including adaptogens and nootropics, further boosts demand for herbal coffee substitutes that provide functional health benefits beyond just flavor.

b. Some of the key players operating in the market include Hand Family Companies; Anthonys Goods; The Hain Celestial Group, Inc.; Rishi Tea and Botanicals; Teeccino Caffe, Inc.; Mud Wtr Inc.; Minus Coffee; Postum; Sip Herbals; Urban Platter; Micro Ingredients; Four Sigma Foods, Inc.; Kein Kaffee; Dandy Blend; Nestlé S.A.

b. One of the primary reasons is the increasing consumer awareness about the health risks associated with caffeine consumption. Many individuals are seeking caffeine-free alternatives due to concerns over caffeine-related issues such as anxiety, sleep disorders, and other health complications. This shift is supported by reports indicating that a significant portion of adults are actively trying to reduce their caffeine intake, which directly boosts demand for coffee substitutes made from ingredients like chicory, barley, and various herbs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.