- Home

- »

- Next Generation Technologies

- »

-

Cold Chain Temperature Monitoring Market Size Report 2030GVR Report cover

![Cold Chain Temperature Monitoring Market Size, Share & Trends Report]()

Cold Chain Temperature Monitoring Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Temperature Range (Chilled, Frozen, Deep-frozen), By Application (Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-492-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

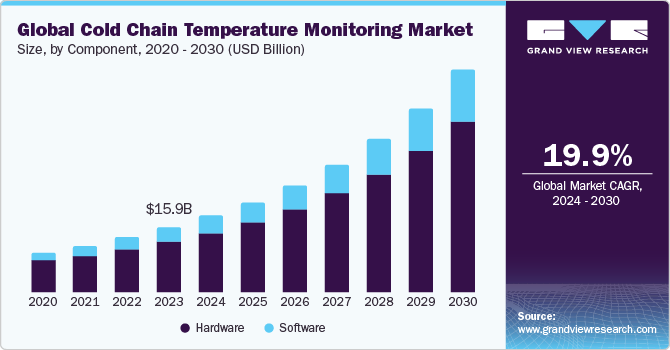

The global cold chain temperature monitoring market size was estimated at USD 15.89 billion in 2023 and is projected to grow at a CAGR of 19.9% from 2024 to 2030. The primary factor contributing to the growth is a substantial increase in demand from the pharmaceutical industry. Additionally, the market is set for significant expansion due to the rise in automation in refrigerated warehouses for managing and monitoring goods such as food products, vegetables, and meat. Consequently, wireless monitors reduce human interference with refrigerated goods, helping maintain product quality for longer periods.

The increasing demand for pharmaceutical products is expected to drive market growth in the near future. This includes numerous temperature-sensitive items, such as vaccines, which require effective monitoring technologies to ensure they remain at the desired temperatures throughout the supply chain. Additionally, regulations like Good Distribution Practices (GDP) and Good Manufacturing Practices (GMP) mandate continuous tracking and data recording for future reference. These monitoring technologies also help prevent product spoilage by maintaining the appropriate temperature during shipment and storage. Consequently, the demand for these technologies is rising significantly in the pharmaceutical sector.

Modern tracking solutions are designed to track and oversee products throughout storage and transportation. They can monitor temperature-sensitive items, such as processed and frozen foods, in real-time. The increasing trade of perishable goods between developed and developing economies is positively impacting market growth. Additionally, advancements in connected device technologies, such as Radio Frequency Identification (RFID) and the Internet of Things (IoT), are expected to create opportunities for innovative cold chain monitoring solutions.

Tracking solutions can help maintain desired temperatures during shipment and storage, preventing product spoilage, ensuring higher quality, and minimizing financial losses. As a result, businesses are increasingly adopting temperature monitoring solutions to mitigate financial risks and sustain in the target market.

Market Concentration & Characteristics

The cold chain temperature monitoring market growth stage is high, and the pace of growth is accelerating. The market is highly fragmented, with the presence of numerous market players, especially the manufacturers of conventional temperature monitors and cost-effective temperature indicators. The target market is characterized by a high degree of innovation, with market players adopting advanced technologies, such as RFID and IoT. Moreover, real-time monitors, coupled with various cloud-based software, are increasingly being adopted to alert businesses in critical instances, such as the storage of products at an undesired temperature, humidity, and so on. This enables operators to collectively predict the foreseeable spoilage and shelf life of the product.

The target market is also characterized by many product launches by the leading companies. For instance, in January 2023, Norway-based Disruptive Technologies introduced a wireless temperature sensor for the cold chain market. This compact sensor, measuring just 19x19x3.5 mm, offers a battery life of up to 15 years and a temperature range from -40°C to +85°C, making it suitable for use in settings such as restaurants, grocery stores, and hospitals.

Regulatory compliance plays a central role in shaping the development, marketing, and implementation of cold chain tracking hardware and software solutions. As regulations evolve and become more stringent over time, companies operating in the target market must continuously update their products and services to remain compliant and competitive in the market. This may involve investing in research and development to enhance the reliability, accuracy, and functionality of their monitoring systems.

The substitutes for cold chain tracking solutions are low as they are critical for businesses operating in industries subject to stringent temperature control requirements. These businesses usually typically opt for specialized tracking solutions to ensure product safety and regulatory compliance.

Various industries, including food & beverages, pharmaceuticals, and others need cold chain surveillance solutions. For instance, in the chemical industry, certain chemicals may require controlled conditions to prevent degradation or reactiveness. Cold chain tracking solutions help ensure that these materials are stored and transported safely.

Component Insights

The hardware segment held the largest revenue share of over 78.0% in 2023. The hardware segment’s growth can be attributed to the growing availability of real-time temperature monitoring hardware solutions that provide reliable and accurate data. Companies such as Switzerland-based ELPRO-BUCHS AG and U.S.-based DeltaTrak Inc. provide real-time data loggers and IoT devices.

The software segment is expected to register the fastest CAGR of 20.9% over the forecast period. The segment’s growth can be attributed to the growing integration of data analytics and IoT, the rising demand for real-time monitoring and alerts, and the growing popularity of cloud-based solutions. Software platforms equipped with real-time monitoring capabilities and alert systems enable proactive management of temperature deviations, driving the adoption of such solutions.

Temperature Range Insights

The frozen (-18°C to -25°C) segment dominated the target market with a share of over 61.0% in 2023. The increasing demand for frozen food products is driving the growth of the segment in the cold chain temperature monitoring market. As consumer preferences shift towards convenient and longer-lasting food options, the frozen food industry continues to expand, necessitating accurate and reliable surveillance solutions to maintain product quality and safety.

The chilled (0°C to 15°C) segment is expected to register a considerable CAGR of 17.9% over the forecast period. The segment’s growth can be attributed to the need to extend the shelf life of temperature-sensitive food & beverage products such as dairy products and fresh fruits and vegetables. Storing these products in the chilled temperature range prevents decomposition. Hence, cold chain tracking solutions are used to maintain the temperature in this range.

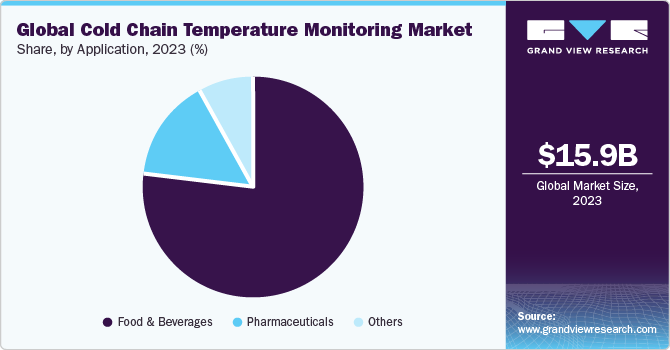

Application Insights

The food & beverages segment dominated the target market with a share of over 77.0% in 2023. The segment’s growth can be attributed to the need to maintain the quality of perishable food products throughout the supply chain. Cold chain tracking solutions help ensure that food products remain fresh and safe for consumption. Moreover, the growing demand for processed food is driving the segment’s growth.

The pharmaceuticals segment is expected to register the fastest CAGR of 21.8% over the forecast period. The expansion is driven by rigorous regulatory requirements implemented worldwide to guarantee the safe and reliable storage and transit of pharmaceutical goods. Certain medications are exceptionally sensitive to temperature variations, necessitating consistent temperature control during storage and transportation. As a result, supply chain operators are increasingly turning to cold chain tracking hardware and software solutions when handling pharmaceutical products.

Regional Insights

North America dominated the market and accounted for over 37.0% of the revenue share in 2023. The growth of the cold chain temperature monitoring market in North America is driven by the growing demand for temperature monitors among food storage facilities and logistics operators. Changing dietary patterns, influenced by escalating obesity rates, have led consumers to favor fresh and organic food items such as leafy greens, organic milk, and eggs. To prevent spoilage, meticulous handling, and surveillance are essential at every stage of storage and transit, fueling market growth in the region.

U.S. Cold Chain Temperature Monitoring Market Trends

The cold chain temperature monitoring market in the U.S. is projected to grow at a CAGR of 18.2% from 2024 to 2030. The growth of the market in the country can be attributed to the presence of prominent target market companies, such as Sensitech (Carrier) and DeltaTrak Inc. Moreover, the growing automation and adoption of advanced technologies in cold storage warehouses in the country drive the demand for cold chain tracking solutions.

Europe Cold Chain Temperature Monitoring Market Trends

The cold chain temperature monitoring market in Europe was valued at USD 3.87 billion in 2023. The market’s growth in the region is driven by the expansion of the pharmaceutical industry and stringent regulations governing the storage, transportation, and handling of temperature-sensitive products. The need to ensure regulatory compliance drives the market’s growth in the region.

The cold chain temperature monitoring market in Germany is expected to grow at a CAGR of 17.7% from 2024 to 2030. The target market's growth in Germany can be attributed to the growth of e-commerce in the country. The expansion of e-commerce and online retailing in Germany has heightened the need for temperature-controlled logistics and target market solutions. Businesses in the area are embracing sophisticated temperature monitoring technologies to address the rising demand for fresh and perishable products purchased online. According to the International Trade Administration (ITA) of the U.S. Department of Commerce, in 2022, total e-commerce sales reached an estimated USD 141.2 billion, marking an 11% increase compared to 2021.

Asia Pacific Cold Chain Temperature Monitoring Market Trends

The cold chain temperature monitoring market in Asia Pacific is expected to grow at the fastest CAGR of 22.3% from 2024 to 2030. Emerging economies like India, Singapore, and Thailand are expected to contribute to the regional market growth. Factors such as population growth, rapid industrialization, ongoing expansions of transportation and warehousing networks, and increasing demands for processed and canned food items are projected to propel regional market expansion. China's market is forecasted to experience steady growth throughout the forecast period, driven by factors including technological advancements, the introduction of smart sensors, and the expansion of pharmaceutical and processed food industries.

The cold chain temperature monitoring market in China is projected to grow at a CAGR of 21.6% from 2024 to 2030. Growing cold chain infrastructure development is driving the market’s growth in the country. Rising innovations in the pharmaceutical sector in China are also expected to boost the demand for cold chain tracking solutions.

Key Cold Chain Temperature Monitoring Company Insights

Some of the key companies operating in the market include Berlinger & Co. AG, Sensitech (Carrier), ELPRO-BUCHS AG, and DeltaTrak Inc., among others.

-

Sensitech (Carrier) is a U.S.-based company offering monitoring solutions for various industries, including food & beverages and pharmaceuticals. The company offers cold chain temperature monitoring software and hardware solutions, including temperature indicators and conventional and real-time temperature monitors. It has a global presence in numerous countries, including the UK, China, Brazil, Mexico, and India.

-

ELPRO-BUCHS AG is a Switzerland-based company that manufactures environmental monitoring solutions for the healthcare, pharmaceutical, and biotech industries. The company offers cold chain temperature monitoring solutions such as wireless temperature indicators and temperature data loggers. It employs over 200 people and has technical support and sales offices globally.

Monnit Corporation and TempSen Electronics are some of the emerging companies in the target market.

-

TempSen Electronics is a China-based company that develops, manufactures, and sells data loggers and data acquisition systems for cold chain monitoring. Its clientele includes pharmaceuticals, food, and chemicals.

-

Monnit Corporation is a U.S.-based company in the field of remote monitoring solutions, offering a comprehensive range of wireless sensors and monitoring systems. The company specializes in providing cost-effective and reliable monitoring solutions for various applications across industries such as agriculture, food & beverages, and pharmaceuticals. Their offerings include wireless sensors for monitoring temperature, humidity, motion, and door access, among others.

Key Cold Chain Temperature Monitoring Companies:

The following are the leading companies in the cold chain temperature monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Berlinger & Co. AG

- DeltaTrak Inc.

- ELPRO-BUCHS AG

- Roambee Corporation

- Omega Engineering, Inc.

- Sensitech (Carrier)

- TempSen Electronics

- Thermo Electric Company, Inc.

- Testo SE & Co. KGaA

- Monnit Corporation

- Shandong Renke Control Technology Co.,Ltd.

- Dickson

Recent Developments

-

In April 2024, ELPRO-BUCHS AG and SmartCAE, a Germany-based company, announced a partnership to introduce predictive analytics service, enhancing temperature control in pharmaceutical cold chain shipments. The collaboration integrates ELPRO-BUCHS AG's LIBERO Gx real-time IoT devices and cold chain database with SmartCAE's digital cold chain models, enabling dynamic risk assessments and faster prediction of temperature excursions, ultimately providing pharmaceutical and life science professionals with the means to prevent such events.

-

In November 2023, Sensitech (Carrier) announced a new offering on its SensiWatch platform, advancing cold chain monitoring by extending real-time cargo protection to the final leg of outbound operations, ensuring the quality of perishable goods. This cloud-based solution, leveraging Sensitech IoT sensors, offers comprehensive real-time monitoring from distribution centers to end destinations, overcoming previous monitoring limitations and enabling transportation managers to proactively address issues impacting the quality of perishables like food and medicine.

-

In December 2021, Monnit Corporation announced the launch of ALTA Wireless Motion+ Sensor, which combines motion and occupancy detection with temperature and humidity monitoring capabilities, suitable for various facilities, including warehouses, offices, hospitals, and farms. The sensor provides real-time alerts for motion detection, temperature tracking (-40°F to +257°F), and humidity monitoring, with additional features such as adjustable range, long-range data transmission, and secure data storage via the iMonnit Sensor Management System.

Cold Chain Temperature Monitoring Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.81 billion

Revenue forecast in 2030

USD 55.75 billion

Growth rate

CAGR of 19.9% from 2024 to 2030

Historical data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, temperature range, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Berlinger & Co. AG, DeltaTrak Inc.; ELPRO-BUCHS AG; Roambee Corporation; Omega Engineering, Inc.; Sensitech (Carrier); TempSen Electronics; Thermo Electric Company, Inc.; Testo SE & Co. KGaA; Monnit Corporation; Shandong Renke Control Technology Co.,Ltd.; Dickson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Chain Temperature Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cold chain temperature monitoring market report based on component, temperature range, application, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Conventional Temperature Loggers

-

Real-Time Monitoring Devices

-

Resistance Temperature Detectors

-

Temperature Indicators

-

Others

-

-

Software

-

On-premise

-

Cloud-based

-

-

-

Temperature Range Outlook (Revenue, USD Million, 2017 - 2030)

-

Chilled (0°C to 15°C)

-

Frozen (-18°C to -25°C)

-

Deep-frozen (Below -25°C)

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice cream

-

Others

-

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold chain temperature monitoring market size was estimated at USD 15.89 billion in 2023 and is expected to reach USD 18.81 billion in 2024.

b. The global cold chain temperature monitoring market is expected to grow at a compound annual growth rate of 19.9% from 2024 to 2030 to reach USD 55.75 billion by 2030.

b. North America dominated the cold chain temperature monitoring market with a share of over 37.0% in 2023. This is attributable to the developed technological infrastructure and growing automation in cold storage warehouses in the region.

b. Some key players operating in the cold chain temperature monitoring market include Berlinger & Co. AG, DeltaTrak Inc., ELPRO-BUCHS AG, Roambee Corporation, Omega Engineering, Inc., Sensitech (Carrier), TempSen Electronics, Thermo Electric Company, Inc., Testo SE & Co. KGaA, Monnit Corporation, Shandong Renke Control Technology Co.,Ltd., and Dickson.

b. Key factors driving market growth include the need to preserve the quality of temperature-sensitive products and meet regulatory compliance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."