- Home

- »

- Communication Services

- »

-

Commerce Cloud Market Size, Share & Trends Report, 2030GVR Report cover

![Commerce Cloud Market Size, Share & Trends Report]()

Commerce Cloud Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Platform, Services), By Offering (Private Cloud, Public Cloud, Hybrid Cloud), By Enterprise Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-443-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Commerce Cloud Market Size & Trends

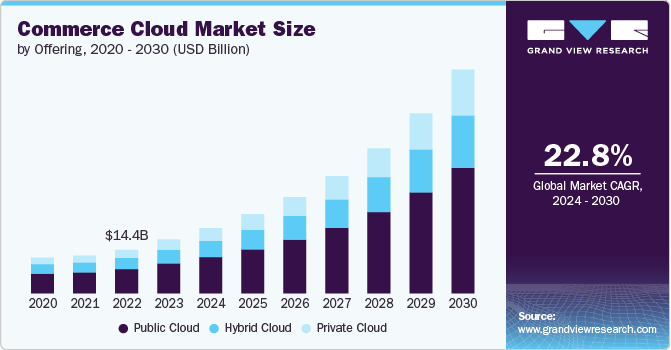

The global commerce cloud market size was estimated at USD 17.78 billion in 2023 and is expected to grow at a CAGR of 22.8% from 2024 to 2030. The market is experiencing robust growth driven by several key factors. The increasing shift towards e-commerce, accelerated by the COVID-19 pandemic, has pushed businesses of all sizes to adopt cloud-based commerce solutions to enhance scalability, flexibility, and customer engagement. The need for personalized customer experiences, omnichannel retail strategies, and seamless integration across various platforms has fueled the demand for advanced commerce cloud platforms. Moreover, the rapid adoption of mobile commerce and the increasing preference for subscription-based business models are further propelling the market growth.

Significant opportunities are emerging within the market, particularly in artificial intelligence (AI) and machine learning (ML) integration. These technologies enable businesses to analyze vast customer data, optimize pricing strategies, and deliver highly personalized shopping experiences. In addition, the rise of digital payments and the growing demand for B2B e-commerce solutions present substantial opportunities for market growth. Companies that leverage AI-driven analytics and offer comprehensive B2B solutions are poised to capture a larger market share.

Key market trends include the growing emphasis on sustainability and ethical consumerism. Consumers increasingly favor brands that demonstrate a commitment to environmental and social responsibility. As a result, commerce cloud providers are incorporating features that enable businesses to track and report on sustainability metrics, offering transparency to eco-conscious consumers. Another trend is the rise of headless commerce, which decouples the front-end presentation layer from the back-end commerce engine, allowing for greater flexibility and customization in creating unique customer experiences.

Moreover, the increasing scrutiny of antitrust practices, especially in the tech industry, may influence market dynamics, particularly for large cloud providers. Companies must navigate legal challenges while adapting to evolving political landscapes, which can impact trade policies, tariffs, and cross-border data flows. Furthermore, the market's legal and political environment is complex and varies across regions. Data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, impose stringent requirements on how businesses collect, store, and process customer data. Compliance with these regulations is critical for businesses operating in the global market, as non-compliance can result in hefty fines and damage to brand reputation.

Offering Insights

The public segment accounted for the largest market share of over 56% in 2023. The public cloud segment in the market is experiencing robust growth, driven by the increasing adoption of cloud-native technologies by enterprises looking to scale operations rapidly. A key trend is the shift toward omnichannel retail strategies, which require scalable and flexible infrastructure that public cloud solutions offer. Retailers increasingly leverage public cloud platforms to unify their online and offline sales channels, enhance customer experiences, and implement advanced analytics for personalized marketing. Furthermore, the lower upfront costs and pay-as-you-go pricing models of public cloud services make it an attractive option for businesses, particularly SMEs, aiming to minimize capital expenditures while maintaining the ability to scale quickly.

The hybrid segment is expected to grow significantly during the forecast period. The hybrid cloud segment is gaining traction in the market, particularly among enterprises that require a balance between the scalability of the public cloud and the control offered by private cloud infrastructure. A key trend driving this growth is the need for businesses to maintain control over sensitive data and mission-critical applications while taking advantage of the public cloud’s scalability and flexibility. Hybrid cloud solutions allow companies to optimize their IT environments by placing sensitive workloads on private clouds and less critical operations on public clouds. This enables a tailored approach that meets specific business needs.

Type Insights

The platform segment accounted for the largest market share of over 62% in 2023. The growing demand for scalable and customizable e-commerce solutions primarily drives the platform segment in the market. Businesses increasingly seek platforms to support complex and personalized customer experiences, allowing them to differentiate themselves in a competitive digital marketplace. This trend is fueled by the need for seamless integration with existing IT infrastructure, enabling businesses to unify their online and offline operations. The shift towards omnichannel retailing is another significant driver, as companies look for platforms that can offer a consistent experience across various touchpoints, including web, mobile, and social media. The increasing adoption of AI and ML within commerce cloud platforms also presents opportunities for businesses to leverage advanced analytics, personalized recommendations, and automated customer service, driving further growth in this segment.

The service segment is experiencing growth driven by the increasing complexity of digital transformation initiatives. As businesses adopt commerce cloud platforms, the need for professional services such as implementation, integration, and support has surged. This trend is particularly pronounced in large enterprises requiring tailored solutions to meet specific business and regulatory requirements. The growing demand for managed services, which provide ongoing support and optimization of commerce cloud environments, is also a key driver. These services help businesses maximize the value of their commerce cloud investments by ensuring optimal performance, security, and scalability. Moreover, the rise of hybrid and multi-cloud strategies creates opportunities for service providers to offer expertise in integrating and managing diverse cloud environments, further driving growth in this segment.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of over 58% in 2023. large enterprises are increasingly adopting cloud solutions because they need scalable, robust, and integrated systems that can handle complex operations and high transaction volumes. One of the key trends driving growth in this segment is the push toward digital transformation and the need for advanced, customizable platforms that integrate seamlessly with existing enterprise systems. Large enterprises leverage commerce cloud solutions to enhance customer experience through advanced analytics, personalized marketing, and seamless omnichannel integration. These platforms enable enterprises to optimize their supply chain, improve inventory management, and streamline operations across multiple regions.

SMEs is expected to grow significantly during the forecast period. In the SMEs industry, the market is driven by the need for cost-effective, scalable, and user-friendly solutions that can support rapid growth and adaptation. One of the significant trends in this segment is the growing adoption of subscription-based and pay-as-you-go models, which provide SMEs with the flexibility to scale their operations without the burden of heavy upfront investments. Cloud solutions offer SMEs access to advanced technology and features previously out of reach due to budget constraints. The rise of e-commerce and digital channels has made it essential for SMEs to adopt cloud platforms that can enhance their online presence, streamline order processing, and provide a seamless shopping experience for customers.

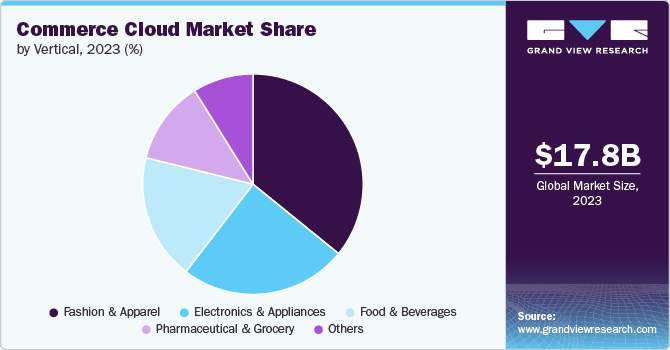

Vertical Insights

The fashion and apparel segment accounted for the largest market share of over 36% in 2023. The fashion and apparel segment within the market is experiencing robust growth, driven primarily by the accelerated shift towards digital shopping experiences and the demand for personalized customer interactions. As consumers increasingly prioritize convenience and a seamless shopping journey, fashion retailers leverage commerce cloud solutions to enhance their online platforms with advanced features such as virtual fitting rooms, AI-driven recommendations, and real-time inventory updates. Integrating these technologies enables brands to deliver a more engaging and customized shopping experience, essential for capturing the attention of the modern, tech-savvy consumer.

The pharmaceuticals segment is expected to grow significantly during the forecast period. In the pharmaceuticals segment, the market is driven by the increasing complexity of the supply chain and the need for more efficient, compliant, and transparent operations. Pharmaceutical companies are adopting cloud-based solutions to streamline their order fulfillment processes, manage inventory more effectively, and ensure regulatory compliance. These solutions provide a centralized platform for managing vast amounts of data, from drug formulations to distribution logistics, and enable real-time tracking and analytics, which is crucial for ensuring product availability and safety.

Regional Insights

The commerce cloud market in North America held a market share of over 35% in 2023. The market is experiencing significant growth driven by the increasing adoption of digital transformation strategies and advanced cloud technologies among businesses. The rapid shift towards e-commerce and omnichannel retailing is a primary factor as companies seek to enhance customer experiences and operational efficiency: major technology hubs and a highly developed infrastructure further support market expansion. Opportunities in North America include leveraging AI and machine learning for personalized customer experiences and expanding into emerging sectors like IoT and blockchain to drive innovation in commerce solutions.

U.S. Commerce Cloud Market Trends

The commerce cloud market in the U.S. is growing significantly at a CAGR of 19.1% from 2024 to 2030. The US market is thriving due to the rapid adoption of cloud-based solutions by a diverse range of industries, including retail, manufacturing, and technology. The market is bolstered by high investment in innovation and infrastructure, alongside a strong emphasis on enhancing customer engagement through digital channels. The increasing need for agile, scalable solutions to handle large transactions and customer interactions presents growth opportunities.

Asia Pacific Commerce Cloud Market Trends

The commerce cloud market in Asia Pacific is growing at the fastest CAGR of 26.1% from 2024 to 2030. In Asia Pacific, the market is driven by the region's rapid economic growth, increasing internet penetration, and a burgeoning middle class. The expansion of e-commerce platforms and digital payment systems across countries like China, India, and Southeast Asian nations is a significant growth driver. Opportunities in this region include capitalizing on the rising demand for localized solutions and mobile-first strategies and addressing the unique challenges of data privacy and regulatory compliance in diverse markets. The growing focus on digital transformation in enterprises also presents substantial growth potential for commerce cloud solutions.

Europe Commerce Cloud Market Trends

The commerce cloud market in Europe is growing significantly at a CAGR of 22.5% from 2024 to 2030. This is due to the region's focus on digitalization and regulatory advancements that promote cloud adoption. The European Union’s General Data Protection Regulation (GDPR) has driven businesses to seek cloud solutions that ensure data security and compliance. In addition, the rise of cross-border e-commerce and the demand for scalable and flexible cloud platforms fuel growth. Opportunities lie in integrating advanced analytics and AI to offer tailored solutions for diverse consumer preferences and regulatory environments across European countries.

Key Commerce Cloud Company Insights

Some of the key players operating in the market include Salesforce.com, Inc., IBM Corporation, SAP SE, Oracle Corporation, BigCommerce Pty. Ltd., Shopify Inc., Episerver, Amazon Web Services, Inc., Adobe, Inc., Apttus Corporation, and Google LLC, among others. The companies focus on various strategic initiatives, including new product development, partnerships, collaborations, and agreements, to gain a competitive advantage over their rivals.

Key Commerce Cloud Companies:

The following are the leading companies in the commerce cloud market. These companies collectively hold the largest market share and dictate industry trends.

- Salesforce.com, Inc.

- IBM Corporation

- SAP SE

- Oracle Corporation

- BigCommerce Pty. Ltd.

- Shopify Inc.

- Episerver

- Amazon Web Services, Inc.

- Adobe, Inc.

- Apttus Corporation

- Google LLC

Recent Developments

-

In May 2024, Salesforce unveiled three new commerce cloud innovations to enhance commerce site development and checkout processes. These updates boost revenue and deliver highly personalized customer experiences, addressing the heightened expectations for seamless, omnichannel integration.

-

In September 2023, Merkle unveiled a global accelerator for Salesforce Commerce Cloud, enhancing its integration with Contentful and Magnolia. This new tool facilitates a modern, composable, API-first architecture, speeding up brand implementation. By streamlining the connection between Salesforce Commerce Cloud and leading content management systems, Merkle boosts time to market and innovation in front-end consumer experiences. This advancement underscores Merkle’s leadership in eCommerce technology and supports businesses in efficiently adopting headless content management solutions.

Commerce Cloud Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21.46 billion

Revenue forecast in 2030

USD 73.68 billion

Growth rate

CAGR of 22.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, offering, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa.

Key companies profiled

Salesforce.com, Inc.; IBM Corporation; SAP SE; Oracle Corporation; BigCommerce Pty. Ltd.; Shopify Inc.; Episerver; Amazon Web Services, Inc.; Adobe, Inc.; Apttus Corporation; Google LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commerce Cloud Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global commerce cloud market report based on type, offering, enterprise size, vertical, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Services

-

-

Offering Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private Cloud

-

Public Cloud

-

Hybrid Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fashion and Apparel

-

Electronics and Appliances

-

Food and Beverages

-

Pharmaceutical and Grocery

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commerce cloud market was valued at USD 17.78 billion in 2023 and is expected to reach USD 21.46 billion in 2024.

b. The global commerce cloud market is expected to grow at a compound annual growth rate of 22.8% from 2024 to 2030 to reach USD 73.68 billion by 2030.

b. The platform segment accounted for the largest market share of over 62% in 2023. The platform segment in the commerce cloud market is primarily driven by the growing demand for scalable and customizable e-commerce solutions. Businesses are increasingly seeking platforms that can support complex and personalized customer experiences, allowing them to differentiate themselves in a competitive digital marketplace.

b. Key players in the commerce cloud market include Salesforce.com, Inc., IBM Corporation, SAP SE, Oracle Corporation, BigCommerce Pty. Ltd., Shopify Inc., Episerver, Amazon Web Services, Inc., Adobe, Inc., Apttus Corporation, and Google LLC.

b. The need for personalized customer experiences, omnichannel retail strategies, and seamless integration across various platforms has fueled the demand for advanced commerce cloud platforms. Moreover, the rapid adoption of mobile commerce and the increasing preference for subscription-based business models are further propelling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.