- Home

- »

- Animal Health

- »

-

Companion Animal Arthritis Market Size & Share Report, 2030GVR Report cover

![Companion Animal Arthritis Market Size, Share & Trends Report]()

Companion Animal Arthritis Market Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Indication, By Treatment, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-953-1

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global companion animal arthritis market size was valued at USD 3.07 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.95% from 2023 to 2030. The increasing companion animal population, growing prevalence of arthritis, rising risk factors for the disease, supportive awareness programs initiated by governments, and strategies implemented by key companies are some of the key factors driving the market.

For instance, in November 2021, American Veterinary Medical Association reported that the companion animal population has increased significantly from 2016 to 2020. As per the article, the dog population in the U.S. was estimated at 76.8 million in 2016, which increased to 83.7 million in 2020. Similarly, the cat population increased from 58.4 million in 2016 to 60 million in 2020. This is expected to contribute to market growth.

The COVID-19 pandemic has resulted in a market decline, especially in 2020. This unfavorable impact is mainly due to the lockdown declaration in various countries and respective restricted access to and closure of veterinary services. The pandemic has created barriers among pet owners in accessing better veterinary care due to the forced limitation and cancellation of veterinary appointments. The key market players have faced difficult challenges in maintaining veterinary product supply due to the uncertainty of distribution channels. For instance, Elanco stated in the 2021 annual report that the company’s revenue decreased by USD 160 million during the first half of 2020. Similarly, the market player American Reagent Inc. saw a decreased revenue owing to the spread of COVID-19.

However, the government agencies and key players have taken various measures to continue their animal arthritis business during the pandemic. For instance, Boehringer Ingelheim International GmbH took comprehensive measures to overcome the pandemic challenges and has significantly maintained its animal health business. The company gained USD 2.31 billion in the animal health business during the first half of 2020, which was an increase from the USD 2.2 billion in sales of the previous year. Some companies prioritized employee safety by taking measures while also maintaining the drug manufacturing process. For instance, Norbrooks invested USD 1.57 million in COVID-19 measures and extended its business unit infrastructure to maintain social distance.

Some of the key drivers propelling the market growth include the increasing adoption of pet insurance, increased animal healthcare expenditure, R&D initiatives by key companies, post-pandemic return to normal, and the expansion of medication offerings. For instance, according to the Insurance Information Institute, Inc., pet care expenditure grew from USD 53.3 in 2012 to USD 123.6 in 2021. Out of which, nearly USD 1,480 is spent per dog and USD 943 is spent per cat in a year. Similarly, as per FEDIAF, in 2020, nearly 21.8 billion is spent on pet-food products and 21.2 billion is spent on other pet-related services and products in Europe. These affirmative factors are contributing to the growth of the market during the forecast period.

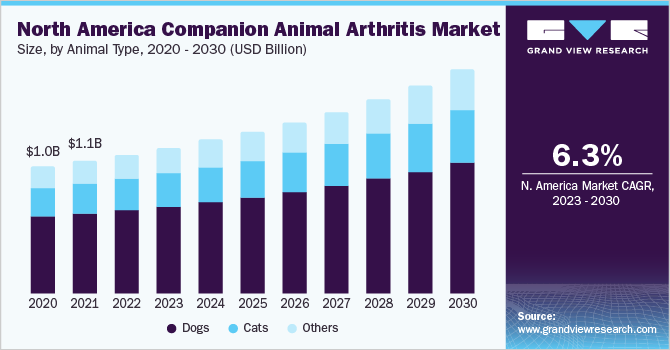

Animal Type Insights

The dogs' segment dominated the global market with a share of over 60.0% in 2022. This is due to the rising adoption rates of dogs and the high disease prevalence that was seen among them. The growing population rate of dogs in every region is further boosting the growth of the market. According to the American Veterinary Medical Association, 45% of American households owned dogs in 2020. Similarly, as per the European Pet Food Industry, nearly 88 million households in Europe owned a pet, and the dog population rate in the region was estimated to be 90 million in 2020. In addition, the COVID-19 pandemic has encouraged most people in the world to adopt companion animals for psychological comfort.

The cats' segment is anticipated to expand at a highest CAGR of 7.0% during the forecast period owing to the increasing awareness among pet parents concerning symptoms of arthritis in their cats. The growing prevalence of osteoarthritis in the cat population is another factor that is boosting the growth of the segment. For instance, according to International Cat Care (ICC), nearly 90% of cats regardless of age suffer from arthritis. The larger breeds are more prevalent to have osteoarthritis. However, due to the natural ability of cats to hide pain owing to their survival instinct, pet owners miss the subtle symptoms shown by their cats during early-stage of arthritis. Such factors might hamper timely diagnosis.

Indication Insights

The osteoarthritis segment dominated the market in 2022 with a revenue share of over 75.0% and estimated to grow the fastest at a rate of about 8% during the forecast period. This is owing to the large number of companion animals diagnosed with osteoarthritis. According to the American College of Veterinary Surgeons, nearly a quarter of the dog population in the U.S. is prone to developing osteoarthritis. This condition is also seen among cats causing clinical signs such as weight loss, depression, and inability to jump or move actively. For instance, in January 2021, the Veterinary Ireland Journal stated that 40% of every cat shows the aforementioned signs, wherein 90% of older cats develop osteoarthritis.

The other arthritis segment is expected to grow significantly during the forecast period. It includes rheumatoid, septic, and poly arthritis conditions. Rheumatoid arthritis in dogs is chronic leading to severe pain and inflammation in joints. It is less common compared to osteoarthritis, but still significantly affects small cats and dogs. In dogs, it can be diagnosed using a canine rheumatoid factor immunologic test in veterinary hospitals or clinics. Research studies indicated that corticosteroids, cyclosporine, and NSAIDs are the best treatments for rheumatoid arthritis in companion animals.

Treatment Insights

The medication segment held the largest revenue share of over 55.0% in 2022. This is owing to a large number of product launches by veterinary pharmaceutical companies. The NSAIDs, opioids, steroids, stem cells, antibodies, and others are available medication drugs for arthritis in companion animals. The rising risk factors such as obesity, age, and nutritional impairments among pets are increasing the prevalence of arthritis in them. It thereby enhances the awareness among pet owners to start timely treatments for their pets. Supplements are initially prescribed by veterinarians when the symptoms of arthritis are less obvious. This factor increases the demand for supplements among pet owners.

The other treatments such as rehabilitation, lifestyle management, and novel medications are significantly evolving to improve the quality of life for companion animals associated with arthritis. The treatments such as surgery are considered when the medication fails to manage the arthritis condition in companion animals. Most common surgical procedures include joint replacement, joint fusion, and surgical removal of the affected joint. Arthroscopy is a minimally invasive surgical approach that reduces postoperative pain in dogs and cats. Other non-medication treatment options such as weight management, environmental modifications, and physical rehabilitation are also recommended by veterinarians.

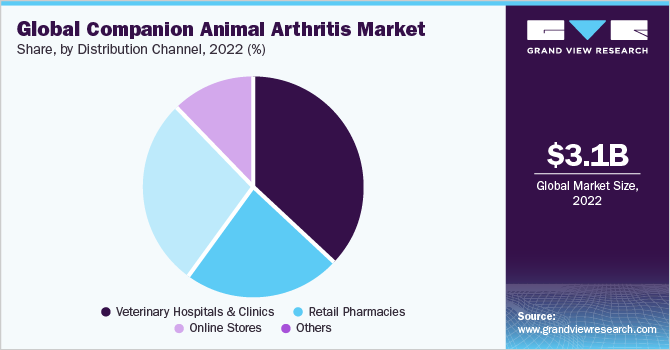

Distribution Channel Insights

The veterinary hospitals and clinics segment held the largest revenue share of 35% in 2022. This is owing to a growing number of veterinary hospitals and clinics globally with advanced infrastructures. The veterinary clinics and hospitals are very crucial for pet healthcare as they help pet owners understand the proper dosage of arthritis medicine with timely diagnosis. The growing number of veterinary professionals is another factor driving the segment. According to the Federation of Veterinarians of Europe, the number of veterinarians was approximately 263 million in Europe in 2019.

The online stores segment is projected to grow the fastest at a rate of about 7%. The other distribution channels such as retail pharmacies, online stores, and research institutes are widely contributing to the growth of the market. With an increased number of households owning companion animals, their demand for convenient access to pet arthritis supplements and NSAIDs is increasing. There are various brands of oral supplements, NSAIDs, opioids, and essential oils available in retail vet pharmacies for arthritis application in companion animals. The online sales of pet arthritic products have grown widely during the COVID-19 pandemic. E-commerce or online stores have become a convenient and easily accessible platform for pet medication products.

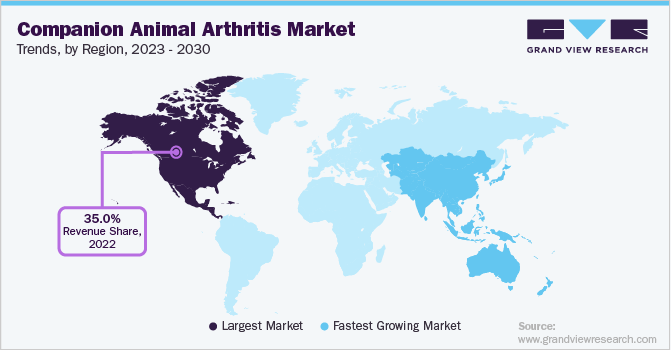

Regional Insights

North America held the largest revenue share of more than 35% in 2022. This is due to the significant presence of key players, the adoption of various strategies initiated by key companies to increase market penetration, rising treatment availability, rising diagnostic rates, and increasing pet population and expenditure. The growing number of veterinary clinics with licensed and trained veterinarians in the countries is another factor expected to boost the growth of the market. According to the AVMA, in 2020, nearly 118,624 licensed veterinarians were estimated in the U.S., which majorly catered to companion animal patients

The European region held the second-largest revenue share in 2021. This is owing to the presence of major players such as Boehringer Ingelheim International GmbH in the European countries. The Asia Pacific region is estimated to expand at the highest CAGR of about 8% in the forecast period. This is attributed to the rising animal healthcare expenditure and disposable income in key markets and increasing awareness about the disease in developing countries. The growing demand for the proper and timely diagnosis of companion animal arthritis in developing countries like India is further boosting the growth of the market.

Key Companies & Market Share Insights

The market is competitive. Leading players deploy various strategic initiatives including competitive pricing strategies, partnerships, product and service expansion, sales and marketing initiatives, and mergers & acquisitions. For instance, in January 2022, Zoetis received FDA approval for Solentia, a monoclonal antibody injection in the U.S. This frunevetmab injection is intended for osteoarthritis pain in cats. Similarly, the new manufacturing units launched by the key companies are enhancing their overall industry presence. For instance, in April 2022, Elanco collaborated with Ginkgo Bioworks to launch a new veterinary company BiomEdit. This was opened to introduce engineered microbes and probiotics in veterinary care services. Such initiatives by organizations and companies are propelling market growth. Some prominent players in the global companion animal arthritis market include:

-

Zoetis

-

Virbac

-

Elanco

-

Boehringer Ingelheim International GmbH

-

Ceva

-

Dechra Pharmaceuticals PLC.

-

Vetoquinol

-

NexGen Pharmaceuticals

-

Norbrook

-

Eltech K-Laser s.r.l.

Companion Animal Arthritis Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 3.24 billion

The revenue forecast in 2030

USD 5.18 billion

Growth rate

CAGR of 6.95% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, indication, treatment, distribution channel, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Zoetis; Virbac; Elanco; Boehringer Ingelheim International GmbH; Ceva; Dechra Pharmaceuticals PLC.; Vetoquinol; NexGen Pharmaceuticals; Norbrook; Eltech K-Laser s.r.l

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels. It provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global companion animal arthritis market report based on animal type, indication, treatment, distribution channel, and region:

-

Animal Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2017 - 2030)

-

Osteoarthritis

-

Other Arthritis

-

-

Treatment Outlook (Revenue, USD Million, 2017 - 2030)

-

Medication

-

NSAIDs

-

Monoclonal Antibodies

-

Others Medications

-

-

Supplements

-

Other Treatment

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Veterinary Hospitals & Clinics

-

Retail Pharmacies

-

Online Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global companion animal arthritis market size was estimated at USD 3.07 billion in 2022 and is expected to reach USD 3.24 billion in 2023.

b. The global companion animal arthritis market is expected to grow at a compound annual growth rate (CAGR) of 6.95% from 2023 to 2030, to reach USD 5.18 billion by 2030.

b. North America dominated the companion animal arthritis market with a share of over 30% in 2022. This is attributable to the increasing animal healthcare expenditure and the region's constant research & development initiatives.

b. Some key players operating in the companion animal arthritis market include Zoetis, Virbac, Elanco, Boehringer Ingelheim International GmbH, Ceva, Dechra Pharmaceuticals PLC., Vetoquinol, NexGen Pharmaceuticals, Norbrook, and Eltech K-Laser s.r.l.

b. Key factors that are driving the companion animal arthritis market growth include the growing prevalence of arthritis in companion animals coupled with the increasing adoption of pet insurance, the increasing companion animal population, and rising risk factors for CA arthritis.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."