- Home

- »

- Biotechnology

- »

-

Competent Cells Market Size & Share, Industry Report, 2033GVR Report cover

![Competent Cells Market Size, Share & Trends Report]()

Competent Cells Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Chemically Competent Cells, Electrocompetent Cells, Ultracompetent Cells), By Application (Cloning, Protein Expression, Mutagenesis), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-310-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Competent Cells Market Summary

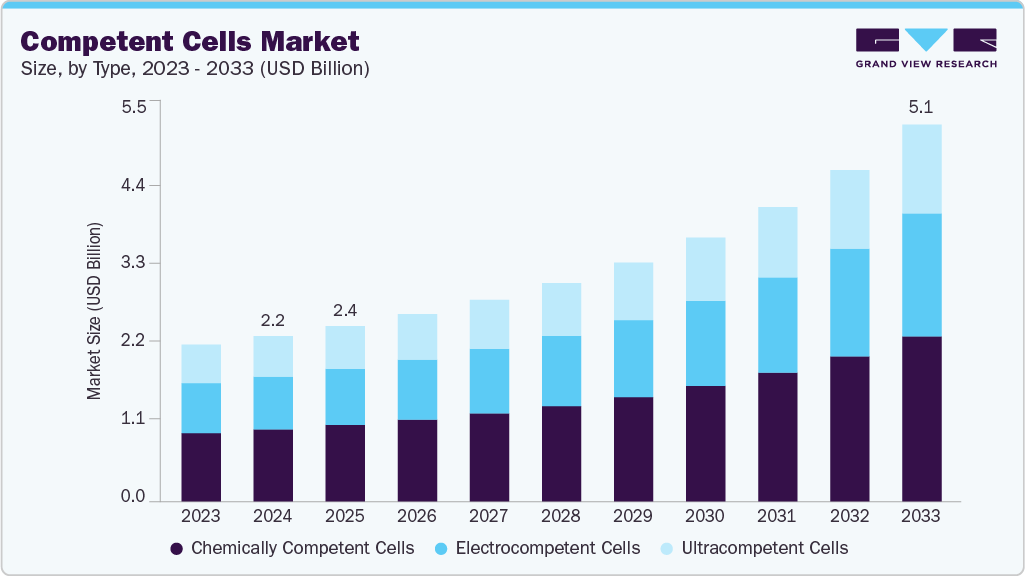

The global competent cells market size was estimated at USD 2.25 billion in 2024 and is projected to reach USD 5.12 billion by 2033, growing at a CAGR of 10.03% from 2025 to 2033, driven by growing adoption of advanced molecular cloning techniques, increasing demand for recombinant proteins, and expanding uses in drug discovery and biotechnology research. As genetic engineering and synthetic biology advance, the demand for effective and high-performance competent cells is expected to increase throughout the forecast period.

Key Market Trends & Insights

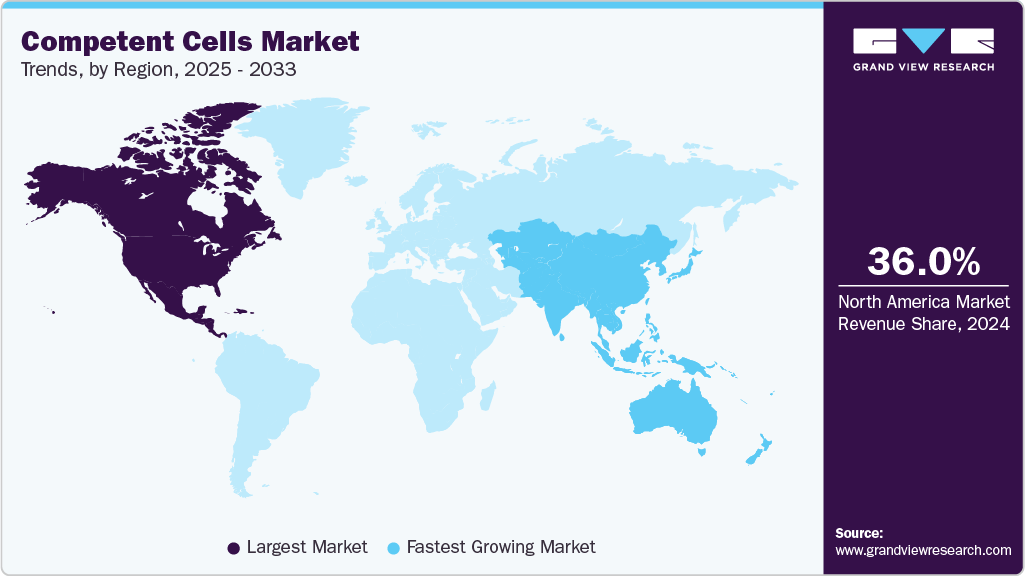

- The North America competent cells market held the largest share of 36.03% of the global market in 2024.

- The competent cells industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the chemically competent cells segment held the highest market share of 43.58% in 2024.

- Based on application, the cloning segment held the highest market share in 2024.

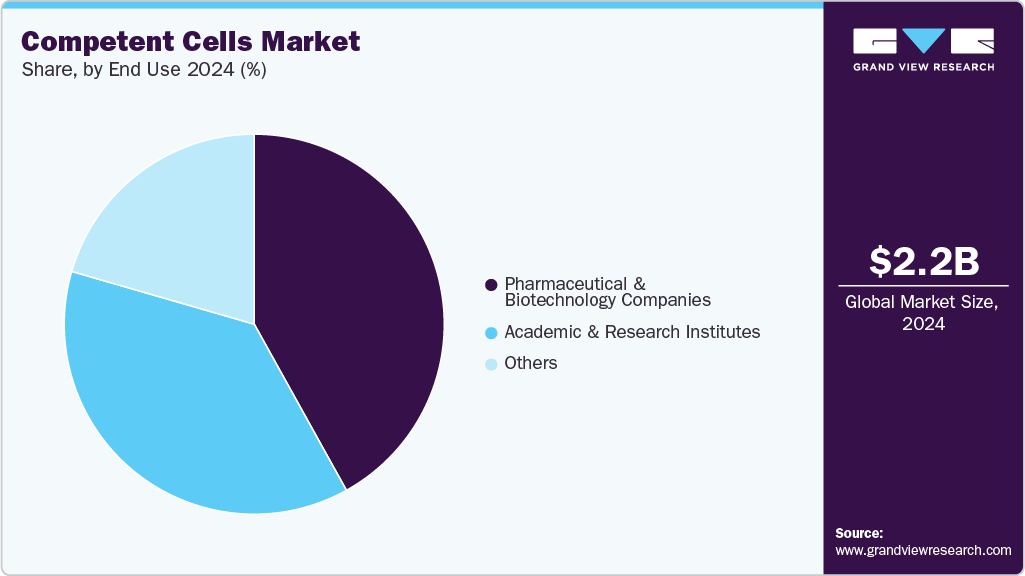

- By end use, the pharmaceutical & biotechnology companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.25 Billion

- 2033 Projected Market Size: USD 5.12 Billion

- CAGR (2025-2033): 10.03%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing Demand for Recombinant Proteins & Enzymes

The rapid growth of recombinant protein and enzyme production is a key driver of the competent cells market. Biopharmaceutical firms rely on the use of recombinant proteins, such as monoclonal antibodies, hormones, cytokines, and biosimilars developed from engineered microbes, for applications in food processing, diagnostics, biofuels, and the biotech industry. Competent cells are required to enable clonal and expression workflows in these applications, for both research laboratories and larger-scale manufacturing. Competent cell performance is in high demand as biologics pipelines expand and the need for new and innovative therapies grows, prompting high transformation efficiency and yield during protein production.

Competent Cells Across the Biotech Workflow

Stage

Role of Competent Cells

DNA Design / Gene Construction

Competent cells are used to clone and assemble gene fragments, plasmids, and DNA libraries. They enable the incorporation of synthetic DNA constructs designed for engineering proteins, metabolic pathways, and gene circuits. This forms the foundation for downstream experiments and product development.

Transformation / DNA Uptake

Competent cells facilitate efficient uptake of plasmid DNA, ensuring successful transformation. High-efficiency strains help laboratories and biopharma companies achieve high cloning success rates, reduce iterative cycles, and accelerate research timelines.

Protein & Vector Production

After successful transformation, competent cells express recombinant proteins or serve as hosts for plasmid amplification needed for viral vector manufacturing (AAV, lentiviral, mRNA production templates). This step is central to therapeutic protein production, enzyme synthesis, and vaccine development.

Scale-up & Manufacturing

Stable engineered cell strains support reliable plasmid amplification and recombinant protein synthesis at pilot and production scale. They enable consistent yield, low mutational rates, and scalability for commercial manufacturing.

Source: Secondary Research, Grand View Research

In addition, innovations in synthetic biology and metabolic engineering are expanding the applications of recombinant enzymes in sustainable materials, chemicals, and bioplastics. Increased investments in precision fermentation and cell-free protein synthesis create increased demand for optimized competent cell systems. As research institutions and biotech companies focus on cloning speed, scalability, and better expression platforms, demand for competent cells continues to grow for drug discovery, protein engineering, and industrial biomanufacturing applications.

Growth in Genetic Engineering & Synthetic Biology

The growing areas of genetic engineering and synthetic biology are primary factors in the competent cells market. These areas rely on competent cells with high efficiency for DNA cloning, plasmid construction, CRISPR editing, and microbial engineering. Demand for reliable, high-performance competent cells continues to grow as research groups implement automated cloning, AI protein design, and sophisticated genome-editing workflows.

At the same time, synthetic biology is rapidly developing into industrial applications, including biomanufacturing, sustainable chemicals, biofuels, precision agriculture, and biosensors. Increased investment in microbial strain engineering and high-throughput screening is putting pressure on finding optimized competent cell lines that enable rapid, scalable, and reproducible results.

Market Concentration & Characteristics

The competent cells industry exhibits a substantial degree of innovation, routinely advancing new technologies and processes to enhance efficiency and effectiveness. Moreover, competent cells are being applied to innovative yet unconventional applications, including drug discovery methods in medicine and therapeutics.

The competent cell industry is also characterized by a moderate level of merger and acquisition activities undertaken by several industry players. This is due to several factors, including the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market.

The regulatory frameworks for the use and production of competent cells can create challenges for market players. Compliance with regulations surrounding biosafety, genetic engineering, and other areas can add to operating costs and hinder the entry of new firms into the market.

The competent cells industry is growing due to diverse applications, improvements in biotechnology and manufacturing service delivery, and increasing investments in research and development. Many players in the industry focus on diversifying their product and service range, resulting in new product launches across various areas, including cloning, protein expression, cDNA, and genomic library construction, as well as high throughput cloning and cloning unstable DNA.

The competent cell industry is currently witnessing a moderate level of regional expansion, with growth opportunities expected from an expanding customer base for gene cloning products & services. As scientific knowledge of the technique increases globally and biotechnology becomes more accessible in emerging markets, leading players in the market are projected to accelerate their initiatives for regional expansions.

Type Insights

The chemically competent cells segment accounted for the largest market share of 43.58% in 2024, primarily due to their effective strategies, ease of use, and efficiency in heat-shock applications. They are commonly used in molecular biology workflows, such as cloning, DNA sequencing, and library construction, and are therefore a common choice for both academic and industrial research.

The electrocompetent cells segment is expected to grow at the fastest CAGR over the forecast period. Electrocompetent cells are important for introducing external DNA into host cells for purposes such as gene cloning, gene expression studies, protein production, and functional genomics. By making cells electrocompetent, researchers can effectively deliver specific DNA sequences into the cells, resulting in genetic modifications and desired phenotypic changes.

Application Insights

The cloning segment dominated the market in terms of revenue in 2024 with a market share of 44.74%. The rising prevalence of infectious and non-communicable diseases has led to an increase in the use of competent cells in research and development (R&D) activities. For instance, according to research published in April 2024, researchers developed recombinant antibodies using phage display technology to treat viral infectious diseases. The phage display libraries used in these technologies were constructed using competent E. coli cells.

The protein expression segment is anticipated to grow at the fastest CAGR over the forecast period. Competent cells are utilized for the synthesis of proteins and enzymes that can be applied in biotechnology and the food & beverage industry, driving demand in the competent cells market.

End Use Insights

In 2024, the segment of pharmaceutical and biotechnology companies had the greatest share, at 41.94%, due to increasing developments in biologics, biosimilars, gene therapies, and mRNA-based platforms. These companies rely on competent cells for essential activities, such as DNA cloning and recombinant protein production, as well as for preparing viral vectors to facilitate drug discovery and large-scale biomanufacturing.

The academic and research institutes segment is projected to exhibit the fastest CAGR during the forecast period, as academic and research institutes utilize competent cells for applications such as subcloning, generating phage display libraries, cloning unstable DNAs, high-throughput workflows, and mutagenesis, which support the market expansion.

Regional Insights

North America dominated the market, accounting for a 36.03% share in 2024, driven by advancements in molecular cloning research, the introduction of newer technologies, and rising commercial demand for molecularly cloned products. Moreover, the region benefits from substantial research and development investments, government funding for biotechnology and healthcare research, as well as highly advanced healthcare infrastructure.

U.S. Competent Cells Market Trends

The competent cells industry in the U.S. is expected to grow over the forecast period due to the robust research and development landscape in biotechnology and life sciences, which fosters innovation & technological advancements in molecular cloning techniques, as well as the presence of key players in the country.

Europe Competent Cells Market Trends

Europe competent cells market was identified as a lucrative region in this industry. Strong research & development in biology, pharmaceuticals, and therapeutics, along with the presence of key market players in the region, are factors driving market growth.

The competent cells market in the UK is expected to grow over the forecast period. The rise in demand for personalized medicine, the increased prevalence of chronic and hereditary diseases, and the surge in gene therapies have propelled the use of gene cloning techniques in the country.

The competent cells market in Germany is expected to grow over the forecast period driven by factors such as increased demand for molecularly cloned products, advancements in cloning technologies, and rising research and development investments in biotechnology sectors.

Asia Pacific Competent Cells Market Trends

Asia Pacific competent cells market is anticipated to witness the fastest CAGR of 10.66% from 2025 to 2033 in the competent cells market. The rapid growth is due to the extensive developments by countries like India and China in the adoption of protein expression in various applications, along with the emerging focus on proteomics and genomics research.

The competent cells market in China is expected to grow significantly over the forecast period, driven by increasing investments and favorable government initiatives in the field of biotechnology. For instance, in March 2022, researchers in China reported exceptionally high transformation and cloning efficiencies using E. coli BW25113, which reinforces the demand for premium competent cells that support advanced synthetic biology and high-throughput DNA assembly workflows.

Japan competent cells industry is anticipated to grow at a significant CAGR over the forecast period. The increasing demand for recombinant DNA technique products, advancement in molecular engineering, and the rising demand for therapeutic products are some of the factors expected to propel market growth.

Middle East & Africa Competent Cells Market Trends

The MEA competent cells market is projected to grow during the forecast period due to the increasing awareness and adoption of cloning techniques for developing recombinant proteins, enzymes, and novel therapeutic tools to combat rising chronic disease prevalence in the region.

Kuwait competent cells market is anticipated to witness growth over the forecast period. Kuwaiti institutions are actively collaborating with international researchers and companies in biotechnology research. This collaboration facilitates knowledge transfer and access to cutting-edge technologies, potentially accelerating market growth.

Key Component Cells Company Insights

The global competent cells industry is shaped by a strong presence of well-established biotechnology and life science companies that maintain leadership through advanced product portfolios, strategic expansions, and sustained investments in research and development. Key players, including Thermo Fisher Scientific, Merck KGaA, Agilent Technologies, Inc., Takara Bio Inc., and New England Biolabs (NEB), continue to hold notable market positions by offering high-efficiency chemically and electrocompetent cells. Their robust distribution networks and broad product range, designed for academic, clinical, and commercial use, contribute to their competitive advantage.

Companies such as Promega Corporation, Bio-Rad Laboratories, Roche Applied Science, QIAGEN, and SGI-DNA (Synthetic Genomics, Inc.) are expanding their market footprint with innovative transformation technologies, engineered microbial strains, and specialized competent cell systems designed for high-throughput workflows and synthetic biology applications. The industry is experiencing a balance between established expertise and emerging competitiveness, with strategic partnerships, product innovation, and mergers driving continuous advancement.

Key Component Cells Companies:

The following are the leading companies in the component cells market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Merck KGaA

- Agilent Technologies, Inc.

- Takara Bio Inc.

- New England Biolabs (UK) Ltd.

- Promega Corporation

- Bio-Rad Laboratories

- Roche Applied Science

- Qiagen

- SGI-DNA (Synthetic Genomics, Inc.)

Recent Developments

-

In February 2024, U.S. researchers developed a naturally competent Vibrio natriegens platform enabling rapid, low-cost plasmid transformation. This advancement accelerated synthetic biology workflows, increasing reliance on high-performance competent cells for fast cloning, strain engineering, and scalable gene expression applications.

-

In February 2024, Bio-Rad launched Vericheck ddPCR kits for replication-competent lentivirus and AAV testing in the U.S., enhancing viral vector QC workflows. As cell and gene therapy pipelines expand, higher volumes of plasmid construction and viral packaging increase cloning workloads, driving demand for high-efficiency competent cells in upstream vector development.

-

In December 2023, CCM Biosciences launched its 5Prime Sciences unit focused on advanced enzyme engineering and DNA technologies. By accelerating cloning, polymerase innovation, and synthetic biology workflows, this expansion supports rising demand for high-efficiency competent cells in recombinant DNA applications.

-

In January 2020, SGI-DNA launched Vmax X2 competent cells, which deliver faster growth and higher protein yields than E. coli, thereby boosting demand for advanced competent cells in the rapid development of vaccines and biologics.

Competent Cells Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.38 billion

Revenue forecast in 2033

USD 5.12 billion

Growth rate

CAGR of 10.03% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific; Merck KGaA; Agilent Technologies, Inc.; Takara Bio Inc.; New England Biolabs (UK) Ltd.; Promega Corporation; Bio-Rad Laboratories; Roche Applied Science; Qiagen; SGI-DNA (Synthetic Genomics, Inc.)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Component Cells Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global competent cells market on the basis of type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemically Competent Cells

-

Electrocompetent Cells

-

Ultracompetent Cells

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloning

-

Protein Expression

-

Mutagenesis

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.