- Home

- »

- Plastics, Polymers & Resins

- »

-

Composite Adhesive Market Size And Share Report, 2030GVR Report cover

![Composite Adhesive Market Size, Share & Trends Report]()

Composite Adhesive Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Acrylic, Epoxy, Polyurethane, Cyanoacrylate), By Application (Automotive & Transportation, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-051-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Composite Adhesive Market Size & Trends

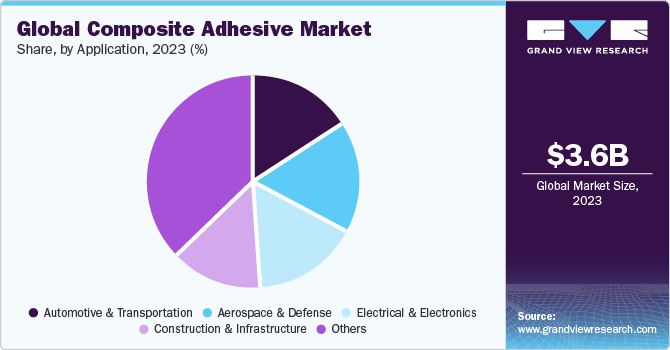

The global composite adhesive market size was valued at USD 3.61 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% in terms of revenue from 2024 to 2030. This is majorly attributed to the penetration of lightweight composites with superior strength and low-density properties in different industries like aerospace & defense, electric vehicles (EVs), sports, and others is expected to propel the demand for composite adhesives in the future. India is another lucrative market for EVs in the world. Various initiatives undertaken by the government are anticipated to propel the EV market in India over the forecast period.

For instance, as per the National Investment Promotion & Facilitation Agency, in 2023 the Indian government has set a target of 30% electrification of the total vehicles in the country by 2023. Moreover, as per the Union Budget of 2023-2024, the government has allocated a budget of 35,000 crores to achieve the energy transition at a net zero target by 2070. Multiple Indian automobile manufacturers such as TATA MOTORS and Mahindra & Mahindra have begun the production of E.V at a higher pace owing to their increasing demand Such initiatives are expected to augment EV production and sales in the country, thereby propelling the demand for composite adhesives over the forecast period.

The growth in construction spending in various economies is anticipated to augment the requirement for composites. Moreover, government initiatives toward infrastructure development, such as the reintroduced Innovative Materials for America’s Growth and Infrastructure Newly Expanded (IMAGINE) Act, are propelling the incorporation of composites in construction applications. Composite adhesives are used in construction applications as they provide strong adhesion for different materials.

The building and construction sector in the Asia Pacific is largely driven by the developing countries of the region including China, India, Malaysia, and Indonesia. The growth of the construction sector in the countries is largely attributed to the continuous support schemes offered by the government. For instance, 100% of foreign direct investment in the construction industry under automatic route is permitted in business construction, malls, and shopping complexes.

Moreover, the construction industry is experiencing a significant boom, particularly in emerging economies. Rapid urbanization, population growth, and increased investment in infrastructure projects are driving the demand for construction materials. Composite adhesives are essential in meeting the requirements of these expanding construction markets.

On the other hand, the composite adhesives manufacturing process has several environmental and health impacts. Exposure to epoxy resin compound, one of the key raw materials used in the manufacturing of composite adhesives, can lead to various health problems like allergic reactions and respiratory problems from breathing vapor. Such environmental hazards can restrain market growth.

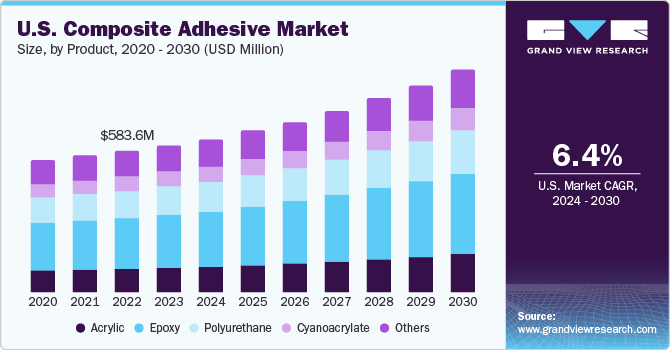

Product Insights

Epoxy accounted for the largest revenue share of around 36.58% in 2023. This is attributable to their growing utilization in numerous end-use industries, especially oil & gas, owing to their ability to withstand extreme environmental conditions. For instance, 3M’s Scotch-Weld Structural Epoxy Adhesive DP940 is used for bonding both carbon fiber-carbon fiber and carbon fiber-stainless steel configurations to achieve lighter shale shaker builds. This helps in meeting the challenge of movement and crude oil presence at high temperatures.

Polyurethane adhesives exhibit superior properties such as fast curing, good abrasion & chemical resistance, and excellent bond strength on various substrates such as metals, plastics, rubber, wood, and glass. These adhesives are generally based on reactive technology. Polyurethane adhesives are produced from polymers containing urethane linkages in the molecular backbone, regardless of the chemical composition of the rest of the chain.

Acrylic adhesives are prominently used for adhesion in various rigid and semi-rigid bonding applications such as automotive and medical. They provide high-strength bonds to composites along with high peel strength. They are highly preferred in a wide range of end-use industries owing to characteristics such as fast curing time and acid & solvent resistance. These factors are expected to contribute toward the growth in their demand over the forecast period.

Application Insights

Aerospace & Defense accounted for the largest revenue share of around 17.42% in 2023, as composite adhesives are used extensively in the aerospace & defense sector owing to their ability to provide strong bonding to the composite materials. Composite materials are widely deployed in the manufacturing of aircraft and military vehicles. Increasing consumption of composite materials in various parts of the aircraft including engines, interior, windows, electrical systems, and other structures is augmenting the demand for the product in this application segment.

Automotive companies are investing in the composites industry considering the potential growth opportunities. For instance, in April 2021, Sundaram Finance Holdings Limited (SFHL), a company with investments in India-based TVS Group, entered into a strategic partnership with Italy-based Mind S.r.l. (Mind Composites). This partnership marks the entry of SFHL in the composites industry at a time when weight reduction in vehicles is becoming of prime importance. Such partnerships are anticipated to further aid the demand for composite adhesives in the automotive industry.

Composite materials have various applications in the electronics & electrical segment, including electromagnetic shielding, wearable devices, batteries, electrical switching & insulations, and sensors. Hence, the growing penetration of composite materials in this end-use segment is propelling the demand for composite adhesives for the assembling of the components. Increasing demand for electronic devices is leading to investments in new manufacturing plants by key consumer electronics manufacturers to focus on expanding their production capacities.

Regional Insights

Asia Pacific region accounted for the largest revenue share of around 48.22% in 2023. This is attributable to the increasing requirement for composite-based products in EVs, renewables, aerospace & defense, and construction industries from the region.

Emphasis on lightweight materials is anticipated to augment the demand for composite materials and consequently benefit the demand for adhesives over the coming years. In February 2022, the Netherlands-based Venturi Aviation partnered with the Netherlands-based Airborne, a company engaged in offering solutions for advanced composites, for using lightweight composite structures for an all-electric commuter aircraft, Echelon 01. Such innovations are expected to propel the use of lightweight composite materials and eventually propel the demand for adhesives over the forecast period.

There have been rising investments in EVs and battery production in Canada, which is anticipated to positively influence the demand for composite adhesives in the country. For instance, in early 2022 Tesla Inc. announced plans to establish a new factory to produce battery manufacturing equipment in Markham, Canada. EV battery packs use a wide variety of adhesives in their production. Such investments are expected to propel the use of composite adhesives in North America over the forecast period.

Key Companies & Market Share Insights

The global composite adhesive market is highly competitive owing to the presence of various emerging and established players. In 2022, companies like DOW, Henkel AG & Co. KGaA, 3M, and Sika accounted for more than 30% of the market share in the market and demonstrated significant leadership in the market. These companies have a global geographical presence catering to a large number of industries worldwide. They also offer a wide range of Composite Adhesive which is used in various applications to their clientele across Europe, U.S., Japan, China, and other Asian countries.

In addition, these companies are also undertaking numerous strategic initiatives like expansion, merger & acquisition, partnerships, new product launches, and others. For instance, in February 2023, Henkel AG & Co. KGaA announced an agreement with the International Centre for Industrial Transformation participation program. (INCIT). The company’s adhesive technologies business section hopes to use INCIT; tools and frameworks to advance the digital transformation of its operations by joining INCIT’s partner network.

Key Composite Adhesive Companies:

- 3M

- Bostik

- Dow

- Henkel AG & Co. KGaA

- H.B. Fuller

- Huntsman International LLC.

- Illinois Tool Works Inc.

- Permabond LLC

- Parker Hannifin Corp

- Sika AG

Composite Adhesive Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.75 billion

Revenue forecast in 2030

USD 5.08 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Volume in Kilotons, Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Volume, and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

3M; Bostik; Dow; Henkel AG & Co. KGaA; H.B. Fuller; Huntsman International LLC.; Illinois Tool Works Inc.; Permabond LLC; Parker Hannifin Corp; Sika AG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Composite Adhesive Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global composite adhesive market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Epoxy

-

Polyurethane

-

Cyanoacrylate

-

Others

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Aerospace & Defense

-

Electrical & Electronics

-

Construction & Infrastructure

-

Others

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global composite adhesive market was estimated at USD 3.61 billion in 2023 and is expected to reach USD 3.75 billion in 2024.

b. The global composite adhesive market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 5.08 billion by 2030.

b. Epoxy was the key product segment of the market with a revenue share of above 36.58% of the market in 2023.

b. Some of the key players operating in the composite adhesive market are 3M, Bostik, Dow, Henkel AG & Co. KGaA, and Huntsman Corporation LLC, among others.

b. Increasing investments in electric vehicle production and the construction industry are the growth drivers for the composite adhesive market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.