- Home

- »

- Healthcare IT

- »

-

Computational Pathology Market Size, Industry Report, 2030GVR Report cover

![Computational Pathology Market Size, Share & Trends Report]()

Computational Pathology Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Application (Disease Diagnosis, Drug Discovery & Development, Academic Research), By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-548-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Computational Pathology Market Summary

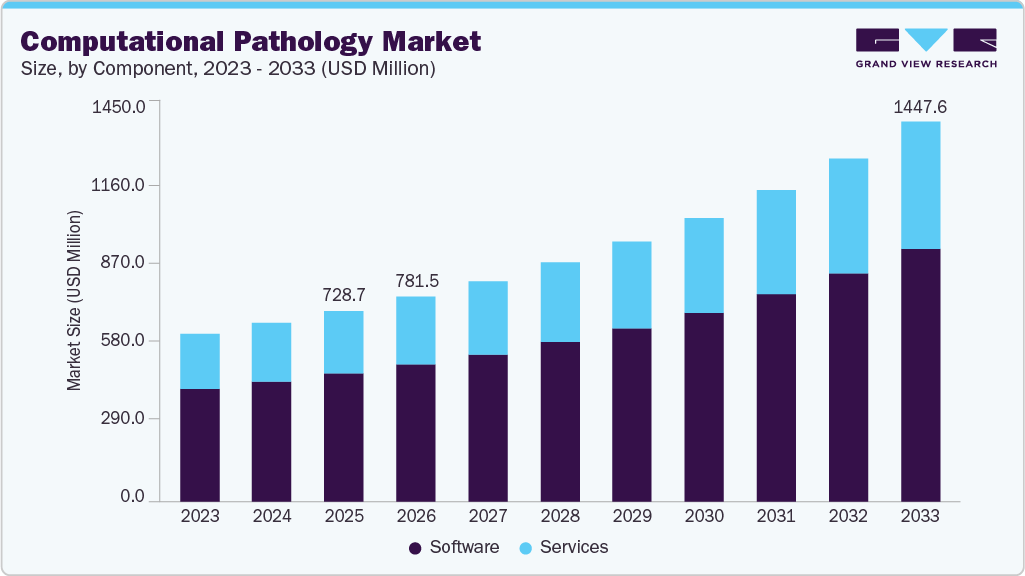

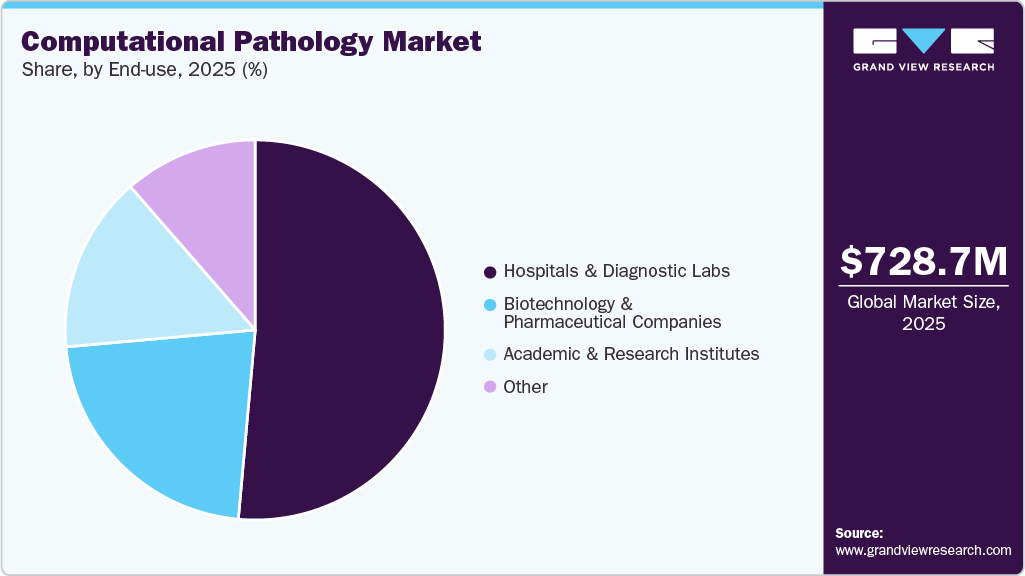

The global computational pathology market size was estimated at USD 728.68 million in 2025 and is projected to reach USD 1,447.62 million by 2033, growing at a CAGR of 9.21% from 2026 to 2033. The growth is attributed to the rising integration of machine learning and artificial intelligence (AI) technologies, the increasing demand for advanced solutions for faster diagnosis, the rising prevalence of chronic diseases, and increasing investment in healthcare, supported by market players focused on developing advanced solutions.

Key Market Trends & Insights

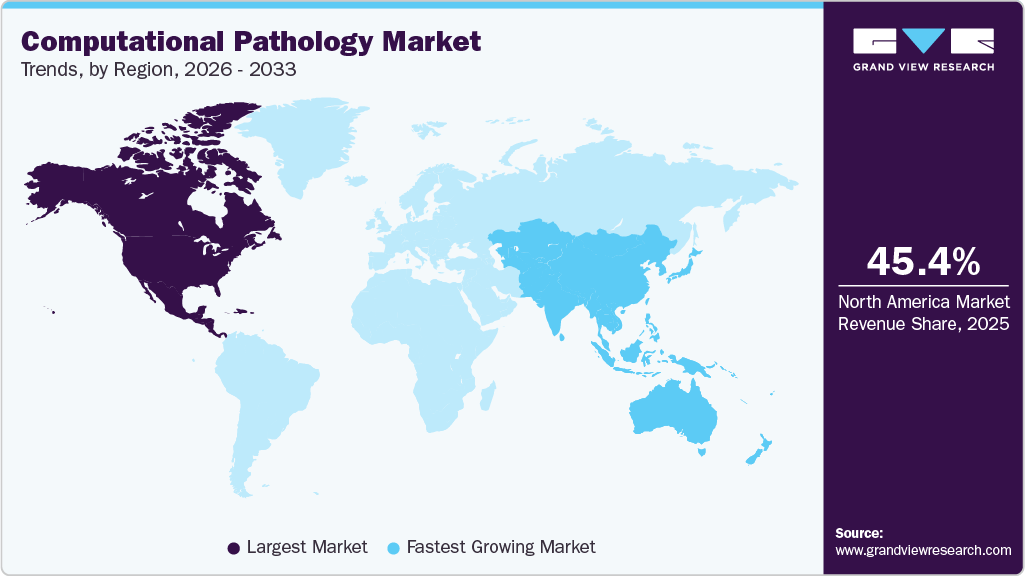

- North America dominated the computational pathology market with a share of 45.40% in 2025.

- The computational pathology market in the U.S. is expected to register significant CAGR over the forecast period.

- Based on component, the software segment held the largest market share of 67.10% in 2025.

- Based on application, disease diagnosis held the dominant market share in 2025.

- Based on technology, the machine learning (ML) segment held the largest revenue share in the computational pathology market in 2025.

- Based on end use, hospitals and diagnostic labs held the dominant market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 728.68 Million

- 2033 Projected Market Size: USD 1,447.62 Million

- CAGR (2026-2033): 9.21%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The growing prevalence of chronic diseases, such as cancer, predominantly drives the market. Owing to the high prevalence of cancer, pathologists require pathology data that can facilitate customizing therapies for patients. Thereby, digital pathology is increasingly being preferred by pathologists, as it accelerates the rate of diagnosis, increases diagnostic accuracy, and provides therapeutic recommendations to improve patient outcomes. For instance, according to a study published in the Journal of Pathology in August 2023, deep learning and artificial intelligence (AI) algorithms to analyze and interpret histopathology images promise substantial improvements in diagnostic accuracy and efficiency, especially for cancer diagnosis and prognosis.

The incorporation of machine learning and AI technologies into pathology workflows significantly transforms the diagnostic process. For instance, in October 2024, Proscia introduced digital pathology toolkits designed to facilitate the development of AI models. These tools enable life science researchers to convert biopsy slide images into quantitative data for training foundation models, improving biomarker discovery, and diagnostics. The development of such solutions enables the rapid and accurate analysis of images, allowing pathologists to identify patterns that may indicate disease progression. By automating routine tasks, AI enables pathologists to focus on more complex diagnostic challenges, thereby improving efficiency and accuracy. This shift enhances diagnostic precision and supports the development of personalized medicine through predictive modeling.

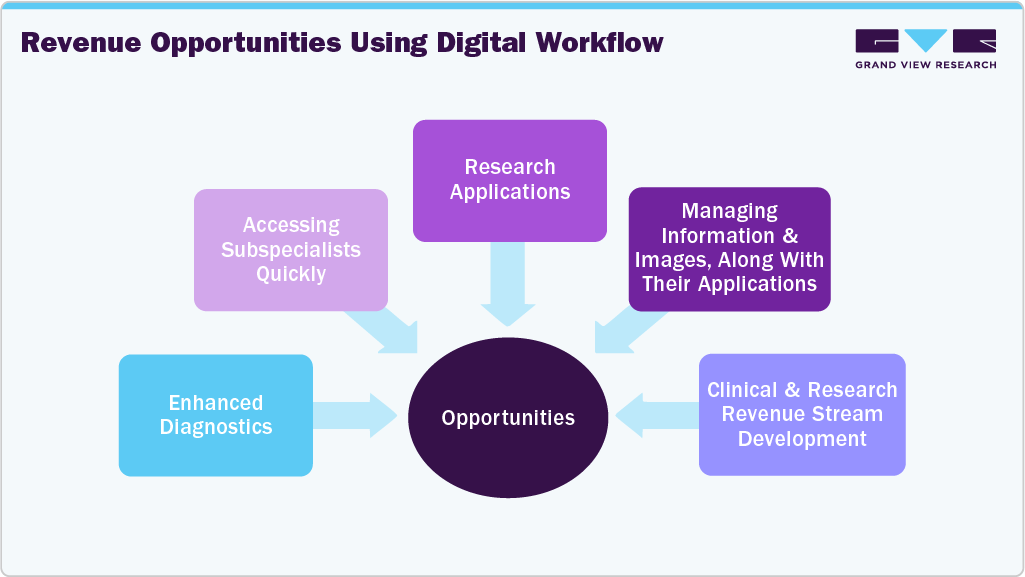

The market holds substantial opportunities driven by significant factors. Advances in artificial intelligence (AI), machine learning (ML), and digital imaging are transforming pathological workflows, enabling faster, more precise analysis of tissue slides and providing critical insights into disease diagnosis and prognosis. This technological progress is addressing the growing demand for rapid, accurate diagnostics, owing to the rising global prevalence of chronic diseases such as cancer and cardiovascular conditions.

Moreover, increasing adoption of telepathology is expanding remote expert consultations and improving healthcare access, especially in underserved regions. Integrating digital health systems enhances laboratory efficiency, automates routine tasks, and allows pathologists to focus on complex diagnostics, fostering greater accuracy and personalized medicine development. Furthermore, rising investments by healthcare providers and industry players in developing AI-powered pathology solutions stimulate innovation and market growth.

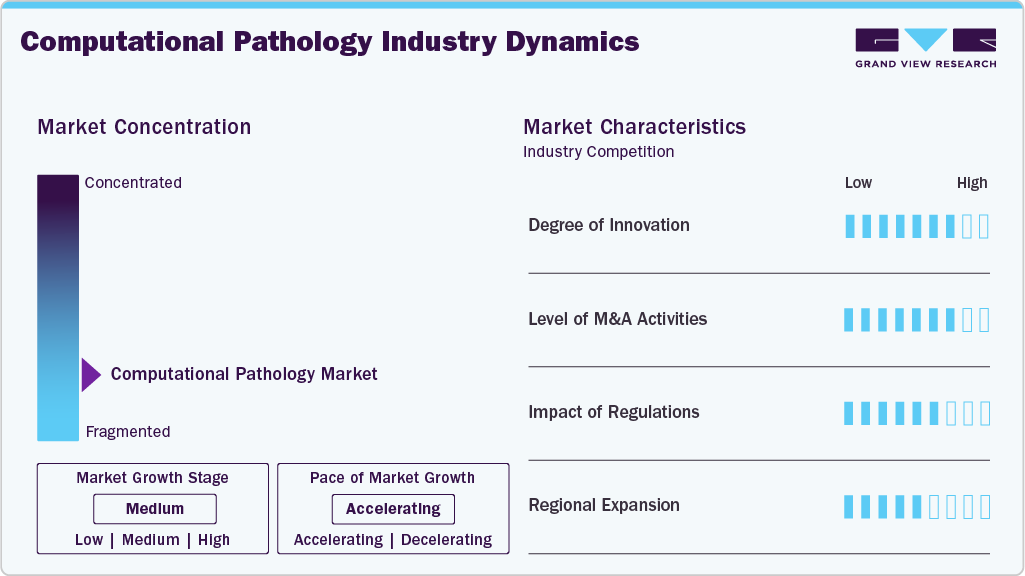

Market Concentration & Characteristics

The computational pathology industry is experiencing a high degree of innovation driven by several interrelated advancements, such as ML, Deep Learning, Natural Language Processing (NLP) models, and Computer Vision. The adoption of ML algorithms has enabled pathologists to enhance diagnostic accuracy through predictive analytics as these algorithms analyze vast datasets to identify patterns that may be overlooked by human eyes, thereby facilitating earlier and more precise cancer detection.

This transition to automated systems has significantly reduced the time required for diagnosis, improving workflow efficiency in clinical settings. For instance, in June 2024, Mindpeak GmbH expanded its AI portfolio with a new prostate cancer AI software co-developed with Clinsight AB. The software analyzes digital histopathology images of prostate needle biopsies, detects suspicious areas, and grades malignancies using Gleason scoring.

The level of M&A activities is moderate in the market. Mature players are acquiring emerging players to strengthen their position. For instance, in July 2025, Quanterix completed its acquisition of Akoya Biosciences, creating the first integrated platform for ultra-sensitive detection of blood- and tissue-based protein biomarkers.

Increasing government support in the form of approvals is encouraging companies to invest in technological advancements and expansion strategies. For instance, in March 2025, Epredia received U.S. FDA 510(k) clearance for the E1000 Dx, a high-speed, automated whole-slide imaging scanner with advanced software capable of digitizing up to 1,500 tissue samples daily.

The geographical expansion is driving the growth by enhancing access to advanced solutions in various geographical locations globally. For instance, in April 2022, Crosscope Inc. partnered with Waleed Pharmacy & Stores LLC to introduce AI-enabled digital pathology solutions in Oman. This collaboration aims to enhance cancer diagnostics and care in response to the rising cancer incidence in the region. Waleed Pharmacy will represent Crosscope in Oman, leveraging its expertise to advance healthcare IT solutions.

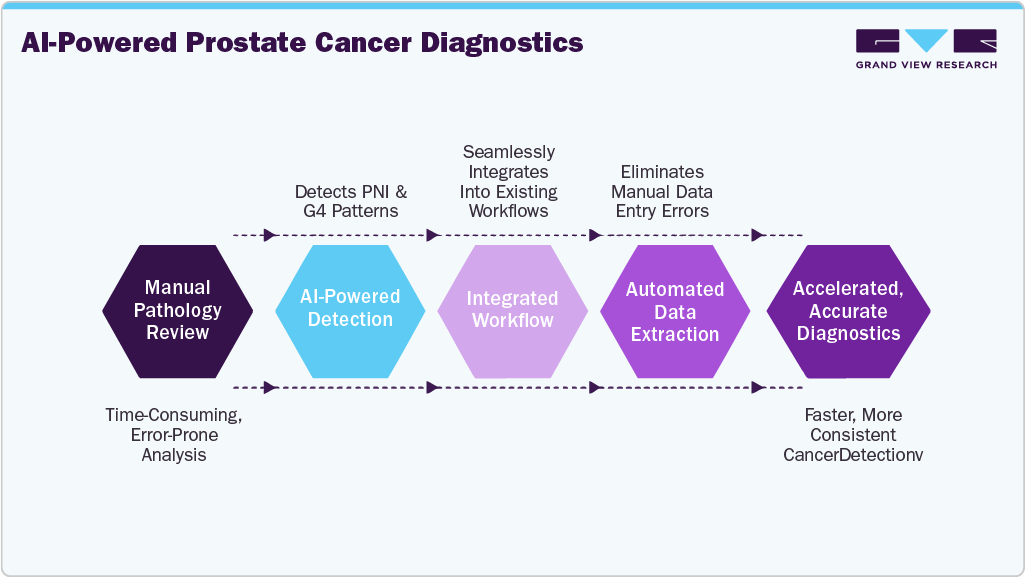

Case Study: AI-Enhanced Detection of High-Risk Prostate Cancer with Aiforia Prostate Cancer Suite

Challenge:

Prostate cancer diagnosis is complex, with pathologists needing to review 10-18 biopsy specimens per patient. Identifying high-risk features like perineural invasion (PNI) and cribriform pattern four is time-consuming, subject to inter-observer variability, and critical for accurate risk stratification.

Solution:

Aiforia’s Prostate Cancer Suite integrates AI models into digital pathology to detect PNI and cribriform patterns alongside Gleason grading. The system provides pixel-level overlays, transparent outputs, and automated data extraction directly into LIS, reducing manual errors and streamlining workflows.

Outcomes:

-

34% faster slide review time with >96% cancer recall rate.

-

92.6% accuracy in PNI detection and 91.3% for cribriform pattern 4.

-

Improved reproducibility, reduced missed lesions, and enhanced diagnostic confidence.

-

CE-IVD validation ensures reliability while supporting scalability and future feature expansions.

Component Insights

The software segment dominated the market and held the largest market share of 67.10% in 2025, owing to its positive impact on clinical workflows and diagnostic processes. Rising demand for precision medicine, coupled with increasing adoption of digital pathology scanners and whole-slide imaging (WSI), is driving the growth of software solutions, as they allow seamless integration of digital workflows, predictive analytics, and standardized reporting across laboratories and hospitals. In June 2025, ASCO 2025 highlighted AI-powered digital pathology software advancing cancer diagnostics and risk prediction. Proscia’s Concentriq platform improved accuracy in breast, colon, lung, and prostate cancer assessments, streamlining workflows and supporting precision medicine through computational pathology.

Services is expected to witness the fastest growth over the forecast period owing to the increasing demand for remote services and telepathology solutions. The outsourcing of computational pathology tasks is becoming a trend driven by the need for cost-effective and scalable solutions. As healthcare institutions face challenges such as a shortage of trained pathologists, they are turning to service providers that offer specialized expertise and advanced technologies, thereby contributing to the segment's growth.

Application Insights

The disease diagnosis segment dominated the market with a revenue share of 46.21% in 2025. Computational pathology is transforming disease diagnosis by enabling pathologists to analyze digital slides with unprecedented precision and consistency. Advanced AI algorithms can detect cellular abnormalities, quantify tissue features, and recognize disease-specific patterns that may be subtle or missed during manual evaluation. This capability reduces diagnostic errors, improves reproducibility across laboratories, and allows pathologists to focus on complex cases requiring expert judgment. In January 2025, an article published in the Journal of Pathology Informatics discussed advances in computational pathology, highlighting how digital whole-slide imaging and AI-powered analysis enhance disease diagnosis, improve workflow efficiency, and support precision medicine through integrated molecular and imaging data.

Academic research is expected to witness the fastest growth owing to the increasing emphasis on precision medicine and personalized healthcare, which drives the demand for advanced analytical techniques for understanding complex biological data. Academic institutions are driving innovation through research initiatives that leverage computational pathology tools to analyze large datasets.

Technology Insights

Machine learning accounted for the largest revenue share of 35.98% in 2025 as these technologies help enhance diagnostic accuracy and efficiency through advanced data analysis. Machine learning in the market is driving advancements in diagnostic accuracy, workflow efficiency, and disease characterization. Machine learning algorithms, including supervised, unsupervised, and deep learning models, are applied to whole slide images (WSIs) to detect patterns, classify tissue types, and quantify biomarkers. These systems enable automated feature extraction and analysis, reducing inter-observer variability and supporting standardized pathology reporting. Integration with multi-omics datasets further enhances the predictive and prognostic capabilities of these models. The demand for machine learning solutions is rising due to their ability to handle large-scale datasets with high throughput and precision.

Computer vision is expected to witness the fastest growth during the forecast period. Computer vision focuses on extracting quantitative information from whole slide images (WSIs) through automated visual analysis. Using advanced image processing and pattern recognition techniques, computer vision algorithms detect, segment, and classify tissue structures with high precision. These models enable automated tumor detection, grading, and identification of morphological biomarkers. Integration with laboratory workflows enhances diagnostic consistency and reduces turnaround times. The segment is crucial to translating image data into clinically actionable insights.

End-use Insights

Hospitals and diagnostic labs held the largest revenue share of 51.42% in 2025. Hospitals and diagnostic labs are major adopters of computational pathology, using AI-driven image analysis, digital slide management, and automated reporting to boost diagnostic accuracy and efficiency. Integration with laboratory information systems ensures seamless data flow, while whole-slide imaging supports remote collaboration. In February 2024, Qritive partnered with Metropolis Healthcare, Rajiv Gandhi Cancer Institute, and CŌRE Diagnostics in India to deploy its Pantheon image management system and AI pathology tools, achieving up to a 90% reduction in diagnosis time and an 80% drop in pathologist discordance.

The biotechnology and pharmaceutical companies segment is expected to witness the fastest growth over the forecast period. These companies are leveraging advanced computational techniques to enhance drug discovery and development processes. By integrating AI and ML algorithms into workflows, they can analyze vast amounts of data more efficiently, leading to faster identification of biomarkers and therapeutic targets. In addition, the rising demand for personalized medicine necessitates precise diagnostic tools, enabling personalized treatment plans based on individual patient needs.

Regional Insights

North America dominated the computational pathology market and accounted for the largest revenue share of 45.40% in 2025, owing to the integration of AI-based diagnostics, strong digital infrastructure, and high investment in clinical research. For instance, major U.S. cancer centers are deploying deep learning models for tumor classification and biomarker quantification, improving diagnostic accuracy and enabling personalized treatment strategies. Partnerships between AI developers, diagnostic labs, and pharmaceutical companies are expanding applications in clinical trials and drug development. In March 2025, Aiforia partnered with PathPresenter to accelerate the adoption of digital pathology and AI in the U.S., integrating Aiforia’s AI-powered image analysis with PathPresenter’s workflow platform. This collaboration enables pathologists to access advanced AI models for cancers such as breast, lung, and prostate, improving diagnostic speed and accuracy.

U.S. Computational Pathology Market Trends

The computational pathology market in the U.S. accounted for the largest share in 2025. One of the key factors driving the market growth is the high adoption rate of these solutions in the country, owing to their wide range of applications, from disease diagnosis to academic research. Moreover, the increasing efforts and investments in research to further enhance the application of computational pathology are further driving the market growth. For instance, in April 2024, the University of Pittsburgh and UPMC launched the Computational Pathology and AI Center of Excellence (CPACE) at the UPMC Cancer Pavilion, which aims to unite experts in these solutions and artificial intelligence to foster collaboration and innovation in medical research. CPACE focuses on utilizing AI to enhance disease detection and personalized treatment plans, ultimately improving patient care and outcomes.

Europe Computational Pathology Market Trends

The computational pathology market in Europe is poised for significant growth, driven by increasing demand for advanced diagnostic tools across a growing healthcare infrastructure and rising prevalence of chronic and complex diseases. Enhanced awareness of precision medicine and expanded access to cutting-edge pathology services are fueling the adoption of AI-powered computational pathology solutions. For instance, in July 2025, Leica Biosystems launched ChromoPlex III, a chromogenic multiplex immunohistochemistry detection system designed for simplicity, reproducibility, and digital pathology compatibility. This system optimizes digital imaging and computational pathology, simplifying workflows and making digital pathology more accessible for laboratories.

“ChromoPlex III is built to meet the evolving needs of researchers working at the intersection of spatial biology and computational pathology. Its chromogenic format mirrors clinical diagnostics, allowing researchers and pathologists to visualize tissue architecture while producing reproducible results that are essential for image analysis and AI interpretation.”

- Karan Arora, Senior Vice President of Advanced Assays, Pharma Services, and AI at Leica Biosystems

Germany computational pathology marketis expanding due to a robust healthcare infrastructure, advanced research in digital diagnostics, and strong technological innovation. Rising cancer incidence and chronic diseases drive demand for precise and efficient pathological analysis, increasing the adoption of computational pathology solutions. University hospitals and pathology centers collaborate with industry to develop and implement AI-powered tools. Digital slide scanning and AI-driven image analysis platforms improve workflow and diagnostic accuracy. In October 2024, nearly 40 AI-assisted pathology products with CE marking became available for routine clinical use in Germany, targeting key cancer diagnostics such as breast, prostate, and lung cancers.

The computational pathology market in the UK is primarily driven by the NHS’s commitment to modernizing diagnostic services through digital transformation. There is a growing emphasis on improving diagnostic speed and accuracy to support personalized medicine, especially in oncology. Initiatives under the NHS Long Term Plan prioritize expanding digital infrastructure and integrating AI-powered pathology tools across pathology networks to enhance efficiency and patient outcomes.

Asia Pacific Computational Pathology Market Trends

The computational pathology market in the Asia Pacific is expected to register the fastest growth rate over the forecast period. The region has seen a rise in the incidence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions. According to the Global Cancer Observatory (GLOBOCAN 2022), around 9,826,539 people were diagnosed with cancer in 2022, with lung, breast, and colorectal cancer being the leading cancer types. This has led to a growing demand for efficient diagnostic tools and increased adoption of these solutions for disease detection, grading, and research. Moreover, the increasing investments and increasing awareness about the advantages of technologically advanced solutions are further contributing to the market growth.

China computational pathology marketis propelled by the country’s aggressive push toward healthcare digitization and the escalating integration of artificial intelligence in diagnostic workflows. Faced with a rapidly aging population and soaring rates of chronic diseases such as cancer, China urgently requires scalable solutions that enhance diagnostic precision and alleviate pathologist shortages. Computational pathology, by harnessing AI-powered image analysis, promises to revolutionize diagnostic accuracy and workflow efficiency. In April 2022, an article published in Gland Surgery reviewed advances in computational pathology in China, focusing on deep learning applications in digital breast cancer diagnosis. The study highlighted how AI-driven models, especially convolutional neural networks, have enhanced diagnostic accuracy, classification, and prognostic predictions by automating complex image analysis.

The computational pathology market in Indiais driven by the awareness of the benefits of digital diagnostics, the rising incidence of cancer and chronic diseases, and government initiatives to modernize healthcare infrastructure. The shortage of trained pathologists and the need for faster, more accurate diagnoses increase the adoption of AI-powered digital pathology solutions. The growing burden of cancer and infectious diseases creates demand for scalable platforms capable of handling large volumes of complex histopathological data.

Latin America Computational Pathology Market Trends

The computational pathology market in Latin America is driven by growing adoption of digital pathology and whole-slide imaging (WSI), enabling pathologists to capture, store, and analyze high-resolution tissue images. Increasing integration of AI and machine learning enhances diagnostic accuracy, reduces human error, and accelerates workflow efficiency.

Middle East & Africa Computational Pathology Market Trends

The computational pathology market in MEA is driven by the increasing healthcare digitization, rising adoption of AI-driven diagnostic tools, and expanding healthcare infrastructure. Government initiatives to modernize healthcare systems, coupled with growing awareness of precision medicine, are driving demand for advanced pathology solutions. In addition, the region's focus on improving cancer diagnosis and treatment is further fueling the adoption of computational pathology technologies, contributing to market expansion. For instance, in July 2025, Qritive's AI-powered diagnostic solution, QAi Prostate Grade, received official market approval from the Department of Health in Abu Dhabi following a comprehensive Health Technology Assessment. This approval allows its use as a clinical decision support tool in specialized pathology labs across the Emirate, enhancing prostate cancer diagnostic accuracy and workflow efficiency.

Key Computational Pathology Company Insights

Key companies are adopting strategies such as mergers and acquisitions, product and service launches, agreements, joint ventures, collaborations, and expansion to strengthen their position in the market.

Key Computational Pathology Companies:

The following are the leading companies in the computational pathology market. These companies collectively hold the largest market share and dictate industry trends.

- Leica Biosystems Nussloch GmbH (subsidiary of Danaher)

- Hamamatsu Photonics K.K.

- Koninklijke Philips N.V.

- Olympus Corporation

- F. Hoffmann-La Roche Ltd.

- Aiforia/ Aiforia Technologies PLC

- Epredia (3DHISTECH Ltd.)

- Visiopharm A/S

- Proscia Inc.

- Mindpeak GmbH

- Akoya Biosciences, Inc. (a Quanterix company)

- Paige AI, Inc.

- CellaVision

- aetherAI

- Qritive

- IBEX (IBEX MEDICAL ANALYTICS)

- Nucleai, Inc.

Recent Developments

-

In June 2025, FUJIFILM Healthcare Europe and Ibex Medical Analytics partnered to integrate Ibex’s AI cancer diagnostics platform with Fujifilm’s SYNAPSE Pathology solution. The initial rollout begins at North Bristol NHS Trust in the UK, which is anticipated to offer AI tools for prostate, breast, and gastric cancer diagnostics to healthcare providers globally.

"Ibex is committed to ensuring our customers can easily integrate our AI tools into their diagnostic workflows, helping them to provide accurate and timely cancer diagnoses to their patients. We're thrilled to partner with Fujifilm and provide streamlined workflows to North Bristol NHS and customers around the world."

- Stuart Shand, Chief Commercial Officer, Ibex Medical Analytics-

In March 2025, Epredia received U.S. FDA 510(k) clearance for the E1000 Dx, a high-speed, automated whole-slide imaging scanner with advanced software capable of digitizing up to 1,500 tissue samples daily.

-

In June 2024, Mindpeak GmbH expanded its AI portfolio with a new prostate cancer AI software co-developed with Clinsight AB. The software analyzes digital histopathology images of prostate needle biopsies, detects suspicious areas, and grades malignancies using Gleason scoring.

-

In May 2024, Microsoft collaborated with the University of Washington and Providence Health to address key challenges in implementing AI for cancer diagnostics, leveraging significant scale. The researchers have developed a machine learning model, which Providence describes as one of the most extensive AI training initiatives in real-world whole-slide tissue analysis.

“This transformative work is the result of focused efforts to overcome three major challenges that have stymied previous computational pathology models from widely being applied in the clinical setting: shortage of real-world data, inability to incorporate whole-slide modeling, and lack of accessibility.”

-Providence’s chief analytics and research officer

-

In March 2023, Aiosyn launched AiosynQC, an AI-powered automated quality control solution designed to enhance digital pathology workflows in research, diagnostics, and pharmaceuticals. This product represents the first in Aiosyn's suite of workflow solutions, aiming to facilitate the integration of computational pathology algorithms into standard practices, thereby enhancing diagnostic precision and quality.

“AiosynQC will be an important foundational layer, and we believe that AI-powered workflow solutions are the entry point for the use and adoption of computational pathology algorithms.”

-Patrick de Boer, CEO of Aiosyn

-

In March 2023, Qritive launched its advanced AI-powered prostate cancer diagnosis tool, QAi Prostate. The tool uses advanced machine learning algorithms to analyze whole slide images of prostate core needle biopsies, accurately identifying and classifying both malignant and benign tumor areas.

-

In November 2022, Visiopharm launched Phenoplex, a unified, easy-to-use AI-driven multiplex tissue image analysis workflow. Integrated into their Oncotopix Discovery platform, it supports major multiplex formats, enabling interactive biomarker visualization, cellular phenotyping, and spatial analysis without coding.

-

In May 2021, Quest Diagnostics partnered with Paige.ai to develop AI-driven digital pathology cancer diagnostics. Paige's computational platform uses machine learning to extract diagnostic information from pathology slides, helping pathologists analyze images more quickly and accurately. The collaboration focuses on developing software for diagnosing solid tumors in lung cancer, prostate, colorectal, and breast cancer patients and aims to deliver insights to improve cancer diagnosis and make precision medicine more accessible and actionable.

“As the leader in advanced diagnostics, we are excited to actively participate in the creation and use of new technologies that further the mission to make precision medicine clinically accessible, actionable, and economical. We are energized about contributing our expertise to Paige’s computational pathology leadership to deliver insights from leading-edge technologies to improve the diagnosis of cancer and other diseases.”

- General Manager, Oncology Franchise, Quest Diagnostics.

Computational Pathology Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 781.51 million

Revenue forecast in 2033

USD 1,447.62 million

Growth rate

CAGR of 9.21% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Leica Biosystems Nussloch GmbH (subsidiary of Danaher); Hamamatsu Photonics K.K.; Koninklijke Philips N.V.; Olympus Corporation; F. Hoffmann-La Roche Ltd.; Aiforia Technologies PLC; Epredia (3DHISTECH Ltd.); Visiopharm A/S; Proscia Inc.; Mindpeak GmbH; Akoya Biosciences, Inc. (a Quanterix company); Paige AI, Inc.; CellaVision; aetherAI; Qritive; IBEX Medical Analytics; Nucleai, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Computational Pathology Market Report Segmentation

This report forecasts revenue growth and provides, at global, regional, and country levels, an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global computational pathology market report based on components, application, technology, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Disease Diagnosis

-

Drug Discovery & Development

-

Academic Research

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Machine Learning (ML)

-

Deep Learning

-

Supervised

-

Unsupervised

-

Others

-

-

Natural Language Processing (NLP) Models

-

Computer Vision

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals and Diagnostic Labs

-

Biotechnology and Pharmaceutical Companies

-

Academic and Research Institutes

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global computational pathology market size was estimated at USD 728.68 million in 2025 and is expected to reach USD 781.51 million in 2026.

b. The global computational pathology market is expected to grow at a compound annual growth rate of 9.21% from 2026 to 2033 to reach USD 1,447.62 million by 2033.

b. North America dominated the computational pathology market, with a share of 45.40% in 202. This is attributable to the rising adoption of digital pathology and AI-driven diagnostic tools. In addition, the increasing prevalence of chronic diseases, such as cancer, and the need for efficient and accurate diagnostic solutions are major growth drivers. Advancements in imaging technology and the expanding use of telepathology are propelling market expansion, enabling remote diagnostics and consultations.

b. Some key players operating in the computational pathology market includes Leica Biosystems Nussloch GmbH (subsidiary of Danaher); Hamamatsu Photonics K.K.; Koninklijke Philips N.V.; Olympus Corporation; F. Hoffmann-La Roche Ltd.; Aiforia Technologies PLC; Epredia (3DHISTECH Ltd.); Visiopharm A/S; Proscia Inc.; Mindpeak GmbH; Akoya Biosciences, Inc. (a Quanterix company); Paige AI, Inc.; CellaVision; aetherAI; Qritive; IBEX Medical Analytics; Nucleai, Inc.

b. Key factors driving the market growth include advancements in artificial intelligence (AI) and machine learning (ML) technologies, increasing adoption of digital pathology, the rising prevalence of chronic diseases, and the demand for personalized medicine. In addition, regulatory support and increased R&D investments further fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.