- Home

- »

- Plastics, Polymers & Resins

- »

-

Conductive Silicone Rubber Market, Industry Report, 2030GVR Report cover

![Conductive Silicone Rubber Market Size, Share & Trends Report]()

Conductive Silicone Rubber Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Thermally Conductive, Electrically Conductive, Others), By Application (Automotive & Transportation, Electrical & Electronics, Industrial Machines), By Region, And Segment Forecasts

- Report ID: 978-1-68038-548-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Conductive Silicone Rubber Market Summary

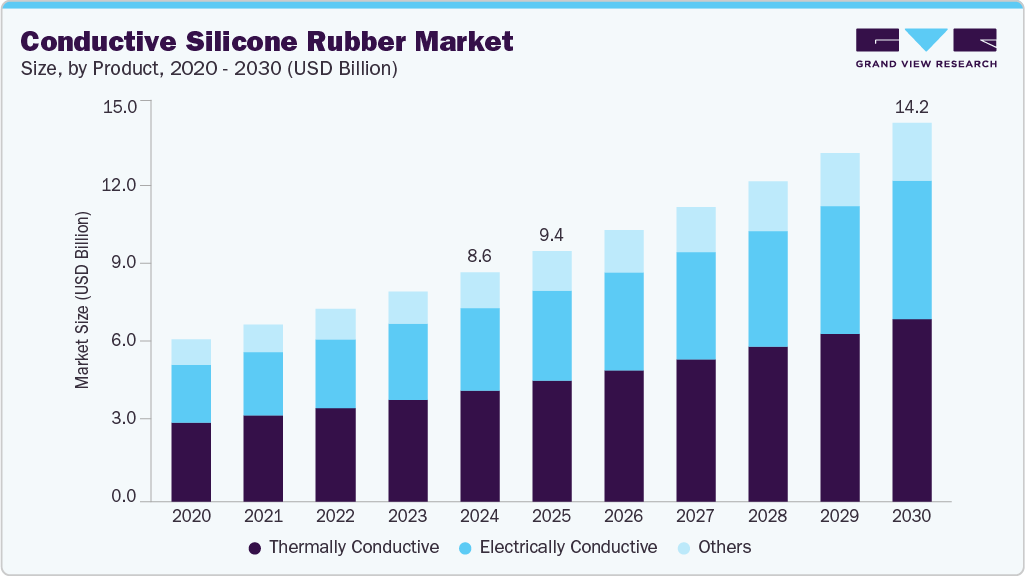

The global conductive silicone rubber market size was estimated at USD 8.59 billion in 2024 and is projected to reach USD 14.20 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. Electronic industry growth, particularly in the Asia Pacific, is expected to fuel the demand for lighting as well as wire applications.

Key Market Trends & Insights

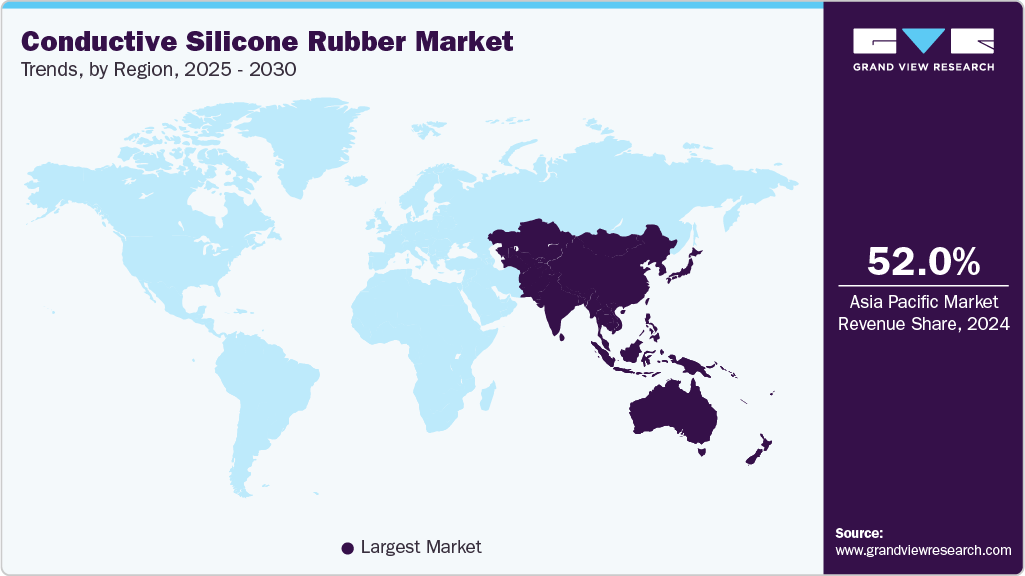

- Asia Pacific conductive silicone rubber market held the largest revenue share of 52.0% in 2024.

- China conductive silicone rubber industry dominated the Asia Pacific region.

- By product, the thermally conductive segment held the largest revenue share of 48.4% in 2024.

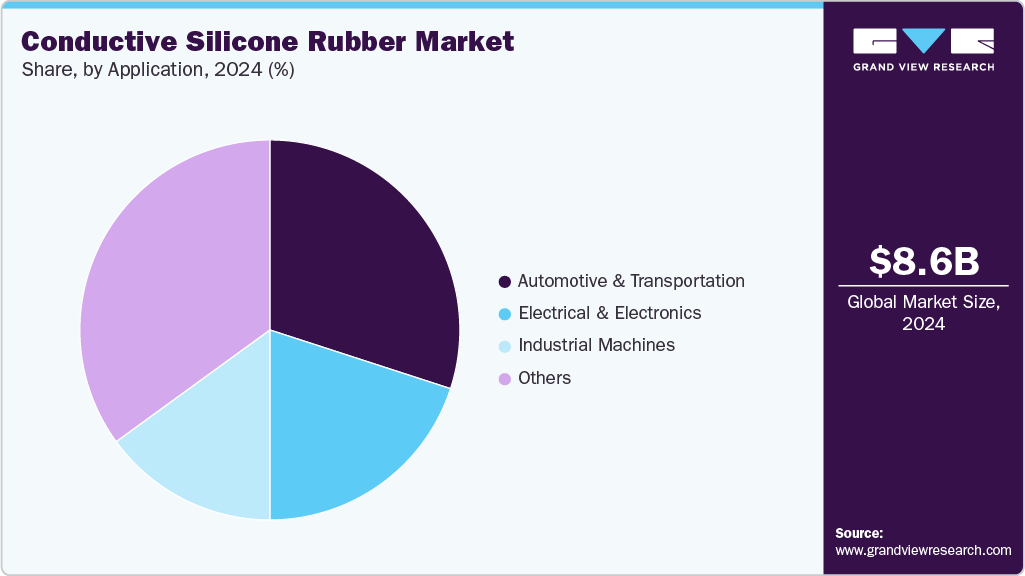

- By application, the automotive & transportation segment held the largest revenue share of 30.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.59 Billion

- 2030 Projected Market Size: USD 14.20 Billion

- CAGR (2025-2030): 8.7%

- Asia Pacific: Largest market in 2024

In addition, the rising importance of anti-static packaging for dust control during electric charge is expected to augment industry growth over the forecast period. The rising demand for lightweight automobile parts, owing to improved fuel efficiency and lower emissions, is expected to drive the demand for conductive silicone rubber. The product is used in manufacturing plastic and rubber modifiers in interior car parts on account of exhibiting superior anti-wear and anti-blocking properties.The industrial and infrastructural growth in emerging economies, including China, India, Brazil, and North African countries, is expected to positively impact the growth of the conductive silicone rubber industry. In addition, favorable regulatory policies, such as the FDI and the free trade agreement, are likely to propel the demand for conductive silicone rubber over the forecast period. The growing use of conductive silicone polymers in manufacturing rings, seals, gaskets, and coupling materials in packaging and oil & gas industries is expected to augment industry growth.

Rising consumer awareness regarding the benefits of bio-based chemicals as compared to their synthetic counterparts is expected to hamper market growth over the forecast period. Furthermore, the steadily growing application scope of silicone in manufacturing lubrication oil and greases is expected to create challenges in the availability of raw materials, which, in turn, is expected to increase the overall product cost over the forecast period.

Market players, including Dow, Wacker, and Shin-Etsu, are integrated across the entire value chain, from raw material suppliers to manufacturers and distributors of conductive silicone rubber.

Product Insights

The thermally conductive segment held the largest revenue share of 48.4% in 2024. The product finds applications in manufacturing various components used in automotive vehicles, personal computers, and home appliances exhibiting superior heat dissipation properties. The increasing use of thermally conductive silicone rubber materials in electronic components such as sensors and printed and electric circuit boards, due to good flow and processing and high thermal stability, is likely to be a favorable factor.

The electrically conductive segment is expected to grow at the fastest CAGR of 9.0% over the forecast period. The rising miniaturization of electronic products has led to the need to protect these parts from Electromagnetic Interference (EMI) and Electrostatic Dissipation (ESD). The increasing use of conductive silicone rubber for ESD and EMI protection is expected to have a positive impact over the forecast period.

Application Insights

The automotive & transportation segment held the largest revenue share of 30.4% in 2024. The increasing use of conductive silicone rubber for automobile interiors, owing to its flame and weather resistance properties, is expected to have a favorable impact on product demand. Conductive silicone is used to manufacture several automotive parts, including engine bay components, wiring harnesses, sealants, gaskets, connectors, and spark plugs, for excellent electrical insulation, weatherability, heat and chemical resistance, tear strength, and adhesive properties. These products provide reliable protection against moisture, dirt, and water spray, thus finding applications in spark plugs. Lightweight materials are increasingly used to reduce automobile weight, decreasing the total fuel consumption of the vehicle. Over the past few years, the automotive industry has started using lighter materials in manufacturing vehicles in order to comply with numerous regulations included in the Euro 6 and 7.

The electrical & electronics segment is expected to grow at the fastest CAGR of 9.6% over the forecast period. Conductive silicone rubber finds applications in adhesives, sealants, and coatings of wires & cables. It acts as an anti-static packaging agent for electronic components. Properties such as resistance to weathering, ozone, moisture, and UV radiation are expected to increase its application scope in manufacturing internal and external components of consumer electronic goods and power distribution & transmission devices.

In the construction sector, the compound is used in coating agents for waterproofing mortar, metal surfaces, and concrete. These rubbers maintain elasticity over a wide range of temperatures and exhibit UV and ozone resistance properties. The increasing use of these rubber compounds for waterproofing and in flame-resistant and airtight gaskets in the construction industry is expected to have a positive impact on market growth over the projection period.

Regional Insights

The easy availability of silver resources in Mexico and a strong manufacturing base in the U.S. and Canada are likely to push the market growth for conductive silicone rubbers in the North American region. The streamlined value chain of the aforementioned countries is expected to play a crucial role in positively influencing market growth over the coming years. Furthermore, a well-established medical devices industry and increased emphasis on industrial automation reinforce demand across sectors, with innovation in nanocomposite-enhanced silicones gaining attention.

U.S. Conductive Silicone Rubber Market Trends

The U.S. remains a leading market for conductive silicone rubber due to its robust technological infrastructure and a strong presence in key end-use industries. The country is rapidly adopting advanced electronic components and miniaturized devices, which require efficient thermal management and electrical conductivity

Europe Conductive Silicone Rubber Market Trends

Europe conductive silicone rubber market is anticipated to grow at a CAGR of 8.4% over the forecast period. The region’s conductive silicone rubber industry is shaped by the region's strong environmental policies and its push toward electrification in mobility and renewable energy. Countries like Germany, France, and the UK are leading the adoption of EVs and renewable technologies, increasing the demand for conductive silicone in batteries, sensors, and charging systems.

Asia Pacific Conductive Silicone Rubber Market Trends

Asia Pacific conductive silicone rubber market held the largest revenue share of 52.0% in 2024. The robust electronics industry in Taiwan, Japan, China, Korea, and India is expected to favor the market growth in the coming years. Supportive government regulations in India are likely to drive the demand for conductive silicone rubber-based products.

In 2024, China conductive silicone rubber industry dominated the Asia Pacific region due to its massive manufacturing base and growing domestic demand. The country is a key supplier of raw and finished conductive silicone materials, benefiting from cost-effective production and strong government backing for strategic industries like EVs, 5G, and industrial automation.

Key Conductive Silicone Rubber Company Insights

Major manufacturers in the silicone rubber industry are expected to opt for forward integration with the rising application scope of conductive silicone rubber. The steadily growing demand for silicone in lubricants and greases is expected to induce price hikes for market players in the future. Industry participants have formed strategic partnerships with compounders and contract manufacturers that convert the conductive silicone rubber into sheets, films, and various compounds.

-

Dow is a leading innovator, offering a wide portfolio of conductive silicone products tailored for applications in automotive electronics, 5G infrastructure, and wearable devices.

-

Wacker Chemie AG is a key global supplier of specialty silicone rubbers, including thermally and electrically conductive grades. The company has been actively expanding its silicone production capacity, vertically integrating operations, and making continued investments in innovation, which has driven its product demand.

Key Conductive Silicone Rubber Companies:

The following are the leading companies in the conductive silicone rubber market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Saint-Gobain

- Wacker Chemie AG

- Western Rubbers

- Western Polyrub India Pvt. Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Specialty Silicone Products, Inc.

- KCC CORPORATION

- China National Bluestar (Group) Co,Ltd.

- Reiss Manufacturing, Inc.

- MESGO S.p.A.

- Jan Huei K.H. Industry Co., Ltd.

Recent Developments

-

In December 2022, LegenDay announced the development of conductive silicone components specifically tailored for the healthcare and medical sectors. These parts are crafted from premium-grade silicone infused with electrically conductive and inert particles, with the option for electromagnetic interference (EMI) shielding. LegenDay has utilized low volatility and ion content conductive silicone, which is particularly suitable for highly sensitive medical electronic systems. This advanced composition ensures that LegenDay's conductive silicone parts are well-suited for use in hermetically sealed, vacuum, or high-temperature environments, meeting the stringent requirements of the healthcare and medical industries

-

In March 2022, Minnesota Rubber and Plastics completed the acquisition of Primasil Silicones, a custom silicone rubber compounder and manufacturer based in Weobley, U.K. Primasil has established itself as a specialist serving the medical, HVAC, and specialty industrial sectors. This strategic acquisition aligns seamlessly with Minnesota Rubber and Plastic's distinguished materials science and molding capabilities, allowing for a synergistic integration of knowledge and resources. Together, the combined expertise of both entities will enable the provision of comprehensive solutions to meet the evolving needs of customers in various industries

-

In January 2021, Novation Solutions, LLC, a company focused on silicone dispersions, announced the development of the PURmix high-consistency rubber (HCR) healthcare compounds. These compounds have been designed to enhance the properties related to the electrical performance of silicone rubber by combining a proprietary single-wall carbon nanotube from Zeon Corporation. This innovative silicone technology finds practical application in different medical devices. The incorporation of NovationSi's advanced compounds, which possess superior electrical properties, presents exciting opportunities for enhancing the performance and efficacy of medical devices

Conductive Silicone Rubber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.36 billion

Revenue forecast in 2030

USD 14.20 billion

Growth rate

CAGR of 8.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Thailand; Malaysia; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Dow; Saint-Gobain; Wacker Chemie AG; Western Rubbers; Western Polyrub India Pvt. Ltd.; Shin-Etsu Chemical Co., Ltd.; Specialty Silicone Products, Inc.; KCC CORPORATION; China National Bluestar (Group) Co,Ltd., Ltd.; Reiss Manufacturing, Inc.; MESGO S.p.A.; Jan Huei K.H. Industry Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

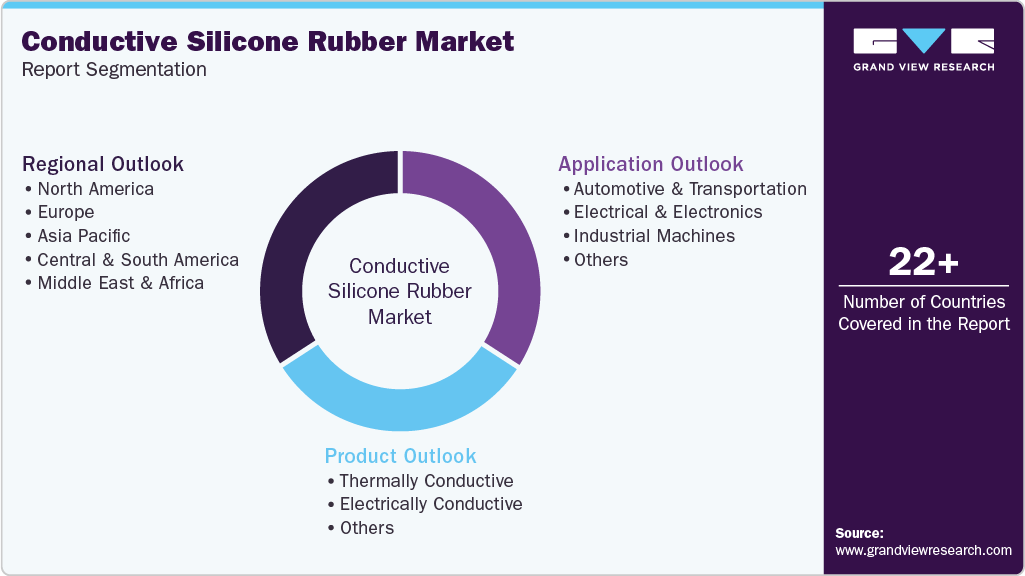

Global Conductive Silicone Rubber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the conductive silicone rubber industry report based on product, application, and region.

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Thermally Conductive

-

Electrically Conductive

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Automotive & Transportation

-

Engine System

-

Wiring Harness

-

Others

-

-

Electrical & Electronics

-

Wires & Cables

-

Lamps & Lighting

-

Others

-

-

Industrial Machines

-

Packaging

-

Stamping & Casting

-

Oil & Gas

-

Others

-

-

Others

-

Construction

-

Food & Beverage

-

Others

-

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.