- Home

- »

- Plastics, Polymers & Resins

- »

-

Construction Elastomers Market Size, Industry Report, 2030GVR Report cover

![Construction Elastomers Market Size, Share & Trends Report]()

Construction Elastomers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Styrene Block Copolymers, Thermoplastic Polyurethane, Styrene Butadiene, Ethylene Propylene Diene Monomer, Natural Rubber), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-537-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction Elastomers Market Summary

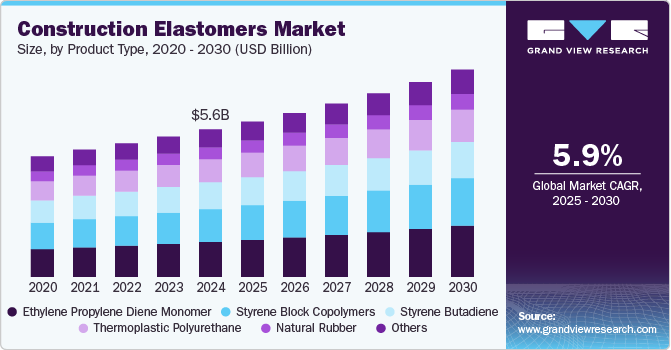

The global construction elastomers market size was estimated at USD 5.62 billion in 2024 and is anticipated to reach USD 7.91 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The market is driven by increasing infrastructure development, rising demand for durable and flexible materials, and growing adoption of eco-friendly elastomers.

Key Market Trends & Insights

- The Asia Pacific dominated the global market with the revenue share of over 49.0% in 2024.

- China is experiencing robust growth in the global market.

- By product type, the ethylene propylene diene monomer segment recorded the largest market revenue share of over 23.0% in 2024.

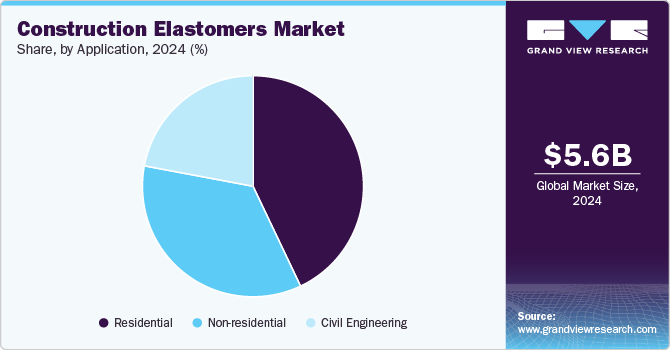

- By application, the residential segment recorded the largest market share of over 42.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.62 Billion

- 2030 Projected Market Size: USD 7.91 Billion

- CAGR (2025-2030): 5.9%

- Asia Pacific: Largest market in 2024

Additionally, advancements in polymer technology and government investments in smart city projects further fuel market growth. The rapid urbanization and industrialization in developing economies, particularly in Asia-Pacific and Latin America is contributing to the market growth. Governments worldwide are investing heavily in residential, commercial, and industrial construction, which directly boosts the demand for elastomers in applications such as sealants, adhesives, roofing membranes, and insulation materials. For example, China's Belt and Road Initiative (BRI) and India’s Smart Cities Mission have significantly increased the consumption of construction elastomers in recent years.

Additionally, the rising demand for sustainable and energy-efficient materials is accelerating the demand for construction elastomers, thus boosting market growth. With stringent environmental regulations and growing consumer awareness, there is a shift toward eco-friendly and recyclable elastomers, such as thermoplastic elastomers (TPEs). These materials offer superior durability, flexibility, and resistance to extreme temperatures, making them ideal for green building applications. The adoption of LEED (Leadership in Energy and Environmental Design) certification and other sustainability standards has further fueled the demand for elastomers in energy-efficient windows, weatherproofing materials, and noise-reducing components.

Technological advancements in elastomer production have also played a crucial role in driving market expansion. Innovations in polymer chemistry have led to the development of high-performance elastomers with enhanced mechanical strength, weather resistance, and UV stability. Companies such as BASF and Dow are continuously investing in R&D to introduce new formulations that improve the lifespan of construction materials. For example, silicone-based elastomers are now widely used in modern infrastructure projects due to their excellent flexibility and water resistance, making them ideal for structural glazing and waterproofing systems.

Furthermore, the growing adoption of prefabricated and modular construction techniques has increased the reliance on elastomer-based products. Prefabricated buildings require high-performance gaskets, adhesives, and flexible joints that can withstand mechanical stress and varying climatic conditions. Elastomers provide superior sealing properties, ensuring long-term durability and reducing maintenance costs. In regions such as North America and Europe, where labor shortages and cost concerns are pushing the industry toward off-site construction, the demand for elastomers continues to surge.

Product Type Insights

The ethylene propylene diene monomer (EPDM) segment recorded the largest market revenue share of over 23.0% in 2024 and is projected to grow at the fastest CAGR of 6.7% during the forecast period. It is a synthetic rubber known for its excellent weather resistance, thermal stability, and flexibility. It is widely used in roofing membranes, window and door seals, expansion joints, and waterproofing applications. EPDM is particularly valued for its ability to withstand extreme weather conditions and UV radiation, making it a preferred choice for outdoor construction applications.

Styrene Butadiene (SB) elastomers are synthetic rubbers that provide high resilience, heat resistance, and wear resistance. In construction, SB elastomers are primarily used in asphalt modification, adhesives, and waterproof coatings. They enhance the durability and flexibility of asphalt pavements and roofing materials, making them an essential component in infrastructure projects. The rising demand for high-performance asphalt in road construction and repair activities is a major factor propelling SB elastomer demand.

Application Insights

The residential segment recorded the largest market share of over 42.0% in 2024 and is projected to grow at the fastest CAGR of 6.6% during the forecast period. In the residential sector, construction elastomers are widely used for sealing, insulation, roofing, flooring, and structural applications. Common elastomers such as silicone, polyurethane, and thermoplastic elastomers (TPEs) contribute to energy efficiency, noise reduction, and long-lasting performance in residential buildings. The growth of construction elastomers in the residential sector is primarily driven by increasing urbanization, rising disposable income, and growing demand for energy-efficient housing.

The non-residential segment, which includes commercial buildings, offices, industrial facilities, and public infrastructure, extensively utilizes construction elastomers for structural reinforcement, sealing, flooring, and roofing applications. The demand for construction elastomers in the non-residential segment is driven by rapid industrialization, commercial expansion, and the need for durable, high-performance materials in modern infrastructure.

In civil engineering applications, construction elastomers play a crucial role in bridge expansion joints, tunnel linings, pavement materials, and structural reinforcements. Their elasticity, weather resistance, and shock-absorbing properties make them ideal for ensuring structural stability and long-term durability in large-scale infrastructure projects.

Region Insights

Asia Pacific construction elastomers market dominated the global market and accounted for the largest revenue share of over 49.0% in 2024 and is anticipated to grow at the fastest CAGR of 6.3% over the forecast period. This positive outlook is due to its unprecedented urbanization and infrastructure development. Countries such as China, India, and Indonesia are undergoing massive construction booms, with new residential complexes, commercial buildings, and infrastructure projects requiring large quantities of elastomers for sealing, insulation, and vibration dampening applications. Moreover, Japan and South Korea contribute significantly through their focus on earthquake-resistant construction technologies, where specialized elastomers play a crucial role in seismic isolation systems.

Construction elastomers market in China is experiencing robust growth primarily due to its massive infrastructure development and continued urbanization. Additionally, China's investment in earthquake-resistant structures has specifically increased the use of specialty elastomers that provide crucial vibration isolation and structural flexibility. The rapid adoption of prefabricated construction methods in China has created unique opportunities for elastomer applications. In cities like Shenzhen, where entire buildings are assembled from factory-built components, specially formulated elastomers are critical for creating weather-tight, durable joints between prefab elements.

North America Construction Elastomers Market Trends

North America’s growth in the global construction elastomers market is primarily due to its robust construction industry, stringent building codes, and emphasis on sustainable, energy-efficient construction solutions. Substantial infrastructure investment programs and the adoption of advanced building technologies that require high-performance elastomeric materials reinforce the region's growth. Moreover, the renovation and retrofitting market in North America also contribute significantly to elastomer demand.

The U.S. construction elastomers market growth is majorly driven by its ongoing infrastructure revitalization efforts. Besides, the stringent building codes and sustainability initiatives in the U.S. have further accelerated the adoption of construction elastomers. Projects seeking LEED certification often incorporate elastomeric materials for their energy efficiency contributions through improved insulation and air sealing properties. Major infrastructure projects like the new Hudson River tunnel and the ongoing rehabilitation of aging bridges nationwide rely heavily on specialized elastomers for waterproofing, vibration control, and structural flexibility.

Europe Construction Elastomers Market Trends

Construction elastomers market in Europe is growing primarily due to the region’s stringent building codes and environmental regulations. Countries such as Germany, France, and the UK have implemented regulations that specifically favor materials with superior thermal insulation properties and weather resistance, driving demand for advanced elastomers in building envelopes and structural components. The European commitment to sustainable building practices has further accelerated elastomer adoption. Projects such as the Bosco Verticale in Milan and the Edge Olympic in Amsterdam showcase the integration of high-performance elastomeric materials in green building design.

The construction elastomers market in Germany is primarily driven by its robust construction sector, stringent building regulations, and focus on energy efficiency. The German government's implementation of energy-efficient building codes, such as the Energy Saving Ordinance (EnEV), has spurred innovation in construction materials, including elastomers.

Key Construction Elastomers Company Insights

The global construction elastomers market is highly competitive, driven by key players such as BASF, Dow, Arkema, DuPont, and Covestro AG. These companies focus on product innovation, strategic partnerships, and mergers & acquisitions to strengthen their market presence. Market share distribution is influenced by technological advancements, raw material availability, and regulatory compliance. Smaller regional players compete by offering cost-effective and specialized solutions, while global leaders maintain their edge through extensive R&D and diversified product portfolios.

-

In August 2023, Covestro AG started production at its new polyurethane elastomers systems plant in Shanghai, China. This investment, in the double-digit USD million range, is part of a series of investments in the company's Elastomers raw materials business worldwide.

-

In September 2022, Lion Elastomers, a synthetic rubber manufacturer, invested USD 22.0 million to expand its Geismar plant in Ascension Parish, Louisiana. The expansion project included the construction of a new multi-level production building housing two new finishing lines. The expansion project is expected to strengthen Lion Elastomers' manufacturing position and enhance quality and service for EPDM (Ethylene Propylene Diene Monomer) consumers.

Key Construction Elastomers Companies:

The following are the leading companies in the construction elastomers market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema

- BASF

- Dow

- Covestro

- Huntsman International LLC

- Teknor Apex Company

- Lubrizol Corporation

- Shanghai Sinopec Mitsui Elastomers

- Mitsubishi Chemical Company

- DuPont

- SIBUR

- Evonik Industries AG

- Motherson

- Dynasol Elastomers

Construction Elastomers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.92 billion

Revenue forecast in 2030

USD 7.91 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

States scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Key companies profiled

Arkema; BASF; Dow; Covestro; Huntsman International LLC; Teknor Apex Company; Lubrizol Corporation; Shanghai Sinopec Mitsui Elastomers; Mitsubishi Chemical Company; DuPont; SIBUR; Evonik Industries AG; Motherson; Dynasol Elastomers

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction Elastomers Market Report Segmentation

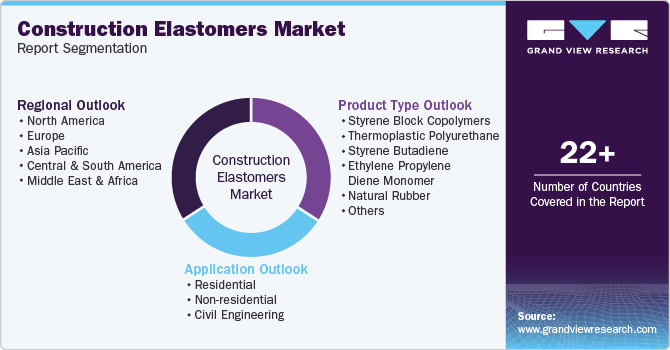

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global construction elastomers market report based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Styrene Block Copolymers

-

Thermoplastic Polyurethane

-

Styrene Butadiene

-

Ethylene Propylene Diene Monomer

-

Natural Rubber

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Residential

-

Non-residential

-

Civil Engineering

-

-

Region Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global construction elastomers market was estimated at around USD 5.62 billion in the year 2024 and is expected to reach around USD 5.92 billion in 2025.

b. The global construction elastomers market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach around USD 7.91 billion by 2030.

b. Residential emerged as the dominant end-use segment in the construction elastomers market due to increasing government initiatives for affordable housing and sustainable construction, which have further fueled the adoption of elastomers in residential applications.

b. The key players in the construction elastomers market include Arkema, BASF, Dow, Covestro, Huntsman International LLC, Teknor Apex Company, Lubrizol Corporation, Shanghai Sinopec Mitsui Elastomers, Mitsubishi Chemical Company, DuPont, SIBUR, Evonik Industries AG, Motherson, and Dynasol Elastomers.

b. The construction elastomers market is driven by rapid urbanization, infrastructure development, and the growing demand for durable, flexible, and energy-efficient materials. Additionally, advancements in polymer technology and increasing government initiatives for sustainable construction further fuel market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.