- Home

- »

- Next Generation Technologies

- »

-

Containers As A Service Market Size, Industry Report, 2033GVR Report cover

![Containers As A Service Market Size, Share & Trends Report]()

Containers As A Service Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Management & Orchestration, Monitoring & Analytics, Security), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-686-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Containers As A Service Market Summary

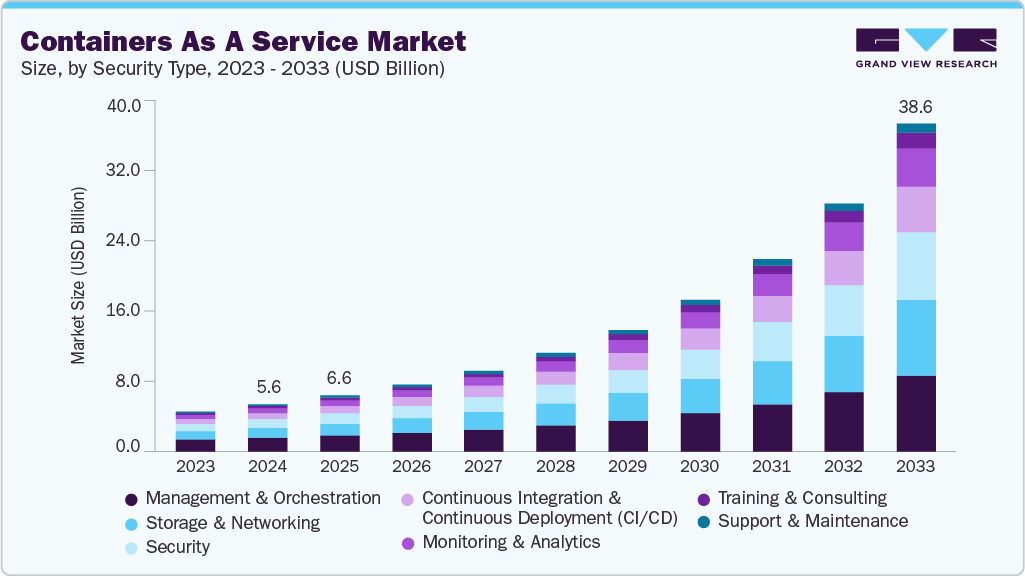

The global containers as a service market size was estimated at USD 5.57 billion in 2024 and is projected to reach USD 38.64 billion by 2033, growing at a CAGR of 24.7% from 2025 to 2033. The shift toward automation and infrastructure-as-code is also driving demand for containers as a service.

Key Market Trends & Insights

- North America held a 34.6% revenue share of the global containers as a service market in 2024.

- The U.S. containers as a service industry is projected to grow during the forecast period.

- By service type, the management & orchestration segment held the largest revenue share of 29.6% in 2024.

- By deployment, the public cloud segment dominated the containers as a service (CaaS) industry with a revenue share of over 46.4% in 2024.

- By enterprise size, the large enterprises segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.57 Billion

- 2033 Projected Market Size: USD 38.64 Billion

- CAGR (2025-2033): 24.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising importance of developer experience in competitive software delivery cycles is also driving the adoption of CaaS platforms. Developers prefer environments that allow them to build, test, and deploy applications with minimal friction. CaaS abstracts much of the infrastructure complexity, giving developers self-service access to container orchestration tools, version control integrations, and automated scaling features-all of which enhance productivity and reduce cycle times. Many CaaS platforms support integration with popular development environments and CI/CD pipelines, allowing for a seamless flow from code to deployment. This streamlined development experience contributes directly to faster innovation, making CaaS a critical enabler of agile development practices.In addition, the growth of open-source container technologies and community support is contributing significantly to the containers as a service (CaaS) market. The adoption of Kubernetes as the industry standard for container orchestration has created a robust and interoperable ecosystem around which CaaS providers build their services. The support of major cloud vendors such as AWS with Amazon EKS, Microsoft with Azure Kubernetes Service, and Google with GKE has further accelerated this trend. The standardization brought by Kubernetes and related tools ensures that enterprises can deploy and scale containerized workloads consistently, while also benefiting from innovations and updates driven by a large open-source community.

The demand for high-availability, fault-tolerant applications is another factor driving CaaS adoption. Enterprises are under increasing pressure to deliver uninterrupted digital services to customers, especially in sectors such as e-commerce, media, and finance. Containers, orchestrated through CaaS platforms, enable applications to be distributed across multiple nodes and regions, providing redundancy and seamless failover. These platforms automate load balancing, health checks, and resource optimization, ensuring minimal downtime even during traffic spikes or hardware failures. This reliability is essential for mission-critical applications and aligns with the broader push toward building more resilient and scalable digital infrastructures.

Moreover, the increasing emphasis on DevSecOps and the shift-left approach to security are driving organizations to adopt CaaS platforms that integrate security features early in the software development lifecycle. Containers introduce specific security concerns, such as image vulnerabilities and runtime risks that must be addressed proactively. Modern CaaS platforms are embedding security into every stage of the container lifecycle, from secure image registries and automated vulnerability scans to network policies and compliance auditing tools. This built-in security framework not only reduces risk but also streamlines compliance with industry standards and regulations, especially for enterprises operating in data-sensitive fields like banking, insurance, and healthcare.

Service Type Insights

The management & orchestration segment dominated the containers as a service (CaaS) market in 2024 with a revenue share of 29.6%. The rise of edge computing and distributed energy resources also contributes to the need for robust Management & Orchestration security. In modern industrial setups, control and data processing are no longer centralized but occur across distributed edge nodes. Management & Orchestration systems must coordinate inputs from multiple, often remote, sources, increasing their attack surface and necessitating endpoint security, network segmentation, and decentralized threat response mechanisms. Security frameworks must evolve to accommodate the decentralized and dynamic nature of these environments, ensuring that each node can detect, respond to, and recover from threats independently without compromising system-wide functionality.

The monitoring and analytics segment is projected to grow at the fastest CAGR from 2025 to 2033. The growing emphasis on DevOps and SRE practices within enterprises is driving the demand for monitoring and analytics tools embedded in CaaS platforms. These practices emphasize continuous feedback, performance benchmarking, and system reliability engineering, all of which depend on actionable insights from telemetry data. Monitoring dashboards, custom alerts, and visual analytics support real-time collaboration between development, operations, and security teams. As organizations adopt site reliability engineering as a standard for managing cloud-native infrastructure, the demand for sophisticated, responsive, and scalable monitoring solutions within the CaaS ecosystem continues to rise, positioning this segment as a key enabler of operational excellence.

Deployment Insights

The public cloud segment dominated the containers as a service (CaaS) industry with a revenue share of over 46.4% in 2024. The rapid growth of data-intensive applications such as artificial intelligence, machine learning, and analytics benefits significantly from public cloud CaaS offerings. These applications often require elastic compute resources, scalable storage, and containerized deployment models for rapid experimentation and iteration. Public cloud CaaS platforms meet these demands with GPU-enabled nodes, autoscaling capabilities, and integration with AI and big data services. This synergy between containerization and public cloud infrastructure is enabling the next generation of intelligent applications, ensuring that the public cloud remains a dominant force in the evolution of the CaaS market.

Hybrid cloud is projected to be the fastest-growing segment from 2025 to 2033. The rise of edge computing is driving the adoption of hybrid cloud CaaS deployments. Enterprises deploying applications in remote locations such as retail stores, manufacturing floors, or logistics hubs require containerized services that can operate at the edge, close to the source of data and end users. CaaS platforms that operate in hybrid models support these use cases by enabling centralized orchestration from the core cloud while deploying lightweight container environments at the edge. This architecture ensures low latency, real-time processing, and operational resilience even in scenarios where internet connectivity is inconsistent. As edge computing becomes integral to digital transformation strategies, hybrid CaaS becomes the foundation for managing and scaling these edge applications effectively.

Enterprise Size Insights

The large enterprises segment dominated the containers as a service (CaaS) industry in 2024. The need for enterprise-level governance, visibility, and control drives the growth of containers as a service in large enterprises. These businesses operate under stringent internal policies and external regulatory requirements, especially in sectors like finance, healthcare, manufacturing, and telecommunications. CaaS solutions tailored to large enterprises offer integrated capabilities for role-based access control, security policy enforcement, logging, auditing, and compliance tracking. This level of centralized governance allows organizations to scale containerized applications with confidence, knowing that visibility and control are not compromised, even across thousands of distributed containers and users.

The small & medium enterprises (SMEs) segment is projected to grow significantly from 2025 to 2033. The globalization of digital commerce and the rise of distributed workforces are encouraging SMEs to adopt CaaS platforms that support remote collaboration and multi-region deployment. Whether serving customers in new markets or enabling developers to work across time zones, containerized environments managed through CaaS ensure consistent performance and deployment across regions. This global scalability, combined with the operational simplicity of managed services, makes CaaS an ideal infrastructure choice for SMEs aiming to grow and compete in a cloud-first economy.

End-use Insights

The IT & telecommunication segment dominated the containers as a serviceindustry in 2024. The rise in targeted attacks on manufacturing infrastructure drives cybersecurity adoption in this segment. Manufacturing processes often depend on continuous operations and just-in-time supply chains. Even a short disruption can ripple through the business ecosystem, delaying deliveries, increasing waste, and violating service-level agreements. The manufacturing sector’s sensitivity to downtime has pushed companies to invest heavily in threat detection, incident response, and network segmentation tools that safeguard their production environments from both external and insider threats.

The retail segment is projected to grow at the fastest CAGR from 2025 to 2033. The increasing adoption of 5G and edge computing in the telecom industry is another powerful driver for CaaS deployment. 5G networks require a distributed, low-latency infrastructure capable of supporting real-time services like IoT, video streaming, autonomous vehicles, and smart cities. Containers are lightweight and portable, making them ideal for edge deployments, where computing resources must be close to end users. CaaS platforms allow telecom companies to deploy, manage, and monitor containerized services at the edge with centralized control, enabling real-time performance while ensuring network efficiency and scalability. As 5G rollouts accelerate globally, CaaS becomes critical in enabling the orchestration and automation of services at both the core and the edge of telecom networks.

Regional Insights

North America dominated the containers as a service market with a revenue share of 34.6% in 2024. The widespread adoption of DevOps and agile methodologies across North American enterprises is a major force behind the region’s growing CaaS usage. Companies are increasingly shifting toward continuous integration and continuous deployment (CI/CD) practices, which rely heavily on containerization for flexibility, speed, and repeatability. CaaS platforms support this transformation by providing standardized environments, automated orchestration, and seamless integration with CI/CD toolchains. These capabilities help businesses shorten development cycles, reduce deployment risks, and respond quickly to market changes, which are essential attributes in North America’s highly competitive digital economy.

U.S. Containers As A Service Market Trends

The U.S. containers as a service industry is projected to grow during the forecast period. The cybersecurity and compliance requirements play an equally critical role in driving CaaS adoption across the U.S. With rising threats of data breaches and ransomware attacks, enterprises are prioritizing infrastructure that provides strong isolation, automated vulnerability scanning, and continuous monitoring. CaaS solutions with built-in security features such as policy enforcement, secrets management, and runtime threat detection are highly valued in sectors like finance, healthcare, and e-commerce, where data protection and compliance with laws like HIPAA, SOX, and CCPA are mandatory. These platforms offer enterprises a more secure approach to scaling applications without compromising on governance.

Asia Pacific Containers As A Service Market Trends

The Asia Pacific containers as a service industry is expected to be the fastest growing segment, with a CAGR of 26.8% over the forecast period. The region's growing emphasis on software development and IT services outsourcing plays a critical role in driving CaaS demand. With countries like India, Vietnam, and the Philippines acting as global software engineering hubs, there is a rising need for development environments that are agile, reproducible, and easy to manage. CaaS platforms support these needs by allowing teams to collaborate across locations, automate builds and testing processes, and consistently deliver containerized applications. This has led to greater adoption of CaaS among software vendors and service providers catering to clients both within and outside the region.

The containers as a service market in China is projected to grow during the forecast period. The national focus on smart cities, 5G rollout, industrial automation, and AI deployment further drives the CaaS platforms. These emerging technologies demand low-latency, scalable, and portable computing frameworks that containers naturally provide. CaaS solutions are being used to manage services deployed at the network edge, in data centers, and across geographically distributed sites, making them indispensable to the realization of China’s long-term digital infrastructure goals. As enterprises seek to balance performance, flexibility, and cost-efficiency, CaaS continues to gain momentum as a strategic infrastructure layer within the Chinese cloud ecosystem.

Europe Containers As A Service Market Trends

The containers as a service industry in Europe is expected to grow during the forecast period. The rise of open-source technology and the growing influence of European cloud initiatives such as Gaia-X are contributing to the momentum behind CaaS. These efforts promote interoperability, transparency, and digital sovereignty values that align well with the containerization model. European enterprises and public entities are increasingly favoring CaaS platforms that are built on open standards, support vendor-neutral orchestration (such as Kubernetes), and integrate with local or federated cloud ecosystems. As the continent continues to invest in digital resilience and cloud independence, CaaS is emerging as a strategic foundation for Europe’s next-generation digital infrastructure.

The UK containers as a service market is expected to grow during the forecast period. The growing embrace of DevOps and continuous integration/continuous deployment (CI/CD) practices across the UK is also accelerating CaaS adoption. Many UK-based businesses are striving to reduce development cycles and improve responsiveness to customer demands. CaaS platforms, especially those integrated with managed Kubernetes and automated orchestration tools, allow development teams to deploy and scale containerized applications consistently across testing, staging, and production environments. This ability to standardize and automate the application lifecycle has made CaaS a strategic asset for digital-first organizations seeking to remain competitive in a fast-moving market.

Key Containers As A Service Company Insights

Some of the key companies operating in the market include IBM Corporation and VMware.

-

IBM Corporation (IBM) is a multinational technology company. IBM’s CaaS offerings are designed to cater to enterprise-grade requirements. It's a managed Kubernetes service on IBM Cloud that allows developers to automate deployments, rollouts, monitoring, and scaling of containerized applications with built-in security, identity management, and high availability. Unlike some hyperscalers that emphasize developer convenience, IBM places strong emphasis on governance, observability, and compliance, making its CaaS solutions particularly appealing to clients in regulated industries like banking, healthcare, and telecom.

-

VMware is an enterprise software company. VMware Tanzu is a suite of containers as a service that allows enterprises to build, run, and manage containerized applications across on-premises and cloud environments. VMware’s Tanzu Kubernetes Grid (TKG) provides a consistent, enterprise-ready Kubernetes runtime that integrates seamlessly with VMware vSphere, NSX, and vSAN. This tight integration enables organizations to manage containers alongside virtual machines using familiar VMware tools, offering a smoother transition for companies modernizing their applications.

IT Outposts and Gcore are some of the emerging participants in the containers as a service market.

-

IT Outposts is a DevOps and cloud engineering consultancy. IT Outposts leverages industry-leading solutions like Docker, Docker Compose, and Kubernetes to help clients build microservices architectures, streamline deployments, and improve system resilience. Their deployments are designed with automation, scalability, and high availability in mind, enabling clients to manage containerized applications across cloud and hybrid environments efficiently.

-

Gcore is a privately held cloud, edge, AI, and network infrastructure provider. Gcore CaaS product enables users to run containerized workloads in a serverless environment without needing to manage virtual machines, bare metal servers, or orchestrators like Kubernetes. Customers can deploy containers via a web portal or REST API, paying only for active container runtime, making the solution both simple to use and cost-efficient.

Key Containers As A Service Companies:

The following are the leading companies in the containers as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Cloud

- Canonical Ltd.

- Cisco Systems, Inc.

- CrowdStrike

- Docker Inc.

- Gcore

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- IT Outposts

- Microsoft Corporation

- SITA Airport IT GmbH

- Successive Technologies LLC

- Tencent Cloud

- VMware (Broadcom)

Recent Developments

-

In January 2025, Alibaba Cloud launched the Alibaba Cloud Container Compute Service (ACS), a solution aimed at streamlining and enhancing workload deployment through container technology. ACS is a serverless container service that delivers compute resources aligned with container standards. By eliminating the need for users to manage underlying infrastructure such as nodes and clusters, ACS significantly lowers both the cost and technical complexity of container deployment.

-

In February 2024, Gcore launched its Container as a Service (CaaS). This serverless cloud solution allows users to run containerized applications without the need to configure or manage virtual machines, servers, or orchestration tools like Kubernetes. By managing all underlying infrastructure, Gcore enables users to focus entirely on their containers and pay only for the time their applications actually run.

Containers As A Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.62 billion

Revenue forecast in 2033

USD 38.64 billion

Growth rate

CAGR of 24.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service type, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Microsoft Corporation; Cisco Systems, Inc.; IBM Corporation; VMware (Broadcom); Canonical Ltd.; Alibaba Cloud; Tencent Cloud; Docker Inc.; Hewlett Packard Enterprise (HPE); IT Outposts; CrowdStrike; Successive Technologies LLC; Gcore; SITA Airport IT GmbH

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Containers As A Service Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the containers as a service market report based on service type, deployment, enterprise size, end-use, and region:

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Management & Orchestration

-

Security

-

Monitoring and Analytics

-

Storage and Networking

-

Continuous Integration and Continuous Deployment (CI/CD)

-

Training and Consulting

-

Support and Maintenance

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT & Telecommunication

-

BFSI

-

Healthcare

-

Retail

-

Manufacturing

-

Government

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global containers as a service market size was estimated at USD 5.57 billion in 2024 and is expected to reach USD 6.62 billion in 2025.

b. The global containers as a service market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2033 to reach USD 38.64 billion by 2033.

b. The management & orchestration segment dominated the containers as a service market in 2024 with a revenue share of 29.6%. The rise of edge computing and distributed energy resources also contributes to the need for robust management & orchestration security

b. Some key players operating in the market include Microsoft Corporation, Cisco Systems, Inc., IBM Corporation, VMware (Broadcom), Canonical Ltd., Alibaba Cloud, Tencent Cloud, Docker Inc., Hewlett Packard Enterprise (HPE),IT Outposts, CrowdStrike, Successive Technologies LLC, Gcore, SITA Airport IT GmbH.

b. Factors such as the shift toward automation and infrastructure-as-code and the rising prevalence of multi-cloud and hybrid cloud strategies among enterprises are the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.