- Home

- »

- Digital Media

- »

-

Creator Economy Market Size, Share, Industry Report, 2033GVR Report cover

![Creator Economy Market Size, Share & Trends Report]()

Creator Economy Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use, By Platform Type (Video Streaming, Blogging Platform, Podcasting Platform), By Creative Service, By Revenue Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-695-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Creator Economy Market Summary

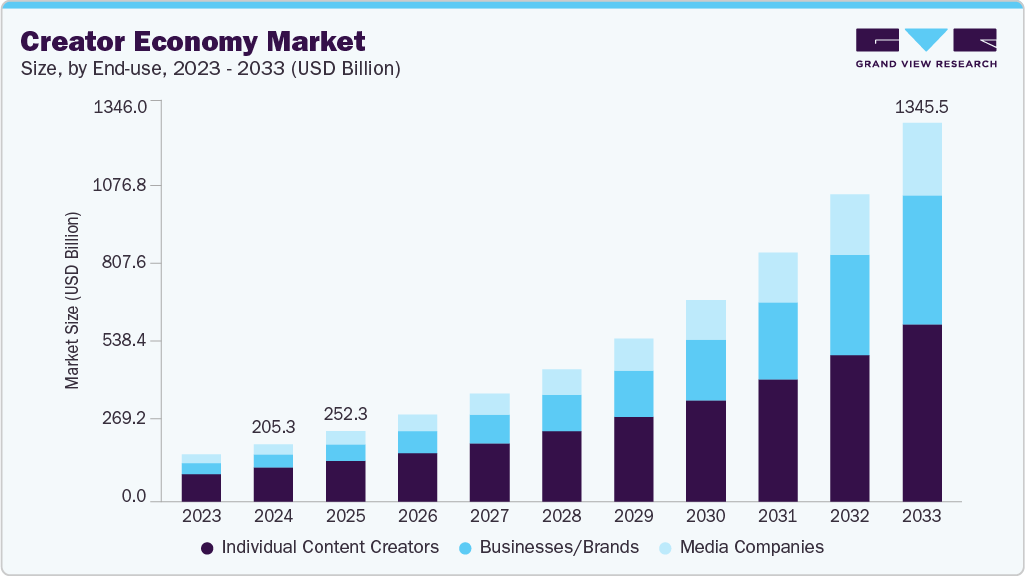

The global creator economy market size was estimated at USD 205.25 billion in 2024 and is projected to reach USD 1,345.54 billion by 2033, growing at a CAGR of 23.3% from 2025 to 2033. The market growth is driven by the rising demand for personalized content, direct-to-fan monetization, and the widespread adoption of digital platforms that empower individuals to become content entrepreneurs.

Key Market Trends & Insights

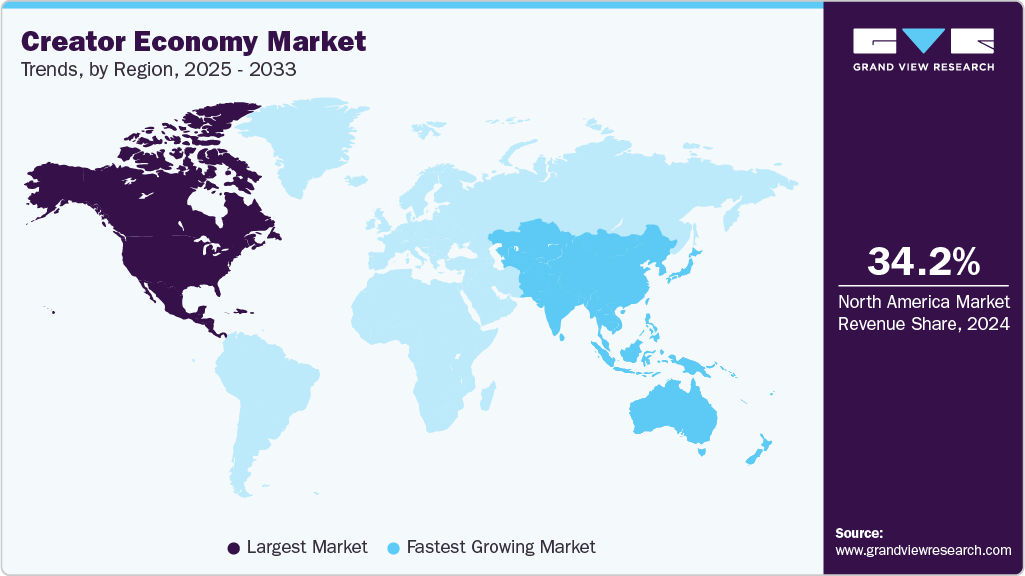

- North America dominated the global creator economy market with the largest revenue share of 34.2% in 2024.

- The creator economy industry in the U.S. is expected to grow at a significant CAGR over the forecast period.

- By end use, the individual content creators segment led the market with the largest revenue share of 58.7% in 2024.

- By platform type, the video streaming segment accounted for the largest market revenue share in 2024.

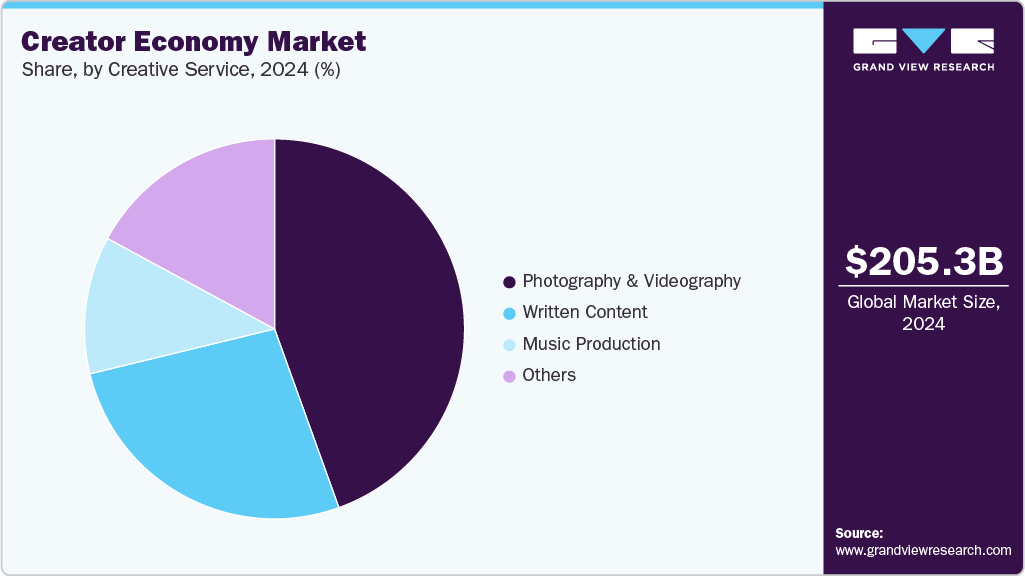

- By creative service, the photography & videography segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 205.25 Billion

- 2033 Projected Market Size: USD 1,345.54 Billion

- CAGR (2025-2033): 23.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing Market

The market is driven by adopting digital platforms that enable individuals to produce, distribute, and monetize content directly to audiences worldwide. Social media’s penetration, combined with the rise of influencer culture, allows creators to build strong personal brands and diverse revenue streams through sponsorships, subscriptions, and affiliate marketing. Technological improvements in content creation tools and easier access to global markets have lowered barriers for emerging creators, establishing a dynamic ecosystem where entrepreneurship and creativity intersect. In addition, increasing consumer demand for authentic and personalized content encourages ongoing innovation and diversification within the creator economy, further accelerating market expansion.

Moreover, the growth is driven by continuous innovation in monetization models and platform features that enhance creator independence and profitability. Increasing integration of AI-powered tools automates content production, audience engagement, and data analytics, allowing creators to scale output and refine strategies more efficiently. In addition, brand partnerships are shifting focus toward authentic, niche micro-creators who generate higher engagement within targeted communities, expanding collaboration opportunities across industries. The blending of social interaction and e-commerce continues, as creators leverage shoppable content and live sales to convert audience attention directly into revenue.

Furthermore, increasing internet access and mobile device usage globally support the scalability of the creator economy, drawing diverse populations into creator ecosystems beyond traditional markets. Platforms are evolving with improved analytics, community-building features, and cross-platform strategies to meet the complex demands of creators and brands alike. Advances in blockchain, digital ownership, and creator-led commerce provide new models for revenue and audience relationships. Together, these factors enable the sustainable expansion of the market as the creator economy transforms the digital content landscape into a multi-billion-dollar industry.

End Use Insights

The individual content creators segment led the market with the largest revenue share of 57.2% in 2024, owing to leveraging platform democratization and direct audience monetization across diverse verticals such as lifestyle, gaming, fitness, and education. Their agility in adopting new formats and building authentic engagement drives audience loyalty and consistent revenue streams through tips, merchandising, and ad-sharing programs. The low barrier to entry and availability of accessible creation tools encourage a continuous influx of new creators. Personalized content strategies and the ability to quickly respond to trends enable these creators to capture and convert large, international audiences. The breadth and diversity of independent creators contribute to sustained monetization and high overall market participation.

The businesses/brands segment is predicted to experience at the fastest CAGR during the forecast period. Businesses and brands increasingly invest in creator-led campaigns and branded content initiatives, using data-driven strategies for influencer partnerships and sponsored storytelling. As consumer trust shifts toward authentic micro-influencer endorsements and value-driven narratives, brands move away from traditional advertising, deploying co-creation models with content creators to boost engagement. Automation tools streamline campaign management, while platforms introduce comprehensive analytics for impact tracking. Brands diversify revenue through digital product launches, webinars, and online communities, harnessing creator expertise to enter new markets.

Platform Type Insights

The video streaming segment accounted for the largest market revenue share in 2024. Video streaming platforms such as YouTube, Twitch, and emerging short-form apps dominate revenue generation due to broad user reach and multifaceted monetization. Viewers prefer video for its immediacy, interactivity, and expressive depth, driving the popularity of live streams, product reviews, gaming sessions, and educational content. Streamers generate income from ad revenue, tipping, paid subscriptions, and sponsored integrations. Advanced AI content discovery and recommendation systems help surface creator content to relevant audiences, boosting engagement and monetization.

The podcasting platform segment is expected to grow at the fastest CAGR during the forecast period. Podcasts engage diverse audiences through accessible, on-demand content tailored for multitasking and community-building. Growth in branded podcasts, subscription models, and advertising integration supports diversified revenue streams for both creators and platforms. The ability to build niche audiences and deepen engagement through serialized storytelling sets podcasts apart from other media. Streaming services and audio platforms invest in exclusive show deals and analytics for better audience targeting. Increased adoption of smart speakers and in-vehicle audio connectivity extends the market reach for podcasting.

Creative Service Insights

The photography & videography segment led the market with the largest revenue share of 44.5% in 2024. Creators specializing in photography and videography capitalize on the growing demand for high-quality visual content across social media, advertising, and digital storytelling. Platforms supporting image and short-form video sharing enable direct monetization through licensing, paid collaborations, and premium content offerings. Tools for editing, distribution, and analytics empower visual creators to optimize their workflows and expand audience exposure. The prevalence of visually driven digital marketing by brands, agencies, and independent businesses further supports revenue growth in this segment.

The music production segment is expected to grow at the fastest CAGR during the forecast period. Music creators benefit from streaming platforms, digital distribution, and direct-to-fan monetization, including digital sales, virtual concerts, and crowdfunded projects. Integration of royalty tracking and licensing systems increases transparency and income opportunities for independent musicians. AI-powered music composition and audio editing advances simplify content creation, encouraging new entrants and diversifying genre experimentation. Social media challenges, sound branding, and influencer-driven music promotion drive discoverability for new releases, while virtual collaborations expand potential reach.

Revenue Channel Insights

The advertising segment accounted for the largest market revenue share in 2024, due to high ROI in influencer marketing, branded content, and native ad partnerships. Platforms deploy automated ad insertion, real-time bidding, and contextual ad placements that optimize return for both brands and creators. Increasing investment in data analytics and campaign measurement supports targeted outreach and improved conversion rates. The authenticity of creator endorsements and the ability to engage niche communities reinforce advertising’s leading role. Innovation in shoppable content and integrated commerce further amplifies advertising-driven revenues.

The subscription segment is anticipated to grow at the fastest CAGR during the forecast period. The rise of subscription-based platforms empowers creators to secure recurring income while delivering exclusive experiences, tutorials, and content bundles to dedicated followers. Flexible payment structures allow fans to support the creators directly, enhancing financial stability and creative independence. Community-building features such as Q&As, private chats, and early releases increase subscribers' engagement. Platforms continue to innovate with tiered access, bundled services, and bundled community benefits, diversifying offerings and increasing subscriber loyalty.

Regional Insights

North America dominated the creator economy market with the largest revenue share of 34.2% in 2024, due to high digital adoption, cultural entrepreneurship, and established creator platforms with global reach. Strong investment flows and favorable legal frameworks support innovation in monetization tools, content rights management, and creator-platform relationships. The region benefits from mature advertising ecosystems and collaborative partnerships between tech companies and content creators. Early adoption of emerging formats, such as NFTs and AR experiences, provides new monetization channels.

U.S. Creator Economy Market Trends

The creator economy market in the U.S. is expected to grow at a significant CAGR during the forecast period, driven by a strong pipeline of creative talent, technology start-ups, and diversified revenue models for creators. The U.S. hosts content incubators, multimedia production studios, and accelerator programs, supporting emerging creators in turning passion projects into sustainable businesses. Corporate brands dedicate considerable budgets to creator collaborations and influencer marketing, pushing innovation in branded content and direct-to-fan commerce.

Europe Creator Economy Market Trends

The creator economy market in Europe is expected to grow at a significant CAGR over the forecast period, driven by increasing creator adoption of multilingual content, cross-border brand partnerships, and platform localization. Regulations supporting digital rights, fair compensation, and data privacy encourage participation from both creators and consumers. Expansion of influencer networks in verticals such as fashion, travel, and sustainability fuels partnerships across industries. Online education and knowledge-sharing content tailored for European audiences add new growth avenues.

Asia Pacific Creator Economy Market Trends

The creator economy market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period, driven by high mobile internet penetration, youthful demographics, and a thriving e-commerce environment. Regional platforms and super-apps introduce innovative creator monetization tools such as live gifting, social commerce integration, and virtual fan clubs. Online marketplaces and collaborative content formats lower barriers for new creators in hyper-local and niche categories. National campaigns supporting digital entrepreneurship and creator upskilling contribute to sector dynamism. The expanding pool of multilingual, culturally diverse creators expands the region's global influence and revenue scale.

Key Creator Economy Company Insights

Some key companies in the creator economy industry are ByteDance Ltd., Meta Platforms, Inc., Patreon, and Vimeo.com, Inc.

-

ByteDance Ltd. operates a diverse portfolio of content platforms, with TikTok as its flagship app, serving billions of users worldwide. The company integrates advertising, e-commerce, and content strategies to support creator monetization and brand partnerships, driving substantial revenue growth. Its global expansion focuses on enhancing user engagement through AI-powered content recommendation and localized experiences. ByteDance Ltd. continues to invest in advanced AI technologies to improve content creation, distribution, and personalized interactions within the creator economy.

-

Meta Platforms, Inc. delivers a broad suite of social media and digital content services, enabling creators and businesses to engage audiences across platforms such as Facebook, Instagram, and WhatsApp. The company emphasizes AI-driven tools for audience analytics, content optimization, and monetization solutions, supporting diverse creator communities. It integrates e-commerce and advertising features to enhance creator revenue streams and brand collaborations. Continuous development of augmented reality and interactive content further expands creator opportunities within its ecosystem.

Key Creator Economy Companies:

The following are the leading companies in the creator economy market. These companies collectively hold the largest market share and dictate industry trends.

- Google LLC

- ByteDance Ltd.

- Meta Platforms, Inc.

- Patreon

- Amazon.com, Inc.

- Substack Inc.

- Canva

- Baron App, Inc.

- Vimeo.com, Inc.

- Ko-fi Labs

Recent Developments

-

In March 2025, the Government of India announced the establishment of a USD 1 billion fund alongside an allocation of approximately USD 47 million to the Indian Institute of Creative Technology, aimed at adapting innovation and skill development within the creative industries. In addition, the WAVES 2025 summit was launched to provide further support and networking opportunities for content creators. This momentum is important for advancing India’s strategic objective of becoming a leading global exporter of digital content.

-

In March 2025, UNESCO and the Knight Center for Journalism in the Americas collaboratively organized a comprehensive training program targeting leading content creators and journalists. The initiative attracted over 10,000 participants who engaged in sessions focused on adapting audience trust, ethically influencing public opinion, and developing compelling content to enhance media and information literacy. This collaboration reflects ongoing efforts to strengthen journalistic standards and promote responsible communication in the digital age.

-

In February 2025, Gushcloud International partnered with Azure Capital Partners to establish the Azure-Gushcloud Entertainment Finance Fund. This fund is designed to offer structured financial support to digital creators, facilitating the expansion of their brand collaborations, content monetization, and licensing activities on a global scale. The initiative aims to empower creators by providing the necessary capital resources to accelerate growth and maximize revenue opportunities within the evolving digital entertainment ecosystem.

Creator Economy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 252.33 billion

Revenue forecast in 2033

USD 1,345.54 billion

Growth rate

CAGR of 23.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Revenue channel, creative service, end use, platform type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Google LLC; ByteDance Ltd.; Meta Platforms, Inc.; Patreon; Amazon.com, Inc.; Substack Inc.; Canva; Baron App, Inc.; Vimeo.com, Inc.; Ko-fi Labs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Creator Economy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global creator economy market report based on end use, platform type, creative service, revenue channel, and region:

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Individual Content Creators

-

Businesses/Brands

-

Media Companies

-

-

Platform Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Video Streaming

-

Blogging Platform

-

Podcasting Platform

-

Others

-

-

Creative Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Written Content

-

Photography & Videography

-

Music Production

-

Others

-

-

Revenue Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Advertising

-

Subscriptions

-

Tips/Donations

-

Affiliate Marketing

-

Brand Partnerships

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global creator economy market size was estimated at USD 205.25 billion in 2024 and is expected to reach USD 252.33 billion in 2025.

b. The global creator economy market is expected to grow at a compound annual growth rate of 23.3% from 2025 to 2033 to reach USD 1,345.54 billion by 2033.

b. North America dominated the creator economy market with a share of 34.2% in 2024 due to high digital adoption, cultural entrepreneurship, and established creator platforms with global reach.

b. Some key players operating in the creator economy market include Google LLC; ByteDance Ltd.; Meta Platforms, Inc.; Patreon; Amazon.com, Inc.; Substack Inc.; Canva; Baron App, Inc.; Vimeo.com, Inc.; Ko-fi Labs

b. .Key factors that are driving the market growth include the rising demand for personalized content, direct-to-fan monetization, and the widespread adoption of digital platforms that empower individuals to become content entrepreneurs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.