- Home

- »

- Food Additives & Nutricosmetics

- »

-

Crocetin Esters Market Size, Share & Trends Report, 2030GVR Report cover

![Crocetin Esters Market Size, Share & Trends Report]()

Crocetin Esters Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Functional Foods & Beverages, Pharmaceuticals, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-076-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Crocetin Esters Market Size & Trends

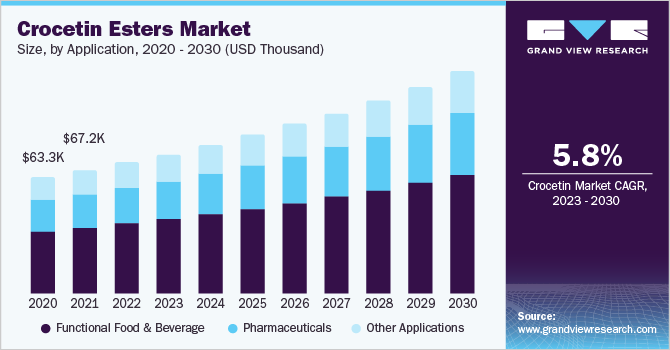

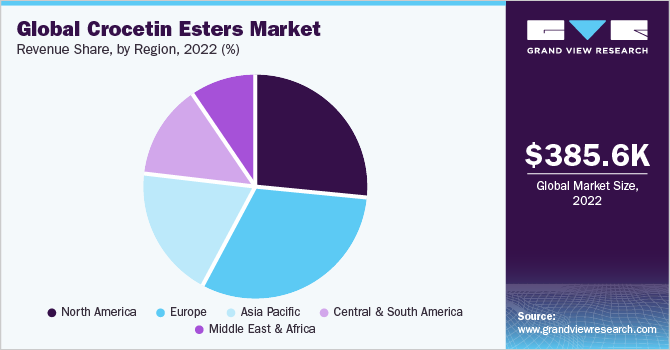

The global crocetin esters market size was valued at USD 385.6 thousand in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. The dried stigmas of the saffron crocus contain crocetin esters and these are considered to be pharmacologically active components of saffron. This component is possessed to have protective effects against cardiovascular diseases, neurological disorders, cancer, and hemorrhagic shock. Additionally, crocetin esters are also known as crocins and have anti-viral, anti-inflammatory, antioxidant, and anti-cancer properties. Such properties are anticipated to positively impact the product demand in the pharmaceutical and functional food & beverage industries over the forecast period.

The use of crocetin esters in nutraceuticals has gained popularity as they are natural and offer potential health benefits such as pain-relieving properties, cognitive and cardiovascular benefits. Nutraceutical products containing crocetin esters include natural supplements and functional foods that provide various health benefits, including reducing inflammation, protecting against oxidative stress, and improving mood and cognitive function. These products may contain saffron extracts or other natural sources of crocetin esters, such as marigold petals, gardenia fruits, zeaxanthin, butterfly bush, and cape jasmine among others.

Crocetin ester is a bioactive chemical compound that is extracted from saffron and gardenia fruit. In the U.S., saffron pills are becoming more popular because of their antioxidant and anticancer properties. Crocetin, safranal, kaempferol, and other well-known antioxidants have antidepressant qualities that may enhance memory, mood, and learning ability in addition to preventing the brain from oxidative stress. Such beneficial properties support the growth of crocetin esters in various pharmaceutical products in the country.

Nutraceuticals have emerged as a promising solution for addressing malnutrition and can help in government initiatives to improve people's overall health and well-being. By incorporating crocetin esters into nutraceutical products, governments can provide a practical way to supplement the diets of people in underprivileged areas with essential nutrients, which may improve their health outcomes. This approach can be efficient for populations consisting of children and the elderly, at higher risk of malnutrition. This strategy can help companies to capitalize on the growing demand for natural and functional food products that cater to the specific nutritional needs of consumers.

For instance, the Food Safety and Standards Authority of India (FSSAI) estimates that 15% of India's population is malnourished. Various schemes, such as the Integrated Child Development Services (ICDS) program, the National Health Mission (NHM), and the Midday Meal initiative are assisting in ensuring the supply of nourishment to all. According to the World Bank, in 2021, the malnutrition costs in India were approximately USD 12 billion in GDP. The current situation demonstrates that Indian nutraceutical companies have the potential to play a significant role in expanding the global pharmaceutical industry.

Application Insights

Functional food & beverage application segment dominated the market with a revenue share of more than 52.8% in 2022. This is attributable to the growing utilization of crocetin esters in dairy, confectionery, convenience food, and beverage items to ensure the stability of food products. It also helps in enhancing the color, taste, and aroma of food & beverages.

Additionally, the increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disease is driving segment growth. These diseases are often caused by oxidative stress and inflammation, which crocetin esters help mitigate. Crocetin esters in functional foods and beverages make it possible to provide consumers with a natural and effective way to reduce the risk of these diseases. Some key players in the functional foods and beverages market already incorporating Crocetin esters into their products includes Kiva Health Food, Swanson Health Products, and Nature’s Bounty.

Crocetin ester is a carotenoid pigment and is used in various pharmaceutical applications. One of its key applications is as a natural coloring agent. Crocetin esters impart a bright yellow-orange color to various pharmaceutical products, including capsules, tablets, and syrups. Using natural colors in pharmaceutical products is becoming increasingly popular as consumers have become more aware of the potential health risks of synthetic colors.

Companies are using partnerships, product launches, mergers, and acquisitions, to increase their product offering and gain a competitive edge in the market. For instance, in May 2021, Pharmactive announced that the U.S. patent office had granted the patent for Affron, a Pharmactive flagship saffron extract (Crocetin Esters), for its demonstrated favorable effect on reducing emotional support. The new patent effectively covers Affron formulation and dosages that make it as powerful as a natural mood-support drug.

Regional Insights

Europe region dominated the market with a revenue share of more than 30.6% in 2022. This is attributable to the increasing demand for natural food colors and flavorings in the food & beverage industry across key countries including Germany, the UK, France, and Italy. Rising demand for natural food colors in pharmaceutical and food & beverage industries is driving demand for crocetin esters.

Crocetin esters is a bioactive substance that naturally occurs in various therapeutic plants, particularly in the fruit of saffron and gardenias. Saffron contains numerous carotenoid pigments. Additionally saffron consists of dried stigma and 70% of the drug prepared from saffron is produced in Spain.

The rising incidence of chronic diseases and cancer in North America is primarily driving the crocetin esters market. Crocetin glycosides like crocetin esters have been recognized as useful dietary components. They are used in various pharmaceuticals as well as functional food and beverage products.

The growth of food & beverage, dietary supplements, and pharmaceutical industries in key countries, including China, South Korea, India, and Japan is expected to drive the demand for crocetin esters over the forecast period. Due to its antioxidant, anti-inflammatory, and neuroprotective qualities, Crocetin esters have been recognized as a potential ingredient for functional foods and beverages. Kiva Health Food, Swanson Health Products, Kerry Group Plc., and Nature's Bounty are a few major companies in the functional foods and beverages segment that already use crocetin esters in their products.

Key Companies & Market Share Insights

The market is competitive in nature with the presence of different domestic and international players across the globe. Manufacturers are taking the initiative to collaborate with one another to expand their product portfolio and geographical reach. For instance, in October 2020, Royal DSM acquired Erber Group with an aim to strengthen its animal health and nutrition solutions for farm productivity and sustainability. Some prominent players in the global crocetin esters market include:

-

Chengdu biopurify

-

Chengdu Gelipu Biotechnology Co., Ltd.

-

Tokyo Chemical Industry Co., Ltd.

-

Amadis Chemical Company Limited

-

Hunan Jiahang Pharmaceutical Technology Co., Ltd.

-

Cayman Chemical

-

Biosynth

Global Crocetin Esters Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 406.9 thousand

Revenue forecast in 2030

USD 606.0 thousand

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD thousand, volume in Kg and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Central & South America;Asia Pacific; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Italy; UK; France; China; India; Japan; Argentina; Brazil; Saudi Arabia; South Africa

Key companies profiled

Chengdu biopurify; Chengdu Gelipu Biotechnology Co., Ltd.; Tokyo Chemical Industry Co., Ltd.; Amadis Chemical Company Limited; Hunan Jiahang Pharmaceutical Technology Co., Ltd.; Cayman Chemical; Biosynth

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crocetin Esters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global crocetin esters market report based on application, and region:

-

Application Outlook (Revenue, USD Thousand; Volume, Kg, 2018 - 2030)

-

Functional Food & Beverage

-

Dairy

-

Confectionery

-

Convenience

-

Beverages

-

Other Functional Food & Beverage

-

-

Pharmaceuticals

-

Other Applications

-

-

Regional Outlook (Revenue, USD Thousand; Volume, Kg, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global Crocetin Esters market size was estimated at USD 385.6 thousand in 2022 and is expected to reach USD 406.9 thousand in 2023

b. The global Crocetin Esters market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 606 thousand by 2030

b. Europe dominated the Crocetin Esters market with a share of 30.6% in 2022. This is attributable to increasing demand for natural food colors and flavorings in the food & beverage industry across key countries including Germany, the UK, France, and Italy

b. Some key players operating in the Crocetin Esters market include Chengdu Biopurify, Chengdu Gelipu Biotechnology Co., Ltd., Amadis Chemical Company Limited, and Cayman Chemicals, among others

b. Key factors that are driving the Crocetin Esters market growth include the growing utilization of crocin chemicals in dairy, confectionery, convenience food, and beverage items to ensure the stability of food products

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.