- Home

- »

- Consumer F&B

- »

-

Dairy Alternatives Market Size, Share & Trends Report, 2030GVR Report cover

![Dairy Alternatives Market Size, Share & Trends Report]()

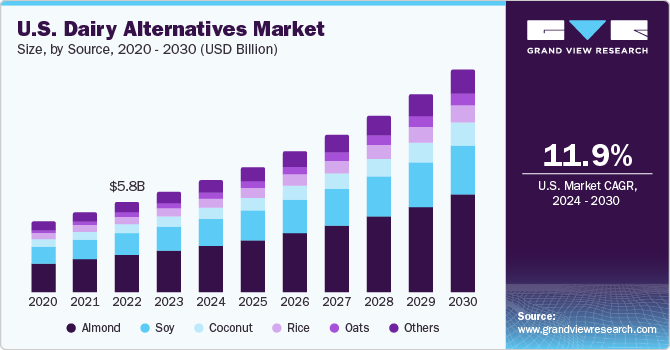

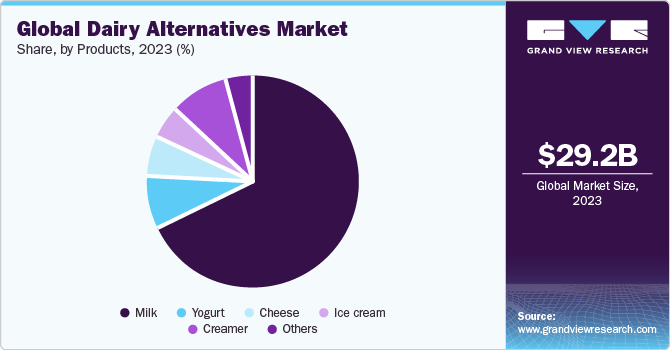

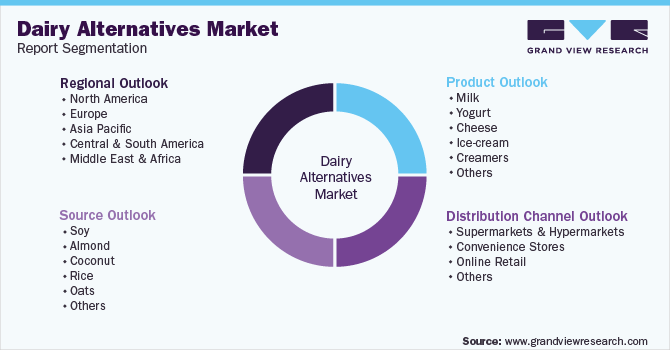

Dairy Alternatives Market Size, Share & Trends Analysis Report By Source (Soy, Almond, Coconut, Rice, Oats), By Product (Milk, Yogurt, Cheese, Ice-cream, Creamers), By Type, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-070-5

- Number of Report Pages: 240

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Dairy Alternatives Market Size & Trends

The global dairy alternatives market size was valued at USD 29.18 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.6% from 2024 to 2030. The market is gaining momentum and witnessing a high demand owing to the shift in consumer eating patterns and changes in diet trends. The increasing occurrences of cases of milk allergies and lactose intolerances are expected to drive the demand further in the forecast period. Numerous food and beverage products are thus making use of the products to appeal to the growing consumer base that is opting for plant-based and other dairy alternatives.

Soy milk is expected to gain popularity in the U.S. among the elderly and female consumer base as it contains isoflavones, which are said to reduce the risk of heart disease and breast cancer. Soy also contains phytoestrogen, which functions similarly to the female hormone estrogen. Drinking soy milk is popular as an alternative therapy among women to increase estrogen levels, which is further expected to drive the market.

Almond milk is becoming increasingly popular among health-savvy youth that pursues a ketogenic diet and vegan diet. Almond milk is a rich substitute for dairy due to its high lipids, fiber, and protein content, and is expected to witness a high adoption rate among consumers as well as end-user industries.

The consumer demand for nutritional foods with values such as low calories, high proteins, and vitamins has grown substantially during the COVID-19 pandemic. Owing to this, a large consumer base across the globe has been shifting to dairy alternatives. Moreover, the popularity of the vegan diet has increased due to COVID-19 as consumers have been increasingly adopting plant-based food products, further boosting sales across the globe.

Market Concentration & Characteristics

The growth of this market can be attributed to increasing consumer spending on skin care products owing to the growing preference for high-quality products. However, the rapidly changing consumer preferences and needs encourage manufacturers to innovate, improve, and diversify their product offerings to meet the changing demands of consumers worldwide.

Product launches are crucial in the dairy alternatives market, particularly for healthy and ingredient-rich products. In this sector, the food companies rely on new product offerings to stay competitive and meet the evolving consumer demands for natural and healthy ingredients.

Obtaining certifications for ingredients, is important in the dairy alternatives market as it underscores the commitment to meeting strict quality, sustainability, and environmental standards. These certifications validate the integrity and reliability of the product, instilling confidence in buyers about its source, processing, and adherence to eco-friendly practices.

Corporate social responsibility (CSR) plays a crucial role in the dairy alternatives market as it underscores the commitment to ethical and sustainable practices. Companies can build a positive brand image and foster long-term relationships with partners and buyers by engaging in initiatives that benefit local communities and the environment

Source Insights

Soy led the market and accounted for a revenue share of over 35% in 2023. Almond is the second-largest source segment of the market. It is rich in Vitamin B, which helps raise the base metabolic rate of the body, enabling it to burn fats and calories more efficiently. Due to these nutritional benefits provided by almond milk, its demand is likely to contribute to the growth.

Almond milk has essential minerals such as iron, magnesium, phosphorous, zinc, and copper that help in controlling blood pressure, improving blood oxygenation, and providing body protection against diseases. In addition, almond milk is rich in Vitamin E and manganese, making it a more powerful drink for improving skin quality and for protecting against cancer.

An increase in consumer preference for plant-based products and ease of raw material availability are the significant factors fueling the market growth. Moreover, the rising demand for rice milk among consumers for manufacturing various food and beverage items such as ice creams, snacks, and beverages is expected to drive the demand for the product in the forecast period. Rice milk is made with white or brown rice and is usually unsweetened; however, it has more carbohydrates and is therefore fortified with iron, vitamin D, and vitamin B12. The organic form of rice milk in the market is gaining momentum over conventional products even though it is priced at a premium, which, in turn, is providing substantial growth to the market.

Dairy alternative products such as hemp milk, cashew milk, and coconut milk are also gaining popularity across the globe. Hemp milk strengthens the immune system, provides healthy skin, hair, and nails, and makes the heart strong. Furthermore, coconut milk makes the bones stronger, helps in the treatment of arthritis, and aids in weight loss. These health benefits of plant-based milk are likely to propel the global demand.

Product Insights

Milk led the market and accounted for a revenue share of around 68% in 2023. The increasing old age population has resulted in people preferring milk-based alternatives in Europe. However, growing health concerns over soymilk, especially for breast cancer survivors, are likely to hamper the market growth.

The increasing demand among consumers for a variety of beverage options has resulted in varied options of flavored beverages consisting of dairy alternatives. The flavored beverages also appeal to lactose-intolerant consumers who are looking for variety in milk-based dairy alternative beverages.

Growing demand for dairy alternatives-based cheese products such as soy and almond-based cream cheese, sour creams, and regular cheese is expected to propel the demand for dairy alternative products over the forecast period. Consumers who are lactose intolerant and have allergies to milk products are switching over to various cheeses made from almonds and soy, which fuels the growth of the market.

Market penetration of dairy alternatives-based cheese products is likely to grow over the forecast period on account of the presence of companies like Galaxy Nutritional Foods, Tofutti, and Trader Joe’s that provide the famous dairy-free soy cream cheeses. In addition, Daiya Foods Inc. makes a variety of cheeses, which are nut, gluten, dairy, and soy-free, making them a great choice for those with allergies to these ingredients.

The shifting preference of consumers toward low-calorie soy and almond milk-based desserts is likely to propel market growth. Several flavoring and masking agents have been developed to make desserts more palatable, increasing their appeal to the taste-conscious population. In addition, the price of such desserts is less as compared to its dairy substitutes, which is likely to increase the penetration of plant-based milk desserts across the globe.

Type Insights

Plain dairy alternatives accounted for a revenue share of over 70% in 2023. The growth of this segment can be attributed to the growing demand for unflavored and low-calorie products by consumers of age groups above 40, with this trend particularly observed in Europe, parts of Asia Pacific, and North America.

The flavored dairy alternatives market is projected to grow at a CAGR of over 15% from 2024 to 2030. Millennials and other health-conscious working-class consumers have been observed to have steered a significant shift towards healthy snacking options, such as flavored yogurts, milk, etc. These consumers are also substituting carbonated beverages with healthier alternatives such as flavored vegan milk products, smoothies, etc., thus driving key market players to innovate and launch novel products to stay abreast with the surging demand in the flavored dairy alternatives market.

Distribution Channel Insights

Supermarkets and hypermarkets dominated the global market, among sales channels, having accounted for a revenue share of nearly 40% in 2023. In developed regions, such as Europe and North America, the penetration of supermarkets and hypermarkets is higher than that in the developing regions. Besides, the presence of a large variety of this product in one place and ease of buying contributed to the dominance of supermarkets and hypermarkets in the market in 2023.

Convenience stores usually offer lower discounts in comparison to hypermarkets and supermarkets, and online stores owing to their low-volume procurement from manufacturers or suppliers. Besides, convenience stores mainly focus on everyday items; thus, the availability of limited shelf sizes restricts them from keeping an extensive assortment of dairy alternative products.

Owing to the limited availability of the brands in convenience stores, consumers mainly prefer other distribution channels, which, in turn, is expected to restrain the growth of this segment over the forecast period. However, convenience stores offer better traction for fresh milk as consumers usually prefer it for everyday use.

Regional Insights

The Asia Pacific dairy alternatives market dominated the global industry, having accounted for a revenue share of over 45.0% in 2023. Expanding population and rising disposable incomes in emerging countries such as India, China, and Japan are expected to augment the demand for the product in the Asia Pacific region.

North America is one of the major markets as various of alternatives such as ice cream and yogurt are consumed on a large scale. Flavored milk accounts for over two-thirds of milk products sold in North American schools. Increasing consumer demand for sweetened flavored soy and almond milk is expected to be a key factor driving the industry.

Milk-based dairy alternatives are used for manufacturing various food items and desserts, which is expected to drive the dairy alternatives market in North America over the coming years. Despite dairy alternatives-based ice cream witnessing moderate demand in North America as compared to milk-based ice cream, the growth of this product category is expected to be much higher over the forecast period.

The dairy alternatives market in Europe is expected to grow at a CAGR of 11.4% from 2024 to 2030, driven by the rising demand for healthy foods and beverages in the region. Dairy alternative-based beverages are often consumed as alternatives to dairy beverages. Manufacturers operating in the region are focusing on new product development, which includes soy juice mixes and fresh soy drinks.

Key Companies & Market Share Insights

The global dairy alternatives market is characterized by the presence of a few well-established players such as ADM; The Whitewave Foods Company; The Hain Celestial Group, Inc.; Daiya Foods Inc.; Eden Foods, Inc.; Nutriops, S.L.; Earth’s Own Food Company; SunOpta Inc.; Freedom Foods Group Ltd.; OATLY AB. The market players face intense competition from each other as some of them are among the top manufacturers with diverse product portfolios for skin care products including skin lightning products. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both, regional and international consumers.

Key Dairy Alternatives Companies:

The following are the leading companies in the dairy alternatives market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these dairy alternatives companies are analyzed to map the supply network.

- ADM

- The Whitewave Foods Company

- The Hain Celestial Group, Inc.

- Daiya Foods Inc.

- Eden Foods, Inc.

- Nutriops, S.L.

- Earth’s Own Food Company

- SunOpta Inc.

- Freedom Foods Group Ltd.

- OATLY AB

- Blue Diamond Growers

- CP Kelco

- Vitasoy International Holdings Limited

- Organic Valley Family of Farms

- Living Harvest Foods Inc.

Recent Developments

-

In November 2022, Oatlay Group AB announced that it would release a new range of oat-based yogurt. The new range of product line includes 4 flavors - strawberry, blueberry, plain and Greek style.

-

In October 2022, Plenish announced the launch of a new line of a plant-based products. The three-strong range of unsweetened enrich milk, almond, oat and soy is fortified with nutrients including iodine, omega-3, and vitamin D.

-

In September 2022, Swedish coffee chain Espresso House, which opertates 35 stores in Germany, extended a partnership with Oatly to serve Oastly Barista edition, across its coffee shops in the Nordics and Germany.

Dairy Alternatives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.77 billion

Revenue forecast in 2030

USD 66.91 billion

Growth rate (Revenue)

CAGR of 12.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, China, India, Japan, Australia, South Korea, Brazil, Argentina, South Africa, UAE

Key companies profiled

ADM; The Whitewave Foods Company; The Hain Celestial Group, Inc.; Daiya Foods Inc.; Eden Foods, Inc.; Nutriops, S.L.; Earth’s Own Food Company; SunOpta Inc.; Freedom Foods Group Ltd.; OATLY AB; Blue Diamond Growers; CP Kelco; Vitasoy International Holdings Limited; Organic Valley Family of Farms; Living Harvest Foods Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Dairy Alternatives Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global dairy alternatives market report on the basis of source, product, distribution channel, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Soy

-

Almond

-

Coconut

-

Rice

-

Oats

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Milk

-

Yogurt

-

Cheese

-

Ice cream

-

Creamer

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Plain

-

Flavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket & Hypermarkets

-

Convenience Stores

-

Online retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global dairy alternatives market size was estimated at USD 26.01 billion in 2022 and is expected to reach USD 29.1 billion in 2030.

b. The global dairy alternatives market is expected to grow at a compound annual growth rate of 12.6% from 2023 to 2030 to reach USD 66.9 billion by 2030.

b. Soy source segment dominated the dairy alternatives market with a share of 35.6% in 2022, owing to high protein content, easy availability, and low cost of the raw material.

b. Supermarket and hypermarkets led the global dairy alternatives market and accounted for more than 40.0% share of the global revenue in the year 2022.

b. Asia-Pacific region dominated the dairy alternatives market with a revenue share of 45.20% in the year 2022 owing to owing to growing demand for flexitarian diets

b. The key factors that are driving the dairy alternatives market include expanding size of vegan consumer base as well as increasing demand of dairy alternatives-based products from lactose intolerant consumers. Besides, the increasing consumption of dairy alternatives for weight loss purpose is also driving the global dairy alternatives market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."