- Home

- »

- Next Generation Technologies

- »

-

Data Center Monitoring Market Size, Industry Report, 2033GVR Report cover

![Data Center Monitoring Market Size, Share & Trends Report]()

Data Center Monitoring Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (On-premises, Cloud), By Monitoring Type, By Data Center Type, By End-use (IT & Telecom, BFSI), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-658-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Monitoring Market Summary

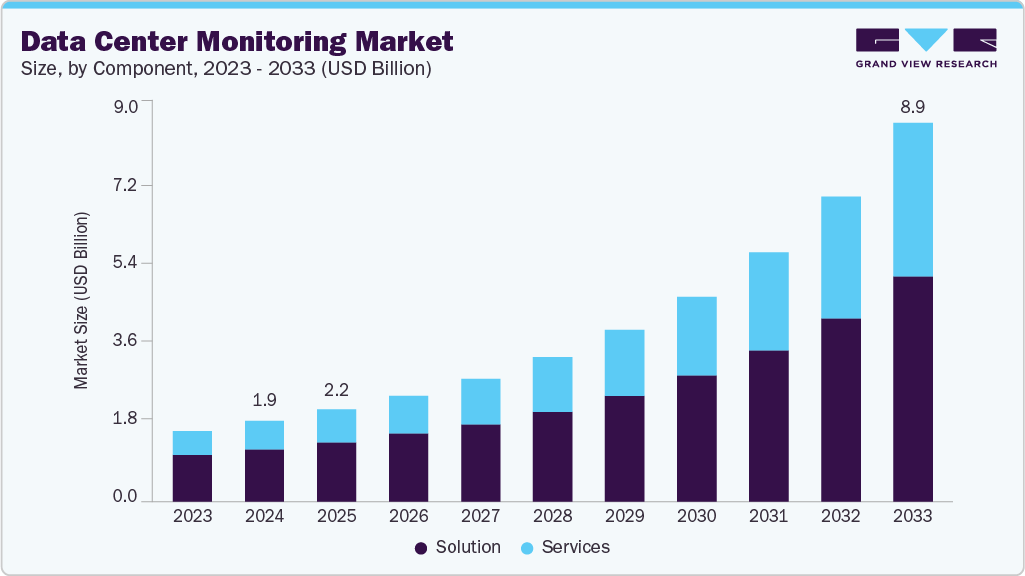

The global data center monitoring market size was estimated at USD 1.90 billion in 2024 and is projected to reach USD 8.92 billion by 2033, growing at a CAGR of 19.3% from 2025 to 2033 due to the increasing demand for real-time visibility and predictive maintenance in increasingly complex data center environments. As enterprises shift to hybrid and multi-cloud infrastructure, the need to ensure operational continuity, reduce downtime, and maintain service level agreements (SLAs) has surged.

Key Market Trends & Insights

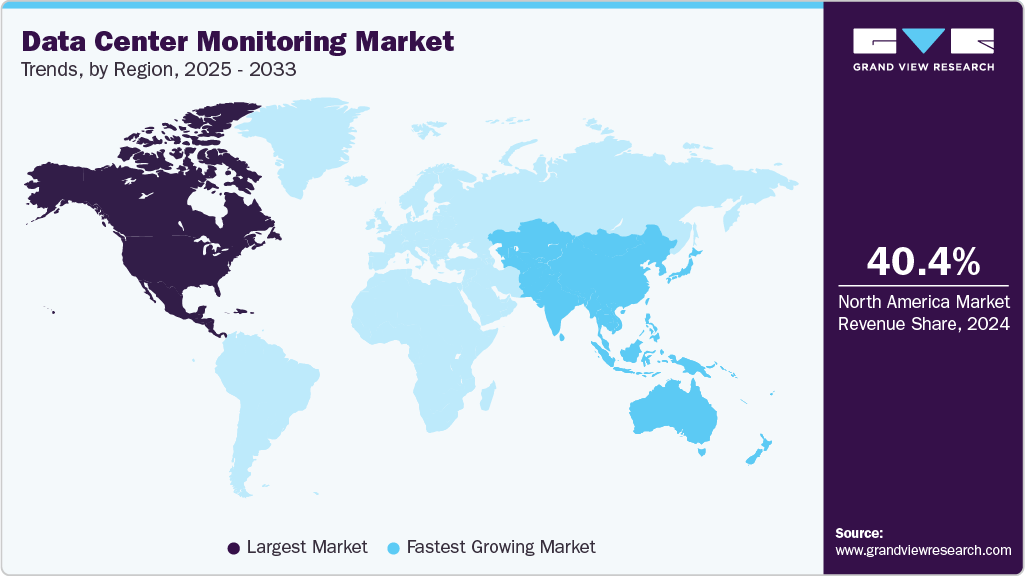

- North America dominated the data center monitoring market with the largest revenue share of 40.4% in 2024.

- The data center monitoring market in the U.S. is expected to grow at a significant CAGR of 18.2% from 2025 to 2033.

- By component, the solution led the market with the largest revenue share of 65.3% in 2024.

- By monitoring type, the security monitoring segment accounted for the largest market revenue share in 2024.

- By deployment, the on-premises segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.90 Billion

- 2033 Projected Market Size: USD 8.92 Billion

- CAGR (2025-2033): 19.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advanced monitoring tools offering real-time alerts, anomaly detection, and predictive analytics are becoming critical in managing temperature, power, humidity, and hardware failures. The rapid growth of hyperscale and colocation data centers, fueled by the expansion of cloud computing, edge data centers, and digital transformation initiatives contributing to the growth of the data center monitoring industry. As these large-scale facilities require continuous uptime and energy-efficient operations, monitoring solutions that provide comprehensive insights into power usage effectiveness (PUE), environmental parameters, and asset utilization are in high demand. Colocation providers, in particular, are leveraging intelligent monitoring tools to deliver transparency and performance assurance to their clients, which enhances customer trust and competitiveness in the market.In addition, the increasing emphasis on regulatory compliance, cybersecurity, and sustainability is accelerating the adoption of data center monitoring solutions. Governments and industry bodies are imposing stricter energy efficiency and data protection mandates, prompting data center operators to implement monitoring systems that support auditing, reporting, and risk mitigation. Germany's new Energy Efficiency Act (EnEfG), which implements the EU Energy Efficiency Directive (EED) at the national level, introduces stringent energy performance standards for data centers.

Under the new regulations, all new data centers are required to achieve a maximum Power Usage Effectiveness (PUE) of 1.2 starting July 2026. Existing data centers face phased targets, with a maximum PUE of 1.5 by July 2027 and 1.3 by July 2030. The law also imposes strict reporting and transparency requirements, aiming to significantly improve energy efficiency and reduce the environmental impact of digital infrastructure across the country.

Moreover, with the rising frequency and sophistication of cyberattacks, integrated monitoring platforms that combine physical and logical security surveillance are becoming vital to prevent breaches and unauthorized access. These evolving needs are driving innovation and investment in next-generation monitoring tools, positioning the market for robust long-term growth.

Component Insights

The solution segment led the market with the largest revenue share of 65.3% in 2024, driven by the real-time visibility, automation, and proactive management. As enterprises adopt hybrid and multi-cloud environments, there's a rising need for unified platforms that can seamlessly monitor infrastructure across distributed locations. In addition, heightened concerns around uptime, energy efficiency, and cybersecurity are pushing organizations to invest in intelligent monitoring solutions that offer predictive analytics, AI/ML-based alerts, and compliance tracking.

The service segment is anticipated to grow at the fastest CAGR during the forecast period, due to the he increasing demand for specialized expertise in deploying, maintaining, and optimizing monitoring systems across complex IT infrastructures. As organizations face skill shortages and rising operational workloads, they are turning to managed services, consulting, and support offerings to ensure reliable monitoring without straining internal resources.

Deployment Insights

The on-premises segment accounted for the largest market revenue share in 2024, driven by the organizations with stringent data sovereignty, security, and compliance requirements that necessitate full control over their infrastructure. Industries such as government, defense, and financial services often opt for on-premises monitoring to avoid third-party data exposure and ensure adherence to internal protocols and regulatory mandates. Moreover, legacy infrastructure and customized hardware setups in many large enterprises require monitoring solutions that are tightly integrated with existing on-site systems.

The cloud segment is expected to grow at the fastest CAGR during the forecast period, due to its scalability, cost-efficiency, and ease of integration with modern IT environments. As businesses increasingly shift to hybrid and multi-cloud architectures, cloud-based monitoring enables centralized oversight of distributed infrastructure without the need for extensive on-site hardware. The pay-as-you-go pricing model appeals to organizations looking to reduce capital expenditures while still gaining access to advanced monitoring features.

Monitoring Type Insights

The security monitoring segment accounted for the largest market revenue share in 2024, driven by rising frequency and sophistication of cyber threats targeting critical infrastructure. As data centers become high-value targets for ransomware, DDoS attacks, and insider threats, organizations are prioritizing comprehensive physical and digital security monitoring to protect sensitive data and maintain business continuity. The convergence of IT and OT systems increases vulnerability, driving demand for integrated solutions that monitor access control, surveillance, and network anomalies in real time.

The cooling monitoring segment is expected to grow at the fastest CAGR during the forecast period, due to the increasing need for energy efficiency and thermal management in high-density computing environments. As data centers expand to support AI workloads, edge computing, and hyperscale operations, managing heat generation becomes critical to maintaining equipment performance and preventing downtime. Cooling monitoring solutions enable real-time tracking of temperature variations, airflow, and humidity across racks and aisles, allowing operators to optimize cooling strategies and reduce overprovisioning.

Data Center Type Insights

The enterprise data centers segment accounted for the largest market revenue share in 2024, fueled by the continued need for dedicated, customizable infrastructure among large organizations seeking full control over their IT environments. Enterprises with complex, mission-critical operations often prefer to maintain their own data centers to ensure high levels of security, compliance, and performance. Monitoring solutions in this segment are essential for managing diverse hardware, legacy systems, and proprietary applications that require tailored oversight.

The edge data centers segment is expected to grow at the fastest CAGR during the forecast period, due to the proliferation of IoT devices, 5G networks, and latency-sensitive applications that require data processing closer to the source. Unlike traditional centralized data centers, edge facilities operate in remote or distributed locations with limited on-site staff, making real-time, autonomous monitoring solutions critical for ensuring uptime and performance.

End-use Insights

The IT and telecom segment accounted for the largest market revenue share in 2024, driven by continuous demand for high availability, rapid scalability, and seamless connectivity to support global digital services. With the surge in data consumption, video streaming, and cloud-based applications, IT and telecom providers are investing heavily in expanding their data center footprints and upgrading infrastructure. This expansion necessitates advanced monitoring to manage complex network topologies, dynamic workloads, and carrier-grade service levels.

The retail & e-commerce segment is expected to grow at the fastest CAGR over the forecast period, as businesses in this sector increasingly rely on digital platforms, omnichannel operations, and real-time transaction processing. With high volumes of online traffic, inventory data, and customer interactions occurring around the clock, retailers require continuous infrastructure monitoring to prevent downtime that could directly impact revenue and customer satisfaction. Seasonal spikes, flash sales, and personalized shopping experiences also demand scalable, responsive backend systems, making proactive monitoring essential for maintaining application performance and managing sudden surges in demand.

Regional Insights

North America dominated the data center monitoring market with the largest revenue share of 40.4% in 2024, driven by the widespread adoption of hybrid IT environments and growing investments in hyper-scale data centers by leading tech firms. The region's mature digital infrastructure and demand for high-availability networks are compelling enterprises to implement advanced monitoring solutions that ensure real-time analytics, automation, and energy optimization across data center operations.

U.S. Data Center Monitoring Market Trends

The data center monitoring market in the U.S. is expected to grow at a significant CAGR of 18.2% from 2025 to 2033, due to stringent government regulations around data protection and environmental sustainability are pushing data center operators to adopt monitoring systems that provide granular compliance reporting, carbon footprint tracking, and risk alerts. The strong presence of global cloud providers and aggressive AI workload deployment is also increasing demand for intelligent monitoring to manage thermal loads and resource usage.

Europe Data Center Monitoring Market Trends

The data center monitoring market in Europe is anticipated to register at a considerable CAGR from 2025 to 2033, due to the growing focus on green data centers and the enforcement of EU energy efficiency directives. Operators are investing in monitoring technologies to align with EU-wide climate goals, reduce energy waste, and optimize resource allocation. In addition, cross-border data localization laws are boosting data center activity, increasing the need for centralized monitoring systems.

The UK data center monitoring market is expected to grow at a rapid CAGR during the forecast period, owing to the acceleration of financial services digitalization, and remote work adoption is increasing the dependency on resilient data infrastructure. Enterprises are turning to monitoring tools that ensure uninterrupted service delivery, real-time incident response, and proactive equipment maintenance to prevent business disruptions and regulatory breaches.

The data center monitoring market in Germany held a substantial market share in 2024, due to the surge in industrial digitalization (Industrie 4.0) and local cloud adoption among SMBs and enterprises. The country’s strong manufacturing base and data protection standards necessitate robust infrastructure monitoring to safeguard operations, maintain GDPR compliance, and support mission-critical workloads.

Asia Pacific Data Center Monitoring Market Trends

The data center monitoring market in the Asia Pacific is anticipated to grow at the fastest CAGR of 21.4% from 2025 to 2033, due to rising internet penetration, cloud adoption, and smart city initiatives across emerging economies. The influx of hyperscale data centers in countries like India, Singapore, and Indonesia is increasing demand for scalable, vendor-agnostic monitoring platforms that support remote management and workload flexibility.

The Japan data center monitoring market is expected to grow at a rapid CAGR during the forecast period, driven by the aging infrastructure and a push for data center modernization to support 5G, AI, and IoT ecosystems. Japanese operators are adopting advanced monitoring tools to manage space, cooling, and power utilization efficiently, reduce latency for edge applications, and ensure uptime amid frequent natural disasters.

The data center monitoring market in China held a substantial market share in 2024, due to government-led digital transformation strategies and the rise of domestic cloud providers. As regulatory pressures around data sovereignty and green energy targets increase, local data center operators are deploying intelligent monitoring systems to balance performance with compliance and sustainability objectives.

Key Data Center Monitoring Company

Key players operating in the data center monitoring industry are Schneider Electric, Cisco Systems, Inc., Vertiv Group Corp., IBM Corporation, Hewlett-Packard Enterprise Development LP, and Siemens AG. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Data Center Monitoring Companies:

The following are the leading companies in the data center monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- 42U.com

- Carrier

- Cisco Systems, Inc.

- Datadog

- Hewlett-Packard Enterprise Development LP

- IBM Corporation

- Nagios Enterprises

- New Relic

- Panduit Corp

- Rittal GmbH & Co. KG

- Schneider Electric

- Securitas Technology

- Siemens AG

- SolarWinds Worldwide, LLC.

- Vertiv Group Corp.

Data Center Monitoring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.17 billion

Revenue forecast in 2033

USD 8.92 billion

Growth rate

CAGR of 19.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, monitoring type, data center type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

42U.com; Carrier; Cisco Systems, Inc.; Datadog; Hewlett Packard Enterprise Development LP; IBM Corporation; Nagios Enterprises; New Relic; Panduit Corp; Rittal GmbH & Co. KG; Schneider Electric; Securitas Technology; Siemens AG; SolarWinds Worldwide, LLC.; Vertiv Group Corp.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Monitoring Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global data center monitoring market report based on component, deployment, monitoring type, data center type, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud

-

-

Monitoring Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Network Monitoring

-

Server Monitoring

-

Power Monitoring

-

Cooling Monitoring

-

Environmental Monitoring

-

Security Monitoring

-

-

Data Center Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Enterprise Data Centers

-

Colocation Data Centers

-

Cloud Data Centers

-

Managed Data Centers

-

Edge Data Centers

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT & Telecom

-

BFSI

-

Government

-

Healthcare

-

Retail & E-commerce

-

Energy & Utilities

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center monitoring market size was estimated at USD 1.90 billion in 2024 and is expected to reach USD 2.17 billion in 2025.

b. The global data center monitoring market is expected to grow at a compound annual growth rate of 19.3% from 2025 to 2033 to reach USD 8.92 billion by 2033.

b. The solution segment dominated the market and accounted for the revenue share of 65.3% in 2024, driven by the real-time visibility, automation, and proactive management.

b. Some key players operating in the data center monitoring market include Cisco Systems Inc., Citrix Systems, Inc., Dell Inc., Hewlett-Packard Enterprise Development LP, IBM Corporation, Microsoft, NEC Corporation, Oracle, SAP SE, VMware, Inc.

b. The key growth drivers include the increasing demand for real-time visibility and predictive maintenance in increasingly complex data center environments. As enterprises shift to hybrid and multi-cloud infrastructure, the need to ensure operational continuity, reduce downtime, and maintain service level agreements (SLAs) has surged.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.