- Home

- »

- Communications Infrastructure

- »

-

Data Center Power Market Size, Share, Industry Report 2033GVR Report cover

![Data Center Power Market Size, Share & Trends Report]()

Data Center Power Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Solution (PDU, UPS, Busway), By Service (Design & Consulting, Integration & Deployment), By End-use (IT & Telecommunications, Government), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-959-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Power Market Summary

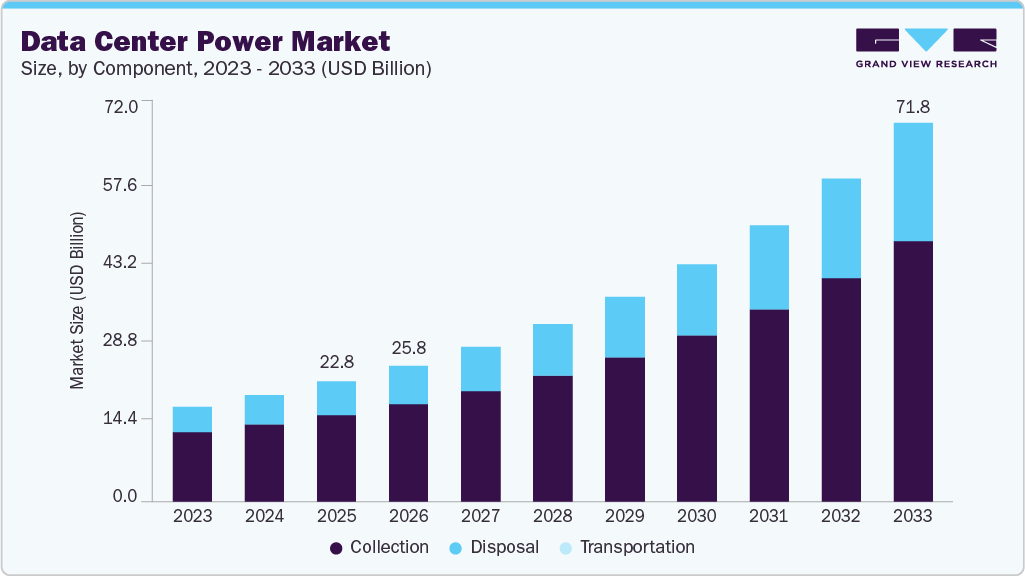

The global data center power market size was estimated at USD 22.77 billion in 2025 and is projected to reach USD 71.76 billion by 2033, growing at a CAGR of 15.7% from 2026 to 2033. The accelerating adoption of cloud platforms, big data processing, and AI-driven applications, all of which demand scalable, high-density, and dependable power infrastructure, drives the market growth.

Key Market Trends & Insights

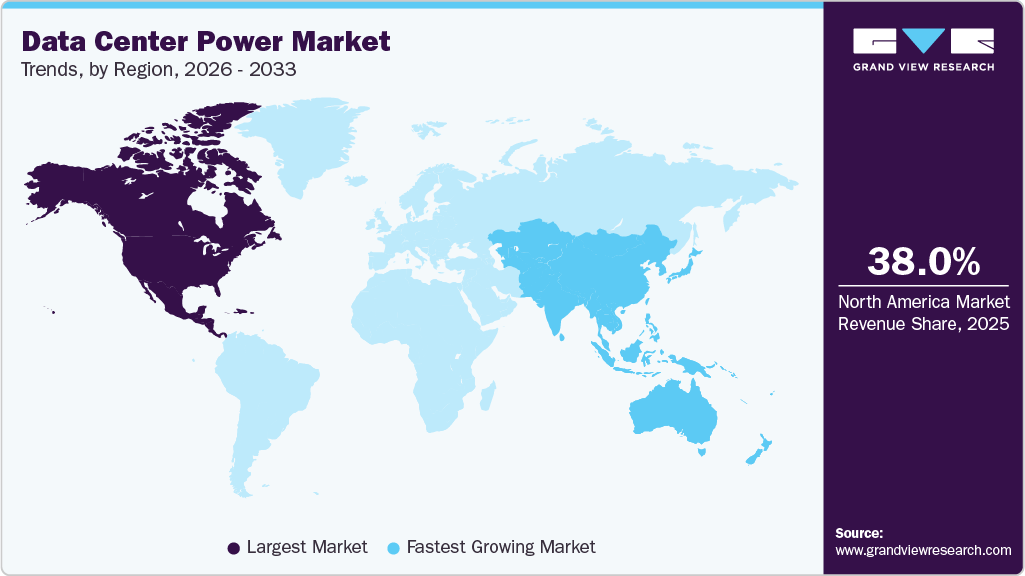

- The North America data center power held the largest global revenue share of 38.0% in 2025.

- The data center power industry in the U.S. is expected to grow significantly from 2026 to 2033.

- By component, the solution segment held the largest revenue share of 72.2% in 2025.

- By solution, the UPS segment held the dominant market position, with the largest revenue share in 2025.

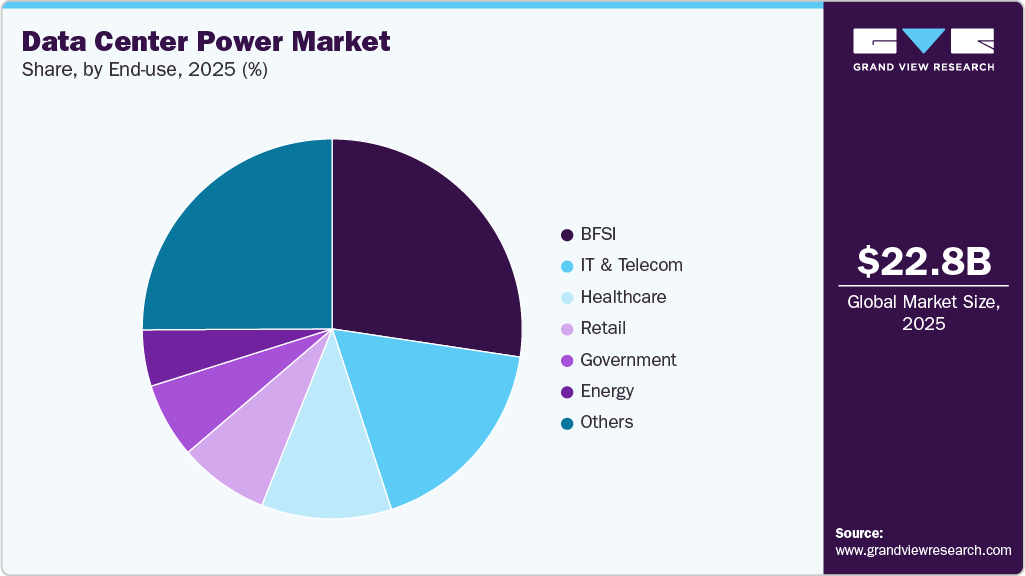

- By end use, the IT & Telecom segment is expected to grow at the fastest CAGR from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 22.77 Billion

- 2033 Projected Market Size: USD 71.76 Billion

- CAGR (2026-2033): 15.7%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The continued expansion of hyperscale and colocation data centers, combined with the growing deployment of edge facilities to support low-latency use cases, is intensifying the requirement for sophisticated power solutions.Moreover, the increasing global internet usage, enterprise-wide digital transformation efforts, and stricter regulations related to uptime, reliability, and energy efficiency are encouraging data center operators to invest in resilient and flexible power architectures. These investments include advanced UPS systems, PDUs, busway solutions, and intelligent power monitoring technologies, all designed to maintain uninterrupted and efficient operations.

The rapid expansion of cloud computing, hyperscale data centers, and data-intensive workloads such as artificial intelligence (AI), machine learning (ML), and big data analytics contributes to the growth of the data center power industry. These applications require highly reliable, high-capacity power infrastructure to support dense server configurations and continuous operations. As enterprises migrate workloads to the cloud and digital services scale globally, data centers are investing heavily in advanced power distribution units (PDUs), uninterruptible power supplies (UPS), backup generators, and switchgear to ensure uninterrupted availability and resilience.

Additionally, the rapid expansion of hyperscale and colocation data centers across both mature and emerging markets also contributes to the growth. Technology companies, cloud service providers, and telecom operators are expanding their data center footprints to meet the growing demands of data consumption, streaming, e-commerce, and remote work. This expansion directly increases demand for scalable and modular power solutions that can be rapidly deployed and upgraded, particularly in facilities designed for high power densities and future capacity expansion.

Component Insights

The solution segment dominated the data center power market, accounting for the largest revenue share of 72.2% in 2025. The widespread adoption of artificial intelligence (AI), machine learning (ML), generative AI, and high-performance computing (HPC) applications has significantly increased power demand per rack, far exceeding traditional requirements. These workloads operate at extreme computational intensity, which in turn requires highly resilient and efficient power infrastructure such as advanced uninterruptible power supply (UPS) systems, intelligent power distribution units (PDUs), and optimized power distribution networks.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. The increasing sophistication of data center power infrastructure is introducing operational and technical complexities that are accelerating the need for specialized services. Power systems are no longer standalone assets; they are intelligent, software-driven environments that interconnect UPS systems, power distribution units, cooling technologies, and centralized management platforms, such as DCIM or building management systems. Integrating these components into a cohesive, high-performing architecture demands in-depth expertise across system design, configuration, deployment, and ongoing optimization. As a result, data center operators are increasingly relying on professional services to ensure seamless interoperability, operational efficiency, and long-term reliability of their power ecosystems.

Solution Insights

The UPS segment dominated the data center power industry, accounting for the largest revenue share in 2025. The increasing emphasis on power reliability and continuous uptime is a key growth driver for the UPS segment. Data centers are required to maintain uninterrupted operations, as even momentary power interruptions can lead to service outages, data integrity issues, and substantial financial and reputational damage. This requirement is becoming increasingly critical with the growing adoption of cloud platforms, artificial intelligence workloads, and high-performance computing, all of which rely on a stable and consistent power supply to function efficiently and without disruption.

The busway segment is expected to grow at a significant CAGR during the forecast period. In contrast to conventional hardwired cabling, which is rigid and requires significant effort to modify or extend power connections, busway systems provide a modular, plug-and-play power distribution model. Tap-off units can be installed, relocated, or removed at any point along the busway without interrupting the primary power supply. This approach minimizes operational downtime and eliminates the need for complex, labor-intensive rewiring, resulting in greater efficiency in power distribution. Such flexibility is especially critical in fast-evolving environments such as colocation and cloud data centers, where power demands and tenant configurations change frequently.

Services Insights

The integration & deployment segment dominated the market and accounted for the largest revenue share in 2025. The growing need for rapid, turnkey deployment is emerging as a key growth driver for the segment. As hyperscale facilities, colocation centers, and AI-driven data centers continue to scale at pace, operators face increasing pressure to avoid prolonged or disruptive installation timelines. Consequently, there is a strong demand for power infrastructure, including UPS systems, PDUs, and busway solutions that can be implemented swiftly and with minimal operational impact. Integration and deployment services are crucial in this context, as they facilitate the use of modular, prefabricated architectures and plug-and-play components, which significantly shorten deployment cycles while reducing installation complexity and downtime.

The support & maintenance segment is expected to grow at a significant CAGR during the forecast period. The rapidly escalating cost of downtime is a major driver for the support and maintenance segment. For cloud service providers, financial institutions, and large enterprises, even brief power disruptions can result in substantial financial losses due to service interruptions, operational delays, and reputational harm. To reduce these risks, data center operators are increasingly prioritizing comprehensive support and maintenance agreements that ensure continuous system availability, proactive issue resolution, and rapid recovery in the event of power-related failures.

End Use Insights

The BFSI segment dominated the data center power industry, accounting for the largest revenue share in 2025. The BFSI sector manages vast volumes of sensitive information, including financial transactions, customer data, and regulatory records, all of which require secure, resilient, and continuously available data center infrastructure. Power interruptions in this environment can result in significant financial losses, regulatory non-compliance, and long-term reputational damage. Therefore, BFSI organizations place strong emphasis on highly reliable power solutions, such as high-efficiency UPS systems, redundant power distribution architectures, and backup generation capabilities, to ensure uninterrupted operations.

The IT & telecom segment is expected to grow at a significant CAGR over the forecast period. The deployment of 5G networks and the rapid growth of edge computing are significantly transforming power requirements within the IT and telecom segment. Unlike centralized data center models, 5G architectures demand ultra-low latency, high data throughput, and localized data processing, which are enabled through a widely distributed network of edge data centers. Although these facilities are smaller in individual capacity, they are deployed in large numbers and positioned closer to end users to support latency-sensitive applications such as IoT ecosystems, high-definition video streaming, mobile gaming, and emerging use cases, including autonomous and connected vehicles.

Regional Insights

North America dominated the global data center power market, accounting for the largest revenue share of 38.0% in 2025, driven by the large-scale modernization of existing data center infrastructure to support higher rack densities and next-generation workloads. Many legacy facilities are being retrofitted with advanced power architectures, including high-capacity UPS systems, intelligent PDUs, and upgraded switchgear, to accommodate AI training, enterprise cloud migration, and data sovereignty requirements.

U.S. Data Center Power Market Trends

The data center power industry in the U.S. is expected to grow at a significant CAGR of 15.4% from 2025 to 2033. This growth can be attributed to the rapid growth of hyperscale campuses driven by domestic cloud providers and global technology firms. These large campuses demand ultra-high power availability, on-site power generation, and sophisticated energy management systems to support multi-megawatt deployments.

Europe Data Center Power Market Trends

The data center power industry in Europe is anticipated to register considerable growth from 2025 to 2033. Data center operators are increasingly adopting high-efficiency power systems, renewable energy integration, and advanced monitoring solutions to comply with stringent environmental standards. This regulatory-driven transition is accelerating demand for next-generation UPS technologies, power optimization software, and energy-efficient distribution systems.

The UK data center power market is expected to grow rapidly in the coming years, owing to thecapacity expansion in major data center hubs to support digital finance, online services, and international connectivity. Space and power availability constraints in key metropolitan areas are forcing operators to maximize power efficiency and reliability within limited footprints.

The data center power market in Germany held a substantial revenue share in 2025, due to the country’s strong industrial digitalization and data localization requirements. Manufacturing, automotive, and Industry 4.0 initiatives are generating demand for highly reliable data processing environments, which in turn require robust and fault-tolerant power systems.

Asia Pacific Data Center Power Market Trends

The Asia Pacific data center industry held a significant global revenue share in 2025, due to the rapid rise in internet users, mobile data consumption, and regional cloud adoption. Emerging economies are witnessing an acceleration in data center construction to support digital government initiatives, fintech platforms, and e-commerce growth.

The Japan data center power market is expected to grow rapidly in the coming years, driven byits strong focus on disaster resilience and business continuity planning. Given the country’s exposure to natural hazards, data center operators prioritize highly reliable power systems with advanced redundancy, seismic resilience, and extended backup capabilities.

The data center power market in China held a substantial revenue share in 2025, due to large-scale national digital infrastructure programs and rapid adoption of AI, cloud, and smart city technologies. Government-backed initiatives to develop massive data center clusters are creating significant demand for high-capacity power systems that can support energy-intensive workloads.

Key Data Center Power Company Insights

Key players operating in the data center power industry are Vertiv Group Corp., Schneider Electric, ABB, Eaton, and GE Vernova. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In September 2025, Eaton introduced an edge-based firmware upgrade (for its Power Xpert PXQ system) that can detect sub-synchronous oscillations (SSO) linked to AI “power bursts” in data centers. This helps operators identify transient power anomalies before they damage infrastructure or overload grids.

-

In August 2025, ABB launched a set of new products under its Installation Products division: Color-Keyed aluminum lugs (narrow-tongue), T&B Liquidtight Systems cable entry plates, and Ocal PVC-coated to PVC conduit adapters. These are for high-density, scalable electrical infrastructure in data centers, aimed at saving space & labor.

-

In August 2025, Vertiv Group Corp. completed the acquisition of Great Lakes Data Racks & Cabinets, strengthening its position in providing high-density integrated infrastructure solutions for data centers. This acquisition enhances Vertiv's capabilities in delivering comprehensive power and cooling solutions.

Key Data Center Power Companies:

The following are the leading companies in the data center power market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Black Box

- CyrusOne

- Eaton

- Equinix Inc.

- GDS Holdings

- Generac Power Systems, Inc.

- General Electric Company

- Huawei Technologies Co., Ltd.

- Legrand

- N1 Critical Technologies

- NTT Global Data Centers

- Raman Power Technologies

- Rittal GmbH & Co. KG,

- Schneider Electric

- Vertiv Group Corp.

Data Center Power Market Report Scope

Report Attribute

Details

Market size in 2026

USD 25.78 billion

Revenue forecast in 2033

USD 71.76 billion

Growth rate

CAGR of 15.7% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, service, solution, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

ABB; Black Box; CyrusOne; Eaton; Equinix Inc.; GDS Holdings; Generac Power Systems, Inc.; General Electric Company; Huawei Technologies Co., Ltd.; Legrand; N1 Critical Technologies; NTT Global Data Centers; Raman Power Technologies; Rittal GmbH & Co. KG; Schneider Electric; Vertiv Group Corp.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Power Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global data center power market report based on component, service, solution, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

PDU

-

UPS

-

Busway

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Design & Consulting

-

Integration & Deployment

-

Support & Maintenance

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT & Telecommunications

-

BFSI

-

Government

-

Energy

-

Healthcare

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center power market size was estimated at USD 22.77 billion in 2025 and is expected to reach USD 25.78 billion in 2026.

b. North America dominated the global market with the largest revenue share of 38.0% in 2025, driven by the large-scale modernization of existing data center infrastructure to support higher rack densities and next-generation workloads. Many legacy facilities are being retrofitted with advanced power architectures, including high-capacity UPS systems, intelligent PDUs, and upgraded switchgear, to accommodate AI training, enterprise cloud migration, and data sovereignty requirements.

b. Some key players operating in the data center power market include ABB, Black Box, CyrusOne, Eaton, Equinix Inc., GDS Holdings, Generac Power Systems, Inc., General Electric Company, Huawei Technologies Co., Ltd., Legrand, N1 Critical Technologies, NTT Global Data Centers, Raman Power Technologies, Rittal GmbH & Co. KG, Schneider Electric, Vertiv Group Corp.

b. The continued expansion of hyperscale and colocation data centers, combined with the growing deployment of edge facilities to support low-latency use cases, is intensifying the requirement for sophisticated power solutions.

b. The global data center power market is expected to grow at a compound annual growth rate of 15.7% from 2026 to 2033 to reach USD 71.76 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.