- Home

- »

- Communication Services

- »

-

Data Center Power Market Size And Share Report, 2030GVR Report cover

![Data Center Power Market Size, Share & Trends Report]()

Data Center Power Market Size, Share & Trends Analysis Report By Component (Solutions, Services), By Solutions (PDU, UPS), By Services (Design & Consulting), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-959-3

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

Data Center Power Market Size & Trends

The global data center power market size was estimated at USD 8.76 billion in 2023 and is expected to grow at a CAGR of 8.1% from 2024 to 2030. The global expansion of data centers in response to the increasing demand for cloud storage has led to a rise in energy consumption. Considering the environmental impact, efforts are underway to integrate advanced systems to reduce power consumption with the emergence of modular data center solutions. Despite facing challenges during the COVID-19 pandemic, such as restrictions on offline activities, the data center power industry continues to evolve, driven by factors such as the widespread adoption of Software as a Service (SaaS) and the shift towards remote work arrangements. This transformation in work culture has heightened the importance of strong data center infrastructure to support smooth remote operations, further fueling market growth and innovation in the sector.

To enhance efficiency and lower the Power Usage Efficiency (PUE) ratio, companies are using advanced power management solutions such as intelligent rack smart Uninterruptible Power Supply (UPS), Power Distribution Units (PDU), and battery monitoring equipment. This trend is expected to drive market growth. In addition, rising energy costs and increasing energy conservation awareness encourage designers to adopt intelligent power management solutions. Technologies such as PUE monitoring devices, smart power strips, and battery monitoring devices are deployed to reduce the PUE ratio and optimize energy consumption in data centers. These innovations aim to improve overall efficiency and reduce operational costs for data center operators.

The data center power industry has experienced remarkable growth due to the increasing demand for technologies and services driven by data centers. Innovations such as cloud computing have surged in popularity, requiring significant computational power. Cloud computing offers various benefits, such as improved scalability, efficiency, and operational flexibility, leading many medium-sized enterprises to adopt effective data center solutions such as web hosting cloud and colocation data centers. Moreover, the widespread use of data centers has led to the rise of cloud and mega data centers, necessitating significant power for peak data-intensive operations. Consequently, there's a growing need for PDUs and UPSs to support these operations.

With the development of technology, traditional data centers are being replaced by more advanced systems with better power management capabilities. This shift towards colocation and hyper-scale data centers is expected to drive market growth over the forecast period. However, the initial investment needed for these solutions and the lack of compatible devices may slow down this growth.

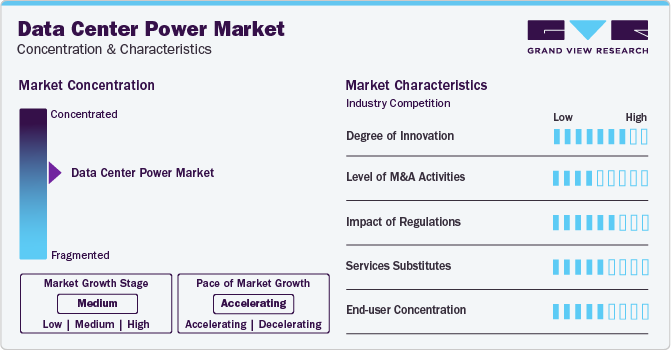

Market Concentration and Characteristics

The competitive landscape of the data center power industry is fragmented, featuring many regional and global players. The major participants are entering into strategic collaborations, mergers and acquisitions, and partnerships to expand their organizations' footprint and survive the competitive environment. Furthermore, service suppliers invest significantly in research and development activities to incorporate the latest technologies and develop advanced products to gain a competitive advantage over other market players.

Key players are engaged in introducing innovative solutions to gain a competitive edge. For instance, in January 2022, Eaton introduced the Tripp Lite as a practical option for connecting and controlling network equipment in industrial conditions such as factories and warehouses. The industrial Gigabit Ethernet switches are new lite managed and consist of a metal case IP30-rated that can penetrate shock, vibration, and the high and low temperatures frequently found on the industrial floor. The switches also provide safety from Electrostatic Discharge (ESD) with a rail clip mount to fit DIN standard 35 mm rail and can be wall mounted.

The data center power market currently has a negligible presence of external substitutes. Furthermore, vendors are focusing on developing innovative products to increase the efficiency of data centers. However, the latest trend gaining momentum in the market is the use of DC power in data centers, which is expected to bring about an internal substitution threat to the existing market. Furthermore, virtualization, blade servers, and consolidation may also act as market substitutes over the coming years.

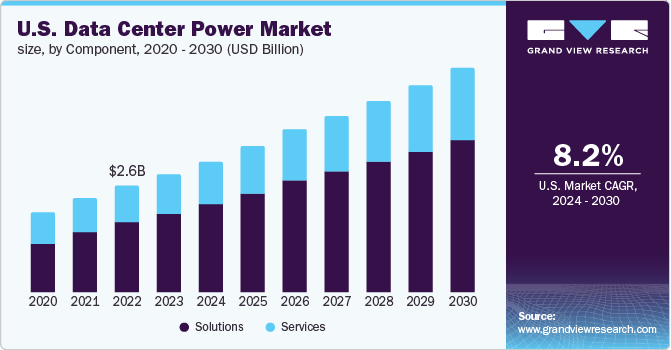

Component Insights

Based on component, solutions held the largest market share in 2023. These solutions involve implementing smart PDUs and UPSs that monitor and optimize power usage at the rack level. Solutions tools leverage advanced technologies such as machine learning (ML) and artificial intelligence (AI) to analyze power consumption patterns and dynamically adjust power delivery based on real-time needs. Moreover, advanced cooling technologies that optimize airflow and temperature management within the data center also contribute significantly.

Services is expected to grow at the highest CAGR from 2024 to 2030. Data centers are becoming increasingly complex with more sophisticated hardware and power demands. This necessitates specialized services for installation, maintenance, and optimization of power systems. Moreover, as energy costs rise, there's a growing focus on improving data center power efficiency. Services such as power management consulting and remote monitoring are in high demand.

Solutions Insights

UPS dominated the market and held the largest market share in 2023. The increasing implementation of cloud computing, along with the requirement for ubiquitous and sensitive data, has encouraged the installation of this product. In addition, the use of portable UPS systems in services, such as High-Performance Computing (HPC), SaaS, online media streaming, and online gaming, has also fueled the segment's growth.

The busway segment is expected to register the fastest CAGR of 10.9% from 2024 to 2030. The rise of data-driven technologies such as AI, ML, and real-time analytics has created a need for powerful computing infrastructures. Data centers rely on robust power distribution systems such as busways to manage heavy workloads efficiently. These systems efficiently deliver power to racks and cabinets, minimizing energy loss and reducing the risk of downtime. Data center busways play a crucial role in supporting the demands of modern data-intensive applications by ensuring uninterrupted operations.

Services Insights

The design and consulting segment accounted for the largest share in the market. Designing efficient and reliable power infrastructure for complex environments requires specialized expertise offered by design and consulting firms. Design and consulting services can help end users identify and implement strategies to reduce energy consumption, such as using energy-efficient equipment, optimizing cooling systems, and utilizing intelligent power management tools.

The support & maintenance segment is expected to grow significantly over the forecast period. The market is experiencing significant growth due to increasing demand for data storage and processing. This growth is also driving the need for robust support and maintenance services to ensure the optimized operation of data center power systems. Modern data centers utilize complex power infrastructure, including UPS, PDUs, and cooling systems. Maintaining these systems' optimal performance and efficiency requires specialized expertise and resources. Thus, the market has a high demand for support and maintenance services.

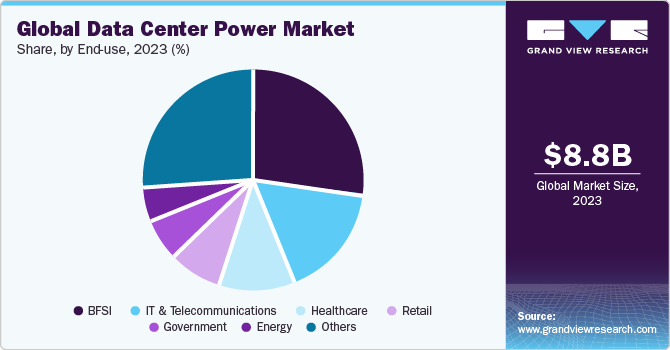

End-use Insights

BFSI accounted for the largest market share, around 27.0%, in 2023. With the rise in cyber threats and data breaches targeting financial institutions, there is a heightened focus on cybersecurity measures. Data centers play a critical role in providing secure environments with advanced security features such as encryption, firewalls, intrusion detection/prevention systems, and physical security measures to safeguard sensitive financial data.

IT and telecommunications is expected to grow significantly over the forecast period. The rapid upsurge in the growth and construction of IT infrastructure is expected to drive the demand during the forecast period. Furthermore, developing telecommunication infrastructure requires data storage facilities to manage enormous amounts of data. In addition, reliability, energy consumption, and maintenance are critical in IT and telecommunication facilities. This factor is anticipated to propel market growth in the forthcoming years.

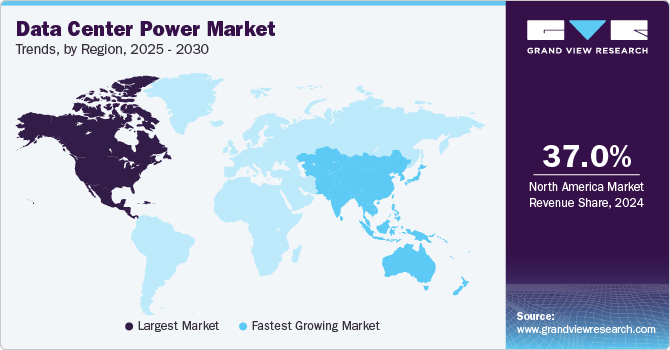

Regional Insights

Data center power market in North America held the largest market share of 37.8% in 2023 as the region has the highest number of data centers in the world. Governments and regulatory bodies have introduced and implemented various norms and regulations to reduce carbon footprints and energy consumption. This has resulted in the high adoption of efficient power management solutions, driving regional demand. For instance, businesses are spending a large portion of their budgets on cooling and maintenance systems. Thus, it becomes essential to incorporate efficient power management devices such as PDU, busway, and UPS, among others, to control unnecessary spending at data centers.

U.S. Data Center Power Market Trends

Data center power market in U.S. held the largest revenue market share in 2023, driven by an increasing adoption of AI servers. AI technologies, including ML, deep learning (DL), and neural networks, require immense computational power and specialized hardware accelerators such as GPUs (Graphics Processing Units) and TPUs (Tensor Processing Units) to efficiently process and analyze large datasets. As organizations across various industries integrate AI into their operations for tasks like predictive analytics, natural language processing (NLP), and computer vision, there's a surge in the deployment of AI-specific servers in data centers. These servers demand strong power solutions to support their high-performance computing requirements, driving the need for scalable and efficient power infrastructure within data center facilities to ensure uninterrupted operation and optimal performance of AI workloads. For instance, according to U.S.-based commercial property consultancy Newmark report released in January 2024, demand for AI/ML-ready racks is expected to drive data center industry growth; U.S. data center power consumption is expected to almost double by 2030, reaching 35GW.

Asia Pacific Data Center Power Market Trends

Data center power market in Asia Pacific is growing significantly at a CAGR of 8.7% from 2024 to 2030, primarily due to the expanding presence of colocation data centers in countries such as India and China. This growth is driven by factors such as the increasing adoption of smartphones and tablets, leading to a surge in telecom subscribers across the region. As more people rely on digital devices for communication and data storage, the demand for data centers to support these services is expected to rise sharply. This trend is expected to continue into the anticipatable future, driving significant market growth.

China data center power market is growing significantly at a fastest CAGR of 11.2% from 2024 to 2030. The increasing demand for data storage and processing capacity in China is fueled by the rapid proliferation of digital content, e-commerce transactions, and online services. As the Chinese population becomes more digitally connected and engaged, there's been an exponential growth in the creation and consumption of digital content, including videos, images, and social media interactions. For instance, in February 2022, China launched an East Data, West Computing initiative. This project aims to establish eight computing hubs and ten national data center clusters nationwide. Its primary goal is to redistribute computing resources from China's more economically advanced eastern regions to its less developed but resource-rich western areas.

Data center power market in India dominated the market and held the highest revenue share in 2023. The Indian government's Digital India initiative aims to transform the country into a digitally empowered society and knowledge economy. This initiative has led to increased adoption of digital technologies across various sectors, driving the demand for data center infrastructure to support digital services, e-governance, and online transactions.

Japan data center power market is growing significantly at a CAGR of 6.9% from 2024 to 2030. The proliferation of edge computing and IoT devices is driving the decentralization of data processing and storage, leading to the deployment of edge data centers and micro data centers closer to end-users and IoT endpoints. These edge facilities require compact and efficient power solutions tailored for space-constrained environments, stimulating demand in the data center power market.For instance, in January 2024, AWS and Google Cloud will invest heavily in their data center operations while recognizing the need for sustainability due to increased energy consumption. AWS announced USD 35 billion in cloud data center campuses in Virginia, U.S., by 2040 and USD 15 billion in expansion of its existing data center regions in Japan by 2027.

Europe Data Center Power Market Trends

Data center power market in Europe is growing significantly at a CAGR of 8.2% from 2024 to 2030. The expansion of 5G networks and the adoption of edge computing technologies are driving the decentralization of data processing and storage closer to end-users in Europe. Edge data centers and micro data centers deployed at the network edge require compact, energy-efficient power solutions to support critical IT loads in remote locations. The proliferation of edge deployments contributes to the overall growth of Europe's data center power industry. For instance, in June 2023, IBM announced it would open its quantum data center in Europe. This data center is expected to provide government agencies, research institutions, and companies access to advanced quantum computing. It is expected to be operational by 2024 and features several IBM quantum computing systems with utility-scale quantum processors of over 100 qubits.

UK data center power market dominated the market with the largest revenue share during 2023. Organizations in the UK are undergoing digital transformation initiatives to stay competitive and meet evolving customer demands. This transformation involves migrating IT infrastructure to cloud-based platforms, adopting hybrid cloud architectures, and modernizing legacy systems, all driving demand for data center power solutions capable of supporting diverse workload requirements and scalability needs. For instance, Google announced building a new data center in Hertfordshire, UK. The USD 1 billion investment aims to ensure reliable digital services for Google Cloud customers and users in the UK. The data center aims to power Google Cloud, Workspace, Search, and Maps. Continual investment in technical infrastructure supports the company's AI innovations and growing cloud needs in the UK.

Data center power market in Germany is growing significantly at a CAGR of 8.4% from 2024 to 2030. A notable German data center market trend involves operators increasingly decentralizing computing power by establishing small data centers nationwide. This strategy aims to minimize latency and enhance user experience. With the advancements in technologies such as 5G, the Internet of Things (IoT), and cloud computing, this trend is expected to grow over the forecast period. By distributing data centers across different regions, companies can better serve local users and businesses, improving efficiency and responsiveness in data processing and delivery.

France data center power market is growing significantly at a CAGR of 7.9% from 2024 to 2030. France has a growing emphasis on sustainability and environmental responsibility, leading to increased investment in renewable energy sources such as wind, solar, and hydroelectric power. Data center operators are increasingly focusing on leveraging renewable energy to power their facilities, driven by regulatory incentives, corporate sustainability goals, and consumer preferences for eco-friendly services. For instance, in February 2024, Equinix signed seven wind power offtake agreements with Wpd in France to support the construction of over 100 MW of installed capacity. Four wind farms are expected to source more than 300 GWh of annual electricity production, allocated to 11 Equinix data centers in France. The deal notes that this adds to a total capacity of 912 MW secured with help of similar agreements in the US, Finland, France, Spain, Portugal, and Sweden.

Middle East & Africa Data Center Power Market Trends

Data center power market in the Middle East & Africa region is growing significantly at a CAGR of 6.4% from 2024 to 2030. There's a growing focus on sustainability and energy efficiency in the region, promoting data center operators to explore renewable energy sources such as solar and wind power. Integrating renewable energy into data center facilities reduces carbon footprint and operational costs while enhancing energy security, thereby driving the adoption of power solutions that support renewable energy integration. The UAE aims to boost its renewable energy share from 25% to 50% by 2050 through its Energy Strategy 2050. Similarly, Saudi Arabia's Vision 2030 includes the National Renewable Energy Program (NREP), with 13 projects to generate over 4.8 gigawatts (GW) of renewable energy. Bahrain is also increasing its efforts, with plans to produce 280 megawatts (MW) of renewable electricity by 2025, increasing to 700 MW by 2030. In addition, Saudi Arabia is committed to developing ten renewable energy projects totaling 7 GW capacity by 2030, signaling a significant stride in the kingdom's renewable energy agenda.

Saudi Arabia data center power market is growing significantly at a CAGR of 6.1% from 2024 to 2030. Saudi Arabia is undergoing significant digital transformation efforts across various sectors, including government, finance, healthcare, and telecommunications. This transformation drives demand for data center infrastructure to support the storage, processing, and management of digital data generated by these initiatives. For instance, in March 2024, Amazon Web Services (AWS) announced establishing an AWS infrastructure Region in Saudi Arabia by 2026. This move aims to provide developers, startups, enterprises, and various organizations such as healthcare, education, gaming, and nonprofits with the option to host their applications within the country's borders. The new AWS Region aims to offer customers the advantage of data centers located in Saudi Arabia, ensuring compliance with local data regulations and preferences. AWS has committed to investing over USD 5.3 billion, emphasizing its long-term dedication to supporting the region's technological advancement and economic growth.

Key Data Center Power Company Insights

Some of the key players operating in the market include ABB.; Eaton; and Schneider Electric among others.

-

The ABB company is one of the key players in the global data center power market, providing automation and power technologies to various industries. ABB offers a wide range of products and services, including intelligent and energy-efficient PDUs. The company extends to developing and implementing entire data center systems, including power delivery chains, automated monitoring, and control systems. In addition, ABB offers software solutions for real-time data center power consumption monitoring, enhancing efficiency and management.

-

Eaton is a power management company that designs, develops, and sells energy-efficient products, technologies, and services that help customers manage electrical, aerospace, hydraulic, and mechanical power more reliably, efficiently, safely, and sustainably. Eaton's solutions enable data centers to implement, manage, and monitor power systems across their operations, integrate renewables, make energy decisions with data, and keep data, equipment, and predictive security solutions.

Vertiv Group Corp., Rittal GmbH & Co. KG, N1 Critical Technologies, and Raman Power Technologies are some of the emerging market participants in the data center power market.

-

Vertiv Group Corp. is an American multinational company specializing in critical infrastructure and services for data centers, communication networks, and industrial and commercial environments. The company offers a range of solutions, including AC and DC power management, thermal management, integrated rack solutions, and preventative maintenance and engineering services. With a global manufacturing footprint and a significant investment in research and development, Vertiv is one of the significant players in the data center industry, focusing on energy efficiency, sustainability, and innovative technologies such as liquid cooling.

-

Rittal GmbH & Co. KG offers a range of industry solutions, including enclosures, power distribution, climate control, and IT rack systems. Rittal provides flexible power distribution technology, energy-saving climate control solutions, and system accessories for industrial and IT enclosures. In addition, Rittal offers IT rack systems tailored to various network applications, IT power distribution solutions, cooling concepts covering single racks to entire data centers, monitoring solutions for IT infrastructure, and security solutions to protect IT infrastructure from physical threats.

-

Raman Power Technologies specializes in designing and manufacturing high-efficiency AC and DC power solutions for data centers. Their products include rectifiers, inverters, and power distribution units. The company is based in Egham, U.K.

Key Data Center Power Companies:

The following are the leading companies in the data center power market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Black Box

- CyrusOne

- Eaton

- Equinix Inc.

- GDS Holdings

- Generac Power Systems, Inc.

- General Electric Company

- Huawei Technologies Co., Ltd.

- Legrand

- N1 Critical Technologies

- NTT Global Data Centers

- Raman Power Technologies

- Rittal GmbH & Co. KG,

- Schneider Electric

- Vertiv Group Corp.

Recent Developments

-

In October 2023, ABB announced inclusion of ZincFive as an authorized vendor for their Uninterruptible Power Supply (UPS) systems. This move allows nickel-zinc batteries to be offered as an alternative option alongside lithium-ion and lead-acid batteries, which are now integrated and supported within ABB's UPS systems.

-

In July 2023, ABB India's Electrification launched the MegaFlex DPA UPS solutions specifically for the Indian market. This innovative, sustainable UPS system is part of ABB EcoSolutions and adheres to ABB's circularity framework. Designed for high-density computing environments, it boasts the highest efficiency rating and smallest footprint. As enterprises increasingly rely on SaaS (Software as a Service) and IaaS (Infrastructure as a Service) applications, data center reliability has become more crucial.

-

In June 2023, Huawei unveiled three sophisticated products in the Bangladesh market. Among these innovations are SmartLi, a battery storage system solution created by Huawei; FusionModule800, a smart data center solution designed with edge computing and branch outlets in mind; and a flexible, modular UPS solution that efficiently caters to medium-sized data centers.

Data Center Power Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.40 billion

Market Value forecast in 2030

USD 15.01 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, solutions, services, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Netherlands; Denmark; Finland; Spain; Russia; China; India; Japan; Australia; South Korea; Singapore; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

ABB; Black Box; CyrusOne; Eaton; Equinix Inc.; GDS Holdings; General Electric Company; Generac Power Systems, Inc.; Huawei Technologies Co., Ltd.; Legrand; N1 Critical Technologies; NTT Global Data Centers; Raman Power Technologies; Rittal GmbH & Co. KG; Schneider Electric; Vertiv Group Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Power Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global data center power market report based on component, solutions, services, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

PDU

-

UPS

-

Busway

-

Others

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Design & Consulting

-

Integration & Deployment

-

Support & Maintenance

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecommunications

-

BFSI

-

Government

-

Energy

-

Healthcare

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Netherlands

-

Denmark

-

Finland

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center power market size was estimated at USD 8.76 billion in 2023 and is expected to reach USD 9.40 billion in 2024.

b. The global data center power market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030, reaching USD 15.01 billion by 2030.

b. North America dominated the data center power market with a share of 37.83% in 2023. This is attributable to the presence of various norms and regulations aimed at reducing carbon footprints and energy consumption in the region.

b. Some key players operating in the data center power market include ABB, Black Box Corporation, Eaton, General Electric, Generac Power Systems, Inc., Huawei Technologies Co., Ltd, Legrand, Rittal GmbH & Co. KG, Schneider Electric, and Vertiv Co.

b. Key factors that are driving the data center power market growth include the rise in the introduction of state-of-the-art variants to reduce power consumption coupled with the emergence of modular data centers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."