- Home

- »

- Communications Infrastructure

- »

-

Data Converter Market Size, Share & Trends Report, 2030GVR Report cover

![Data Converter Market Size, Share & Trends Report]()

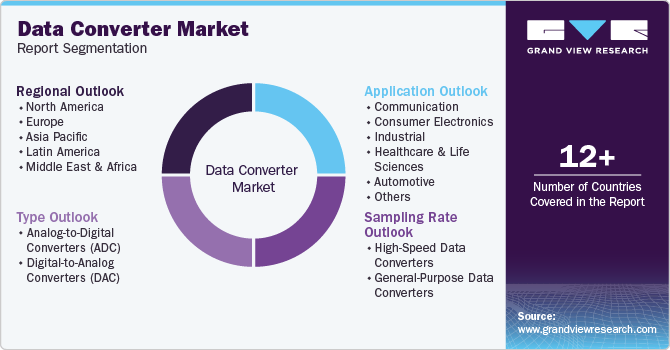

Data Converter Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Analog-to-Digital Converters (ADC), Digital-to-Analog Converters (DAC)), By Sampling Rate (High-Speed Data Converters), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-350-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Converter Market Summary

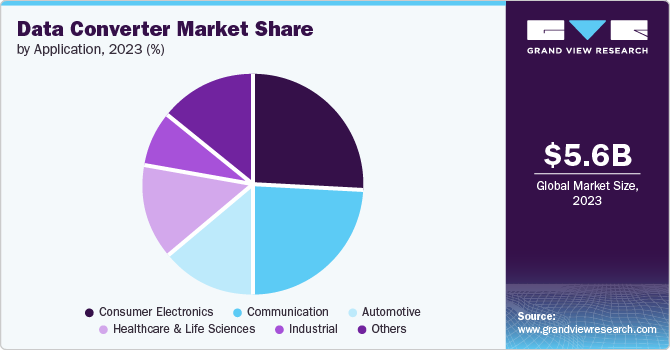

The global data converter market size was estimated at USD 5.57 billion in 2023 and is projected to reach USD 8.52 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030. The increasing digital transformation across various industry sectors and the growing use of advanced data collection technologies are driving the growth of the market growth.

Key Market Trends & Insights

- The data converter market in North America accounted for a significant share of over 36% of the global market revenue in 2023.

- Based on type, the Analog-to-Digital Converters (ADC) segment led the market and accounted for over a share of 67.0% in 2023.

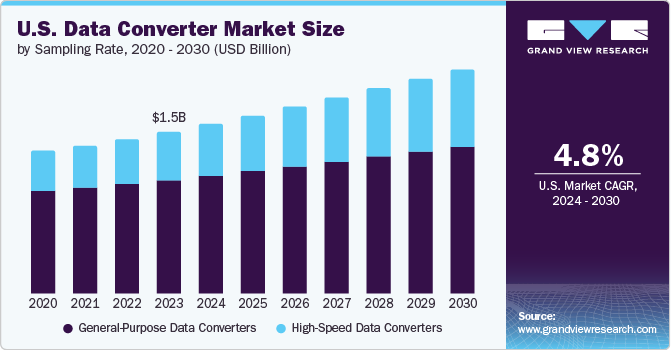

- Based on sampling rate, the general-purpose data converters segment led the market in 2023.

- Based on application, the consumer electronics segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.57 Billion

- 2030 Projected Market Size: USD 8.52 Billion

- CAGR (2024-2030): 6.2%

- North America: Largest market in 2023

Furthermore, the extensive application of data converters in the aerospace and defense sectors is fueling market growth. Data converters play a crucial role converting and transmitting signals in electronic warfare, communication systems, weapons, and defense vehicles. In addition, the integration of data converters with consumer electronics, such as smartphones, laptops, and tablets, for various purposes, such as video calls, network signal processing, touch sensitivity enhancement, and image processing, is also driving industry growth. A surge in demand for data converters in optical communication devices is driven by the evolution of wireless communication networks, including 4G, 5G, and Long-Term Evolution (LTE). This trend, together with the Internet of Things (IoT) becoming a key component of connected devices, is expected to significantly contribute to the market's growth.

The movement of end users from traditional to computer-based data acquisition (DAQ) systems is driving the market growth. These modern systems transform analog signals, such as voltage and current, into digital formats using Analog-to-Digital Converters (ADCs). A DAQ system typically includes components like ADC, a Digital-to-Analog Converter (DAC), a multiplexer, a high-speed timer, and a Random-Access Memory (RAM) card. These systems have evolved due to technological advancements, offering end users greater flexibility, along with cost and time savings. In addition, computer-based DAQ systems allow engineers to tailor the software to their specific needs, enhancing overall efficiency. Furthermore, high-speed DAQ systems are crucial for achieving precise accuracy and consistency without sacrificing bit resolution, memory capacity, or streaming capability.

As wireless networks increasingly incorporate high-bandwidth devices like routers, repeaters, access points, and wireless antennas, they are expected to encounter data networking congestion due to the substantial data generated by various devices and heightened data usage by smartphones. Consequently, the demand for fast communication networks and solutions for network congestion control is anticipated to rise with the implementation of 5G technology. The introduction of 5G is poised to greatly expand the number of mobile users, necessitating the development of infrastructure capable of managing user data demands. To cater to diverse use cases with ample bandwidth, 5G networks are expected to operate at higher frequency bands, introducing the concept of small cell networks. This shift presents an opportunity for the deployment of high-speed data converters in the construction of advanced 5G infrastructure since these converters play a crucial role in the functionality of communication transceivers.

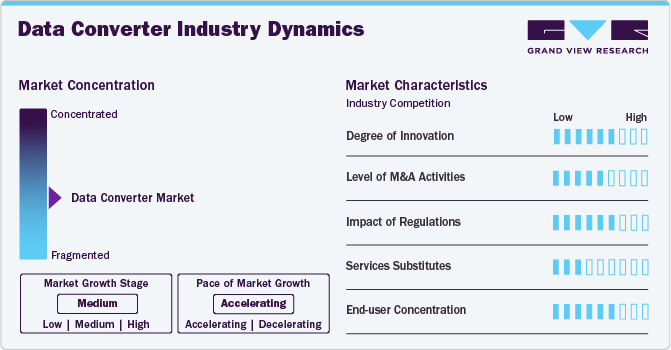

Industry Dynamics

The data converter market is in a high growth stage due to rapid technological advancements. Computer-based solutions are replacing traditional data acquisition methods. These systems rely on data converters, such as analog-to-digital converters (ADCs), to convert analog signals into digital formats for efficient processing and analysis.

The market is experiencing high M&A activities. Mergers and acquisitions can allow companies to combine their product portfolios and areas of expertise. This can create a more comprehensive range of data converter solutions, catering to a wider variety of customer needs and applications.

The data converter market faces increasing regulatory scrutiny to address data protection and privacy regulations. There are industry-specific regulations for the market. For instance, data converters used in medical equipment, such as pacemakers and imaging machines, fall under the purview of regulatory bodies like the Food and Drug Administration (FDA) in the US and Medical Devices Directive (MDD) in Europe. These regulations ensure the safety, efficacy, and reliability of medical devices.

The market faces a low threat of substitutes. Data converters are designed for specific applications and optimized for factors, such as speed, resolution, power consumption, and cost. There are general-purpose data converters. However, it's difficult to develop a single substitute that can match the performance of a specialized converter in a particular application.

End-user concentration significantly influences the market dynamics. Various industries, such as communications and consumer electronics, are significant consumers of data converters. These industries have a high demand for these components due to the sheer volume of devices produced. This can give them some bargaining power with data converter manufacturers.

Type Insights

The Analog-to-Digital Converters (ADC) segment led the market and accounted for over a share of 67.0% in 2023. The increasing reliance on digital technology across various industries is a primary driver. Analog signals from the real world, such as temperature, pressure, and sound, need conversion into digital data for processing by computers and other digital devices. ADCs play a vital role in this process, enabling the integration of analog sensors and systems into the digital world. Moreover, the proliferation of IoT devices that collect and transmit real-world data creates a massive demand for ADCs. These converters are essential for transforming sensor data from various IoT devices, such as wearables, smart meters, and industrial sensors, into digital formats for analysis and decision-making.

The Digital-to-Analog Converters (DAC) segment is poised for the highest growth in the forecasted period. Consumers are increasingly seeking immersive and high-quality audio and video experiences. DACs play a crucial role in this by converting digital audio/video signals from sources, such as computers and streaming services into high-fidelity analog signals for playback on speakers, TVs, and other display devices. The growing market for consumer electronics like smartphones, tablets, gaming consoles, and smart speakers is a significant driver for DACs. These devices rely on DACs to convert digital audio and video signals into analog formats for user output.

Sampling Rate Insights

The general-purpose data converters segment led the market in 2023. General-purpose data converters offer a balance between performance and cost. They provide adequate speed and resolution for many applications, making them a cost-effective choice compared to high-speed converters with more advanced features. The versatility of general-purpose data converters allows them to be used in various applications across different industries, such as industrial automation, medical electronics, consumer electronics, and communications. Moreover, general-purpose data converters are often easier to design and integrate into systems compared to high-speed converters. This reduces development time and costs for manufacturers using them in their products.

The high-speed data converters segment is poised for the highest growth over the forecasted period. The growing communication landscape, particularly the introduction of 5G, demands high-speed data converters to handle the massive increase in data traffic. These converters ensure efficient and reliable transmission of data at ever-faster speeds. Moreover, the rise of AI and ML applications that involve processing large datasets necessitates high-speed data converters for real-time data acquisition and signal processing.High-speed data converter manufacturers are constantly innovating and integrating new technologies like Gallium Nitride (GaN) into their products. GaN offers superior performance compared to traditional silicon-based converters, enabling even faster data conversion speeds.

Application Insights

The consumer electronics segment accounted for the largest revenue share in 2023. Smartphones, tablets, laptops, and TVs with high-resolution displays (HD, 4K, 8K) rely on data converters to convert digital video data into analog signals for optimal image quality on the screen. Data converters play a vital role in high-fidelity audio experiences. They convert digital audio files or streaming data into analog signals for playback on speakers or headphones. Features, such as, Wi-Fi, Bluetooth, and cellular connectivity, rely on data converters to handle the conversion of digital data packets into analog signals for data transmission. Moreover, consumer electronics are typically high-volume products with cost constraints. This drives demand for data converters that offer a good balance between performance and affordability.

The healthcare & life sciences segment is poised for significant growth. Modern medical care heavily relies on advanced medical devices for diagnosis, treatment, and monitoring. These devices, such as pacemakers, imaging machines (MRI, CT scanners), and diagnostic equipment, use data converters. ADCs convert bio signals like ECG (electrical activity of the heart), EEG (electrical activity of the brain), and blood pressure readings into digital data for analysis and monitoring. Moreover, DACs are used in some devices for specific functions, such as converting digital signals into analog outputs to control stimulation parameters in programmable stimulators.The rise of telemedicine and remote patient monitoring (RPM) creates a demand for data converters in wearable health sensors and telehealth devices. These devices collect physiological data (heart rate, blood pressure) and convert it into digital format for transmission to healthcare providers for remote monitoring and analysis.

Regional Insights

The data converter market in North America accounted for a significant share of over 36% of the global market revenue in 2023. The region has a well-developed communication infrastructure and a high demand for high-speed data converters to support 5G adoption, increasing internet traffic, and advancements in data center technology. Moreover, the strong presence of well-established aerospace and defense sectors in North America creates a demand for high-performance and reliable data converters for critical applications in aircraft, missiles, and communication systems.

U.S. Data Converter Market Trends

The U.S. data converter market is expected to grow substantially over the forecast period. The U.S. is at the forefront of 5G deployment, demanding high-speed data converters for efficient data transmission and advanced communication infrastructure. Manufacturing automation is a growing trend in the U.S., creating demand for data converters for data acquisition and control systems in factories.

Europe Data Converter Market Trends

The data converters market in Europewill have significant growth in the coming years as data converters are gaining traction in Europe. The Europe automotive industry is a major consumer of data converters for advanced driver-assistance systems (ADAS), infotainment systems, and electric vehicle (EV) technology. Focus on safety and efficiency drives demand for reliable converters. Moreover, industrial automation in Europe necessitates data converters for data acquisition and control systems in factories, with a potential emphasis on Industry 4.0 initiatives.

The UK data converter market is expected to grow significantly over the forecast period. The UK government initiatives promoting R&D in areas like 5G, advanced manufacturing, and AI could indirectly benefit the market. Moreover, industrial automation in the UK necessitates data converters for data acquisition and control systems, with a potential emphasis on aligning with Industry 4.0 initiatives.

The data converter market in France is expected to grow substantially over the forecast period. France has a strong focus on innovation, particularly in the aerospace and defense sectors. Thus, there is a growing demand for specialized or application-specific data converters to cater to technological advancements.

The Germany data converter market is expected to grow significantly. A pioneer in Industry 4.0 initiatives, Germany heavily relies on data converters for data acquisition and control systems in factories. Germany has an advanced automotive industry, driving a significant demand for high-performance data converters used in ADAS, in-vehicle infotainment systems, and electric vehicle powertrains. The focus remains on safety, efficiency, and meeting stringent automotive regulations.

Asia Pacific Data Converter Market Trends

The data converter market in Asia Pacific is positioned for significant growth. Asia Pacific is a hub for consumer electronics manufacturing and boasts a large and growing consumer base. Thus, there is a high demand for data converters in smartphones, laptops, TVs, wearables, and other devices, with a focus on features, such as high-resolution displays and immersive audio.

The China data converter market is positioned for substantial growth. China is aggressively expanding its telecommunication infrastructure, including large-scale 5G network rollout. This necessitates high-speed data converters for efficient data transmission and network operations. Moreover, the government in the country heavily invests in promoting domestic semiconductor manufacturing, including data converters. This creates a favorable environment for domestic companies and fosters innovation.

The data converter market in India is poised for significant growth. India is witnessing the emergence of domestic companies developing data converters. This can lead to increased competition, innovation, and potentially cost-effective solutions suited for the Indian market. The Indian government is taking steps to support the domestic semiconductor industry, including data converter production. Initiatives, such as, the "Modified Electronics Manufacturing Cluster (MEMC)" scheme can provide a boost to the market.

The Japan data converter market is expected to grow significantly over the forecast period. Japan has a well-developed healthcare system that utilizes advanced medical devices relying on high-fidelity data converters for precise signal processing and data acquisition. Moreover, Japanese manufacturers prioritize exceptional quality and reliability in data converters for their critical applications. This translates to a demand for various features, such as high signal-to-noise ratio, low distortion, and robust performance.

Middle East & Africa (MEA) Data Converter Trends

The data converter market in Middle East and Africa (MEA) is witnessing rapid growth due to a surge in demand for data converters. The oil & gas industry, a major economic driver in the region, is increasingly adopting digital technologies for exploration, production, and refining processes. This creates a demand for data converters for data acquisition and control systems.

The Kingdom of Saudi Arabia data converter market is poised for significant growth. Saudi Arabia government’s Vision 2030 plan emphasizes economic diversification and technological innovation. This translates to a growing demand for data converters in various industries, such as energy, manufacturing, government, and oil & gas.

The data converter market in South Africa is poised for substantial growth. South Africa is actively deploying 4G networks and looking towards 5G implementation. This necessitates high-speed data converters for efficient data transmission and improved network capacity.Moreover, government plans for infrastructure development, the telecom network upgrade, and a potential push for domestic production is driving the growth of the market in the country.

Key Data Converter Company Insights

Key players have strengthened their market presence through a strategic mix of product launches, expansions, mergers, acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in November 2023, ROHM CO., LTD., an electronics components manufacturer, acquired the assets from the former Kunitomi Plant of Solar Frontier, situated in Japan, following the initial agreement made with Solar Frontier. LAPIS Semiconductor Co., Ltd., a subsidiary of the ROHM Group, would manage the facility as its Miyazaki Plant No. 2. The acquisition would help start operations, establishing the site as the Group's main manufacturing hub for SiC power devices.

Key Data Converter Companies:

The following are the leading companies in the data converter market. These companies collectively hold the largest market share and dictate industry trends.

- Analog Devices, Inc.

- Asahi Kasei Microdevices Corporation

- Avia Semiconductor Ltd.

- Cirrus Logic, Inc.

- Datel, Inc.

- IQ- Analog

- Mouser Electronics, Inc.

- Microchip Technology Inc.

- Renesas Electronics Corporation

- Texas Instruments

Recent Developments

-

In June 2024, Nisshinbo Micro Devices Inc., an industrial equipment manufacturer, introduced the NA2202/NA2203/NA2204 series, a 5V analog front end (AFE) with high precision 1A-D converter for industrial equipment.The series NA2202/NA2203/NA2204, offering 16-bit, 20-bit, and 24-bit resolutions, features a programmable gain amplifier (PGA) with amplification up to 128 times, along with a multiplexer. This enables the use of multiple sensors simultaneously, addressing the issue of extended work hours needed for frequent adjustments. In addition, its compatibility with a 5 V operation makes it a suitable Analog Front End (AFE) for systems based on microcontrollers. The compact package size, measuring 4.0 × 4.0 × 0.75 mm*1, aids in the reduction of overall system size

-

In November 2023, Synopsys Inc., a provider of electronic design automation (EDA), and the Indian Institute of Technology, Bombay, inaugurated Virtual Fab Solutions, at the IIT Bombay, Department of Electrical Engineering and part of the Center for Semiconductor Technologies (SemiX). This initiative aims to offer an interdisciplinary venue dedicated to industry-driven research and education, fostering entrepreneurship, and facilitating policy research in the semiconductor field

-

In May 2023, WAVR LLC, an energy converter manufacturer, introduced a modular Wave Energy Converter (WEC) concept. This technology is engineered to convert the energy generated by ocean waves into electrical power. Currently, the prototype is sized for consumer use, but the technology can be scaled up for bigger applications. In addition, its design facilitates seamless integration with various other renewable energy technologies

Data Converter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.92 billion

Revenue forecast in 2030

USD 8.52 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, sampling rate, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa

Key companies profiled

Analog Devices, Inc.; Asahi Kasei Microdevices Corp.; Avia Semiconductor Ltd.; Cirrus Logic, Inc.; Datel, Inc.; IQ- Analog; Mouser Electronics, Inc.; Microchip Technology Inc.; Renesas Electronics Corp.; Texas Instruments

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Converter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the data converter market report based on type, sampling rate, application, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Analog-to-Digital Converters (ADC)

-

Digital-to-Analog Converters (DAC)

-

-

Sampling Rate Outlook (Revenue, USD Billion, 2017 - 2030)

-

High-Speed Data Converters

-

General-Purpose Data Converters

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Communication

-

Consumer Electronics

-

Industrial

-

Healthcare & Life Sciences

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global data converter market size was estimated at USD 5.57 billion in 2023 and is expected to reach USD 5.92 billion in 2024.

b. The global data converter market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 8.52 billion by 2030.

b. North America dominated the market in 2023, accounting for over 36% share of the global revenue. The region has a well-developed communication infrastructure and a high demand for high-speed data converters to support 5G adoption, increasing internet traffic, and advancements in data center technology.

b. Some key players operating in the data converter market include Analog Devices, Inc.; Asahi Kasei Microdevices Corporation; Avia Semiconductor Ltd.; Cirrus Logic, Inc.; Datel, Inc.; IQ- Analog; Mouser Electronics, Inc.; Microchip Technology Inc.; Renesas Electronics Corporation; and Texas Instruments

b. Key factors driving the data converter market growth include the increasing adoption of technologically advanced data acquisition systems and the potential use of data converters in developing advanced 5G infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.