- Home

- »

- Medical Devices

- »

-

Dental Prosthetics Market Size, Share, Industry Report, 2033GVR Report cover

![Dental Prosthetics Market Size, Share & Trends Report]()

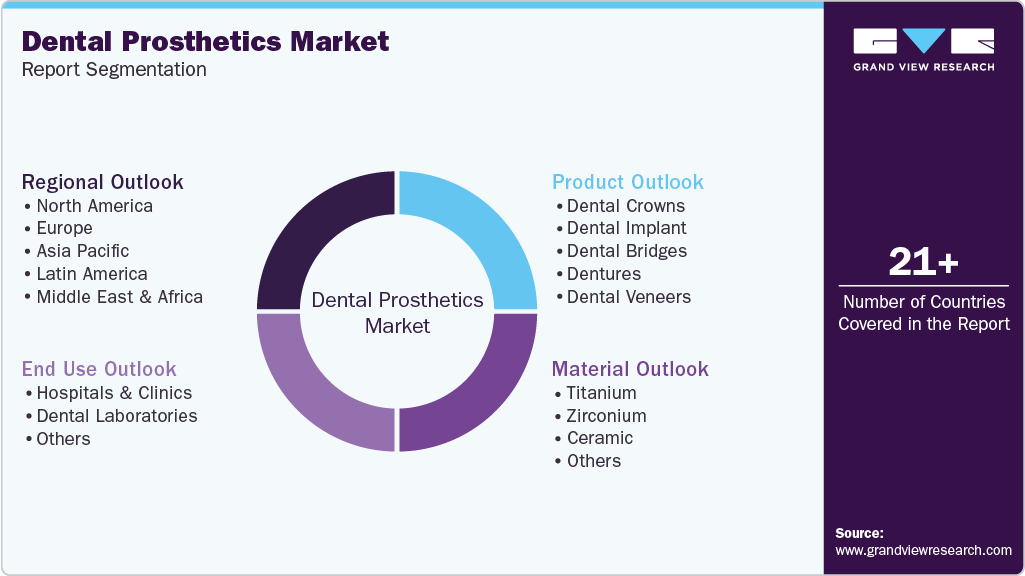

Dental Prosthetics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dental Crowns, Dental Implant, Dental Bridges, Dentures, Dental Veneers), By Material (Titanium, Zirconium, Ceramic), By End-use (Hospitals & Clinics, Dental Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-759-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Prosthetics Market Summary

The global dental prosthetics market size was estimated at USD 13.28 billion in 2024 and is projected to reach USD 30.27 billion by 2033, growing at a CAGR of 9.7% from 2025 to 2033. The increasing awareness about dental treatments and the rising burden of oral diseases are anticipated to drive the market growth.

Key Market Trends & Insights

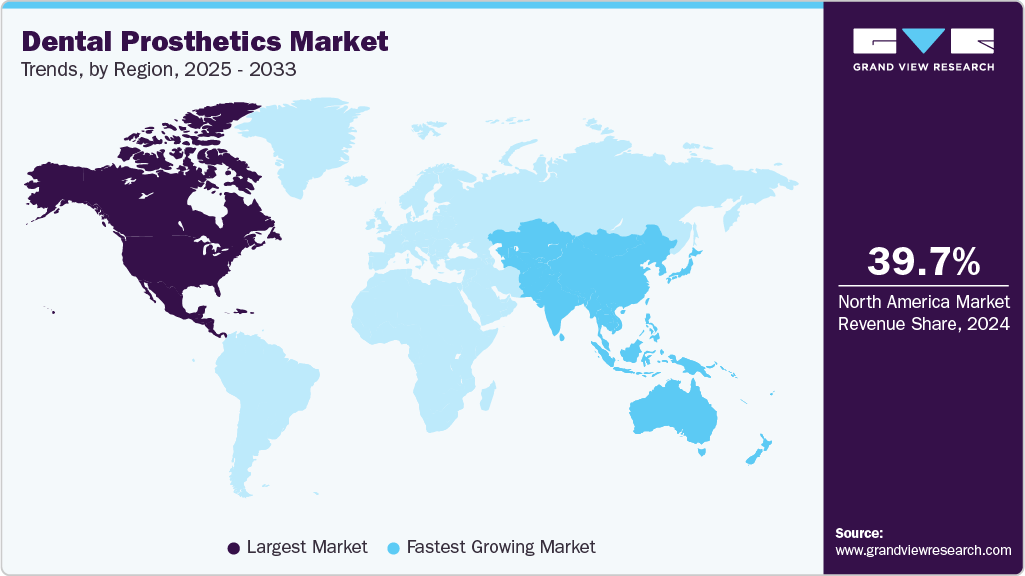

- North America dominated the dental prosthetics market with the largest revenue share of 39.7% in 2024.

- The U.S. dental prosthetics industry is expected to grow significantly over the forecast period.

- By product, the dental implant segment is anticipated to witness the fastest growth with a CAGR of 10.7% from 2025 to 2033.

- By material, the titanium segment led the market with the largest revenue share of 39.9% in 2024.

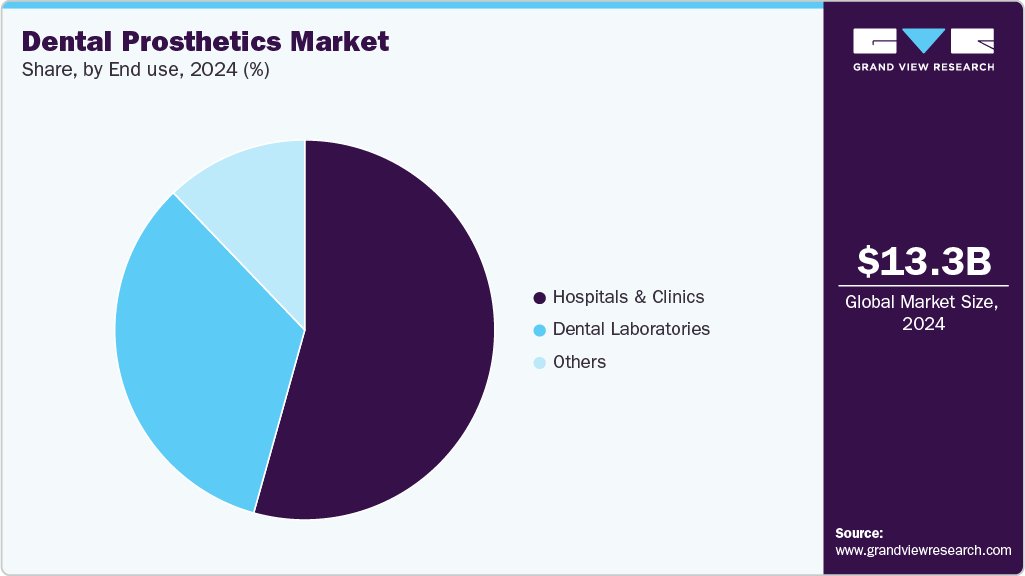

- By end use, the hospitals & clinics segment led the market with the largest revenue share of 54.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.28 Billion

- 2033 Projected Market Size: USD 30.27 Billion

- CAGR (2025-2033): 9.7%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

In addition, the increasing focus on aesthetic and cosmetic dentistry is expected to support the growth. The rising prevalence of the geriatric population and increasing burden of oral disorders are anticipated to boost the demand for dental prosthetics such as crowns, bridges, implants, veneers, and dentures. Older adults need more restorative treatments to restore function (chewing, speech) and comfort. According to data published by the WHO in March 2025, the global prevalence of total tooth loss for people aged 60 years and older is estimated to be significantly higher at 23%. Such a high burden of oral diseases among the older population is expected to propel the demand for prosthetics in the coming years.

Furthermore, growing dental tourism supports the adoption of the dental prosthetics industry. Several emerging economies, such as India, Turkey, and Mexico, are witnessing a growth in dental tourism. These countries offer cost-effective oral treatments, which support dental tourism and demand for prosthetics in these countries. According to the data published in the 2024 study published in the Journal of Clinical Periodontology, Turkish clinics offer prices 50-70% lower than those in the U.S., the UK, and Canada.

Dental Implant Cost Comparison: Turkey vs. Other Nations

Country

Turkey

U.S.

UK

Single Implant Cost (Approximately)

USD 440

USD 3,000-4,500

USD 1,830

Source: Industry Journals, Grand View Research Analysis

Such affordability in oral treatments in emerging economies is anticipated to propel the demand for prosthetics in emerging markets.

Moreover, the rising demand for aesthetic and cosmetic dental procedures is expected to propel the demand for prosthetics over the forecast period. With growing consumer awareness around oral appearance and oral health, there is an increasing inclination toward procedures that restore functionality and enhance overall facial aesthetics. Aesthetic and cosmetic treatments, including veneers, implants, crowns, and bridges, have seen a sharp rise in demand due to various factors such as increasing disposable income, growing social media influence, and the broader societal shift towards physical appearance. According to the data published by the Smile Circle in September 2024, over 3 million individuals in the UK have opted for dental implants; this number is increasing by approximately 500,000 annually. Thus, such growing preference for aesthetic and cosmetic oral procedures is expected to support the adoption of dental prosthetics over the forecast period.

Key Opinion Leaders

Company Name

KOLs

Growth Opportunities

Vafa Jamali, Chairman of the Board and Chief Executive Officer of ZimVie.

"Partnering with Osstem, a respected leader known for exceptional service and a strong portfolio of high-quality products, presents a superior opportunity for ZimVie to expand and grow in the Chinese market,

- Expansion in emerging economies

- Distribution collaborations

Stanley M. Bergman, chairman of the board and CEO at Henry Schein

“This agreement marks our planned entry into the large Brazilian implant market.”

- Partnerships & Collaborations

- Mergers & Acquisitions for Improving Distribution

Mr. Elik Yefet,Regional Sales Manager (Asia) AB-Dent

“It is our pleasure to introduce one of the recent innovations in the Indian Market. We have been present in the Asian continent with a significant presence among the Indian Government and Defence sector. Our authorized partner - ABA Technologies has played an indispensable role in our journey to date.As organizations, AB-Dent and ABA Technologies together have done 8 successful years of business and are now venturing into the private Indian dental market. This implant would change the face of Indian Implantology. I-ON implants were developed with aesthetic outcomes in mind. Esthetic results can be achieved by successful soft tissue management. I-ON design allows for natural, esthetic soft tissue forming and maintenance. A wide range of temporary solutions is available for soft tissue shaping, with an emergence profile identical to the final restorations, to ensure a consistent process and maximum predictability of the esthetic outcome.”

- Growing product launches

- Scalability in Emerging Markets

Source: Grand View Research Analysis

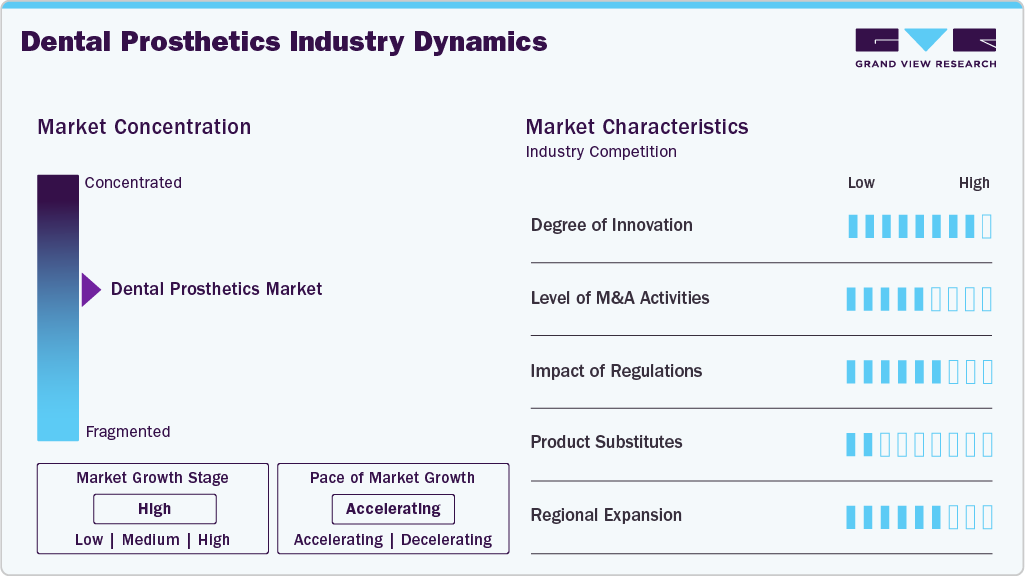

Market Concentration & Characteristics

The dental prosthetics market growth stage is high, and the pace of growth is accelerating. The market is characterized by high growth owing to the growing launches of novel products, rising demand for aesthetic and cosmetic dentistry, and increasing burden of oral disorders.

Adoption of advanced technologies such as 3D printing and Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM) technology is enabling the creation of dental restorations, such as crowns, in a single visit. Moreover, modern materials are used in prosthetics to enhance aesthetics. According to the data published by the imes-icore GmbH in June 2024, several modern materials such as PEEK (polyetheretherketone), composites, and biocompatible alloys are being used in prosthetic manufacturing to offer high strength, lower weight, and enhanced biocompatibility. Such material and technological advancements are anticipated to bring novel dental prosthetics to the industry.

Regulatory authorities such as Health Canada, the U.S. FDA, and the European Medicines Agency (EMA) oversee the authorization, classification, and monitoring of prosthetics used in dentistry.

U.S. FDA Regulatory Classification Dental Prosthetics:

Product

Regulatory Class

Regulation Number

Denture

Class II

872.3590

Implant

Class II

872.3640

Crown and bridge

Class II

872.3770

Source: U.S. FDA

Mergers and acquisitions play a crucial role in the dental prosthetics industry. They enable companies to expand their product offerings, foster innovation, and strengthen their market position. Both established and emerging firms are adopting these strategies. For instance, in November 2024, Modern Dental Group Limited, a provider of oral prosthetics, acquired the 74% shares in Hexa Ceram Dental Laboratory, a laboratory in Thailand. This laboratory has been the pioneer in the industry for nearly 30 years and provides high-quality dental prosthetics with a group of over 900 skilled technicians and the sales team in 12 branches across Thailand. This acquisition focuses on increasing the reach of Modern Dental Group Limited in the local market.

Dental prosthetics companies are increasingly prioritizing regional expansion to improve market reach and enhance their manufacturing capabilities in various regional markets. For instance, in May 2024, Implacil De Bortoli, Brazil's third-largest dental implant company, was acquired by Osstem Implant. Such acquisitions strengthen the companies' positions both regionally and globally.

Product Insights

The dental implant segment held the largest share of the dental prosthetics market in 2024. It is also anticipated to grow the fastest with a CAGR of 10.7% from 2025 to 2033. The increasing adoption of implantation procedures and the rising demand for cosmetic dentistry drive this robust growth. Companies are innovating their implant offerings. For instance, in February 2023, the authorized partner of Israel, an Israel-based dental manufacturer, ABA Technologies, revealed the launch of the i-ON Conical Implant in India. Such product launches in developing countries are expected to propel the segment expansion in the coming years.

The veneers segment is expected to grow substantially during the forecast period, primarily driven by a rising focus on aesthetic appearance. Increasing awareness and social media influence are driving demand for veneers. In addition, companies operating in this segment are focusing on increasing their regional presence. For instance, in May 2025, MINISH Technology, a Korean company, expanded its global footprint by launching its advanced veneer solution to the U.S. market. The company presented this solution at an event at The West Hollywood EDITION, welcoming more than 80 regional dentists from across the U.S. Such strategies employed by industry players are anticipated to drive the segment growth in the coming years.

Material Insights

The titanium segment led the dental prosthetics market with a total revenue share of 39.9% in 2024. It is also anticipated to register the fastest growth rate over the forecast period. This growth is mainly attributed to the rising prevalence of tooth-related disorders and the increasing number of dental procedures, such as implant placements and tooth extractions. In addition, titanium's unique properties, its strength, biocompatibility, and resistance to corrosion, make it an ideal choice for dental implants. These characteristics ensure that the implants can endure the daily stresses of chewing and biting, providing a reliable long-term solution for tooth replacement. This trend is expected to further support the growth of the titanium segment in the coming years.

The zirconium segment is expected to grow significantly over the forecast period. This growth is primarily fueled by the growing demand for aesthetic dentistry and several advantages of zirconium prosthetics in dentistry. According to an article published by Avant Dental in July 2023, Zirconia crowns have become increasingly popular in dentistry in recent years. This adoption of zirconium can be attributed to its benefits, such as superior aesthetics, long-term durability, biocompatibility, precision fit, maximum tooth preservation, and stain resistance.

End Use Insights

The hospitals & clinics segment led the dental prosthetics industry with the largest revenue share of 54.3 % in 2024. This dominance can be attributed to the high number of patient visits, the availability of skilled professionals, and the availability of advanced equipment. In addition, rising demand for quality oral care boosts prosthetic procedures in these settings. Moreover, aging populations and growing oral health awareness also support segment growth.

The dental laboratories segment is expected to witness the fastest growth during the forecast period, primarily driven by a rise in the number of labs. In addition, growing collaboration between these labs and dental solutions providers to improve digital dentistry and prosthetic development is anticipated to support the segment growth. In August 2025, Dantech Dental Lab collaborated with iTero at the launch of the iTero Lumina Pro Scanner.

Regional Insights

In 2024, North America led the dental prosthetics market with the largest revenue share of 39.7%. The regional market growth is driven by a growing burden of oral disorders and the presence of key players. According to the data published by Statistics Canada in October 2024, among adults aged 18 and older, 4% reported having lost all their natural teeth. Moreover, 22% of Canadians experienced regular oral pain. Such a high burden of oral disorders among North Americans is anticipated to drive the regional market growth in the coming years.

U.S. Dental Prosthetics Market Trends

The U.S. dental prosthetics industry is expected to grow significantly over the forecast period, driven by the increasing product launches, technological advancements, and growing adoption of restorative and aesthetic procedures. Several key industry players operating in the country are introducing dental prosthetics. For instance, in February 2025, Aspen Dental collaborated with Ivoclar to introduce the Signature Elite Denture, a product that blends precision, accessibility, and innovation.

Europe Dental Prosthetics Market Trends

The Europe dental prosthetics industry is driven by an aging population, the increasing prevalence of oral disorders, and the rising demand for cosmetic dentistry. Technological advancements in dentistry materials and procedures, along with growing awareness about oral health, also fuel market growth. In addition, supportive government policies further contribute to the rising demand for dental prosthetics.

The UK dental prosthetics market for dental prosthetics is experiencing growth, mainly driven by an increasing aging population and growing demand for implants and regenerative dentistry. According to the data published by the Centre for Ageing Better, in 2023, 4.2 million people aged 65 and over lived alone in England.

The dental prosthetics market in France is anticipated to witness rapid growth over the forecast period. This growth is driven by an aging population, increasing tooth loss, and rising demand for aesthetic dentistry solutions. Government support for oral healthcare and advancements in prosthetic technologies contribute to market growth. In addition, heightened awareness of oral health further boosts the sector.

Asia Pacific Dental Prosthetics Market Trends

The Asia Pacific dental prosthetics industry is growing fastest, driven by a growing population in India and China. The rising prevalence of tooth-related disorders, increasing focus on aesthetic dentistry, and improving healthcare infrastructure are anticipated to support market growth. Moreover, the region's expanding medical and dental tourism sector, particularly in countries such as Thailand and India, attracts international patients seeking affordable, high-quality dental prosthetics and treatments.

The India dental prosthetics market is anticipated to witness lucrative growth over the forecast period. Factors such as a growing prevalence of oral disorders, rising patient awareness, and an aging population are expected to boost the market demand across India. Moreover, the increasing focus of the Indian Government on the "Make in India" initiative and rising private investments in oral prosthetic manufacturing companies operating there are anticipated to support the domestic market growth. For instance, in September 2024, Dantech Digital Dental Solutions, a manufacturer of prosthetics such as crowns, bridges, orthodontics, and implants, received USD 2.5 million in funding. Dantech's commitment to tech-driven medical devices supports India's "Make in India" initiative, enhancing domestic product manufacturing and global competitiveness. Such increasing investments in dentistry product manufacturing are anticipated to support the country's market demand.

The China dental prosthetics market is anticipated to witness significant growth. The country's large population and the growing distribution agreements for increasing access to prosthetics in China are expected to drive this growth. International players are focusing on expanding their presence in China. For instance, in July 2025, ZimVie Inc., a global player offering oral implants, revealed a distribution agreement with Osstem Implant Co., Ltd., a provider of dentistry technologies and implants. The agreement further expands ZimVie's global presence to penetrate China's growing market and improve customer access to its innovative implant portfolio.

Latin America Dental Prosthetics Market Trends

The Latin America dental prosthetics industry is experiencing steady growth. The rising implant procedures and increasing burden of oral disorders are gaining the attention of major distributors in key Latin America countries. Distributors are expanding their network in Latin America to provide high-quality oral prosthetic solutions. For instance, in May 2023, Henry Schein, the distributor of dentistry products, revealed its plans to enter the Brazil market through the acquisition of S.I.N. Implant System. Such initiatives by industry players are expected to propel the growth of the Latin America market.

Middle East and Africa Dental Prosthetics Market Trends

The Middle East and Africa dental prosthetics industry is growing due to the increasing aging population, high prevalence of oral disorders, and advances in dentistry. Moreover, the growing demand for aesthetic and cosmetic dentistry procedures is anticipated to propel the market growth. In October 2024, Emirates Health Services (EHS) reported significant growth in its dental implant services, with the number of implant procedures growing from 110 to 813 over the 4 years from 2020 to 2024.

The Saudi Arabia dental prosthetics market is anticipated to grow significantly due to the increasing burden of oral diseases, supportive government regulations, and expanding healthcare infrastructure. In addition, increasing demand for cosmetic dentistry in Saudi Arabia is anticipated to propel the country's market growth. According to the article by Dr. Ali Majki in March 2025, the Saudi Arabian dental industry has witnessed a significant shift, with cosmetic procedures like teeth whitening, implants, anti-ageing dentistry, and Digital Smile Design (DSD) becoming more desired. Social media platforms such as TikTok, Instagram, YouTube, and Snapchat have driven the desire for bright white, perfectly-aligned teeth, making smile makeovers one of the top cosmetic procedures among males and females. Such changing consumer preferences are expected to support the country's market growth.

Key Dental Prosthetics Company Insights

Major companies are broadening their range of prosthetics and are placing greater emphasis on increasing distribution reach across emerging markets. Additionally, industry players are collaborating to enhance their competitive edge.

Key Dental Prosthetics Companies:

The following are the leading companies in the dental prosthetics market. These companies collectively hold the largest market share and dictate industry trends.

- Ivoclar Vivadent

- Dentsply Sirona

- Institut Straumann AG

- Nobel Biocare Services AG.

- BioHorizons, AB Dental Devices Ltd.

- Solventum

- Henry Schein, Inc.

- GC Corporation

- Zimmer Biomet Holdings, Inc.

- Shofu Dental Corporation

- VITA Zahnfabrik H. Rauter GmbH & Co. KG

- Kuraray Noritake Dental Inc.

- Coltene Holding AG

- Bego GmbH & Co. KG

- Dentaurum GmbH & Co. KG

- Keystone Dental, Inc.

Recent Developments

-

In July 2025, ZimVie Inc., a global player offering oral implants, revealed a distribution agreement with Osstem Implant Co., Ltd., a provider of dentistry technologies and implants. The agreement further expands ZimVie's global presence to penetrate China's growing market and improve customer access to its innovative implant portfolio.

-

In March 2025, Solventum collaborated with SprintRay, a chairside 3D dental printing provider, to address dentists' needs for in-office, same-day 3D-printed inlays, crowns, and onlays. This commercialization agreement aims to develop and bring to market high-quality, durable, and permanent restorations that can be completed on the same day.

-

In February 2025, Aspen Dental collaborated with Ivoclar to introduce the Signature Elite Denture, a product that blends precision, accessibility, and innovation.

Dental Prosthetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.45 billion

Revenue forecast in 2033

USD 30.27 billion

Growth rate

CAGR of 9.7% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ivoclar Vivadent; Dentsply Sirona; Institut Straumann AG; Nobel Biocare Services AG.; BioHorizons, AB Dental Devices Ltd.; Solventum; Henry Schein, Inc.; GC Corporation; Zimmer Biomet Holdings, Inc.; Shofu Dental Corporation; VITA Zahnfabrik H. Rauter GmbH & Co. KG; Kuraray Noritake Dental Inc.; Coltene Holding AG; Bego GmbH & Co. KG; Dentaurum GmbH & Co. KG; Keystone Dental, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Prosthetics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dental prosthetics market report based on product, material, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dental Crowns

-

Dental Implant

-

Dental Bridges

-

Dentures

-

Dental Veneers

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Titanium

-

Zirconium

-

Ceramic

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Dental Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental prosthetics market size was estimated at USD 13.28 billion in 2024 and is expected to reach USD 14.45 billion in 2025.

b. The global dental prosthetics market is expected to grow at a compound annual growth rate of 9.69% from 2025 to 2033 to reach USD 30.27 billion by 2033.

b. North America dominated the dental prosthetics market with a share of 39.7% in 2024. This is attributable to the growing burden of oral disorders and the presence of key players.

b. Some key players operating in the dental prosthetics market include Ivoclar Vivadent, Dentsply Sirona, 3M Company, Nobel Biocare Services AG, Straumann Group, Zimmer Biomet Holdings, Inc., Henry Schein, Inc., GC Corporation, Shofu Dental Corporation, VITA Zahnfabrik H. Rauter GmbH & Co. KG, Kuraray Noritake Dental Inc., Coltene Holding AG, Bego GmbH & Co. KG, Dentaurum GmbH & Co. KG, and Keystone Dental, Inc.

b. Key factors that are driving the market growth include the increasing awareness about dental treatments and the rising burden of oral diseases

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.