- Home

- »

- Pharmaceuticals

- »

-

Diabetic Neuropathy Treatment Market Size Report, 2030GVR Report cover

![Diabetic Neuropathy Treatment Market Size, Share & Trends Report]()

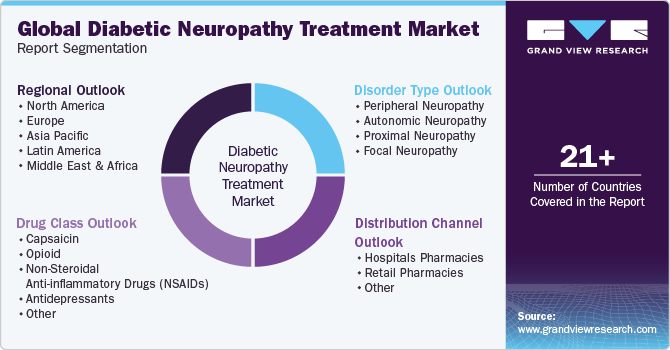

Diabetic Neuropathy Treatment Market Size, Share & Trends Analysis Report By Disorder Type (Peripheral Neuropathy, Autonomic Neuropathy), By Drug Class (NSAIDs, Capsaicin, Opioid), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-241-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global diabetic neuropathy treatment market size was estimated at USD 4.34 billion in 2023 and is projected to grow at a CAGR of 7.72% from 2024 to 2030. The market is growing due increasing prevalence of diabetes, advancements in therapeutic & diagnostic techniques, and rising awareness about the condition's complications. According to the International Diabetes Federation, in 2022, approximately 537 million adults between the ages of 20 and 79 are affected by diabetes, equating to 1 in 10 individuals. This number is estimated to rise to 643 million by 2030 and further to 783 million by 2045. In addition, some of the key pipeline therapies that are expected to propel the market space over the forecast period include LX9211, VM202, Ricolinostat, GRC 17536, CBD, VX-548, and LY3857210, among others.

As more individuals are diagnosed with diabetes, the likelihood of them developing diabetic neuropathy also increases, creating a higher demand for effective treatments and management options. For instance, the IDF reported that diabetes is increasing globally, with the highest increases witnessed in low- and middle-income countries. The International Diabetes Federation (IDF) has reported a global rise in diabetes prevalence, with the most substantial increases observed in low- and middle-income countries. In 2021, the regions with the most significant adult diabetes population included the Western Pacific (167 million), and Europe (59 million). In the U.S., as reported by the Centers for Disease Control and Prevention (CDC), approximately 34.2 million individuals, accounting for 10.5% of the population, were diagnosed with diabetes. This includes both diagnosed and undiagnosed cases. Moreover, there are also a significant number of people who are undiagnosed or have prediabetes.

In addition, as more individuals become aware of the risks and consequences of diabetes, the importance of managing and treating diabetic neuropathy is gaining prominence. The increasing number of initiatives being undertaken by governments and nonprofit organizations to increase diabetes awareness is expected to boost the industry. For instance, the Ministry of Health and Family Welfare and WHO Country Office for India, as well as other partners, launched a mobile health initiative known as mDiabetes in India, such a health initiative is focused on increasing awareness about early diagnosis and treatment of diabetes. Similarly, WHO and IDF are working together to prevent & control diabetes and ensure good quality of life for people worldwide. For instance, the WHO Diabetes Program is aimed at preventing type 2 diabetes, reducing complications, and improving the quality of life for people with diabetes. Several NGOs and governments are creating norms and standards, raising awareness about diabetes prevention, and promoting surveillance to strengthen prevention & control of diabetes.

Furthermore, Research and development (R&D) advancements have been steadily progressing, leading to the growth of the diabetic neuropathy treatment space. Innovative treatments such as gene therapy, stem cell therapy, and targeted drug delivery systems are being explored, offering hope for more effective management and potential reversal of neuropathy symptoms. For instance, the study published by NIH in 2021 is a placebo-controlled phase III study, being conducted to evaluate the efficacy and safety of VM202, a gene therapy involving the administration of plasmid DNA encoding human hepatocyte growth factor, for the treatment of diabetic peripheral neuropathy.

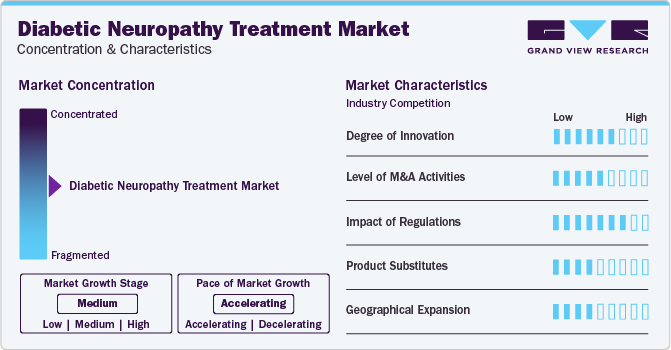

Market Concentration & Characteristics

The market is currently in a growth stage, with accelerated expansion driven by innovation and technological advancements. For instance, in December 2023, Vertex Pharmaceuticals has announced that a new non-opioid painkiller has shown promising results in reducing pain in patients with diabetes who suffer from chronic nerve pain, marking a significant advancement in the development of a treatment that does not carry the potential risk of addiction

The space is also characterized by a moderately high level of merger and acquisition (M&A) and collaboration activity. Key players in the global market include pharmaceutical companies such as Pfizer, Novartis, Johnson & Johnson, and Eli Lilly, which are actively participating in mergers and acquisition for strengthening both treatment devices and drugs.

Regulatory frameworks play a crucial role in shaping the diabetic neuropathy treatment industry by ensuring patient safety, promoting innovation, and maintaining market competition. These guidelines govern various aspects, including drug approval processes, clinical trial requirements, and post-marketing surveillance.

In the global market, product substitution can be moderate, as various therapies cater to different aspects of the condition and patient preferences. Diabetic neuropathy is a complex and multifaceted complication of diabetes, which may involve peripheral, autonomic, and proximal neuropathies. As a result, a diverse range of treatment options exists, including pharmacological, device-based, and lifestyle interventions.

In the diabetic neuropathy treatment space, the level of regional expansion can be considered moderate, as the prevalence of diabetes and the associated neuropathy continue to grow globally. This increasing demand for effective treatment options has led to a corresponding expansion in the market, with various players seeking to establish their presence across different geographical regions.

Disorder Type Insights

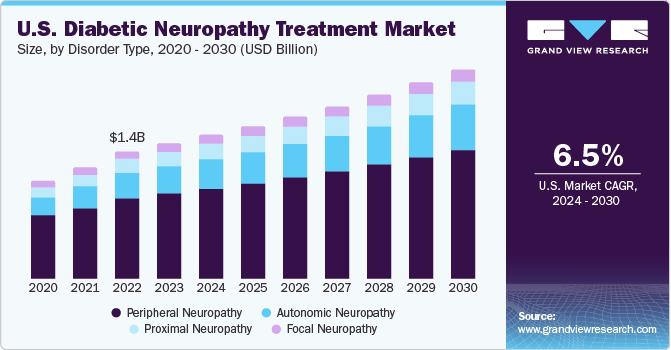

Based on disorder type, the peripheral neuropathy segment led the market with the largest revenue share of 63.09% in 2023. Several factors contribute to the dominance of peripheral neuropathy. It is the most common form of diabetic neuropathy, affecting a majority of diabetic patients. According to the study published in NIH in 2021, approximately 2.4% of the overall population experiences peripheral neuropathy, with this percentage rising to 8% among older age groups. This high prevalence leads to increased demand for treatments and management options specifically targeting peripheral neuropathy. In addition, according to an article published in ScienceDirect in July 2021, the prevalence was high among diabetic patients, accounting for around 40.3%, and type 2 diabetic patients are more susceptible to it than type 1 diabetic patients.

The autonomic neuropathy segment is expected to witness the fastest CAGR over the forecast period. An aging population is more susceptible to diabetes and its related complications, including autonomic neuropathy, which further drives industry growth. It affects various body systems, such as the cardiovascular, gastrointestinal, genitourinary, and sudomotor systems. In older individuals with diabetes, the combination of aging and diabetes can worsen nerve damage, leading to a higher prevalence of this condition.

Drug Class Insights

Based on drug class, the non-steroidal anti-inflammatory drugs (NSAIDs) segment led the market with the largest revenue share of 38.63% in 2023. One of the primary reasons NSAIDs are popular in diabetic neuropathy treatment is their ability to effectively manage pain and prescribes as first line of treatment. NSAIDs work by reducing inflammation and inhibiting prostaglandin synthesis, which helps alleviate pain and discomfort associated with diabetic neuropathy. Moreover, NSAIDs are widely available over the counter and are generally more affordable than other treatment options. This accessibility makes them an attractive choice for many patients suffering from diabetic neuropathy. For instance, various drugs, such as, ibuprofen and naproxen, can effectively alleviate mild to moderate pain resulting from diabetic neuropathy.

The opioid segment is expected to witness the moderate CAGR over the forecast period. Opioids are potent analgesics that can provide more effective pain relief for some patients with severe diabetic neuropathy-related pain compared to other treatment options such as NSAIDs. This strong pain-relieving effect makes them appealing to patients experiencing intense discomfort. For instance, a 2021 NIH study publication reveals that opioid analgesics are typically regarded as secondary or tertiary options for managing moderate-to-severe neuropathic pain.

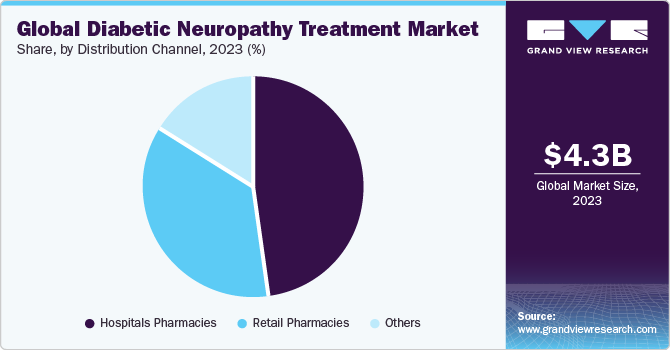

Distribution Channel Insights

Based on distribution channel, the hospital pharmacies segment led the market with the largest revenue share of 47.64% in 2023, owing to diabetic neuropathy high hospitalization rate. Furthermore, Hospital pharmacies have a centralized system for managing medications, which makes it easier to provide specialized care for patients with diabetic neuropathy. This centralizatiossn allows for better organization and availability of the required medications and treatments. In addition, government’s support is one of the reasons for the growth of the hospital pharmacies segment. For instance, the FIP (International Pharmaceutical Federation) Hospital Pharmacy Section (HPS) is dedicated to advancing the practice of hospital pharmacy through various initiatives and grants. The HPS aims to encourage innovative research in the field of hospital pharmacy. The FIP Hospital Pharmacy Section has developed a strategic plan for the period 2022-2027. This plan outlines how hospital pharmacists across different countries can contribute to the realization of the FIP Development Goals (DGs) in various dimensions.

The others segment is expected to witness the fastest CAGR over the forecast period, which includes online/ e-pharmacies. The convenience and ease of ordering medications online and having them delivered directly to one's doorstep have significantly contributed to the increasing popularity of e-pharmacy. This level of convenience is particularly appealing to individuals with mobility issues or those living in remote areas, as it eliminates the need to visit a physical pharmacy. For instance, The Government of India (GoI) and the Ministry of Health and Family Welfare (MoHFW) have introduced a range of public health-oriented initiatives leveraging information and communication technologies to enhance access to healthcare services for residents. These initiatives include the National Health Portal, which serves as a comprehensive platform for health-related information and resources.

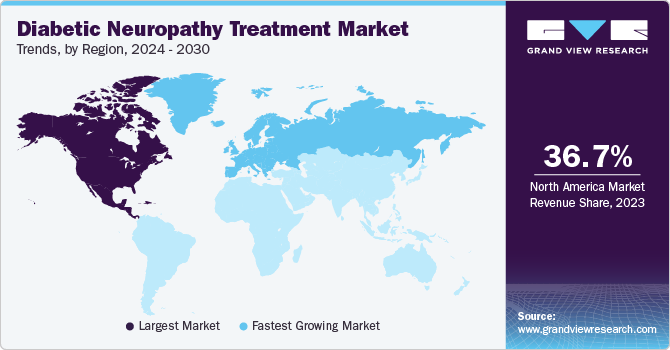

Regional Insights

North America dominated the diabetic neuropathy treatment market with the revenue share of 37.67% in 2023. The market is driven by several key factors, including the region's advanced healthcare infrastructure and high healthcare spending, create a beneficial environment for the adoption of innovative diabetic neuropathy treatment. Some of the market leaders, such as Abbott, Pfizer Inc., Eli Lilly, and Johnson & Johnson have their operational companies in this region, which is contributing to the market growth. Moreover, the completion of Neuralace Medical's Painful Diabetic Neuropathy (PDN) label expansion study and the potential FDA clearance for its non-invasive treatment could have a transformative impact on the diabetic neuropathy market in North America

U.S. Diabetic Neuropathy Treatment Market Trends

The diabetic neuropathy treatment market in U.S. is poised for significant growth, driven by several key factors. The increasing prevalence of diabetes in the country is leading to a higher incidence of diabetic neuropathy, creating a greater demand for effective treatments.

Europe Diabetic Neuropathy Treatment Market Trends

The diabetic neuropathy treatment market in Europe is expected to witness the fastest CAGR over the forecast period. Europe market presents a lucrative opportunity for pharmaceutical companies. Increasing government funding to improve healthcare infrastructure and research initiatives is expected to positively reinforce the market in Europe. For instance, nonprofit organizations such as Central European Diabetes Association (CEDA) collaborate with pharmaceutical companies for the development of innovative products.

The UK diabetic neuropathy treatment market is expected to grow at the fastest CAGR over the forecast period. According to Diabetes UK, an estimated 4.9 million people were affected by diabetes in 2022, and around 13.6 million people are currently at risk of developing type 2 diabetes in the UK.

The diabetic neuropathy treatment market in France is influenced by trends such as rising disease incidence. According to International Diabetes Federation (IDF), in France, around 3.9 million adults were living with diabetes. An increase in healthcare programs is expected to boost the market. For instance, Diabsat, a health initiative by Sanofi, can diagnose complications of diabetes using a mobile unit in remote locations thereby supporting the adoption of diabetic neuropathy treatment in the country.

The Germany diabetic neuropathy treatment market is expected to witness the significant CAGR over the forecast period, owing to factors such as favorable reimbursement policies and the increase in research initiatives to develop novel treatment alternatives. The presence of Statutory Health Insurance (SHI) in Germany provides benefits to all patients by reimbursing the expense of hospitals and pharmacies.

Asia Pacific Diabetic Neuropathy Treatment Market Trends

The diabetic neuropathy treatment market in Asia Pacific is expected to witness the significant CAGR over the forecast period, owing to factors such as rising geriatric & target populations, increasing number of collaborations for development of novel drugs, geographic expansion of key players, and active participation of government & nonprofit organizations in the market space.

The China diabetic neuropathy treatment market is expected to grow at the fastest CAGR over the forecast period. More than 114 million people are living with diabetes in China. With China being the most populated country in the world, improving treatment efficiency in metabolic diseases has become crucial. Increasing approval of products in China is anticipated to drive market growth.

The diabetic neuropathy treatment market in Japan is expected to grow at the fastest CAGR over the forecast period. According to the IDF, over 7.4 million Japanese individuals were living with diabetes in 2020. Westernized lifestyle, unhealthy diet, lack of exercise, and aging population are major risk factors boosting the prevalence of diabetes in the country. As per an article published by Diabetes Obesity and Metabolism, in 2022, the prevalence of diabetes in Japan accounted for 5.6% of the global prevalence.

Latin America Diabetic Neuropathy Treatment Market Trends

The diabetic neuropathy treatment market in Latin America is expected to grow at the fastest CAGR over the forecast period. A large section of the society in South America is aging rapidly, which has led to an increase in healthcare expenditure and is driving market growth in the region. The increasing focus of multinational pharmaceutical companies on this region is expected to drive market growth over the forecast period.

The Brazil diabetic neuropathy treatment market is expected to grow at the fastest CAGR over the forecast period. Brazil is expected to witness significant growth due to an increase in prevalence of diabetes. As per the IDF Diabetes Atlas, around 15.7 million people were living with diabetes in Brazil in 2021. This number is expected to reach around 19.2 million by 2030.

MEA Diabetic Neuropathy Treatment Market Trends

The diabetic neuropathy treatment market in MEA is anticipated to grow at the fastest CAGR during the forecast period. Major challenges faced by the Middle East and North Africa (MENA) market include lack of health awareness among people in the lower socioeconomic classes. Increasing prevalence of diabetes in MEA countries is anticipated to drive market growth. According to the IDF, around 3.4 million people were affected by diabetes mellitus in 2022 in Kuwait, followed by 990,900 in the UAE, 1.60 million in Afghanistan, 4.27 million in Saudi Arabia, 183,000 in Palestine, 2.01 million in Algeria, 396,100 in Lebanon, and 119,800 in Bahrain.

The Saudi Arabia diabetic neuropathy treatment market is expected to grow at the fastest CAGR over the forecast period. Organizations such as the Saudi Diabetes & Endocrine Association (SDEA) are creating general awareness among the population. In addition, growing technological advancements in R&D of drug delivery may increase the prescription rate for a product, driving the market. For instance, in January 2022, the Saudi Health Council and Sanofi signed an agreement to collaborate on various initiatives in the R&D of diabetes treatments.

Key Diabetic Neuropathy Treatment Company Insights

Some of the leading players in the market include, Eli Lilly and Company and Pfizer Inc. Different strategies are taken by the players to strengthen their market positions. Companies are involved in expanding their market presence by signing agreements with other players in emerging economies. Product approval is another strategy adopted by these companies.

Emerging players such as Vertex Pharmaceuticals are making strategic moves, such as collaborations and partnerships, to strengthen their presence in the market. They are also focusing on specific areas of R&D, to establish a solid foundation. One of their key developments is VX-548, currently in the works to address postoperative pain, diabetic peripheral neuropathy, and neuropathic pain.

Key Diabetic Neuropathy Treatment Companies:

The following are the leading companies in the diabetic neuropathy treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Eli Lilly and Company

- Pfizer. Inc

- Janssen Pharmaceuticals, Inc

- Lupin Pharmaceuticals

- Astellas Pharma Inc

- Glenmark Pharmaceuticals Ltd

- Boehringer Ingelheim GmbH

- Novartis

Recent Developments

-

In December 2023, Vertex Pharmaceuticals received FDA-approved for CRISPR-based gene editing therapy, a strategic move that focuses on the development and promotion of non-opioid pain management drugs. Building on Vertex's phase 2 clinical trial results for VX-548, the emphasis on alternative pain relief methods aligns with the growing demand for safer and more effective treatments for diabetic peripheral neuropathy. This initiative ensures a competitive edge by addressing the pressing need for innovative solutions in the market

-

In July 2023, Asprius Lifesciences, an Indian pharmaceutical company, has recently introduced a treatment for Diabetic Neuropathy, a condition causing nerve damage in peripheral body areas. The company has filed a patent for a Fixed-Dose Combination (FDC), showing potential in addressing peripheral neuropathy. This development positions Asprius as a competitive player in the global market, catering to the widespread need for effective solutions

Diabetic Neuropathy Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.66 billion

Revenue forecast in 2030

USD 7.28 billion

Growth rate

CAGR of 7.72% from 2024 to 2030

Base year for estimation

2023

Actual Years

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disorder type, drug class, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; Denmark, Sweden, Norway, France; Italy; China; India; Japan, Thailand, South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Abbott; Eli Lilly and Company; Pfizer. Inc; Janssen Pharmaceuticals, Inc; Lupin Pharmaceuticals; Astellas Pharma Inc; Glenmark Pharmaceuticals Ltd; Boehringer Ingelheim GmbH; Novartis

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diabetic Neuropathy Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global diabetic neuropathy treatment market report on the basis of disorder type, drug class, distribution channel, and region:

-

Disorder Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral Neuropathy

-

Autonomic Neuropathy

-

Proximal Neuropathy

-

Focal Neuropathy

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsaicin

-

Opioid

-

Morphine

-

Others

-

-

Non-Steroidal Anti-inflammatory Drugs (NSAIDs)

-

Ibuprofen

-

Naproxen

-

Others

-

-

Antidepressants

-

Tricyclic Antidepressants (TCAs)

-

Amitriptyline

-

Imipramine

-

Others

-

-

Serotonin and Norepinephrine Reuptake Inhibitors (SNRIs)

-

Duloxetine

-

Others

-

-

Selective Serotonin Reuptake Inhibitors (SSRIs)

-

Citalopram

-

Paroxetine

-

Others

-

-

Anticonvulsant Drugs

-

Gabapentin

-

Pregabalin

-

Topiramate

-

Others

-

-

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals Pharmacies

-

Retail Pharmacies

-

Other

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global diabetic neuropathy treatment market size was estimated at USD 4.34 billion in 2023 and is expected to reach USD 4.66 billion in 2024

b. The global diabetic neuropathy treatment market is expected to grow at a compound annual growth rate of 7.72% from 2024 to 2030 to reach USD 7.28 billion by 2030.

b. The peripheral neuropathy segment dominated the space and accounted for the largest revenue share of 63.09% in 2023. Peripheral neuropathy is the most common form of diabetic neuropathy, affecting a majority of diabetic patients.

b. Key players in space include Abbott, Eli Lilly and Company, Pfizer. Inc, Janssen Pharmaceuticals, Inc, Lupin Pharmaceuticals, Astellas Pharma Inc, Glenmark Pharmaceuticals Ltd, Boehringer Ingelheim GmbH, Novartis.

b. The diabetic neuropathy treatment market is influenced by factors such as the increasing global prevalence of diabetes, advancements in therapeutic and diagnostic techniques, and growing awareness about the complications associated with the condition.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."