- Home

- »

- Advanced Interior Materials

- »

-

Digital Mining Market Size And Share, Industry Report, 2030GVR Report cover

![Digital Mining Market Size, Share & Trends Report]()

Digital Mining Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Automation & Robotics, Real-time Analytics), By Application (Iron & Ferro Alloys, Non-ferrous Metals), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-074-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Mining Market Summary

The global digital mining market size was estimated at USD 8.49 billion in 2023 and is projected to reach USD 18.11 billion by 2030, growing at a CAGR of 9.8% from 2024 to 2030. The growing need for the safety of mine workers on account of increasing injuries during mining is one of the primary drivers for the rise in demand for digital mining solutions.

Key Market Trends & Insights

- The Asia Pacific digital mining market held the largest share in 2023 and is likely to maintain its position during the forecast period.

- The digital mining market in China is expected to observe lucrative growth over the coming years.

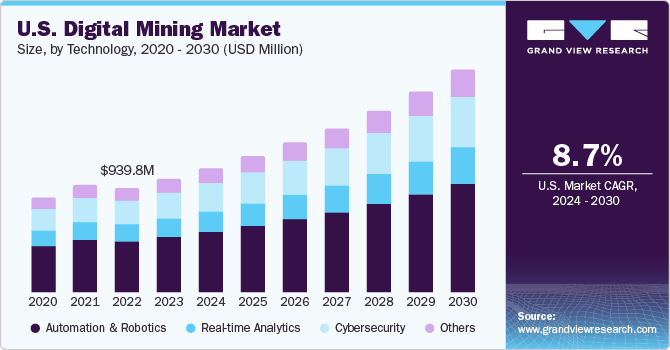

- Based on technology, automation and robotics was the largest segment in 2023 and accounted for a revenue share of over 43.0%.

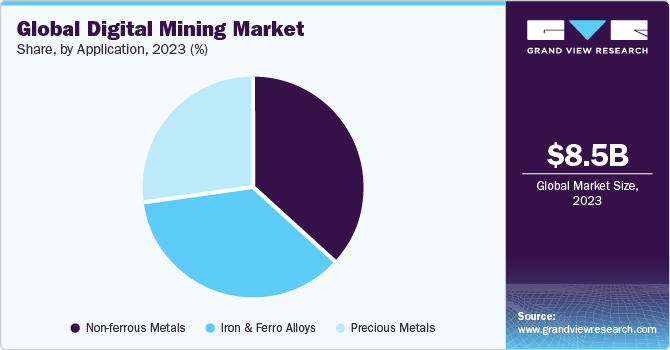

- In terms of application, the iron & ferroalloys segment accounted for a revenue share of over 35.0% in 2023.

- On the basis of application, the non-ferrous metals segment is projected to grow at a lucrative CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 8.49 billion

- 2030 Projected Market Size: USD 18.11 billion

- CAGR (2024-2030): 9.8%

- Asia Pacific: Largest market in 2023

Traditional drilling and exploration techniques have resulted in several injuries in the recent past. Digital mining solutions use deep learning algorithms without the need for a scaling object. Moreover, the particle size analysis solution uses stereo imaging to provide round-the-clock monitoring, thereby reducing routine and manual work. Advanced technologies, such as the Internet of Things (IoT), have the potential to reduce the environmental impact of mining and improve safety in mines. Moreover, unmanned vehicles and machines operated from remote locations can ensure safety in deep underground mining.

There is also a need to adopt cost-optimizing digital technologies in the sector. In the digital mining sector, 3D modeling technology can create diagrams of underground areas for more effective exploration. Thus, the implementation of digitization in the mining sector is likely to boost market growth over the coming years. Many U.S.-based miners have started automating their processes and operations to improve productivity and enhance their output as the U.S. is one of the leading countries involved in mining. In 2018, Newmont Mining partnered with Caterpillar to develop a new process and improve hard rock underground mining by enhancing productivity and increasing loader utilization during operations. Digital technology can be implemented across the entire value chain of mining including exploration, mine development, mines, ore processing, logistics, and sales marketing channels.

Although sales and marketing channels have not been primary adopters of digital technology, some companies are keen on implementing digitization in the late stages of the value chain. This can help balance the supply and demand between mine operations and customers in end-use industries. Increasing deployment of innovative digital technologies, such as drones, sensors, robotics, and integration techniques, drives the demand for automated solutions. For instance, in February 2023, Coal India and MCL introduced drone technology in coal mines. This will digitize of mining using techniques, such as volume measurement, environmental monitoring, and photogrammetric mapping of mines. The company also launched a web-based portal with a ground control system and drone.

Market Concentration & Characteristics

Market growth stage is high, and the pace of its growth is accelerating. Improved telecommunication, data availability, and automation allow various mining operations to be performed remotely. This has benefited in rising penetration of digital technologies like automation & robotics.

Numerous players in the market are focused on partnerships, joint ventures, and collaborations to assist the miners. For instance, in March 2024, ABB and TAKRAF Group renewed their partnership for the deployment of Gearless Conveyor Drive (GCD) technology. This reduces the need for a gearbox reducing the number of worn parts, and thus, directly minimizing carbon emissions. In the past, the TAKRAF group delivered GCD technology to one of the largest copper ore mines in Chile.

The digital mining industry is moderately impacted by regulations. Metals & mining companies are governed by stringent government regulations due to rising greenhouse gas (GHG) emissions and thus increasing pollution. Several such companies are working with technology providers to increase digitization that will reduce carbon emissions. For instance, Petrosea, a mining company in Indonesia adopted a digital strategy to efficiently use the resources and to improve the ESG score.

Digital mining includes the adoption of technologies for efficient operations and optimization of resources. As such, there are no substitutes for it; however, it can reduce the dependence on laborers in complex and dangerous situations. This can also reduce the injuries to laborers working in difficult mining environments.

Technology Insights

Automation and robotics was the largest segment in 2023 and accounted for a revenue share of over 43.0%. This is attributed to the increasing focus of market players on these technologies in digital mining. For instance, in May 2023, BHP and Microsoft collaborated to use machine learning (ML) and artificial intelligence (AI) to increase copper recovery at copper mines. Using these technologies, BHP expects to increase the production and value of their mines in the future. The need to protect data and safeguard companies from potential cyber threats drives the demand for cyber security in the digital mining sector. Analysis of real-time data involves remote operations and predictive maintenance and is the fastest way to resolve the current issues faced in operations.

BHP, an Australian mining giant, uses real-time analytics to resolve current issues at its iron ore operations in Western Australia. This ensures consistent operational flow from drill control to dispatch and logistics. Roy Hill, a mining company, uses digital boardroom techniques for its remote operations center to deliver real-time parameter data to the demand chain and supply chain teams. The other technologies segment is likely to register the second-fastest CAGR from 2024 to 2030. The key factor driving the segment growth includes rising expenditure on these emerging technologies and high adoption in end-use industries. For instance, in September 2023, The Metals Company (TMC) and Kongsberg Digital formed a partnership to develop a digital twin to understand the environmental consequences of deep sea mining operations.

Application Insights

The iron & ferroalloys segment accounted for a revenue share of over 35.0% in 2023. Based on applications, the market has been further segmented into iron & ferroalloys, non-ferrous metals, and precious metals. The growing demand for steel and related alloys in the construction, transportation, heavy machinery, and consumer durable industries indirectly drives the digital mining sector’s growth. To improve production output and utilize maximum capacities, companies, such as Anglo American, Rio Tinto, BHP, and Vale SA, deploy various digital technologies for their operations. Increasing demand for non-ferrous metals, such as aluminum, copper, and zinc, has led to the digitalization of operations to support the demand for these metals.

Lightweight materials, such as aluminum, are increasingly being used in automobiles to improve fuel efficiency and curb pollution to reduce the environmental impact. The non-ferrous metals segment is projected to grow at a lucrative CAGR from 2024 to 2030. Precious metal companies, such as Newmont Mining Corp.; Barrick Gold Corp.; Newcrest Mining Ltd.; and Goldcorp Inc., are some early adopters of digital technologies in the market. For instance, Goldcorp Inc. developed a digital strategy to optimize its mine lifecycle through an autonomous fleet, advanced process control, smart mines, and advanced analytics.

Regional Insights

The North America digital mining market held a market share of over 26% in 2023. The market is expected to benefit from the rising production of mining companies and the adoption of digital technologies by these companies to improve their operations.

U.S. Digital Mining Market Trends

The digital mining market in the U.S. is expected to remain a key consumer of digital mining as the country is one of the early adopters of digital mining. Rising capital expenditure in mining along with the presence of several digital technology providers is likely to influence the domestic market in the U.S.

Europe Digital Mining Market Trends

The Europe digital mining market holds a key position in the global industry owing to the development of new technologies and research on emerging techniques. The European Union project in Sweden is currently working on a new generation of technologies to improve the sustainability and efficiency of digital mining activities at the X-mine project. This new sensing technology uses a combination of 3D vision and X-ray, which is anticipated to reduce the consumption of energy and carbon dioxide emissions.

The digital mining market in Russia held over 37.0% of the share in Europe in 2023. The presence of large reserves of bauxite, nickel, copper, and other key minerals & metals is anticipated to boost mining activities, thus benefiting market growth.

Asia Pacific Digital Mining Market Trends

The Asia Pacific digital mining market held the largest share in 2023 and is likely to maintain its position during the forecast period. Providers involved in the development and delivery of both hardware and software platforms for digital mining are expected to be offered ample opportunities. The regional market growth is driven by a consistent increase in mining output and penetration of automation and robotics in the digital mining sector in China and Australia.

The digital mining market in China is expected to observe lucrative growth over the coming years. China is the leading producer of 28 different mineral raw materials through mining activities. Thus to improve the mining operations and optimization of resources, penetration of digital technologies is expected to rise over the coming years.

The India digital mining market is one of the fastest-growing markets in Asia Pacific. A moderate rise in the adoption of digital technologies, especially in state-run enterprises, is expected to fuel the domestic market growth.

Central & South America Digital Mining Market Trends

The digital mining market in Central & South America held a revenue share of over 7.0% in 2023. Countries, such as Peru and Chile, have huge resources of important metals and minerals. Thus, the production of such resources is expected to boost the requirement for digital technologies.

The Chile digital mining market held a revenue share of approximately 28.0% in Central & South America in 2023. The rising production of copper in Chile on account of the growing demand for electric vehicles (EVs) and batteries is expected to benefit the market in the country.

Middle East & Africa Digital Mining Market Trends

The digital mining market in Middle East & Africa is anticipated to register a CAGR of 10.6% over the forecast period. The presence of a wide range of resources, such as minerals and metals, characterizes the region. South Africa is a key country in the region wherein many companies utilize automated machines and software to optimize their operations.

The South African digital mining market held a revenue share of approximately 50% in Middle East & Africa in 2023. Mining is one of the key industries contributing to South Africa’s GDP. As per the South African Revenue Service, the mining sector contributed around 60% of South Africa’s exports in the first half of 2023.

Key Digital Mining Company Insights

Some of the key players operating in the market include Caterpillar and Sandvik AB

-

Caterpillar is one of the leading manufacturers of mining equipment, construction equipment, industrial gas turbines, natural gas engines, and diesel locomotives. The company’s headquarters is located in Texas, U.S. The company’s revenue was USD 67.1 billion in 2023

-

Sandvik AB is a provider of solutions and services to different industries, such as Aerospace, Automotive, Energy, Infrastructure, and Mining. The company was founded in 1862 and employs around 41,000 people

Hexagon AB and Metso are some of the emerging market participants.

-

Hexagon AB is a smart solution and service provider to different industries, such as mining, aerospace, automotive, and energy. With respect to mining, the company provides services related to exploration, planning, drill & blast, material movement, and survey & monitoring.

Key Digital Mining Companies:

The following are the leading companies in the digital mining market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- Sandvik AB

- SAP

- ABB

- Rockwell Automation, Inc.

- GE, Siemens

- Komatsu Mining Corp.

- IBM

- Hexagon AB

Recent Developments

-

In October 2023, Sandvik launched a new automation platform for large-scale mining operations. This platform known as Automine Core can provide data aggregation, underground connectivity, analysis, and different automation equipment options

-

In July 2023, Hexagon AB announced the acquisition of HARD-LINE, a solution provider for the mining industry. HARD-LINE provides services related to mine production optimization, remote-control technology, and mine automation. This acquisition improved the company’s life-of-mine-technology stack

Digital Mining Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.39 billion

Revenue forecast in 2030

USD 18.11 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Russia; Turkey; China; Australia; India; Indonesia; Brazil; Chile; South Africa

Key companies profiled

Caterpillar; Sandvik AB; SAP; ABB; Rockwell Automation, Inc.; GE; Siemens; Komatsu Mining Corp.; IBM; Hexagon AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Mining Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the digital mining market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Automation & Robotics

-

Real-time Analytics

-

Cybersecurity

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Iron & Ferro Alloys

-

Non-ferrous Metals

-

Precious Metals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

Australia

-

India

-

Indonesia

-

-

Central & South America

-

Brazil

-

Chile

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital mining market size was estimated at USD 8.49 billion in 2023 and is expected to reach USD 9.39 billion in 2024.

b. The global digital mining market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030, reaching USD 18.11 billion by 2030.

b. The automation and robotics application segment dominated the global market, with a revenue share of over 43.0% in 2023. The growing need to ensure the smooth flow of mining operations and reduce work-related injuries is projected to boost the demand in this segment.

b. Some of the key players operating in the digital mining market include Caterpillar, Sandvik AB, SAP, ABB, Rockwell Automation, Inc., GE, Siemens, Komatsu Mining Corp., IBM, and Hexagon AB

b. The growing awareness in firms associated with benefits of digitization in mining coupled with rising need to optimize the resources is expected to drive the digital mining market over the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.