- Home

- »

- Advanced Interior Materials

- »

-

Digital Multimeter Market Size & Share, Industry Report 2033GVR Report cover

![Digital Multimeter Market Size, Share & Trends Report]()

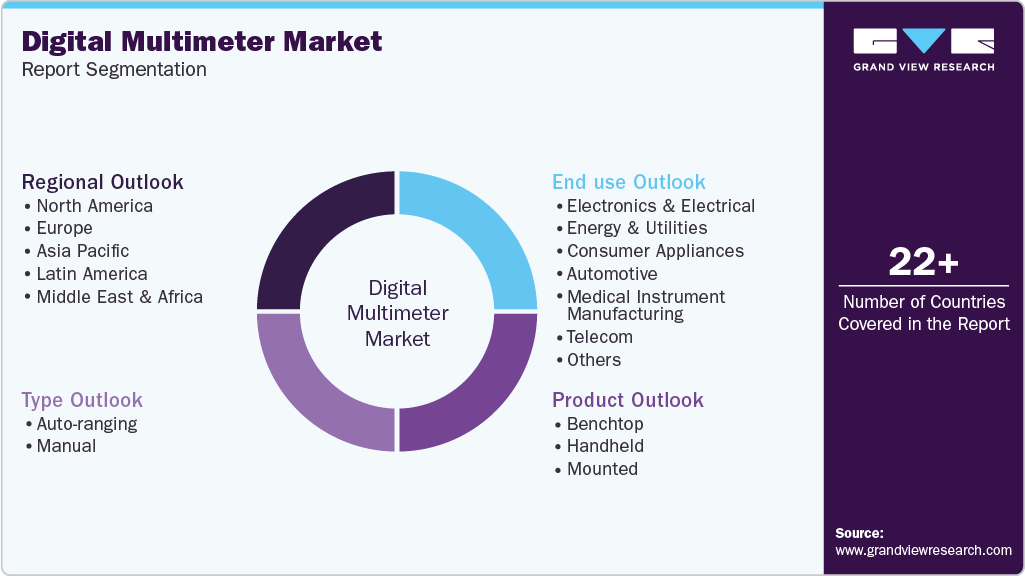

Digital Multimeter Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Benchtop, Handheld, Mounted), By Type (Auto-ranging, Manual), By End Use (Electronics & Electrical, Automotive, Energy & Utilities), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-805-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Multimeter Market Summary

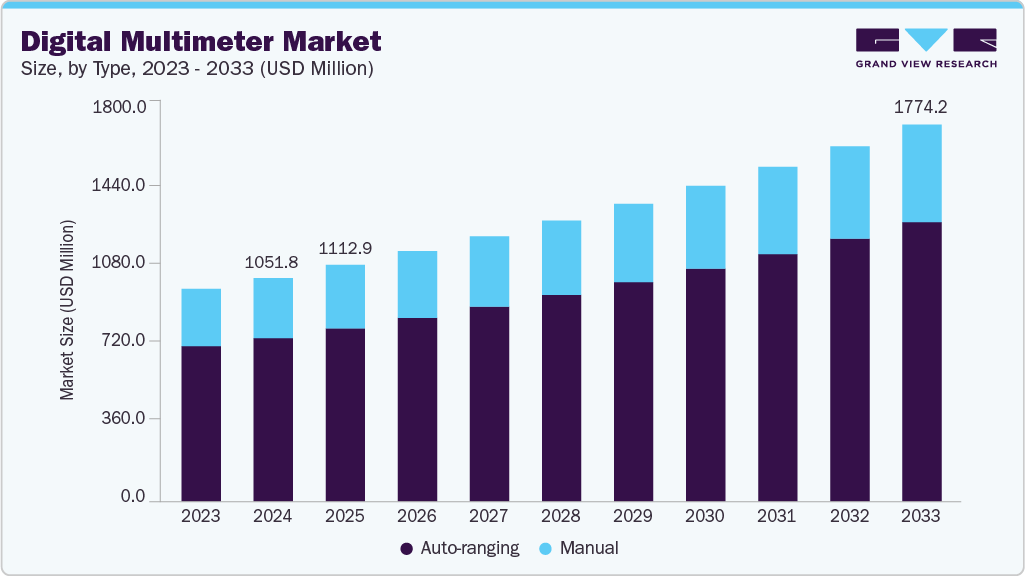

The global digital multimeter market size was estimated at USD 1,051.8 million in 2024 and is projected to reach USD 1,774.2 million by 2033, growing at a CAGR of 6.0% from 2025 to 2033. The market is poised for significant growth, supported by increased automation, smart connectivity, and expanding industrial applications.

Key Market Trends & Insights

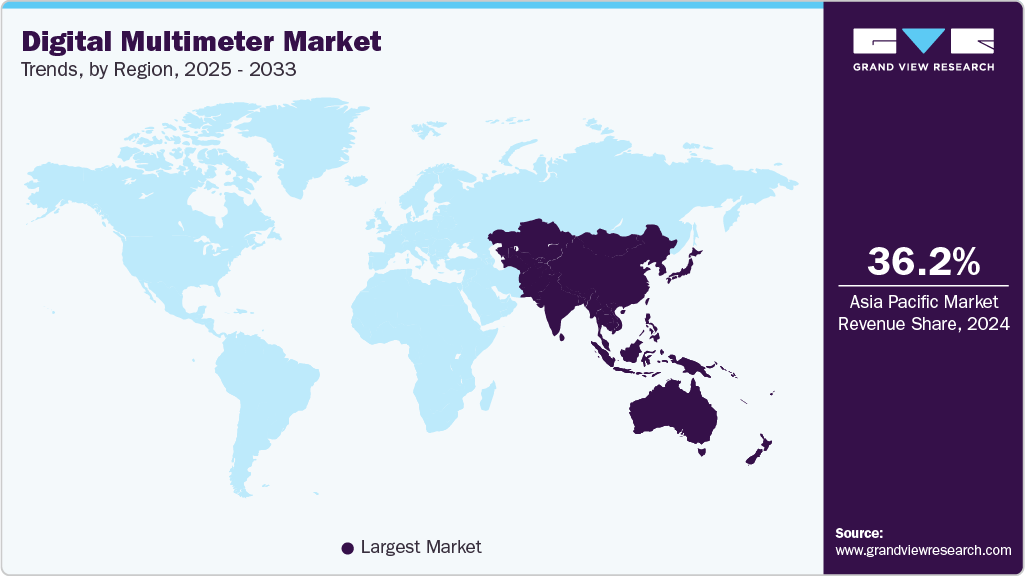

- Asia Pacific dominated the digital multimeter market with the largest revenue share of 36.2% in 2024.

- By product, the handheld segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

- By type, the auto-ranging segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

- By end use, the automotive segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1,051.8 Million

- 2033 Projected Market Size: USD 1,774.2 Million

- CAGR (2025-2033): 6.0%

- Asia Pacific: Largest market in 2024

Demand is rising due to the adoption of advanced manufacturing and electronics sectors. The shift toward renewable energy and electric vehicles further fuels the need for multimeters capable of handling high-voltage and complex diagnostics

With IoT integration, wireless connectivity, and enhanced data logging capabilities becoming standard, manufacturers are focusing on innovation and precision. These factors collectively drive market expansion, as industries increasingly rely on accurate, reliable, and versatile measurement tools for operational efficiency and safety.

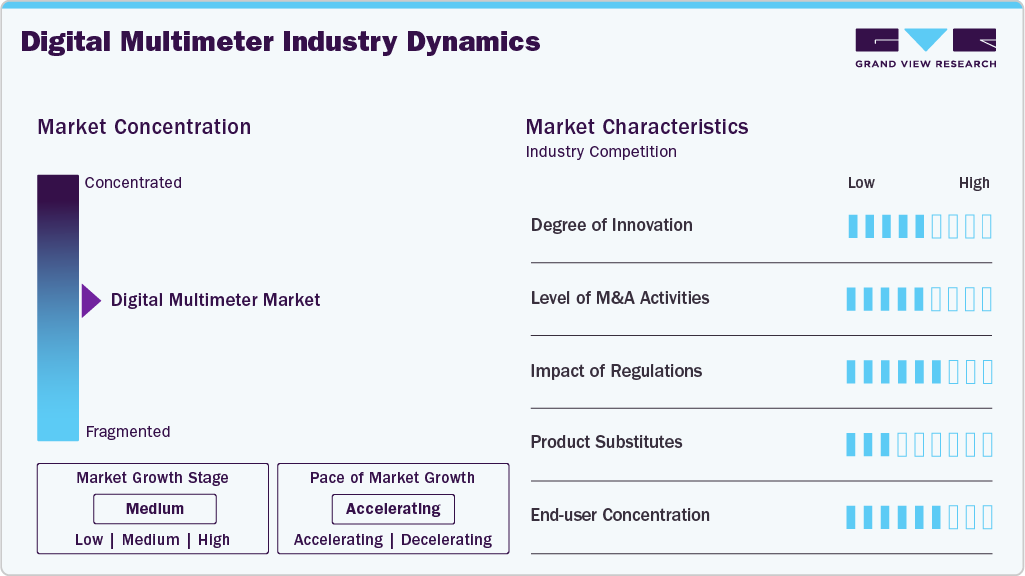

Market Concentration & Characteristics

The digital multimeter industry is moderately fragmented, with several global and regional players competing on technology, pricing, and product reliability. Leading companies, such as Fluke, Keysight Technologies, and Tektronix, dominate through innovation and a strong brand presence, while smaller manufacturers serve niche or regional markets. Continuous product differentiation, expanding distribution networks, and the integration of digital features, such as Bluetooth connectivity and data logging, maintain competition. This balanced landscape ensures steady innovation without excessive market dominance by a single player.

The market for digital multimeter is witnessing strong innovation with the introduction of IoT connectivity, Bluetooth, and Wi-Fi enabled data logging, and integration with cloud platforms for remote monitoring. Instruments now combine multiple functions such as voltage, current, resistance, frequency, and temperature measurement, improving versatility and efficiency. These advancements are driven by industrial automation, the expansion of smart grids, and the growing need for precise, real-time measurement in complex electrical and electronic systems.

Mergers and acquisitions are fostering consolidation and technological enhancement. Companies are acquiring complementary technologies and expanding portfolios to integrate hardware, software, and connectivity solutions. Such activities allow firms to strengthen their position in industrial automation, calibration, and analytics, moving beyond standalone meters toward comprehensive test and measurement ecosystems that address emerging digital and industrial needs.

Regulatory standards have strongly influenced the global landscape, requiring compliance with safety and performance norms, such as IEC 61010, as well as environmental directives, including RoHS. These regulations ensure product reliability, operator safety, and environmental sustainability. Compliance increases development and manufacturing costs but enhances product quality and market credibility. Additionally, energy efficiency and sustainability mandates are driving manufacturers to design eco-friendly and durable multimeters, aligning with global industrial safety and environmental objectives.

Drivers, Opportunities & Restraints

The rapid growth of the electronics and automotive industries is significantly driving the market, where precise measurement and testing are critical. Increasing adoption of electric vehicles, renewable energy systems, and smart devices demands accurate voltage, current, and resistance testing. In addition, industrial automation and IoT technologies fuel the need for advanced, portable, and multifunctional DMMs, enhancing performance monitoring, maintenance efficiency, and safety compliance across sectors.

An emerging opportunity in the digital multimeter market lies in integrating wireless connectivity and smart features. IoT-enabled DMMs that offer remote monitoring, real-time data logging, and cloud-based analytics are gaining traction. These smart solutions improve diagnostics and predictive maintenance in industrial and energy applications. Furthermore, growing demand in developing regions for affordable, user-friendly testing tools creates opportunities for manufacturers to expand market reach through innovative, cost-effective product offerings.

A major challenge in the industry is intense price competition and product commoditization. Low-cost alternatives from regional manufacturers put pressure on established brands to maintain profitability while ensuring accuracy and durability. Furthermore, technological complexity and calibration standards require continuous innovation and compliance efforts. Limited technical knowledge among end users can also hinder the adoption of advanced models, restricting market growth and reducing differentiation in an increasingly crowded landscape.

Product Insights

The benchtop segment is expected to grow at a considerable CAGR of 5.9% from 2025 to 2033 in terms of revenue. The handheld segment held the dominant share in the market and accounted for a share of 62.2% in 2024, driven by its portability, affordability, and ease of use in field applications. The increasing demand for quick, on-site electrical diagnostics in the maintenance, construction, and automotive industries supports this trend. Advancements in rugged, battery-efficient, and Bluetooth-enabled handheld models enhance user convenience and connectivity. Moreover, growing adoption by electricians, technicians, and DIY enthusiasts, coupled with expanding infrastructure projects and renewable energy installations, is expected to fuel significant market opportunities for handheld multimeters globally.

The benchtop segment remains significant in the market due to the increasing demand for high-precision measurement in research laboratories, manufacturing facilities, and calibration centers. These instruments offer superior accuracy, advanced data logging, and multi-channel measurement capabilities, making them ideal for complex testing environments. Growth in electronics R&D, semiconductor testing, and industrial automation further supports adoption. Additionally, rising investment in quality control and the need for reliable instrumentation in aerospace, defense, and telecommunications sectors are driving the segment’s long-term expansion.

Type Insights

The manual segment is expected to grow at a considerable CAGR of 5.6% from 2025 to 2033 in terms of revenue. The auto-ranging segment continues to dominate the market, accounting for 73.1% share in 2024, due to its ease of operation and time-saving functionality. These devices automatically select the appropriate measurement range, reducing user error and improving efficiency, making them ideal for both professionals and beginners. Rising demand in electronics repair, industrial testing, and educational applications supports adoption.

The manual segment is projected to witness significant growth driven by demand from cost-sensitive users and training institutions. These multimeters allow manual range selection, offering greater control and precision for experienced technicians. Their affordability and durability make them suitable for small workshops, educational labs, and developing markets. However, slower adoption is anticipated compared to auto-ranging models, due to limitations in ease-of-use. Still, consistent demand from professionals preferring traditional testing methods will sustain steady growth within niche applications.

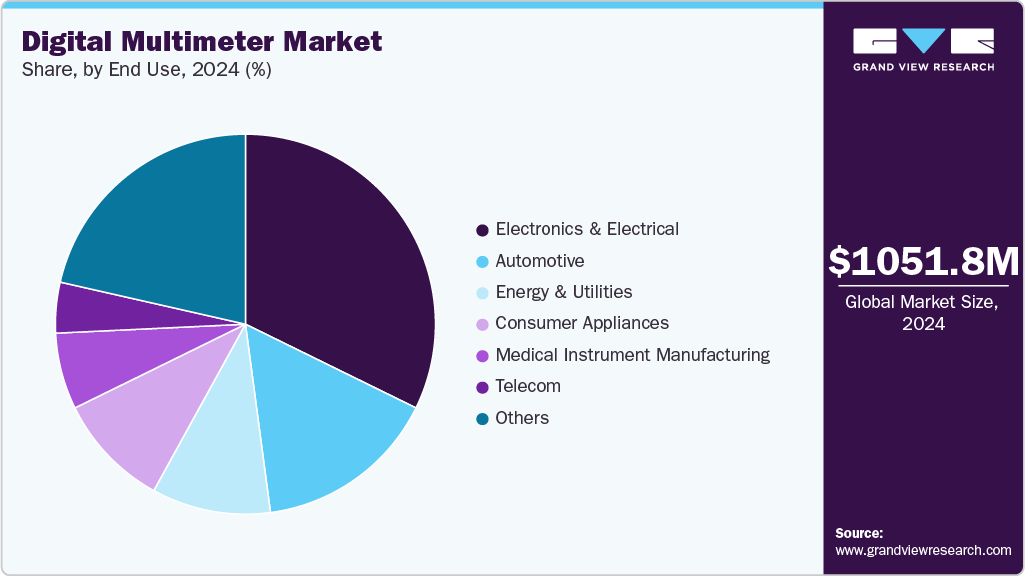

End Use Insights

The automotive segment is expected to grow at a significant CAGR of 7.1% from 2025 to 2033 in terms of automotive revenue. The electronics & electrical segment dominates the digital multimeter industry and accounted for a share of 32.2% in 2024. It has witnessed strong growth due to increasing demand for precision testing and troubleshooting in circuit design, manufacturing, and maintenance. Rapid advancements in consumer electronics, semiconductors, and IoT devices are driving the need for accurate measurement tools. Moreover, expanding electrification in developing regions and continuous upgrades in electrical infrastructure support market expansion.

The automotive segment is anticipated to witness the fastest growth in the market, driven by the rising adoption of electric vehicles (EVs), hybrid models, and advanced electronic systems in modern vehicles. Digital multimeters are essential for testing voltage, current, and continuity in automotive circuits, batteries, and sensors. The increasing adoption of vehicle electrification and the growing complexity of diagnostics are driving demand for high-accuracy, durable, and portable testing instruments. Moreover, the expansion of automotive manufacturing and maintenance activities worldwide, along with the integration of smart diagnostic tools, is expected to propel segment growth in the forecast years.

Regional Insights

The North America digital multimeter industry is poised to depict a CAGR of 5.9% over the forecast period due to its strong industrial base, advanced electronics sector, and widespread adoption of automation technologies. Rising demand for accurate testing in manufacturing, automotive, and energy applications drives market expansion. The region also benefits from increasing R&D investments and the presence of major test equipment manufacturers offering technologically advanced, high-performance multimeters suited for diverse industrial applications.

U.S. Digital Multimeter Market Trends

The digital multimeter industry in the U.S. is growing rapidly, supported by strong demand from the electronics, aerospace, and automotive sectors. The country’s focus on innovation, research, and industrial automation fuels the adoption of high-precision testing tools. Expanding electric vehicle manufacturing and renewable energy projects further enhance market prospects. Furthermore, the presence of leading multimeter manufacturers and increasing investment in infrastructure modernization strengthen the U.S. position in the global market.

The Mexico digital multimeter industry is expanding due to its growing manufacturing and automotive industries, supported by foreign investments and nearshoring trends. The country’s role as a key production hub for electronics and vehicle components drives demand for reliable testing equipment. Increasing adoption of industrial automation and vocational training programs in electrical engineering also supports market growth. Affordable, durable, and portable multimeters are witnessing strong demand from local industries and technicians.

Europe Digital Multimeter Market Trends

The digital multimeter industry in Europe is growing steadily, driven by advanced industrial automation, stringent quality standards, and strong demand from the automotive and electronics sectors. The region’s focus on renewable energy, smart manufacturing, and electric vehicle infrastructure fuels the need for precise testing tools. Ongoing R&D investments, coupled with government initiatives promoting energy efficiency and innovation, are boosting the adoption of advanced digital multimeters across factories and maintenance facilities.

The Germany digital multimeter industry leads the Europe market, largely attributed to its strong engineering base and leadership in automotive, electronics, and industrial automation sectors. High-quality testing instruments are in demand for precision manufacturing and R&D applications. The country’s transition toward electric mobility and Industry 4.0 technologies further drives the adoption of advanced multimeters.

The digital multimeter industry in the UK is growing steadily, supported by advancements in electrical testing, automotive innovation, and renewable energy projects. Expanding infrastructure upgrades and industrial automation initiatives drive demand for accurate and efficient measurement tools. Increasing emphasis on energy efficiency, safety compliance, and modernization of testing facilities further boosts adoption. The presence of skilled professionals and growing interest in smart, connected instruments enhances market potential across industries.

Asia Pacific Digital Multimeter Market Trends

The digital multimeter industry in the Asia Pacific is a dominant market as it accounted for a 36.2% share in 2024, driven by rapid industrialization, expanding electronics manufacturing, and infrastructure development. Countries such as China, India, Japan, and South Korea are key contributors, driven by strong demand from the consumer electronics, automotive, and energy sectors. Rising adoption of automation, vocational training, and affordable digital tools further supports market expansion. Local manufacturing capabilities and cost-effective production enhance regional competitiveness globally.

The China digital multimeter industry is fueled by its massive electronics manufacturing industry and growing automotive production. Increasing adoption of electric vehicles, renewable energy systems, and smart factories drives demand for high-precision multimeters. Government support for industrial modernization and quality assurance enhances market growth. Moreover, China’s strong domestic manufacturing base and rising exports of cost-effective testing instruments position it as a key global supplier.

The digital multimeter industry in India is expanding rapidly due to growing industrialization, infrastructure development, and a thriving electronics sector. Rising investments in renewable energy, electric vehicles, and smart grid projects drive demand for reliable testing equipment. The government’s “Make in India” initiative promotes domestic manufacturing, boosting the availability of affordable multimeters. Increasing technical education and awareness among electricians and engineers also contribute to steady market adoption across multiple industries.

Middle East & Africa Digital Multimeter Market Trends

The digital multimeter industry in the Middle East and Africa is witnessing moderate growth, driven by expanding industrial infrastructure, power generation, and construction projects. Rising adoption of automation technologies and renewable energy systems creates opportunities for testing equipment. Gulf countries’ investment in smart grids and industrial development supports demand. However, limited awareness and high import dependency challenge growth. Increasing technical training and economic diversification initiatives are improving market prospects.

The Saudi Arabia digital multimeter industry is witnessing growth fueled by major investments in industrial development, energy diversification, and smart infrastructure. The Vision 2030 initiative promotes advanced manufacturing and renewable energy projects, driving demand for electrical testing tools. Expanding construction and automation sectors further support the adoption of high-precision instruments. Increasing focus on workforce training and localization of industrial technologies strengthens Saudi Arabia’s position as a key market in the region.

Latin America Digital Multimeter Market Trends

The digital multimeter industry in Latin America is driven by industrial modernization, infrastructure projects, and expanding automotive manufacturing. Countries like Brazil and Mexico lead demand, driven by increased use of electrical and electronic testing tools. The region’s focus on renewable energy and maintenance efficiency further fuels adoption. However, price sensitivity and limited technical expertise remain challenges. Continued investments and regional trade partnerships are expected to strengthen market growth.

The Brazil digital multimeter industry is experiencing market growth due to growing demand from the automotive, construction, and energy sectors. Increasing infrastructure development and renewable energy initiatives create a strong need for reliable electrical testing tools. The rise of local manufacturing and technical training programs supports the adoption of advanced instruments. Although economic fluctuations pose some challenges, continued industrial investment and modernization efforts are expected to sustain steady market growth.

Key Digital Multimeter Company Insights

Some of the key players operating in the market include Keysight Technologies, Kyoritsu, and National Instruments, among others.

-

Keysight Technologies is a U.S.-based company that designs and manufactures electronic measurement instruments and software. It provides digital multimeters, oscilloscopes, power supplies, and test solutions for industries such as telecommunications, aerospace, automotive, and electronics manufacturing. The company focuses on precision testing, innovation, and research support, helping engineers develop, validate, and optimize electronic systems efficiently across various applications.

-

Gossen Metrawatt, based in Germany, specializes in electrical measurement and testing equipment. The company offers digital multimeters, power analyzers, insulation testers, and calibration systems used in industrial, electrical, and maintenance applications. It emphasizes product reliability, safety compliance, and accuracy. Gossen Metrawatt also provides solutions for energy monitoring and quality assurance across manufacturing, service, and technical training environments.

Key Digital Multimeter Companies:

The following are the leading companies in the digital multimeter market. These companies collectively hold the largest market share and dictate industry trends.

- Keysight Technologies

- Gossen Metrawatt

- National Instruments

- Danaher Corporation

- Yokogawa Electric Corporation

- Fluke Corporation

- FLIR System

- B&K Precision

- Chauvin Arnoux

- Hioki E.E. Corporation

- Rohde & Schwarz

- UNI‑T

- Kyoritsu

- Tenma

- Mastech

Recent Developments

-

In April 2025, Bosch introduced a new digital multimeter as part of its professional electrical testing range. Designed for durability and precision, it features a high protection class, rubber sheathing, and impact resistance for construction site use. The digital multimeter offers simplified handling with an inverted display, magnetic hanger, and dual power source for versatile and reliable measurements.

-

In April 2025, Siglent launched the SDM4065A, a 6½-digit digital multimeter offering enhanced precision, speed, and stability for advanced measurement applications. It features high-resolution accuracy, fast data acquisition, and multiple measurement functions suited for research, calibration, and production environments. The SDM4065A delivers improved performance and reliability, meeting the demands of engineers and technicians requiring detailed, high-precision electrical testing.

Digital Multimeter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,112.9 million

Revenue forecast in 2033

USD 1,774.2 million

Growth rate

CAGR of 6.0% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end use, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Keysight Technologies; Gossen Metrawatt; National Instruments; Danaher Corporation; Yokogawa Electric Corporation; Fluke Corporation; FLIR System; B&K Precision; Chauvin Arnoux; Hioki E.E. Corporation; Rohde & Schwarz; UNI‑T; Kyoritsu; Tenma; Mastech

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Multimeter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global digital multimeter market report based on product, type, end use and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Benchtop

-

Handheld

-

Mounted

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Auto-ranging

-

Manual

-

-

End use Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronics & Electrical

-

Energy & Utilities

-

Consumer Appliances

-

Automotive

-

Medical Instrument Manufacturing

-

Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital multimeter market size was estimated at USD 1,051.8 million in 2024 and is expected to be USD 1,112.9 million in 2025.

b. The global digital multimeter market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 1,774.2 million by 2033.

b. Handheld segment continues to dominate the market and accounted for a share of 62.2% in 2024, driven by its portability, affordability, and ease of use in field applications. Increasing demand for quick, on-site electrical diagnostics in maintenance, construction, and automotive industries supports this trend. Advancements in rugged, battery-efficient, and Bluetooth-enabled handheld models enhance user convenience and connectivity.

b. Some of the key players operating in the global digital multimeter market include Keysight Technologies, Gossen Metrawatt, National Instruments, Danaher Corporation, Yokogawa Electric Corporation, Fluke Corporation, FLIR System, B&K Precision, Chauvin Arnoux, Hioki E.E. Corporation, Rohde & Schwarz, UNI‑T, Kyoritsu, Tenma, Mastech,

b. Key factors driving the global digital multimeter market include increasing demand from electronics, automotive, and renewable energy sectors, rapid industrial automation, and the growing adoption of electric vehicles. Rising need for accurate, portable, and multifunctional testing tools, along with technological advancements like smart and wireless connectivity, further propel market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.