- Home

- »

- Next Generation Technologies

- »

-

Digital Product Passport Market Size, Industry Report, 2030GVR Report cover

![Digital Product Passport Market Size, Share & Trends Report]()

Digital Product Passport Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Software, Services, Discrete ATE, Others), By Deployment, By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-573-4

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2020 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Product Passport Market Summary

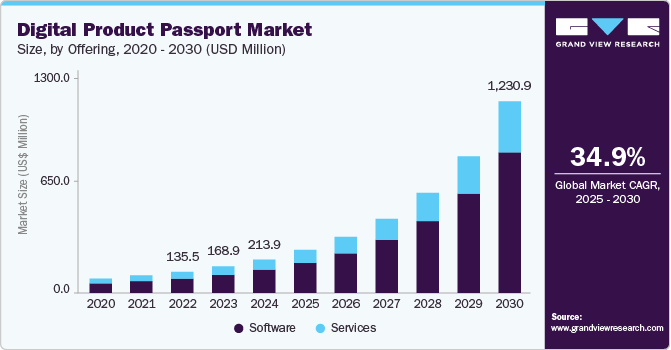

The global digital product passport market size was valued at USD 213.9 million in 2024 and is projected to reach USD 1230.9 million by 2030, growing at a CAGR of 34.9% from 2025 to 2030. This growth is primarily driven by the increasing global demand for product transparency, sustainable manufacturing practices, and circular economy solutions.

Key Market Trends & Insights

- Europe digital product passports (DPPs) market accounts for the largest market share of 36.29% in 2024.

- Based on offering, the services segment accounted for a significant market share of over 30% in 2024.

- Based on industry, the textile & apparel segment accounted for significant market share in 2024.

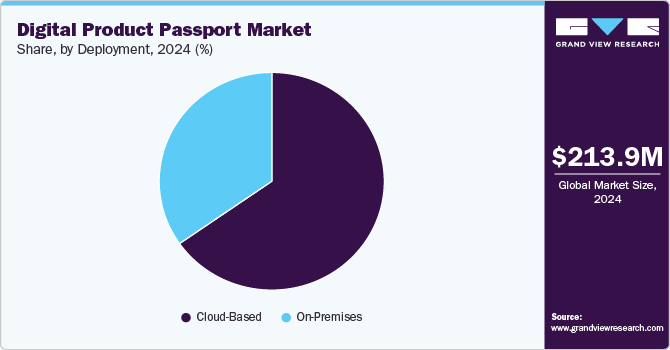

- Based on deployment, the on-premises segment accounted for a significant market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 213.9 Million

- 2030 Projected Market Size: USD 1230.9 Million

- CAGR (2025-2030): 34.9%

- Europe: Largest market in 2024

Companies across various industries are adopting DPP systems to track and share detailed product information, including material sources, environmental impact, and end-of-life options. This trend is supported by rising consumer awareness, investor pressure regarding environmental, social, and governance (ESG) performance, and the need for businesses to optimize resource use and minimize waste.

Furthermore, consumers are giving more priority to eco-products and demanding rich information regarding sourcing and sustainability about products. Consumers' new perceptions are nudging businesses towards taking up DPPs as a means of creating brand trust and fulfilling market needs. One of the key trends in the worldwide DPP market is the adoption of innovative technologies such as blockchain, the Internet of Things (IoT), and Artificial Intelligence (AI), which enhance the scalability and efficiency of DPP deployments. Blockchain technology provides secure and unalterable product information tracking across supply chains, while IoT sensors enable real-time monitoring of product conditions. AI is increasingly used to process lifecycle data, forecast product behavior, and automate compliance procedures. Such technologies are evolving DPPs from passive tracking systems to active systems that are capable of monitoring supply chain activities and disruptions and hence improving operating efficiency and sustainability performance.

A new trend is emerging where DPP applications are used not only for compliance and traceability but also to enhance customer engagement and promote circular economy initiatives. Brands are leveraging DPPs to provide consumers with detailed product information, such as sourcing, manufacturing processes, and environmental impact, accessible via QR codes or NFC tags. This level of transparency not only builds consumer trust but also facilitates services such as product authentication, resale, repair, and recycling. For instance, fashion brands are using DPPs to enable instant resale platforms and offer post-sale services, thereby extending product lifecycles and supporting sustainable consumption patterns.

Leading companies are working to establish and implement DPPs across various sectors. Siemens has launched a Battery Passport Platform that monitors the lifecycle carbon footprint of battery products, providing transparency in the battery sector. 3E has acquired ChemChain to integrate a blockchain-based DPP with compliance offerings, ensuring greater visibility in the supply chain. OPTEL has partnered with ERM to enhance supply chain visibility and reporting, utilizing digital technologies to optimize sustainability and transparency. Additionally, Avery Dennison has introduced a Digital Product Passport as a Service (DPPaaS) to help brands prepare for forthcoming EU legislation, providing consultancy, hardware, software, and digital ID technology.

Offering Insights

The services segment accounted for a significant market share of over 30% in 2024. This dominant position is primarily driven by the growing demand for advisory, implementation, and compliance services as businesses prepare to meet upcoming EU regulations. Organizations across various industries, including fashion, consumer electronics, automotive, and industrial manufacturing, are increasingly seeking expert assistance to develop DPP strategies, analyze technical specifications, and implement pilot programs. Additionally, the complexity of integrating DPP solutions with existing legacy systems and diverse supply chain data sources has heightened the need for specialized service providers, even in the early stages of deployment.

On the other hand, the software segment is expected to experience the fastest growth in the digital product passport (DPP) industry during the forecast period. As regulatory guidelines become clearer and standardization improves, companies are turning to robust software platforms capable of managing product lifecycle data, simplifying traceability, and enabling automated compliance reporting. The demand for interoperable and scalable solutions is rising, particularly those that integrate with enterprise systems such as ERP, PLM, and SCM, and offer advanced features such as blockchain-based verification and cloud-native deployment. The increasing emphasis on digital transparency, sustainability, and circular economy principles will further drive the adoption of DPP software in industries including electronics, textiles, and building materials.

Industry Insights

The textile & apparel segment accounts for significant share in the digital product passport (DPP) market. The market growth is driven by increasing regulatory demand and consumer pressure for transparency and sustainability throughout the value chain. The European Union has prioritized the textile industry in its sustainable product policy, positioning this sector as a leader in implementing DPPs. Brands and manufacturers are actively introducing digital passports to disclose information about material composition, manufacturing processes, country of origin, and care instructions. These solutions improve traceability, support sustainability claims, and ensure compliance with eco-design and circularity regulations. The sector's strong presence is also supported by the high number of SKUs and short product lifecycles typical in fashion, where effective digital tracking can enhance inventory management and reduce waste.

On the other hand, consumer electronics is expected to experience the fastest growth in the digital product passport (DPP) market during the forecast period. This industry is increasingly scrutinized for issues such as electronic waste, the use of critical raw materials, and product obsolescence. Digital product passports offer an effective way to document device characteristics, repairability, recyclability, and carbon footprint information. These passports enhance lifecycle transparency, help reduce compliance burdens from sustainability directives and provide consumers with actionable data. With growing regulatory clarity and momentum towards extended producer responsibility (EPR), demand for robust DPP systems in electronics is expected to accelerate, further supported by increased investment in traceability technology and digital infrastructure across the industry.

Deployment Insights

The on-premises segment accounted for a significant share of the digital product passport (DPP) industry in 2024. This growth can largely be attributed to adoption by large corporations and industries with strict regulations, which prioritize data sovereignty, security, and internal management of sensitive product and supply chain information. Sectors such as automotive, aerospace, and industrial manufacturing typically operate within stringent compliance environments, making on-premises deployment a better fit for customized configurations and integration with legacy systems. Additionally, early adopters of DPP frameworks have developed proprietary in-house solutions to address their specific operational requirements, further reinforcing their reliance on on-premises infrastructure during the initial stages of implementation.

The cloud-based segment is projected to experience the highest growth rate during the forecast period. This can be attributed to its scalability, ease of access, and lower capital expenditure. Cloud deployment models appeal to small and medium-sized enterprises (SMEs) as well as multinational corporations seeking to implement DPP solutions across geographically dispersed operations. The growing maturity of cloud platforms characterized by the ability to provide real-time data updates, seamless integration with ERP and supply chain systems, and enhanced data-sharing capabilities is driving this transition at a rapid pace. As the regulatory landscape stabilizes and businesses seek flexible, collaborative, and future-proof deployment models, the demand for cloud-based DPP solutions is poised for significant expansion, which will transform product information management and exchange across various industries.

Regional Insights

Europe digital product passports (DPPs) market accounts for the largest market share of 36.29% in 2024 owing to stringent regulatory frameworks such as the Ecodesign for Sustainable Products Regulation (ESPR) and the Circular Economy Action Plan. These initiatives require comprehensive product lifecycle data to promote sustainability and circularity in industries such as automotive, electronics, fashion, and construction. By 2030, all products sold in the EU are expected to include DPPs, which will facilitate transparency regarding material sourcing, environmental impact, and recyclability. This regulatory initiative is further supported by consumer demand for eco-friendly products and technological advancements, such as blockchain and NFC, which enhance the feasibility and adoption of DPPs across the region.

U.K. Digital Product Passport Market Trends

In the United Kingdom digital product passports (DPP) market is gaining traction, especially in the fashion industry. Brands such as Nobody's Child have launched DPP pilot programs since 2023, with a goal of a full rollout by late 2025. These efforts respond to increasing regulatory pressures and consumer demands for transparency regarding product sourcing, energy use, and sustainability. The UK's approach focuses on early supplier engagement, gradual piloting, and investment in the necessary technologies to ensure successful DPP implementation. This proactive strategy positions UK brands to comply with forthcoming EU regulations and align with broader sustainability goals.

Germany digital product passports (DPP) market is driven by its strong commitment to sustainability and environmental regulations. The country's National Circular Economy Strategy (NCES), developed in December 2024, aims for climate neutrality by 2045 and promotes the integration of DPPs across industries such as automotive, electronics, and manufacturing. German companies such as Siemens and Bosch have implemented DPP systems to improve product traceability and comply with EU circular economy policies. This strategic alignment with both national and EU sustainability objectives positions Germany as a key player in the growth and innovation of the DPP market.

Asia-Pacific Digital Product Passport Market Trends

The Asia Pacific region is emerging as a significant player in the digital product passport (DPP) industry, fueled by its expansive manufacturing base and a growing emphasis on sustainability. Countries such as China, Japan, and South Korea are leading the way by integrating DPPs in sectors including electronics, textiles, and automotive, in order to meet global compliance standards and consumer expectations. The region's rapid digital transformation, supported by advancements in technologies such as blockchain and the Internet of Things (IoT), facilitates the seamless adoption of DPPs throughout supply chains. Additionally, the increasing demand for transparency and traceability in products is prompting manufacturers to implement DPPs, positioning Asia Pacific as a crucial region in the global DPP market.

China is making significant strides in adopting digital product passports, particularly within its strong manufacturing sectors. Government initiatives aimed at modernizing trade and enhancing sustainability are driving the integration of DPPs in industries such as electronics and textiles. Major corporations are utilizing blockchain technology to ensure transparency and traceability in their supply chains, in alignment with both domestic regulations and international standards. This strategic approach not only helps comply with global sustainability requirements but also enhances China's position in the international market by demonstrating its commitment to product authenticity and environmental responsibility.

In India digital product passports (DPP) market is gradually gaining traction, especially in the textile and apparel sectors. Although awareness and implementation are still in the early stages, there is an increasing recognition of the importance of traceability and sustainability to meet international market demands. Challenges such as limited understanding of DPPs, technical complexities, and the need for standardized protocols are being addressed through educational initiatives and pilot programs. As Indian manufacturers and exporters strive to align with global sustainability standards, the adoption of DPPs is expected to rise, ultimately enhancing the country's competitiveness in the international arena.

North America Digital Product Passport Market Trends

The North America digital product passports (DPPs) market is experiencing significant growth. This growth is driven by regulatory pressures, corporate sustainability goals, and technological advancements. In 2024, the region accounted for approximately 35% of the global DPP market share, with the United States leading this expansion. Various industries, including automotive, electronics, and consumer goods, are implementing DPPs to improve product traceability, comply with emerging regulations, and respond to consumer demands for transparency. The integration of technologies such as blockchain and NFC enables secure and efficient tracking of product lifecycles, supporting the region's transition toward a circular economy.

The United States digital product passports (DPP) market is accelerating as companies align with sustainability initiatives and regulatory requirements. The U.S. market is characterized by early adoption of DPPs across multiple sectors, including manufacturing, retail, and logistics. Companies are utilizing DPPs to provide detailed product information, enhance supply chain transparency, and promote recycling and reuse practices. The government's focus on environmental responsibility, combined with the growing consumer demand for sustainable products, are essential factors driving this trend. As a result, the U.S. is positioned to maintain its leadership in the North American DPP market.

Key Digital Product Passport Company Insights

Some of the key players operating in the market are SIEMENS, 3E, Avery Dennison, Billon Group, among others.

-

3E is an environmental, health, and safety (EHS) compliance solutions provider that specializes in data services supporting manufacturers in managing chemical and material data. For DPP, 3E's platforms help businesses accumulate and store mandatory data attributes such as substance declarations, regulatory flags (e.g., REACH, RoHS), and safety data. Such datasets are critical inputs for businesses in electronics, packaging, and chemical industries trying to meet upcoming digital passport regulations.

-

Avery Dennison focuses on labelling technologies, smart packaging, and digital identification systems. It supplies RFID labels, QR code technologies, and traceability platforms in the cloud that enable physical products to be connected with digital records. For applications related to DPP, Avery Dennison solutions enable brands to store and transmit rich product information such as composition, origin, and recyclability. Its solutions are commonly applied in apparel, logistics, and consumer goods industries where product traceability is becoming increasingly important from a regulatory perspective.

-

Billon Group creates secure digital identity, data transfer, and document storage technologies on the blockchain. Its solution is engineered to enable immutable and decentralized storage of structured data, such as those required for DPP frameworks. Billon's architecture enables permissioned sharing of data, version control, and compliance auditing, especially applicable to firms with intricate cross-border supply chains and companies handling sensitive material declarations or supplier information.

Circularise, CIRPASS, and Det Norske Veritas Group (DNV) are some of the emerging market participants in the Digital Product Passport (DPP) Market.

-

Circularise offers a blockchain-based software solution that enables safe and confidential transfer of material and product information through supply chains. Its technology allows stakeholders to confirm environmental and traceability statements recycled content or carbon footprint without revealing underlying proprietary information. Circularise's solution is especially suited to polymer producers, electronics companies, and auto parts suppliers anticipating DPP-related reporting requirements.

-

CIRPASS is a coordination project funded by the European Commission to build the building blocks of Digital Product Passports. It involves bringing together businesses, associations, and researchers to establish technical specifications, data formats, and governance principles for large-scale DPP deployment. CIRPASS targets electronics, batteries, and textiles sectors and contributes to coordinating stakeholder inputs with EU policy objectives around circularity, transparency, and product stewardship.

-

Det Norske Veritas Group (DNV) is a risk management, quality assurance, and digital assurance services provider. In the DPP domain, DNV provides data verification, audit readiness solutions, and secure digital infrastructure to guarantee that information held in a digital passport is correct and compliant with regulations. DNV provides services to customers in heavy industry, maritime, energy, and manufacturing—where lifecycle accountability is becoming increasingly required by regulators and customers.

Key Digital Product Passport Companies:

The following are the leading companies in the digital product passport market. These companies collectively hold the largest market share and dictate industry trends.

- 3E

- Avery Dennison

- Billon Group

- Circularise

- CIRPASS

- Det Norske Veritas Group (DNV)

- iPoint-systems GmbH

- Kezzler

- LyondellBasell Industries Holdings B.V.

- OPTEL GROUP

- Sigma Technology

Recent Developments

-

In February 2025, Victoria's Secret & Co. rolled out its initial batch of Digital Product Passports (DPPs) across several collections such as the Signature Cotton T-shirt Bra and the VSX Featherweight Max Sports Bra. Each passport, available through QR code on the product label, gives consumers detailed product information, such as fabric makeup, transparency around sourcing, manufacturing partners, and environmental impact metrics. The DPP implementation is just one aspect of Victoria's Secret's overall focus on sustainability and responsible production practices, designed to increase traceability and customer involvement.

-

In January 2025, Madaster launched its own Digital Product Passport (DPP) platform specifically designed for the construction and manufacturing industries. The system collects and deals with detailed information on product material composition, embodied carbon, reusability potential, and end-of-life disposition. Intended to assist firms in meeting soon-to-be imposed European Union circular economy regulations, the platform helps stakeholders minimize waste and maximize efficiency of resources. Madaster's DPP service highlights the change toward data-led sustainability in built environments and manufacturing.

-

In June 2024, Eviden, in partnership with the IOTA Foundation, launched the Eviden Digital Passport Solution (EDPS), a turnkey Digital Product Passport solution using blockchain technology. Based on IOTA's distributed ledger technology, EDPS provides secure and tamper-proof storage of data about a product's life cycle, carbon footprint, and sustainability performance. The first application targets automotive batteries, facilitating compliance with future EU regulations as well as more general use across industries looking for traceability and ESG compliance.

Digital Product Passport Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 275.1 million

Revenue forecast in 2030

USD 1230.9 million

Growth Rate

CAGR of 34.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2020 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/USD billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

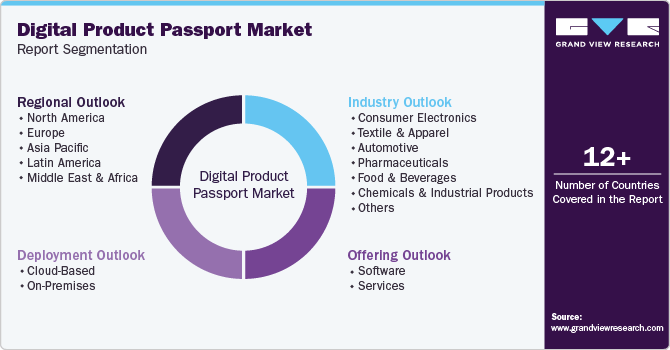

Offering, Deployment, Industry, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

3E; Avery Dennison; Billon Group; Circularise; CIRPASS; Det Norske Veritas Group (DNV); iPoint-systems gmbh; Kezzler; LyondellBasell Industries Holdings B.V.; OPTEL GROUP; Sigma Technology

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Digital Product Passport Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global digital product passport market report based on offering, deployment, industry, and region:

-

Offering Outlook (Revenue, USD Million, 2020 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2020 - 2030)

-

Cloud-Based

-

On-Premises

-

-

Industry Outlook (Revenue, USD Million, 2020 - 2030)

-

Consumer Electronics

-

Textile & Apparel

-

Automotive

-

Pharmaceuticals

-

Food & Beverages

-

Chemicals & Industrial Products

-

Construction & Building Materials

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global digital product passport market size was estimated at USD 213.9 million in 2024 and is expected to reach USD 275.1 million in 2025.

b. The global digital product passport market is expected to grow at a compound annual growth rate (CAGR) of 34.9% from 2025 to 2030 to reach USD 1,230.9 million by 2030

b. Europe digital product passport market accounted for the largest market share of over 36% in 2024, owing to stringent regulatory frameworks such as the Ecodesign for Sustainable Products Regulation (ESPR) and the Circular Economy Action Plan.

b. Some key players operating in the DPP market include 3E; Avery Dennison; Billon Group; Circularise; CIRPASS; Det Norske Veritas Group (DNV); iPoint-systems gmbh; Kezzler; LyondellBasell Industries Holdings B.V.; OPTEL GROUP; Sigma Technology.

b. The key factors driving the digital product passport (DPP) include the increasing global demand for product transparency, sustainable manufacturing practices, and circular economy solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.