- Home

- »

- Next Generation Technologies

- »

-

Drip Irrigation Market Size & Share, Industry Report, 2033GVR Report cover

![Drip Irrigation Market Size, Share & Trends Report]()

Drip Irrigation Market (2026 - 2033) Size, Share & Trends Analysis By Component, By Flow Rate (Low, Medium, High), By Method (Surface, Subsurface), By Crop (Field Crops, Fruits And Nuts, Vegetable Crops), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-356-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Drip Irrigation Market Summary

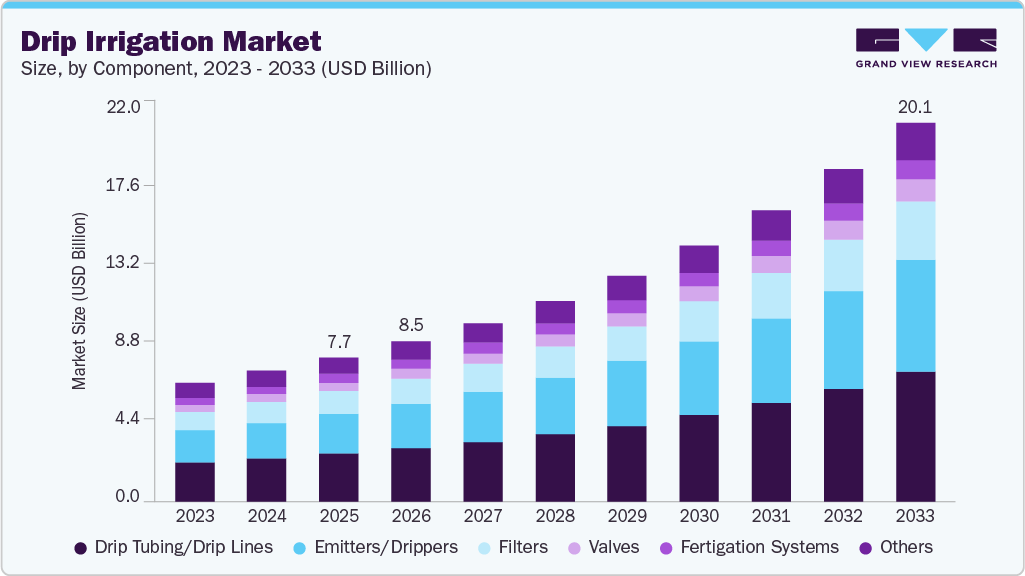

The global drip irrigation market size was estimated at USD 7.67 billion in 2025 and is projected to reach USD 20.12 billion by 2033, growing at a CAGR of 13.1% from 2026 to 2033. The global market has been witnessing substantial growth, driven by the increasing need for efficient water management in agriculture.

Key Market Trends & Insights

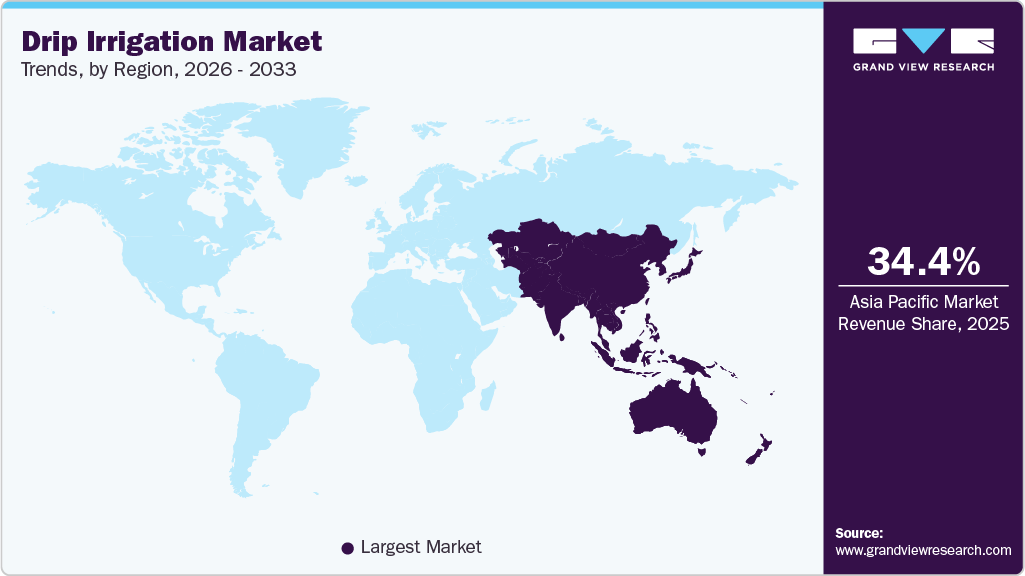

- Asia Pacific held 34.4% revenue share of the global drip irrigation industry in 2025.

- In the U.S., the expansion of the greenhouse and horticulture sector are contributing to the growth of drip irrigation industry.

- By component, drip tubing/drip lines segment held the largest revenue share of 33.4% in 2025.

- By method, the surface segment held the largest revenue share in 2025.

- By flow rate, the low flow rate segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7.67 Billion

- 2033 Projected Market Size: USD 20.12 Billion

- CAGR (2026-2033): 13.1%

The expansion of greenhouse and controlled environment agriculture is a major driver of the market growth. These high-value farming systems require precise and consistent water and nutrient management. Drip irrigation supplies water directly to the root zone, which helps maintain balanced moisture levels and prevents both overwatering and water stress. Hence, demand for year-round crop production and fully automated greenhouses is growing in both developed and emerging regions. As a result, investments in advanced and intelligent drip irrigation systems are growing. Drip irrigation is highly compatible with automation, IoT devices, and sensor-based climate control systems. Drip lines and emitters can be connected to digital platforms, and these systems automatically adjust irrigation and fertigation using real-time data such as soil moisture, temperature, and crop growth stage. This capability is especially important for hydroponics and soilless farming systems. In these systems, accurate delivery of nutrient-rich water is essential for fast and healthy plant growth. This positions drip irrigation as a core technology in modern controlled environment agriculture.

Water shortages and changing climate conditions are also key drivers of the market. Many regions now face limited freshwater availability. As a result, farmers are shifting to micro-irrigation to save water while maintaining crop yields. Government support through subsidies, low-interest loans, and training programs has reduced the high initial cost for farmers. For instance, the Andhra Pradesh government launched an automation-based micro-irrigation initiative to help farmers adopt smart drip and sprinkler systems. The program supports sensor-based irrigation with automated controllers, soil-moisture monitoring, and fertigation. Farmers receive up to 55% subsidy to reduce installation costs. The initiative aims to save water, improve crop yields, and promote precision farming. This has encouraged the replacement of traditional flood and sprinkler irrigation. In addition, crop patterns are changing toward fruits, vegetables, and high-value crops. These crops perform better with controlled watering and fertigation. Rising crop prices and visible savings in water and fertilizer make drip irrigation a cost-effective investment for both small and large farms.

Component Insights

The drip tubing/drip lines segment dominated the market and accounted for the revenue share of 33.4% in 2025. This dominance is driven by the important role of drip lines in every drip irrigation system, as they directly deliver water and nutrients to the plant root zone. Demand remains high across open-field farming, horticulture, orchards, and protected agriculture. The segment also sees repeat demand because drip lines need regular replacement due to wear, clogging, and crop cycle changes. For instance, in February 2025, Netafim introduced the world’s first Hybrid Dripline, combining inline and on-line drip features in a single product. This new design reduces leakage, clogging, and installation effort while improving durability. Such innovations show the continued importance of drip tubing in modern irrigation systems.

The emitters/drippers segment is anticipated to grow at the fastest CAGR during the forecast period, driven by its key role in delivering water accurately and efficiently to the plant roots. As core parts of drip systems, emitters control the flow of water to maintain proper soil moisture and reduce water loss from evaporation and runoff. The market growth is supported by continuous improvements in pressure-compensating, anti-clog, and self-flushing technologies, which ensure even water flow across different field conditions, lower maintenance needs, and extend system life. The increasing use of inline emitters for large farms and flexible online drippers for nurseries and tree crops is increasing their use in both surface and subsurface systems. Different flow-rate options allow use across a wide range of crops and soil types. In addition, the integration of digital and IoT-based features, such as sensor-linked and remotely monitored drippers, is strengthening their role in precision irrigation. The shift toward durable, UV-resistant, and recyclable materials also supports long-term growth and sustainability goals.

Flow Rate Insights

The low flow rate segment dominated the market and accounted for the largest revenue share in 2025. The low flow rate segment in the market is gaining traction primarily due to the increasing focus on water conservation and precise resource management in modern agriculture. Low flow rate drip emitters enable farmers to deliver water slowly and directly to the plant root zone, significantly reducing water loss through surface runoff and evaporation. This precise water application is particularly critical in regions facing water scarcity or irregular rainfall patterns, where every drop of water contributes to improved crop productivity and sustainability. By enabling controlled irrigation, low flow systems help optimize soil moisture levels without over-saturating the root zone, which can prevent nutrient leaching and reduce the risk of plant diseases. This careful balance of water application has made the low flow rate segment an attractive solution for high-value crops, specialty fruits, vegetables, and orchards that require meticulous water management

The medium flow rate segment is expected to grow at a significant CAGR during the forecast period. The growing prevalence of integrated water and nutrient management is a key factor accelerating the adoption of medium flow systems. As farms increasingly adopt fertigation, chemigation, and micro-dosing practices, the ability to deliver larger volumes of water along with soluble nutrients becomes critical. Medium flow drip lines can handle the additional pressure requirements and ensure uniform distribution of both water and nutrients, thereby improving crop nutrition and reducing the risk of localized over- or under-fertilization. This capability enhances crop quality and yield while minimizing input wastage, making medium flow systems a cost-effective and environmentally sustainable choice for modern agricultural operations.

Method Insights

The surface segment dominated the market and accounted for the largest revenue share in 2025. This dominance is driven by the relatively lower installation cost, simpler design, and easier operation of surface drip systems compared with subsurface alternatives, making them more accessible for small and medium farmers in developing as well as developed markets. Growing government and institutional support for micro-irrigation adoption, especially in water-stressed regions, also favors surface systems because they can be rapidly deployed over large areas and integrated with existing field layouts. For instance, in India, under the PMKSY-Per Drop More Crop scheme, backed by the USD 555.5 million Micro Irrigation Fund (MIF) with NABARD, more than 8.3 million hectares were brought under micro-irrigation between 2015 and 2024. The scheme provides major subsidies and low-interest loans to states, making drip and sprinkler irrigation affordable for farmers and accelerating nationwide adoption. In addition, the ease of inspection, maintenance, and seasonal repositioning of surface laterals encourages adoption among farmers who rotate crops frequently or operate leased land, further supporting the larger revenue contribution of the surface segment.

The subsurface segment is expected to grow at a significant CAGR during the forecast period. This growth is driven by the method’s ability to deliver water directly to the root below the soil surface. By keeping laterals buried, subsurface systems also minimize weed growth and do not interfere with field operations such as mechanized harvesting, inter-cultivation, and traffic movement, making them attractive for large-scale commercial farms and long-duration crops like sugarcane, alfalfa, and orchards. Demand is further supported by rising pressure on groundwater resources and tightening water regulations, which are pushing progressive farmers and agribusinesses toward technologies that maximize every unit of water applied over multi-year horizons.

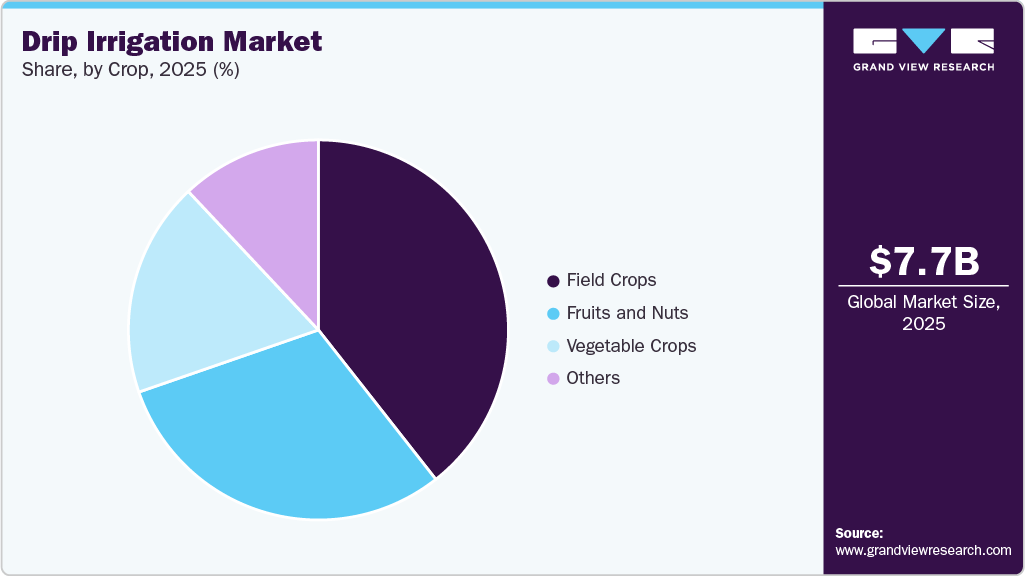

Crop Insights

The field crops segment dominated the market and accounted for the largest revenue share in 2025, driven by the widespread need for efficient water management in crops such as cereals, grains, legumes, oilseeds, maize, sugarcane, and cotton. Drip irrigation helps reduce water loss, ensures uniform soil moisture, and supports precise nutrient delivery through fertigation, which improves yield and resource efficiency. Strong government subsidies in countries such as India, China, and Egypt are accelerating adoption for large-scale field cultivation. In addition, the use of precision agriculture tools such as soil moisture sensors, automated controllers, and remote monitoring is improving farm productivity and lowering operating costs.

The fruits and nuts segment is expected to grow at a significant CAGR during the forecast period, driven by the growing cultivation of orchards and perennial crops where long-term yield, quality, and consistency are required. Crops such as almonds, grapes, mangoes, citrus, and apples require controlled moisture and nutrient supply throughout multiple growth stages, which makes drip irrigation the preferred solution. Growers are increasingly adopting smart fertigation, subsurface drip, and sensor-based monitoring to improve fruit size, color, and uniformity while reducing water stress. Water scarcity in key producing regions, along with increasing global demand for premium fruits and nuts, is further accelerating investment in advanced drip systems.

Regional Insights

Asia Pacific drip irrigation industry dominated the global market with a revenue share of 34.4% in 2025. Many countries in the region, including India, China, and Australia, are facing serious water shortages due to falling groundwater levels and unpredictable rainfall. As a result, farmers are turning to drip irrigation to use water more efficiently and reduce wastage while maintaining farm productivity. Government support is also playing an important role. Programs such as India’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) and China’s water-efficient agriculture initiatives offer subsidies and technical assistance, making drip irrigation more affordable and encouraging wider adoption.

The China drip irrigation industry held a significant market share in 2025. Farmers in China are increasingly investing in IoT-enabled drip irrigation systems, AI-powered irrigation controllers, and soil moisture sensors. These technologies optimize water distribution, improve yield predictions, and reduce manual labor costs, making drip irrigation more efficient and profitable.

The Japan drip irrigation industry held a significant market share in 2025. Japan experiences climate challenges such as typhoons, droughts, and unpredictable rainfall, impacting traditional farming. To enhance food production and sustainability, the country is expanding greenhouses, hydroponics, and vertical farming. Drip irrigation plays a crucial role in these controlled-environment farms, ensuring precise water and nutrient delivery for optimal crop growth.

Europe Drip Irrigation MarketTrends

The drip irrigation industry in Europe is expected to register a significant CAGR from 2026 to 2033. The European Union (EU) promotes sustainable irrigation through initiatives such as the Common Agricultural Policy (CAP), which provides financial incentives to farmers for adopting water-efficient technologies. In addition, national governments offer subsidies and grants to support drip irrigation adoption in both small and large farms. Similarly, Europe is a major producer of high-value crops like grapes, olives, citrus fruits, and vegetables, which require precise irrigation methods for optimal yield and quality. Countries such as Spain, France, and Italy, known for their vineyards and orchards, are increasingly adopting drip irrigation to enhance crop productivity while conserving water.

The UK drip irrigation industry is expected to grow rapidly in the coming years. The UK’s growth in greenhouses, vertical farms, and hydroponics is supporting drip irrigation adoption for efficient water use. Urban farming initiatives in London and Manchester further drive demand for precision irrigation, ensuring optimal crop growth, reduced water waste, and enhanced sustainability in controlled environment agriculture (CEA).

The Germany drip irrigation industry held a substantial market share in 2025. German farmers are integrating IoT-based drip irrigation systems, AI-driven water management, and real-time soil moisture sensors to optimize irrigation schedules. These technologies enhance water efficiency, reduce labor dependency, and improve farm productivity.

North America Drip Irrigation Market Trends

North America drip irrigation industry held a significant market share in 2025. The growing adoption of greenhouse farming and hydroponics is increasing demand for drip irrigation systems, which provide precise water and nutrient delivery for crops grown in controlled environments. The expansion of urban farming and vertical agriculture across various cities in the U.S. and Canada is also contributing to market growth.

U.S. Drip Irrigation Market Trends

The drip irrigation industry in the U.S. is expected to grow significantly from 2026 to 2033. Numerous drip irrigation equipment providers, such as Lindsay Corporation, HUNTER INDUSTRIES INC., and T-L Irrigation, contribute to the market’s growth in the country. Moreover, the integration of IoT, AI, and automation in the U.S. farming sector is accelerating the adoption of smart drip irrigation systems. Sensor-based drip irrigation solutions allow farmers to monitor soil moisture levels, automate irrigation schedules, and optimize water usage, improving overall farm efficiency and profitability.

Drip Irrigation Company Insights

Key players operating in the drip irrigation industry are ARKA, Antelco, Amiad Water Systems Ltd., AZUD, Chinadrip Irrigation Equipment (Xiamen) Co., Ltd, HUNTER INDUSTRIES INC., Irritec S.p.A, and others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In December 2025, the Toro Company launched the Toro Aqua Traxx Azul REvive, an advanced drip tape developed using recycled resins to enhance circularity in the agricultural plastics industry. This next-generation product is tailored for commercial growers, residential users, and larger agricultural operations aiming to reduce their environmental footprint without sacrificing performance. The drip tape builds upon the trusted durability and efficiency of the original Aqua-Traxx Azul by promoting water savings, reducing labor demands, and minimizing clogging issues, while also strengthening land stewardship efforts through the use of recycled materials.

-

In October 2025, Rain Bird Corporation partnered with the California Water Efficiency Partnership (CalWEP) to launch the Direct Distribution Program (DDP), designed to help CalWEP member agencies deliver advanced water-saving smart irrigation products directly to their customers. Through this program, agencies gain streamlined access to a curated range of high-efficiency irrigation solutions that support large-scale landscape transformation and smart watering initiatives. The DDP product portfolio includes smart irrigation controllers, sensors, and flow meters, as well as drip conversion kits, high-efficiency spray bodies, nozzles, and other water-efficient components tailored to the needs of participating water agencies and their millions of end-users.

-

In November 2024, Netafim Italia acquired 100% of Tecnir S.r.l., a leading Italian irrigation system design and installation company. The acquisition strengthens Netafim Italia’s position in precision irrigation by expanding its technical expertise and enhancing its ability to deliver innovative, sustainable, and customized irrigation solutions tailored to the needs of Italian farmers.

-

In September 2024, Rivulis opened North America’s largest micro-irrigation manufacturing facility in Tijuana, Mexico. The 160,000-square-foot plant boosts production of its T-Tape products to meet growing demand for water-efficient irrigation solutions, supports sustainability goals with advanced film technology, and expands the company’s capacity to serve growers across America.

Key Drip Irrigation Companies:

The following are the leading companies in the drip irrigation market. These companies collectively hold the largest market share and dictate industry trends.

- ARKA

- Antelco

- Amiad Water Systems Ltd.

- AZUD

- Chinadrip Irrigation Equipment (Xiamen) Co., Ltd

- HUNTER INDUSTRIES INC.

- Irritec S.p.A

- Jain Irrigation Systems Ltd.

- Lindsay Corporation

- metzer

- NETAFIM

- Rain Bird Corporation

- Rivulis

- The Toro Company

Drip Irrigation Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8.51 billion

Revenue forecast in 2033

USD 20.12 billion

Growth rate

CAGR of 13.1% from 2026 to 2033

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report application

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, flow rate, method, crop, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Peru; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

ARKA; Antelco; Amiad Water Systems Ltd.; AZUD; Chinadrip Irrigation Equipment (Xiamen) Co., Ltd; HUNTER INDUSTRIES INC.; Irritec S.p.A; Jain Irrigation Systems Ltd.; Lindsay Corporation; Metzer; NETAFIM; Rain Bird Corporation; Rivulis; The Toro Company

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drip Irrigation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global drip irrigation market report based on component, method, flow rate, crop, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Drip Tubing/Drip Lines

-

Thin-wall Drip Lines

-

Medium-wall Drip Lines

-

Heavy-wall Drip Lines

-

-

Emitters/Drippers

-

Valves

-

Fertigation Systems

-

Filters

-

Others

-

-

Flow Rate Outlook (Revenue, USD Billion, 2021 - 2033)

-

Low

-

Medium

-

High

-

-

Method Outlook (Revenue, USD Billion, 2021 - 2033)

-

Surface

-

Subsurface

-

-

Crop Outlook (Revenue, USD Billion, 2021 - 2033)

-

Field Crops

-

Fruits and Nuts

-

Vegetable Crops

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Peru

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global drip irrigation market size was estimated at USD 7.67 billion in 2025 and is expected to reach USD 8.51 billion in 2026.

b. The global drip irrigation market is expected to grow at a compound annual growth rate of 13.1% from 2026 to 2033 to reach USD 20.12 billion by 2033.

b. Asia Pacific dominated the drip irrigation market with a share of over 34.2% in 2025. This is attributable to the high agricultural production in the region and the growing adoption of sustainable farming practices to address water scarcity issues in the region.

b. The key market players in the global drip irrigation market include ARKA, Antelco, Amiad Water Systems Ltd., AZUD, Chinadrip Irrigation Equipment (Xiamen) Co., Ltd., HUNTER INDUSTRIES INC., Irritec S.p.A, Jain Irrigation Systems Ltd., Metzer, STF, NETAFIM, Rain Bird Corporation, Rivulis, and The Toro Company.

b. The global drip irrigation market has been witnessing substantial growth, driven by the increasing need for efficient water management in agriculture. The market is fueled by the rising demand for sustainable agricultural practices, government initiatives promoting water conservation, and technological advancements in irrigation systems. Governments worldwide are actively promoting the adoption of drip irrigation through various subsidies and incentive programs to encourage sustainable farming practices. With the increasing threat of water scarcity and the need to enhance agricultural productivity, many countries are implementing policies that provide financial assistance, tax benefits, and grants to farmers for installing drip irrigation systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.