- Home

- »

- Power Generation & Storage

- »

-

Drone Battery Market Size & Share, Industry Report, 2033GVR Report cover

![Drone Battery Market Size, Share & Trends Report]()

Drone Battery Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Lithium-based, Nickel-based), By Point Of Sale (Aftermarket, OEMs), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-631-0

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drone Battery Market Summary

The global drone battery market size was estimated at USD 8.13 billion in 2024, and is projected to reach USD 48.99 billion by 2033, growing at a CAGR of 21.9 % from 2025 to 2033. The increasing use of drones across defense, agriculture, logistics, and media sectors is driving market growth.

Key Market Trends & Insights

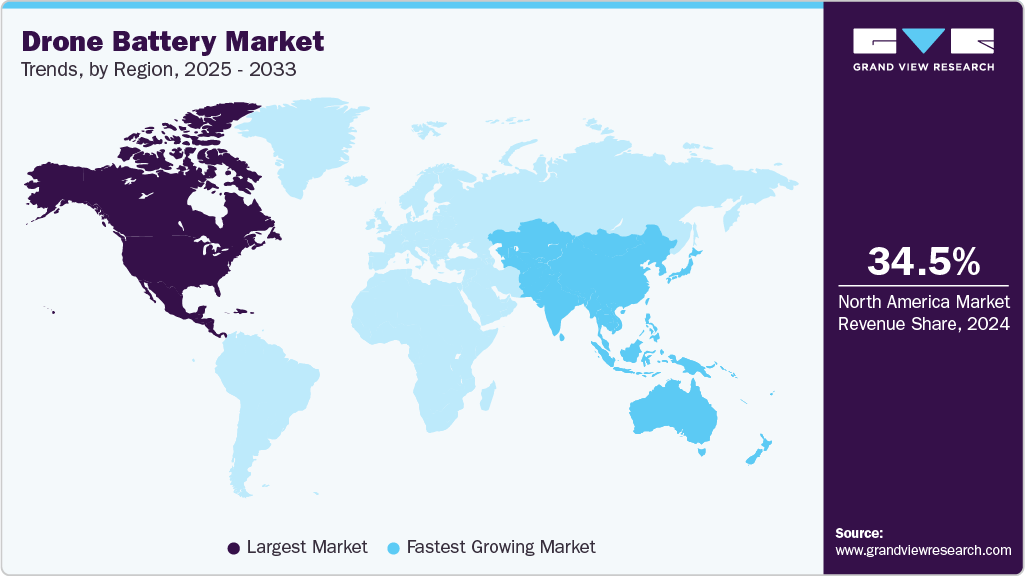

- North America drone battery market held the largest share of 34.45 % of the global market in 2024.

- The drone battery market in the U.S. is expected to grow significantly over the forecast period.

- By technology, the lithium-based segment held the highest market share of 91.14% in 2024.

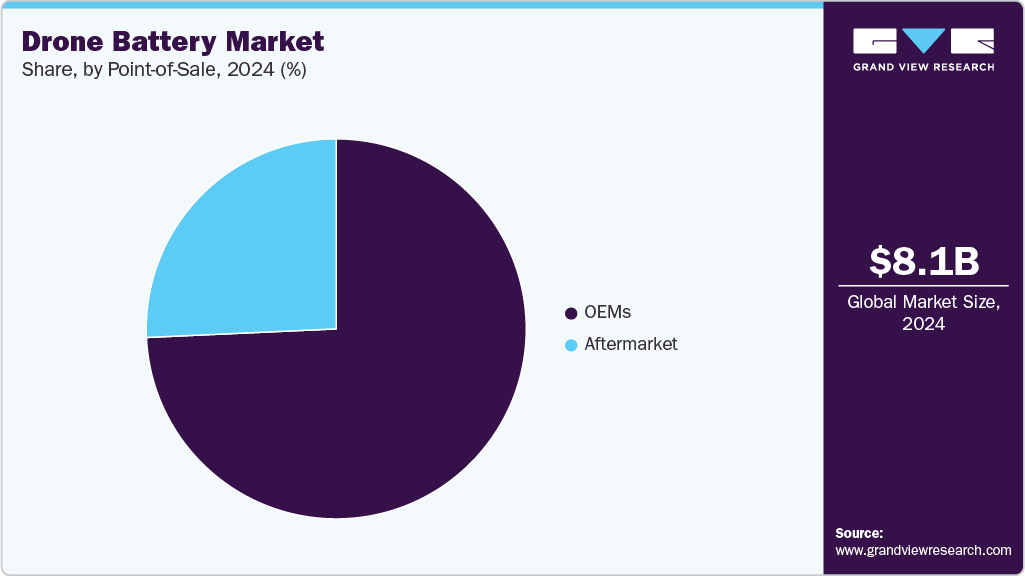

- Based on point of sale, the OEMs segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.13 Billion

- 2033 Projected Market Size: USD 48.99 Billion

- CAGR (2025-2033): 21.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As drone operations demand longer flight times and greater reliability, the need for high-performance battery systems is rising rapidly. Advancements in lithium-based technologies and emerging alternatives like solid-state and lithium-sulfur batteries are boosting energy density and reducing weight. In addition, expanding drone delivery services and autonomous flight systems is accelerating battery R&D. Supportive government regulations and incentives encourage drone adoption, creating strong momentum for battery innovation and production through 2033. Technological advancements, including integrating artificial intelligence and IoT, are transforming the drone battery market by enabling real-time monitoring, predictive maintenance, and efficient power management. These innovations improve flight safety, extend battery life, and optimize energy usage, particularly in high-demand applications such as delivery, surveillance, and agricultural monitoring. As drones become more embedded in mission-critical operations, the need for intelligent, high-performance batteries continues to grow in both civilian and commercial sectors.

Industries are increasingly investing in drone technologies to improve operational efficiency, and adopting flexible models such as battery leasing or battery-as-a-service is gaining traction. These models help reduce upfront investment and ensure consistent performance through managed services. The trend is especially strong in regions such as Asia Pacific, where drone usage is accelerating due to rapid digitalization and expanding logistics infrastructure. While challenges such as limited battery range and regulatory constraints remain, ongoing R&D and supportive government initiatives are expected to drive long-term growth in the global drone battery market.

Drivers, Opportunities & Restraints

The growing adoption of drones in critical sectors such as defense, agriculture, logistics, and surveillance significantly drives demand for high-performance batteries. As drones become integral to real-time operations, the need for reliable, lightweight, and long-lasting power sources has intensified. Drone batteries enable extended flight durations, higher payload capacity, and improved operational efficiency-key factors for missions that demand precision and endurance. Furthermore, the surge in e-commerce deliveries and smart farming solutions is creating a strong demand for drone-based services, thereby accelerating the growth of the drone battery market.

Opportunities in the market are expanding with the emergence of next-generation battery chemistries such as lithium-sulfur, solid-state, and fast-charging technologies. Integrating AI and IoT makes battery systems smarter, allowing for predictive maintenance, performance optimization, and real-time diagnostics. This opens significant potential in commercial sectors and developing regions where drones can offer low-cost, high-impact solutions for surveying, crop health monitoring, and last-mile delivery. In addition, flexible business models like battery-as-a-service are gaining traction, helping operators reduce upfront costs and ensure consistent battery performance.

Despite the positive outlook, the drone battery market faces key restraints. Short flight durations due to current battery limitations, high replacement costs, and the need for frequent charging are ongoing challenges. The market also contends with regulatory hurdles around battery safety, airspace use, and waste disposal. Moreover, increasing concerns over battery sustainability, lifecycle emissions, and the environmental impact of lithium extraction may pose long-term obstacles. Overcoming these challenges through innovation, recycling solutions, and clear policy frameworks will be essential to unlocking the full potential of the drone battery ecosystem.

Technology Insights

The technology segment is pivotal in the drone battery market by driving advancements that enhance flight time, reliability, and overall performance. Lithium-based batteries hold the largest market share among the various sub-segments due to their high energy density, lightweight design, and superior charge-discharge efficiency. These attributes make lithium-ion and lithium-polymer batteries the preferred choice across commercial, industrial, and defence drone applications. As drone operations become more demanding regarding range and payload, the need for high-performance battery technologies continues to rise, cementing lithium-based solutions as the industry standard.

Ongoing innovation within the lithium segment-such as improvements in thermal management, fast-charging capabilities, and safety mechanisms-further strengthens its market position. In addition, lithium-based batteries are highly adaptable to a wide range of drone sizes and use cases, from small consumer drones to large, long-range delivery drones. Their compatibility with smart battery systems also enables integration with real-time monitoring tools, essential for predictive maintenance and mission-critical reliability. As a result, the dominance of lithium-based technologies is expected to persist, supported by continuous R&D and growing demand across diverse drone applications worldwide.

Point of Sale Insights

The Point-of-Sale segment is experiencing significant growth, driven by rising demand for efficient and reliable battery solutions across consumer and commercial drone applications. Within this segment, the OEM (Original Equipment Manufacturer) subsegment holds the largest market share due to its ability to deliver batteries specifically designed for seamless integration with drone systems. These batteries offer enhanced safety, performance, and compatibility, making them the preferred choice for end-users who prioritize quality and reliability. The growing adoption of drones in defence, logistics, and agriculture continues to boost OEM battery sales, supported by strong collaborations between drone manufacturers and battery suppliers.

The aftermarket subsegment is also expanding steadily, fueled by the increasing need for battery replacements, upgrades, and extended operations as drone usage intensifies. This subsegment caters to operators seeking flexible, cost-effective alternatives beyond OEM offerings. However, OEMs maintain a competitive edge due to their ability to provide certified, warrantied products that ensure optimal performance. As drone fleets expand and battery wear becomes more frequent, the Point-of-Sale segment especially the OEM subsegment is expected to remain a major contributor to market growth through 2033.

Regional Insights

The North American drone battery market is experiencing robust growth, fueled by the rapid expansion of drone applications across defense, agriculture, logistics, and public safety sectors. Key drivers include rising demand for longer flight times, improvements in battery energy density, and growing investment in unmanned aerial systems (UAS) by government and private entities. Technological advancements, such as integrating smart battery management systems and AI-powered diagnostics, enhance battery performance, safety, and operational efficiency. OEMs are leading the market with high-quality, integrated battery solutions, while the aftermarket segment is also expanding to meet replacement and upgrade needs. The U.S. remains the dominant market due to its advanced defense and logistics infrastructure, while Canada is witnessing steady growth, particularly in remote area monitoring and resource exploration using drones.

U.S. Drone Battery Market Trends

Technological advancements are significantly improving the performance and management of drone batteries in the U.S. Innovations in battery chemistry, such as lithium-metal and solid-state technologies, enable longer flight durations, faster charging, and enhanced safety. Integrating artificial intelligence (AI) and Internet of Things (IoT) in battery systems allows real-time monitoring, predictive maintenance, and smart power management, which are critical for mission-critical drone operations. These developments are making drone batteries more efficient, reliable, and attractive to defense, logistics, agriculture, and public safety sectors that demand high performance and operational continuity.

Asia Pacific Drone Battery Market Trends

The Asia Pacific drone battery market is experiencing rapid growth, driven by the expanding use of drones across agriculture, logistics, infrastructure inspection, and public safety. Rising demand for high-endurance drone operations and strong government support for drone technology adoption are key growth drivers. Countries such as China and India are leading the regional market, with China being a global hub for drone manufacturing and India actively promoting drone use through initiatives such as the Production Linked Incentive (PLI) scheme for drone and battery manufacturing. The push for localization and self-reliance in drone ecosystems further accelerates battery innovation and production.

Technological advancements in lithium-based and hybrid battery systems enable longer flight times and improved power efficiency, crucial for commercial-scale applications. Integrating AI and IoT technologies enhances real-time battery health monitoring, energy optimization, and safety. As industrial and commercial drone deployment continues to rise, the demand for high-performance and cost-effective battery solutions will remain strong globally, positioning Asia Pacific as a key growth engine in the global drone battery market.

Europe Drone Battery Market Trends

The European drone battery market is growing steadily, supported by the region’s expanding drone applications in defense, environmental monitoring, precision agriculture, and logistics. The EU’s focus on green technology, coupled with stringent battery efficiency and sustainability regulations, is driving innovation in lightweight, high-capacity battery systems. Countries such as Germany, France, and the UK are at the forefront, investing in R&D and public-private collaborations to enhance drone performance and operational safety. The rise of drone delivery trials and smart city projects is also fueling demand for reliable, long-lasting battery solutions.

Key trends in the region include the adoption of lithium-silicon and solid-state batteries, integrating battery management systems with AI for predictive diagnostics, and the growing use of recyclable and eco-friendly materials to meet EU environmental directives. In addition, partnerships between battery tech firms and drone manufacturers are helping to overcome cost and scalability challenges, ensuring steady progress in the region’s drone battery landscape.

Latin America Drone Battery Market Trends

The Latin American drone battery market is gaining momentum as drone usage expands across agriculture, mining, infrastructure inspection, and emergency services. Countries such as Brazil, Chile, and Mexico are at the forefront, leveraging drones for operations in remote and hard-to-reach areas, which drives demand for high-capacity, long-endurance battery systems. The region’s challenging geography and infrastructure gaps make battery reliability and performance crucial. Ongoing advancements in lithium-based technologies, regional partnerships, and growing regulatory support for UAV operations are helping reduce costs and improve accessibility, positioning Latin America as an emerging market for drone battery innovation.

Middle East & Africa Drone Battery Market Trends

The Middle East and Africa drone battery market is driven by the expanding adoption of drones across sectors such as oil & gas, infrastructure inspection, agriculture, and defense. With vast, remote terrains and increasing demand for aerial surveillance and logistics, countries such as Saudi Arabia and the United Arab Emirates are investing in drone technologies that require advanced, long-endurance battery systems. These nations also align with broader technological and sustainability goals, including Saudi Arabia’s Vision 2030 and the UAE’s Energy Strategy 2050, emphasizing innovation and efficiency across critical industries. As drone deployment grows in commercial and governmental applications, the need for high-performance, reliable batteries continues to rise, positioning the region as a promising frontier in the global drone battery landscape.

Key Drone Battery Company Insights

Some of the key players in the drone battery market include Eaglepicher Technologies, Oxis Energy Ltd, Plug Power Inc., HES Energy Systems, and Intelligent Energy.

-

In April 2024, a leading drone manufacturer partnered with Solid Energy Systems to develop high-capacity lithium-metal batteries to extend drone flight times for commercial delivery services. This collaboration focuses on enhancing battery energy density and safety to meet the growing demand for longer and more reliable drone operations.

-

In March 2024, the U.S. Department of Transportation announced over USD 250 million in funding to support research and development of advanced drone battery technologies and infrastructure. This initiative targets improvements in battery efficiency, fast charging, and recycling capabilities to accelerate drone adoption in logistics, agriculture, and emergency response sectors, particularly in remote and underserved areas.

Key Drone Battery Companies:

The following are the leading companies in the drone battery market. These companies collectively hold the largest market share and dictate industry trends.

- Eaglepicher Technologies

- Oxis Energy Ltd

- Plug Power Inc

- HES Energy Systems

- Intelligent Energy

- RRC Power Solutions

- Micromulticopter Aero Technology Co., Ltd.

- SolidEnergy Systems

- Sion Power

- Doosan Mobility Innovation

- Shenzhen Grepow Battery Co. Ltd.

- Epsilor

Drone Battery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.08 billion

Revenue forecast in 2033

USD 48.99 billion

Growth rate

CAGR of 21.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, point of sale, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Spain; UK; France; Italy; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Eaglepicher Technologies; Oxis Energy Ltd; Plug Power Inc; HES Energy Systems; Intelligent Energy; RRC Power Solutions; Micromulticopter Aero Technology Co., Ltd.; SolidEnergy Systems; Sion Power; Doosan Mobility Innovation; Shenzhen Grepow Battery Co. Ltd.; EpsilorTop of Form

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drone Battery Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global drone battery market report on the basis of technology, point of sale, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Lithium-based

-

Nickel-based

-

Others

-

-

Point of Sale Outlook (Revenue, USD Million, 2021 - 2033)

-

Aftermarket

-

OEMs

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global drone battery market size was estimated at USD 8.13 billion in 2024 and is expected to reach USD 10.08 billion in 2025.

b. The global drone battery market is expected to grow at a compound annual growth rate of 21.9% from 2025 to 2033 to reach USD 48.99 billion by 2033.

b. North America accounted for the largest share of the global drone battery market, with a revenue share of over 34.45% in 2024. The region's dominance is driven by the widespread adoption of drones in defense, agriculture, logistics, and surveillance, coupled with strong government support and advanced manufacturing capabilities.

b. Some of the key players in the global drone battery market include EaglePicher Technologies; Oxis Energy Ltd; Plug Power Inc; HES Energy Systems; Intelligent Energy; RRC Power Solutions; Micromulticopter Aero Technology Co., Ltd.; SolidEnergy Systems; Sion Power; Doosan Mobility Innovation; Shenzhen Grepow Battery Co. Ltd.; and Epsilor.

b. The growth of the global drone battery market is due to the rapid increase in drone adoption across commercial, industrial, and defense sectors, which demands high-performance, lightweight, and long-endurance battery solutions. Expanding applications such as aerial surveillance, precision agriculture, last-mile delivery, and infrastructure inspection are accelerating the need for reliable and energy-dense batteries that can support extended flight times and faster charging capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.