- Home

- »

- Power Generation & Storage

- »

-

Lithium-Sulfur Battery Market Size, Industry Report, 2033GVR Report cover

![Lithium-Sulfur Battery Market Size, Share & Trends Report]()

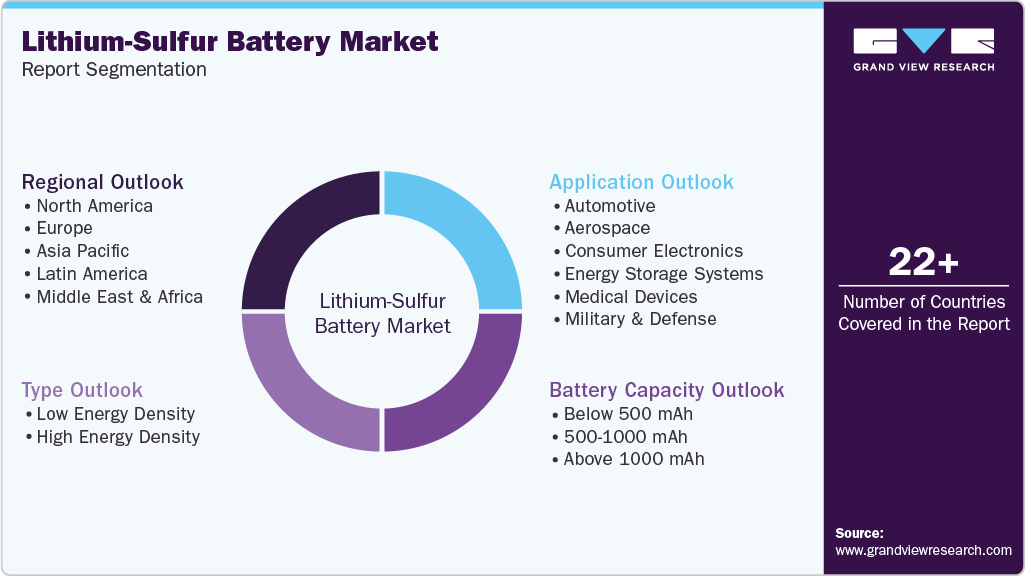

Lithium-Sulfur Battery Market (2026 - 2033) Size, Share & Trends Analysis Report By Battery Capacity (Below 500 mAh, 500-1000 mAh), By Type (Low Energy Density, High Energy Density), By Application (Automotive, Aerospace, Consumer Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-377-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lithium-Sulfur Battery Market Summary

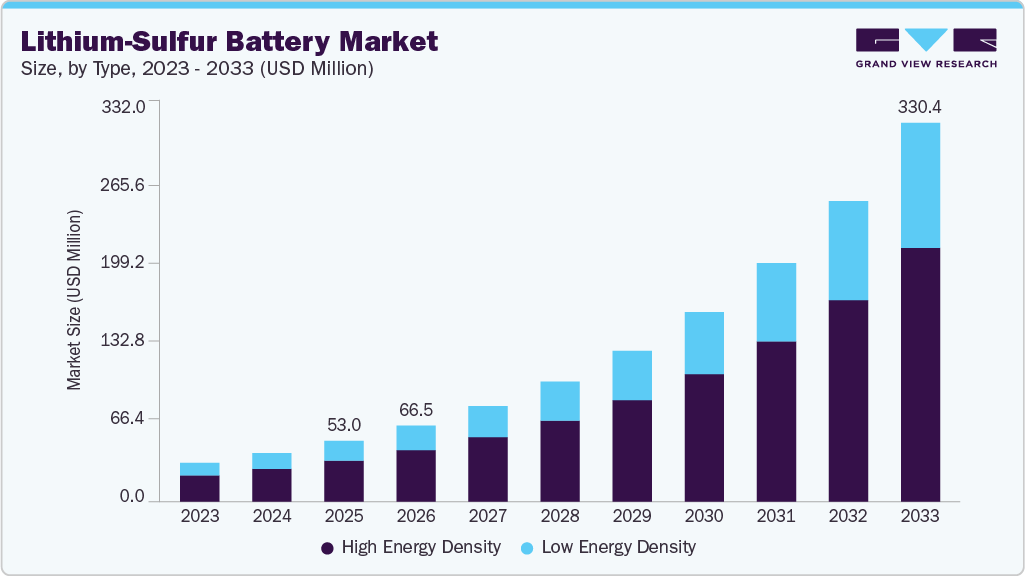

The global lithium-sulfur battery market size was estimated at USD 53.0 million in 2025 and is projected to reach USD 330.4 million by 2033, growing at a CAGR of 25.7% from 2026 to 2033. The market is being driven by its significantly higher theoretical energy density compared with conventional lithium ion batteries.

Key Market Trends & Insights

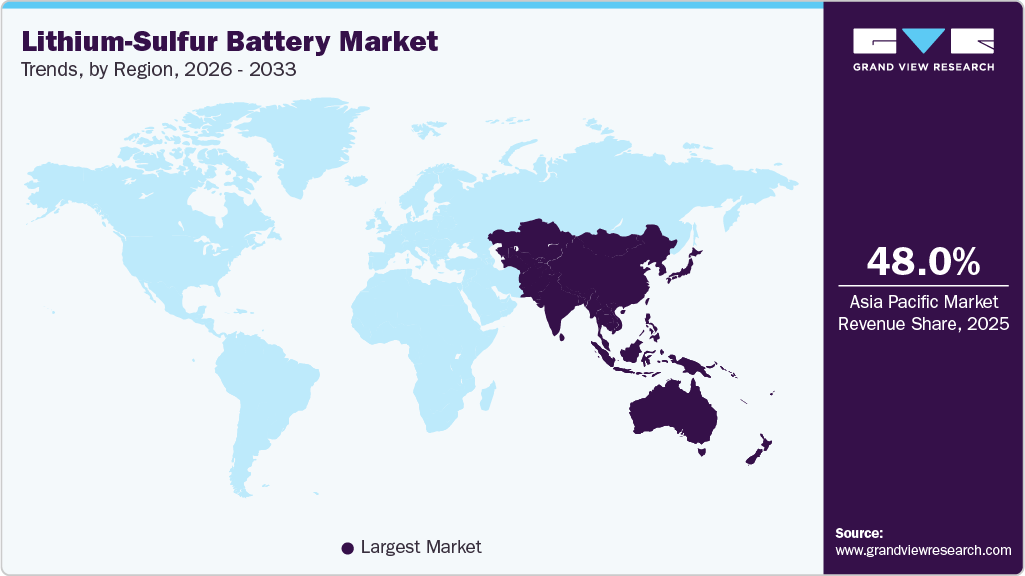

- Asia Pacific lithium-sulfur battery market held the largest share of over 48% of the global market in 2025.

- China accounted for 48.4% of the Asia Pacific lithium-sulfur battery market.

- By battery capacity, above 1000 mAh segment held the largest market share of over 53% in 2025.

- By type, the high energy density segment held the revenue share of over 67.0% in 2025.

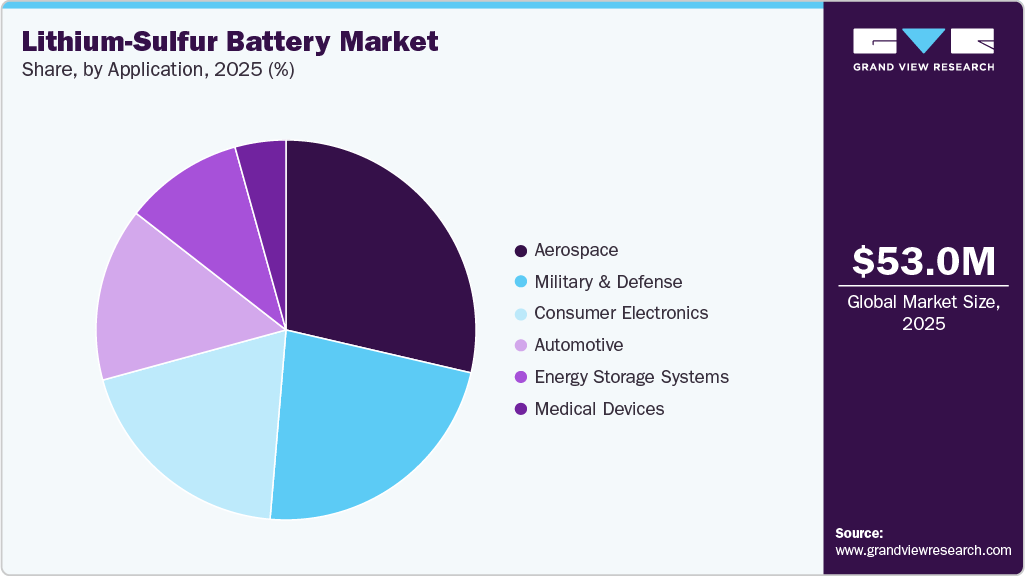

- By application, the aerospace segment held the largest market share of over 28% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 53.0 Million

- 2033 Projected Market Size: USD 330.4 Million

- CAGR (2026-2033): 25.7%

- Asia Pacific: Largest market in 2025

This advantage allows devices and vehicles to achieve longer operating ranges while reducing overall battery weight, which is particularly valuable in applications where energy per kilogram is a critical design parameter. As industries push for lighter and more efficient energy storage solutions, lithium sulfur chemistry is gaining attention as a next-generation alternative.Sulfur is widely available as an industrial byproduct and is far less expensive than metals such as cobalt and nickel used in many lithium-ion cathodes. This improves long-term cost competitiveness and reduces exposure to volatile critical mineral markets, making lithium sulfur batteries attractive for manufacturers seeking stable input economics and more sustainable supply chains.

Rising demand from aerospace, defense, and advanced mobility sectors is further accelerating market growth. These segments prioritize high specific energy and lightweight power sources over long cycle life alone, aligning well with the strengths of lithium sulfur technology. Increased adoption in drones, electric aviation concepts, and specialized military systems is creating early commercial demand and validate performance in real-world conditions.

Public funding for advanced battery research, along with private capital flowing into startups and pilot manufacturing facilities, is speeding up the transition from laboratory-scale innovation to industrial-scale production. Policies focused on energy security and domestic battery manufacturing are strengthening the commercial outlook for alternative chemistries such as lithium sulfur.

Moreover, ongoing technological advancements are addressing earlier limitations related to cycle life and stability. Improvements in electrolyte formulation, cathode design, and cell engineering are enhancing durability and performance consistency. As these technical barriers continue to decline, confidence among end users and investors is improving, which is expected to support broader adoption and sustained growth of the lithium sulfur battery market.

Drivers, Opportunities & Restraints

The primary driver of the lithium sulfur battery market is its high theoretical energy density, which enables longer operating time and reduced battery weight compared with conventional lithium ion technologies. This advantage strongly supports adoption in weight-sensitive applications such as aerospace, drones, and next-generation electric mobility. In addition, the abundance and low cost of sulfur improve raw material availability and reduce dependence on expensive and supply-constrained metals, strengthening the long-term economic and sustainability appeal of this chemistry. Growing investments in advanced battery research and pilot-scale manufacturing further accelerate technology maturation and market acceptance.

Significant opportunities exist in emerging applications where high specific energy outweighs the need for a very long cycle life. Electric aviation, defense systems, space technologies, and high-endurance unmanned platforms present strong near-term commercialization potential. As improvements in materials engineering continue, lithium sulfur batteries also have the opportunity to penetrate electric vehicle segments focused on extended range. Furthermore, increasing emphasis on supply chain diversification and reduced reliance on critical minerals creates favorable conditions for lithium sulfur adoption as governments and manufacturers seek alternative battery chemistries.

Despite strong potential, the market faces notable technical and commercial restraints. Limited cycle life and performance degradation caused by polysulfide shuttling remain key challenges, restricting use in high-cycle applications. Manufacturing scalability and consistency are still under development, which affects cost competitiveness in early commercialization stages.

Battery Capacity Insights

Above 1000 mAh segment held the largest revenue share of over 53% in 2025. The above 1000 mAh capacity segment of the lithium sulfur battery market is being driven by rising demand from applications that require extended operating time and high energy storage within a limited weight envelope. Electric vehicles focused on long-range performance, high-endurance drones, aerospace platforms, and defense equipment increasingly prefer higher-capacity cells to reduce the number of battery units needed at the system level. Lithium sulfur chemistry aligns well with these needs because its low material density enables higher energy per cell compared with conventional lithium-ion batteries, making capacities above 1000 mAh commercially attractive for performance-critical use cases.

The below 500 mAh capacity segment of the lithium sulfur battery market is primarily driven by demand from compact and low power applications, where size, weight, and safety take priority over long runtime. Wearable electronics, medical monitoring devices, wireless sensors, and small IoT modules favor lower-capacity cells that can deliver stable performance in miniature form factors. Lithium sulfur chemistry supports this segment by offering lightweight cells with acceptable energy density, enabling device designers to reduce overall mass while maintaining sufficient operating time for intermittent or low duty cycle usage.

Type Insights

High energy density segment held the revenue share of over 67.0% in 2025. The high energy density segment under the lithium sulfur battery type is driven by growing demand for power sources that can deliver maximum energy storage within minimal weight and volume constraints. Advanced mobility applications such as long-range electric vehicles, electric aviation platforms, space systems, and high-altitude drones increasingly prioritize energy density to extend range and mission duration. Lithium sulfur chemistry supports this requirement through its high theoretical specific energy, making it attractive for next generation systems where conventional battery technologies face physical and performance limitations.

The low energy density segment under the lithium sulfur battery type is driven by applications where cost efficiency, operational safety, and stable performance outweigh the need for maximum energy storage. Entry level consumer electronics, basic industrial devices, backup power units, and short duration portable equipment often prioritize reliability and ease of integration rather than high energy output. Lithium sulfur batteries configured for lower energy density can offer improved stability, simpler cell design, and predictable discharge behavior, making them suitable for these use cases.

Application Insights

Aerospace dominated the lithium-sulfur battery market with a 28.6% revenue share, driven by the sector’s strong emphasis on ultra-lightweight energy storage and high specific energy for mission-critical applications. Aircraft, satellites, space vehicles, and unmanned aerial systems benefit significantly from lithium-sulfur chemistry, as reducing battery mass directly improves payload capacity, flight endurance, and operational efficiency, making it highly attractive for both defense and commercial aerospace programs.

Consumer electronics is projected to register the fastest CAGR of 26.2% over the forecast period, supported by growing demand for slimmer, lighter, and more power-efficient devices. Smartphones, wearables, wireless audio products, and handheld electronics increasingly require batteries that enable compact designs without sacrificing runtime, and lithium-sulfur batteries address these needs through their low density and high energy potential, driving rapid adoption in this segment.

Regional Insights

Asia Pacific held over 48% revenue share of the global lithium-sulfur battery market. Lithium sulfur batteries in the Asia Pacific are being pulled forward by rapidly growing demand for higher energy density and lighter weight storage for electric mobility and aerospace applications. Vehicle electrification and expanding fleets of drones and delivery robots are increasing the appetite for cells that can deliver more range per kilogram, while grid-scale energy storage needs are rising as wind and solar penetration climb across the region. Large cloud and AI-related data center projects are adding pressure for reliable backup storage and fast deployment, which increases interest in alternative chemistries that promise different performance tradeoffs compared with conventional lithium-ion.

China Lithium-Sulfur Battery Market Trends

China accounted for 48.4% of the Asia Pacific lithium-sulfur battery market, dominating the region due to its strong control over electric vehicle manufacturing, advanced battery supply chains, and aggressive government support for next-generation energy technologies. Large-scale investments in R&D, pilot-scale commercialization of lithium-sulfur chemistries, and rapid adoption across EVs, drones, and aerospace applications are accelerating demand, as manufacturers seek lighter batteries with higher energy density and longer range. China’s ability to scale production quickly, coupled with strategic policies aimed at reducing reliance on conventional lithium-ion systems, continues to reinforce its leadership position and makes it the primary growth engine for the Asia Pacific lithium-sulfur battery market.

North America Lithium-Sulfur Battery Market Trends

In North America the growth of the industry is strongly linked to rising uptake of advanced energy storage applications that benefit from higher energy density and lower weight compared with traditional options. This includes electric vehicles, unmanned aerial systems and aerospace platforms where extended runtime and reduced mass are critical performance criteria. Demand is also stimulated by renewable energy integration and grid resilience projects, as stakeholders seek storage technologies that can support intermittent generation with compact, efficient solutions.

In the U.S., the rising adoption of electric vehicles and unmanned systems with demand for longer range and lighter power sources is one of the main forces pushing interest in lithium-sulfur batteries. These cells offer significantly higher theoretical energy density and reduced mass compared with conventional lithium-ion alternatives, which appeals to EV manufacturers, drone producers, and aerospace developers seeking improved performance and extended operational life. Widespread use of these technologies in commercial and defense sectors is increasing pressure on companies to explore advanced chemistries that can deliver competitive advantages in range, efficiency and total cost of ownership. This trend is reflected in broader market projections showing strong demand tied to electrification and energy storage expansion.

Europe Lithium-Sulfur Battery Market Trends

In Europe the expansion of the market is being propelled by efforts to integrate advanced energy storage solutions into key high-growth sectors such as electric mobility, aerospace and renewable energy systems. Manufacturers and research organizations across the EU are investing in development projects aimed at improving the performance, durability and manufacturability of these chemistries, especially for applications where high energy density and lower weight matter. Germany’s strong automotive R&D ecosystem and broader industrial battery technology infrastructure provide a solid foundation for innovation and early adoption.

Middle East & Africa Lithium-Sulfur Battery Market Trends

In the Middle East and Africa market is at an early but rapidly expanding stage with interest driven by the growing need for advanced energy storage technologies that support renewable power systems and emerging clean mobility solutions. Uptake of solar and wind generation in several countries is creating demand for energy storage that can handle variable supply and improve grid reliability, which gives lithium-sulfur technology potential appeal thanks to its high theoretical energy density and lightweight design compared with traditional chemistries.

Key Lithium-Sulfur Battery Company Insights

Some of the key players operating in the global Lithium-sulfur battery market include PolyPlus Battery Company, NexTech Batteries Inc., Li-S Energy Limited, Zeta Energy LLC, GS Yuasa Corporation, LG Energy Solutions Ltd., among others. These companies are actively engaged in expanding their market footprint through product innovation, strategic acquisitions, and collaborations aimed at enhancing their global distribution networks and technology capabilities.

Key Lithium-Sulfur Battery Companies:

The following key companies have been profiled for this study on the lithium-sulfur battery market.

- Gelion PLC

- Giner, Inc.

- GS Yuasa Corporation

- Guang Dong Xiaowei New Energy Technology Co., Ltd.

- Ilika Technologies

- Johnson Matthey

- LG Energy Solutions Ltd.

- Li-S Energy Limited

- Lynntech, Inc.

- NexTech Batteries Inc.

- PolyPlus Battery Company

- Saft Groupe SA

- Sion Power Corporation

- Williams Advanced Engineering

- Zeta Energy LLC

Recent Developments

-

In August 2025, Zeta Energy highlighted its breakthrough lithium-sulfur battery technology, achieving 450 Wh/kg specific energy, nearly double current lithium-ion batteries, and up to 10C charging rates, using cheap sulfur cathodes and dendrite-free carbon nanotube anodes with metallic lithium.

Lithium-Sulfur Battery Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the total global revenue generated from the sale of lithium-sulfur battery cells, packs, and integrated systems across all end-use applications and regions during the defined period.

Market size value in 2026

USD 66.5 million

Revenue forecast in 2033

USD 330.4 million

Growth rate

CAGR of 25.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Battery capacity, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

PolyPlus Battery Company; NexTech Batteries Inc.; Li-S Energy Limited; Zeta Energy LLC; GS Yuasa Corporation; LG Energy Solutions Ltd.; Saft Groupe SA; Gelion PLC; Sion Power Corporation; Johnson Matthey; Giner, Inc.; Lynntech, Inc.; Ilika Technologies; Williams Advanced Engineering; Guang Dong Xiaowei New Energy Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lithium-Sulfur Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global lithium-sulfur battery market report based on battery capacity, type, application and region:

-

Battery Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Below 500 mAh

-

500-1000 mAh

-

Above 1000 mAh

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Low Energy Density

-

High Energy Density

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Aerospace

-

Consumer Electronics

-

Energy Storage Systems

-

Medical Devices

-

Military & Defense

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lithium-sulfur battery market size was estimated at USD 53.0 million in 2025 and is expected to reach USD 66.5 million in 2026.

b. The global lithium-sulfur battery market is expected to grow at a compound annual growth rate of 25.7% from 2026 to 2033 to reach USD 330.4 million by 2033.

b. Based on the application segment, aerospace held the largest revenue share of over 28% in the lithium-sulfur battery market in 2025.

b. PolyPlus Battery Company, NexTech Batteries Inc., Li-S Energy Limited, Zeta Energy LLC, GS Yuasa Corporation, LG Energy Solutions Ltd., Saft Groupe SA, Gelion PLC, Sion Power Corporation, Johnson Matthey, Giner, Inc., Lynntech, Inc., Ilika Technologies, Williams Advanced Engineering, Guang Dong Xiaowei New Energy Technology Co., Ltd. and others.

b. The key factors driving the lithium-sulfur battery market due to rising demand for high energy density storage solutions, growing adoption of electric vehicles and aerospace applications, advancements in sulfur cathode and electrolyte technologies, increasing focus on lightweight batteries, and the availability of low cost and abundant sulfur raw materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.