- Home

- »

- Plastics, Polymers & Resins

- »

-

Corrugated Board Market Size, Share & Growth Report, 2030GVR Report cover

![Corrugated Board Market Size, Share & Trends Report]()

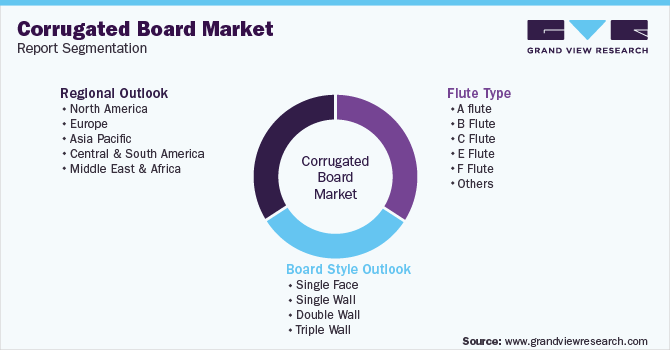

Corrugated Board Market (2023 - 2030) Size, Share & Trends Analysis Report By Flute Type (A-Flute, B-Flute, C-Flute, E-Flute, F-Flute), By Board Style (Single Face, Single Wall, Double Wall, Triple Wall), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-454-2

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Corrugated Board Market Summary

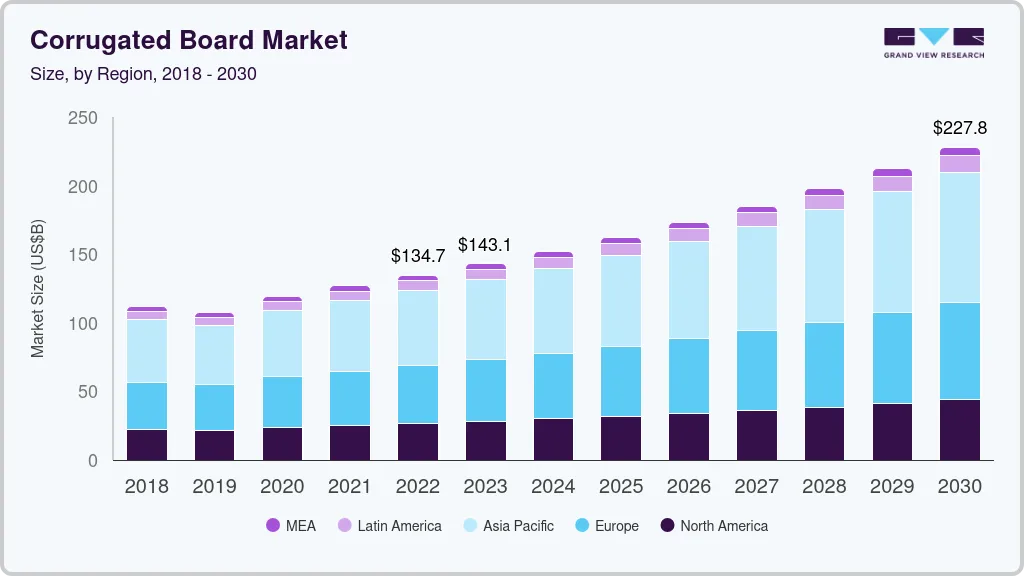

The global corrugated board market size was estimated at USD 134.7 billion in 2022 and is projected to reach USD 227.8 billion by 2030, growing at a CAGR of 6.8% from 2023 to 2030. The key factors driving the market are the global expansion of the e-commerce market and growing demand for sustainable packaging.

Key Market Trends & Insights

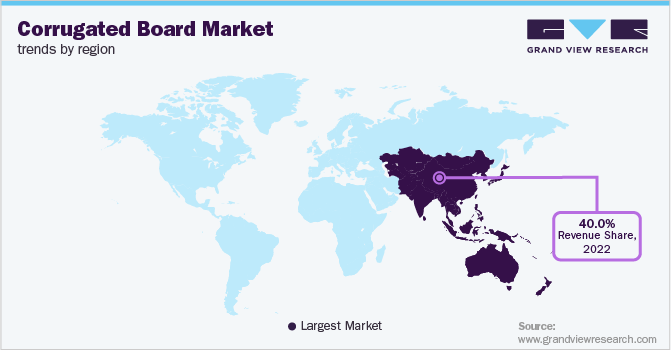

- Asia Pacific emerged as the largest market for corrugated board in 2022 with a revenue share of over 40.0%.

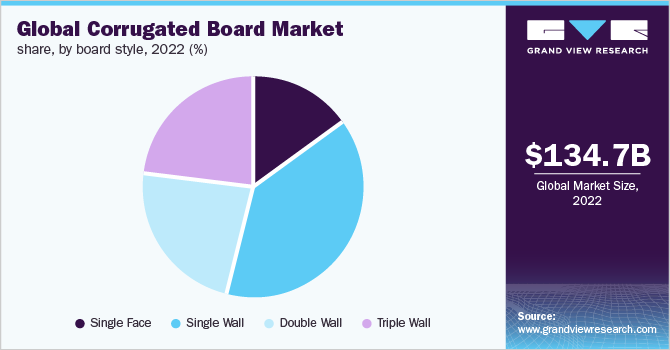

- By board style, the single wall segment emerged as the largest segment in 2022 with a revenue share of over 35.0%.

- By flute type, c-flute segment held the largest share of over 25.0% in terms of revenue in 2022.

Market Size & Forecast

- 2022 Market Size: USD 134.7 Billion

- 2030 Projected Market Size: USD 227.8 Billion

- CAGR (2023-2030): 6.8%

- Asia Pacific: Largest market in 2022

However, lack of durability in corrugated boards is expected to restrain the growth of the market. Plastic is one of the majorly used materials for packaging in various industries including food and beverage, healthcare, cosmetics and personal care, and consumer goods. However, increasing consumption of plastic is causing an adverse impact on the environment. According to the UN, 300 million tons of plastic waste is generated every year globally, which is nearly equivalent to the weight of the global human population. To curb this humongous amount of plastic waste generated annually, the approach of sustainable packaging was adopted. The end-use industries are switching from plastic packaging to corrugated board packaging in order to cater to the growing consumer-driven demand for sustainable packaging.

The U.S. emerged as the largest market for corrugated board in North America in 2022. The country is home to several foodservice and packaged food companies including ready-to-eat meals, convenience meals, and ready-to-make meals. The high demand for out-of-home food due to busy work-life schedules and convenience is a key growth driver.

According to the USDA, in 2021, consumers in the U.S. spent an average of 10.3% of their disposable personal income on food, which is divided between food at home (5.2%) and food away from home (5.1%). The high expenditure on food is anticipated to support the growth of the market from 2023 to 2030.

Further, the U.S. is the second largest e-commerce market after China. The country is likely to witness steady and significant growth during the forecast years. Some of the factors driving this industry include the increasing dependency of customers on online shopping, the high purchasing capability of the population, and the rising penetration of the internet and smartphones in the country. This, in turn, is creating demand for corrugated board boxes for packaging.

Flute Type Insights

C-flute held the largest share of over 25.0% in terms of revenue in 2022. C-flute offers greater compression strength than B flute and greater stacking strength for lightweight products. It is commonly used for shipping cases, packaging glass products, and furniture.

C-flute provides the packaging with a high load-bearing capacity with minimal use of fiber material. For instance, Acme Box Co. Inc. offers a high-performance C-flute board, which is available in kraft as well as white outside liner options. These products find applications in the packaging of food products, pet supplies, pharmaceuticals, and personal care items. They can be configured as conventional boxes or die cuts.

A-flute is expected to expand at the highest CAGR of 7.7% during the forecast period. A flute is one of the thickest types and is predominantly used for transit packaging. For instance, STI - Gustav Stabernack GmbH uses cardboard or corrugated board for shipping boxes to deliver goods to recipients in undamaged condition. A thick flute acts as a shock absorber and prevents the packed goods from external impacts.

Board Style Insights

The single wall segment emerged as the largest segment in 2022 with a revenue share of over 35.0% and it is expected to retain its pole position over the forecast period. It is used as a supplemental protective material, divider, pad, or partition that can be used to separate the different layers of products. Nordpack GmbH offers single-wall boxes in C flute, B flute, or E flute that can be used as lower packing weight shipping cartons. Therefore, it is also used to make cartons for the packaging of various types of goods and can be easily printed, wherein different coatings can be applied on its surface.

Boxes made from single-wall corrugated boards are lighter in weight due to a single layer of fluted paper, which lowers shipping costs. They are widely used in e-commerce packaging for delivering smaller and compact items. The rising trend of online shopping is likely to contribute to increased demand for packaging solutions.

Regional Insights

Asia Pacific emerged as the largest market for corrugated board in 2022 with a revenue share of over 40.0%. The presence of highly populated countries such as China and India, growing urbanization, and increasing spending power in the countries would support the growth of the packaging industry in Asia Pacific and thereby corrugated boards.

Rising awareness about the environment and increasing demand for greener packaging solutions in the region would drive the growth of the market. Further, government initiatives to ban plastic-based packaging in countries such as India would shift the focus toward paper packaging. Foreign Direct Investments (FDIs) and investments in a number of projects in packaging in Asian countries are likely to grow at a rapid pace. These trends are projected to propel the growth of the packaging manufacturing sector in these countries. Economic and industrial developments would build a strong foundation for the demand growth of corrugated board in the region over the forecast period.

Asia Pacific is estimated to exhibit the fastest CAGR, in terms of revenue, over the forecast period. The region is witnessing exponential growth on account of technological innovations such as blockchain technology, machine learning, artificial intelligence, and the Internet of Things (IoT). A large number of paper mills in Asia are well positioned on the cost curve of global corrugated board manufacturing owing to low energy and labor cost and high productivity of workers.

Key Companies & Market Share Insights

The market is large and fragmented across the world. Therefore, the players in the market are very competitive at all levels, from small to big manufacturers. Moreover, the market is marked with the presence of numerous well-established, century-old public companies. However, the manufacturing companies also, in several instances, compete with other companies producing similar products that are potential substitutes for corrugated boards. The primary factors that influence competition in the market include services, product quality, cost, and price.

Due to the rise in highly specialized products including corrugated boards with lightweight flutes, plastic coatings, and printing compatible surface sheets, the manufacturers in the industry are able to gain a competitive edge to stand out in the market. Services and related machinery solutions are other ways in which the companies compete by providing value adding differentiated solutions for customers. For instance, WestRock Company offers automated packaging machines that are customized as per complexities of distribution and logistics of customers’ products. Some prominent players in the global corrugated board market include:

-

International Paper

-

Georgia-Pacific

-

WestRock Company

-

Packaging Corporation of America

-

Stora Enso

-

Oji Holdings Corporation

-

Smurfit Kappa

-

Port Townsend Paper Company

-

Mondi

-

DS Smith

Corrugated Board Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 152.2 billion

Revenue forecast in 2030

USD 227.8 billion

Growth Rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million tons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flute type, board style, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; South Africa

Key companies profiled

International Paper; Georgia-Pacific; WestRock Company; Packaging Corporation of America; Stora Enso; Oji Holdings Corporation; Smurfit Kappa; Port Townsend Paper Company; Mondi; DS Smith

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corrugated Board Market Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global corrugated board market report on the basis of flute type, board style, and region:

-

Flute Type (Volume, Million Tons; Revenue, USD Million, 2017 - 2030)

-

A flute

-

B Flute

-

C Flute

-

E Flute

-

F Flute

-

Others

-

-

Board Style Outlook (Volume, Million Tons; Revenue, USD Million, 2017 - 2030)

-

Single Face

-

Single Wall

-

Double Wall

-

Triple Wall

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global corrugated board market was estimated at USD 134.7 billion in the year 2022 and is expected to reach USD 152.2 billion in the year 2023.

b. The global corrugated board market is expected to witness a moderate CAGR of 6.8% from 2023 to 2030 to reach USD 227.8 billion by 2030.

b. C- Flute commanded the largest share of 29.4% in terms of revenue in 2022. C- Flute offers greater compression strength than B-Flute and greater stacking strength for lightweight products. It is commonly used for shipping cases, packaging glass products, and furniture.

b. Some of the key players in the corrugated board market include international Paper ;Georgia-Pacific; WestRock Company; Packaging Corporation of America; Stora Enso; Oji Holdings Corporation; Smurfit Kappa; Port Townsend Paper Company; Mondi; DS Smith

b. C-Flute held the highest revenue share of 29.4% in 2020 in the corrugated board market.

b. The factors attributed to drive the market are the global expansion of the e-commerce market and the growing demand for sustainable packaging. However, lack of durability in corrugated boards is a major restrain for the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.