- Home

- »

- Next Generation Technologies

- »

-

Edge Artificial Intelligence Chips Market, Industry Report, 2030GVR Report cover

![Edge Artificial Intelligence Chips Market Size, Share & Trends Report]()

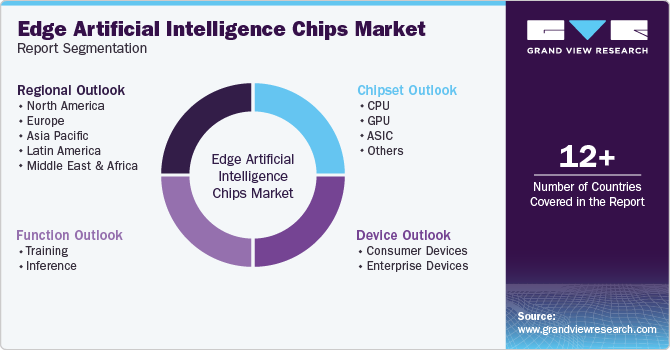

Edge Artificial Intelligence Chips Market (2024 - 2030) Size, Share & Trends Analysis Report By Chipset (CPU, GPU, ASIC), By Function (Training, Inference), By Device (Consumer, Enterprise), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-471-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Edge Artificial Intelligence Chips Market Summary

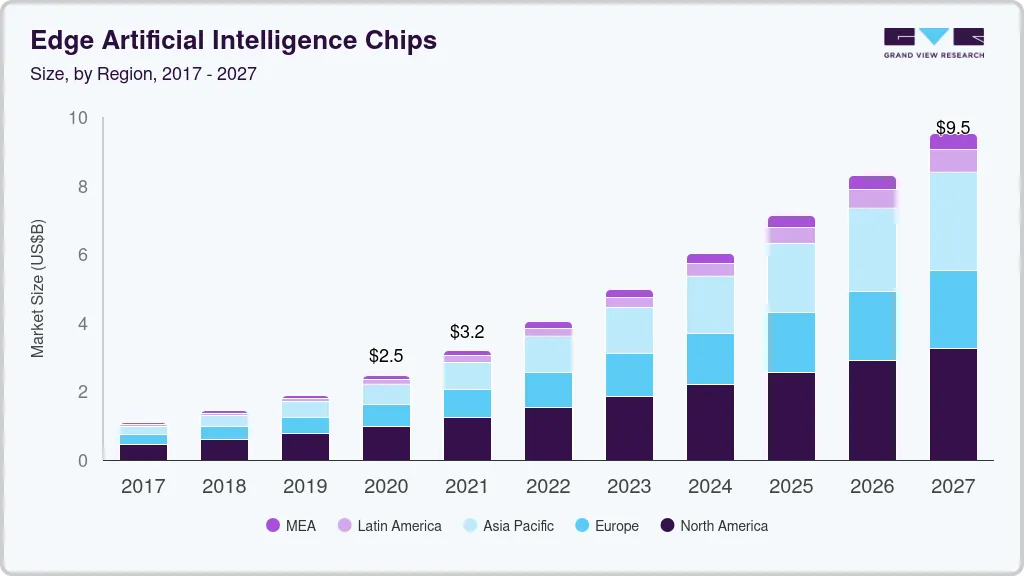

The global edge artificial intelligence chips size was estimated at USD 2,470.3 million in 2020 and is projected to reach USD 9,519.1 million by 2027, growing at a CAGR of 21.3% from 2021 to 2027. The increasing use of e-commerce platforms and social media is generating a vast amount of data.

Key Market Trends & Insights

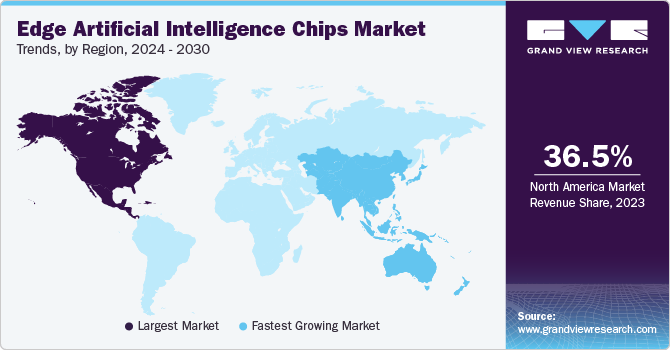

- In terms of region, North America was the largest revenue generating market in 2020.

- Country-wise, U.S. is expected to register the highest CAGR from 2021 to 2027.

- In terms of segment, cpu accounted for a revenue of USD 2,071.5 million in 2020.

- ASIC is the most lucrative processor segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2020 Market Size: USD 2,470.3 Million

- 2027 Projected Market Size: USD 45,289.1 Million

- CAGR (2020-2027): 21.3%

- North America: Largest market in 2020

Artificial intelligence chips are addressing this need by enabling quicker processing. A major trend in chip technology is the implementation of edge-based AI, which involves running AI processes on a device instead of a remote server. This approach offers faster speed and better privacy. The growing interest in Internet of Things (IoT) devices is a key factor driving tech companies to invest in developing high-speed processors.

Edge artificial intelligence chips eliminate or reduce the need to transmit bulk data to data centers or cloud stations. Thus, these chips offer numerous benefits for speed, usability, and data privacy & security by locally enabling processor-intensive machine learning computations. However, for some applications, not all machine learning-related tasks have to occur locally, and transmitting data by a remote AI array for processing is preferred. For instance, data center usage is preferred for applications involving data in large volumes, such as online video streaming.

The AI-related application technologies for edge computing are intelligent robots, autonomous vehicles, and smart hardware. Artificial intelligence-supported edge computing technology is multifaceted as it runs through the algorithm mechanism, application, processor type, and computing technology. The primary applications that run over edge AI are related to image/video, sound and speech, natural language processing, device control, and high-volume computing.

Chipset Insights

CPU chipset dominated the market and accounted for a revenue share of 63.1% in 2023. CPU chipsets have long been the cornerstone of general-purpose computing, offering a versatile and well-established architecture. Their ability to handle a wide range of tasks, including sequential and parallel processing, and their widespread availability and compatibility with existing software ecosystems make them an attractive choice for many edge AI applications. In addition, continuous advancements in CPU technology, such as increased core counts and improved performance per watt, have further solidified their position in the market.

ASIC chipset is expected to register the fastest CAGR of 47.2% during the forecast period due to its exceptional performance and efficiency. The surge in demand for AI applications in different sectors, such as autonomous vehicles, healthcare, and smart cities, creates a need for custom hardware to provide real-time insights at the edge. ASICs, designed for AI tasks, provide better computing power, lower latency, and reduced energy usage compared to CPUs designed for general use. ASICs are the favored option for edge AI deployments due to their various benefits, leading to their rapid expansion in the edge AI chips market.

Device Insights

The consumer devices segment dominated the market in 2023, which is primarily attributed to the widespread adoption of AI-powered devices in everyday life. Consumer electronics such as smartphones, smart speakers, and laptops increasingly incorporate AI features, such as natural language processing, image recognition, and personalized recommendations, to improve user experiences. The rise in popularity of these gadgets, along with the incorporation of AI capabilities, has led to a surge in the requirement for edge AI chips capable of effectively managing the computing needs of consumer applications. The increase in demand has strengthened the segment position in the market.

The enterprise devices segment is projected to grow at the fastest CAGR over the forecast period. The rising adoption of AI in business applications fuels the need for specific edge AI chips that can provide immediate insights and enhance operational efficiency. Moreover, the increasing focus on data privacy and security motivates businesses to implement AI solutions at the edge, minimizing the requirement to send confidential information to the cloud. The rise in cost-effective and powerful edge AI hardware is fueling the rapid growth of the enterprise devices segment.

Function Insights

The inference function accounted for the largest revenue share in 2023 due to the increasing demand for instant decision-making and data analysis at the edge. With the growth of AI technology in industries, there is a significant demand for chips capable of processing and analyzing data locally without relying on cloud-based systems. Inference functions involve trained AI models to make predictions or classifications based on new data, which is essential for enabling these edge AI applications. The growing complexity and variety of AI models and the strict latency needs of edge applications are fueling the need for high-performance inference chips, strengthening their dominance in the market.

The training function is expected to register the fastest CAGR during the forecast period. The increasing complexity and size of AI models, along with the growing emphasis on on-device learning and privacy, drive the need for edge devices capable of locally training AI models. Furthermore, progress in hardware technologies, such as dedicated neural processing units (NPUs), allows more effective and affordable training on edge devices. As edge AI applications continue to evolve and become more sophisticated, the demand for training capabilities at the edge is expected to surge, propelling the growth of this segment.

Regional Insights

North America edge artificial intelligence chips market dominated the market in 2023. The region boasts a strong presence of leading technology companies and research institutions, driving innovation and development in AI technologies. In addition, the high adoption of AI-driven devices and applications in the automotive, healthcare, and manufacturing industries has created a significant demand for edge AI chips. Furthermore, the favorable regulatory environment and substantial investments in AI research and development have further contributed to the edge AI chips market growth.

U.S. Edge Artificial Intelligence Chips Market Trends

The U.S. edge artificial intelligence chips market dominated North America in 2023 due to the country's robust environment for AI development and innovation and the presence of top technology companies and research institutions. These businesses have made substantial investments in research and development, resulting in progress in edge AI chip technology and structure. Moreover, the crucial growth of the market has been driven by the U.S. government's strong support for AI projects, which includes financial support for research and development.

Europe Edge Artificial Intelligence Chips Market Trends

Europe edge artificial intelligence chips market was identified as a lucrative region in 2023. The increasing adoption of AI technologies across various industries and a focus on data privacy and security have driven the demand for edge AI solutions. In addition, leading technology companies and research institutions in countries such as Germany, France, and the UK have fostered innovation and development in this field. Moreover, government initiatives and investments in AI research and infrastructure have further contributed to the region's growth potential in the edge AI chips market.

The edge artificial intelligence chips market in UK is expected to grow rapidly in the coming years due to the growing utilization of Internet of Things (IoT) devices in different sectors such as smart homes, factories, healthcare, and transportation, which is creating a large amount of data that needs to be processed quickly and on-site. The increasing need for autonomous systems, such as self-driving cars and drones, necessitates high-performance edge AI chips for instant decision-making and object detection.

Asia Pacific Edge Artificial Intelligence Chips Market Trends

Asia Pacific edge artificial intelligence chips market is anticipated to grow with the fastest CAGR over the forecast period. The growing population, increasing digitalization, and economic growth drive a surge in demand for AI-driven applications. Furthermore, support from governments and funding for AI research and infrastructure, especially in countries such as China and India, create a conducive setting for advancing edge AI technologies. In addition, the strong manufacturing capabilities and cost benefits make it an appealing location for AI chip production and deployment, further enhancing its potential for robust growth.

China edge artificial intelligence chips market held a substantial market share in 2023 owing to the country's significant investments in AI research and development and prioritizing domestic technology independence, which has driven the expansion of AI chip production and utilization. Moreover, the increasing Chinese market for AI-driven applications, especially in surveillance, smart cities, and industrial automation sectors, has generated a high need for edge AI chips. Moreover, government support, policies, and strategies to encourage AI innovation and growth have also played a role in solidifying China's growth in this industry.

Key Edge Artificial Intelligence Chips Company Insights

Some key companies in the edge artificial intelligence chips market include Advanced Micro Devices, Inc., Alphabet Inc., Intel Corporation, Qualcomm Technologies, Inc., Apple Inc., Mythic, and others. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Advanced Micro Devices, Inc. is a semiconductor company that designs, manufactures, and sells microprocessors, graphics processing units (GPUs), and other computing technologies. The company has a significant presence in the edge AI chip market, offering products well-suited for this segment's unique requirements.

-

Intel Corporation is a global leader in semiconductors and is renowned for its x86 processors. While mainly known for traditional computing, Intel has also played an active role in the AI chip market. The company created various AI-optimized processors and accelerators to meet AI applications' complex computational needs.

Key Edge Artificial Intelligence Chips Companies:

The following are the leading companies in the edge artificial intelligence chips market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc.

- Alphabet Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Apple Inc.

- Mythic

- Arm Limited

- Samsung

- NVIDIA Corporation

- Huawei Technologies Co., Ltd.

Recent Developments

-

In June 2024, Intel revealed innovative technologies and structures expected to greatly speed up the AI environment in various areas such as the data center, cloud, network, edge, and PC. With increased processing capabilities, cutting-edge energy efficiency, and a reduced total cost of ownership (TCO), customers can now take full advantage of the AI system opportunity.

-

In June 2024, Advanced Micro Devices, Inc. announced the launch of the latest AMD Ryzen AI 300 Series processors, presenting a Neural Processing Unit (NPU) for upcoming AI PCs and next-generation AMD Ryzen 9000 Series processors for desktop computers. These processors will enhance performance for content creators, gamers, and prosumers.

Edge Artificial Intelligence Chips Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.9 billion

Revenue forecast in 2030

USD 120.0 billion

Growth Rate

CAGR of 33.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Chipset, function, device, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Advanced Micro Devices, Inc.; Alphabet Inc.; Intel Corporation; Qualcomm Technologies, Inc.; Apple Inc.; Mythic; Arm Limited; Samsung; NVIDIA Corporation; Huawei Technologies Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edge Artificial Intelligence Chips Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global edge artificial intelligence chips market report based on chipset, function, device, and region.

-

Chipset Outlook (Revenue, USD Million, 2018 - 2030)

-

CPU

-

GPU

-

ASIC

-

Others

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Training

-

Inference

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Devices

-

Enterprise Devices

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.