- Home

- »

- Network Security

- »

-

Edge Security Market Size & Share, Industry Report, 2033GVR Report cover

![Edge Security Market Size, Share & Trends Report]()

Edge Security Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment Mode (Cloud Based, On Premise), By Organization Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-648-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Edge Security Market Summary

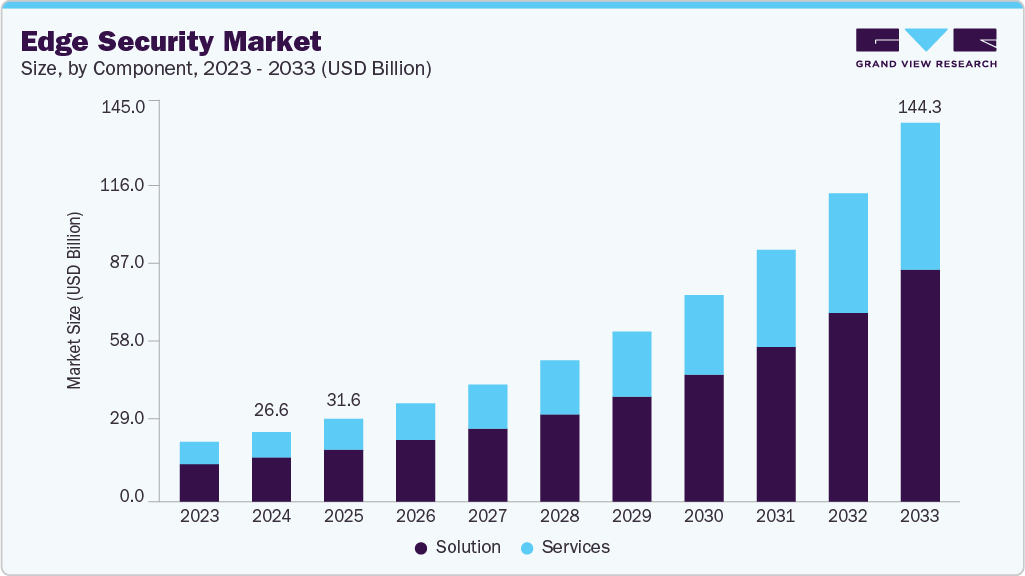

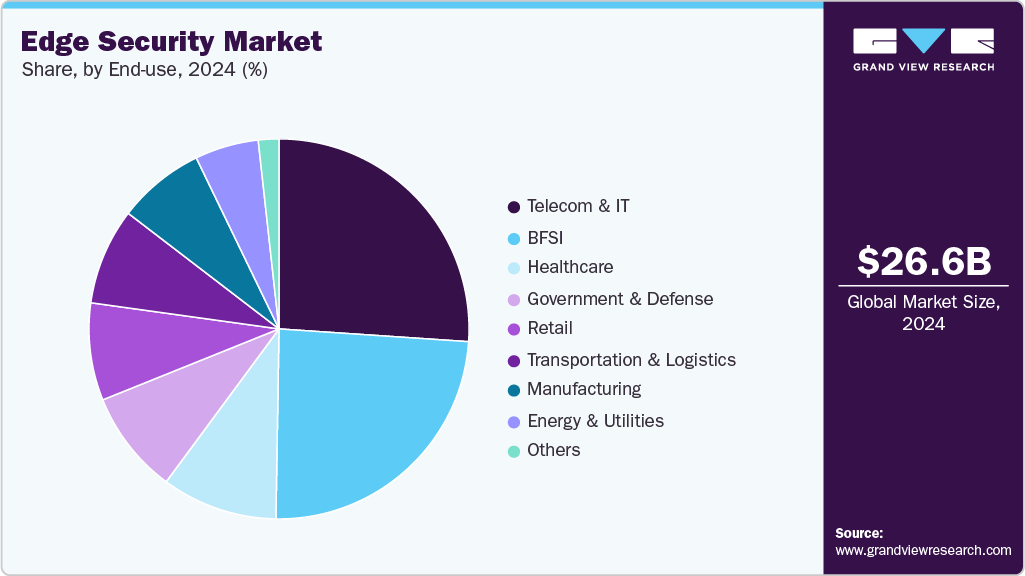

The global edge security market size was estimated at USD 26.64 billion in 2024 and is projected to reach USD 144.32 billion by 2033, growing at a CAGR of 20.9% from 2025 to 2033. The growth is driven by the rising need to protect data and applications at distributed endpoints as enterprises adopt hybrid work models, edge computing, and IoT at scale.

Key Market Trends & Insights

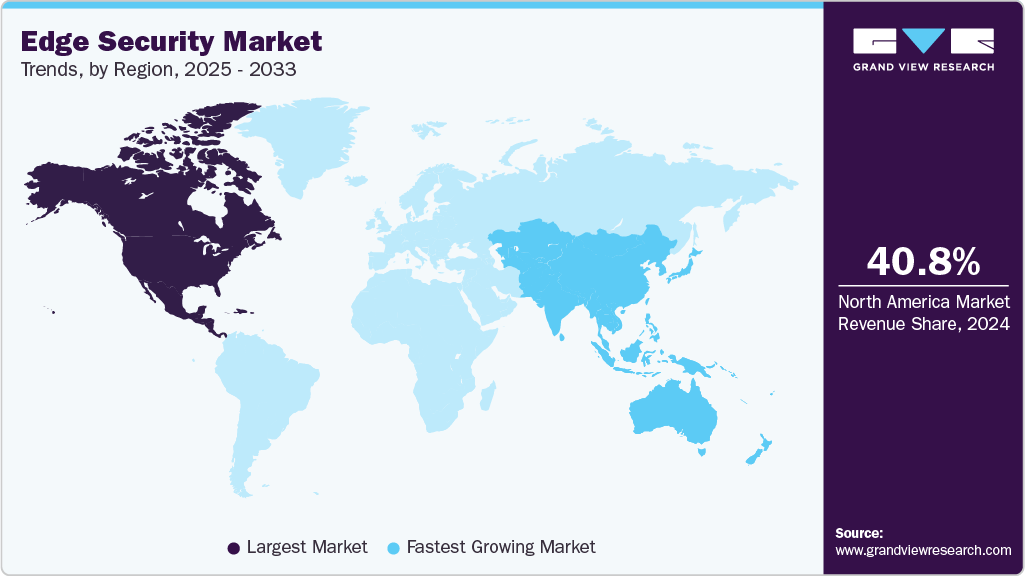

- North America held a 40.8% revenue share of the global edge security market in 2024.

- In the U.S., the market is driven by the increasing demand the increasing demand for real-time threat detection and policy enforcement at the edge, particularly across sectors.

- By component, solution segment held the largest revenue share of 62.8% in 2024.

- By deployment mode, the on-premises segment accounted for the largest revenue share of 59.44% in 2024

- By organization size, large enterprises segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.64 Billion

- 2033 Projected Market Size: USD 144.32 Billion

- CAGR (2025-2033): 20.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

With increasing cyberattacks targeting remote and edge devices, organizations are prioritizing zero trust network architectures (ZTNA), Secure Access Service Edge (SASE), and AI-driven edge firewalls to secure decentralized infrastructures. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) into edge security platforms is significantly driving market growth by enabling faster, more adaptive threat detection and autonomous response at the network edge. AI-powered edge security systems analyze large volumes of data directly at the edge, detect unusual behavior in real time, and react to threats instantly. This is valuable in time-sensitive environments such as manufacturing lines, connected medical devices, and smart logistics networks, where even a slight delay can compromise safety or disrupt critical operations.

In addition, the rapid adoption of 5G, autonomous technologies, and smart infrastructure in sectors like manufacturing, healthcare, and logistics is driving the need for real-time edge security solutions. Therefore, both governments and enterprises are bolstering regulatory frameworks and increasing investments to safeguard edge environments. For instance, in January 2025, Federal Communications Commission (FCC) launched U.S. Cyber Trust Mark, a cybersecurity labeling program, which aims to enhance the security of consumer IoT devices by certifying products that meet government-endorsed cybersecurity standards. Designed to function like an "Energy Star" label for connected devices, this initiative encourages manufacturers to adopt secure-by-design practices, fostering transparency in edge-connected ecosystems.

Component Insights

Solution segment dominated the market and accounted for the revenue share of 62.76% in 2024 due to the rising demand for AI-driven security platforms that protect IT environments across edge, cloud, and hybrid infrastructures. Organizations are adopting comprehensive solutions such as Secure Access Service Edge (SASE), Zero Trust Network Access (ZTNA), and Firewall-as-a-Service (FWaaS), which unify access control, threat detection, and policy enforcement into a single framework.

A key driver further accelerating adoption is the rise of secure AI-enabled browsing tools embedded within these platforms. For instance, in April 2025, Palo Alto Networks unveiled Prisma Access Browser 2.0, the industry’s first SASE-native secure browser, which uses Precision AI and LLM-based data classification to prevent data leaks and block AI-generated threats in real time. The solution enables secure workflows by monitoring clipboard activity, screenshots, and keystrokes without impacting user experiences, supporting zero trust strategies, and enhancing protection directly at the edge.

The service segment is expected to register the fastest growth during the forecast period due to the increasing complexity of hybrid edge environments and the rising reliance on specialized expertise for seamless deployment, integration, and management of edge security architectures. As organizations adopt frameworks like SASE, SSE, ZTNA, and AI-powered edge firewalls, they lack the internal resources to implement and operate these solutions effectively. This drives demand for professional services like consulting, architecture, implementation, compliance, and managed security services that deliver continuous monitoring, threat detection, incident response, and patch management directly at edge locations. For instance, in January 2024, Kyndryl partnered with Cisco to launch two new Security Edge Services Consult SSE with Cisco Secure Access and Managed SSE with Cisco Secure Access offering modular consulting and fully managed SSE deployments through a cloud-delivered model. These services help enterprises bridge the talent gap, simplify SSE adoption, and transition smoothly to SASE architectures, highlighting the essential role of service in driving the edge security market.

Deployment Mode Insights

The on-premises segment accounted for the largest revenue share of 59.44% in 2024, due to growing concerns around data sovereignty and latency-sensitive operations. Additionally, in applications like industrial automation, smart factories, and connected medical devices, edge security solutions need to respond in real time without relying on cloud connectivity, which increases the demand for locally hosted infrastructure.

Moreover, on-premises deployment offers deeper customization, seamless integration with legacy systems, and granular control over access policies, features that are non-negotiable for large enterprises. For instance, in April 2024, Fortinet announced updates to its FortiGate Next-Generation Firewall appliances to enhance on-prem edge security performance for operational technology (OT) networks. These appliances offer improved segmentation, deep packet inspection, and real-time threat intelligence deployed locally to meet compliance and uptime requirements. Subsequently, the aforementioned factors are contributing significantly in driving the growth of the global edge security market.

The cloud-based segment is expected to grow at the fastest CAGR of 21.7% over the forecast period due to increasing enterprise demand for scalable and centrally managed edge security solutions that can adapt to dynamic digital ecosystems. As organizations accelerate digital transformation and adopt hybrid work models, cloud-based deployments offer faster provisioning and simplified management across distributed users and locations.

Additionally, the rise of Security-as-a-Service (SECaaS) models and cloud-native architectures like SASE and ZTNA is also fueling adoption, as these solutions integrate threat intelligence, data protection, and access control into one cloud-delivered platform. For instance, in June 2025, Zscaler expanded its Zero Trust Exchange with AI-powered data protection and digital experience monitoring capabilities delivered through its global cloud platform, enabling organizations to secure edge access with high performance and minimal operational burden. The flexibility to scale on demand, coupled with continuous feature updates and lower upfront costs, is driving the rapid growth of the cloud segment during the forecast period.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share of 67.23% in 2024 due to its extensive and highly distributed edge deployments, which demand security architectures like SASE, ZTNA, and AI-enhanced edge firewalls. These organizations possess both financial resources and in-house expertise to adopt high-performance edge security frameworks that unify access control, threat detection, encryption, and incident response.

A significant catalyst reinforcing this trend is the increasing focus on emerging threats and future-proofing strategies on scale. For example, in March 2025, IBM and Vodafone collaborated on a proof-of-concept to integrate IBM’s Quantum-Safe cryptography into Vodafone Secure Net, deploying post-quantum, encryption-resistant protection for millions of smartphone users across Europe. Therefore, the dominance of the large-enterprise segment is driven by these organizations’ ability to deploy cutting-edge and resilient edge security solutions.

The small and medium enterprises segment is expected to grow at the highest CAGR of 21.7% during the forecast period, driven by the increasing demand to secure distributed endpoints, remote workforces, and cloud-based operations. As cyber threats are increasing, SMEs are turning to cloud-native, AI-powered edge security solutions that offer enterprise-grade protection with simplified deployment and management. For instance, in January 2024, Check Point Software launched its Quantum Spark 1900 and 2000 firewalls for SMBs with features like zero-touch provisioning, integrated threat prevention, and centralized cloud management.

These solutions offer a 99.8% block rate against phishing, malware, DNS, and IoT attacks, empowering SMEs to adopt robust, scalable edge security without overextending their resources. This shift toward affordable, automated, and easily managed solutions is accelerating edge security adoption among SMEs, hence driving the growth of the segment.

End Use Insights

The telecom & IT segment accounted for the largest revenue share of 26.07% in 2024, driven by its critical role in deploying and securing digital infrastructure from 5G networks to cloud connectivity and IoT ecosystems. Telecom operators ensure secure data transmission across countless endpoints, base stations, edge data centers, and mobile devices. This scale is driving the adoption of advanced edge security frameworks such as SASE, AI-enhanced threat detection, and zero-trust architectures.

Additionally, these solutions are essential to protect both the network itself and the downstream industries that rely on it for connectivity and services. For instance, in May 2025, Airtel launched an AI-powered fraud detection system, which automatically scans and blocks malicious websites for all mobile and broadband customers, a real-time security measure delivered directly by the carrier’s network. Consequently, the above-mentioned factors are contributing significantly in spurring the edge security market share.

The healthcare segment is expected to register the fastest growth of 22.6% during the forecast period. Evolving regulatory mandates to secure electronic protected health information (ePHI) are significantly driving the growth of the healthcare segment by compelling providers to adopt advanced, edge-native cybersecurity architectures that ensure data protection and operational resilience.

Additionally, as patient data flows through a network of distributed endpoints from remote monitoring devices and wearable health sensors to edge-based diagnostic systems, the need for edge security solutions is increasing. For instance, in December 2024, the U.S. Department of Health and Human Services (HHS) issued a Notice of Proposed Rulemaking (NPRM) to update the HIPAA Security Rule, emphasizing mandatory practices such as system activity monitoring, asset inventory management, and network segmentation. Consequently, these factors are contributing notably in spurring market growth.

Regional Insights

North America edge security market accounted for the largest revenue share of 40.8% in 2024, driven by the regulatory environment and public-private collaboration to secure critical infrastructure and data at the edge. The U.S. government’s launch of the Cyber Trust Mark in 2025 specifically targets IoT and edge device manufacturers, setting minimum security standards that vendors must meet to sell into federal and regulated markets. Additionally, the National Institute of Standards and Technology (NIST) is actively working on edge-focused zero trust architecture guidelines, which are influencing procurement decisions in the defense and healthcare sectors. Moreover, major telecom providers like AT&T and Verizon are also contributing substantially to driving the market growth in this region.

U.S. Edge Security Market Trends

The U.S. edge security market is shaped by national cybersecurity strategies, regulatory initiatives, and enterprise-level innovation. Federal efforts such as the Cyber Trust Mark and expanded BGP/RPKI requirements for companies seeking government contracts are setting higher benchmarks for edge and IoT device security. This policy-driven environment compels vendors and integrators to embed edge-native protections and cryptographic controls into their offerings.

Europe Edge Security Market Trends

The Europe edge security market is anticipated to register significant growth from 2025 to 2033, owing to a strategic emphasis on digital sovereignty and regional cybersecurity resilience. Additionally, European Union institutions are accelerating edge security market growth by implementing robust protective frameworks aimed at enhancing cyber resilience, regulatory compliance, and digital sovereignty across member states. The rollout of legislation like the NIS2 Directive and the Digital Operational Resilience Act (DORA) mandates that critical infrastructure providers, including those in finance, energy, and telecom, adopt advanced, real-time cybersecurity measures at the edge.

The UK edge security market is experiencing notable growth driven by government-driven regulatory and legislative action aimed at improving cybersecurity across digital infrastructure and connected devices. In May 2025, the government introduced the Cyber Security and Resilience Bill, an expansion of existing NIS regulations that mandate mandatory incident reporting, detailed cybersecurity audits, and tighter security controls across sectors. This legislation is driving demand for edge-native solutions capable of real-time monitoring, zero-trust segmentation, and automated incident response, enabling companies to meet increasing compliance obligations.

Germany edge security market is experiencing growth driven by increasing cyber threats, stringent regulatory frameworks, and rapid digital transformation across industries. A key trend is the strong emphasis on data sovereignty and compliance, prompting many organizations to adopt edge computing to keep sensitive data locally encrypted and processed, thereby reducing exposure to cyber risks and ensuring adherence to strict data residency laws. The market is further propelled by widespread investments in cloud-native security solutions, AI-powered threat detection, and zero-trust frameworks, reflecting Germany’s focus on advanced, automated defenses. Additionally, government initiatives aimed at bolstering national cybersecurity resilience and the establishment of dedicated cyber defense units underscore the strategic importance of edge security. The competitive landscape features both global leaders and strong local players innovating in areas such as DevSecOps integration and AI-enhanced monitoring.

Asia Pacific Edge Security Market Trends

The Asia Pacific edge security market is expected to register the fastest CAGR of 23.7% from 2025 to 2033, driven by a dual surge in 5G-driven network expansion and AI-powered threat detection. Leading telcos, such as Singapore’s Singtel and SK Telecom, are embedding edge-native security and AI-driven anomaly detection directly into 5G infrastructure, reducing response latency and managing threats at points of ingress. Meanwhile, government initiatives like Singapore’s edge data-center rollouts, paired with IoT public-sector projects, are adding urgency to securing distributed compute nodes. In India, the rapid deployment of security services to support its cloud-first strategy has positioned edge analytics as a key enabler of operational resilience.

Japan edge security market is experiencing substantial growth, due to a combination of government-driven cybersecurity reforms and strategic infrastructure modernization that underscores the importance of protecting distributed edge environments. Additionally, the Active Cyberdefence Law empowers Japanese authorities to proactively identify and neutralize foreign cyber threats and mandates critical infrastructure operators to report breaches. This legislative shift is pushing enterprises to deploy advanced edge-native systems such as Zero Trust frameworks, micro‑segmentation tools, and AI-powered anomaly detectiondirectly at network boundaries and device endpoints, ensuring that real‑time threat detection aligns with national defense requirements.

China edge security market held a substantial revenue share in 2024, driven by its aggressive rollout of AI-enhanced cybersecurity initiatives and large-scale edge computing deployments. The Ministry of Industry and Information Technology (MIIT) emphasized integrating AI into cybersecurity at an industry expo in Shanghai, noting this move will "spur the development of new technologies, products and models in the cybersecurity space".

Additionally, China is deploying 5G-enabled edge computing in strategic use cases, such as China Telecom's trials that combine network slicing with Multi-access Edge Computing (MEC) for smart manufacturing-processing real-time video streams with <20 ms latency and isolating data flows at the edge for improved performance and security. Consequently, the aforementioned factors are contributing significantly to boosting market growth.

Key Edge Security Company Insights

Key players operating in the edge security industry are Palo Alto Networks, Fortinet, Cisco Systems, Zscaler, and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2024, Fortinet completed the acquisition of Lacework, and this acquisition enhances Fortinet’s Security Fabric by integrating Lacework’s advanced cloud security technology, which includes AI and machine learning capabilities, enabling consistent protection across on-premises and cloud environments.

-

In May 2024, Palo Alto Networks launched new security solutions infused with its proprietary Precision AI technology, combining machine learning, deep learning, and generative AI to provide real-time protection against advanced cyber threats. These solutions, including AI Access Security, AI Security Posture Management, and AI Runtime Security, are designed to help organizations safely adopt AI by securing AI ecosystems.

Key Edge Security Companies:

The following are the leading companies in the edge security market. These companies collectively hold the largest market share and dictate industry trends.

- Palo Alto Networks

- Fortinet

- Cisco Systems

- Zscaler

- Cloudflare

- Check Point Software Technologies

- Akamai Technologies

- VMware (Broadcom)

- Trend Micro

- McAfee (Trellix)

- Forcepoint

- Sophos

- Barracuda Networks

- Hewlett Packard Enterprise (Aruba Networks)

- Juniper Networks

Edge Security Market Report Scope

Report Attribute

Details

Market size in 2025

USD 31.56 billion

Revenue forecast in 2033

USD 144.32 billion

Growth rate

CAGR of 20.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report Organization Size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, organization size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Palo Alto Networks; Fortinet; Cisco Systems; Zscaler; Cloudflare; Check Point Software Technologies; Akamai Technologies; VMware (Broadcom) Trend Micro; McAfee (Trellix); Forcepoint; Sophos; Barracuda Networks; Hewlett Packard Enterprise (Aruba Networks); Juniper Networks

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edge Security Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global edge security market report based on component, deployment mode, organization size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Secure Access Service Edge (SASE)

-

Secure Web Gateways (SWG)

-

Cloud Access Security Brokers (CASB)

-

Firewall-as-a-Service (FWaaS)

-

Zero Trust Network Access (ZTNA)

-

Edge Firewalls/UTM Appliances

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud-Based

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Manufacturing

-

Healthcare

-

Retail

-

Telecom & IT

-

Energy & Utilities

-

BFSI

-

Transportation & Logistics

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global edge security market size was valued at USD 26.64 billion in 2024 and is expected to reach USD 31.56 billion in 2025.

b. The global edge security market is expected to witness a compound annual growth rate of 20.9% from 2025 to 2033 to reach USD 144.32 billion by 2033.

b. Solution segment dominated the market and accounted for the revenue share of 62.8% in 2024 due to the rising demand for AI-driven security platforms that protect IT environments across edge, cloud, and hybrid infrastructures.

b. Some of the key companies operating in the edge security market include Palo Alto Networks, Fortinet, Cisco Systems, Zscaler, Cloudflare, Check Point Software Technologies, Akamai Technologies, VMware (Broadcom) Trend Micro, McAfee (Trellix), Forcepoint, Sophos, Barracuda Networks, Hewlett Packard Enterprise (Aruba Networks), Juniper Networks and Others

b. The market growth is driven by the rising need to protect data and applications at distributed endpoints as enterprises adopt hybrid work models, edge computing, and IoT at scale. With increasing cyberattacks targeting remote and edge devices, organizations are prioritizing zero trust network architectures (ZTNA), Secure Access Service Edge (SASE), and AI-driven edge firewalls to secure decentralized infrastructures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.