- Home

- »

- Automotive & Transportation

- »

-

Smart Transportation Market Size, Industry Report, 2030GVR Report cover

![Smart Transportation Market Size, Share & Trends Report]()

Smart Transportation Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution (Ticketing Management System, Parking Management System, Integrated Supervision System), By Service, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-246-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Transportation Market Summary

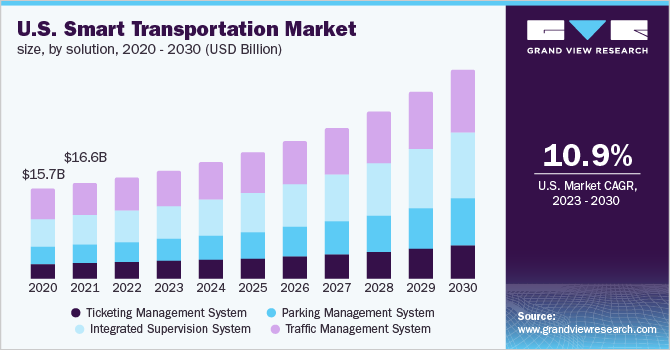

The global smart transportation market size was estimated at USD 110.53 billion in 2022 and is projected to reach USD 285.12 billion by 2030, growing at a CAGR of 13.0% from 2023 to 2030. The market growth is driven by growing advancements in urban projects, government initiatives aimed at reducing greenhouse gas emissions, and the increasing demand for technology integration in traffic control systems.

Key Market Trends & Insights

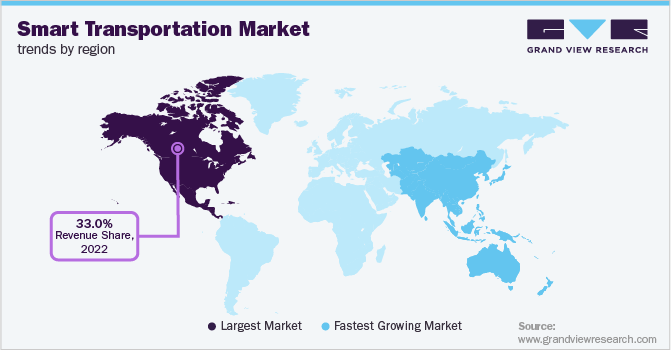

- North America dominated the global smart transportation market with the largest revenue share of over 33% in 2022.

- By solution, the traffic management segment led the market with the largest revenue share of over 32% in 2022.

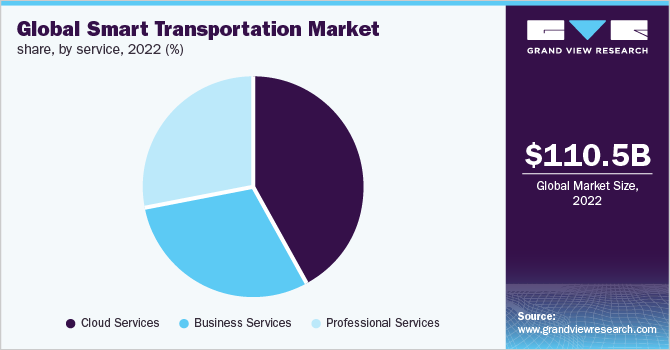

- By service, the cloud services segment led the market with the largest revenue share of over 42.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 110.53 Billion

- 2030 Projected Market Size: USD 285.12 Billion

- CAGR (2023-2030): 13.0%

- North America: Largest market in 2022

Lack of good quality and safe public transportation, inadequate capacity to manage public transport, concerns about reduced road safety, poor traffic management, and parking problems are significant issues affecting most cities (including pedestrian walkways). Thus, demand for smart transportation systems is likely to witness significant growth in the near future. Factors such as urbanization, the increased acceptance of IoT-based technology, and the expansion of 5G-based connectivity make smart transportation infrastructure easier to execute.In 2018-2019, to improve traffic management, boost safety, lessen maintenance costs, and enable more efficient use of transportation networks, the market experienced a tremendous expansion in the application of current technology in cars and transportation infrastructure. Furthermore, the introduction of autonomous vehicles, increased expenditures on smart city initiatives, the fall in vehicle ownership, and the expansion of mobility as a service (MaaS) will likely provide significant growth opportunities for players in the smart transportation industry.

For instance, in September 2022, Indra Sistema S.A. announced a partnership with Masmovil Group, a broadband service provider, to create an advanced ecosystem that will fuel the growth of smart 5G services and solutions for the transportation sector. The partnership aims to develop and test innovative solutions based on the 5G communications standard, promoting smarter, more connected, and sustainable mobility.

Several industries around the world were negatively impacted by the COVID-19 outbreak. Government-imposed national shutdowns and quarantines to stop the disease's spread had a significant impact on businesses all around the world, including the market for smart mobility. The transportation sector was significantly impacted by the COVID-19 pandemic.

Travel restrictions implemented to stop the transmission of disease hindered companies' capacity to move people. Total revenues, growth, and people’s income in the transportation sector reduced drastically, as a result. To enhance their offerings and regain consumer trust, travel organizations are keenly focused on data-driven decisions, as public transportation remains highly vulnerable to disease outbreaks. These factors are expected to boost the demand for private transportation services during the forecast period.

The prolonged downtime and substantial capital costs associated with rebuilding the current infrastructure will hinder industry growth over the forecast period. Smart transportation integrates a variety of elements, including hardware, application, and mobile network parts made by various manufacturers, leading to compatibility issues since there is no defined approach. Additionally, communication norms differ greatly across nations, which present difficulties for businesses looking to market their products internationally. However, it is anticipated that expanding demand in developing countries such as China, Brazil, and India would open up new opportunities.

Solution Insights

The traffic management segment accounted for the largest market share of over 32% in 2022 and is projected to remain dominant throughout the forecast period. Integrated monitoring systems, intelligent parking systems, transportation planning systems, and ticketing management solutions are among the essential marketable solutions. The traffic management system remains the most well-known option in the market.

Traffic management systems are in demand due to features such as the high level of safety, effective management of traffic congestion, low energy consumption, and low pollution, among others. The system also promises to solve conventional difficulties such as delays in transit, and provides additional security for citizens.

For instance, in August 2022, LG CNS announced proposing systems for both public transit and electric vehicles. The company aims to offer consulting services for smart city design projects for East Kalimantan, Borneo Island, and the new capital city of Indonesia. Moreover, the company also aims to develop a foundational plan for the introduction of electric vehicles and public transit networks.

Parking management is another segment anticipated to register the highest growth rate in the global market over the forecast period. These systems include exit ticket readers, decentralized payment collecting systems, and ticket dispensers at the entrance or exit. The adoption of cloud-based parking services and an increase in off-street parking are driving the segment's growth. For instance, due to the COVID-19 outbreak, jurisdictions have restored parking fines for off-street parking. In May 2020, in some of its off-street parking areas, the Lancaster City Council reinstated parking fees.

Service Insights

The cloud services segment accounted for the largest market share of over 42.4% in 2022. The segment is anticipated to retain its dominance over the forecast period owing to its capacity to handle the massive amounts of data created by mobile technology and sensors. With the advancement of technologies such as big data and cloud technology, these are becoming increasingly crucial in transportation systems. A safe storage facility and processing power are offered by the cloud platforms to help with traffic forecasts. The increased use and interest in machine learning/data analytics, IoT, and cybersecurity will impact smart transportation ventures during the forecast period.

The professional service segment continues to witness increased penetration in the smart transportation industry. These also continue to significantly differ from each other, as they offer, among other things, design guidance, strategy formulation, and implementation support. These components will therefore support the segment's expansion. A rise in the demand for professional services is a result of the upgradation of outdated systems to more modern ones, made possible by the increased need for consulting services. With the help of expert services available in the market, traffic control, smart parking, and other options can be rapidly helped with better advice and can make intelligent decisions.

Regional Insights

North America accounted for over 33% of the global market share in 2022. The region is the largest adopter of smart transportation solutions owing to a growing emphasis of regional governments on improving the transportation infrastructure, against the backdrop of congested highways, poor air quality, and growing highway accidents and fatalities. Major companies in the ICT sector that are suppliers of smart transportation solutions are established in the U.S.

Other major companies related to transport infrastructure are likely to collaborate and innovate solutions by using a wide spectrum of their technical expertise and benefit the region as a whole. For instance, in November 2022, Iteris, Inc. announced a four-year agreement with the North Carolina Department of Transportation (NCDOT), to increase mobility across the state using its ClearGuide system. To increase traffic flow and safety, ClearGuide helps analyze and visualize traffic data.

Europe is expected to present significant opportunities for industry expansion, owing to the rapid adoption of technology and rising traffic congestion in the major cities. Factors such as increased car use, which leads to increased parking challenges, and increased demand for efficient transportation worldwide are predicted to accelerate the growth of the intelligent transportation industry. The smart transportation market is expected to benefit from rapid evolution and significant technology advancements in semi-autonomous and autonomous vehicles.

For instance, in January 2022, Kapsch TrafficCom AG provided a free-flow AET at toll plazas by introducing All-Electronic Tolling (AET) to the New Hampshire Transportation Department (NHDOT). For vehicles without a toll transponder, video tolling will be possible because of the AET's license plate reading cameras, sensors, and in-pavement treadles. The free new roadways at all NHDOT toll locations will also give drivers more convenience and quicker travel times.

Key Companies & Market Share Insights

The market is highly competitive, with several players catering to different sectors. The presence of established players is a crucial factor deterring potential players from entering the market. However, the increasing development of differentiated smart transportation solutions and services in the market is expected to create growth opportunities for new entrants. Market players are focusing on expanding their businesses and strengthening their market positions through collaborations and partnerships.

Key players are adopting strategic approaches to dominate the market share and expand their dominance globally. One of the best strategies is to build a novel system or service that buyers and end-users continue to demand. For instance, in October 2022, Iteris, Inc. announced that it received approval from the City of Anaheim to enforce its recently unveiled set of managed services as part of an ongoing deal for a regional smart mobility, security, and sustainability program. The effective management of major transportation operations using Iteris' cloud-enabled managed services reduces traffic congestion, boosts safety, and creates a more robust, egalitarian, and sustainable transportation infrastructure. Some prominent players in the global smart transportation market include:

-

Accenture PLC

-

Alstom, SA

-

Cisco System, Inc.

-

Cubic Corporation

-

General Electric Company (GE)

-

Indra Sistema S.A.

-

International Business Machines Corporation

-

Kapsch

-

LG CNS Corporation

-

Xerox Holdings Corporation

Smart Transportation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 121.36 billion

Revenue forecast in 2030

USD 285.12 billion

Growth rate

CAGR of 13.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Accenture PLC; Alstom, SA; Cisco System, Inc.; Cubic Corporation; General Electric Company (GE); Indra Sistema S.A.; International Business Machines Corporation; Kapsch; LG CNS Corporation; Xerox Holdings Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Transportation Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart transportation market report based on solution, service, and region:

-

Smart Transportation Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ticketing Management System

-

Parking Management System

-

Integrated Supervision System

-

Traffic Management System

-

-

Smart Transportation Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud Services

-

Business Services

-

Professional Services

-

-

Smart Transportation Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

- MEA

-

Frequently Asked Questions About This Report

b. The global smart transportation market size was estimated at USD 110.53 billion in 2022 and is expected to reach USD 121.36 billion in 2023.

b. The global smart transportation market is expected to grow at a compound annual growth rate of 13.0% from 2023 to 2030 to reach USD 285.12 billion by 2030.

b. The traffic management system segment held the largest market share in 2022 with a share of more than 30% of the overall market. Increasing traffic congestion in the urban areas and a growing number of vehicles is driving the demand to deploy effective traffic management systems.

b. Key players in the smart transportation industry include Siemens AG, Kapsch, and TrafficCom. Furthermore, GE Company, Cubic Corp, Cisco Systems, and IBM Corp. are some key vendors in the market.

b. Growing demand in developing economies including India, Brazil, and China is anticipated to open new avenues for growth opportunities. The limited space for transportation network expansion is expected to further impact congestion costs, which in turn is expected to fuel smart transportation demand over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.