- Home

- »

- Next Generation Technologies

- »

-

Electric Sub-meters Market Size, Share, Industry Report 2033GVR Report cover

![Electric Sub-meters Market Size, Share & Trends Report]()

Electric Sub-meters Market (2025 - 2033) Size, Share & Trends Analysis Report By Phase (Single Phase, Three Phase), By Type, By Connectivity (Wired, Wireless), By End Use (Industrial, Commercial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-720-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Sub-meters Market Summary

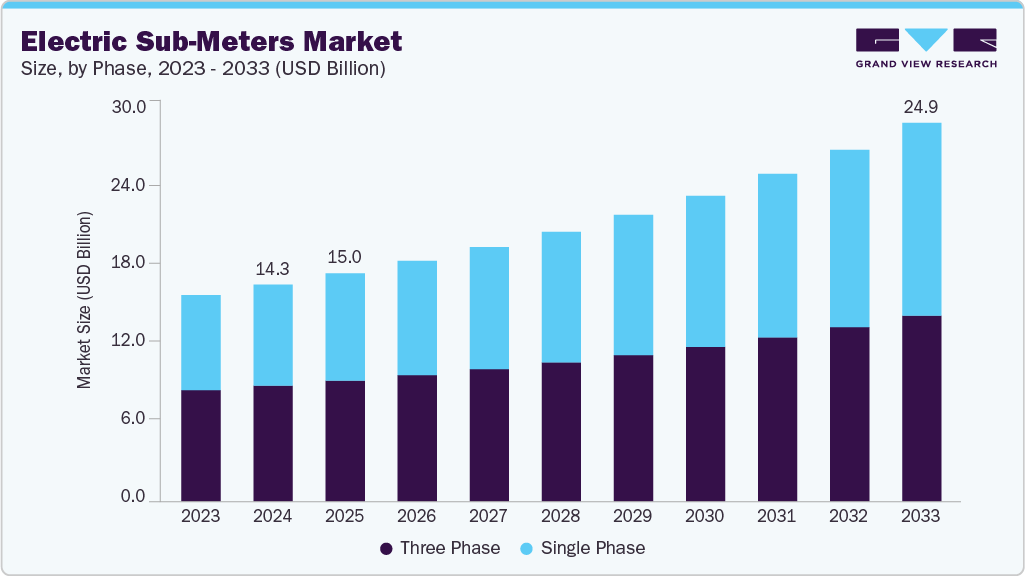

The global electric sub-meters market size was estimated at USD 14.26 billion in 2024 and is projected to reach USD 24.92 billion by 2033, growing at a CAGR of 6.5% from 2025 to 2033. This growth is driven by increasing adoption of smart grids, stricter energy efficiency regulations, rising demand for real-time energy monitoring with IoT integration, and the rapid expansion of industrial, commercial, and residential infrastructure projects worldwide.

Key Market Trends & Insights

- North America dominated the global electric sub-meters market with the largest revenue share of 31.0% in 2024.

- The electric sub-meters market in the U.S. led the North America market in 2024.

- By phase, three phase segment led the market, holding the largest revenue share of 53.4% in 2024.

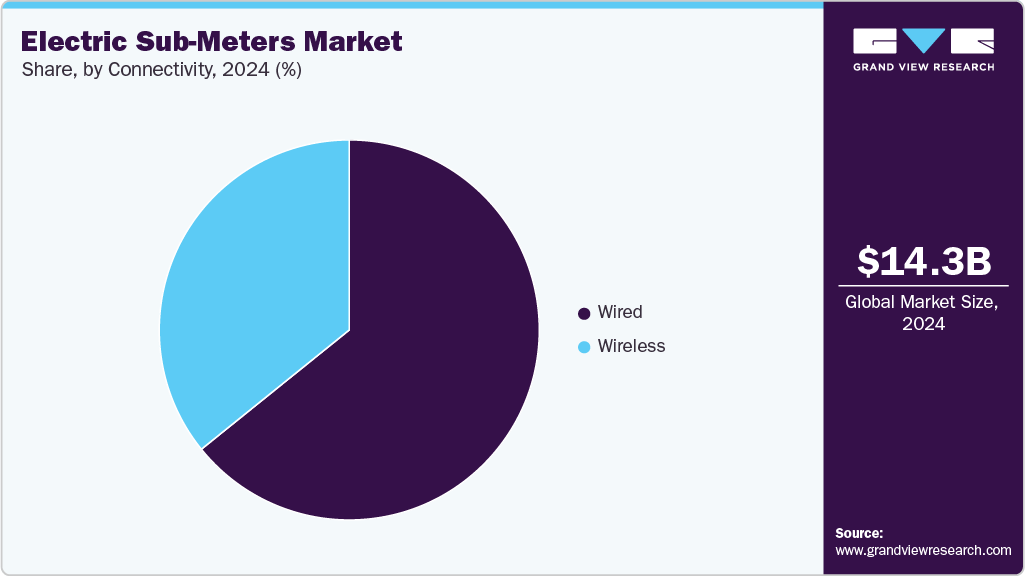

- By connectivity, the wired segment held the dominant position in the market.

- By end use, the industrial segment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 14.26 Billion

- 2033 Projected Market Size: USD 24.92 Billion

- CAGR (2025-2033): 6.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The current growth of the electric sub-meters market is supported by increasing demand for energy management and cost allocation in residential, commercial, and industrial sectors. The rising focus on reducing energy wastage and improving billing accuracy drives the adoption of sub-metering solutions. In addition, regulatory mandates and energy efficiency standards in various regions promote the installation of sub-meters to monitor consumption at granular levels, enabling accountability and optimized usage. Growing awareness about sustainability and environmental impacts also motivates consumers and businesses to adopt precise energy measurement tools that support responsible consumption behaviors.Moreover, the market is driven by technological advances such as IoT-enabled smart sub-meters that provide real-time monitoring, remote access, and integration with building management and energy management systems. Growing urbanization and smart city initiatives contribute significantly to increased deployment of sub-metering solutions for efficient resource and infrastructure management. The rising need for transparent energy consumption data to support sustainability goals, demand-side management efforts, and regulatory compliance further reinforces market growth. Moreover, developments in wireless communication protocols and cloud-based platforms enhance the feasibility and appeal of advanced sub-metering systems.

Furthermore, digital transformation within the energy sector encourages utilities and property managers to adopt advanced sub-metering systems capable of interfacing with cloud analytics, AI-driven insights, and smart grid technologies. These innovations facilitate proactive maintenance, predictive insights, and enhanced operational efficiency by providing accurate and timely data on energy flows. Expansion of renewable energy installations, distributed energy resources, and electric vehicle infrastructure increases the complexity of energy distribution systems, necessitating precise and adaptable metering solutions. The increasing emphasis on cost transparency and energy efficiency initiatives at corporate and governmental levels also drives ongoing demand for electric sub-meters, ensuring sustained growth in the market.

Phase Insights

The three phase segment led the market in 2024, accounting for over 52% of global revenue due to its broad applicability in industrial, commercial, and large residential complexes that require accurate measurement of high-capacity and multi-phase energy consumption. Three-phase sub-meters support complex load management, enabling more effective balancing across phases and reducing energy losses, which is essential for grid stability. Their enhanced durability and ability to handle fluctuating and heavy power loads make them indispensable in manufacturing, data centers, and large commercial buildings, encouraging continuous demand and innovation.

The single phase segment is predicted to experience the fastest growth in the forecast years, driven by expansion in urban housing and smaller commercial establishments where energy monitoring demands are increasing. In addition, solutions must be compact, cost-effective, and easy to install. Advancements in agentic capabilities allow single-phase sub-meters to provide real-time consumption data, remote accessibility, and integration with smart home systems, making them highly appealing to property managers and consumers. Increased penetration of renewable home energy systems, such as rooftop solar, and the rise in electric vehicles requiring smart charging, further accelerate demand for single-phase solutions.

Type Insights

The electronic sub-meters segment accounted for the largest market revenue share in 2024 due to their superior measurement precision, adaptability, and ability to integrate with emerging digital energy architectures. Electronic sub-meters accommodate complex tariff structures, including time-of-use and demand charges, enabling flexible billing models. Enhanced cyber-physical integration, with agentic AI facilitating fault detection and energy pattern recognition, increases energy management efficacy. Their modular design supports upgrades and scalability, aligning with evolving smart grid frameworks and making electronic sub-meters a core component of modern energy infrastructure.

The smart sub-meters segment is expected to grow at the fastest CAGR during the forecast period, driven by innovations that transform traditional metering into intelligent, connected devices capable of autonomous operation. These sub-meters harness AI to analyze consumption trends, optimize energy distribution, and support grid-edge computing. Integration with blockchain for secure, transparent data management and decentralized energy transactions expands their applicability. The ability to interact dynamically with distributed ledger systems and interoperable smart devices enhances energy traceability and automated billing, reinforcing their significance in future-ready energy ecosystems.

Connectivity Insights

The wired segment accounted for the prominent market revenue share in 2024, attributable to its dependable connectivity, minimal latency, and secured data transmission necessary for mission-critical operations in utilities and manufacturing. Wired sub-metering systems support extensive geographical spread within a facility, integrating seamlessly with industrial control systems and automation protocols such as Modbus and BACnet. The assurance of consistent data integrity and minimal interference from electromagnetic sources supports utility providers and industrial users in maintaining operational oversight and regulatory compliance, making wired connections indispensable in complex energy management scenarios.

The wireless segment is anticipated to grow significantly during the forecast period as it offers flexible deployment and integration options that address the limitations of wired infrastructures. Wireless sub-meters enable rapid installation in retrofit applications and geographically dispersed environments such as multi-tenant residential complexes and remote industrial sites. They support mesh networking and Low-Power Wide-Area Network (LPWAN) technologies that optimize battery life and data throughput, facilitating granular energy monitoring and AI-driven predictive analytics. Enhanced security features, including end-to-end encryption and anomaly detection, safeguard communication channels, increasing trust in wireless metering solutions for critical infrastructure.

End Use Insights

The industrial segment accounted for the largest market revenue share in 2024 due to its high-energy intensity and the need for accurate consumption tracking to optimize production, reduce waste, and comply with environmental regulations. Agentic electric sub-meters support complex operational environments by providing condition-based monitoring, facilitating energy audits, and enabling participation in demand response and energy markets. Industry 4.0 integration further leverages AI analytics to correlate energy consumption with production metrics, improving asset utilization and operational uptime through predictive maintenance and real-time adjustments.

The residential segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing consumer awareness of energy costs, environmental concerns, and adoption of smart home technology. Agentic electric sub-meters empower residents with actionable insights, enabling energy-saving behaviors and integration with home renewable energy sources and battery systems. Demand for smart charging solutions for electric vehicles and participation in utility demand response programs emphasize the growing complexity of residential energy management. Policy initiatives promoting energy transparency and net-zero targets amplify investment in residential sub-metering infrastructure.

Regional Insights

North America electric sub-meters market dominated the global market with a revenue share of over 31.0% in 2024, driven by extensive smart grid rollout, technological innovation, and regulatory frameworks promoting energy efficiency and carbon reduction. Multiple utility-scale AI pilot projects and collaborations with technology firms are adapting to the rapid adoption of agentic electric sub-meters. Strong consumer demand for sustainable and transparent energy services and government incentives for smart infrastructure development reinforce market expansion. In addition, North America benefits from a mature digital communication infrastructure, facilitating real-time energy data exploitation.

U.S. Electric Sub-meters Market Trends

The electric sub-meters industry in the U.S. is expected to grow significantly in 2024, driven by nationwide investments in grid modernization and renewable energy integration. Policies such as tax credits for smart metering and grid resiliency initiatives encourage utilities and private developers to deploy intelligent sub-metering systems. High urbanization rates and technological readiness permit the incorporation of next-generation energy management solutions. Agile regulatory environments support innovation while promoting consumer protection and efficient energy distribution, sustaining demand for agentic sub-metering technologies.

Europe Electric Sub-meters Market Trends

The European electric sub-meters market is expected to grow significantly over the forecast period due to stringent EU energy directives emphasizing sustainability, regulatory compliance, and consumer empowerment. Harmonized standards and incentives for energy efficiency prompt widespread adoption of advanced electric sub-metering solutions capable of supporting multi-energy vectors, including electricity, heating, and cooling. Cross-border energy trade in the EU motivates enhanced metering precision and transparency, supported by agentic AI facilitating interoperability and real-time monitoring.

Asia Pacific Electric Sub-eters Market Trends

The electric sub-meters industry in the Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period, driven by rapid industrialization, urbanization, and government-backed infrastructure modernization. Expanding electricity access in developing economies necessitates efficient and scalable metering solutions, driving adoption of agentic electric sub-meters with low deployment costs and high adaptability. Increased renewable energy penetration and smart grid projects require granular monitoring and control capabilities. Regional investments in digital infrastructure, IoT, and AI ecosystems enhance the feasibility of sub-metering systems, enabling broad market penetration across emerging and developed areas.

Key Electric Sub-meters Company Insights

Some key companies in the electric sub-meters industry are Siemens AG, Honeywell International Inc., Schneider Electric, and ABB

-

Schneider Electric is an energy technology provider of energy management and automation solutions, with a strong presence in the electric sub-meters market. The company offers a range of smart electric sub-metering products with advanced features such as real-time energy monitoring, IoT integration, and compatibility with building automation systems. Schneider Electric focuses on enhancing energy efficiency and cost allocation in residential, commercial, and industrial sectors through its reliable and scalable sub-metering solutions.

-

Siemens is a prominent player in the electric sub-meter market, delivering advanced sub-metering devices and integrated energy management solutions for optimized power consumption monitoring. Siemens incorporates state-of-the-art technology such as smart metering, IoT connectivity, and data analytics to enable utilities and end-users to achieve accurate energy measurement and enhanced operational efficiency. The company’s electric sub-meters cater to diverse applications, including residential complexes, commercial buildings, and industrial facilities, helping customers reduce energy waste and improve billing accuracy.

Key Electric Sub-meters Companies:

The following are the leading companies in the electric sub-meters market. These companies collectively hold the largest market share and dictate industry trends.

- Schneider Electric

- Siemens

- Honeywell International Inc.

- ABB

- Itron, Inc.

- Landis+Gyr

- Eaton

- General Electric Company

- Leviton Manufacturing Co., Inc.

- Zhejiang Chint Instrument & Meter Co., Ltd

Recent Developments

-

In August 2025, the Kerala State Electricity Board (KSEB) announced the establishment of a specialized sub-division dedicated to overseeing the implementation of smart electricity metering across the state. This focused organizational unit aims to ensure the effective deployment, monitoring, and management of advanced metering infrastructure, which is expected to enhance energy efficiency, improve billing accuracy, and support the state’s broader digitalization goals in the power sector. The initiative reflects KSEB’s strategic commitment to modernizing its electricity distribution network and promoting sustainable energy management through cutting-edge technology adoption.

-

In September 2024, Trilliant Holdings Inc. partnered with Milton Hydro Services Inc. (MHSI), a Milton Hydro Holdings Inc. subsidiary. This collaboration launched a community-wide sub-metering initiative utilizing Trilliant Holding Inc.’s Smart Building platform to enhance customer experience and facilitate energy savings. By deploying this state-of-the-art technology, MHSI aims to empower its customers with innovative energy management services that support efficient consumption and sustainability throughout the ongoing energy transition.

-

In August 2023, Northleaf Capital Partners Ltd. announced a partnership with Provident Energy Management Inc., a prominent provider of building automation services and sub-metering primarily serving the multi-residential new construction sector. As part of this collaboration, funds managed by Northleaf Capital Partners Ltd. acquired a majority stake in Provident, while the company’s existing management team retained a minority interest. This alignment aims to accelerate Provident’s growth trajectory by leveraging Northleaf Capital Partners Ltd’s capital resources and strategic expertise, positioning the company for expanded market presence and enhanced service delivery within its core sectors.

Electric Sub-meters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.00 billion

Revenue forecast in 2033

USD 24.92 billion

Growth rate

CAGR of 6.5% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, type, connectivity, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Schneider Electric SE; Siemens AG; Honeywell International Inc.; ABB Ltd.; Itron, Inc.; Landis+Gyr Group AG; Eaton Corporation plc; General Electric Company; Leviton Manufacturing Co., Inc.; Zhejiang CHINT Instrument Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Sub-Meters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electric sub-meters market report based on phase, type, connectivity, end use, and region:

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Single Phase

-

Three Phase

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronic Sub-Meters

-

Digital Sub-Meters

-

Smart Sub-Meters

-

Analog/Conventional Sub-Meters

-

Other

-

-

Connectivity Outlook (Revenue, USD Million, 2021 - 2033)

-

Wired

-

Wireless

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Commercial

-

Residential

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric sub-meters market size was estimated at USD 14.26 billion in 2024 and is expected to reach USD 15.00 billion in 2025.

b. The global electric sub-meters market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2033 to reach USD 24.92 billion by 2033.

b. North America dominated the electric sub-meters market with a share of 31.0% in 2024. This is attributable to extensive smart grid rollout, technological innovation, and regulatory frameworks promoting energy efficiency and carbon reduction.

b. Some key players operating in the electric sub-meters market include Schneider Electric, Siemens, Honeywell International Inc., ABB, Itron, Inc., Landis+Gyr, Eaton , General Electric Company, Leviton Manufacturing Co., Inc., and Zhejiang Chint Instrument & Meter Co.,Ltd.

b. Key factors that are driving the electric sub-meters market growth include increasing adoption of smart grids, stricter energy efficiency regulations, rising demand for real-time energy monitoring with IoT integration, and the rapid expansion of industrial, commercial, and residential infrastructure projects worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.