- Home

- »

- Semiconductors

- »

-

Electrical Resistor Market Size, Share & Growth Report, 2030GVR Report cover

![Electrical Resistor Market Size, Share & Trends Report]()

Electrical Resistor Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Linear Resistor, Fixed Resistor, Variable Resistor, Non-linear Resistor), By Product Type, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-366-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrical Resistor Market Summary

The global electrical resistor market size was estimated at USD 5.83 billion in 2023 and is projected to reach USD 8.48 billion by 2030, growing at a CAGR of 5.9% from 2024 to 2030. The market is witnessing substantial growth driven by the escalating demand for electronic devices and the rapid advancements in technology.

Key Market Trends & Insights

- Asia Pacific dominated the electrical resistor market with a share of over 39.0% in 2023.

- Based on type, the fixed resistor segment dominated the market in 2023 and accounted for a more than 34% share of global revenue.

- Based on product type, the power supplies segment dominated the market in 2023.

- Based on application, the distribution channels segment dominated the market in 2023.

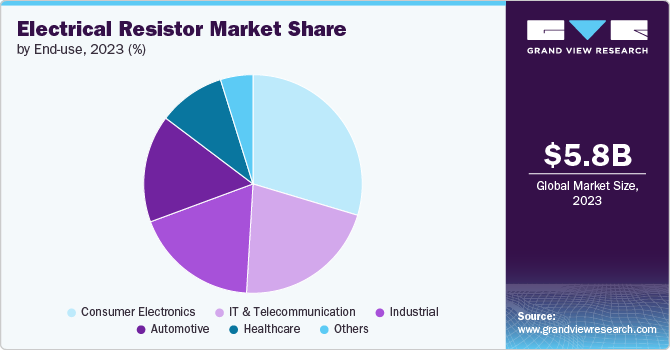

- Based on end use, the consumer electronics segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.83 Billion

- 2030 Projected Market Size: USD 8.48 Billion

- CAGR (2024-2030): 5.9%

- Asia Pacific: Largest market in 2023

Resistors are fundamental components in electronic circuits, responsible for controlling current flow, dividing voltages, and protecting components from excessive current. The market is buoyed by several key trends, drivers, and opportunities that are shaping its landscape. The market growth is primarily driven by the expanding electronics industry.

Consumer electronics, including smartphones, tablets, and wearable devices, rely heavily on resistors for their operation. The proliferation of these devices, alongside the continuous innovation in features and functionalities, ensures a steady demand for resistors. The automotive industry is another major driver, especially with the increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). These technologies require a multitude of resistors for battery management, power conversion, and various control systems.

Moreover, the transition to renewable energy sources such as solar and wind power is boosting the demand for resistors in energy management systems. Resistors are crucial in controlling and distributing electrical energy efficiently in these systems. Additionally, the increasing focus on energy efficiency and smart grid technologies is further propelling the market. Industrial automation and the shift towards Industry 4.0 are also significant drivers, as modern industrial systems rely on resistors for accurate and efficient operation.

One of the predominant trends in the electrical resistor market is the miniaturization of electronic components. As devices become smaller and more integrated, the demand for compact, high-performance resistors is increasing. Additionally, the rise of IoT (Internet of Things) devices is propelling the need for resistors that can support complex, interconnected systems. Another significant trend is the push towards higher precision and reliability, particularly in sectors such as automotive, aerospace, and medical devices, where safety and performance are paramount.

The market presents numerous opportunities for growth and innovation. The development of advanced materials and technologies is opening new avenues for resistor performance enhancements. For instance, the use of materials like carbon composites and thin films can lead to resistors with higher precision and stability. Additionally, the sustainability trend is creating opportunities for resistors designed to be more energy-efficient and environmentally friendly. The increasing integration of AI and machine learning in electronic systems also presents opportunities for the resistor market. These technologies require sophisticated electronic components that can support complex algorithms and processing power, thereby driving the demand for high-quality resistors.

Type Insights

The fixed resistor segment dominated the market in 2023 and accounted for a more than 34% share of global revenue. Fixed resistors hold a dominant position in the electrical resistors market due to their widespread use across various applications. These resistors are favored for their reliability, stability, and cost-effectiveness, making them integral components in consumer electronics, automotive, and industrial applications. The simplicity of their design, with a fixed resistance value that doesn't change with temperature or electrical load, contributes to their widespread adoption. The fixed resistor segment is characterized by a vast array of types, including carbon film, metal film, and wire-wound resistors, each catering to different performance requirements. This diversity ensures that fixed resistors remain a staple in both low-power applications and high-precision tasks, underpinning their continued market dominance.

The variable resistors segment is projected to witness significant growth from 2024 to 2030. Variable resistors, including potentiometers and rheostats, represent the fastest-growing segment in the electrical resistors market. Their ability to adjust resistance in a circuit dynamically makes them crucial for applications requiring fine-tuning and calibration, such as audio equipment, instrumentation, and advanced control systems. The rise in consumer demand for customizable electronic devices and the increasing complexity of automotive and industrial systems drive the growth of variable resistors. Innovations in material science and miniaturization further propel this segment, enabling more compact and efficient designs. As electronics continue to evolve towards greater precision and adaptability, the variable resistor market is poised for significant expansion.

Product Type Insights

The power supplies segment dominated the market in 2023. Power supplies are the dominating product type in the electrical resistors market due to their critical role in regulating voltage and current within electronic circuits. Resistors in power supplies help manage electrical loads, protect components from overvoltage, and ensure stable operation of devices. The increasing demand for energy-efficient power solutions across various sectors, including consumer electronics, telecommunications, and industrial automation, underscores the importance of resistors in power supplies. The shift towards renewable energy sources and smart grid technologies also contributes to the robust demand, as resistors play a key role in energy conversion and distribution systems, reinforcing their market dominance.

The electric motors are the fastest-growing technology segment in the electrical resistor market driven by the expanding adoption of electric vehicles (EVs) and industrial automation. Resistors are essential in electric motor control systems for regulating speed, torque, and ensuring smooth operation. The global push towards electrification, supported by governmental incentives and advancements in motor technology, is fueling demand. Additionally, the increasing integration of electric motors in household appliances, robotics, and renewable energy systems further accelerates growth. The trend towards sustainability and energy efficiency aligns with the rising popularity of electric motors, making this segment a significant contributor to the resistor market's expansion.

Application Insights

The distribution channels segment dominated the market in 2023 driven by the extensive need for reliable electrical components in power transmission and distribution networks. Resistors are crucial for controlling voltage levels, protecting infrastructure from power surges, and ensuring efficient electricity flow across vast distances. The modernization of aging grid infrastructure, coupled with the expansion of electricity access in developing regions, fuels the demand for high-quality resistors. Additionally, the integration of smart grid technologies and the increasing use of renewable energy sources in the grid contribute to the prominence of distribution channels. This dominance is expected to continue as the global energy landscape evolves, requiring robust and resilient electrical components.

The power generation segment is experiencing significant growth, due to the rising investments in renewable energy sources and modern power generation technologies. Resistors are pivotal in managing electrical loads, protecting circuits, and ensuring efficient energy conversion in power plants, solar panels, wind turbines, and hydroelectric systems. As the global focus shifts towards reducing carbon emissions and increasing the share of renewable energy in the energy mix, the demand for advanced electrical resistors in power generation equipment is surging. This growth is further bolstered by innovations in energy storage solutions and smart grid technologies, which rely on resistors for effective power distribution and management.

End-use Insights

The consumer electronics segment dominated the market in 2023 due to the pervasive integration of resistors in everyday electronic devices. From smartphones and laptops to home appliances and wearable technology, resistors are essential for ensuring optimal performance and energy efficiency. The rapid pace of technological advancements and the constant demand for smaller, more powerful, and energy-efficient devices drive the significant consumption of resistors. Furthermore, the expansion of the Internet of Things (IoT) ecosystem, which relies heavily on interconnected smart devices, amplifies the need for reliable and high-performance resistors, solidifying the consumer electronics segment's dominance.

The automotive segment is experiencing significant growth in the electrical resistor market, propelled by the rapid adoption of electric vehicles (EVs) and advanced automotive electronics. Resistors are critical components in various automotive applications, including battery management systems, infotainment, climate control, and driver assistance systems. The shift towards autonomous driving and connected car technologies further enhances the demand for precise and durable resistors. Additionally, stringent regulatory standards aimed at reducing vehicle emissions and improving fuel efficiency drive the integration of more sophisticated electronic systems in vehicles, fueling the growth of the resistor market within the automotive sector.

Regional Insights

The electrical resistor market in North America is expected to hold a prominent position in the electrical resistor market driven by its advanced industrial landscape and technological innovation. The region's strong emphasis on research and development, coupled with the presence of leading electronics and automotive companies, fosters robust demand for resistors. The ongoing adoption of renewable energy solutions and smart grid technologies also contributes to market growth. Furthermore, the increasing focus on automation in various sectors, including manufacturing and healthcare, amplifies the need for reliable resistors to ensure efficient operation of sophisticated electronic systems.

U.S. Electrical Resistor Market Trends

The electrical resistor market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030 and is driven by technological advancements and a strong focus on innovation across various industries. The country’s leading position in the development and adoption of cutting-edge technologies in consumer electronics, automotive, and industrial sectors fuels significant demand for resistors. Additionally, the U.S. government’s emphasis on infrastructure modernization and renewable energy projects further propels market growth. The presence of major technology companies and a robust research and development ecosystem ensures continuous advancements in resistor technology, supporting the market’s expansion in the U.S.

Asia Pacific Electrical Resistor Market Trends

Asia Pacific stands as both the dominating and fastest-growing region in the electrical resistors market, driven by the robust industrial base, growing consumer electronics market, and rapid urbanization. Countries like China, Japan, South Korea, and India are major hubs for electronics manufacturing, automotive production, and renewable energy projects, creating substantial demand for resistors. The region's strong focus on technological innovation, coupled with significant investments in infrastructure and smart city initiatives, further boosts market growth. Additionally, the rising disposable income and increasing penetration of electronic devices among consumers amplify the demand for high-quality resistors, reinforcing Asia Pacific's dominant and accelerating market position.

Europe Electrical Resistor Market Trends

The electrical resistor marketinEurope represents a significant market share characterized by its strong automotive industry and commitment to sustainability. The region's stringent regulatory standards for energy efficiency and emissions drive the adoption of advanced resistors in automotive and industrial applications. Additionally, Europe’s focus on renewable energy sources, such as wind and solar power, creates substantial demand for resistors in energy management and distribution systems. The presence of leading electronics manufacturers and a well-established research infrastructure further supports market growth, positioning Europe as a key market for electrical resistors.

Key Electrical Resistor Company Insights

Key players operating in the market include Cressall Resistors Ltd.; Bourns Inc.; Zonkas Electronic Co. Ltd.; Murata Manufacturing Co. Ltd.; TE Connectivity; Viking Tech Corporation; YAGEO Group; Japan Resistor Mfg. Co. Ltd.; KOA Speer Electronics Inc. (KOA Corporation); and Vishay Intertechnology Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, Cressall Resistors, one of the leading manufacturer of automotive resistors, will showcase its lineup of power resistor solutions tailored for the automotive sector at The Battery Show Europe, scheduled for June 18-20, 2024, at Messe Stuttgart in Germany. This event stands as Europe’s premier exhibition for battery and hydrogen electric vehicle (EV) technologies, bringing together industry leaders, major EV component manufacturers, and automotive suppliers.

-

In April 2022, TE Connectivity (TE), a prominent provider of connectivity solutions and sensors, has launched the HPBA series braking resistor assemblies designed to enhance braking performance in variable frequency and servo drive applications. These assemblies offer improved control and acceleration in drive systems used across industrial applications, robotics, and warehouse automation, thereby boosting reliability and operational efficiency.

Key Electrical Resistor Companies:

The following are the leading companies in the electrical resistor market. These companies collectively hold the largest market share and dictate industry trends.

- Cressall Resistors Ltd.

- Bourns Inc.

- Zonkas Electronic Co. Ltd.

- Murata Manufacturing Co. Ltd.

- TE Connectivity

- Viking Tech Corporation

- YAGEO Group

- Japan Resistor Mfg. Co. Ltd.

- KOA Speer Electronics Inc. (KOA Corporation)

- Vishay Intertechnology Inc.

Electrical resistor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.01 billion

Revenue forecast in 2030

USD 8.48 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, product type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Cressall Resistors Ltd.; Bourns Inc.; Zonkas Electronic Co. Ltd.; Murata Manufacturing Co. Ltd.; TE Connectivity; Viking Tech Corporation; YAGEO Group; Japan Resistor Mfg. Co. Ltd.; KOA Speer Electronics Inc. (KOA Corporation); Vishay Intertechnology Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scopes

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrical Resistor Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the electrical resistor market report based type, product type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Linear Resistor

-

Fixed Resistor

-

Variable Resistor

-

Non-linear Resistor

-

Others

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Supplies

-

Electric Motors

-

Drives

-

Inverters

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Transmission

-

Distribution Channels

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

IT and Telecommunication

-

Automotive

-

Industrial

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electrical resistor market size was estimated at USD 5.83 billion in 2023 and is expected to reach USD 6.01 billion in 2024.

b. The global electrical resistor market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 8.48 billion by 2030.

b. Asia Pacific dominated the electrical resistor market with a share of over 39.0% in 2023. This is attributable to the growing demand for consumer electronic devices and high electronic manufacturing activities in the region.

b. Some key players operating in the electrical resistor market include Cressall Resistors Ltd., Bourns Inc., Zonkas Electronic Co. Ltd., Murata Manufacturing Co. Ltd., TE Connectivity, Viking Tech Corporation, YAGEO Group, Japan Resistor Mfg. Co. Ltd., KOA Speer Electronics Inc. (KOA Corporation), and Vishay Intertechnology Inc.

b. Key factors driving market growth include the expanding electronics industry and the rapid technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.