- Home

- »

- Plastics, Polymers & Resins

- »

-

Electromagnetic Shielding Polymers Market Report Size 2033GVR Report cover

![Electromagnetic Shielding Polymers Market Size, Share & Trends Report]()

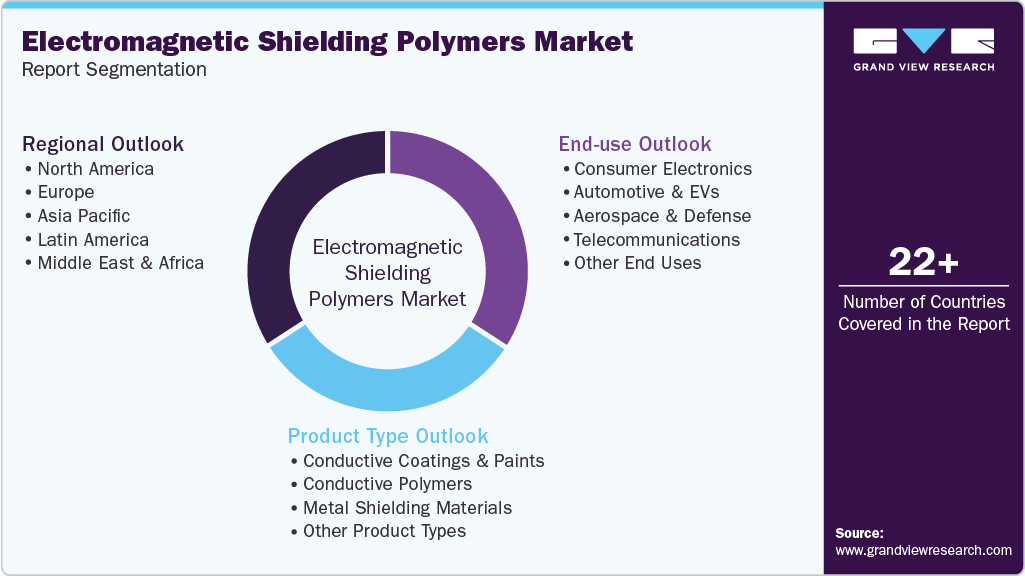

Electromagnetic Shielding Polymers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Conductive Coatings & Paints, Conductive Polymers, Metal Shielding Materials), By End-use (Consumer Electronics, Automotive & EVs, Aerospace & Defense, Telecommunications), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-791-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electromagnetic Shielding Polymers Market Summary

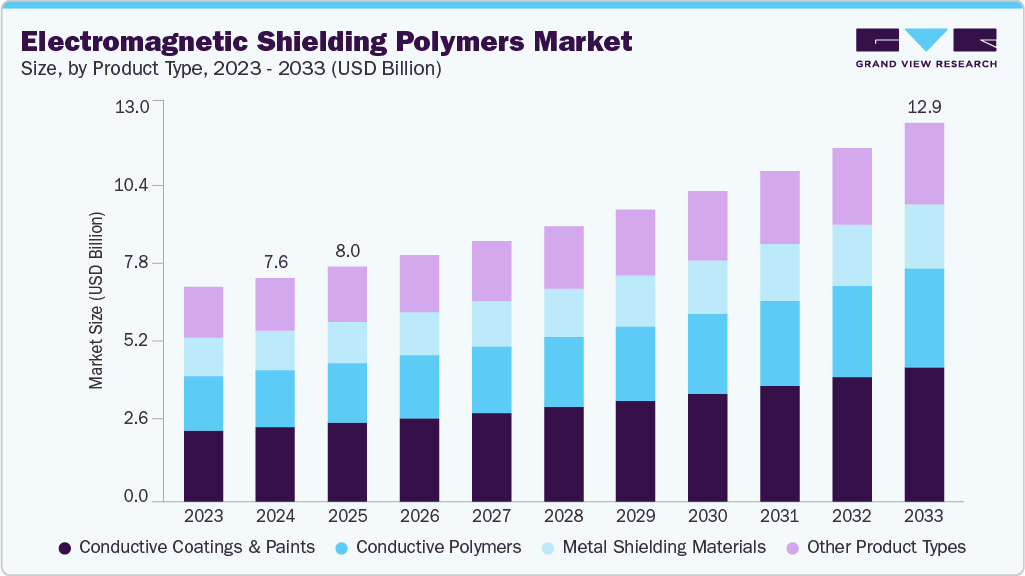

The global electromagnetic shielding polymers market size was estimated at USD 7.63 billion in 2024 and is projected to reach USD 12.90 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. Growing use of lightweight materials in electric vehicles and portable electronics is driving the demand for electromagnetic shielding polymers, as they offer effective EMI protection without adding significant weight.

Key Market Trends & Insights

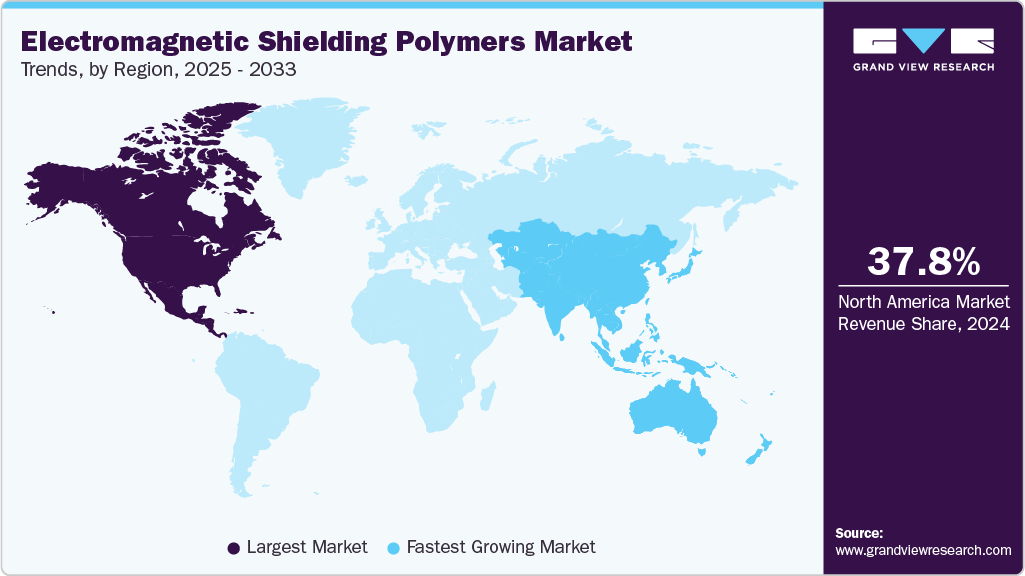

- North America dominated the electromagnetic shielding polymers market with the largest revenue share of 37.82% in 2024.

- The electromagnetic shielding polymers market in Canada is expected to grow at a substantial CAGR of 6.3% from 2025 to 2033.

- By product type, the conductive coatings & paints segment is expected to grow at the fastest CAGR of 6.8% from 2025 to 2033.

- By end use, the automotive & EVs segment is expected to grow at the fastest CAGR of 6.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 7.63 Billion

- 2033 Projected Market Size: USD 12.90 Billion

- CAGR (2025-2033): 6.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Manufacturers are increasingly opting for these materials to enhance energy efficiency and design flexibility. The electromagnetic shielding polymers industry is shifting from bulk metal enclosures toward engineered polymer solutions that combine electrical conductivity with mechanical flexibility and low weight.

This trend is driven by device miniaturization, the need for conformal and printed shielding in flexible electronics, and rising adoption in automotive and telecom applications where space and mass savings matter. Market forecasts indicate steady expansion in the materials and coatings segments, as manufacturers prioritize the integration of shielding into polymer substrates and surface treatments.

Drivers, Opportunities & Restraints

The accelerating deployment of 5G infrastructure, proliferation of IoT endpoints, and electrification of vehicles are increasing system complexity and the need for more frequency bands, which in turn create a strong demand for reliable EMI control. End-users prefer polymers because they enable the integration of shielding into housings, gaskets, and thin films without the weight and corrosion issues associated with metal, thereby improving assembly efficiency and design flexibility for OEMs. Regulatory emphasis on electromagnetic compatibility across consumer and automotive sectors further amplifies the procurement of engineered polymer shielding.

There is a clear commercial opportunity for material suppliers who can deliver conductive polymer composites, coatings, and printable inks that meet higher-frequency shielding requirements while remaining cost-competitive. Suppliers that invest in higher loadings of advanced fillers, hybrid metal-polymer laminates, or intrinsically conductive polymers can capture share across fast-growing segments such as EV battery enclosures, wearable electronics, and 5G radio units. Partnerships with OEMs to co-develop conformal coatings and design-for-manufacture processes will unlock premium pricing and longer-term supply contracts, ultimately benefiting both parties.

Despite progress, polymers still face performance gaps versus metal shields at very high frequencies and in applications requiring extreme attenuation or thermal management; achieving comparable conductivity often requires expensive fillers and complex processing. These technical trade-offs increase unit cost and can complicate qualification cycles for safety-critical sectors such as aerospace and certain automotive subsystems. As a result, some buyers default to metal solutions where absolute shielding performance, thermal conductivity, or EMI grounding is non-negotiable, thereby slowing the adoption of polymers in those niches.

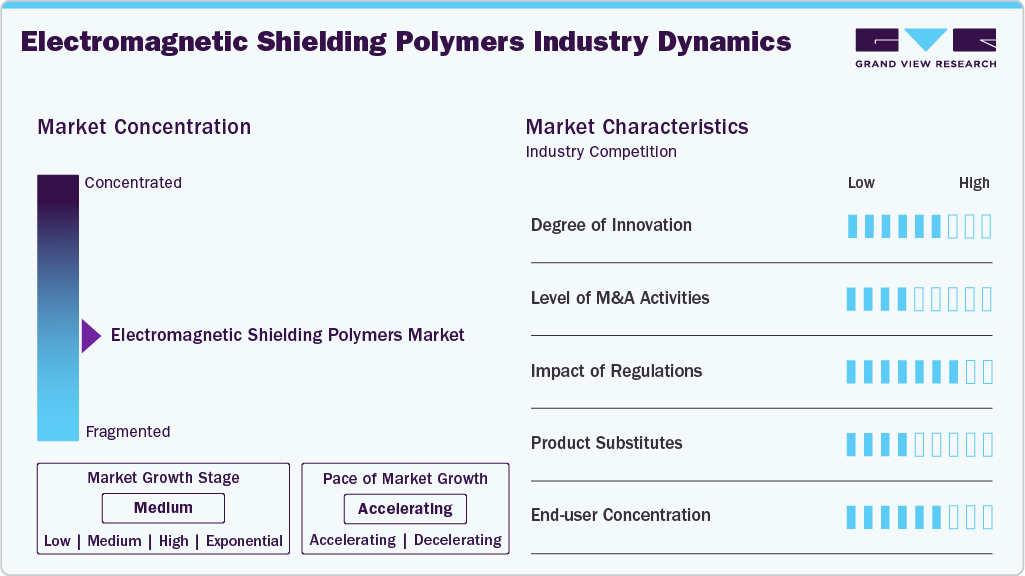

Market Concentration & Characteristics

The market growth stage of the electromagnetic shielding polymers industry is medium, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies, including Henkel AG & Co. KGaA, DuPont de Nemours, Inc., PPG Industries, Inc., 3M Company, Parker Hannifin Corporation, Dow Inc., Nanotech Energy Inc., Lubrizol Corporation, Tech-Etch, Inc., Heraeus Holding GmbH, and others, play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

Innovation in electromagnetic shielding polymers is advancing rapidly through two complementary paths: novel conductive chemistries such as intrinsically conductive polymers and 2D materials, and engineering of composite architectures that integrate MXenes, graphene, and metallic nanofillers into printable inks, foams, and laminates. These developments are shifting the performance envelope, enabling higher-frequency attenuation, thinner conformal layers, and multifunctional properties such as thermal management and mechanical damping, which in turn shorten qualification cycles for demanding end uses. Suppliers that convert lab-scale nanomaterial gains into robust, scalable formulation and curing processes will capture disproportionate value as OEMs prioritize design integration over retrofit shielding.

Polymers compete with a mature set of substitutes that remain preferred where absolute shielding or thermal conduction is critical. Stamped metal housings, metal foils, and woven metalized fabrics continue to dominate heavy-duty and aerospace applications due to their predictable performance and established qualification. Conductive elastomeric gaskets, plated metal cans, and discrete metal shielding plates are also incorporated at the board and subsystem levels, as they simplify grounding and heat dissipation. The economics and supply-chain familiarity of these metal-based solutions mean polymers must demonstrate reliable parity on attenuation, durability, and regulatory qualification to displace incumbents in risk-averse sectors.

Product Type Insights

The conductive coatings & paints segment led the market with the largest revenue share of 33.56% in 2024. Manufacturers are increasingly specifying conductive coatings as a first-line shielding solution because they enable lightweight, conformal protection directly on complex housings and printed circuit assemblies, reducing assembly steps and part counts. Recent commercial rollouts of solvent- and waterborne conductive paints that meet automotive and telecom EMC requirements have accelerated their adoption in volume applications where form factor and throughput are key considerations.

The conductive polymers segment is anticipated to grow at the fastest CAGR of 6.5% through the forecast period. Conductive polymers are winning share where intrinsic conductivity and mechanical integration are required, particularly in flexible electronics and printed devices, where traditional fillers would compromise conformability. Investment in intrinsically conductive chemistries and conductive polymer composites has improved high-frequency attenuation while reducing filler loadings, thereby lowering weight and preserving mechanical properties important to both consumer and industrial designers.

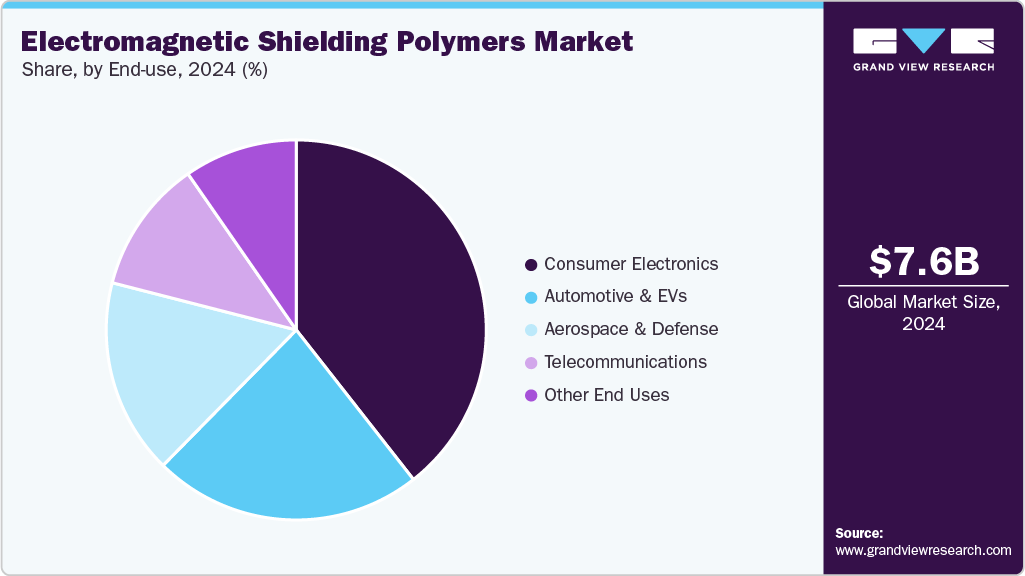

End-use Insights

The consumer electronics segment led the market with the largest revenue share of 39.41% in 2024 and is forecasted to grow at the fastest CAGR of 6.4% from 2025 to 2033. The rapid roll-out of 5G, the rise of foldable and wearable devices, and denser multi-band radio architecture have made compact, integrated shielding a procurement priority. OEMs prefer polymer-based shielding in antenna surrounds, display stacks, and connector modules because these materials support thinner assemblies and enable printed or sprayed application methods that align with automated manufacturing. The net result is sustained growth in specification for conductive coatings and engineered polymer composites across handsets, earbuds, and small-form-factor IoT devices.

The automotive & EVs segment is expected to expand at a substantial CAGR of 6.7% through the forecast period. Electrification and increased electronic content per vehicle are creating new shielding requirements for inverters, battery management systems, and high-voltage harnesses. Polymers are favored where weight reduction and corrosion resistance are key considerations. Recent technical work on polymer composites for battery enclosures demonstrates that combined EMI shielding and mechanical performance can be achieved without the mass penalty of metal, making these materials attractive to OEMs focused on improving range and enhancing manufacturability. Regulatory pressure on electromagnetic compatibility in safety-critical subsystems further propels the specification of validated polymer shielding solutions.

Regional Insights

North America dominated the electromagnetic shielding polymers market with the largest revenue share of 37.82% in 2024 and is expected to grow at the significant CAGR over the forecast period. The build-out of 5G small cells, private wireless networks, and edge data centers across North America is creating concentrated high-frequency EMI environments that favor lightweight, conformal shielding solutions. OEMs and telecom contractors prefer conductive coatings and printed shielding to meet tight form-factor and thermal budgets while avoiding heavy metal enclosures that complicate deployment. As network densification accelerates, procurement teams are specifying validated polymeric shielding systems that integrate with antenna housings and remote radio heads to shorten installation cycles.

U.S. Electromagnetic Shielding Polymers Market Trends

The electromagnetic shielding polymers market in the U.S. accounted for the largest market revenue share in North America in 2024. Targeted U.S. policy measures, notably CHIPS-era subsidies for semiconductor fabs and tax incentives under the Inflation Reduction Act for electric vehicle EV manufacturing, are reshaping where electronic subsystems are designed and sourced. Higher domestic production of power electronics, battery management systems, and advanced sensors directly raises specifications for EMI control, creating commercial demand for polymer-based shielding that reduces weight and corrosion risk in vehicle and factory environments. State-level incentives and high-profile plant openings are further anchoring long-term procurement pipelines.

Europe Electromagnetic Shielding Polymers Market Trends

The electromagnetic shielding polymers market in Europe is anticipated to grow at a significant CAGR during the forecast period. European regulators and OEMs maintain rigorous electromagnetic compatibility and safety requirements across automotive, medical, and industrial sectors, prompting early specification of qualified shielding materials. The combination of aggressive vehicle electrification targets and tight harmonized EMC rules drives demand for polymer solutions that can be validated for functional safety, lifecycle durability, and recyclability. Suppliers able to document compliance with EU directives capture preference from conservative procurement organizations.

Asia Pacific Electromagnetic Shielding Polymers Market Trends

The electromagnetic shielding polymers market in the Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. Asia Pacific’s large-scale expansion in battery electric vehicle production, consumer device manufacturing, and 5G deployments is creating the world’s largest addressable market for EMI shielding polymers. Domestic OEM investments, new regional EV plants, and a dense contract-manufacturing ecosystem favor cost-efficient conductive coatings and printable inks that can be localized quickly. Companies that offer scalable formulations and regional technical support are positioned to win volume contracts as manufacturers prioritize throughput and supply continuity.

Key Electromagnetic Shielding Polymers Company Insights

The electromagnetic shielding polymers industry is highly competitive, with several key players dominating the landscape. Major companies include Henkel AG & Co. KGaA, DuPont de Nemours, Inc., PPG Industries, Inc., 3M Company, Parker Hannifin Corporation, Dow Inc., Nanotech Energy Inc., Lubrizol Corporation, Tech-Etch, Inc., and Heraeus Holding GmbH. The electromagnetic shielding polymers industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Electromagnetic Shielding Polymers Companies:

The following are the leading companies in the electromagnetic shielding polymers market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Co. KGaA

- DuPont de Nemours, Inc.

- PPG Industries, Inc.

- 3M Company

- Parker Hannifin Corporation

- Dow Inc.

- Nanotech Energy Inc.

- Lubrizol Corporation

- Tech-Etch, Inc.

- Heraeus Holding GmbH

Recent Developments

-

In June 2025, Koyo Sangyo announced the commercial launch of a noncombustible electromagnetic wave shielding film designed for tent and outdoor-fabric applications. The product targets defense and outdoor infrastructure use cases where flame resistance and radio-wave attenuation are both required.

-

In May 2025, Henkel introduced conformal metal inks for package-level EMI shielding aimed at semiconductor packaging and high-frequency module applications. The inks enable direct, package-level shielding, reducing part count and supporting automated application in advanced assembly lines.

Electromagnetic Shielding Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.00 billion

Revenue forecast in 2033

USD 12.90 billion

Growth rate

CAGR of 6.2% from 2024 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Henkel AG & Co. KGaA; DuPont de Nemours, Inc.; PPG Industries, Inc.; 3M Company; Parker Hannifin Corporation; Dow Inc.; Nanotech Energy Inc.; Lubrizol Corporation; Tech-Etch, Inc.; Heraeus Holding GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electromagnetic Shielding Polymers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electromagnetic shielding polymers market report based on the product type, end-use, and region:

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Conductive Coatings & Paints

-

Conductive Polymers

-

Metal Shielding Materials

-

Other Product Types

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Automotive & EVs

-

Aerospace & Defense

-

Telecommunications

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global electromagnetic shielding polymers market size was estimated at USD 7.63 billion in 2024 and is expected to reach USD 8.00 billion in 2025.

b. The global electromagnetic shielding polymers market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 12.90 billion by 2033.

b. Conductive coatings & paints dominated the electromagnetic shielding polymers market across the product type segmentation in terms of revenue, accounting for a market share of 33.56% in 2024 and is forecasted to grow at 6.8% CAGR from 2025 to 2033.

b. Some key players operating in the electromagnetic shielding polymers market include Henkel AG & Co. KGaA, DuPont de Nemours, Inc., PPG Industries, Inc., 3M Company, Parker Hannifin Corporation, Dow Inc., Nanotech Energy Inc., Lubrizol Corporation, Tech-Etch, Inc., and Heraeus Holding GmbH.

b. Growing use of lightweight materials in electric vehicles and portable electronics is driving the demand for electromagnetic shielding polymers, as they offer effective EMI protection without adding significant weight. Manufacturers are increasingly choosing these materials to improve energy efficiency and design flexibility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.