- Home

- »

- Paints, Coatings & Printing Inks

- »

-

EMEA Paints & Coatings Market Size, Industry Report, 2033GVR Report cover

![EMEA Paints And Coatings Market Size, Share & Trends Report]()

EMEA Paints And Coatings Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Acrylic, Polyester, Alkyd, Polyurethane), By Application (Architectural & Decorative, Non-Architectural), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-693-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

EMEA Paints And Coatings Market Summary

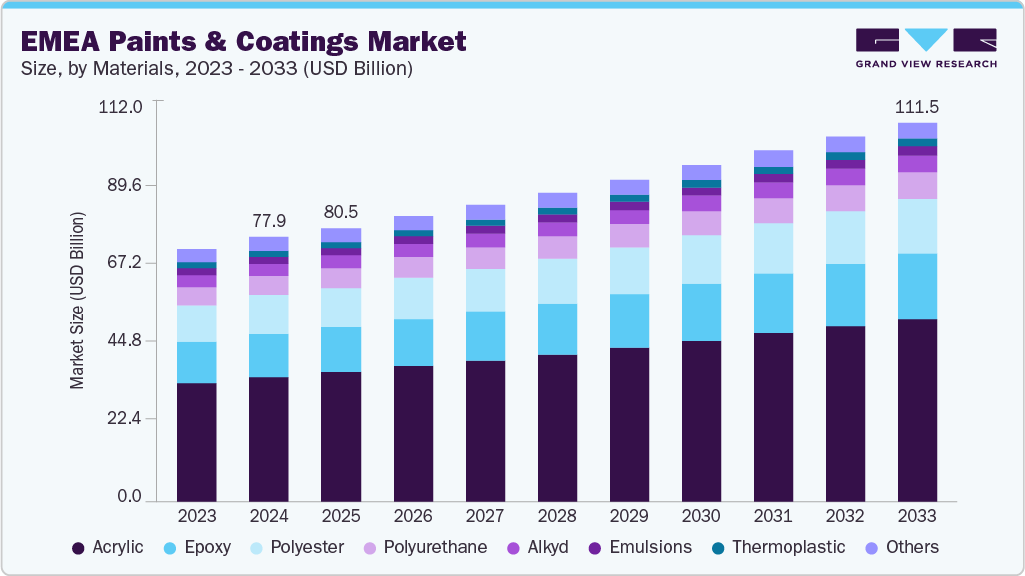

The EMEA paints and coatings market size was estimated at USD 77.86 billion in 2024 and is projected to reach USD 111.51 billion by 2033, growing at a CAGR of 4.2% from 2025 to 2033. The market is expected to be driven by the increasing consumption of paints and coatings in construction, automotive, and general industries.

Key Market Trends & Insights

- Europe dominated the EMEA paints & coatings market with the largest revenue share of 81.80% in 2024.

- The market in Italy is expected to grow at the significant CAGR of 4.5% from 2025 to 2033.

- By material, the epoxy segment is expected to grow at the highest CAGR of 4.8% from 2025 to 2033 in terms of revenue.

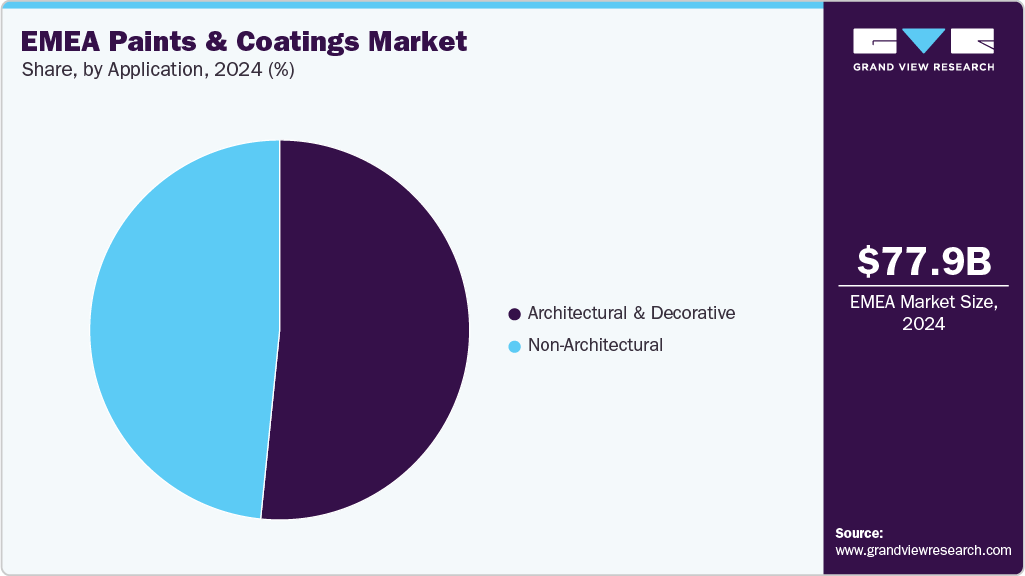

- By application, the architectural & decorative segment held the largest revenue share of 51.6% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 77.86 Billion

- 2033 Projected Market Size: USD 111.51 Billion

- CAGR (2025-2033): 4.2%

- Europe: Largest market in 2024

- Middle East & Africa: Fastest growing market

Rapid urbanization and industrialization are anticipated to fuel the demand for paints and coatings in construction applications. The strong demand for paints and coatings is driven by growth in infrastructure renovation, construction, and government-supported urban redevelopment projects across the region. Initiatives related to the European Green Deal, such as large-scale energy upgrades for buildings, significantly increase decorative and protective coatings in new structures and renovation projects.

In the EMEA (Europe, Middle East, and Africa) paints and coatings market, the growing emphasis on environmental sustainability and regulatory compliance is a key driver. Governments and regulatory bodies across Europe and parts of the Middle East are enforcing stricter limits on volatile organic compounds (VOCs), encouraging manufacturers to shift toward waterborne and bio-based formulations. Consumers and industries alike are prioritizing coatings that reduce environmental impact while maintaining performance. This is particularly evident in the architectural and industrial segments, where green building certifications and sustainability goals are influencing procurement decisions. The demand for low-VOC and high-solid coatings is expected to rise steadily across the region in response to these factors.

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Jotun; The Sherwin-Willams Company; BASF SE, and Axalta Coating Systems, LLC, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the EMEA paints & coatings market are adopting a combination of capacity expansion, product innovation, strategic partnerships, and sustainability initiatives to strengthen their market position. Companies such as Henkel AG & Company KGaA, 3M, and AkzoNobel N.V., and Hempel A/S are investing in advanced refining technologies to enhance product purity and performance for high-end applications like cosmetics and phase change materials. To cater to rising demand in Asia Pacific and the Middle East, several players are expanding their production and distribution networks in these regions.

Materials Insights

The acrylic segment dominated the market with a revenue share of 47.1% in 2024. These coatings are often used in interior and exterior applications, offering high flexibility across industries ranging from construction to automotive and industrial coatings. Acrylic-based formulations provide superior color retention, ensuring that coatings remain vibrant and intact over long periods, even when exposed to harsh weather conditions. This makes acrylics particularly suitable for exterior surfaces in both residential and commercial settings.

Epoxy is expected to grow fastest with a CAGR of 4.8% during the forecast period. Epoxy resins are known for their excellent adhesion, corrosion resistance, and mechanical properties, making them ideal for coatings in industrial, automotive, architectural, and marine sectors. The exceptional durability of epoxy coatings allows them to withstand harsh environmental conditions, such as high humidity, extreme temperatures, and exposure to chemicals, making them particularly popular in industries where performance and longevity are paramount. One of the prominent applications of epoxy coatings in the EMEA region is the protective and decorative coatings for metal substrates.

Applications Insights

The architectural & decorative segment dominated the market with a revenue share of 51.6% in 2024. This includes interior and exterior applications across residential, commercial, and public infrastructure. The demand is fueled by ongoing urbanization, renovation projects, and a preference for aesthetically pleasing environments. From eco-friendly options to vibrant color choices, products within this category are designed to meet diverse requirements for durability, aesthetic appeal, and surface protection.

Non-Architectural is expected to grow with a CAGR of 3.9% during the forecast period. The Non-Architectural segment within the EMEA Paints & Coatings market primarily includes applications outside residential and commercial building structures, focusing instead on industrial, automotive, marine, and specialty applications. It serves many industries that require specific coatings for functional and protective purposes, often under challenging environmental conditions. In the automotive industry, coatings enhance aesthetics and provide functional benefits, such as UV resistance and protection against scratches and chips. High-performance coatings, including clear and base coats, are designed to withstand harsh outdoor conditions and maintain a vehicle's appearance over time.

Regional Insights

Europedominated the market with a revenue share of 81.8% during the forecast period. Europe's paints and coatings market is propelled by its robust demand across multiple end-use industries, including automotive, construction, and packaging. Each sector’s growth and unique needs create demand for specialized coatings that enhance performance, aesthetics, and durability. In Europe’s automotive sector, major manufacturers such as BMW and Volkswagen increasingly utilize advanced coatings to improve vehicle performance and aesthetics. BMW, for example, collaborates with BASF to develop sustainable coatings that reduce energy consumption during the curing process, thus cutting down on CO₂ emissions. On the other hand, Volkswagen has integrated innovative anti-corrosion coatings that extend vehicle life by protecting against harsh environmental factors.

Italy EMEA Paints And Coatings Market Trends

Italy’s role as a fashion and design hub drives demand for unique, customizable, and high-quality decorative coatings. Italian design emphasizes high aesthetic standards, which are reflected in the demand for specialized finishes in interior design and retail. This demand for sophisticated finishes is often met with coatings that mimic natural textures, metallic finishes, or vibrant colors that align with region design trends.

Middle East And Africa Paints & Coatings Market Trends

EMEA paints & coatings market in Asia Pacific has experienced significant growth owing to continuous demand for these enzymes in various industries, including food and beverage, detergents, pulp and paper, personal care, and cosmetics. Enzymes, known for their remarkable catalytic properties, have become essential in optimizing different processes and enhancing their efficiency, as well as for promoting sustainability in these industries.

The Middle East & Africa (MEA) paints and coatings market is primarily driven by rapid urbanization, infrastructure development, and rising demand in the construction, automotive, and oil and gas sectors. Countries like Saudi Arabia and the United Arab Emirates are investing heavily in megaprojects such as NEOM in Saudi Arabia and the Dubai Expo site, requiring high-performance and durable coatings for infrastructure and commercial buildings.

In Saudi Arabia, the construction industry, especially infrastructure projects driven by Saudi Arabia's Vision 2030, has created a strong demand for paints and coatings. The ambitious plan aims to diversify the economy, lessen dependence on oil, and invest in sustainable cities like NEOM. This megacity project, along with other large developments such as Qiddiya and the Red Sea Project, requires high-performance coatings for structural protection, decorative uses, and environmental sustainability. Companies like AkzoNobel and Jotun have responded by offering coatings that meet durability and environmental standards, aligning with Saudi Arabia's increasing focus on sustainable infrastructure.

Key EMEA Paints And Coatings Company Insights

Key players, such as Jotun, The Sherwin-Willams Company, Axalta Coating System, LLC, BASF SE, and Henkel AG & Company KGaA, are dominating the market.

BASF SE

-

BASF SE operates through six business segments: Industrial Solutions, Materials, Surface Technologies, Chemicals, Nutrition and care, and Agricultural Solutions. The company's products are used in agriculture, construction, pharmaceuticals, energy and power, home care and nutrition, automotive and transportation, rubber and plastics, leather and textiles, and personal care and hygiene industries. The company has more than 355 manufacturing facilities in over 90 countries in regions, including Europe, Asia Pacific, North America, Central America, South America, and the Middle East & Africa. It is traded on the Frankfurt, London, and Zurich stock exchanges. BASF has a presence in 93 countries and operates 234 production sites worldwide.

Key EMEA Paints And Coatings Companies:

- Jotun

- The Sherwin-Williams Company

- Axalta Coating Systems, LLC

- BASF SE

- Henkel AG & Company KGaA

- 3M

- AkzoNbobel N.V.

- Albi Protective Caotings

- Nullfire

- Hempel A/S

Recent Developments

-

In September 2024, BASF SE announced the launch of its ChemCycling product line, which is used in the automotive refinish market. The move is designed to improve efficiency, optimize resource allocation, and increase financial flexibility.

-

In May 2024, Axalta launched BioCore, a new line of eco-friendly industrial coating designed to reduce the environmental impact of coating applications. The product range utilizes renewable raw materials to decrease dependence on fossil resources while maintaining high performance and durability standards. BioCore coatings are engineered to offer enhanced protection, ease of application, and lower carbon emissions compared to traditional alternatives. This launch is part of Axalta’s broader strategy to support industries meeting sustainability goals by providing more environmentally responsible coating solutions without compromising quality or efficiency.

EMEA Paints And Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 80.49 billion

Revenue forecast in 2033

USD 111.51 billion

Growth rate

CAGR of 4.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Materials, application, region

Regional scope

Europe; Middle East & Africa

Country scope

Poland; Italy; Turkey; Greece; Spain; Saudi Arabia; South Africa; Iran; Egypt; Tanzania; Kenya; Jordan; Oman; UAE; Israel; Kuwait

Key companies profiled

Jotun; The Sherwin-Williams Company; Axalta Coating Systems, LLC; BASF SE; Henkel AG & Company KGaA; 3M; AkzoNbobel N.V.; Albi Protective Coatings; Nullfire; Hempel A/S

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

EMEA Paints And Coatings Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the EMEA paints & coatings market report based on material, application and region.

-

Material Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

Acrylic

-

Polyester

-

Alkyd

-

Polyurethane

-

Epoxy

-

Emulsions

-

Thermoplastics

-

Other Materials

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

Architectural & Decorative

-

Non-Architectural

-

Automotive

-

Wood

-

General Industries

-

Coil

-

Packaging

-

Marine

-

Protective

-

Other Non-Agriculture Applications

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

Europe

-

Poland

-

Italy

-

Turkey

-

Greece

-

Spain

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Iran

-

Egypt

-

Tanzania

-

Kenya

-

Jordan

-

Oman

-

UAE

-

Israel

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global EMEA paints and coatings market size was estimated at USD 77.86 billion in 2024 and is expected to reach USD 80.49 billion in 2025.

b. The global EMEA paints and coatings market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2033 to reach USD 111.51 billion by 2033.

b. Europe dominated the market with a revenue share of 81.8% during the forecast period. Europe's paints and coatings market is propelled by its robust demand across multiple end-use industries, including automotive, construction, and packaging. Each sector’s growth and unique needs create demand for specialized coatings that enhance performance, aesthetics, and durability

b. Some key players for EMEA paints & coatings market are as follow: Jotun, The Sherwin-Williams Company, Axalta Coating Systems, LLC, BASF SE, Henkel AG & Company KGaA, 3M, AkzoNbobel N.V., Albi Protective Coatings, Nullfire, and Hempel A/S

b. The market is expected to be driven by the increasing consumption of paints and coatings in construction, automotive, and general industries. Rapid urbanization and industrialization are anticipated to fuel the demand for paints and coatings in construction applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.