- Home

- »

- Personal Care & Cosmetics

- »

-

Emollients Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Emollients Market Size, Share & Trends Report]()

Emollients Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Esters, Fatty Alcohols, Fatty Acids, Ethers, Silicones), By Form, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-999-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Emollients Market Summary

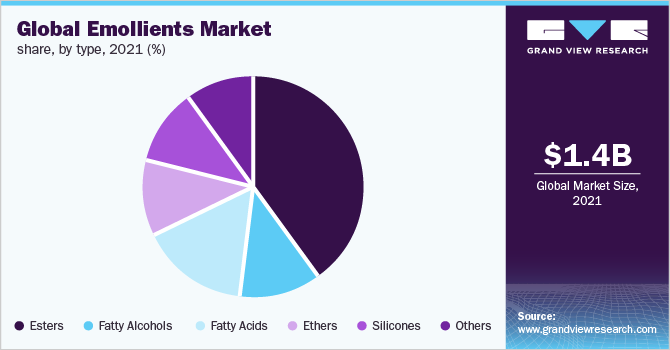

The global emollients market was estimated at USD 1.38 billion in 2021 and is projected to reach USD 2.09 billion by 2030, growing at a CAGR of 4.7% from 2022 to 2030. The market is anticipated to be driven by globally increasing demand for cosmetic, beauty care, and personal care products. Moreover, the rise in demand for natural ingredients like plant-based and animal-based oils and emollients in cosmetic products is expected to drive the market over the forecast period.

Key Market Trends & Insights

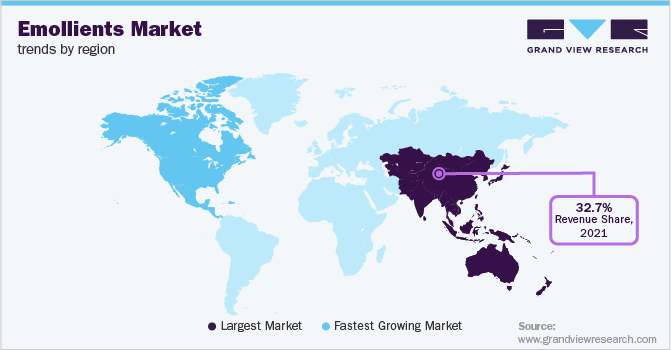

- Asia Pacific dominated the global emollients market with a revenue share of 32.7% in 2021.

- North America is expected to expand at a CAGR of 4.8% over the forecast period.

- By type, esters dominated the market in 2021 with a 40.4% revenue share.

- By form, the solid segment is expected to witness the fastest CAGR of 5.1% over the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 1.38 billion

- 2030 Projected Market Size: USD 2.09 billion

- CAGR (2022-2030): 4.7%

- Asia Pacific: Largest market in 2021

The COVID-19 pandemic had a negative impact on the emollient market. The pandemic led to the sealing of national borders and the temporary shutting down of various industries globally in 2020. Before the COVID-19 pandemic, numerous countries were dependent on China for raw material supply. In 2020, restrictions imposed by the government on transportation and lack of raw materials supply from China resulted in less production of emollients.

The demand for emollients in personal care products is rising significantly due to the rise in skin diseases worldwide. Skin diseases such as acne, itching, dryness, and fissure, among others are rising in the U.S. Acne is the most prevalent skin disease in the U.S. and it is most common in adults.

According to the American Academy of Dermatology Association, between the ages of 12 and 24, around 85% of individuals have at least mild acne in U.S. Such factors are increasing the demand for skin care products which in turn is expected to drive the market.

Form Insights

The liquid segment accounted for the largest revenue share of 69.0% in 2021 and is expected to retain its position over the forecast period. Emollients are usually available in liquid form. Natural emollients such as fatty acids, oils, and lipids are majorly found in liquid form. Moreover, synthetic emollients such as butylene glycol and capric/caprylic triglyceride are also offered in liquid form owing to their applications in liquid personal care formulations such as creams, lotions, moisturizers, and shampoos, among others.

The solid segment is expected to attain the fastest CAGR of 5.1% over the forecast period 2022-2030. Several industry players are offering semi-solid, powdered-based, and waxy-solid emollients to various personal care and cosmetics manufacturers. Various companies are developing solid personal care products for long shelf life and better handling. For instance, Evonik Industries AG offers shampoo powder, a conditioning shampoo bar, and a hair conditioning bar to consumers across the globe. Such innovations are expected to drive solid emollient market growth.

Application Insights

The skin care segment accounted for the largest revenue share of 38.7% in 2021 and is expected to retain its position over the forecast period. This can be attributed to the increasing use of skin care products such as moisturizers, creams, and lotions, among consumers. Also, the increasing use of plant-based emollients in the personal care industry is further driving market growth. Several personal care product manufacturers are developing new products by using plant-based oil to provide effective personal care solutions to consumers. In August 2022, OrgaGlo entered the Indian market with around 18 latest products including hair care and skin care products which include plant-based ingredients.

The hair care segment is expected to exhibit the fastest CAGR of 5.2% in the forecast period 2022-2030. Increasing consumer awareness of beauty and personal care is driving the demand for hair care products such as shampoos, conditioners, hair masks, creams, and hair gels, among others which in turn are expected to propel the emollient market growth. Emollients are used in hair care products to provide hydration.

Type Insights

Based on type, the market has been segmented into esters, fatty alcohols, ethers, fatty acids, and silicones. The esters segment dominated the market and accounted for the largest share of 40.4% in 2021 in terms of revenue and is expected to continue to dominate the market over the forecast period. Esters such as isopropyl myristate, C12-15 alkyl benzoate, cetyl palmitate, and myristyl myristate are extensively used in the preparations of personal care emollients. In June 2017, BASF SE opened a new USD 22 million production facility in Shanghai, China for emollients and waxes. This production plant was aimed to meet the increasing demand for Asia Pacific’s personal care market.

The fatty acids segment is expected to attain a CAGR of 5.5% over the forecast period 2022-2030. This can be attributed to the unique properties of fatty acids as emollients such as skin-hydrating properties by sealing in the skin’s moisture. Fatty acid emollients also reduce the evaporation of the surrounding atmosphere. Some of the common fatty acids used as emollients are glycerides, phospholipids, and sterols.

Several makeup manufacturers are using various types of fatty acid emollients in their products for a better consumer experience. For instance, in January 2022, Charlotte Tilbury released a new medium-coverage foundation. This foundation is suitable for fair, deep tones, medium, or tan, as well as warm, cool, and neutral undertones. The foundation contains hyaluronic acid to moisturize, along with coconut ingredients to plump and fortify the skin barrier and Bix'Activ (a plant-derived chemical).

Regional Insights

Asia Pacific dominated the market with a revenue share of 32.7% in 2021. The region is expected to maintain its position in the market during the forecast period. The population of Asia makes up almost 60% of the entire world's population, making it the simple majority. Emollients are used as important ingredients in various personal care products such as shampoos, conditioners, moisturizers, lotions, and deodorants, among others. Increasing consumption of such products in the region is expected to drive the market.

North America is expected to expand at a CAGR of 4.8% over the forecast period. This is due to the increasing demand for personal care and cosmetic products in the U.S. According to L'ORÉAL 2021, the U.S. and China are the major growth drivers for cosmetics.

Rising skin-related diseases in the region are driving the demand for skin care products which in turn are expected to propel the market growth in the region. According to the National Psoriasis Foundation, in the year 2021, more than 8 million Americans, suffer from psoriasis. Emollients help protect the skin, encourage healing, and prevent symptom recurrence.

Key Companies & Market Share Insights

The global emollients market is highly competitive owing to the presence of various global and regional market players. The world’s leading companies are undertaking strategies such as partnerships, collaborations, acquisitions, mergers, and agreements to withstand the intense competition and increase their market share.

Emollients manufacturers are spending extensively on research and development activities to develop advanced products and integrate new technologies and characteristics to lead a sustainable future. For instance, in September 2021, BASF SE announced an innovation partnership with a U.S.-based technology startup, RiKarbon Inc. This partnership was built due to the successful research and development activities of RiKarbon for new bio-based green emollients. Some of the prominent players operating in the global emollients market are:

-

BASF SE

-

Clariant

-

Eastman Chemical Company

-

The Lubrizol Corporation

-

Covestro AG

-

Evonik Industries AG

-

Hallstar

-

Croda International PLC

-

Ashland Inc.

-

Sasol

-

Lonza

-

Stepan Company

-

Oleon Health and Beauty

-

Solvay

-

Vantage Speciality Chemicals.

Emollients Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.52 billion

Revenue forecast in 2030

USD 2.09 billion

Growth Rate

CAGR of 4.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and Volume in Kilo Tons and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, form, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Italy; U.K.; France; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Clariant; Eastman Chemical Company; The Lubrizol Corporation; Covestro AG; Evonik Industries AG; Hallstar; Croda International PLC; Ashland Inc.; Sasol; Lonza; Stepan Company; Oleon Health and Beauty; Solvay; Vantage Speciality Chemicals.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Emollients Market Segmentation

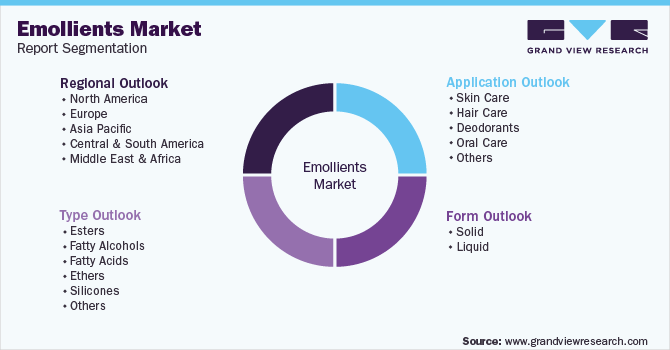

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global emollients market report based on type, form, application, and region:

-

Type Outlook (Revenue, USD Million; Volume, Kilo Tons, 2017 - 2030)

-

Esters

-

Fatty Alcohols

-

Fatty Acids

-

Ethers

-

Silicones

-

Others

-

-

Form Outlook (Revenue, USD Million; Volume, Kilo Tons, 2017 - 2030)

-

Solid

-

Liquid

-

-

Application Outlook (Revenue, USD Million; Volume, Kilo Tons, 2017 - 2030)

-

Skin Care

-

Hair Care

-

Deodorants

-

Oral Care

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilo Tons, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global emollients market size was estimated at USD 1.38 billion in 2021 and is expected to reach USD 1.52 billion in 2022

b. The global emollients market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2022 to 2030 to reach USD 2.09 billion by 2030

b. Asia Pacific dominated the emollients market with a revenue share of 32.7% in 2021. This is attributed to the presence of major market vendors, availability of raw materials and labor at a lower price, and the high adoption of emollients in personal care and cosmetic industry.

b. Some of the key players operating in the emollients market include BASF SE, Clariant, Eastman Chemical Company, The Lubrizol Corporation, Covestro AG, Evonik Industries AG, Hallstar, Croda International PLC, Ashland Inc., Sasol, Lonza, Stepan Company, Oleon Health and Beauty, Solvay, Vantage Speciality Chemicals. among others.

b. The key factors that are driving the global emollients market include the increase in demand for cosmetics across the globe. Also, the growing consumption of moisturizers and skin-softening creams globally is propelling the demand for emollients.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.